PTChronicle - October 2012 - PTC India Limited

PTChronicle - October 2012 - PTC India Limited

PTChronicle - October 2012 - PTC India Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOT FOR SALE<br />

<strong>October</strong> <strong>2012</strong><br />

Journal from <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

Regional<br />

Energy Trade<br />

An answer for energy security ?<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 1

2 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

From the<br />

Chairman’s Desk<br />

“A developed <strong>India</strong> by 2020, or even earlier, is not a dream. It<br />

need not be a mere vision in the minds of many <strong>India</strong>ns. It is a<br />

mission we can all take up – and succeed” –<br />

Dr. A P J Abdul Kalam, Former President of <strong>India</strong><br />

Post the economic reforms initiated in the 90’s, the <strong>India</strong>n<br />

economy has been pacing ahead with an unprecedented<br />

economic growth, projecting <strong>India</strong> to be one the leading economic<br />

stalwart by 2020. However, one of the primary bottlenecks in<br />

achieving such sustained growth is the nation’s concern for<br />

energy security. The wavering energy crisis ails <strong>India</strong>'s economic<br />

prowess and may prove detrimental to the country's growth.<br />

FOREWORD<br />

Promotion of Regional Energy Trade, allowing adjacent nations<br />

to utilize and optimize the energy resources available within the<br />

region, is one such initiative that needs to be recognized by the<br />

<strong>India</strong>n Subcontinent. The growing power trading market in <strong>India</strong><br />

is now encouraging investments in countries of Bhutan and<br />

Nepal allowing the surplus power from these projects, to flow in<br />

this market. The possibilities just don’t limit to these regions, but<br />

could be extended to the entirety of South Asia. Sharing of energy<br />

resources will help in meeting the energy demand in the region<br />

and also catalyze economic or financial growth in the region.<br />

This edition of <strong><strong>PTC</strong>hronicle</strong> emphasizes on Regional Power Trade<br />

as a prime solution for grid and energy security, and throws light<br />

on the recent grid failures those that brought nation wide outages.<br />

Editorial Team:<br />

Lavjit Singh, Nirmita Singh, Anupum Vadehra, Varun Sethi,<br />

S C Shukla<br />

Editorial Address:<br />

<strong>PTC</strong> <strong>India</strong> Ltd., 2nd Floor, NBCC Tower, 15, Bhikaji Cama Place,<br />

New Delhi 110066<br />

<strong><strong>PTC</strong>hronicle</strong> takes no responsibility in case of any unsolicited<br />

photographs or material.<br />

<strong><strong>PTC</strong>hronicle</strong> journal is the property of <strong>PTC</strong> <strong>India</strong> Ltd. No part<br />

of this publication or any part of the contents thereof may be<br />

reproduced, stored in a retrieval system, or transmitted in any<br />

form without the written permission from <strong>PTC</strong> <strong>India</strong> Ltd.<br />

Design & Printing by:<br />

Colour Bar Communications, New Delhi<br />

Millions of lives had been daily affected owing to these outages<br />

and the shortfall of energy supply, and yet the question on energy<br />

security still lingers across the corridors of ministries, market<br />

regulators, state commission offices, load schedulers and local<br />

substations. The reason for the largest blackout in the world<br />

was accounted to overdrawal of power by Northen Utilities as<br />

the delay in monsoon triggered higher agrarian demand from<br />

Northern States. From all what was witnessed, there needs to<br />

be effective mechanisms in place for better grid coordination,<br />

frequency monitoring, load forecasting and real time supply for<br />

reducing such grid failures.<br />

This fourth edition of <strong><strong>PTC</strong>hronicle</strong> also includes our maket<br />

analysis and coverage for the past quarter, section reasoning<br />

grid failures, supply chain model for solar renewable industry and<br />

possible reforms brooming the clogs of our energy sector.<br />

We would like to thank all our readers, authors and critics those<br />

providing valuable feedbacks and continued support in helping<br />

us publish yet another resourceful edition for the pleasure and<br />

senses of our esteemed readers.<br />

Wishing you a valuable read<br />

Tantra Narayan Thakur<br />

Chairman & Managing Director<br />

<strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 3

C O N T E N T<br />

POWER SECTOR OUTLOOK 6<br />

CMD of <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

Shri T N Thakur<br />

MARKET WATCH 10<br />

Corporate Development Team<br />

<strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

REGIONAL POWER TRADING 12<br />

Connecting the Lines<br />

Director Finance of <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

Deepak Amitabh<br />

THE POWER BITES 18<br />

Quarterly Sector Coverage<br />

Your feedback is valuable to us. Kindly share them at marketing@ptcindia.com<br />

4 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

CHARGE OF THE LIGHT BRIGADE 24<br />

Former Union Power Minister<br />

Suresh Prabhu<br />

Power Parlance 27<br />

HIGHLIGHTS OF<br />

CERC ANNUAL MARKET<br />

MONITORING REPORT 36<br />

LEARNING FROM TELECOM 38<br />

Supply Chain, R&D key to growth of renewable energy<br />

Assoiate Director TERI<br />

Shahid Hasan<br />

THE NORTH EAST AIDE 29<br />

Summarising Indo-Bhutan & Indo-Nepal<br />

Cross Border Power Trade<br />

Executive Vice President, <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

Harish Saran<br />

THE BLACK OUT 33<br />

Need for a Vibrant Power Market to Avoid<br />

Grid Disturbance<br />

Executive Director, <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

Dr. Rajiv Kumar Mishra<br />

FINANCING POWER PROJECTS 40<br />

Professor of Economics & Energy, MDI<br />

Dr. Atmanand<br />

DISTRIBUTION TARIFF REFORM 44<br />

Missing Link<br />

President- Strategy and Corporate Affairs,<br />

Moser Baer Power Projects Pvt Ltd<br />

Dr. Harish K. Ahuja<br />

All the contents of <strong><strong>PTC</strong>hronicle</strong> are only for general information and/or use. Such contents do not constitute advice and should not be relied upon<br />

in making (or refraining from making) any decision. Any specific advice or replies to queries in any part of the journal is/are the personal opinion<br />

of such experts/consultants/persons and are not subscribed to by <strong>PTC</strong> <strong>India</strong>. <strong><strong>PTC</strong>hronicle</strong> has employed due care and caution in compilation of<br />

data for preparing this journal. The information or data of photographs have been compiled from various sources including newspapers, websites,<br />

etc. <strong><strong>PTC</strong>hronicle</strong> does not guarantee the accuracy, adequacy or completeness of any data/information that was furnished by external reports and<br />

is not responsible for any error or omission or for the results obtained from the use of such data/ information.<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 5

6 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

Opinion<br />

Sh. Tantra Narayan Thakur<br />

Chairman & Managing Director, <strong>PTC</strong> Group<br />

Power<br />

Sector<br />

Outlook<br />

Last year i.e. FY2011-12 was the terminal year of 11th plan.<br />

Generation capacity added during the year was highest ever for<br />

any financial year. Today we have crossed the remarkable figure of<br />

200 GW installed capacity in the country. A large proportion of this<br />

addition came from private sector – 58% in FY12 and 41% in 11th<br />

plan. They have raised the bar of performance by bringing projects<br />

on fast track and efficiently. Private sector initiative in hydro sector<br />

also saw achievement close to the targeted capacity.<br />

In general, power market is growing. Short-term power market<br />

grew by 16% YoY and now constitutes 11% of the total generation<br />

in the country (including Unscheduled Interchange (UI)). Bilateral<br />

segment has shown comparatively higher growth when compared<br />

to power exchanges which shows buyers preference for certainty<br />

and longer visibility. Due to frequency band reduction by CERC,<br />

there has been pressure on UI and it has reduced YoY which is<br />

a positive sign. However, there is a need for further tightening of<br />

UI frequency regime to achieve discipline and avoid kind of grid<br />

disturbances that the country faced on 30th July and 31st July <strong>2012</strong>.<br />

