2011 WFEC Annual Report - Western Farmers Electric Cooperative

2011 WFEC Annual Report - Western Farmers Electric Cooperative

2011 WFEC Annual Report - Western Farmers Electric Cooperative

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

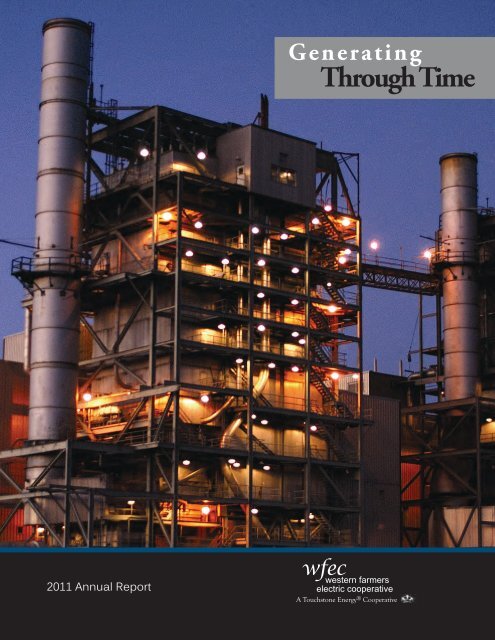

G e n e r a t i n g<br />

Through Time<br />

<strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

wfec<br />

western farmers<br />

electric cooperative<br />

A Touchstone Energy ® <strong>Cooperative</strong><br />

1

Kansas<br />

Northwestern<br />

Alfalfa<br />

Kay<br />

Oklahoma<br />

Cimarron<br />

Texas<br />

Northfork<br />

Harmon<br />

Kiwash<br />

South-<br />

west<br />

Rural<br />

Caddo<br />

Cotton<br />

Oklahoma<br />

Rural<br />

Red River<br />

Valley Rural<br />

Canadian<br />

Valley<br />

People’s<br />

East Central<br />

Oklahoma<br />

Southeastern<br />

Kiamichi<br />

Choctaw<br />

New Mexico<br />

Cen<br />

tral<br />

Valley<br />

<strong>Farmers</strong>’<br />

Roo<br />

sevelt<br />

County<br />

Lea<br />

Cou<br />

nty<br />

<strong>WFEC</strong><br />

Service<br />

Area<br />

<strong>WFEC</strong> provides essential electric service to<br />

23 member cooperatives, Altus Air Force<br />

Base and other power users. These members<br />

are located primarily in Oklahoma and<br />

New Mexico, with some service territories<br />

extending into portions of Texas and<br />

Kansas. <strong>WFEC</strong> crews operate and maintain<br />

over 3,650 miles of transmission line and<br />

329 sub and switch stations across this<br />

service territory.<br />

2 Generating<br />

Through Time

About <strong>WFEC</strong><br />

<strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong> (<strong>WFEC</strong>) is a generation and transmission (G&T)<br />

cooperative that provides essential electric service to 23 member cooperatives, Altus Air Force<br />

Base and other power users. These members are located primarily in Oklahoma and New<br />

Mexico, with some service territories extending into portions of Texas and Kansas.<br />

Organized in 1941, <strong>WFEC</strong> marked its 70th year of operation in <strong>2011</strong>. The G&T was formed when<br />

western Oklahoma rural electric distribution cooperatives found it necessary to secure an adequate power<br />

supply at rates farmers and rural industrial developers could afford.<br />

<strong>WFEC</strong> has five generating facilities located at Mooreland, Anadarko and Hugo, and a total power<br />

capacity of more than 1,700 megawatts (MW) when purchased hydropower is included. <strong>WFEC</strong> owns<br />

and maintains approximately 3,650 miles of transmission line to 272 substations and 57 switch stations.<br />

<strong>WFEC</strong> maintains a well-balanced and diversified portfolio of generation resources that includes<br />

owned facilities and capacity and energy provided through purchase power agreements. These resources<br />

reflect a mix of technologies and fuel types, including one of the state’s largest renewable energy<br />

portfolios. The diversity in <strong>WFEC</strong>’s generation mix helps reduce exposure to changing market conditions,<br />

helping to keep rates competitive.<br />

<strong>WFEC</strong> is led by an experienced management group, with years of industry experience, and governed<br />

by a 24-member Board of Trustees.<br />

wfec<br />

(Clockwise, from left)<br />

Anadarko Headquarters<br />

Anadarko Plant<br />

Hugo Plant<br />

Mooreland Plant<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 3

President & CEO <strong>Report</strong><br />

A<br />

year of records, at least weather-wise, will mark<br />

<strong>2011</strong>. The winter months delivered lots of<br />

snow and excessively cold temperatures. And<br />

if that was not enough, the summer brought relentless<br />

heat and drought. In Anadarko, a record 61 days above<br />

100 degrees eclipsed the old record of 50 days. Parts of<br />

Oklahoma saw in excess of 75 days with temperatures<br />

above the century mark.<br />

As expected with these extreme temperatures,<br />

annual sales for <strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong><br />

(<strong>WFEC</strong>) were over 7.8 million megawatt-hours<br />

(MWh), which is an increase over prior year sales by<br />

5.8%. Generation for these sales came from a diverse<br />

mix of resources with 36% generated by coal, 16% from<br />

natural gas, 17% from renewable resources and 31%<br />

from economy and contract purchases.<br />

<strong>WFEC</strong> also enjoyed several significant<br />

accomplishments during the year. Among these was<br />

the completion of <strong>WFEC</strong>’s new mortgage indenture<br />

that provides a more predictable and timely process for<br />

future borrowing alternatives. In addition, <strong>WFEC</strong>, with<br />

assistance from CoBank, completed its first multi-year,<br />

syndicated, line of credit. With the indenture and lines<br />

of credit, <strong>WFEC</strong> will be more flexible and responsive to<br />

its members’ facility requirements, while continuing to<br />

keep member wholesale power costs competitive.<br />

During <strong>2011</strong>, <strong>WFEC</strong> completed and received Rural<br />

Utilities Service (RUS) loan approvals for transmission,<br />

<strong>2011</strong>...<br />

A Year of Records<br />

distribution and generation projects that will finance<br />

additions and improvements through 2015. New<br />

facilities and upgrades provided by these loans will<br />

continue the steady construction plans required for the<br />

next few years.<br />

Stable, competitively priced fuel delivery and<br />

resources are important to keep wholesale power costs<br />

low. In <strong>2011</strong>, <strong>WFEC</strong> continued its natural gas hedging<br />

program by placing positions to cap the cost of natural<br />

gas for a portion of its portfolio through 2012. Coal<br />

supply and delivery contracts expiring in early 2012<br />

were successfully re-negotiated for additional years at<br />

competitive prices. While coal delivery was sporadic<br />

during <strong>2011</strong> due to flooding and rail delivery outages,<br />

<strong>WFEC</strong> maintained adequate coal inventory at the plant<br />

site and ended the year at normal levels, above 50 days.<br />

Plans to provide power to <strong>WFEC</strong>’s four New<br />

Mexico members continue with initial service starting<br />

in mid-2012. Transmission and generation plans for<br />

additional service are well under way for<br />

the 2017 period. The transition of these<br />

new members is expected to be completed<br />

by 2026.<br />

Gary Roulet (right) serves as the chief executive<br />

officer of <strong>WFEC</strong>, a position he has had since<br />

July 2003. Overall, Roulet has 37 years of<br />

service with the G&T. Bob Allen, who serves<br />

as Board president, represents Harmon <strong>Electric</strong><br />

Association on the <strong>WFEC</strong> Board of Trustees.<br />

Allen has served as president since October<br />

2009.<br />

4 Generating<br />

Through Time

The <strong>WFEC</strong> Board of<br />

Trustees take part in<br />

two strategic retreats<br />

each year to keep<br />

advised of upcoming<br />

events within <strong>WFEC</strong><br />

and the utility industry<br />

as a whole. Senior<br />

management and other<br />

<strong>WFEC</strong> staff discuss<br />

information from<br />

within their respective<br />

departments.<br />

Nitrogen Oxide (NOx) and mercury reductions<br />

were all proposed by the Environmental Protection<br />

Agency (EPA) with the Cross State Air Pollution<br />

Rule (CSAPR) and the Mercury and Air Toxics<br />

Standards (MATS). <strong>WFEC</strong>’s Board of Trustees<br />

approved projects that would bring <strong>WFEC</strong> into<br />

compliance with NOx and CSAPR. The mercury<br />

reduction rule did not require compliance so<br />

quickly, but <strong>WFEC</strong> expects to comply with this rule<br />

also within the proposed EPA schedule.<br />

<strong>Annual</strong> margins needed to exceed $4 million to<br />

meet all required end-of-year lender covenants and<br />

ratios. For <strong>2011</strong>, margins exceeded $10 million,<br />

with all margins allocated to member patronage.<br />

Although many challenges presented themselves<br />

during <strong>2011</strong>, <strong>WFEC</strong> finished the year with a<br />

