Magic Quadrant for Network Access Control.pdf - WIT

Magic Quadrant for Network Access Control.pdf - WIT

Magic Quadrant for Network Access Control.pdf - WIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

1 of 18 19/8/2553 15:31<br />

2 July 2010<br />

Lawrence Orans, John Pescatore<br />

Gartner RAS Core Research Note G00201432<br />

The network access control market continued to mature, squeezing hype out of the market and intensifying the focus on<br />

ease of implementation and near-term payback. Several point solutions persist, with some continuing to provide<br />

differentiated value.<br />

What You Need to Know<br />

<strong>Network</strong> access control (NAC) will increasingly be used to help enterprises<br />

manage the consumerization trend, as more enterprises allow employees to "bring<br />

their own PC to work." NAC will enable network managers to gain back some<br />

control over their networks by allowing access to some devices, while denying<br />

access to others. When evaluating NAC solutions, look <strong>for</strong> vendors that<br />

understand the consumerization trend and support, or have plans to support,<br />

policies <strong>for</strong> managing the non-Microsoft endpoints that will inevitably attempt to<br />

connect to your network.<br />

Return to Top<br />

Vendors Added or Dropped<br />

We review and adjust our inclusion criteria <strong>for</strong><br />

<strong>Magic</strong> <strong>Quadrant</strong>s and MarketScopes as markets<br />

change. As a result of these adjustments, the<br />

mix of vendors in any <strong>Magic</strong> <strong>Quadrant</strong> or<br />

MarketScope may change over time. A vendor<br />

appearing in a <strong>Magic</strong> <strong>Quadrant</strong> or MarketScope<br />

one year and not the next does not necessarily<br />

indicate that we have changed our opinion of<br />

that vendor. This may be a reflection of a<br />

change in the market and, there<strong>for</strong>e, changed<br />

evaluation criteria, or a change of focus by a<br />

vendor.<br />

Evaluation Criteria Definitions<br />

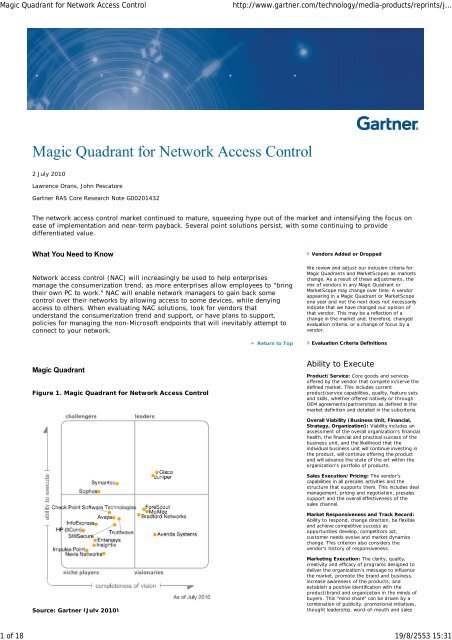

<strong>Magic</strong> <strong>Quadrant</strong><br />

Figure 1. <strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

Ability to Execute<br />

Product/Service: Core goods and services<br />

offered by the vendor that compete in/serve the<br />

defined market. This includes current<br />

product/service capabilities, quality, feature sets<br />

and skills, whether offered natively or through<br />

OEM agreements/partnerships as defined in the<br />

market definition and detailed in the subcriteria.<br />

Overall Viability (Business Unit, Financial,<br />

Strategy, Organization): Viability includes an<br />

assessment of the overall organization's financial<br />

health, the financial and practical success of the<br />

business unit, and the likelihood that the<br />

individual business unit will continue investing in<br />

the product, will continue offering the product<br />

and will advance the state of the art within the<br />

organization's portfolio of products.<br />

Sales Execution/Pricing: The vendor's<br />

capabilities in all presales activities and the<br />

structure that supports them. This includes deal<br />

management, pricing and negotiation, presales<br />

support and the overall effectiveness of the<br />

sales channel.<br />

Market Responsiveness and Track Record:<br />

Ability to respond, change direction, be flexible<br />

and achieve competitive success as<br />

opportunities develop, competitors act,<br />

customer needs evolve and market dynamics<br />

change. This criterion also considers the<br />

vendor's history of responsiveness.<br />

Source: Gartner (July 2010)<br />

Marketing Execution: The clarity, quality,<br />

creativity and efficacy of programs designed to<br />

deliver the organization's message to influence<br />

the market, promote the brand and business,<br />

increase awareness of the products, and<br />

establish a positive identification with the<br />

product/brand and organization in the minds of<br />

buyers. This "mind share" can be driven by a<br />

combination of publicity, promotional initiatives,<br />

thought leadership, word-of-mouth and sales

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

2 of 18 19/8/2553 15:31<br />

Market Overview<br />

Return to Top<br />

Although NAC adoption increased (primarily to support guest networking) in<br />

2009, as we predicted in "<strong>Network</strong> <strong>Access</strong> <strong>Control</strong> Market Overview" in December<br />

2004, the increasing availability of NAC functionality in network infrastructure and<br />

endpoint protection (EPP) products put severe pressure on NAC revenue. In 2004,<br />

we said, "However, as organizations progress through the technology refresh<br />

cycle and upgrade to solutions with built-in NAC functions, many will no longer<br />

pay extra <strong>for</strong> independent NAC solutions." We saw many enterprises decide to<br />

look to their EPP vendors <strong>for</strong> embedded NAC capabilities, as well as many that<br />

decided to wait until they rolled out Windows 7 on desktops to make NAC<br />

decisions. Although this was partly driven by the economic slowdown, it mostly<br />

represents what will be the continuing market reality.<br />

This led to the exit of ConSentry <strong>Network</strong>s from the NAC market, while other NAC<br />

vendors attempted to broaden their products' appeal beyond NAC functionality.<br />

Aruba, which had been reselling a private-labeled version of Brad<strong>for</strong>d <strong>Network</strong>s'<br />

NAC appliance, decided it made more sense to focus on selling rich wireless<br />

networking solutions with embedded NAC capabilities, rather than to pursue<br />

specific NAC revenue.<br />

The pressure on the NAC market and the failure of several NAC vendors have led<br />

to a common misconception that "NAC is dead" — classic Trough of<br />

Disillusionment behavior. However, in working with Gartner clients evaluating and<br />

deploying NAC during the past year, as well as in talking to the reference<br />

customers supplied by vendors as part of this <strong>Magic</strong> <strong>Quadrant</strong> analysis, we<br />

continue to see early adopters expanding beyond basic NAC functionality, while<br />

new NAC installations continue to focus on meeting immediate guest networking<br />

needs. The "consumerization of IT" trend is driving the need <strong>for</strong> guest networking<br />

to rapidly expand beyond contractors and visitors to employees using their own<br />

laptops or smartphones. To a large extent, many enterprises are starting to look<br />

more like the early adopters of NAC, college campuses, with an increasingly<br />

chaotic mix of managed and unmanaged IT on the corporate network. Because<br />

employee-owned laptops or smartphones will typically not have corporate<br />

endpoint security software on them, stand-alone NAC capabilities will see higher<br />

demand.<br />

As targeted botnet attacks (such as that suffered by Google and many other<br />

high-profile businesses in 2010) cause increasing damage, Gartner believes those<br />

initial guest networking implementations will be expanded to include the endpoint<br />

baselining/health check — provided that NAC vendors move beyond simple<br />

vulnerability checking and build in support <strong>for</strong> detecting whether an endpoint is<br />

dangerous versus just missing patches or being behind in antivirus signatures.<br />

