Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

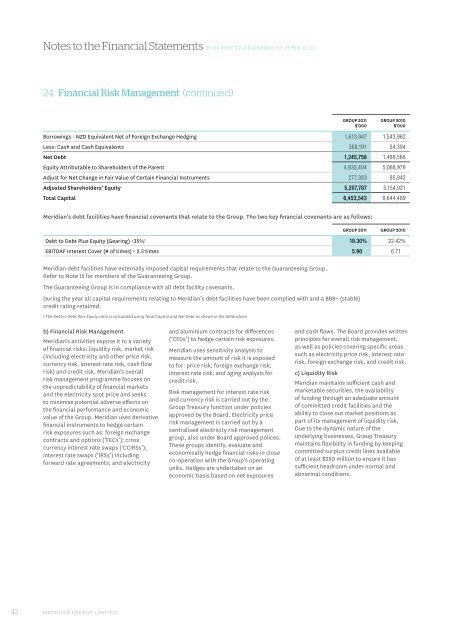

24. Financial Risk Management (continued)<br />

GROUP 2011<br />

$’000<br />

GROUP 2010<br />

$’000<br />

Borrowings - NZD Equivalent Net of Foreign Exchange Hedging 1,613,947 1,543,962<br />

Less: Cash and Cash Equivalents 368,191 54,394<br />

Net Debt 1,245,756 1,489,568<br />

Equity Attributable to Shareholders of the Parent 4,930,404 5,068,979<br />

Adjust for Net Change in Fair Value of Certain Financial Instruments 277,383 85,942<br />

Adjusted Shareholders’ Equity 5,207,787 5,154,921<br />

Total Capital 6,453,543 6,644,489<br />

<strong>Meridian</strong>’s debt facilities have <strong>financial</strong> covenants that relate to the Group. The two key <strong>financial</strong> covenants are as follows:<br />

GROUP 2011 GROUP 2010<br />

Debt to Debt Plus Equity (Gearing) 2.5 times 5.90 6.71<br />

<strong>Meridian</strong> debt facilities have externally imposed capital requirements that relate to the Guaranteeing Group.<br />

Refer to Note 15 for members of the Guaranteeing Group.<br />

The Guaranteeing Group is in compliance with all debt facility covenants.<br />

During the year all capital requirements relating to <strong>Meridian</strong>’s debt facilities have been complied with and a BBB+ (stable)<br />

credit rating retained.<br />

1 The Debt to Debt Plus Equity ratio is calculated using Total Capital and Net Debt as shown in the table above<br />

b) Financial Risk Management<br />

<strong>Meridian</strong>’s activities expose it to a variety<br />

of <strong>financial</strong> risks: liquidity risk, market risk<br />

(including electricity and other price risk,<br />

currency risk, interest rate risk, cash flow<br />

risk) and credit risk. <strong>Meridian</strong>’s overall<br />

risk management programme focuses on<br />

the unpredictability of <strong>financial</strong> markets<br />

and the electricity spot price and seeks<br />

to minimise potential adverse effects on<br />

the <strong>financial</strong> performance and economic<br />

value of the Group. <strong>Meridian</strong> uses derivative<br />

<strong>financial</strong> instruments to hedge certain<br />

risk exposures such as: foreign exchange<br />

contracts and options (‘FECs’); cross<br />

currency interest rate swaps (‘CCIRSs’);<br />

interest rate swaps (‘IRSs’) including<br />

forward rate agreements; and electricity<br />

and aluminium contracts for differences<br />

(‘CFDs’) to hedge certain risk exposures.<br />

<strong>Meridian</strong> uses sensitivity analysis to<br />

measure the amount of risk it is exposed<br />

to for: price risk; foreign exchange risk;<br />

interest rate risk; and aging analysis for<br />

credit risk.<br />

Risk management for interest rate risk<br />

and currency risk is carried out by the<br />

Group Treasury function under policies<br />

approved by the Board. Electricity price<br />

risk management is carried out by a<br />

centralised electricity risk management<br />

group, also under Board approved polices.<br />

These groups identify, evaluate and<br />

economically hedge <strong>financial</strong> risks in close<br />

co-operation with the Group’s operating<br />

units. Hedges are undertaken on an<br />

economic basis based on net exposures<br />

and cash flows. The Board provides written<br />

principles for overall risk management,<br />

as well as policies covering specific areas<br />

such as electricity price risk, interest rate<br />

risk, foreign exchange risk, and credit risk.<br />

c) Liquidity Risk<br />

<strong>Meridian</strong> maintains sufficient cash and<br />

marketable securities, the availability<br />

of funding through an adequate amount<br />

of committed credit facilities and the<br />

ability to close out market positions as<br />

part of its management of liquidity risk.<br />

Due to the dynamic nature of the<br />

underlying businesses, Group Treasury<br />

maintains flexibility in funding by keeping<br />

committed surplus credit lines available<br />

of at least $250 million to ensure it has<br />

sufficient headroom under normal and<br />

abnormal conditions.<br />

42 MERIDIAN ENERGY LIMITED