competitive, reliable power supply and sound<br />

financial performance and is well positioned to<br />

continue its high level of service into the future.<br />

wfec<br />

Bob Allen (right), president of the <strong>WFEC</strong> Board of<br />

Trustees, congratulates Leslie Hinds on his 35 years of<br />

service on the <strong>WFEC</strong> Board. Thirty-five years is the<br />

longest length of service of any previous Board member.<br />

Many longtime members make up the 24-member<br />

Board.<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 5

<strong>2011</strong> Fuel Mix<br />

Coal<br />

Natural Gas<br />

Economy Purchases<br />

8%<br />

* 9%<br />

7%<br />

36%<br />

Hydro<br />

Other *<br />

Contract Purchases<br />

24%<br />

16%<br />

*Energy generated by wind facilities for which <strong>WFEC</strong> does not retain or retire the<br />

environmental attributes.<br />

6 Generating<br />

Through Time

<strong>2011</strong> Highlights<br />

Energy Sales (to Members & Cities)<br />

Total Operating Revenue<br />

Net Margins<br />

Assets<br />

$427 million<br />

$463 million<br />

$10 million<br />

$1,118 million<br />

Members 24<br />

Member Consumer Meters Served<br />

Member Population Served<br />

System Peak Demand<br />

Miles of Transmission Line<br />

273,813 (est.)<br />

473,500 (est.)<br />

1,582 megawatts<br />

3,650 miles<br />

Substations 272<br />

Switch Stations 57<br />

Generating Capacity<br />

Coal<br />

Natural Gas<br />

Purchased Power Capacity<br />

Natural Gas<br />

Hydro<br />

Portfolio of GRDA Assets<br />

Total Capacity<br />

450 megawatts<br />

870 megawatts<br />

70 megawatts<br />

260 megawatts<br />

75 megawatts<br />

1, 725 megawatts<br />

Number of Employees 370<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 7

<strong>WFEC</strong>’s 70 th Year...<br />

Continued Reliability, Relati<br />

The energy business is constantly changing.<br />

Today, the ability to generate and deliver a<br />

continuous supply of electric power is even<br />

more significant than in times past. Society, as a whole,<br />

as well as the economy itself, is dependent on the<br />

benefits and values provided by affordable, reliable and<br />

dependable electricity.<br />

Each of these traits is a key factor in the success of<br />

<strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong> (<strong>WFEC</strong>), which in<br />

<strong>2011</strong> marked its 70 th year of “Generating Through Time.”<br />

<strong>2011</strong> was a productive year in many ways, from<br />

the continuing support of organizational goals to the<br />

building of valuable financial relationships. However,<br />

it will also likely be a year remembered most for its<br />

challenging and record-setting weather extremes.<br />

Growth & Sales<br />

Looking back at <strong>2011</strong> from the regional market<br />

perspective, it was a year of record-setting statistics.<br />

New records were set for Oklahoma weather for low and<br />

high temperatures and days above 100 degrees. Drought<br />

conditions plagued a large section of the service territory<br />

for much of the summer. All of these factors influenced<br />

record <strong>WFEC</strong> peak demands and energy sales.<br />

Although much of the national economy continued<br />

in a recessionary mode, <strong>WFEC</strong> member and municipal<br />

kilowatt-hour (kWh) sales grew approximately 5.8% in<br />

<strong>2011</strong>, compared to about 3% growth in the previous year.<br />

In August <strong>2011</strong>, <strong>WFEC</strong> recorded a new total system<br />

hourly peak of 1,582 megawatts (MW), eclipsing the<br />

8 Generating<br />

Through Time

onship Building & Record-Setting Extremes<br />

prior year system peak of 1,509 MW by 73 MW or 5%.<br />

More significantly, the <strong>2011</strong> peak hour occurred during<br />

summer conditions, at a time when peak day load<br />

reductions considerably reduced the potential peak.<br />

<strong>WFEC</strong> and its member distribution cooperatives<br />

continue to utilize the demand management programs<br />

deployed over the last decade to improve efficiencies.<br />

These programs provided over 80 MW of peak load<br />

reduction in <strong>2011</strong>. Together with other <strong>WFEC</strong><br />

programs, such as distributed generation, municipal<br />

generation and load curtailment, the <strong>WFEC</strong> system can<br />

remove up to approximately 150 MW of load during<br />

peak periods to improve overall system efficiency.<br />

On the other hand, in 2010, the peak occurred<br />

during the winter when peak day load reductions<br />

were not being called upon. This factor supports the<br />

determination that <strong>WFEC</strong> load is indeed growing<br />

despite the weather variant.<br />

Many of our member distribution cooperatives have<br />

experienced significant growth, much of it oil and gas<br />

related. In <strong>2011</strong>, <strong>WFEC</strong> member cooperatives signed<br />

agreements for approximately 75 MW of new load. A<br />

portion of this load was connected to the electric system<br />

immediately; however, the remaining portion requires<br />

upgrades to <strong>WFEC</strong>’s transmission and distribution<br />

system, again pointing to continuing growth potential.<br />

Power sales to members and cities in <strong>2011</strong> were<br />

approximately $427 million. This reflects a slight<br />

(Continued on Page 10)<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 9<br />

(Continued on Page 10)

