PDF 1.27 MB - Barrick Gold Corporation

PDF 1.27 MB - Barrick Gold Corporation

PDF 1.27 MB - Barrick Gold Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

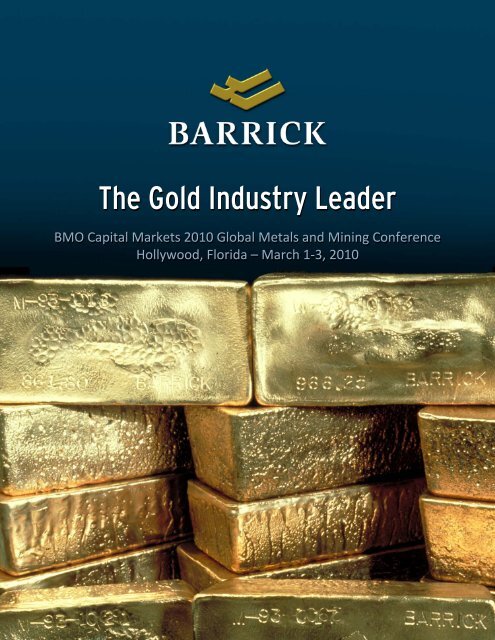

The <strong>Gold</strong> Industry Leader<br />

BMO Capital Markets 2010 Global Metals and Mining Conference<br />

Hollywood, Florida –March 1‐3, 2010

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION<br />

Certain information contained in this presentation, including any information as to our strategy, plans or future financial or<br />

operating performance and other statements that express management's expectations or estimates of future performance,<br />

constitute "forward-looking statements”. All statements, other than statements of historical fact, are forward-looking<br />

statements. The words “believe”, "expect", "will", “anticipate”, “contemplate”, “target”, “plan”, “continue’, “budget”, “may”,<br />

“intend”, “estimate” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily<br />

based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently<br />

subject to significant business, economic and competitive uncertainties and contingencies. The Company cautions the reader<br />

that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the<br />

actual financial results, performance or achievements of <strong>Barrick</strong> to be materially different from the Company's estimated<br />

future results, performance or achievements expressed or implied by those forward-looking statements and the forwardlooking<br />

statements are not guarantees of future performance. These risks, uncertainties and other factors include, but are not<br />

limited to: the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and<br />

liabilities based on projected future cash flows; changes in the worldwide price of gold, copper or certain other commodities<br />

(such as silver, fuel and electricity); fluctuations in currency markets; changes in U.S. dollar interest rates; risks arising from<br />

holding derivative instruments; ability to successfully complete announced transactions and integrate acquired assets;<br />

legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or<br />

technical difficulties in connection with mining or development activities; employee relations; availability and increasing costs<br />

associated with mining inputs and labor; the speculative nature of exploration and development, including the risks of<br />

obtaining necessary licenses and permits and diminishing quantities or grades of reserves; adverse changes in our credit<br />

rating; level of indebtedness and liquidity; contests over title to properties, particularly title to undeveloped properties; and<br />

the risks involved in the exploration, development and mining business. Certain of these factors are discussed in greater<br />

detail in the Company’s most recent Form 40-F/Annual Information Form on file with the U.S. Securities and Exchange<br />

Commission and Canadian provincial securities regulatory authorities.<br />

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of<br />

new information, future events or otherwise, except as required by applicable law.