Transmission sector has also grown with construction of many new<br />

transmission lines. Inter-regional transfer capacity has now increased<br />

to 28000 MW. Power Grid has also undertaken development of 11<br />

High Capacity Transmission Corridors to facilitate power transfer<br />

from various upcoming power generation projects near resource<br />

centers.<br />

Renewable Energy (RE) sector’s growth has been prominent in past<br />

few years. Introduction of Renewable Purchase Obligation (RPO)<br />

and Renewable Energy Certificates (RECs) to meet the same has<br />

provided a definite spur in the growth of RE in <strong>India</strong>. Developers have<br />

There is a need<br />

for further<br />

tightening of<br />

UI frequency<br />

regime to<br />

achieve<br />

discipline<br />

and avoid<br />

kind of grid<br />

disturbances<br />

that the<br />

country faced<br />

on 30th July<br />

and 31st July<br />

of <strong>2012</strong><br />

power sector outlook<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 7

RECs are<br />

presently<br />

allowed to be<br />

traded only<br />

on power<br />

exchanges,<br />

which is acting<br />

as a barrier in<br />

utilizing the<br />

full potential<br />

of REC<br />

mechanism<br />

started to come up for power projects banking<br />

their investments on REC mechanism. However<br />

RECs are presently allowed to be traded only on<br />

power exchanges, which is acting as a barrier in<br />

utilizing the full potential of REC mechanism.<br />

Cutting-edge technological interventions, under<br />

the umbrella of Smart Grid solutions, have also<br />

started to take shape. Government has finalized<br />

8 new smart grid pilot projects worth nearly INR<br />

500 crore to be undertaken over the next year and<br />

half.<br />

Despite all these progressive developments,<br />

shortages in the country (both energy as well<br />

as peak) are still high – to the tune of 10%. This<br />

shows that demand growth is outpacing new<br />

capacity additions. It is a challenge before all of<br />

us to bridge this demand-supply gap, optimally<br />

use our energy resources and ensure quality<br />

power for all.<br />

Present Bottlenecks<br />

Scarcity of fuel is a major bottleneck in the<br />

progress of power sector. Apart from coal, output<br />

of domestic gas has been less than what was<br />

projected earlier which was the basis of viability of<br />

many gas based power plants. International prices<br />

for LNG have increased owing to the demand<br />

in Japan, Korea etc. as they have reduced their<br />

dependence on nuclear power after Fukushima<br />

disaster. In <strong>India</strong>, there is a problem in absorbing<br />

the power produced from gas based plants as it<br />

is perceived costly.<br />

Due to gas unavailability, many power plants are<br />

running at sub-standard PLFs. This is a colossal<br />

waste of assets of national importance as we are<br />

not able to utilize them fully.<br />

Finances of distribution utilities is another major<br />

roadblock haunting the sector. Though tariff<br />

revisions have happened in many States in past<br />

couple of years, these have to be sustained in<br />

future to pull the utilities out of red.<br />

Experience of procurement of power through<br />

case-1 bidding has not been satisfactory so far.<br />

Whole process of bidding is mired with issues<br />

like renegotiations, counter offers, cancellation<br />

of bidding processes etc. This has created<br />

uncertainty in the market for IPP projects already<br />

established or are coming in near future.<br />

Due to these issues, overall market sentiment is<br />

low currently. We have to ensure that the good<br />

work done in past few years towards development<br />

of the sector doesn’t get undone. Government<br />

is aiming at more participation from private<br />

sector. But if the bottlenecks of the sector are not<br />

removed, sustained interest from private sector is<br />

at risk. And once lost, it will be very difficult to<br />

bring them on board again and plans may go<br />

haywire.<br />

The Path ahead<br />

Overall outlook is challenging because of the<br />

magnitude of issues in the sector.<br />

Increasing production by CIL to tackle coal<br />

shortage is not easy. It will require more manpower<br />

and state of the art equipments. A wise step<br />

would be to have Joint Ventures (JV) with strong<br />

international partners who will bring their expertise<br />

and equipments for increasing the production.<br />

International coal is available but prices have<br />

increased over the past few years forcing many<br />

developers to put their plans of imported coal<br />

based plants on hold. Also basic infrastructure<br />

capacity for fuel transportation like ports, roads<br />

and railways is not commensurate with the<br />

demand.<br />

In distribution sector, tariff revisions have<br />

happened but it will take a while to realize the<br />

results of those hikes. Moreover, if these turn out<br />

be one time hike only, buyers’ paying capacity<br />

cannot be enhanced. Losses in the distribution<br />

sector (for many States) have been very high since<br />

years. Government bodies including Planning<br />

Commission should devise strategies on how to<br />

bring the losses down in a sustained manner.<br />

Government has made it mandatory to procure<br />

power in short-term also through bidding<br />

procedure. Without removing difficulties in the<br />

long-term procurement (case-1), it may be a<br />

challenge for all the players to make short-term<br />

bidding process successful.<br />

So the next couple of years will be critical for<br />

power sector and will lay the foundation of its<br />

long-term growth.<br />

Overcoming persisting challenges<br />

Since we are a largely coal dependent country,<br />

scarcity of coal is a bigger issue among fuels.<br />

8 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

And to ensure sufficient coal, opening of the sector is very<br />

important. There have been talks going on about a Coal<br />

Regulator but it has not been operationalized yet. Coal<br />

regulator is urgently required to lay down norms of private<br />

participation in coal sector.<br />

Coal production needs to be ramped up which is not<br />

easy as pointed out earlier and it can’t happen overnight.<br />

More manpower (skilled as well as unskilled) coupled with<br />

proper training will be the first step towards increasing the<br />

production.<br />

If we look at China, there is glaring difference in the way<br />

we produce coal. More than 80% of the mines in <strong>India</strong><br />

are open cast mines while it is opposite in case of China.<br />

It is imperative for us to go towards underground mining<br />

(long wall technique) which is environmentally friendlier,<br />

will improve yield and result in better recovery of assets.<br />

It will also help in getting environment clearances faster.<br />

Focus on other types of fuels should also be increased<br />

to relieve pressure from coal. Focus on nuclear power is<br />

a good step. The issue of Nuclear liability clause should<br />

be addressed immediately on the lines of international<br />

liability laws to attract foreign nuclear project developers.<br />

Our country has 5th largest hydro potential in the world<br />

(~150 GW) but the success has not been up to the mark.<br />

Hydro power should be given its due focus from 12th plan<br />

and beyond. Pumped storage schemes should also be<br />

developed to cater to peaking power requirements and<br />

other emergency services.<br />

We have seen increased focus towards Renewable<br />

Energy (RE) sources lately which is a progressive move<br />

considering our high dependence on imported oil & gas<br />

and huge RE potential in the country. Grid parity has<br />

already been achieved in case of wind power and solar<br />

power is also moving in that direction. Distributed solar<br />

generation including rooftops is particularly helpful for<br />

rural areas where grid supply has not been provided yet<br />

and will prove to be a boon for rural development.<br />

Reforms for solution<br />

Tariff revisions should be reflective of cost of supply.<br />

Consumers need to be sensitized about higher tariffs. Also<br />

the revisions should happen regularly to avoid sudden<br />

tariff shocks to the consumers.<br />

Adequate infrastructure should be built to arrest<br />

Aggregate Technical & Commercial (AT&C) losses. Focus<br />

should be given on automation wherever necessary and<br />

redeployment of unskilled labor which has been neglected<br />

so far. State utilities have to make efforts for and ensure<br />

reliable and efficient supply to the consumers.<br />

Regulatory procedures and scrutiny should also be<br />

revisited. The regulators should be exposed to world’s<br />

best practices. Focus should not only be on approving<br />

Annual Revenue Requirement (ARR) but on ensuring<br />

universal obligation of discoms to supply, quality of power<br />

to the consumers etc.<br />

Many a times, State utilities want to build their own power<br />

plants with a view to ensure supply and reduce costs.<br />

However, managing a power plant is totally a different ball<br />

game. There are many private projects coming up which<br />

can cater to utility’s demand at competitive prices. So,<br />

utilities should focus on efficient procurement process<br />

rather than deploying their limited resources on setting up/<br />

managing a power plant.<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 9

MARKET<br />

WATCH<br />

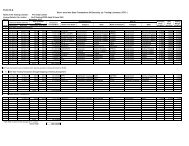

Max. Price : 7.04 Min. Price : 1.91 Avg. Price : 3.76<br />

Daily Prices - <strong>India</strong>n Energy Exchange (IEX)<br />

Weighted Average Prices <strong>2012</strong> (June - August)<br />

Max. Price : 7.17 Min. Price : 1.49 Avg. Price : 3.75<br />

Daily Prices - Power Exchange <strong>India</strong> <strong>Limited</strong> (PXIL)<br />