(Continued from Page 9)<br />

increase of only $9 million, or 2%, as compared to<br />

2010 sales. This small increase reflects the support in<br />

2010 of about $16.5 million of revenue deferred from<br />

prior years.<br />

Energy Resources<br />

Active participation by staff within the Southwest<br />

Power Pool’s (SPP) working groups has contributed to<br />

<strong>WFEC</strong>’s preparedness for the future market. Known as<br />

the Integrated Market (IM), it has a projected start date<br />

of March 2014. The first version of these market rules,<br />

released in April <strong>2011</strong>, is continuously evolving and is<br />

anticipated to affect every aspect of electrical service.<br />

In addition, rules of the current SPP Energy Imbalance<br />

Market (EIM), launched in February 2007, present<br />

another focus of staff’s efforts as the 30 th version of<br />

these rules was in place for <strong>2011</strong>.<br />

Diversification of fuels, purchased power and<br />

renewable resources have been among <strong>WFEC</strong>’s<br />

priorities and strategies, in an effort to minimize the<br />

impact of fuel volatility and environmental regulation.<br />

Generation diversity offers protection against increased<br />

prices of any single fuel source. <strong>WFEC</strong>’s strategy<br />

includes the purchase of fuels on a deliberate and<br />

planned schedule. The schedule takes into account<br />

projected member loads, fuel needs and purchased<br />

power opportunities. <strong>WFEC</strong>’s fuel risk management<br />

strategy focuses on catastrophic protection and provides<br />

a measure of protection against significant price<br />

increases in natural gas, while participating more fully<br />

in price decreases.<br />

<strong>WFEC</strong> practices a conservative budget strategy to<br />

serve load with owned generation. The cooperative<br />

coordinates power supply to members in the SPP<br />

market, which adds to reliability and helps achieve<br />

greater value of generating assets. <strong>WFEC</strong> takes<br />

advantage of lower-priced economic purchases and<br />

sales of excess energy, when available, by utilizing the<br />

bilateral spot market and SPP EIM. Market purchases<br />

of energy represented approximately 24% of <strong>WFEC</strong>’s<br />

total energy during <strong>2011</strong>.<br />

Internal staff reviews day-to-day resource planning<br />

in collaboration with Aces Power Marketing (APM)<br />

to position <strong>WFEC</strong> assets for reliable energy service<br />

to its members. APM, owned by <strong>WFEC</strong> and other<br />

electric cooperatives, serves as an agent for, and<br />

works with, <strong>WFEC</strong> in a concerted effort to schedule<br />

the physical assets, including contract purchases, as<br />

well as generation from natural gas and coal, while<br />

participating extensively in the power marketplace.<br />

This relationship also focuses on risk management<br />

policies, counterparty credit analysis, locating<br />

transmission liquidity, market participation and new<br />

market readiness, identification of potential new<br />

counterparties, hedging activity and standardized<br />

contracts.<br />

Power Production<br />

Staff provided support for a safe and secure<br />

workplace by assessing and managing safe work<br />

practices and training. All of <strong>WFEC</strong> power generation<br />

employees, operating and maintaining 15 generating<br />

units at three locations, achieved an accident-free <strong>2011</strong>.<br />

The diverse energy<br />

mix, self-generated and<br />

purchased, actual versus<br />

budgeted by <strong>WFEC</strong><br />

during <strong>2011</strong> included:<br />

<strong>2011</strong> Actual <strong>2011</strong> Budget<br />

Coal 36% 45%<br />

Gas 16% 22%<br />

Economy Purchases 24% 6%<br />

Contract Purchases 7% 7%<br />

Hydro 8% 8%<br />

Other* 9% 12%<br />

Total 100% 100%<br />

* Energy generated by wind facilities for which <strong>WFEC</strong> does<br />

not retain or retire all of the environmental attributes.<br />

10 Generating<br />

Through Time

Building upon this accomplishment, staff is pursuing<br />

the development of a safety management system to<br />

facilitate compliance with safety and security standards.<br />

Like the utility industry as a whole, <strong>WFEC</strong> faces<br />

numerous employee retirements in the near future.<br />

As part of preparing new employees, a state-ofthe-art<br />

online, self-paced training curriculum that<br />

allows employees and apprentices to access hundreds<br />

of courses related to power plant operations and<br />

maintenance has also been developed.<br />

Hugo Plant:<br />

There were no major outages scheduled in <strong>2011</strong>;<br />

however, there were two planned load reductions,<br />

during spring and fall, to perform maintenance on<br />

plant equipment.<br />

Coal and Transportation<br />

Maintaining an adequate coal supply to <strong>WFEC</strong>’s<br />

coal-fired Hugo Plant can oftentimes range from<br />

routine to challenging during any given year. In<br />

<strong>2011</strong>, coal supply proved challenging as a result<br />

of unprecedented flooding in the upper Midwest,<br />

disrupting railroad traffic and delivery of coal. These<br />

conditions literally put railroad tracks under water and<br />

even washed away portions of the tracks all together for<br />

more than five months.<br />

Using coal supplies stored at the plant site, some<br />

planned offloading of the plant and<br />

rerouting of trains, <strong>WFEC</strong> was able to<br />

keep the facility online without any fuelrelated<br />

interruptions.<br />

Also in <strong>2011</strong>, favorable long-term rail<br />

transportation delivery services and base<br />

coal supply agreements were put in place.<br />

These agreements will provide security<br />

of supply for this important asset and<br />

continue to position the Hugo facility<br />

as a competitively priced generation<br />

resource for the future.<br />

Anadarko Plant:<br />

Combined Cycle Units 4 and 5 both<br />

had combustion inspections in <strong>2011</strong>,<br />

with the generator rotor from Unit 5<br />

being shipped for a rewind in December.<br />

Mooreland Plant:<br />

Mooreland Unit 2 underwent a<br />

major outage and generator rewind and<br />

new cooling towers were installed for<br />

Unit 1 during the year.<br />

(Continued on Page 12)<br />

A 140,000 pound generator housing is<br />

tilted to an impressive 90 degree angle<br />

for repair work during an overhaul of<br />

Mooreland Plant Unit 2. This overhaul<br />

began in September <strong>2011</strong>, continuing<br />

until January 2012.<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 11

(Continued from Page 11)<br />

Environmental Regulations:<br />

New and proposed aggressive regulations by the<br />

Environmental Protection Agency (EPA) continue<br />

to present challenges, with a significant potential to<br />

impact <strong>WFEC</strong> operations, resulting in increased cost<br />

and complexity associated with timely evaluation and<br />

modeling of the potential impacts and the most costeffective<br />

compliance solutions. The Cross State Air<br />

Pollution Rule (CSAPR) and Mercury and Air Toxics<br />

Standards (MATS) are two proposed guidelines with<br />

fast-approaching compliance deadlines. Originally,<br />

CSAPR required compliance in May 2012, but since<br />

has been delayed by legal challenges, leaving compliance<br />

deadlines unclear. To achieve the original May 2012<br />

deadline, <strong>WFEC</strong> contracted to install dry low NOx<br />

burners on three Anadarko gas-fired generating units.<br />

Since litigation has delayed the compliance deadline,<br />

<strong>WFEC</strong> plans to install the burners on Anadarko Units<br />

4 and 6 in 2012 and on Unit 5 in 2013. The combined<br />

installed cost at Anadarko is estimated at $16.5 million.<br />

As for the Hugo Plant, plant staff undertook a study<br />

to prepare for the MATS regulation, anticipating a<br />

requirement to install mercury controls in 2014.<br />

<strong>WFEC</strong>’s environmental team obtained necessary<br />

environmental permits for existing and future<br />

generation resources, while ensuring compliance with<br />

operating permits.<br />

Generation Resource Planning<br />

As a generation and transmission (G&T)<br />

cooperative, <strong>WFEC</strong>’s core responsibilities include<br />

providing reliable and affordable power for its members’<br />

current needs, while identifying and planning the<br />

necessary resources to meet future requirements.<br />

Even with the implementation of a number of<br />

member-wide energy-efficiency programs and <strong>WFEC</strong>’s<br />

demand side management programs, a much greater<br />

system load growth was experienced in <strong>2011</strong> than was<br />

forecast. <strong>WFEC</strong> met these <strong>2011</strong> demands seamlessly,<br />

utilizing our diverse fleet of generators and through<br />

purchases of market energy.<br />

Integration of the uncharacteristic increase in the<br />

<strong>2011</strong> demand into ongoing <strong>WFEC</strong> member cooperative<br />