Key Priorities and Progress<br />

• Meet production and cost targets<br />

– met gold and copper guidance<br />

– 7.4 M oz at total cash costs of $466 per ounce (1)<br />

– 393 M lbs at total cash costs of $1.17/lb (1)<br />

• Ensure low cost, advanced projects remain on track<br />

– Cortez Hills, Pueblo Viejo and Pascua-Lama advancing<br />

construction on time and budget<br />

• Grow reserves through disciplined Corporate Development<br />

and Exploration<br />

– grew reserves for 4th consecutive year<br />

• Ensure continued license to operate<br />

– relisted on Dow Jones Sustainability Indexes (World and North<br />

America) in 2009<br />

– 25% improvement in lost time injury rate<br />

(1) See final slide #1<br />

1<br />

Key Priorities and Progress<br />

• Focus on high performing global organization<br />

– completed organization review; expect annualized<br />

savings of >$50 million<br />

• Eliminate gold hedges<br />

– completely eliminated in Q4 2009<br />

• Maintain financial strength<br />

– “A” credit rating, substantial liquidity<br />

• Deliver bottom line financial results<br />

– record adjusted net income of $1.8 B ($2.00/share) (1)<br />

– record adjusted operating cash flow of $2.9 B (1)<br />

– adjusted ROE increased to 12%<br />

(1) See final slide #1<br />

2

<strong>Gold</strong>’s Diversifying Role<br />

Trailing 10 year performance to February 25, 2010<br />

<strong>Gold</strong><br />

+278.1%<br />

CRB Index<br />

+30.7 %<br />

Source: Bloomberg<br />

–15.6%<br />

MSCI World<br />

Equity Index<br />

–17.3%<br />

S&P<br />

3<br />

Global FX Reserves<br />

• 2/3 of FX reserves are in US dollars<br />

• FX reserves are exploding<br />

US$ trillions<br />

8<br />

7<br />

6<br />

• $6 trillion<br />

held by 19<br />

countries<br />

China<br />

2.2<br />

5<br />

4<br />

3<br />

2<br />

$5<br />

trillion<br />

increase<br />

2002-2009<br />

Japan 1.0<br />

Taiwan 0.5<br />

Russia 0.4<br />

1<br />

0<br />

79 89 99 09<br />

Source: DundeeWealth Economics<br />

2009<br />

4

Net Official Sector Sales<br />

(tonnes of gold)<br />

479<br />

663<br />

365<br />

484<br />

• Net official sector<br />

sales dropped<br />

to 44 tonnes in 2009<br />

• Net buying in last<br />

three quarters<br />

236<br />

2009<br />

62<br />

04<br />

05<br />

06<br />

07<br />

08<br />

Q1<br />

Q2<br />

Q3<br />

Q4<br />

Source: GFMS, World <strong>Gold</strong> Council<br />

-5<br />

-9<br />

-4<br />

5<br />

Scarcity Value<br />

US$ trillions<br />

60<br />

Global Financial Assets<br />

total $117 trillion<br />

60<br />

50<br />

40<br />

30<br />

Equities<br />

declined by<br />

45% in 2008<br />

Equities<br />

Private<br />

Debt<br />

Govt.<br />

Debt<br />

Managed<br />

Assets<br />

$40 trillion<br />

50<br />

40<br />

30<br />

20<br />

20<br />

10<br />

0<br />

Sources: McKinsey & Company, IMF, Barclays, Bloomberg, Dundee Wealth Economics (1) As at Feb. 25, 2010<br />