• OTC prices were lower than IEX and PXIL prices in June and<br />

July of <strong>2012</strong>. This is because of higher prices discovered in<br />

Power Exchanges for Southern Region over congestion in<br />

tranmsission corridors.<br />

• OTC prices were slightly higher than IEX and PXIL prices in<br />

August of <strong>2012</strong> - a premium for certainty in OTC contracts<br />

• Short-term contract volume for June <strong>2012</strong> was 2234.09<br />

MUs, 636.55 MUs in July <strong>2012</strong> and for the month of<br />

August <strong>2012</strong>, 1932.83 MUs.<br />

• Out of the total volume for the period of June-August of<br />

<strong>2012</strong>, 56.5% (2712.67 MUs) was contracted above Rs.<br />

4.00/kWh.<br />

• Banking transactions are increasing in the market<br />

predominantly due to the poor paying capability of<br />

discoms.<br />

Total Short Term Contract Volume <strong>2012</strong> (June - August)<br />

• The market has prefered shorter duration contracts<br />

for the period June-August of <strong>2012</strong> due to prevailing<br />

uncertainties.<br />

• Over the period from June-August of <strong>2012</strong>, <strong>PTC</strong> has led<br />

the market by undertaking 206 contracts (53% of total<br />

market contracts)<br />

Contributed by Coorporate Development Team<br />

<strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

10 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

Total Volume Traded in Short Term vs Total Generation <strong>2012</strong><br />

(May - July)<br />

Volume of Unscheduled Interchange <strong>2012</strong><br />

(May - July)<br />

Top 5 Sellers GUJARAT KHARCHAM WANGTOO Jindal Power Sterlite Energy JAMMU & KASHMIR<br />

Top 5 Buyers<br />

PUNJAB DELHI MAHARASHTRA Haryana WEST BENGAL<br />

• Poor financial health of the buyers make them buy from Power<br />

Exchange only during acute distress.<br />

• Banking transactions have risen as they are cashless<br />

transactions.<br />

• Bilateral (direct) has been increasing as generators do not see<br />

effective payment security with majority of traders.<br />

(Excluding UI)<br />

Percentage of Different Segments in Short Term Market <strong>2012</strong><br />

(May - July)<br />

REC<br />

Price Trends<br />

Non-Solar RECs Volume Details <strong>2012</strong> (June - August)<br />

• Solar RECs commenced trading from May <strong>2012</strong> with volumes yet insignificant<br />

• So far, 910 Solar RECs have been traded over both IEX and PXIL, with prices<br />

ranging from Rs.12500 per REC to Rs.13000 per REC<br />

Source:<br />

CERC Market Monitoring Report<br />

REC Registry <strong>India</strong><br />

<strong>India</strong>n Energy Exchange<br />

Power Exchange <strong>India</strong> Ltd.<br />

Non-Solar RECs Price Trend - PXIL (July 2011 - August <strong>2012</strong>)<br />

Non-Solar RECs Price Trend - IEX (July 2011 - August <strong>2012</strong>)<br />

Market Outlook<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 11

Regional Power Trading<br />

connecting the lines<br />

<strong>India</strong> is aiming to emerge as a major economy in the world - in<br />

growth, size and purchasing power parity (PPP) terms. Surge in<br />

private investments and increase in economic activities are streaming<br />

the business potential of <strong>India</strong> to global scales. However, the wavering<br />

energy crisis ails <strong>India</strong>'s economic prowess and may prove detrimental<br />

to the country's growth.<br />

Deepak Amitabh<br />

Director (Finance), <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

“Sh. Deepak Amitabh would be<br />

taking charge as<br />

Chairman and Managing Director<br />

of <strong>PTC</strong> Group with effect from<br />

11th <strong>October</strong>, <strong>2012</strong>”<br />

The recent nation wide outages, also the largest power outages in<br />

the world, are indicative of the present weak energy scenario in <strong>India</strong>.<br />

The power supply position is characterized by shortages, unreliability<br />

and higher prices. <strong>India</strong>'s dependence on oil imports touched 70%<br />

in FY 2011 and imports further surged by 45% in FY <strong>2012</strong>. Wriggled<br />

by constraints, the energy security in <strong>India</strong> depicts a bleak potential<br />

that may further cause decline in economic growth. Unless corrective<br />

reforms are urgently initiated and implemented to revive the energy<br />

security in <strong>India</strong>, it may be challenging to sustain the unprecedented<br />

economic growth the nation has achieved in recent years.<br />

The prime requisite for sustaining an effective economic growth is an<br />

adequate infrastrucutre, predominantly of the energy sector. Yet, there<br />

remains a severe acuity in the energy sector of major economies in the<br />

subcontinent region – that includes <strong>India</strong>, Pakistan and Bangladesh.<br />

Unless the region co-operates and coordinates towards achieving<br />

12 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

a sustainable and secured energy supply, the energy<br />

insecurity will prove a major constraint in the growth of<br />

these economies.<br />

Promotion of Regional Energy Trade, allowing adjacent<br />

nations to utilise and optimize the energy resources<br />

available within the region, is one such initiative that needs<br />

to be recognized by the <strong>India</strong>n Subcontinent. Regional<br />

Energy Trade shall prove beneficial in fostering energy<br />

security and increasing diversification of energy resources.<br />

The energy trade shall also aim to curb shortages, meet<br />

deficits and improve the inadequate generation, adding<br />

significant support to the power supply position.<br />

Adjacent countries including Nepal, Bhutan and Tajikistan<br />

have energy resources far in excess of their demand for<br />

energy. Whereas <strong>India</strong>, Pakistan, Bangladesh and Sri<br />

Lanka have an energy demand growth far outstripping<br />

domestic supply. Sharing of excess energy resources<br />

will help in meeting the energy demand on both sides<br />

and achieve certain optimization in same. The initiative<br />

would resolve the issue of <strong>India</strong>’s energy security as well<br />

as pull the prices of energy down through reliance on<br />

competitive hydro reserves. Also, reducing our domestic<br />

energy constraints, such energy trades would also prove<br />

beneficial by contributing to the GDP growth of relatively<br />

smaller economies like Nepal and Bhutan.<br />

Presently, the cross border electricity trade and<br />

interconnections are insignificant, except for trade<br />

prevailing between <strong>India</strong>-Bhutan and <strong>India</strong>-Nepal.<br />