load forecasts further emphasizes the need for additional<br />

capacity in the 2017 time frame. Resource planning<br />

A technician adjusts instrumentation for testing at the<br />

Hugo Plant stack. These tests provide baseline numbers<br />

about the plant’s emissions to determine compliance with<br />

future EPA rules and regulations.<br />

continues to evaluate those needs through either selfbuild<br />

or market options.<br />

Power Delivery<br />

Member growth also created the need for upgrades<br />

and new construction of substations and transmission<br />

lines in <strong>2011</strong>. Reliability oriented projects, primarily<br />

involving <strong>WFEC</strong>’s switch stations, were a key focus for<br />

the transmission and distribution crews.<br />

A large transmission project that will increase<br />

reliability in the northern part of <strong>WFEC</strong>’s system and<br />

allow distribution cooperative members to increase load<br />

and improve reliability was also supported. This project<br />

will address tremendous planned load growth in north<br />

central and northwestern Oklahoma.<br />

Additionally, a new approach to contracting for<br />

services was developed to augment current staff. This<br />

will enable a number of transmission and distribution<br />

projects to be completed more timely.<br />

The final repairs due to the 2009 tornado that<br />

ripped through the transmission and distribution<br />

maintenance facility were completed during the year.<br />

This building was reoccupied at year-end <strong>2011</strong>.<br />

(Continued on Page 14)<br />

12 Generating<br />

Through Time

<strong>2011</strong> <strong>WFEC</strong> Statistics<br />

2007<br />

2008<br />

2009<br />

2010<br />

<strong>2011</strong><br />

Equity<br />

(Millions of Dollars)<br />

$112<br />

$130<br />

$146<br />

$170<br />

$187<br />

Equity growth is intended to<br />

ensure that <strong>WFEC</strong> remains a<br />

robust resource for members and a<br />

financially strong player attractive<br />

to lenders as the balance sheet grows.<br />

<strong>WFEC</strong>’s equity balance grew to<br />

$187 million as of year-end. The<br />

equity growth prior to <strong>2011</strong> was a<br />

result of earnings. Equity in <strong>2011</strong><br />

was boosted by the first year of equity<br />

contributions by four new members.<br />

Coincident Peak Demand<br />

(Megawatts)<br />

A reflection of the growth, coincident<br />

peak demand tipped the scale at<br />

1,582 MW, establishing a new<br />

all-time peak demand on Aug. 3,<br />

<strong>2011</strong>. This summer peak surpassed<br />

the previous record coincident peak<br />

demand set in the winter of 2010,<br />

by 5%<br />

1,308<br />

1,392<br />

1,366<br />

1,444<br />

1,352<br />

1,455 1,479<br />

1,509<br />

1,499<br />

1,582<br />

2007 2008 2009 2010 <strong>2011</strong><br />

Winter<br />

Summer<br />

Energy Sales to Members and Municipals<br />

(Millions of kWhs)<br />

2007<br />

2008<br />

2009<br />

2010<br />

336 6,468 6,804<br />

306 6,807 7,113<br />

310 6,860 7,170<br />

216 7,156 7,372<br />

Rural Oklahoma growth is an<br />

important ingredient in <strong>WFEC</strong>’s<br />

past and future strategic goals,<br />

with exciting challenges and new<br />

opportunities becoming evident<br />

for many parts of the state. Some<br />

municipal contracts have been<br />

allowed to expire to provide for<br />

members’ load needs.<br />

<strong>2011</strong><br />

161 7,638 7,799<br />

Municipal<br />

Member<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 13

(Continued from Page 12)<br />

Ron Cunningham (left),<br />

vice president, power<br />

delivery, and Terry<br />

Lisenbery, lead station<br />

technician, discuss progress<br />

at the Cana Substation,<br />

which was completely<br />

destroyed by a tornado passing through the area on May 24. This facility serves the Devon Energy Cana Gas Plant, located<br />

west of El Reno. Shown in the background, working with a transformer, are Rex Mathis and Mark Palesano, journeyman<br />

station technicians, and Jeramy Tackett, apprentice station technician. (Photo inset) Mark Palesano guides crews working at<br />

the substation site.<br />

Electronic communication systems continue<br />

to be a focal point for <strong>WFEC</strong> and its members. A<br />

dialogue with member cooperative managers regarding<br />

necessary system upgrades to accommodate automation<br />

requirements resulted in a study to develop a longrange<br />

communication plan.<br />

Also during the year, staff initiated a project to<br />

develop a system to access and maintain 360 degree<br />

photographs for virtual tours of all <strong>WFEC</strong> substations<br />

and switch stations. The tour will identify equipment<br />

and nameplate data to be shared with <strong>WFEC</strong> and<br />

members’ employees for purposes of improved<br />

communications in the field, maintenance activities,<br />

employee training, troubleshooting and knowledge<br />

retention.<br />

A secondary power feed to the headquarters<br />

complex was designed and installed to improve the<br />

reliability of headquarters’ operations. Additional efforts<br />

to improve <strong>WFEC</strong> efficiencies and operation included<br />

a transmission maintenance system that will be used to<br />

track transmission system assets and to schedule, record<br />

and track system maintenance and testing activities.<br />

Copper and other metal thefts are costly and time<br />

consuming issues that <strong>WFEC</strong> and other electric and<br />

public service utilities are facing. <strong>WFEC</strong> has supported<br />

the Oklahoma Association of <strong>Electric</strong> <strong>Cooperative</strong>s,<br />

which has taken a leading role in organizing the copper<br />

theft task force in Oklahoma. The task force meetings<br />

have been well attended by law enforcement, public<br />

officials, salvage dealers and utilities. The efforts are<br />

focused on reducing theft activity and may result<br />

in legislative efforts aimed at preventing theft. New<br />

Mexico legislature is also considering a proposed law<br />

intended to regulate salvage of metals and deter thieves.<br />

Relationship Building & Indenture Mortgage<br />

Over the next several years, <strong>WFEC</strong> has plans to<br />

add capacity through owned plants or purchase power<br />

agreements (PPAs) needed to serve growing member<br />

loads and incremental sales to the New Mexico<br />

members. <strong>WFEC</strong>’s goal is to continue to develop and<br />

14 Generating<br />

Through Time

maintain a power supply portfolio that includes a mix<br />

of renewable, gas-fired and coal-fired resources and<br />

a delivery system that will supply its members with<br />

reliable and reasonably priced power.<br />

With a strategic planning horizon, <strong>WFEC</strong><br />

maintains target financial ratios that are deemed<br />

appropriate to ensure adequate liquidity, equity and<br />

debt service coverage (DSC) ratios to support the<br />

additional debt that will be needed to fund system<br />

projects. The target ratios influence management and<br />

the Board of Trustees in establishing annual budgets<br />

and setting rates. <strong>WFEC</strong>’s financial policies are<br />

intended to enable the financing of all future projects<br />

with an appropriate mix of debt and equity while<br />

maintaining strong financial ratios.<br />

To support its need for access to capital, in an<br />

historic move on April 8, <strong>2011</strong>, <strong>WFEC</strong> adopted a<br />

mortgage indenture (Indenture) to replace its existing<br />

joint mortgage with the Rural Utilities Service<br />

(RUS), CoBank, ACB (CoBank)<br />

and National Rural Utilities<br />

<strong>Cooperative</strong> Finance Corporation<br />

(CFC). The Indenture closely<br />

models those indentures recently<br />

adopted by other G&Ts and offers<br />

opportunities that are a departure<br />

from the practices used since the<br />

cooperative’s inception. While the<br />

Indenture preserves access to RUS<br />

guaranteed financing, it sets the<br />

strategic environment to provide<br />

greater access to a broader range<br />

of capital sources in a more timely<br />

fashion when RUS financing is<br />

not an option. This will help in<br />

providing greater certainty of<br />

meeting <strong>WFEC</strong>’s capital needs and<br />

supporting strong credit ratings.<br />

The Indenture provides a more<br />

predictable approach to issuance<br />

of additional secured debt, subject<br />

to objective, mechanical tests.<br />

The result is a more streamlined<br />

approach to lending partners as<br />

<strong>WFEC</strong> moves forward in financing<br />

its capital program. <strong>WFEC</strong> believes<br />

that long-standing financial<br />

relationships will continue to be important while new<br />

relationships will be formed that will provide additional<br />

options and flexibility for the future.<br />

Line of Credit Syndication<br />

To increase access to liquidity in preparation for<br />

serving an increased volume of sales and developing<br />

capacity, a short-term $100 million CoBank revolving<br />

facility was replaced with a $200 million four-year<br />

unsecured committed syndicated line of credit.<br />

<strong>WFEC</strong> selected CoBank to act as lead arranger and<br />

administrative agent for this effort, and the process<br />

offered an opportunity to build relationships with other<br />

financial institutions active in the cooperative utility<br />

sector. The syndication was over-subscribed by $60<br />

million and one of the terms of the agreement provides<br />

a feature to upsize the facility an additional $50 million<br />

(Continued on Page 16)<br />

Peter Fozzard (center) speaks to <strong>WFEC</strong> personnel regarding a newly adopted<br />

mortgage indenture (Indenture) and Rural Utilities Service (RUS) Loan Contract<br />

that will affect <strong>WFEC</strong> loan practices and numerous typical employee activities.<br />

Within <strong>WFEC</strong>, power requirement studies, construction work plans and financial<br />

forecasts will still require Board approval, for example. However, when RUS<br />

financing is not the preferred option, <strong>WFEC</strong> will now have greater access to a<br />

broader range of capital sources subject to objective, mechanical tests. This typically<br />

represents a much quicker time frame for approval. The model for <strong>WFEC</strong>’s new<br />

Indenture is based on those recently adopted by other G&Ts. Fozzard is a law<br />

partner with Sutherland Asbill & Brennan LLP.<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 15