<strong>Gold</strong> Equities<br />

& <strong>Gold</strong> ETFs<br />

Outlook ‐ Bullish on <strong>Gold</strong><br />

• Price supportive macroeconomic environment:<br />

– low interest rates<br />

– increased liquidity<br />

– sovereign debt<br />

– fiscal policies<br />

• Growth in investment demand<br />

• Diversification benefits<br />

• Central banks become net buyers<br />

• Mine supply expected to contract<br />

• Scarcity value<br />

7<br />

2010 Outlook<br />

ounces<br />

millions<br />

7.4<br />

7.6-8.0<br />

higher production and<br />

lower costs expected in 2010 (1)<br />

US$/oz<br />

$466<br />

$425-$455<br />

Total cash costs<br />

• Net of African<br />

<strong>Barrick</strong> <strong>Gold</strong> IPO<br />

6.5<br />

(1) See final slide #5<br />

2009 2010<br />

2009 2010<br />

400<br />

8

Margin Expansion<br />

Total Cash Costs (1) vs <strong>Gold</strong> Prices<br />

US$ per ounce<br />

985<br />

872<br />

429<br />

519<br />

~1100 Current Spot<br />

645-<br />

675<br />

Margin (1)<br />

439<br />

214<br />

225<br />

545<br />

265<br />

280<br />

621<br />

276<br />

345<br />

443<br />

466<br />

425-<br />

455<br />

Total Cash Cost<br />

Avg. Realized Price (1) 10<br />

05 06 07 08 09<br />

(1) See final slide #1<br />

10E<br />

9<br />

Margin Expansion<br />

Net Total Cash Costs (1) (1) vs vs<strong>Gold</strong> Prices<br />

US$ per ounce<br />

Avg. Realized Price (1)<br />

872<br />

535<br />

985<br />

622<br />

564<br />

~1100 Current Spot<br />

725-<br />

755<br />

Margin (1)<br />

439<br />

214<br />

545<br />

344<br />

225 201<br />

621<br />

393<br />

228<br />

337<br />

363<br />

345-<br />

375<br />

Net Cash Cost<br />

05 06 07 08<br />

(1) See final slide #1<br />

09<br />

10E

Reserves & Resources (1)<br />

ounces millions<br />

12.4<br />

17.6<br />

88.6<br />

24.9<br />

35.0<br />

123.1<br />

31.9<br />

50.6<br />

124.6<br />

34.8<br />

65.0<br />

138.5<br />

31.6<br />

Inferred<br />

Resources<br />

61.8<br />

M+I<br />

Resources<br />

139.8<br />

P&P<br />

Reserves<br />

• Grew reserves<br />

for the fourth<br />

consecutive<br />

year<br />

• <strong>Gold</strong> industry’s<br />

largest<br />

unhedged<br />

reserves<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

(1) At Dec. 31, 2009. See final slide #3<br />

11<br />

History of Reserve Growth<br />

THROUGH ACQUISITION AND EXPLORATION<br />

proven and probable – millions of ounces<br />

• Spent $2.1B on exploration to find<br />

~$59B (135 Moz @ $438/oz)<br />

• Overall finding cost ~$15.50/oz<br />

135<br />

TOTAL<br />

EXPLORA-<br />

TION<br />

~140<br />

20<br />

100<br />

Divestitures<br />

1990 2009<br />

TOTAL<br />

MINED<br />

103<br />

TOTAL<br />

ACQUIRED<br />

18 Moz<br />

12

Balanced Portfolio<br />

2010E Production<br />

North America<br />

39%<br />

Africa 8%<br />

South<br />

America<br />

28% Australia<br />

Pacific<br />

25%<br />

North<br />

America<br />

South<br />

America<br />

2009 P&P Reserves<br />

North America<br />

40%<br />

South<br />

America<br />

35%<br />

Africa<br />

12%<br />

Australia<br />

Pacific<br />

13%<br />

Africa<br />

Australia<br />

Pacific<br />

• Industry’s Largest Reserves and Production<br />

Mine<br />

Project<br />

13<br />

History of Project Execution<br />

• Proven track record of<br />

successful development<br />

of reserves and resources<br />

FEASIBILITY<br />

Exploration Pipeline<br />

Kabanga<br />

Donlin Creek<br />

Reko Diq<br />

Cerro Casale<br />

Pascua-Lama<br />

CONSTRUCTION<br />

Pueblo Viejo<br />

Cortez Hills<br />

Buzwagi 2009<br />

PRODUCTION<br />

Ruby Hill 2007<br />

Cowal 2006<br />

Veladero 2005<br />

Lagunas Norte 2005<br />

Tulawaka 2005<br />

Bulyanhulu 2001<br />

Pierina 1998<br />

<strong>Gold</strong>strike Complex 1989<br />

14

Impact of Low Cost Mines<br />

• Three new low cost<br />

mines expected to<br />

come on stream over<br />

the next three years<br />

~2.4<br />

million<br />

low cost<br />

ounces (1)<br />

+<br />

+<br />

CERRO CASALE<br />

REKO DIQ<br />

CORTEZ<br />

HILLS<br />

PUEBLO<br />

VIEJO<br />

PASCUA-<br />

LAMA<br />

+<br />

+<br />

DONLIN CREEK<br />

KABANGA Nickel<br />

2010<br />

2011<br />

2013<br />

(1) See final slide #4<br />

15<br />

Cortez Hills Project Update<br />

• Construction expected<br />

to be completed in line<br />

with $500 M capital<br />