The increasing publicity around targeted malware has also caused increased<br />

demand <strong>for</strong> post-connect containment capabilities, but we have seen very limited<br />

demand <strong>for</strong> advanced identity-aware NAC capabilities, outside of the traditional<br />

high-security "belt and suspenders" enterprises. We believe that NAC vendors that<br />

manage to grow in 2010 and beyond will be the ones that increase their<br />

capabilities <strong>for</strong> enterprises to safely allow unmanaged PCs and mobile devices to<br />

be used to meet business needs.<br />

activities.<br />

Customer Experience: Relationships, products<br />

and services/programs that enable clients to be<br />

successful with the products evaluated.<br />

Specifically, this includes the ways customers<br />

receive technical support or account support.<br />

This can also include ancillary tools, customer<br />

support programs (and the quality thereof),<br />

availability of user groups, service-level<br />

agreements and so on.<br />

Operations: The ability of the organization to<br />

meet its goals and commitments. Factors include<br />

the quality of the organizational structure,<br />

including skills, experiences, programs, systems<br />

and other vehicles that enable the organization<br />

to operate effectively and efficiently on an<br />

ongoing basis.<br />

Completeness of Vision<br />

Market Understanding: Ability of the vendor<br />

to understand buyers' wants and needs and to<br />

translate those into products and services.<br />

Vendors that show the highest degree of vision<br />

listen to and understand buyers' wants and<br />

needs, and can shape or enhance those with<br />

their added vision.<br />

Marketing Strategy: A clear, differentiated set<br />

of messages consistently communicated<br />

throughout the organization and externalized<br />

through the website, advertising, customer<br />

programs and positioning statements.<br />

Sales Strategy: The strategy <strong>for</strong> selling<br />

products that uses the appropriate network of<br />

direct and indirect sales, marketing, service and<br />

communication affiliates that extend the scope<br />

and depth of market reach, skills, expertise,<br />

technologies, services and the customer base.<br />

Offering (Product) Strategy: The vendor's<br />

approach to product development and delivery<br />

that emphasizes differentiation, functionality,<br />

methodology and feature sets as they map to<br />

current and future requirements.<br />

Business Model: The soundness and logic of<br />

the vendor's underlying business proposition.<br />

Vertical/Industry Strategy: The vendor's<br />

strategy to direct resources, skills and offerings<br />

to meet the specific needs of individual market<br />

segments, including vertical markets.<br />

Innovation: Direct, related, complementary and<br />

synergistic layouts of resources, expertise or<br />

capital <strong>for</strong> investment, consolidation, defensive<br />

or pre-emptive purposes.<br />

Geographic Strategy: The vendor's strategy<br />

to direct resources, skills and offerings to meet<br />

the specific needs of geographies outside the<br />

"home" or native geography, either directly or<br />

through partners, channels and subsidiaries as<br />

appropriate <strong>for</strong> that geography and market.<br />

The four most common uses <strong>for</strong> NAC are:<br />

Guest network services: Isolating guests and visitors from the corporate<br />

network and providing them with limited connectivity — typically, Internet<br />

access only. Guest networking was the primary driver in approximately 75%<br />

of NAC deployments. Most organizations are starting with wireless guest<br />

access and are planning to extend guest networking capabilities to the<br />

wired network.<br />

Endpoint baselining: Determining whether endpoints on the corporate<br />

network are compliant with device configuration policies (<strong>for</strong> example,<br />

up-to-date patches and antivirus signatures). Endpoint baselining was the<br />

primary driver in approximately 15% of NAC deployments.<br />

Quarantine/containment: Restricting network access either when<br />

endpoints are noncompliant with configuration policies, or when suspicious<br />

traffic from the endpoint presents a risk to the network or to other<br />

endpoints. Quarantining noncompliant endpoints is common in educational<br />

environments (where schools often don't control the endpoints); however,<br />

in other environments, it is only the primary driver in approximately 5% of<br />

deployments. Remediating noncompliant endpoints and "dangerous"<br />

endpoints is an important aspect of this use case.<br />

Identity-aware networking: Providing greater visibility and control over

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

3 of 18 19/8/2553 15:31<br />

user behavior on the network. Organizations add identity awareness to the<br />

network to monitor user traffic and en<strong>for</strong>ce access to critical resources.<br />

Identity-aware networking was the primary driver in approximately 5% of<br />

NAC deployments.<br />

Return to Top<br />

Market Definition/Description<br />

The NAC market consists of several categories, as outlined below:<br />

Infrastructure: Most enterprise-class LAN switch manufacturers offer NAC<br />

solutions. Seven of the eight vendors analyzed in "<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong><br />

Enterprise LAN (Global)," sell NAC products. The LAN switch vendors<br />

primarily target their NAC solutions to their installed base. That is a good<br />

strategy, because network managers, who are the buyers of LAN switches,<br />

are usually the buyers of NAC solutions. Infrastructure vendors have had<br />

limited success in selling their NAC solutions outside of their installed bases<br />

and into their competitors' accounts.<br />

EPP: Some vendors that sell EPP suites also offer NAC solutions (<strong>for</strong><br />

example, Check Point Software Technologies, McAfee, Sophos and<br />

Symantec). All these vendors benefit from their existing desktop "footprint,"<br />

which gives them an advantage in the endpoint baselining usage case.<br />

<strong>Network</strong> security vendors: A mix of intrusion prevention system (IPS),<br />

firewall and virtual private network (VPN) vendors offer NAC solutions.<br />

Because they already serve as en<strong>for</strong>cement points in the network, these<br />

products can be easily repurposed to become NAC policy en<strong>for</strong>cement<br />

points.<br />

Pure-play vendors: Several vendors are pure-play NAC vendors or<br />

vendors with multifunctional offerings whose primary focus is NAC (<strong>for</strong><br />

example, Avenda Systems, Brad<strong>for</strong>d <strong>Network</strong>s, ForeScout, Impulse Point,<br />

InfoExpress and Nevis <strong>Network</strong>s). The pure-play vendors face the biggest<br />

challenges, as vendors in the other three categories continue to enhance<br />

their NAC offerings.<br />

When measured by annual revenue, the NAC market is declining. Gartner<br />

estimates that the size of the NAC market in 2009 was approximately $199<br />

million, a decrease of approximately 10% over the market in 2008. We had<br />

anticipated a slowdown in market growth to 25%, but market factors detailed<br />

above and the severity of the economic slump contributed to the shrinking<br />

market. Also, some vendors exited the market, and others entered, but the overall<br />

effect was a net loss in market size. As we predicted back in 2004, the NAC<br />

capabilities existing or promised in network infrastructure, EPP plat<strong>for</strong>ms and the<br />

latest Windows desktop operating system impacted the growth of NAC-specific<br />

revenue, even as NAC "seats" increased. For 2010, we expect a flat market, with<br />

total revenue of approximately $200 million. Positive NAC demand factors, such<br />

as support <strong>for</strong> consumerization, will be offset by embedded NAC and a focus on<br />

inexpensive authentication, particularly 802.1X.<br />

Return to Top<br />

Inclusion and Exclusion Criteria<br />

The goal of the inclusion/exclusion criteria listed below is to identify those<br />

vendors that own core NAC technology. Vendors whose solutions are based<br />

heavily on technology that is licensed from original equipment manufacturers<br />

have been excluded from this <strong>Magic</strong> <strong>Quadrant</strong>.<br />

To be included in this <strong>Magic</strong> <strong>Quadrant</strong>, the vendors' solutions must include the<br />

policy, baseline and access control elements of NAC, as defined by the following<br />

criteria:<br />

Policy: The NAC solution must include a dedicated policy management<br />

server with a management interface <strong>for</strong> defining and administering security<br />

configuration requirements and <strong>for</strong> specifying the access control actions<br />

(<strong>for</strong> example, allow or quarantine) <strong>for</strong> compliant and noncompliant<br />

endpoints. The ability to report on the overall state of endpoint compliance<br />

is a critical component of the policy function. Because policy administration<br />

and reporting functions are key areas of NAC innovation and differentiation,<br />

vendors must own the core policy function to be included in this <strong>Magic</strong><br />

<strong>Quadrant</strong>.<br />

Baseline: A baseline determines the security state of an endpoint that is<br />

attempting a network connection (LAN, wireless LAN or VPN) so that a<br />

decision can be made about the level of access that will be allowed.<br />

Baselining must include the ability to assess policy compliance (<strong>for</strong>