(Continued from Page 15)<br />

During <strong>2011</strong>, RUS approved a loan guarantee<br />

commitment in the amount of $184.1 million for the<br />

purpose of financing certain <strong>WFEC</strong> generation and<br />

transmission projects planned for the 2012 to 2015<br />

construction work plan period.<br />

Capital Budget<br />

Approximately $37 million was expended for<br />

capital construction efforts in <strong>2011</strong> for normal<br />

transmission additions and replacements and for<br />

generation system improvement projects.<br />

In comparison, the $72 million 2012 capital<br />

budget includes approximately $38 million for<br />

transmission additions, upgrades and expansion efforts<br />

for increased oil and gas activity in northern Oklahoma<br />

as well as generation projects at each plant location.<br />

These projects include dry low NOx burner conversions<br />

for certain Anadarko units to address approaching EPA<br />

compliance deadlines.<br />

The $72 million 2012 capital budget includes<br />

approximately $38 million for transmission additions,<br />

upgrades and expansion efforts for increased oil and gas<br />

activity in northern Oklahoma.<br />

with additional commitments from existing lenders<br />

or new commitments from other financial institutions<br />

under certain conditions. With this facility and a $75<br />

million revolving facility with CFC, <strong>WFEC</strong> is well<br />

positioned for normal operating needs, bridge financing<br />

for immediate and on-going construction efforts and to<br />

take advantage of market opportunities.<br />

Liquidity is also supported by a Board strategy to<br />

maintain a fuel hedging program to protect against<br />

catastrophic prices, a banked fuel balance to moderate the<br />

volatility of fuel prices to its members and a contingent<br />

cash reserve for significant unbudgeted events.<br />

Loans<br />

Approximately $36 million in Federal Financing<br />

Bank (FFB) loan funds were advanced at an<br />

approximate weighted average long-term fixed rate of<br />

3.3% with maturities ranging from 2024 to 2043.<br />

Financial Performance<br />

<strong>WFEC</strong> reported a net margin of $10.5 million in<br />

<strong>2011</strong>, compared with $24.0 million in 2010, which<br />

included approximately $16.5 million of deferred<br />

revenue from prior years. A positive operating margin<br />

target was also achieved.<br />

<strong>WFEC</strong>’s DSC ratio in <strong>2011</strong> and 2010 was 1.13 and<br />

1.20, respectively, exceeding the 1.1 minimum target.<br />

The equity-to-assets ratio was 16.7% and 15.5% at<br />

year-end <strong>2011</strong> and 2010, respectively. <strong>WFEC</strong> has a goal<br />

of not permitting this ratio to fall below 15% through<br />

2017, as a substantial multi-year capital expenditure<br />

program is implemented. Members’ equity increased<br />

in <strong>2011</strong> due to the normal margin impact, but also<br />

due to the first year of equity contributions from New<br />

Mexico members. These equity contribution payments<br />

are determined by <strong>WFEC</strong>’s projected capital resource<br />

additions or purchase power contract, or share thereof,<br />

required to supply power and energy to the respective<br />

cooperative.<br />

In <strong>2011</strong>, the cooperatives contributed<br />

approximately $6.3 million in equity to <strong>WFEC</strong>,<br />

which was directly assigned to their respective<br />

patronage accounts. The target DSC ratio and<br />

minimum equity ratio are intended to ensure that<br />

<strong>WFEC</strong> remains a robust resource for members and a<br />

16 Generating<br />

Through Time

financially strong player attractive to lenders as the<br />

balance sheet grows.<br />

In addition, <strong>WFEC</strong> monitors its annual margins<br />

for interest (MFI) ratio that is defined in its mortgage<br />

Indenture. A minimum annual MFI ratio of 1.10 is<br />

required in order to permit the issuance of secured<br />

obligations under the Indenture. The annual MFI ratio<br />

was 1.29 and 1.78 for <strong>2011</strong> and 2010, respectively.<br />

The variable components of the rate schedule<br />

for members that are adopted each year during the<br />

annual budget are intended to cover <strong>WFEC</strong>’s cost<br />

of service and meet target financial ratios. <strong>WFEC</strong><br />

reviews its financial position each month with the<br />

Board of Trustees, which may make adjustments to<br />

certain components of the member rate schedule<br />

during the year in order to meet financial targets and<br />

other objectives.<br />

Wholesale Power Contracts<br />

Strong credit ratings are an important tool<br />

for accessing capital as <strong>WFEC</strong> embarks on its<br />

next significant construction phase and validates<br />

the members’ ownership purpose in their G&T<br />

cooperative. <strong>WFEC</strong>’s financial stability, a key to<br />

strong credit ratings, is based on its long-term, allrequirements<br />

contracts with member-owners and our<br />

combined financial strength.<br />

In March <strong>2011</strong>, <strong>WFEC</strong>’s Standard and Poor’s<br />

“BBB+” rating was affirmed and the outlook revised<br />

to positive from negative. This action reflected steps<br />

taken to restructure the 2001 financial lease, the<br />

addition of four distribution cooperative members,<br />

the increasing diversity of power supply resources and<br />

mechanisms for timely cost recovery. When combined<br />

with its FitchRatings “A-” (stable) ratings, <strong>WFEC</strong><br />

management anticipates access to capital markets on<br />

favorable terms.<br />

Twenty-one of 23 cooperative members have allrequirements<br />

contracts through 2050, with the two<br />

remaining members’ contracts effective into 2025.<br />

These commitments facilitate long-term planning to<br />

meet <strong>WFEC</strong>’s energy and financing needs. In <strong>2011</strong>,<br />

the distribution cooperative members with contracts<br />

through 2050 represented 83% of <strong>WFEC</strong> member<br />

cooperative sales. There were no sales to the New<br />

Mexico members in 2010 or <strong>2011</strong>.<br />

Upgrades to the switch station, located adjacent to the<br />

Anadarko Plant, were among the many transmission,<br />

switch and substation projects completed during <strong>2011</strong>.<br />

Energy Resources<br />

A new wholesale tariff and rate structure, R-15(a),<br />

was developed in cooperation with members and<br />

implemented in April <strong>2011</strong>. The new tariff is designed<br />

to provide a range of demand and energy surcharge<br />

rates that will provide adequate recovery for projected<br />

costs associated with the National <strong>Electric</strong> Reliability<br />

Council (NERC) compliance costs, the full cost of<br />

permanent long-term financing of the Bob Orme<br />

Combustion Turbine Plant, charges for escalating<br />

demand associated with long-term PPAs and projected<br />

costs associated with a 2001 financial lease amendment,<br />

which had previously been covered by deferred revenue<br />

in 2010. Members were billed an average price of $53.93<br />

per MWh in <strong>2011</strong> compared with $52.73 per MWh in<br />

2010. There was no rate change budgeted for 2012.<br />

(Continued on Page 18)<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 17

(Continued from Page 17)<br />

<strong>WFEC</strong> line crews work to rebuild transmission structures destroyed by a spring tornado. A nearby home and<br />

adjacent buildings were completely leveled by the same storm that blew through the area west of Fairview,<br />

Oklahoma. (Photo inset) Journeyman Power Line Technician Vince Lalli drills into a rebuilt cross arm<br />

structure. Several spring tornadoes destroyed homes and transmission structures across Oklahoma.<br />