budget (1)<br />

• 1.08-1.12 Moz at<br />

total cash costs of<br />

$295-$315/oz in 2010 (1)<br />

• Motion filed by <strong>Barrick</strong><br />

for a limited<br />

preliminary injunction<br />

Process Stockpile<br />

(1) See final slide #2 and #5<br />

Completed Conveyor<br />

16 16

Cortez Hills Project Update<br />

Mining in the Open Pit<br />

Heavy Equipment<br />

Commissioned<br />

Completed Truck Shop<br />

Crusher and Reinforced Earth Wall<br />

17<br />

Pueblo Viejo Project Update<br />

• 625-675 Koz to <strong>Barrick</strong>’s<br />

account (60%) (1)<br />

• Total cash costs of<br />

$250-$275/oz (1,2)<br />

• $3.0 B capital budget (1)<br />

(100%) includes<br />

accelerated expansion<br />

to 24,000 tpd<br />

• ~60% of capital committed<br />

• On track for first<br />

production Q4 2011<br />

(1) See final slide #2 (2) See final slide #1<br />

Plantsite Construction<br />

Ball Mill Section<br />

18

Pascua‐Lama Project Update<br />

• 750-800 Koz of gold<br />

at total cash costs<br />

of $20-$50/oz (1,2)<br />

• 35 Moz of silver (1)<br />

• On track for first<br />

production Q1 2013<br />

Truck Shop/Conveyor Area Excavation<br />

Barriales Camp Expansion<br />

• +25% of capital<br />

committed<br />

• In line with $2.8-$3.0 B<br />

capital budget (1)<br />

(1) See final slide #2 (2) See final slide #1 19<br />

Cerro Casale Project Update<br />

• First full 5 years (75%):<br />

– 750-825 K oz gold and<br />

170-190 M lbs copper (1)<br />

– Total cash costs of<br />

$240-$260/oz (1,2)<br />

• Life-of-mine (75%):<br />

– 600-650 K oz gold and<br />

170-190 M lbs copper (1)<br />

– Total cash costs of<br />

$140-$160/oz (1,2)<br />

• ~$4.2 B pre-production<br />

capital budget (100%) (1)<br />

• ~3 year construction period<br />

• ~20 year mine life<br />

(1) See final slide #2 (2) See final slide #1<br />

20

Cerro Casale Project Update<br />

• Acquiring additional 25% interest for $475 M<br />

• Increases metal leverage – adds 5.8 M oz Au and<br />

1.4 B lbs Cu (1)<br />

• Gives <strong>Barrick</strong> control of large, long life project in<br />

attractive region<br />

• Benefits from regional synergies<br />

(1) Copper contained within gold reserves. See final slide #3<br />

21<br />

Projects in Feasibility<br />

<strong>Gold</strong><br />

<strong>Barrick</strong>’s share<br />

of resources (1)<br />

M oz<br />

DONLIN CK.<br />

6.4<br />

Inferred<br />

9.5<br />

M&I<br />

2.6<br />

REKO DIQ<br />

18.4<br />

Reko Diq, Pakistan (37.5%)<br />

• Feasibility being finalized and is<br />

under review<br />

Donlin Creek, Alaska (50%)<br />

• Evaluating gas pipeline option<br />

• Review expected to be<br />

completed by mid-2010<br />

Kabanga, Tanzania (50%)<br />

• One of the world’s largest<br />

undeveloped nickel sulfide<br />

deposits<br />

Copper Nickel<br />

<strong>Barrick</strong>’s share<br />

of resources (1)<br />

B lbs B lbs<br />

REKO DIQ<br />

8.4<br />

Inferred<br />

11.7<br />

M&I<br />

KABANGA<br />

0.5<br />

Inferred<br />

1.1<br />

M&I<br />

(1) See final slide #3<br />

22

Strong Financial Position<br />

A-Rated<br />

$2.6B<br />

$1.5B<br />

0.18:1<br />

$2.9B (1)<br />

Industry’s Highest Rated Balance Sheet<br />

Cash Balance<br />

Undrawn Line of Credit<br />

Net Debt to Total Capitalization<br />

Strong Cash Flow Generation<br />

(1) Adjusted operating cash flow. See final slide #1<br />

All figures as of Dec. 31, 2009<br />

23<br />

African <strong>Barrick</strong> <strong>Gold</strong><br />

• Creation of independent company<br />

• Will hold <strong>Barrick</strong>’s African gold mines and<br />

exploration properties<br />

• Initial public offering of ~25%<br />

• <strong>Barrick</strong> to retain remaining interest<br />

• Primary listing to be sought on London Stock<br />

Exchange; intention to pursue future listing on<br />

Dar es Salaam Stock Exchange<br />

24

African <strong>Barrick</strong> <strong>Gold</strong><br />

• Business model customized to Africa<br />

• Benefits from <strong>Barrick</strong> support and expertise<br />

• <strong>Barrick</strong> participates in value creation through its<br />

+70% interest post IPO<br />

• The return of capital to <strong>Barrick</strong> will provide<br />

increased financial capacity to fund <strong>Barrick</strong>’s<br />

significant pipeline of projects<br />

25<br />

African <strong>Barrick</strong> <strong>Gold</strong><br />