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

4 of 18 19/8/2553 15:31<br />

example, up-to-date patches and antivirus signatures) and may include the<br />

ability to detect installed malware. Various technologies may be used <strong>for</strong><br />

the baseline function, including agentless solutions (such as vulnerability<br />

assessment scans), dissolvable agents and persistent agents. NAC solutions<br />

must include a baseline function, but "reinventing the wheel" is not<br />

necessary. Baseline functionality may be obtained via an OEM or licensing<br />

partnership.<br />

<strong>Access</strong> control: The NAC solution must include the ability to block,<br />

quarantine or grant full access to an endpoint. The solution must be flexible<br />

enough to en<strong>for</strong>ce access control in a multivendor network infrastructure,<br />

and it must be able to en<strong>for</strong>ce access in both LAN and remote-access<br />

environments. En<strong>for</strong>cement must be accomplished either via the network<br />

infrastructure — <strong>for</strong> example, 802.1X, virtual LANs (VLANs), access control<br />

lists (ACLs) — or via the vendor's NAC solution — <strong>for</strong> example,<br />

dropping/filtering packets or Address Resolution Protocol (ARP) spoofing.<br />

Dynamic Host Configuration Protocol (DHCP) en<strong>for</strong>cement qualifies <strong>for</strong><br />

inclusion, provided that policy en<strong>for</strong>cement can be delivered via<br />

partnerships with two or more DHCP solutions. Vendors that rely solely on<br />

agent-based endpoint self-en<strong>for</strong>cement do not qualify as NAC solutions.<br />

Additional criteria:<br />

Solutions must link to remediation systems (<strong>for</strong> example, patch and<br />

configuration management), but they do not need to own core mitigation<br />

technology.<br />

The products with the required features and functions must be shipping as<br />

of 1 February 2010.<br />

The vendor must have at least $2 million in NAC sales during the 12 months<br />

leading up to 1 February 2010.<br />

Vendors Considered but Not Included in the 2010 <strong>Magic</strong> <strong>Quadrant</strong><br />

LAN Switch Manufacturers<br />

LAN switch manufacturers that base critical components of their NAC solutions on<br />

OEM technology or that resell NAC solutions from other vendors have been<br />

excluded from this <strong>Magic</strong> <strong>Quadrant</strong>. For example, Extreme <strong>Network</strong>s has not been<br />

included in our analysis, because its Sentriant AG200 NAC solution is based on<br />

StillSecure's Safe <strong>Access</strong> product. Alcatel-Lucent has not been included, because<br />

its approach to NAC is to resell the CyberGatekeeper solution from InfoExpress.<br />

Small or Midsize Business (SMB) Vendors<br />

SMB vendors that lack enterprise-class features and functions have been excluded<br />

from this <strong>Magic</strong> <strong>Quadrant</strong>. For example, NetClarity is a vendor that targets SMBs.<br />

Its NetClarity family of NACwall appliances use an agentless (no additional<br />

software on the PCs) approach to baseline the health of the endpoints. NACwalls<br />

are deployed out of band in LANs, so they install easily and are not in the line of<br />

traffic (no additional latency to the network). NACwall appliances interface with<br />

existing switches and firewalls to en<strong>for</strong>ce access control. ARP manipulation can<br />

also be used to en<strong>for</strong>ce access. Napera <strong>Network</strong>s, an SMB-focused vendor that<br />

previously sold a family of switches with embedded support <strong>for</strong> Microsoft <strong>Network</strong><br />

<strong>Access</strong> Protection (NAP), has shifted its strategy to offer a cloud-based<br />

subscription service that per<strong>for</strong>ms endpoint baselining.<br />

Microsoft<br />

Microsoft embeds NAC functionality (branded as Microsoft NAP) within its more<br />

recent operating systems (Windows 7, Vista and XP Service Pack 3) and within<br />

Windows Server 2008. Consistent with our practice from 2009, we did not include<br />

Microsoft in this year's <strong>Magic</strong> <strong>Quadrant</strong> because of the requirement that<br />

organizations need to upgrade to the required Microsoft products. None of the<br />

other solutions in this <strong>Magic</strong> <strong>Quadrant</strong> require a desktop operating system update.<br />

However, we will re-evaluate Microsoft and the market penetration of Microsoft<br />

NAP-ready endpoints in 2011.<br />

Return to Top<br />

Added<br />

Avaya (via its acquisition of Nortel's Enterprise Solutions unit).<br />

Avenda Systems<br />

HP (via its acquisition of 3Com)<br />

Nevis <strong>Network</strong>s<br />

Return to Top

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

5 of 18 19/8/2553 15:31<br />

Dropped<br />

Aruba has terminated its licensing agreement with Brad<strong>for</strong>d <strong>Network</strong>s,<br />

which was the OEM of Aruba's Endpoint Compliance Systems appliance.<br />

Aruba is re-evaluating its NAC strategy.<br />

ConSentry effectively went out of business in August 2009 (although its<br />

website, at the time of this <strong>Magic</strong> <strong>Quadrant</strong>'s publication, is still operational<br />

and makes no mention of the company's change in status).<br />

Return to Top<br />

Evaluation Criteria<br />

Ability to Execute<br />

The Ability to Execute criteria are:<br />

Product/Service: An evaluation of the features and functions of the<br />

vendor's NAC solution. Because the most common usage case <strong>for</strong> NAC is<br />

guest networking (blocking unmanaged endpoints from the main network,<br />

and granting them limited access or Internet access only), those solutions<br />

with strong support <strong>for</strong> guest networking will score strongly. Support <strong>for</strong><br />

endpoint baselining and, to a lesser extent, identity-aware networking is<br />

also an important part of this criterion. Ease of use and the overall quality<br />

of the management and reporting features will be important considerations.<br />

Those solutions that support a variety of en<strong>for</strong>cement options (<strong>for</strong> example,<br />

VLAN steering, ACLs, DHCP and others) will score more highly than<br />

solutions with limited en<strong>for</strong>cement options.<br />

Overall Viability: Viability includes an assessment of the vendor's overall<br />

financial health, the financial and practical success of the business unit, and<br />

the likelihood of the individual business unit to continue to invest in an NAC<br />

solution.<br />

Sales Execution/Pricing: The vendors' capabilities in all presales<br />

activities and the structure that supports them. The ability of vendors to<br />

succeed in their target markets is important. Vendors that target large<br />

enterprises should demonstrate success in winning NAC deals of 10,000<br />

endpoints and more. Vendors that target SMBs should demonstrate a high<br />

volume of smaller and midsize deals.<br />

Market Responsiveness and Track Record: Ability to respond, change<br />

direction and be flexible as market dynamics vary. This criterion also<br />

considers the vendor's history of responsiveness, including how quickly it<br />

responded when the primary focus on NAC shifted from endpoint baselining<br />

to guest networking.<br />

Marketing Execution: This criterion assesses the effectiveness of the<br />

vendor's marketing programs and its ability to create awareness and "mind<br />

share" in the NAC market. Those vendors that frequently appear on client<br />

shortlists are succeeding in marketing execution.<br />

Customer Experience: Quality of the customer experience based on<br />

reference calls and input from Gartner clients.<br />

Operations: The ability of the organization to meet its goals and<br />

commitments in an efficient manner. Past per<strong>for</strong>mance is weighted heavily.<br />

Note — this criterion will not be evaluated <strong>for</strong> the NAC <strong>Magic</strong> <strong>Quadrant</strong>.<br />