Human Resources<br />

<strong>WFEC</strong> continues to prepare for the effects of<br />

experienced employees retiring. <strong>WFEC</strong> enrolled its first<br />

eight participants in the new Growing Leaders Program<br />

to develop internal talent for future opportunities<br />

at <strong>WFEC</strong>. This program, requiring two years to<br />

complete, provides training courses that support the<br />

goals identified in the participant’s individual needs<br />

assessments and participation in several additional on<br />

and off-site activities.<br />

Benefit plan design and cost management strategies<br />

played an important role in meeting the <strong>WFEC</strong> Board<br />

of Trustees’ targets for controlling employee benefit<br />

costs, while continuing to offer competitive benefit<br />

packages to attract and retain qualified employees.<br />

Staff continued to meet or exceed the Board’s cost<br />

targets while providing flexibility and opportunities for<br />

employees to partially fund programs with tax savings.<br />

Meeting cost management goals is facilitated by<br />

increasing numbers of employees and retirees choosing<br />

consumer-directed health care consisting of high<br />

deductible health plans, combined with health savings<br />

accounts.<br />

Risk Management<br />

Risk management staff spent a significant portion<br />

of <strong>2011</strong> directing and assisting with the physical repairs<br />

and insurance recovery associated with recent storm<br />

damage. This damage was caused by the direct hit of a<br />

tornado in the spring of 2009 and hail storms in 2010.<br />

The damages from the tornado and hail storms were in<br />

excess of $16 million and recovery is now essentially<br />

complete. More recently, the May 24, <strong>2011</strong> tornado<br />

outbreak that swept across parts of the <strong>WFEC</strong> service<br />

territory destroyed the Mooreland Power Plant Unit 1<br />

Cooling Tower and the Cana Substation.<br />

Fortunately for consumers, <strong>2011</strong> natural gas prices<br />

continued to decline, seeing a 70% drop since 2008.<br />

<strong>WFEC</strong>’s risk management strategy allows its members<br />

to enjoy lower costs as a result of participation in the<br />

move to lower prices. <strong>WFEC</strong> continues to review<br />

and revise, as warranted, its fuel hedging strategy to<br />

minimize associated costs.<br />

Hydro and wind energy deliveries, with their more<br />

stable pricing, have also reduced exposure to volatile<br />

fuel prices. <strong>WFEC</strong>’s portfolio of wind will again<br />

be expanded in 2012 due to the renewable energy<br />

18 Generating<br />

Through Time

purchase agreement for the output of the 150<br />

MW Rocky Ridge Wind Project in western<br />

Oklahoma, planned for operation in late spring<br />

2012.<br />

Marketing & Communication<br />

In <strong>2011</strong>, <strong>WFEC</strong> member cooperatives sold<br />

19,022,700 kWh hours of energy generated by<br />

local wind resources to Oklahoma cooperative<br />

consumers through the WindWorks® program.<br />

This is a 15% increase compared to 2010. The<br />

WindWorks® program is just one way that<br />

<strong>WFEC</strong> is promoting renewables. Other ways<br />

include events to support Earth Day awareness<br />

and the promotion of energy efficiency<br />

websites, such as “Together We Save.”<br />

Education regarding the development,<br />

value, limitations and challenges associated<br />

with renewable energy is essential.<br />

<strong>2011</strong> marked the completion of two<br />

years of the <strong>WFEC</strong> Energy Efficiency<br />

Rebate Program targeting more efficient<br />

commercial and residential heating and<br />

cooling. Upon evaluation of the results of<br />

the program to date, necessary changes were identified<br />

that will help attain load reduction goals. <strong>WFEC</strong><br />

and its member distribution systems are working to<br />

implement those changes to the program to enhance its<br />

success.<br />

<strong>WFEC</strong> continues to use the Touchstone Energy®<br />

brand to offer services and benefits to rural electric<br />

consumers. For the third straight year, the Co-op<br />

Connections® Card Program provided rural electric<br />

consumers in Oklahoma savings on prescriptions<br />

exceeding $1 million. This success has spurred new<br />

national programs offering member consumers savings<br />

on vision, dental and hearing products and services.<br />

Much of <strong>2011</strong> was focused on the development<br />

of the new “Member’s Only” section of the <strong>WFEC</strong><br />

corporate website as a primary tool for acquiring<br />

information. Another endeavor in <strong>2011</strong> for the<br />

Touchstone Energy brand was the title sponsorship<br />

of a streaming video network used by over 40 schools<br />

across Oklahoma and New Mexico. This network has<br />

been, and will be, used to stream everything from high<br />

school sporting events to graduation ceremonies over<br />

Key account managers, commercial customers, cooperative<br />

representatives and industry-related vendors took part in the annual<br />

Emerging Technology Conference that was hosted over a two-day<br />

period in late August. This popular event was hosted by <strong>WFEC</strong>, with<br />

the support of its member Touchstone Energy <strong>Cooperative</strong>s. Various<br />

speakers addressed a wide range of topics during the conference that<br />

is designed to allow networking opportunities and discuss innovative<br />

ideas and cooperative services.<br />

the Internet. This is just another example of how the<br />

rural electric cooperatives work to improve the standard<br />

of living in rural Oklahoma.<br />

Conclusion<br />

Overall, <strong>2011</strong> offered some challenging, but<br />

innovative and exciting, times. As usual, weatherrelated<br />

events were in the forefront of the year, with<br />

drought, tornadoes, powerful thunderstorms and<br />

extreme heat taking its toll across <strong>WFEC</strong>’s service<br />

territory. However, work continued for both <strong>WFEC</strong><br />

and its cooperatives.<br />

Preparations continued to be made for the future<br />

with the potential to strategically bolster <strong>WFEC</strong><br />

and all of its members into the electrical industry of<br />

tomorrow. Members can be assured that their G&T<br />

will continue its strong and loyal commitment to<br />

provide cost-effective, reliable and quality service,<br />

with a dedicated focus on future progress.<br />

wfec<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 19

<strong>WFEC</strong> Board of Trustees<br />

Bob S. Allen<br />

President<br />

Harmon <strong>Electric</strong><br />

Association<br />

David Ray<br />

Vice President<br />

Kiamichi <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Mike Lebeda<br />

Secretary/Treasurer<br />

Kay <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Rusty Grissom<br />

Asst. Secretary/Treasurer<br />

Oklahoma <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Max W. Ott<br />

Alfalfa <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Bob Thomasson<br />

Caddo <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Gary Crain<br />

Canadian Valley<br />

<strong>Electric</strong> <strong>Cooperative</strong><br />

Charles G. Wagner<br />

Central Valley <strong>Electric</strong><br />

<strong>Cooperative</strong> (NM)<br />

<strong>WFEC</strong> is<br />

governed by<br />

a 24-member<br />

Board of Trustees,<br />

including a<br />

representative<br />

from each<br />

member<br />

system & Altus<br />

Air Force Base.<br />

Bob Holley<br />

Choctaw <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Russell D. Pollard<br />

Cimarron <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Charles Spencer<br />

Cotton <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

20 Generating<br />

Through Time

Jerry Rempe<br />

East Central Oklahoma<br />

<strong>Electric</strong> <strong>Cooperative</strong><br />

Michael B. West<br />

<strong>Farmers</strong>’ <strong>Electric</strong><br />

<strong>Cooperative</strong> (NM)<br />

Leslie Hinds<br />

Kiwash <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

John Ingle<br />

Lea County <strong>Electric</strong><br />

<strong>Cooperative</strong> (NM)<br />

Charles Hickey<br />

Northfork <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Ray O. Smith<br />

Northwestern <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Jack Lambert<br />

People’s <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

King Martin<br />

Red River Valley Rural<br />

<strong>Electric</strong> Association<br />

Jerry W. Partin<br />

Roosevelt County<br />

<strong>Electric</strong> <strong>Cooperative</strong> (NM)<br />

Gary Jones<br />

Rural <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Lloyd G. Owens<br />

Southeastern <strong>Electric</strong><br />

<strong>Cooperative</strong><br />

Fred J. Stowe<br />

Southwest Rural <strong>Electric</strong><br />

Association<br />

<strong>WFEC</strong> <strong>Annual</strong> <strong>Report</strong> 21

<strong>WFEC</strong><br />

Senior Management<br />

A qualifed senior management level staff, with an impressive<br />

combined 208 years of service with <strong>WFEC</strong>, oversee the daily<br />

operations of the G&T.<br />

Each vice president and senior manager has particular areas<br />

of expertise within the electric utility industry, providing<br />

valuable years of experience for <strong>WFEC</strong> overall and for its<br />

member cooperatives<br />

Gary Roulet<br />

Chief Executive Officer<br />

Ron Cunningham<br />

Vice President<br />

Power Delivery<br />

Gary Gilleland<br />

Vice President<br />

Generation<br />

Brian Hobbs<br />

Vice President<br />

Legal & Corporate Services<br />

Jane Lafferty<br />

Vice President<br />

& Chief Financial Officer<br />

Dan Fleming<br />

Senior Manager<br />

Resource Planning<br />

Roy Klusmeyer<br />

Senior Manager<br />

Regional Market Planning<br />

22 Generating<br />

Through Time

KPMG LLP<br />

210 Park Avenue, Suite 2850<br />

Oklahoma City, OK 73102-5683<br />

Independent Auditors’ <strong>Report</strong><br />

Board of Trustees<br />

<strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong>:<br />

We have audited the accompanying consolidated balance sheets of <strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong><br />

(<strong>WFEC</strong>) and subsidiaries as of December 31, <strong>2011</strong> and 2010, and the related consolidated statements of<br />

operations, changes in members’ equity and comprehensive income, and cash flows for the years then<br />

ended. These consolidated financial statements are the responsibility of <strong>WFEC</strong>’s management. Our<br />

responsibility is to express an opinion on these consolidated financial statements based on our audits.<br />