(i) The Kingdom of Bhutan has capitalised on such<br />

opportunity, exporting surplus power (excess power<br />

available after domestic consumption) of around<br />

1200 MW to 1400 MW to <strong>India</strong>. During the year 2010-<br />

11, more than 5 Billion units of energy were exported<br />

to <strong>India</strong>, resulting in revenue earning of Rs. 10 Billion.<br />

(ii) Indo-Nepal power trade began in the year 1971 with<br />

exchange of mere 5 MW of power. The same grew to<br />

100-150 MW by the year 2001-02. Nepal is reported<br />

to have a hydropower potential of 83,000 MW, of<br />

which about 42,000 MW is considered economically<br />

feasible to develop. Currently, Nepal’s installed<br />

generation capacity is about 650 MW, which is 2% of<br />

the total hydro potential. Nepal may export their hydro<br />

power potential to finance its economic and social<br />

transformation.<br />

(iii) Afghanistan has imported 430 GWh from Iran,<br />

Turkmenistan, Uzbekistan and Tajikistan<br />

(iv) Pakistan has imported 25 MW of power from Iran to<br />

the isolated grid of Baluchistan near Gwadar deep<br />

sea port.<br />

(Source: World Bank Report 2008 on South Asia Regional Trade)<br />

Notwithstanding the roles played by the Governments,<br />

the bilateral development between these countries has<br />

been possible by cross-border trading arrangements, and<br />

the available sector policies and structure. However, to<br />

sustain such trade and enable the development of a wider<br />

integrated regional energy market (just not including the<br />

<strong>India</strong>n Sub-continent), there is a need for enhancement of<br />

capacity building and effective sector reforms.<br />

The Opportunity of Regional Trade<br />

An effective Power Market is yet to develop in <strong>India</strong>, as the<br />

inate energy market is at a nascent stage of growth, where<br />

currently just 11% of total generated electricity is traded.<br />

With Government of <strong>India</strong> introducing Power Trading<br />

Corporation of <strong>India</strong> (now, <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong>) in 1999,<br />

there has been significant development in the power<br />

sector in <strong>India</strong>. <strong>PTC</strong> <strong>India</strong> played a pivotal role in creating<br />

a bilateral power market in the country by 2005, and later<br />

introduced Spot Market in the country by promoting the<br />

<strong>India</strong>n Energy Exchange (<strong>India</strong>’s first Power Exchange).<br />

With Power Exchange kicking-off Day-Ahead spot<br />

contracts, promising more products (derivative-driven) in<br />

future, the inter-play of demand-supply and competitive<br />

supply-procurement is much visible today. However, there<br />

still exists the need to learn lessons from the experience<br />

of already developed power markets, such as Nordic<br />

Power Market – the world’s first international commodity<br />

for electrical power, in organizing trade with standard<br />

physical and financial power contracts both in spot and<br />

derivative markets.<br />

The Integrated Energy Policy presented by the Planning<br />

Commission of <strong>India</strong> indicates the import of hydro power<br />

from Nepal and Bhutan (eliciting the combined potential<br />

of about 55000 MW) as possibly the major source of<br />

energy security for <strong>India</strong>. As a sub-regional approach,<br />

providing access in future to hydro power generators in<br />

Bhutan and Nepal for operating through Power Exchange,<br />

and subsequently promoting the integration of SAARC<br />

region could add more market participants in the regional<br />

trade and rapid growth, in liquidity as well, of the regional<br />

market.<br />

The World Bank has speculated an increase of 7% annually<br />

in peak power demand of <strong>India</strong> through FY 2006 to FY<br />

REGIONAL POWER TRADING<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 13

Weak crossborder<br />

links<br />

and infra<br />

have been<br />

preventing the<br />

exchange of<br />

power between<br />

the regional<br />

Nations<br />

2032. The Integrated Energy Policy has envisaged<br />

import of hydropowers from Bhutan and Nepal.<br />

Some of the key opportunities available with <strong>India</strong><br />

for trade of energy are listed below:-<br />

(i) <strong>India</strong> and Bhutan<br />

Bhutan’s unexploited hydropower potential<br />

exceeds 30,000 MW, with easily accessible sites<br />

estimated at 10,000 MW with 60% load factor.<br />

The evolution of the power trading market in <strong>India</strong><br />

has encouraged investments in Bhutan, allowing<br />

<strong>India</strong>’s demand pattern to be matched by Bhutan’s<br />

supply pattern. Both the nations are committed<br />

to cooperate in the field of hydroelectric power<br />

through public and private sector participation<br />

and promoting regional energy trade. <strong>India</strong> is<br />

expecting to import 10000 MW surplus power<br />

from Bhutan by the year 2020.<br />

(ii) Hydropower exports from Nepal<br />

Also, Nepal’s unexploited hydropotential exceeds<br />

43,000 MW and government is continuing to invite<br />

RFPs for investing in Hydro Power Projects. Again,<br />

the investors are drawing confidence in these<br />

projects on account of an effective power trading<br />

market available in <strong>India</strong>. Recently, <strong>PTC</strong> <strong>India</strong><br />

too has signed an Memorandum of Agreement<br />

with GMR Group for a 600 MW Marsyangdi HE<br />

Project and a similar agreement with Brass Power<br />

International Engineering for purchase of 248 MW<br />

from Lower Arjun project for 25 years. <strong>India</strong> is also<br />

planning to supply coal based 150 MW power<br />

to Nepal for next 25 years to meet their interim<br />

requirement till Nepal is in a position to generate<br />

surplus capacity for export.<br />

(iii) <strong>India</strong> and Bangladesh<br />

The Government of Bangladesh has recently<br />

agreed to purchase 500 MW of electricity from<br />

<strong>India</strong> by 2013. They are also contemplating to<br />

import another 500 MW through north-west route<br />

by 2018. Apart from these, Bangladesh is also<br />

eyeing the North-Eastern states of <strong>India</strong> for some<br />

potential capacity of 2000 MW in near future. In<br />

January <strong>2012</strong>, Bangladesh Power Development<br />

Board and NTPC signed an agreement to set up<br />

a Joint Venture for the establishment of a 1320<br />

MW coal based power plant in Bagerhat district,<br />

Khulna at an estimated cost of $ 1.5 Billion and is<br />

expected to be commissioned by 2016.<br />

However, though Bangladesh has undertaken an<br />

ambitious plan to augment the energy starved<br />

nation through import of an approximate 4500 MW<br />

of electricity by 2030, this can be only possible<br />

with construction of an interconnected regional<br />

power grid. Such integrated grid spanning the<br />

large region is extensive in proposition, but is a<br />

necessary solution for providing energy security<br />

to the entire region.<br />

Bangladesh has current generation capacity of<br />

7000 MW and has deficit of 1200 MW in peak<br />

hours. HVDC (high-voltage-direct-current) power<br />

link with 500 MW capacity is being setup between<br />

Bheramara in Bangladesh to Baharampur in <strong>India</strong>,<br />

which is expected to be commissioned by 2014.<br />

(iv) <strong>India</strong> and Sri Lanka<br />

<strong>India</strong>n Government has signed a MoU with<br />

Ceylon Electricity Board (CEB) of Sri Lanka for<br />

establishment of HVDC bi-pole interconnection<br />

between the countries. The line would have an<br />

initial transfer capability of 500 MW and later<br />

another 500 MW would be added. Power trading<br />

between the two countries is likely to start from<br />

2015-16 after the completion of the line between<br />

Madurai and New Anuradhapura substation of<br />

385 km in length including a 50 km submarine<br />

cable.<br />

(v) <strong>India</strong> and Pakistan<br />

Faced with a serious power crisis, Pakistan is<br />

keen to draw power from <strong>India</strong>. A proposal aimed<br />

at setting up transmission infrastructure on a<br />

joint-ownership basis to facilitate the wheeling<br />

of around 500 MW of electricity via Amritsar is<br />

being considered by the two sides. HDVC power<br />

link, as being proposed for Bangladesh, is being<br />

considered for enhancing the gird interconnection<br />

at the borders. At present, no transmission link<br />

exists between <strong>India</strong> and Pakistan.<br />

(vi) <strong>India</strong> and Myanmar<br />

Myanmar has unexploited hydro potential of about<br />

39,000 MW and is developing about 10,400 MW<br />

of new capacity through joint ventures with Thai<br />

and Chinese developers and utilities mainly for<br />

export of power to Thailand and China. <strong>India</strong>n and<br />

Myanmar governments are collaborating in the<br />

design and formulation of Tamanti multipurpose<br />

project located near the <strong>India</strong>n border, initially with<br />

14 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

a power component of 1,200 MW, essentially for export<br />

to <strong>India</strong>. This is likely to be developed as a joint venture<br />