Table 1. Ability to Execute Evaluation Criteria<br />

Evaluation Criteria<br />

Weighting<br />

Product/Service<br />

High<br />

Overall Viability (Business Unit, Financial, Strategy, Organization) High<br />

Sales Execution/Pricing<br />

Standard<br />

Market Responsiveness and Track Record<br />

Standard<br />

Marketing Execution<br />

Standard<br />

Customer Experience<br />

High<br />

Operations<br />

No rating<br />

Source: Gartner (July 2010)<br />

Return to Top<br />

Completeness of Vision

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

6 of 18 19/8/2553 15:31<br />

Completeness of Vision criteria are:<br />

Market Understanding: Ability of the vendor to understand buyers' needs<br />

and translate these needs into NAC products. This includes the ability to<br />

anticipate market trends and to quickly adapt via partnerships, acquisitions<br />

or internal development.<br />

Marketing Strategy: This criterion analyzes whether the vendor's<br />

marketing strategy succeeds in differentiating its NAC solution from its<br />

competitors.<br />

Sales Strategy: The vendor's strategy <strong>for</strong> selling to its target audience,<br />

including an analysis of the appropriate mix of direct and indirect sales<br />

channels.<br />

Offering (Product) Strategy: An evaluation of the vendor's strategic<br />

product direction and its road map <strong>for</strong> NAC. The product strategy should<br />

address the NAC trends reflected in Gartner's client inquiries.<br />

Business Model: The soundness and logic of the vendor's underlying value<br />

proposition. How well will the vendors' NAC strategy succeed in an<br />

environment where NAC is increasingly becoming a feature of broader<br />

network and security solutions.<br />

Vertical/Industry Strategy: The vendor's strategy <strong>for</strong> meeting the<br />

specific needs of individual vertical markets and market segments (<strong>for</strong><br />

example, higher education).<br />

Innovation: This criterion includes product leadership and the ability to<br />

deliver NAC features and functions that distinguish the vendor from its<br />

competitors.<br />

Geographic Strategy: The vendor's strategy <strong>for</strong> penetrating geographies<br />

outside its home or native market.<br />

Table 2. Completeness of Vision<br />

Evaluation Criteria<br />

Evaluation Criteria Weighting<br />

Market Understanding High<br />

Marketing Strategy Standard<br />

Sales Strategy<br />

Standard<br />

Offering (Product) Strategy High<br />

Business Model<br />

Standard<br />

Vertical/Industry Strategy Low<br />

Innovation<br />

Standard<br />

Geographic Strategy Low<br />

Source: Gartner (July 2010)<br />

Return to Top<br />

Leaders<br />

Leaders are successful in selling large NAC implementations (10,000 nodes and<br />

above) to multiple large enterprises as a primary offering. Leaders are networking<br />

and/or security companies that recognized early on that NAC would be an<br />

important component of their overall product portfolios and have been first to<br />

market with enhanced capabilities as the market matures. Leaders have the<br />

resources to maintain their commitment to NAC, have strong channel strength and<br />

have financial resources. They have also demonstrated a strong understanding of<br />

the future direction of NAC, including market demand <strong>for</strong> inexpensive guest<br />

network and authentication solutions. Leaders should not equate to a default<br />

choice <strong>for</strong> every buyer, and clients should not assume that they must buy only<br />

from vendors in the Leaders quadrant.<br />

Return to Top<br />

Challengers<br />

Challengers are networking and/or security companies that have been successful<br />

in selling NAC to their installed bases, although they are generally unsuccessful in<br />

selling NAC to the broader market. Challengers are generally not NAC innovators,<br />

but are large enough and diversified enough to continue investing in their NAC<br />

strategy. They are able to withstand challenges and setbacks more easily than<br />

Niche Players.

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

7 of 18 19/8/2553 15:31<br />

Return to Top<br />

Visionaries<br />

Visionaries have led the market in product innovation and/or displayed an early<br />

understanding of market <strong>for</strong>ces and trends. They are either smaller pure-play NAC<br />

vendors or larger networking and/or security companies. A common theme in<br />

visionary vendors is that they don't have significant channel strength and have not<br />

succeeded in building installed bases as large as the leaders. Pure-play vendors in<br />

the Visionaries quadrant face challenges in moving into the Leaders quadrant, due<br />

to the trend of network and security companies embedding NAC functionality in<br />

their existing solutions.<br />

Return to Top<br />

Niche Players<br />

Niche Players represent a mix of small and large companies. The large companies<br />

are network and/or security vendors that have had some success in selling NAC to<br />

their traditional installed base, but typically face stiff competition from other NAC<br />

vendors. Large Niche Players have generally struggled to sell NAC to the broader<br />

market. Small Niche Players don't appear often on Gartner clients' shortlists, but<br />

some of them are successful in addressing subsets of the overall market. Niche<br />

Players are valid suppliers in the market and often provide solutions targeted to<br />

the needs of a particular vertical industry.<br />

Return to Top<br />

Vendor Strengths and Cautions<br />

Avaya<br />

Avaya appears in the NAC <strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> the first time, as a result of its<br />

acquisition of Nortel's Enterprise Solutions unit. The key component in Avaya's<br />

NAC strategy is its RADIUS-based policy server, known as the Ignition Server,<br />

which is part of a solution that Nortel gained by acquiring key intellectual<br />

property of Identity Engines. The Ignition Server is available only as a virtual<br />

machine on VMware. The Avaya Health Agent is capable of baselining Windows<br />

endpoints. The primary use case <strong>for</strong> Avaya's NAC solution is the installed base of<br />

Nortel switch and wireless LAN customers, although the Ignition Server is capable<br />

of supporting non-Nortel environments.<br />

Return to Top<br />

Strengths<br />

Support <strong>for</strong> Microsoft NAP makes the Ignition Server a good choice in<br />

all-Microsoft environments.<br />

The Identity Engines offering provides a strong guest networking solution<br />

that is complete with user provisioning, reporting and management<br />

capabilities.<br />

Avaya has strong multivendor 802.1X support and operational tools (<strong>for</strong><br />

example, authentication reports) <strong>for</strong> easing the operational challenges of<br />

managing an 802.1X environment.<br />

Return to Top<br />

Cautions<br />

Avaya's NAC solution does not include permanent agents <strong>for</strong> baselining OS<br />

X, Linux or other non-Microsoft endpoints. It also does not offer an<br />

agentless scanning option.<br />

The Avaya installed base of network infrastructure (the main target<br />

audience <strong>for</strong> Avaya NAC) remains somewhat cautious and skeptical about<br />

Avaya's commitment to the market after enduring a very difficult and<br />

uncertain period as Nortel consolidated investments and dispersed its<br />

assets.<br />

Avaya's NAC solution has little visibility in the broader market (beyond<br />

Nortel's installed base).

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

8 of 18 19/8/2553 15:31<br />

Return to Top<br />

Avenda Systems<br />

Avenda Systems is a new entrant in the NAC <strong>Magic</strong> <strong>Quadrant</strong>. Its focus on the<br />

guest network use case and on interoperability (it was an early supporter of<br />

Trusted <strong>Network</strong> Connect [TNC] protocols) has contributed to its position in the<br />

Visionaries quadrant. Founded in 2006, Avenda's flagship offering is a<br />

RADIUS-based policy server, known as Enterprise Trust & Identity Policy System<br />

(eTIPS), that can be used in heterogeneous environments (mixed endpoints<br />

and/or mixed network infrastructure). eTIPS is available in an appliance <strong>for</strong>m<br />

factor, and also as a virtual machine <strong>for</strong> VMware. It supports 802.1X and<br />

Web-based authentication <strong>for</strong> wireless, wired and VPN environments, and can also<br />

be used to enable the endpoint baselining use case <strong>for</strong> NAC (it supports<br />

permanent agents, dissolvable agents and agentless scans via Nessus). Multiple<br />

en<strong>for</strong>cement options are offered, including VLAN steering, ACLs and DHCP.<br />

Enterprises that can tolerate the risks of a startup and need a solution to support<br />

a heterogeneous environment should consider Avenda.<br />

Return to Top<br />

Strengths<br />

Support <strong>for</strong> the TNC's Statement of Health protocol enables Avenda to<br />

provide endpoint baselining <strong>for</strong> Microsoft NAP-enabled endpoints (Windows<br />