We conducted our audits in accordance with auditing standards generally accepted in the United States of<br />

America. Those standards require that we plan and perform the audit to obtain reasonable assurance about<br />

whether the financial statements are free of material misstatement. An audit includes consideration of<br />

internal control over financial reporting as a basis for designing audit procedures that are appropriate in the<br />

circumstances, but not for the purpose of expressing an opinion on the effectiveness of <strong>WFEC</strong>’s internal<br />

control over financial reporting. Accordingly, we express no such opinion. An audit also includes<br />

examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements,<br />

assessing the accounting principles used and significant estimates made by management, as well as<br />

evaluating the overall financial statement presentation. We believe that our audits provide a reasonable<br />

basis for our opinion.<br />

In our opinion, the consolidated financial statements referred to above present fairly, in all material<br />

respects, the financial position of <strong>WFEC</strong> as of December 31, <strong>2011</strong> and 2010, and the results of their<br />

operations and their cash flows for the years then ended, in conformity with U.S. generally accepted<br />

accounting principles.<br />

March 6, 2012<br />

KPMG LLP is a Delaware limited liability partnership,<br />

the U.S. member firm of KPMG International <strong>Cooperative</strong><br />

(“KPMG International”), a Swiss entity.<br />

23

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Consolidated Balance Sheets<br />

December 31, <strong>2011</strong> and 2010<br />

(In thousands)<br />

Assets <strong>2011</strong> 2010<br />

<strong>Electric</strong> utility plant, at cost:<br />

In-service $ 1,352,795 1,325,257<br />

Construction work-in-progress 27,554 27,653<br />

Total electric utility plant 1,380,349 1,352,910<br />

Less accumulated depreciation and amortization 592,388 572,387<br />

Net electric utility plant 787,961 780,523<br />

Investments in associated organizations and other investments,<br />

at cost 125,039 118,766<br />

Current assets:<br />

Cash and cash equivalents 2,449 3,840<br />

Restricted cash 31,428 23,530<br />

Accounts receivable from energy sales 36,995 34,592<br />

Other accounts receivable 15,900 16,229<br />

Inventories, at average cost:<br />

Coal and oil 16,731 22,426<br />

Material and supplies 42,890 43,026<br />

Other 3,905 3,662<br />

Total current assets 150,298 147,305<br />

Other noncurrent assets 1,272 1,272<br />

Deferred debits 53,050 53,958<br />

Total assets $ 1,117,620 1,101,824<br />

Members’ Equity and Liabilities<br />

Capitalization:<br />

Patronage capital $ 180,610 170,331<br />

Contributed capital 6,256 —<br />

Long-term debt 828,437 784,058<br />

Total capitalization 1,015,303 954,389<br />

Current liabilities:<br />

Current portion of long-term debt 37,012 31,126<br />

Accounts payable and accrued liabilities 57,183 61,364<br />

Short-term notes payable — 46,678<br />

Total current liabilities 94,195 139,168<br />

Other liabilities 8,122 8,267<br />

Commitments and contingencies (note 13)<br />

Total members’ equity and liabilities $ 1,117,620 1,101,824<br />

See accompanying notes to consolidated financial statements.<br />

24

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Consolidated Statements of Operations<br />

Years ended December 31, <strong>2011</strong> and 2010<br />

(In thousands)<br />

<strong>2011</strong> 2010<br />

Operating revenues:<br />

Power sales to members and cities $ 427,270 417,959<br />

Other power sales and operating revenues 35,625 37,693<br />

Total operating revenues 462,895 455,652<br />

Operating expenses:<br />

Operations:<br />

Production 161,011 170,481<br />

Purchased and interchanged power 142,977 121,353<br />

Transmission 44,243 39,300<br />

Distribution 5,204 4,980<br />

General and administrative 15,383 14,091<br />

Maintenance 17,643 19,817<br />

Depreciation and amortization 31,294 30,299<br />

Total operating expenses 417,755 400,321<br />

Operating margin before interest 45,140 55,331<br />

Interest expense, less amounts capitalized during construction<br />

of approximately $855 and $1,032 in <strong>2011</strong> and 2010, respectively (43,177) (40,395)<br />

Interest income 6,678 7,008<br />

Operating margin 8,641 21,944<br />

Other nonoperating margin (loss), net (294) 280<br />

Patronage capital assigned by associated organizations 2,116 1,731<br />

Net margin $ 10,463 23,955<br />

See accompanying notes to consolidated financial statements.<br />

25

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Consolidated Statements of Changes in Members’ Equity and Comprehensive Income<br />

Years ended December 31, <strong>2011</strong> and 2010<br />

(In thousands)<br />

Accumulated<br />

other<br />

Patronage Contributed comprehensive<br />

Memberships capital capital income (loss) Total<br />

Balance, December 31, 2009 $ 2 148,864 — (2,752) 146,114<br />

Net margin — 23,955 — 23,955<br />

Change in fair value of derivative<br />

financial instrument — — — (1,374) (1,374)<br />

Reclassification adjustment of<br />

derivative losses reclassified<br />

into interest expense — — — 1,224 1,224<br />

Change in net asset associated with<br />

postretirement benefit plan — — — 412 412<br />

Total comprehensive income 24,217<br />

Balance, December 31, 2010 2 172,819 — (2,490) 170,331<br />

Net margin — 10,463 — — 10,463<br />

Contributed capital — — 6,256 — 6,256<br />

Change in fair value of derivative<br />

financial instrument — — — (1,593) (1,593)<br />

Reclassification adjustment of<br />

derivative losses reclassified<br />

into interest expense — — — 1,147 1,147<br />

Change in net asset associated with<br />

postretirement benefit plan — — — 262 262<br />

Total comprehensive income 16,535<br />

Balance, December 31, <strong>2011</strong> $ 2 183,282 6,256 (2,674) 186,866<br />

See accompanying notes to consolidated financial statements.<br />

26

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Consolidated Statements of Cash Flows<br />

Years ended December 31, <strong>2011</strong> and 2010<br />

(In thousands)<br />

<strong>2011</strong> 2010<br />

Cash flows from operating activities:<br />

Net margin $ 10,463 23,955<br />

Adjustments to reconcile net margin to net cash provided by operating activities:<br />

Depreciation 28,330 27,335<br />

Other depreciation included in operating expenses 1,876 1,820<br />

Amortization of regulatory asset expense 2,964 2,964<br />

Accretion of asset retirement obligation 78 71<br />

Noncash interest income (5,456) (5,829)<br />

Noncash interest expense 5,344 5,717<br />

Deferred (recognized) revenue — (16,530)<br />

Changes in assets and liabilities:<br />

Restricted cash (7,898) (283)<br />

Accounts receivable from energy sales (2,403) (1,004)<br />

Other accounts receivable 329 (9,071)<br />

Coal and oil inventory 5,695 (1,740)<br />

Materials and supplies inventory 136 3,064<br />

Other current assets (243) (2,386)<br />

Deferred debits and other 1,693 (788)<br />

Accounts payable and accrued liabilities (2,402) (13,551)<br />

Other liabilities (407) 775<br />

Net cash provided by operating activities 38,099 14,519<br />

Cash flows from investing activities:<br />

Net extension and replacement of electric utility plant (39,190) (52,141)<br />

Proceeds from use of restricted cash – Special Construction Fund (SCF) — 24,757<br />

Proceeds from liquidation of lease securities — 78,083<br />

Purchase of lease securities held to maturity — (102,840)<br />

Net cash used in investing activities (39,190) (52,141)<br />

Cash flows from financing activities:<br />

Advances of long-term debt 238,216 63,432<br />

Payments on long-term debt (191,838) (29,010)<br />

Advances of short-term debt 351,279 549,617<br />

Payments on short-term debt (397,957) (545,049)<br />

Net cash (used in) provided by financing activities (300) 38,990<br />

Net decrease in cash and cash equivalents (1,391) 1,368<br />

Cash and cash equivalents, beginning of year 3,840 2,472<br />

Cash and cash equivalents, end of year $ 2,449 3,840<br />

Supplemental schedule of cash flow information:<br />

Cash paid during the year for interest $ 38,372 27,777<br />

Supplemental schedule of noncash financing and investing activities:<br />

Lease-leaseback amendments<br />

Deferral of loss on restructure of lease-leaseback $ 1,179 (40,687)<br />

Adjustments in present value of long-term debt related to lease-leaseback<br />

restructure — 3,942<br />

Loss on restructure of lease-leaseback — 36,745<br />

See accompanying notes to consolidated financial statements.<br />

27

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Notes to Consolidated Financial Statements<br />

