Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Investor Presentation May 2013 - Northland Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

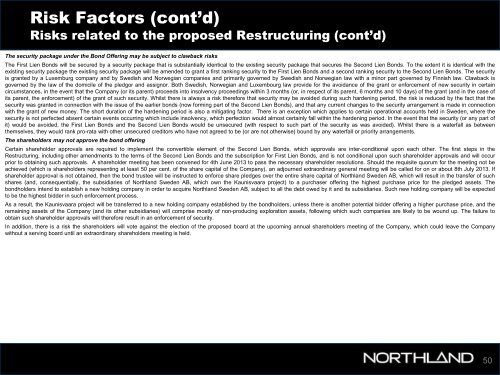

Risk Factors (cont’d)<br />

Risks related to the proposed Restructuring (cont’d)<br />

The security package under the Bond Offering may be subject to clawback risks<br />

The First Lien Bonds will be secured by a security package that is substantially identical to the existing security package that secures the Second Lien Bonds. To the extent it is identical with the<br />

existing security package the existing security package will be amended to grant a first ranking security to the First Lien Bonds and a second ranking security to the Second Lien Bonds. The security<br />

is granted by a Luxemburg company and by Swedish and Norwegian companies and primarily governed by Swedish and Norwegian law with a minor part governed by Finnish law. Clawback is<br />

governed by the law of the domicile of the pledgor and assignor. Both Swedish, Norwegian and Luxembourg law provide for the avoidance of the grant or enforcement of new security in certain<br />

circumstances, in the event that the Company (or its parent) proceeds into insolvency proceedings within 3 months (or, in respect of its parent, 6 months and 10 days) of the grant (and in the case of<br />

its parent, the enforcement) of the grant of such security. Whilst there is always a risk therefore that security may be avoided during such hardening period, the risk is reduced by the fact that the<br />

security was granted in connection with the issue of the earlier bonds (now forming part of the Second Lien Bonds), and that any current changes to the security arrangement is made in connection<br />

with the grant of new money. The short duration of the hardening period is also a mitigating factor. There is an exception which applies to certain operational accounts held in Sweden, where the<br />

security is not perfected absent certain events occurring which include insolvency, which perfection would almost certainly fall within the hardening period. In the event that the security (or any part of<br />

it) would be avoided, the First Lien Bonds and the Second Lien Bonds would be unsecured (with respect to such part of the security as was avoided). Whilst there is a waterfall as between<br />

themselves, they would rank pro-rata with other unsecured creditors who have not agreed to be (or are not otherwise) bound by any waterfall or priority arrangements.<br />

The shareholders may not approve the bond offering<br />

Certain shareholder approvals are required to implement the convertible element of the Second Lien Bonds, which approvals are inter-conditional upon each other. The first steps in the<br />

Restructuring, including other amendments to the terms of the Second Lien Bonds and the subscription for First Lien Bonds, and is not conditional upon such shareholder approvals and will occur<br />

prior to obtaining such approvals. A shareholder meeting has been convened for 4th June <strong>2013</strong> to pass the necessary shareholder resolutions. Should the requisite quorum for the meeting not be<br />

achieved (which is shareholders representing at least 50 per cent. of the share capital of the Company), an adjourned extraordinary general meeting will be called for on or about 8th July <strong>2013</strong>. If<br />

shareholder approval is not obtained, then the bond trustee will be instructed to enforce share pledges over the entire share capital of <strong>Northland</strong> Sweden AB, which will result in the transfer of such<br />

shares (and, consequentially, the subsidiaries of <strong>Northland</strong> Sweden AB, which own the Kaunisvaara project) to a purchaser offering the highest purchase price for the pledged assets. The<br />

bondholders intend to establish a new holding company in order to acquire <strong>Northland</strong> Sweden AB, subject to all the debt owed by it and its subsidiaries. Such new holding company will be expected<br />

to be the highest bidder in such enforcement process.<br />

As a result, the Kaunisvaara project will be transferred to a new holding company established by the bondholders, unless there is another potential bidder offering a higher purchase price, and the<br />

remaining assets of the Company (and its other subsidiaries) will comprise mostly of non-producing exploration assets, following which such companies are likely to be wound up. The failure to<br />

obtain such shareholder approvals will therefore result in an enforcement of security.<br />

In addition, there is a risk the shareholders will vote against the election of the proposed board at the upcoming annual shareholders meeting of the Company, which could leave the Company<br />

without a serving board until an extraordinary shareholders meeting is held.<br />

50