7, Vista and XP SP3) without requiring an additional agent. Avenda also<br />

provides agents that can baseline endpoints running Apple OS X and Linux<br />

operating systems.<br />

Avenda's Quick 1X tool simplifies the configuration of a broad set of<br />

supplicants, including supplicants native to Windows and Linux. It also<br />

supports supplicants on Mac OS X, iPhone and iPad operating systems.<br />

References <strong>for</strong> Avenda commented that its solution provides a flexible and<br />

granular approach to creating policies.<br />

Return to Top<br />

Cautions<br />

Avenda's prospects <strong>for</strong> success are tied heavily to 802.1X, <strong>for</strong> which<br />

adoption in wired networks has been slow thus far.<br />

Enterprise inertia is a challenge <strong>for</strong> Avenda. Most enterprises have already<br />

implemented RADIUS servers from Cisco, FreeRADIUS, Microsoft or Juniper<br />

<strong>for</strong> their VPN and wireless access, and they are likely to stay with these<br />

existing solutions as they begin to extend RADIUS-based authentication to<br />

their wired networks.<br />

Avenda is a small company with limited resources. Microsoft and other<br />

vendors with a focus on the TNC specifications (<strong>for</strong> example, Juniper) have<br />

the resources to thwart Avenda's progress by duplicating eTIPS functionality<br />

on their own policy servers.<br />

Return to Top<br />

Brad<strong>for</strong>d <strong>Network</strong>s<br />

Brad<strong>for</strong>d <strong>Network</strong>s was one of the earlier entrants into the NAC market,<br />

developing its Campus Manager product to meet the needs of universities to allow<br />

a wide variety of university-owned and student-owned PCs to connect without<br />

causing security problems. Brad<strong>for</strong>d has built on this vertical industry to attack<br />

the broader NAC market. In May 2009, it brought in a new CEO. Brad<strong>for</strong>d renamed<br />

its lead NAC product "<strong>Network</strong> Sentry" and took steps to put more discipline in its<br />

channel strategy to go after corporate markets. In 2009, Aruba terminated its<br />

agreement to license technology from Brad<strong>for</strong>d. The loss of that OEM deal offset<br />

gains in its ability to execute, brought by Brad<strong>for</strong>d expanding beyond the<br />

academic vertical market. Enterprises should evaluate Brad<strong>for</strong>d's capabilities when<br />

NAC requirements are driven by diverse IT environments.<br />

Return to Top<br />

Strengths<br />

Ease of deployment is rated very high <strong>for</strong> <strong>Network</strong> Sentry. Brad<strong>for</strong>d's<br />

out-of-band approach and wide plat<strong>for</strong>m support eliminate many potential

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

9 of 18 19/8/2553 15:31<br />

problems.<br />

Brad<strong>for</strong>d's experience in diverse university requirements puts it in a good<br />

position <strong>for</strong> satisfying enterprise needs to use NAC to secure the use of<br />

employee-owned PCs and smartphones.<br />

Brad<strong>for</strong>d consistently gets high marks <strong>for</strong> customer support and overall<br />

corporate responsiveness.<br />

In the past year, Brad<strong>for</strong>d had a number of wins outside of the university<br />

vertical market, some displacing other incumbent NAC vendors.<br />

Return to Top<br />

Cautions<br />

The ending of the OEM relationship with Aruba will slow Brad<strong>for</strong>d's<br />

progress in expanding beyond the academic vertical market.<br />

Like all other NAC pure-play vendors, Brad<strong>for</strong>d will be increasingly<br />

squeezed by NAC solutions offered by incumbent network infrastructure and<br />

EPP software vendors.<br />

Brad<strong>for</strong>d users consistently request improvements in <strong>Network</strong> Sentry's user<br />

interface and reporting.<br />

Return to Top<br />

Check Point Software Technologies<br />

Check Point Software Technologies is one of the largest pure-play security<br />

companies, with a large firewall and VPN gateway installed base, and a strong<br />

global channel. Check Point has been slowly accumulating the component pieces<br />

to compete in the EPP plat<strong>for</strong>m market, and is gradually building on its installed<br />

base from the acquisition of Pointsec in 2006. Thus, Check Point's NAC<br />

capabilities are features that can be enabled by enterprises using its network<br />

security, endpoint security products or both, rather than a stand-alone NAC<br />

offering. Check Point's planned support <strong>for</strong> advanced guest management<br />

capabilities and its embrace of industry standards gained it an increased vision<br />

rating this year. Check Point's offerings should be considered by enterprises using<br />

Check Point's network security and/or endpoint security products.<br />

Return to Top<br />

Strengths<br />

Check Point Cooperative En<strong>for</strong>cement works well across Checkpoint network<br />

security products and third-party Open Plat<strong>for</strong>m <strong>for</strong> Security (OPSEC)<br />

partner technology.<br />

Check Point offers both a dissolvable agent and the Abra USB-based<br />

"portable personality" device <strong>for</strong> securing access by unmanaged PCs.<br />

Check Point's installed base and global channel provide a strong<br />

competitive advantage, especially where the NAC deployment is remoteaccess-centric.<br />

Return to Top<br />

Cautions<br />

In the EPP plat<strong>for</strong>m market, Check Point competes against more-established<br />

solutions from McAfee, Sophos and Symantec, putting Check Point at a<br />

disadvantage in competitive endpoint-centric NAC deployments.<br />

Although Checkpoint has supported guest access through a captive portal<br />

approach, it has been slow to add advanced guest networking management<br />

capabilities.<br />

Return to Top<br />

Cisco<br />

Cisco's execution in the NAC market has not mirrored its success in the network<br />

infrastructure market. The most common complaint about Cisco's NAC solution is<br />

that it is too complex and too expensive. Cisco was slow to recognize and adapt<br />

to these deficiencies — thus, its backward movement along the Completeness of<br />

Vision axis. Cisco also lost points in its ability to execute, because many of its<br />

customers chose to implement competing NAC solutions. However, Cisco is<br />

shifting its NAC strategy, and if it executes well, it should remain a leader in the

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

10 of 18 19/8/2553 15:31<br />

NAC market. The two main elements of the renewed strategy are an increased<br />

focus on 802.1X <strong>for</strong> controlling guest access and a new NAC appliance that<br />

consolidates functionality that is presently distributed among multiple NAC<br />

appliances. Cisco customers should consider the new NAC appliances once these<br />

products become available. Gartner expects that the new solutions will be<br />

shipping be<strong>for</strong>e year-end 2010.<br />

Return to Top<br />

Strengths<br />

Cisco's renewed focus on 802.1X in wired networks will enable it to deliver<br />

basic and inexpensive guest network access, thereby addressing the<br />

primary NAC requirement <strong>for</strong> most enterprises.<br />

AnyConnect, which combines VPN, NAC and other security technologies into<br />

a single endpoint client, will help Cisco grow its installed base of NAC<br />

endpoint software. Cisco has a strong market share in the VPN market, and<br />

when its customers upgrade to AnyConnect, they will also be installing the<br />

embedded NAC software.<br />

The combination of Cisco's profiling solution (NAC Profiler) and its guest<br />

networking solution (NAC Guest Server) make <strong>for</strong> a strong approach to<br />

guest networking. NAC Profiler (Great Bay Software is the OEM provider)<br />

discovers and monitors nonauthenticating devices (<strong>for</strong> example, IP phones<br />

and printers), thereby easing the process of supporting endpoints that are<br />

non-NAC capable. NAC Guest Server (this technology is also licensed from<br />

an OEM provider) provisions guest accounts and monitors guest activity on<br />

the network. (Note: functionality from NAC Profiler and NAC Guest Server<br />

will be included in Cisco's new NAC appliance.)<br />

Cisco's long-term strategy of embedding identity awareness into its Catalyst<br />

switches (a component of its TrustSec strategy) will enable it to support<br />

identity policies more granularly and more flexibly than most of its NAC<br />

competitors.<br />

Return to Top<br />

Cautions<br />

Be<strong>for</strong>e making further investments in Cisco's current family of NAC<br />

appliances (NAC Appliance 33XX Series, NAC Profiler and NAC Guest<br />

Server), Cisco customers should wait <strong>for</strong> Cisco to publicly announce its<br />

plans to upgrade these solutions and offer investment protection.<br />

Although Cisco's updated TrustSec positioning is a good start, it still needs<br />

improvements to its NAC marketing and branding. For example, Cisco needs<br />

to clarify the role that Secure <strong>Access</strong> <strong>Control</strong> System (ACS) plays in its<br />

broader NAC strategy.<br />

Despite a stated partnership with Microsoft, dating back to 2004, Cisco still<br />

does not support the Microsoft NAP protocols or the equivalent TNC<br />

specifications. Thus, Cisco software is required on Windows desktops to<br />

per<strong>for</strong>m anything beyond the most basic endpoint baselining functionality.<br />