between Myanmar and <strong>India</strong>n power entities.<br />

The Challenges in Regional Trading<br />

Even amid political instabilities and insecurities, and<br />

wavering economic prowess, possibilities of regional<br />

energy trade have come a long way.<br />

Also, weak cross-border transmission links and<br />

infrastructure have been preventing the exchange<br />

of power between the regional nations. The internal<br />

transmission and distribution infrastructure of South Asian<br />

countries too are crippled by high AT&C losses and ailing<br />

inefficiencies. Pervasive state ownership of the utilities,<br />

their poor earnings, and their inadequate internal cash<br />

generation to finance their own domestic needs—let alone<br />

the investments for export infrastructure—proved a major<br />

handicap for the development of regional trade.<br />

Overcoming the Challenges<br />

Liberalization of the <strong>India</strong>n economy proved a major<br />

positive mood swing for the <strong>India</strong>n economy. The<br />

economies realized it was the time to augment power<br />

supply and strengthen distribution for sustaining national<br />

growth.<br />

- Transmission organizations in <strong>India</strong>n Subcontinent<br />

have realized the importance of increasing interregional<br />

transmission systems. There is an imperative<br />

need to mitigate the risk of power insecurity and<br />

could only be achieved if individual nations cooperate<br />

in coordinating their demand supply patters among<br />

each other. In <strong>India</strong>, the transfer capacities today<br />

have touched an estimate 25000 MW. The 400 kV<br />

transmission link between eastern and western<br />

regions of <strong>India</strong> (enabling the absorption of Bhutan<br />

power imports) has been constructed by a joint<br />

venture between a private develepor and the Power<br />

Grid Corporation of <strong>India</strong>.<br />

- The framing of the Electricity Act 2003 has led to an<br />

emergance of a National and Regional power market<br />

in South Asia. Non-discriminating Open Access and<br />

introducing Power Trading as a distinct activity, <strong>India</strong>n<br />

Power Market took a major leap for evolving to more<br />

organized markets.<br />

- In <strong>India</strong>, generation capcacity has crossed the<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 15

200000 MW mark. This has been possible on account<br />

of surging private investments. The distribution<br />

systems are beginning to get reformed through<br />

distribution franchisees and privatization.<br />

- Commercialization across the entire value chain<br />

is inevitable, though there needs to be a strong<br />

expedition of the same.<br />

- A credible development in South Asian regional power<br />

market is delineating the power sector and placing<br />

generation, transmission and distribution as distinct<br />

functions. The development has been led by <strong>India</strong><br />

and is followed suit by other regional countries.<br />

- With national movements, political cooperations,<br />

international interventions and strenghtening treaties<br />

and agreements, there is increasing interest in<br />

discussing energy-related cooperation, cross-border<br />

energy investments and trade possibilities in a range<br />

of regional cooperation organizations such as SAARC,<br />

ECO, and BIMSTEC.<br />

Conclusion<br />

<strong>India</strong> has played a centrestage role in reviving the regional<br />

power market in South Asia. The economic policies and<br />

restructural developments have introduced possibilities of<br />

strong regional integration. Bilateral energy trade between<br />

<strong>India</strong> and its neighbors is a key building block of the<br />

integrated regional energy market.<br />

Notwithstanding other stakeholders promoting regional<br />

trade, the pace of regional integration will be in large<br />

part determined by the pace of development of energy<br />

trade with <strong>India</strong>, especially on the eastern side of the<br />

region. In this context, it is very encouraging to see the<br />

reforms gradually taking place in the <strong>India</strong>n energy sector<br />

alongside efforts in strengthening the national electricity<br />

transmission grid. ‘One Nation, One Grid’ is going to be<br />

realized in the near future.<br />

It is also encouraging to see that similar reforms are<br />

either under way or being planned in other countries in<br />

the region. The rising interest, translating to a necessity,<br />

among the regional nations in jointly promoting regional<br />

trade, shall prove beneficial for the region of South Asia.<br />

16 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 17

The Power<br />

Bites<br />

20 states plunge into darkness<br />

In the country’s worst electricity crisis ever, three of the five regional transmission grids collapsed this July. The grid<br />

failure threw more than 60 per cent of the country’s population in the dark and left several essential services, including<br />

railways, hospitals and water supply, paralysed. The other two grids - western and southern - remained unaffected. While<br />

the exact cause of the incident was yet to be ascertained, heavy overdrawing of power from the grid by a few states,<br />

including Uttar Pradesh, Punjab and Haryana, appeared to be the main reason.<br />

Business Standard, 01 August, <strong>2012</strong><br />

MSMEs demand open power access<br />

The micro, small and medium enterprises (MSMEs) have<br />

urged the government to strengthen power reforms and<br />

facilitate open access to power for industrial clusters.<br />

The MSMEs face production losses and decline in profit<br />

margin due to severe power crisis. Small entrepreneurs<br />

want an open access to power at a threshold of 1 MW<br />

and easing of licensing norms to facilitate electricity<br />

distribution in industrial clusters and MSME collectives<br />

such as cooperatives and associations<br />

Hindustan Times, 09 July, <strong>2012</strong><br />

Indo-Nepal cross border power line<br />

to come to life by 2015<br />

With commercially viable potential of 42,000MW<br />

hydropower in hand, Himalayan Country Nepal has<br />

become a Tantalus cup facing almost 12 hr power cut a<br />

day. A new Indo-Nepal cross border power transmission<br />

line, now expected to be on life by 2015, is to bring the<br />

country out of its trouble in newer future while opening up<br />

new opportunity for <strong>India</strong>n hydropower companies.<br />

According to Nepal Electricity Authority (NEA) records,<br />

with around 700 MW installed capacity against peak hour<br />

demand of 900 MW, Hydropower dependent Nepal faces<br />

power cut of even 12 hr a day at places which may go up<br />

to 18 hours next dry winter season.<br />

Economic Times, 12 September, <strong>2012</strong><br />

The Power<br />

Bites<br />

18 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

3 States oppose coal pricing formula of CEA<br />

The Central Electricity Authority’s proposal on a price pooling formula for blending domestic and imported coal has<br />

run into rough weather with three States — West Bengal, Jharkhand and Orissa — opposing it on the grounds that<br />

it will help coastal power plants and lead to a rise in electricity tariffs. For coastal power stations (up to 300 km from<br />

coast), the Central Electricity Authority (CEA) had suggested that a blend of imported coal up to 20 per cent be allowed<br />

of committed coal quantity. For non-coastal and non-pithead power stations (equidistant from mine-head and port),<br />

it has proposed a blend of imported coal up to 15 per cent of its committed quantity. For pit-head stations, where<br />

transportation of indigenous coal is a major constraint, it has suggested blend of imported coal up to 15 per cent of its<br />

committed coal quantity.<br />

However, the West Bengal government has opposed the proposal and did not attend the meeting held by the CEA on<br />

coal pool pricing as a mark of protest. The Coal and Railways Ministries also did not take part in the meeting. Jharkhand<br />

and Orissa have also shown their dissent against the proposal, and are of the view that electricity tariff will rise if it were to<br />

come into effect. These states have also questioned the authority of the CEA to decide issues related to pricing of coal.<br />