• Four producing mines plus exploration properties<br />

• 2009 reserves of 16.8 M oz (1) (100%)<br />

• 2010e production of 800,000-850,000 oz (100%)<br />

• Strong balance sheet with $280 million of cash<br />

and no debt post IPO<br />

• Experienced management team and strong Board<br />

• Closing expected by end of March 2010<br />

(1) See final slide #3<br />

26

In Closing<br />

• Positive on the outlook for gold<br />

• Exceptional leverage to the gold price<br />

– unhedged production and reserves<br />

• Expect higher production, lower cash costs in 2010<br />

• Large and growing resource base<br />

• Deep project pipeline:<br />

– three lower cost, advanced projects on track<br />

– additional four projects in feasibility/permitting stage<br />

• Financial strength<br />

27<br />

Footnotes<br />

1. Net cash costs per ounce, net cash margin per ounce, total cash costs per ounce, cash margin per ounce, total cash costs per<br />

pound, adjusted net income, adjusted operating cash flow and realized price are non-GAAP financial measures with no<br />

standardized meaning under US GAAP. See pages 60-65 of <strong>Barrick</strong>’s Year-End 2009 Report.<br />

2. All references to total cash costs and production are based on first full 5 year average, except where noted. Expected total cash<br />

costs for Cortez Hills, Pueblo Viejo, Pascua-Lama and Cerro Casale are based on $75/bbl oil. Cortez Hills total cash cost and<br />

production estimates include existing Cortez operation. Pueblo Viejo total cash cost estimates are calculated assuming a gold<br />

price of $950/oz. Pascua-Lama total cash cost estimates are calculated assuming a gold price of $800/oz and applying silver<br />

credits assuming a by-product silver price of $12/oz. Cerro Casale total cash cost estimates are calculated assuming a gold price<br />

of $950/oz and applying copper credits assuming a by-product copper price of $2.50/lb for both first full 5 years and LOM. All<br />

‘budget’ references refer to ‘pre-production’ capital budgets on a 100% basis and exclude capitalized interest. Pueblo Viejo preproduction<br />

capital of $3.0B (100% basis) includes $0.3B to complete an accelerated expansion to 24,000 tpd. Pascua-Lama preproduction<br />

capital assumes Chilean peso f/x rate of 550:1; Argentine peso f/x rate of 3.7:1. Cerro Casale pre-production capital<br />

assumes Chilean peso f/x rate of 500:1.<br />

3. Calculated in accordance with National Instrument 43-101 as required by Canadian securities regulatory authorities. For United<br />

States reporting purposes, Industry Guide 7 (under the Securities Exchange Act of 1934), as interpreted by the Staff of the SEC,<br />

applies different standards in order to classify mineralization as a reserve. Accordingly, for U.S. reporting purposes, Cerro Casale<br />

is classified as mineralized material. Cerro Casale and Round Mountain reserves are calculated at $800 per ounce. For a<br />

breakdown of reserves and resources by category and additional information relating to reserves and resources, see pages 126-<br />

131 of <strong>Barrick</strong>’s Year-End 2009 Report.<br />

4. ~2.4 M oz of production is based on the estimated cumulative average annual production once all four mines are at full capacity.<br />

Low cost ounces refers to total cash costs per ounce.<br />

5. Subject to the US District Court allowing Cortez Hills to operate consistent with <strong>Barrick</strong>’s motion for a limited preliminary<br />

injunction of activities.<br />

6. <strong>Barrick</strong>’s exploration programs are designed and conducted under the supervision of Robert Krcmarov, Senior Vice President,<br />

Global Exploration of <strong>Barrick</strong>. For information on the geology, exploration activities generally, and drilling and analysis<br />

procedures on <strong>Barrick</strong>’s material properties, see <strong>Barrick</strong>’s most recent Annual Information Form / Form 40-F on file with<br />

Canadian provincial securities regulatory authorities and the US Securities and Exchange Commission.<br />

28

Appendix<br />

29<br />

El Morro<br />

• <strong>Barrick</strong> disputes that Xstrata or New <strong>Gold</strong><br />

could properly sell the interest to <strong>Gold</strong>corp<br />

• <strong>Barrick</strong> filed an action in Ontario involving<br />

New <strong>Gold</strong>, <strong>Gold</strong>corp and Xstrata<br />

• <strong>Barrick</strong> intends to vigorously pursue its claims<br />

30