Return to Top<br />

Enterasys<br />

In 2008, the Gores Group purchased Siemens Enterprise Communications and<br />

merged it with Enterasys (which it already owned). Since then, Enterasys has<br />

struggled to gain market share (currently 1% to 2%) in the wired network<br />

infrastructure market, its core competency. Enterasys offers out-of-band (NAC<br />

Gateway) and in-line (NAC <strong>Control</strong>ler) components. The NAC <strong>Control</strong>ler enables<br />

NAC <strong>for</strong> older third-party switches that do not support 802.1X or RADIUS-based<br />

authentication. The Enterasys solution per<strong>for</strong>ms endpoint baselining via agents<br />

(permanent and dissolvable) and agentless technology. The primary usage case<br />

<strong>for</strong> Enterasys NAC is Enterasys switch and wireless LAN customers, although the<br />

solution is capable of supporting non-Enterasys environments.<br />

Return to Top<br />

Strengths<br />

Enterasys' main product strength remains the flow-based technology in its<br />

S-Series and N-Series switches. NAC policies can be applied <strong>for</strong> each<br />

unique flow (by tracking the source/destination address pairing). For<br />

example, granular policies can be established to implement bandwidth rate<br />

limits or trigger deep-packet inspection.

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

11 of 18 19/8/2553 15:31<br />

Enterasys' NAC management console has an integrated profiling capability,<br />

which automatically discovers and identifies all endpoints on the network.<br />

Enterasys has integrated its Dragon IPS, as well as third-party IPS<br />

solutions, with its NAC offering, so that it can quarantine endpoints that<br />

Dragon identifies as suspicious.<br />

Return to Top<br />

Cautions<br />

Its shrinking market share limits Enterasys' ability to grow its NAC<br />

business, particularly because it has had limited success in selling NAC to<br />

the broader market.<br />

For a network infrastructure vendor, Enterasys lacks operational and<br />

troubleshooting tools <strong>for</strong> managing an 802.1X environment.<br />

Return to Top<br />

ForeScout<br />

ForeScout is a network security pure-play company that offers the CounterACT<br />

NAC appliance and the CounterACT Edge security appliance. CounterACT is highly<br />

rated by users <strong>for</strong> ease of deployment and flexible en<strong>for</strong>cement scenarios.<br />

ForeScout's out-of-band approach simplifies moving from guest networking to<br />

baselining to en<strong>for</strong>cement, the common success pattern <strong>for</strong> NAC deployments.<br />

ForeScout had a number of new customer wins since the publication of the 2009<br />

NAC <strong>Magic</strong> <strong>Quadrant</strong>, with a strong presence at government agencies, gaining it<br />

an increase in its Ability to Execute rating. ForeScout should be considered by<br />

enterprises looking at NAC solutions that are not tied to network infrastructure or<br />

EPP software.<br />

Return to Top<br />

Strengths<br />

CounterACT is highly rated <strong>for</strong> ease of deployment and price/per<strong>for</strong>mance in<br />

large installations, and ForeScout consistently gets good ratings <strong>for</strong><br />

responsiveness and support.<br />

CounterACT provides strong support <strong>for</strong> the guest network and endpoint<br />

baselining use cases, and it provides basic support <strong>for</strong> role-based policies.<br />

CounterACT also supports post-connect NAC, via its IDS-like functionality.<br />

ForeScout customers tend to grow their deployment of CounterACT<br />

appliances and scale their NAC solutions quickly.<br />

ForeScout's visibility (as reflected by how often it appears on the shortlists<br />

of Gartner clients) has improved since 2009.<br />

Return to Top<br />

Cautions<br />

Although CounterACT's price/per<strong>for</strong>mance is strong across large<br />

installations, users report that ForeScout's management console needs<br />

ease-of-use improvements <strong>for</strong> large-scale implementations.<br />

Like all other NAC pure-play vendors, ForeScout will be increasingly<br />

squeezed by NAC solutions offered by incumbent network infrastructure and<br />

EPP software vendors.<br />

Return to Top<br />

HP (3Com)<br />

HP Identity Driven Manager is HP's lead offering in NAC. In April 2010, HP<br />

completed the acquisition of 3Com, along with H3C, the joint venture between<br />

Huawei and 3Com. H3C has an NAC solution, as did TippingPoint, which 3Com<br />

had previously acquired in 2005. Prior to these acquisitions, HP's NAC solution<br />

consisted of Identity Driven Manager and the ProCurve <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

800 appliance, which was based on technology licensed from StillSecure (via an<br />

OEM agreement). HP discontinued the ProCurve <strong>Network</strong> <strong>Access</strong> <strong>Control</strong> 800<br />

appliance in April 2010, and it recommends the StillSecure branded NAC offering<br />

as a replacement (StillSecure is an HP AllianceONE NAC Specialization Partner).<br />

Until HP articulates a coherent strategy and road map <strong>for</strong> its NAC products, we<br />

continue to rate it as a Niche Player in the market. Users of HP network

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

12 of 18 19/8/2553 15:31<br />

infrastructure technology should consider HP's NAC offering.<br />

Return to Top<br />

Strengths<br />

Identity Driven Manager is a plug-in to HP's ProCurve Manager Plus,<br />

simplifying NAC deployment <strong>for</strong> ProCurve wired and wireless network users.<br />

HP has tightly coupled Identity Driven Manager to Microsoft's NAP<br />

technology that is built into PCs running the XP SP3, Vista and Windows 7<br />

operating systems, easing NAC deployment <strong>for</strong> enterprises that have<br />

deployed these newer operating systems.<br />

As a large company with global support and significant R&D resources, and<br />

a good track record in supporting and driving industry standards, if HP<br />

chooses to focus on NAC as a key part of competing in the network<br />

infrastructure market, then it could become a major market factor.<br />

Return to Top<br />

Cautions<br />

Identity Driven Manager's integration to ProCurve puts it in direct<br />

competition with Cisco's NAC strategy. Although Gartner gives ProCurve a<br />

strong rating as a network infrastructure contender, Cisco's domination of<br />

the installed base is a major challenge to HP NAC adoption.<br />

HP's reliance on Microsoft NAP puts it at a disadvantage in environments<br />

with older Microsoft desktop operating systems (that do not support<br />

Microsoft NAP) and where consumerization demands are resulting in more<br />

use of PCs and smartphones that run non-Microsoft operating systems.<br />

Although HP has a large portfolio of security products, its overall strategy<br />

<strong>for</strong> security is unclear, and its NAC strategy and road map suffer as a result.<br />

Return to Top<br />

Impulse Point<br />

Impulse Point has shown growth in the higher education market, and also the<br />

K-12 sector, but it has not demonstrated an ability to penetrate the commercial<br />

enterprise market. Its strong vertical focus keeps it positioned in the Niche Players<br />

quadrant. En<strong>for</strong>cement is provided via ACLs at Layer 3 (<strong>for</strong> example, routers and<br />

switches), at Layer 4 (support is provided <strong>for</strong> Blue Coat proxies) or via firewall<br />

policies. This approach is suitable <strong>for</strong> some university environments, although it<br />

does not meet the en<strong>for</strong>cement requirements of most corporate environments,<br />

where en<strong>for</strong>cement is required at Layer 2 (at the LAN switch). Impulse Point<br />

delivers its solution as a managed service, which includes managing updates<br />