Hindu Business Line, 08 August, <strong>2012</strong><br />

CoalMin wants captive block holders<br />

to sell power through bidding<br />

The coal ministry has asked power companies having<br />

coal block allocations to participate in the bids for sale<br />

of power from end-use projects in line with the guidelines<br />

from the ministry of power. Else, they face cancellation of<br />

their coal blocks. The coal ministry has also threatened<br />

to cancel allocation of coal blocks of power companies<br />

that are selling power in the short-term market at lucrative<br />

rates, and has asked them to enter into power purchase<br />

agreements (PPAs) on the basis of competitive bidding<br />

The coal ministry has also asked the companies to take<br />

necessary steps accordingly and file compliance report<br />

to it, along with ministry of power and the coal controller.<br />

The directive has incorporated it as a condition in the<br />

allocation letter even for already allotted coal blocks for<br />

power sector IPPs.<br />

Dip in Indonesian coal prices brings<br />

cheer to <strong>India</strong>n importers<br />

A sharp fall in spot prices of Indonesian thermal-coal,<br />

during July, brought cheers among <strong>India</strong>n importers.<br />

According to importers, market conditions were expected<br />

to remain weak for at least another three months.<br />

According to importers, the crash was triggered by refusal<br />

of contracted cargoes by a number of Chinese buyers<br />

beginning early June. The rupee has also remained<br />

relatively stable during the period, which benefited <strong>India</strong>n<br />

buyers.<br />

<strong>India</strong>n end users generally enter into rupee denominated<br />

term contracts – for a maximum period of three months<br />

– with importers. The meltdown in coal prices, therefore,<br />

may reflect on the balance sheets of <strong>India</strong>n companies.<br />

Hindu Business Line, 19 July, <strong>2012</strong><br />

Business Standard, 06 July, <strong>2012</strong><br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 19

The Power<br />

Bites<br />

State keen to tap full hydel potential<br />

The Jammu & Kashmir State government has decided to come up with micro hydroelectric projects in remote areas of<br />

the state where there is no electricity distribution network or where it is economically not viable to serve from a network.<br />

Although a number of micro hydel projects already exist in the state, the authorities have decided to go in for more such<br />

units as they usually demand minimal reservoirs and civil construction work. They are seen as having a relatively low<br />

impact on the environment as compared to large hydel projects.<br />

The Tribune, 17 July, <strong>2012</strong><br />

38,000 MW produced from garbage<br />

The Okhla waste to energy plant has produced a total<br />

of 38,138 MW energy from 2,22,000 tonnes of garbage<br />

since its inception. The plant was installed by the<br />

erstwhile Municipal Corporation of Delhi in coordination<br />

with the Okhla Waste Management Company. According<br />

to the agreement, 1,500 metric tonnes of solid waste is<br />

provided by the corporation to the plant which disposes<br />

of it through boiler maintaining the temperature above<br />

850° C to generate 16 MW of energy daily.<br />

Tribune, 02 August, <strong>2012</strong><br />

Plans afoot to develop offshore wind<br />

energy<br />

The Government is gearing up to prepare a time-bound<br />

action plan for development of offshore wind energy<br />

especially in the coastal states of Tamil Nadu, Andhra<br />

Pradesh, Maharashtra and Karnataka. At a meeting of<br />

the sub-committee for preparation of the draft policy<br />

guidelines for development of offshore wind energy<br />

projects of the Ministry for New and Renewable Energy,<br />

Tamil Nadu Electricity Board chairman, Rajeev Ranjan,<br />

who is also chairman of the sub-committee, said it was<br />

high time that policy guidelines are formulated to attract<br />

investment into the sector. It was felt that that since<br />

resource assessment is a time consuming affair, projects<br />

at the sites where initial assessment has already been<br />

carried out could be taken up initially.<br />

The Hindu, 17 July, <strong>2012</strong><br />

20 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

DERC to introduce new power tariff<br />

system<br />

In a major reform initiative, Delhi's power regulator<br />

DERC has decided to introduce a new system under<br />

which tariff will be charged according to electricity<br />

consumption in peak and off peak hours. The proposed<br />

mechanism -- aimed at encouraging consumers to<br />

limit their power consumption in peak hours -- will be<br />

introduced on a pilot basis, officials in Delhi Regulatory<br />

Electricity Commission said. The system, known<br />

as Time of Day (TOD) metering, is also expected to<br />

discourage commercial users from consuming more<br />

power during peak hours and result in minimising load<br />

shedding in residential areas when the demand goes<br />

up substantially. If implemented Delhi will be the first<br />

state in the country to have such a metering system,<br />

which, experts said, would benefit everybody including<br />

the consumers. The power distribution companies<br />

often have to procure additional power from the market<br />

at very high cost to meet the demand at the peak hours<br />

from 6:00 PM to 11:00 PM.The power demand in the<br />

city registered an all-time high of 5,642 MW on July 6,<br />

breaking all previous records<br />

Economics Times, 22 July, <strong>2012</strong><br />

Debt recast package for SEBs soon<br />

The much-awaited debt recast package for state<br />

electricity boards (SEBs) may soon receive government<br />

approval. “We have worked out some financial<br />

package and also a debt restructuring package that<br />

will be approved by the Cabinet in a week or two,”<br />

power minister M. Veerappa Moily told reporters on<br />

the sidelines of a Confederation of <strong>India</strong>n Industry (CII)<br />

corporate governance summit in Mumbai on Tuesday.<br />

Moily said the government had devised the package in<br />

consultation with the states and distribution companies<br />

(discoms). Speaking separately to reporters at the state<br />

guest house in Mumbai on Tuesday, he also assured<br />

that “the recent cancellations of coal blocks will not<br />

affect power generation in the country”. State utilities,<br />

which buy power from the generation companies and<br />

distribute them, are caught in a vicious trap as political<br />

pressure often prevents them from raising electricity<br />

tariffs even though they have to buy power at a higher<br />

price. Having accumulated losses for years now,<br />

they have emerged as a huge counter-party risk for<br />

banks that have provided them loans and for power<br />

producers, which depend on them for offtake.<br />

Live Mint, September 18<br />

Punjab power tariff hiked 12%; ind<br />

furious<br />

Power consumers in the state will have to shell out<br />

more, with regulator Punjab State Electricity Regulatory<br />

Commission (PSERC) announcing an average tariff<br />

hike of 12.08 per cent. The hike, the second highest<br />

increase in the last five years, will be applicable to all<br />

categories of consumers for the financial year <strong>2012</strong>-<br />

13. Apart from this, a 10 paise per unit tariff has also<br />

been levied for the first time on continuous process<br />

industry including textile, spinning, casting which will<br />

be applicable from November 1, this year. Besides, a 4<br />

paise fuel surcharge for metered category and Rs 2 per<br />

BHP on unmetered category (Agriculture Pumpsets)<br />

will also be levied on all categories on account of 20<br />

per cent rise in fuel cost. Notably, the actual outgo for<br />

power consumers will be higher as Punjab government<br />

also levies electricity duty of 13 per cent and 10 paise<br />

per unit as octroi on energy consumption which is<br />

exclusive of tariff rates.<br />

Banks ask state power boards to<br />

raise rates<br />

Bankers have asked state electricity boards to increase<br />

power rates and cut leakages. The direction was given<br />

to ensure that the power distribution companies, which<br />

have requested banks to restructure their debts, are<br />

able to generate surplus revenues to repay the loans.<br />

Banks have also sought state governments’ guarantees<br />

on these loans to avoid slippages in the restructured<br />

loans.<br />

Business Standard, 10 July, <strong>2012</strong><br />

<strong>India</strong>n Express, 16 July, <strong>2012</strong><br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 21

