Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Annual Report 2005 - Bank am Bellevue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28<br />

Consolidated financial statements<br />

Notes<br />

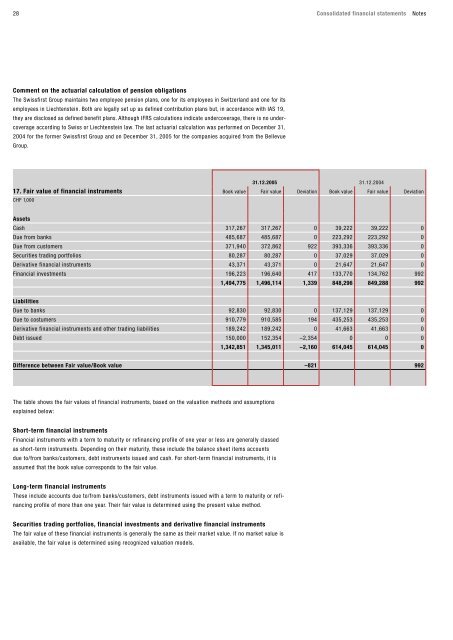

Comment on the actuarial calculation of pension obligations<br />

The Swissfirst Group maintains two employee pension plans, one for its employees in Switzerland and one for its<br />

employees in Liechtenstein. Both are legally set up as defined contribution plans but, in accordance with IAS 19,<br />

they are disclosed as defined benefit plans. Although IFRS calculations indicate undercoverage, there is no undercoverage<br />

according to Swiss or Liechtenstein law. The last actuarial calculation was performed on December 31,<br />

2004 for the former Swissfirst Group and on December 31, <strong>2005</strong> for the companies acquired from the <strong>Bellevue</strong><br />

Group.<br />

31.12.<strong>2005</strong> 31.12.2004<br />

17. Fair value of financial instruments Book value Fair value Deviation Book value Fair value Deviation<br />

CHF 1,000<br />

Assets<br />

Cash 317,267 317,267 0 39,222 39,222 0<br />

Due from banks 485,687 485,687 0 223,292 223,292 0<br />

Due from customers 371,940 372,862 922 393,336 393,336 0<br />

Securities trading portfolios 80,287 80,287 0 37,029 37,029 0<br />

Derivative financial instruments 43,371 43,371 0 21,647 21,647 0<br />

Financial investments 196,223 196,640 417 133,770 134,762 992<br />

1,494,775 1,496,114 1,339 848,296 849,288 992<br />

Liabilities<br />

Due to banks 92,830 92,830 0 137,129 137,129 0<br />

Due to costumers 910,779 910,585 194 435,253 435,253 0<br />

Derivative financial instruments and other trading liabilities 189,242 189,242 0 41,663 41,663 0<br />

Debt issued 150,000 152,354 –2,354 0 0 0<br />

1,342,851 1,345,011 –2,160 614,045 614,045 0<br />

Difference between Fair value/Book value –821 992<br />

The table shows the fair values of financial instruments, based on the valuation methods and assumptions<br />

explained below:<br />

Short-term financial instruments<br />

Financial instruments with a term to maturity or refinancing profile of one year or less are generally classed<br />

as short-term instruments. Depending on their maturity, these include the balance sheet items accounts<br />

due to/from banks/customers, debt instruments issued and cash. For short-term financial instruments, it is<br />

assumed that the book value corresponds to the fair value.<br />

Long-term financial instruments<br />

These include accounts due to/from banks/customers, debt instruments issued with a term to maturity or refinancing<br />

profile of more than one year. Their fair value is determined using the present value method.<br />

Securities trading portfolios, financial investments and derivative financial instruments<br />

The fair value of these financial instruments is generally the s<strong>am</strong>e as their market value. If no market value is<br />

available, the fair value is determined using recognized valuation models.