(patches and antivirus status) to its policy server and housing daily policy<br />

configuration backups. Safe Connect is available as an appliance or via software<br />

(it is certified to run in a virtualized VMware environment). Educational<br />

institutions dealing with heterogeneous endpoint environments should consider<br />

Impulse Point.<br />

Return to Top<br />

Strengths<br />

Safe Connect can be deployed quickly, because its Layer 3 approach to<br />

en<strong>for</strong>cement eliminates the need to test compatibility at Layer 2 (among an<br />

enterprise's LAN switches).<br />

Impulse Point provides a scalable and relatively inexpensive approach to<br />

NAC. In large environments (10,000 nodes and above), Impulse Point's<br />

pricing model is highly favorable.<br />

With several of its university customers, SafeConnect displaced its<br />

competitors' NAC equipment.<br />

Its endpoint agent provides continuous posture assessment and<br />

quarantining (agent-based self-en<strong>for</strong>cement). Many endpoint-based NAC<br />

solutions require scheduled posture assessment scans.<br />

Return to Top<br />

Cautions<br />

Safe Connect's Layer 3-based en<strong>for</strong>cement mechanism (ACLs on routers)<br />

makes it a poor choice <strong>for</strong> enterprises seeking to implement guest networks

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

13 of 18 19/8/2553 15:31<br />

in corporate environments. Endpoints are still able to gain access by<br />

connecting to a Layer 2 LAN switch. Impulse Point provides the option to<br />

integrate FreeRADIUS in the Safe Connect policy server to authenticate<br />

802.1X-enabled endpoints, although the solution is not competitive with<br />

other appliance-based RADIUS solutions that are more scalable and have<br />

better tools <strong>for</strong> troubleshooting failed authentications.<br />

Although its focus on NAC as a managed service shifts the daily support<br />

burden to Impulse Point, some of its customers have commented that<br />

product documentation quality is weak. In the most recent release, updated<br />

documentation was not available <strong>for</strong> several months after the product<br />

shipped.<br />

Outside the higher education market, Impulse Point suffers from low market<br />

visibility, because of its small size and its limited resources.<br />

Although Impulse Point has improved its reporting and graphical interface,<br />

its policy controls in the area of guest networking and its Windows patch<br />

management are weaker than many of its competitors.<br />

Return to Top<br />

InfoExpress<br />

InfoExpress is largely focused on the NAC market, although it also offers a<br />

personal firewall product. It is still a small company (fewer than 100 employees),<br />

but it was founded in 1993 and remains a "bootstrap" company — it has never<br />

needed to raise money from venture capitalists. In 2009, InfoExpress partnered<br />

with Alcatel-Lucent and integrated its technology with Alcatel-Lucent's LAN<br />

switches, wireless access points (from Aruba) and its VitalQIP Suite (which<br />

enables DHCP-based en<strong>for</strong>cement). Alcatel-Lucent is now a global reseller of<br />

InfoExpress solutions. Enterprises should evaluate InfoExpress' capabilities when<br />

NAC requirements are driven by diverse IT environments.<br />

Return to Top<br />

Strengths<br />

InfoExpress provides a broad array of deployment options <strong>for</strong> NAC.<br />

Persistent or dissolvable agents can be used to baseline endpoints. Its<br />

CyberGatekeeper appliances provide in-line and out-of-band en<strong>for</strong>cement<br />

<strong>for</strong> LAN, wireless LAN and VPN connections, and its policy server functions<br />

as a RADIUS proxy. InfoExpress' most popular NAC solution is its Dynamic<br />

NAC offering, which uses permanent agents to implement ARP-based<br />

en<strong>for</strong>cement of noncompliant endpoints.<br />

Dynamic NAC can be a cost-effective solution <strong>for</strong> organizations that have<br />

many sparsely populated branch offices, because it does not require<br />

additional hardware.<br />

InfoExpress' CyberGatekeeper NAC solution is a good complement to its<br />

personal firewall offering.<br />

Return to Top<br />

Cautions<br />

InfoExpress' policy management console lacks some of the user-friendly<br />

features (<strong>for</strong> example, drop-down menus and radio buttons) found in<br />

competitive offerings.<br />

Guest networking functionality is limited. Guest accounts must be<br />

provisioned on a RADIUS server or on Active Directory, and managing an<br />

exception list of endpoints is manually intensive.<br />

The company's technology differentiation has eroded as large competitors,<br />

such as McAfee and Symantec, have expanded their endpoint security<br />

solutions to include better personal firewalls and NAC support.<br />

Return to Top<br />

Insightix<br />

Insightix is a pure-play network visibility vendor with products branded under the<br />

Insightix Business Security Assurance (BSA) line. BSA Visibility is the main<br />

product, which uses a mixture of active and passive techniques to detect and<br />

profile devices connected to the network. Visibility greatly reduces the manual<br />

ef<strong>for</strong>t required to maintain a continuous and accurate inventory of everything<br />

connected to the network and the key attributes of each device. BSA NAC provides<br />

en<strong>for</strong>cement capabilities through ARP manipulation, while BSA Guest <strong>Access</strong>

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

14 of 18 19/8/2553 15:31<br />

<strong>Control</strong> provides a captive portal approach <strong>for</strong> allowing limited guest access.<br />

Insightix has improved its management and workflow capabilities and added<br />

integration to McAfee and Juniper environments, but its lack of visibility and<br />

limited large-scale deployments acted to offset these gains in the Ability to<br />

Execute and Completeness of Vision axes. Enterprises that have demand and<br />

funding <strong>for</strong> network discovery capabilities that later may be used as the<br />

foundation <strong>for</strong> broader NAC deployment should consider Insightix.<br />

Return to Top<br />

Strengths<br />

Ease of implementing discovery and baselining and the depth and accuracy<br />

of the profiling in<strong>for</strong>mation are Insightix's core strengths. Embracing the<br />

IF-MAP standard will help it increase partnerships with network<br />

infrastructure vendors that lack their own discovery capabilities.<br />

Insightix's en<strong>for</strong>cement technique is easy to deploy <strong>for</strong> organizations that<br />

are mostly interested in visibility and inventory, with limited quarantining<br />

requirements.<br />

Return to Top<br />

Cautions<br />

Insightix's visibility in North American and larger European companies is<br />

very limited, and it rarely appears on Gartner client shortlists in those<br />

geographies.<br />

Insightix's integration with remediation products and its support <strong>for</strong> guest<br />

access management are limited.<br />

Although Insightix can sell network visibility outside the NAC space, it will<br />

be increasingly squeezed in NAC opportunities by incumbent network<br />

infrastructure and EPP software vendors that embed NAC functionality.<br />

Return to Top<br />

Juniper<br />

Juniper has been an early promoter of NAC standards, and its Unified <strong>Access</strong><br />

<strong>Control</strong> (UAC) solution was one of the first to implement the TCG/TNC's protocols<br />

that enable NAC interoperability. Juniper has also been an early adopter of the<br />

TNC's IF-MAP specification, which creates an open and structured way <strong>for</strong> devices<br />

and users to share in<strong>for</strong>mation on a network. Juniper's success in selling UAC into<br />

large accounts and its <strong>for</strong>esight with regard to NAC interoperability have enabled<br />

it to remain in the Leaders quadrant, although it lost points overall in the<br />

Completeness of Vision and Ability to Execute axes. With regard to vision, Gartner<br />

believes that Juniper is missing opportunities by not targeting UAC more strongly<br />

as a solution <strong>for</strong> the Guest <strong>Network</strong> use case. With regard to its ability to execute,<br />

Juniper lost points because it needs to create stronger mind share and sales <strong>for</strong><br />

UAC among its installed base of enterprise customers. Juniper customers and<br />

enterprises that emphasize NAC interoperability due to diverse IT environments<br />

should consider Juniper's UAC solution.<br />

Return to Top<br />

Strengths<br />

Junos Pulse, which combines VPN, NAC and WAN acceleration technology<br />

into a single endpoint client, will help Juniper grow its installed base of<br />