The Power<br />

Bites<br />

Power loans cross `6 lakh cr, now over 6% of GDP<br />

Outstanding debt of state power utilities have grown to a staggering `6 lakh crore or 6% of the GDP, according to data<br />

gathered by FE from various sources. Roughly a third of these are loans taken to fund past losses which cannot be<br />

serviced through tariff hikes and, hence, are being considered for a benign restructuring by the Centre. Needless to say,<br />

the extreme indebtedness of these utilities is attributable to state governments that don’t let regulators increase tariffs in<br />

tandem with rising costs, leading to a constantly widening revenue-expenditure gap at the utilities. This undermines their<br />

ability to invest and thwarts <strong>India</strong>’s ambitious plan to multiply its power generation capacity and create a competitive<br />

power market.<br />

Financial Express, 08 August, <strong>2012</strong><br />

RBI tightens norms for securitisation<br />

of loans by NBFCs<br />

Reserve Bank of <strong>India</strong> (RBI) on Tuesday tightened the nonbanking<br />

finance company (NBFC) securitisation norms<br />

by stipulating that a non-banking finance company will<br />

have to retain at least 5 per cent of the loan being sold to<br />

another entity. The revised guidelines, issued by the RBI<br />

also stipulate that NBFC cannot sell or securitise a loan<br />

unless three monthly instalments have been paid by the<br />

borrower. These stipulations, the central bank said are<br />

aimed at checking "unhealthy practices" and distributing<br />

risk to a wide spectrum of investors.<br />

Sebi grants MCX-SX equity trading<br />

licence<br />

The capital market regulator allowed MCX Stock<br />

Exchange Ltd (MCX-SX) to become a full-fledged<br />

bourse, ending a two-year-long tussle that saw the two<br />

sides lock horns in court over ownership rules governing<br />

such bourses. The exchange can start trading in equities,<br />

equity derivatives and other asset classes like its rivals<br />

BSE and the National Stock Exchange (NSE).<br />

Live Mint, 11 July, <strong>2012</strong><br />

Business Standard, 22 August, <strong>2012</strong><br />

22 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

Power failure: Panel for smart grids, special protection plan<br />

Implementation of smart grids and Special Protection Schemes (SPSs) are the long-term solutions recommended by the<br />

panel headed by A.S. Bakshi, Chairman of Central Electricity Authority. The panel was set up to look into the massive<br />

grid failure that left the entire North, East and North-East in dark for more than six hours on July 30-31. Meanwhile, the<br />

National Load Despatch Centre (NLDC) has filed a petition with the Central Electricity Regulatory Commission (CERC)<br />

against some of the Northern States for not maintaining grid discipline, another reason being cited for the failure. At<br />

CERC’s first hearing last week, the States are understood have deposed that the wide gap between demand and the<br />

allotment led to the overdrawal from the grid.<br />

Hindu Business Line, 21 August, <strong>2012</strong><br />

Environment ministry for clearance<br />

to infra projects on case-by-case<br />

basis<br />

The environment ministry is veering towards considering<br />

forest clearance for coal, mining and other infrastructure<br />

projects on a case-by-case basis. This move comes as<br />

an alternative to the "go/no-go" classification of forests<br />

and would take at least two to three years to put in place.<br />

In the meantime, the pressure to clear infrastructure<br />

projects, which are crucial to propel economic growth<br />

and industrialisation, is mounting.<br />

Economic Times, 11 July, <strong>2012</strong><br />

PowerMin may intervene to make<br />

regulators perform<br />

The Union Power Ministry, in a bid to provide some<br />

relief to cash-strapped distribution utilities, is firming<br />

up the strategy of statutory intervention to make power<br />

regulators perform better. This is aimed at holding<br />

regulators accountable so that distribution utilities should<br />

not face troubles for lack of adequate revenue streams.<br />

The ministry proposes to put in place a mechanism<br />

whereby the appointments of regulators and their<br />

performance would be reviewed.<br />

Business Standard, 05 July, <strong>2012</strong><br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 23

24 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

Charge of the<br />

Light Brigade<br />

power reforms<br />

“Charge of the light brigade”, was published in<br />

Times Crest on 4 August <strong>2012</strong> and is authored by<br />

Sh. Suresh Prabhu, Former Union Power Minister<br />

The future isn't black. <strong>India</strong> needs to up power generation,<br />

acquire global fuel assets, and focus on renewable energy.<br />

For two consecutive days last week, north <strong>India</strong> suffered<br />

spectacular outages, rated the worst in the world. The East and<br />

North-East suffered as well the second day. While 70 crore <strong>India</strong>ns<br />

struggled with the challenge of total power collapse, the 50 crore<br />

who live in western and southern <strong>India</strong> didn't know if they should<br />

celebrate being spared or brace for their turn. This brings us to an<br />

important issue - how do we make <strong>India</strong> power sufficient? It isn't<br />

just a question of generating power but also of dealing with the<br />

challenges of environment and energy security.<br />

At a per capita consumption of just 700 Kwh, we have the<br />

dubious distinction of being one of the lowest per capita users of<br />

electricity in the world. In fact, 44 per cent of <strong>India</strong>n households<br />

still don't have power. A big percentage of the rest have to make<br />

do with erratic supply for not more than a few hours of the day.<br />

If you live in rural or semi rural areas, 24-hour power supply is a<br />

distant dream.<br />

To deal with this supply gap, we need to increase the generation<br />

of electricity to 30, 000-40, 000 MW each year for at least the<br />

next 30 years. We have now a comprehensive policy framework<br />

for this in the form of the Electricity Act which I had introduced in<br />

the Parliament. The success of this law is there for all to see - we<br />

generated 55, 000 MW of power in the last five years, more than<br />

double the quantity we ever produced in the same period earlier.<br />

The substantial private sector investment that made this happen<br />

was possible only due to the new law.<br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 25