December 31, <strong>2011</strong> and 2010<br />

(1) Summary of Significant Accounting Policies<br />

(a)<br />

Nature of Operations<br />

<strong>Western</strong> <strong>Farmers</strong> <strong>Electric</strong> <strong>Cooperative</strong> (<strong>WFEC</strong>) is a generation and transmission cooperative<br />

headquartered in Anadarko, Oklahoma. <strong>WFEC</strong> owns and operates five generating plants, fueled by<br />

coal and gas, three located in Anadarko, one in Mooreland, Oklahoma, and one near Hugo,<br />

Oklahoma. <strong>WFEC</strong> also owns and maintains more than 3,650 miles of transmission line. <strong>WFEC</strong> has a<br />

combined capacity of over 1,700 megawatts, including hydropower allocation. With the addition of<br />

four New Mexico cooperatives in 2010, member-owners consist of 23 distribution cooperatives and<br />

a United States Air Force base. Substantially all of <strong>WFEC</strong>’s assets are currently located in Oklahoma<br />

and substantially all revenue is related to Oklahoma operations. See note 13 for further information<br />

related to the addition of and sales to the New Mexico cooperatives.<br />

(b)<br />

(c)<br />

(d)<br />

Basis of Presentation<br />

<strong>WFEC</strong> maintains its accounting records in accordance with the Uniform System of Accounts of the<br />

United States Department of Agriculture Rural Development Utilities Programs (RDUP), formerly<br />

known as the Rural Utilities Service, which conforms with U.S. generally accepted accounting<br />

principles in all material respects. These consolidated financial statements reflect the transactions of<br />

<strong>WFEC</strong> and its wholly owned subsidiaries, <strong>WFEC</strong> Railroad Company and <strong>WFEC</strong> EnergyCo, LLC<br />

(EnergyCo). <strong>WFEC</strong> GenCo, LLC (GenCo) is a wholly owned subsidiary of EnergyCo. All<br />

significant intercompany balances and transactions have been eliminated upon consolidation. The<br />

more significant accounting policies of <strong>WFEC</strong> are described below.<br />

Use of Estimates<br />

The preparation of financial statements in conformity with U.S. generally accepted accounting<br />

principles requires management to make estimates and assumptions that affect the reported amounts<br />

of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the<br />

financial statements and the reported amounts of revenues and expenses during the reporting period.<br />

Actual results could differ from those estimates.<br />

<strong>Electric</strong> Utility Plant<br />

<strong>Electric</strong> utility plant is stated at original cost. The capitalized cost of additions to electric utility plant<br />

includes the cost of material, direct labor, contract services, and various other indirect charges, such<br />

as engineering, supervision and overhead costs, and interest on funds used during construction.<br />

Retirements or other dispositions of electric utility plant are based on an average unit cost that is<br />

deducted from plant and, together with removal costs less salvage, is charged to accumulated<br />

depreciation. The cost of repairs and minor renewals is charged to maintenance expense in the period<br />

incurred.<br />

28<br />

(Continued)

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Notes to Consolidated Financial Statements<br />

December 31, <strong>2011</strong> and 2010<br />

Provision for depreciation of electric utility plant is computed on the straight-line method at rates<br />

based on estimated service lives and salvage values of the class of property. These rates are applied<br />

on a composite class basis. <strong>Annual</strong> depreciation rates used in <strong>2011</strong> and 2010 are as follows:<br />

Production plant 0.79 – 17.04%<br />

Transmission plant 2.75 – 10.00%<br />

Distribution plant 2.88 – 10.00%<br />

General plant 3.00 – 33.33%<br />

Depreciation and amortization for the year ended December 31, <strong>2011</strong> was $33,170,000, of which<br />

$28,330,000 was charged to depreciation expense, $1,876,000 was included in fuel and other<br />

operating expenses, and $2,964,000 was charged to amortization of regulatory assets. Depreciation<br />

and amortization for the year ended December 31, 2010 was $32,119,000, of which $27,335,000 was<br />

charged to depreciation expense, $1,820,000 was included in fuel and other operating expenses, and<br />

$2,964,000 was charged to amortization of regulatory assets.<br />

<strong>WFEC</strong> periodically reviews the carrying values of its utility plant assets for impairment whenever<br />

events or changes in circumstances indicate the carrying amount of an asset or group of assets may<br />

not be recoverable through the future net cash flows expected to be generated by the asset or group<br />

of assets. If such assets are considered impaired, the impairment is recognized by the extent that<br />

carrying value exceeds fair value.<br />

(e)<br />

(f)<br />

Capitalization of Interest<br />

Interest costs are capitalized as part of the cost of various capital assets under construction. <strong>WFEC</strong><br />

uses the weighted average rate of interest associated with long-term borrowings. Interest charged to<br />

construction during <strong>2011</strong> and 2010 totaled $855,000 and $1,032,000, respectively.<br />

Restricted Cash<br />

Restricted cash consists of the following:<br />

<br />

<br />

A Contingent Cash Reserve (CCR) that is restricted by <strong>WFEC</strong> Board Policy to be utilized<br />

based upon certain significant events or other approved uses as determined by the Board. The<br />

CCR had a balance of $22,790,000 and $21,896,000 as of December 31, <strong>2011</strong> and 2010,<br />

respectively.<br />

A Cushion of Credit (Unapplied Advance Payment) account with the RDUP. As an RDUP<br />

borrower, <strong>WFEC</strong> may participate in the RDUP Cushion of Credit Program, which allows<br />

voluntary prepayment of debt. These advance payments are held on behalf of <strong>WFEC</strong> and earn<br />

interest at 5% per annum. The prepaid account balance and earned interest may only be used<br />

for debt service on loans made or guaranteed under the Rural Electrification Act. The Cushion<br />

of Credit account had a balance of $29,048,000, of which $22,790,000 represents CCR funds<br />

as of December 31, <strong>2011</strong>, and $17,359,000 as of December 31, 2010 which represented a<br />

portion of the CCR balance.<br />

(Continued)<br />

29

WESTERN FARMERS ELECTRIC COOPERATIVE<br />

Notes to Consolidated Financial Statements<br />

December 31, <strong>2011</strong> and 2010<br />

<br />

Other cash accounts with funds that are restricted as to withdrawal for various purposes had a<br />

total balance of $2,380,000 and $1,634,000 as of December 31, <strong>2011</strong> and 2010, respectively.<br />

(g)<br />

(h)<br />

(i)<br />

(j)<br />

(k)<br />

<br />

A Debt Service Reserve account that is set aside in case of default on an interest and/or<br />

principal payment of long-term debt. The Debt Service Reserve account had a balance of<br />

$1,272,000 as of December 31, <strong>2011</strong> and 2010, and is reflected as other noncurrent assets in<br />

the accompanying financial statements.<br />

Cash and Cash Equivalents<br />

For purposes of reporting cash flows, cash and cash equivalents include unrestricted cash on hand<br />

and investments purchased with original maturities of three months or less.<br />

Investments in Associated Organizations<br />

Investments in associated organizations are stated at cost plus <strong>WFEC</strong>’s share of patronage capital<br />

credits allocated, reduced by distributions received.<br />

Inventories<br />

Inventories of coal and oil, and materials and supplies of <strong>WFEC</strong> are valued at average cost. These<br />

inventories are consumed by <strong>WFEC</strong>’s operations or utilized as additions to electric utility plant and<br />

are not held for resale.<br />

Emission Allowances<br />

In accordance with the Federal Clean Air Act, <strong>WFEC</strong> has received an annual allocation of<br />

SO 2 (sulfur dioxide) emission allowances from the Environmental Protection Agency as part of a<br />

nationwide program to limit SO 2 emissions. An allowance provides authority to emit one ton of SO 2 .<br />