NAC endpoint software. Juniper has strong market share in the VPN market,<br />

and when its customers upgrade to Junos Pulse, they will also be installing<br />

the embedded NAC software.<br />

Integrating Webroot anti-spyware, another component of Junos Pulse,<br />

enables Juniper to go beyond basic endpoint compliance checking to also<br />

assess whether an endpoint is infected with malware.<br />

UAC support is embedded in Juniper's firewall, IPS and Ethernet switch<br />

product families. This integrated approach enables Juniper components to<br />

en<strong>for</strong>ce device policies and/or identity policies (user policies), and makes<br />

UAC a good option <strong>for</strong> multiple NAC use cases.<br />

Juniper's support <strong>for</strong> Microsoft NAP enables it to provide basic endpoint<br />

baselining on Windows PCs without requiring the Junos Pulse agent.<br />

Return to Top

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

15 of 18 19/8/2553 15:31<br />

Cautions<br />

Feedback from some Juniper references reflects poorly on the ease of UAC<br />

deployment. Gartner received complaints about the deployment and<br />

manageability of the UAC client, and also received similar input regarding<br />

Juniper's RADIUS functionality.<br />

Juniper is too focused on selling the complete UAC solution, and has not<br />

leveraged its 802.1X support to gain a beachhead in accounts <strong>for</strong> guest<br />

networking.<br />

For a solution with a strong emphasis on identity-aware networking,<br />

Juniper's policy management console lacks some important features <strong>for</strong><br />

enabling guest access. For example, setting up time-based access requires<br />

custom filters (instead of radio buttons), and guest credentials cannot be<br />

automatically e-mailed or texted in advance.<br />

Return to Top<br />

McAfee<br />

As an EPP vendor with a strong set of network security products, McAfee is<br />

well-positioned to sell NAC into its installed base of ePolicy Orchestrator (ePO)<br />

customers. In addition to embedding NAC functionality into its EPP suites, McAfee<br />

also offers NAC as a stand-alone component. An optional software module <strong>for</strong><br />

McAfee's IPS appliance enables it to en<strong>for</strong>ce NAC policies. Non-IPS customers<br />

have the option of purchasing a stand-alone NAC appliance, which runs the same<br />

software but without the IPS functionality. McAfee had purchased the assets of<br />

failed NAC vendor Lockdown <strong>Network</strong>s, which would have enabled it to deliver an<br />

inexpensive NAC solution <strong>for</strong> the SMB market, but it appears to have abandoned<br />

that strategy. McAfee's <strong>Network</strong> User Behavior Analysis, a solution that it gained<br />

with its acquisition of Secure Computing, monitors user behavior on an enterprise<br />

network and could be deployed as part of a post-connect NAC project, although<br />

McAfee does not market it as an NAC offering. Even with its strengths in network<br />

security, McAfee has yet to demonstrate that it can consistently win large NAC<br />

deals in its installed base of ePO accounts, and Gartner has positioned it below<br />

the Ability to Execute line in the Visionaries quadrant. McAfee customers should<br />

evaluate its NAC solution.<br />

Return to Top<br />

Strengths<br />

McAfee's <strong>Network</strong> Security Manager (NSM) enables organizations to build<br />

and en<strong>for</strong>ce rich policies, including identity policies and location-based<br />

policies.<br />

The user interface <strong>for</strong> provisioning guest accounts is good and includes<br />

several options <strong>for</strong> notifying guests of the account credentials (<strong>for</strong> example,<br />

SMS and e-mail).<br />

McAfee has gained additional network security experience through its<br />

acquisition of Secure Computing, which should help it compete in NAC sales<br />

against other EPP vendors.<br />

Return to Top<br />

Cautions<br />

McAfee's N-450 NAC Appliance is available in only one size, and it is not<br />

cost-effective <strong>for</strong> small environments or small remote sites.<br />

McAfee's NAC solution lacks the ability to en<strong>for</strong>ce policy by configuring<br />

ACLs on LAN switches, a common feature in competing offerings.<br />

Return to Top<br />

Nevis <strong>Network</strong>s<br />

Nevis <strong>Network</strong>s appears <strong>for</strong> the first time in the NAC <strong>Magic</strong> <strong>Quadrant</strong>, although it<br />

also appeared in Gartner's NAC MarketScope in 2007 and 2008. Nevis went<br />

through a period of transition in 2009, after a management buy-out that resulted<br />

in the management team relocating to India, where the company already had a<br />

development center. Due to the uncertainty surrounding the company, Gartner did<br />

not include Nevis in the 2009 NAC <strong>Magic</strong> <strong>Quadrant</strong>. Nevis offers an in-line<br />

approach to NAC via two options — an Ethernet switch (Secure Switch<br />

LANen<strong>for</strong>cer) and a LAN appliance (LANen<strong>for</strong>cer) that is positioned between an<br />

edge switch and a core switch. Both products are based on Nevis' ASIC

<strong>Magic</strong> <strong>Quadrant</strong> <strong>for</strong> <strong>Network</strong> <strong>Access</strong> <strong>Control</strong><br />

http://www.gartner.com/technology/media-products/reprints/j...<br />

16 of 18 19/8/2553 15:31<br />

technology, which has enabled it to cost-effectively integrate basic IPS<br />

capabilities in the LAN. Organizations that need the benefits of an in-line<br />

approach to NAC and can accept dealing with a geographically remote support<br />

organization should consider Nevis. Organizations that are located in India or<br />

China should consider Nevis.<br />

Return to Top<br />

Strengths<br />

Nevis' in-line positioning enables it to en<strong>for</strong>ce granular user-based policies<br />

by dropping and filtering packets — a flexible approach to adding identity<br />

awareness to the network.<br />

The IPS capabilities in the LANen<strong>for</strong>cer products enable strong post-connect<br />

NAC functionality, using both signature and anomaly-based detection.<br />

LANen<strong>for</strong>cers provide application detection and control capability <strong>for</strong><br />

applications that companies typically seek to limit, including instant<br />

messaging and other peer-to-peer applications, as well as gaming and<br />

streaming audio/video applications.<br />

Return to Top<br />

Cautions<br />

Outside of India and China, Nevis has a small presence and low market<br />

visibility.<br />

The requirement to deploy appliances in-line can be expensive, particularly<br />

in network topologies where the Nevis appliances are only partially used<br />

(<strong>for</strong> example, if many ports are left unused). Often, it is not cost-effective<br />

to deploy Nevis appliances in small remote offices or to en<strong>for</strong>ce NAC in<br />

VPNs.<br />

Despite its increased market penetration in India and China, Nevis will be<br />

challenged to sell its LAN switches and NAC appliances against established<br />

network infrastructure vendors, such as Cisco, HP and Juniper.<br />

Return to Top<br />

Sophos<br />

In May 2010, Apax Partners, a private equity firm, announced plans to acquire<br />

70% of Sophos. The deal gives Sophos additional financial backing, and should<br />

have limited impact on Sophos customers in 2010. Sophos offers two NAC<br />

solutions (both are based on technology from its 2007 acquisition of End<strong>for</strong>ce).<br />

Sophos' EPP suite, Endpoint Security and <strong>Control</strong>, provides basic NAC policy,<br />

reporting and en<strong>for</strong>cement capabilities. Sophos' NAC Advanced solution, which<br />

requires a separate agent and management console, provides more-advanced<br />

features, such as custom policy creation, stronger reporting capabilities and more<br />

en<strong>for</strong>cement options (including support <strong>for</strong> 802.1X). Sophos' NAC solutions are a<br />

reasonable choice <strong>for</strong> Sophos customers. Larger customers, with<br />

more-sophisticated needs, should evaluate the NAC Advanced solution.<br />

Return to Top<br />

Strengths<br />

Basic NAC functions are embedded (at no extra charge) in Sophos' Endpoint<br />

Security and <strong>Control</strong> suite, although this version does not support VPN<br />

environments (the NAC Advanced Solution is required <strong>for</strong> VPNs).<br />

The Sophos policy server acts as a RADIUS proxy and provides very flexible<br />