We need<br />

to support<br />

<strong>India</strong>n power<br />

companies,<br />

both<br />

government<br />

owned and<br />

private, in<br />

their quest to<br />

acquire fuel<br />

assets globally<br />

Now there is huge interest in investing in the<br />

power sector but fuel remains a big problem area.<br />

Coal, gas and even water have to be tied up by a<br />

very high powered group as soon as investment<br />

decisions are finalised. The import of fuel needs a<br />

special regime to ensure smooth landing.<br />

We need to support <strong>India</strong>n power companies, both<br />

government-owned and private, in their quest to<br />

acquire fuel assets globally. China puts the entire<br />

might of the state behind overseas investment by<br />

its companies. Could all our foreign missions and<br />

the external affairs ministry not stand behind our<br />

endeavours similarly ? Could we not ensure that<br />

we work collaboratively in alien markets for this<br />

rather than compete?<br />

It's also time for us to revisit our fuel mix. <strong>India</strong>n<br />

coal will not be as available as we believe. Most<br />

of our coal reserves are in tribal areas which are<br />

also host to some our best forests. We cannot<br />

neglect social and ecological issues in our haste<br />

to become self-sufficient in power. We can't<br />

afford to depend on imports as it affects our<br />

energy security. Our wind potential is now at least<br />

6 lakh MW. Solar power can easily be generated<br />

in a country that has more than 300 days of<br />

sunshine with very good radiation to harness it<br />

in electricity. We need to put more renewables in<br />

our grids to address our environmental concerns.<br />

The climate change threat can be mitigated only<br />

by shifting to non-fossil sources. And we need<br />

to harness the huge potential offered by our 7,<br />

800-km-long coast to become a hub for oceanic<br />

energy. Our 1. 2 billion people produce so much<br />

household waste that we would need indigenous<br />

technology to convert it into energy. We need to<br />

invest in R&D for storage of electricity as well.<br />

We need a national grid connecting all our<br />

regional grids. For this we need a grid code which<br />

can't be violated at any cost. Let's now also focus<br />

more on the Smart Grid concept to catch up with<br />

the best in the world. This could help in better<br />

load as well as demand management. Our subtransmission<br />

and distribution segment can be<br />

revamped with ICT solutions. To this end, I had<br />

got Nandan Nilekani to chair a group to prepare<br />

a plan. All these measures can help us avoid<br />

theft and address power quality issues and make<br />

redundant inverters, diesel operated gensets and<br />

voltage stabilisers.<br />

We now think of distributed generation wherein<br />

we will generate electricity for a cluster of villages<br />

and distribute it through gram panchayats,<br />

cooperatives and so on. We have telecom towers<br />

in most of villages which operate on diesel. These<br />

could be used as hubs of renewables generation<br />

and the excess could be sold to nearby villages.<br />

We can reach universal electrification and still be<br />

locally accountable with ICT to track abuse and<br />

theft.<br />

I had created the Bureau of Energy Efficiency<br />

(BEE) for conservation of energy. We must<br />

focus on this idea more. We can save as much<br />

as 23 per cent of the power we consume<br />

through conservation. We must have more<br />

inventive demand management. For instance,<br />

differential tariffs encouraging lower energy use<br />

in metropolitan areas is a good idea. We can also<br />

replace the energy guzzling agriculture pumps<br />

and introduce dedicated feeders for agriculture<br />

consumption.<br />

As per the law, regulators are mandatory for all<br />

states. Now let's focus on their appointment,<br />

training and so on to make them a truly formidable<br />

and autonomous body which is sensitive to both<br />

consumers as well as producers. It's critical that<br />

we have a separate route to select regulators who<br />

are so crucial for the progress of the power sector.<br />

Late starters have the advantage of being able<br />

to avoid the problems faced by pioneers. Let's<br />

seize this advantage by integrating new concerns<br />

of climate change and self reliance with the old<br />

challenges of power shortages.<br />

All this needs a pliable political economy. Political<br />

will can't be bought off the shelf. I used to meet<br />

political leaders, chief ministers, trade unions<br />

and other stake holders regularly to ensure that<br />

the effort is based on partnership. We need to<br />

realise we can't get off the ground a project that<br />

is not shared but pushed only by the Centre. Let's<br />

launch a national mission headed by PM himself<br />

with all CMs as members. They must meet once<br />

in three months and review operational obstacles.<br />

There is no bigger priority than this because<br />

drinking water, agriculture, jobs, manufacturing,<br />

transportation and even peace are dependent on<br />

adequate power supply.<br />

26 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

POWER<br />

PARLANCE<br />

The government would<br />

discuss the proposed<br />

amendment to the<br />

Electricity Act<br />

Dr. M Veerappa Moily<br />

Hon’ble Minister of Power, GOI<br />

Economic Times, 28 August, <strong>2012</strong><br />

Relying too much on<br />

imported fuel will hit<br />

power sector<br />

Shri Sushil Kumar Shinde<br />

Former Union Power Minister<br />

Hindu Business Line, 17 July, <strong>2012</strong><br />

Please do not buy cheap<br />

stuff from China for making<br />

a quick buck<br />

Dr. Farooq Abdullah<br />

Minister of New & Renewable Energy<br />

Economic Times, 23 August, <strong>2012</strong><br />

Accumulated losses<br />

of state distribution<br />

companies have crossed<br />

Rs 92,000 crore<br />

K C Venugopal<br />

Union Minister of State for Power<br />

Economic Times, 27 August, <strong>2012</strong><br />

Power regulator can regulate<br />

and revise electricity tariffs<br />

irrespective of the contracts<br />

signed by power producers with<br />

distribution companies<br />

Goolam E Vahanvati<br />

Attorney General of <strong>India</strong><br />

Economic Times, 28 August, <strong>2012</strong><br />

OCTOBER <strong>2012</strong> | <strong>PTC</strong> INDIA LIMITED | 27

the North East aide<br />

Summarising Indo-Bhutan & Indo-Nepal Cross Border Power Trade<br />

<strong>India</strong> has always envisaged and envisioned<br />

multi-faceted relations with its neighbouring<br />

counterparts in the <strong>India</strong>n subcontinent by<br />

promoting social, cultural and economic<br />

cooperations. The Indo-Bhutan and Indo-Nepal<br />

relations have strengthened over the recent past<br />

with all endeavoring to achieve a sustainable<br />

growth through Regional cooperation. The<br />

Government of <strong>India</strong> on consistent pursuance for<br />

meeting the energy security of the region has been<br />

working to develop mutually beneficial projects<br />

and supply strategies with both Bhutan and Nepal,<br />

enabling them to earn through exports to power<br />

trading market in <strong>India</strong> and allowing <strong>India</strong> to meet<br />

its ever increasing demand for power.<br />

The demand for energy in <strong>India</strong> has been on the<br />

rise with the economy propelling to sustain growth<br />

rate of 8-10%. The domestic energy resources<br />

post power reforms in early 2000s are yet short<br />

and inadequate in meeting power requirement of<br />

the nation. Today, an established rationale exists<br />

for reducing <strong>India</strong>’s reliance on thermal power<br />

and increasing diversification of energy resources.<br />

However, the share of hydro resources is declining<br />

in the generation mix offered by generators in<br />

<strong>India</strong>. This is a matter of concern as the <strong>India</strong>n<br />

subcontinent has a huge potential of hydro<br />

resources that remains untapped. Also, <strong>India</strong><br />

needs to lead environment stewardship in South<br />

Asian region by using cleaner sources of energy.<br />

Recent commitments for cooperating in the<br />

field of hydroelectric power through public and<br />

private sector participation have encouraged<br />

private investments in generation in Bhutan.<br />

Nepal and <strong>India</strong> are also improving the interregional<br />

transmission capacities through grid<br />

augmentation. <strong>India</strong> aims to import 10000 MW<br />

from Bhutan by 2020 withstanding the support in<br />

cooperating with the latter in developing renewable<br />

energy projects under CDM.<br />

<strong>India</strong> is vying for opportunities in Bhutan and<br />

Nepal for development of hydro projects under<br />

joint ventures or public private partnerships or<br />

wholly private participation. The Government of<br />

<strong>India</strong>, Ministry of Power and Ministry of External<br />

Affairs have authorized <strong>PTC</strong> as Nodal Agency for<br />

Cross- Border trade in Electricity with Bhutan and<br />

Nepal. Since the year 2002 of trade, <strong>PTC</strong> has been<br />

playing this role with alacrity to the full satisfaction<br />

of all stake holders. E-transfer of funds, guaranteed<br />

payments, prompt handling of reconciliation and<br />

other services offered to Bhutan are so far very<br />

smooth and has not raised any issue of dispute.<br />

For better understanding of the regional trade<br />

between Indo-Bhutan and Indo-Nepal, one needs<br />

to look at the milestones achieved so far.<br />

Hydropower Exports from Bhutan<br />

Bhutan and <strong>India</strong> are connected at varying voltage<br />

levels from 11 KV to 400 KV transmission networks.<br />

<strong>India</strong> has been purchasing power from Tala (1020<br />

MW), Chhukha (336 MW) and Kurichhu (60 MW)<br />

Hydro Plants, through <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong> via<br />

respective Long Term Power Purchase Agreement.<br />

The total capacity of hydro developed so far in<br />

Bhutan is about 1500 MW, which is less than 5% of<br />

the total potential.<br />

The table below details the energy export to<br />

<strong>India</strong> (MUs)<br />

Year Energy Exports to <strong>India</strong> (MUs)<br />

2003-04 1751<br />

2004-05 1735<br />

2005-06 1762<br />

2006-07 2963<br />

2007-08 5234<br />

2008-09 5883<br />

2009-10 5334<br />

2010-11 5569<br />

2011-12 5275<br />

Bhutan’s unexploited hydropower potential<br />

exceeds 30,000 MW, with easily accessible sites<br />

estimated at 10,000 MW with 60% load factor.<br />

28 | <strong>PTC</strong>HRONICLE | OCTOBER <strong>2012</strong>

Harish Saran<br />

Executive Vice President, <strong>PTC</strong> <strong>India</strong> <strong>Limited</strong><br />

The evolution of the power trading market in <strong>India</strong><br />

has encouraged investments in Bhutan, allowing<br />

<strong>India</strong>’s demand pattern to be matched by Bhutan’s<br />

supply pattern. The electricity trade with <strong>India</strong> has<br />

been the largest revenue earner for Bhutan in<br />

exports. The cumulative energy import by <strong>India</strong><br />

from Bhutan has been about 36 BUs till 31st<br />

March’<strong>2012</strong>.<br />

The development of hydro projects in Bhutan is<br />

fostering on account of smoother environmental<br />

clearances, lesser rehabilitation and resettlement<br />

issues, easier ‘Right of Way’ for transmission and<br />

comparatively easier land acquisition for projects.<br />

Some Important Hydro Projects proposed for<br />

development are:<br />

• Run-of-the River<br />