Cannon Equity Fund Factsheet - Cannon Asset Managers

Cannon Equity Fund Factsheet - Cannon Asset Managers

Cannon Equity Fund Factsheet - Cannon Asset Managers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CANNON EQUITY FUND<br />

JANUARY 2012<br />

CONTACT: Bella Shongwe 0800 CANNON (0800 226 666)<br />

EMAIL: unittrusts@cannonassets.co.za<br />

INVESTMENT OBJECTIVES<br />

The <strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong> aims to deliver sustainable growth in capital<br />

through exposure to listed equities over a three-to-five year investment<br />

horizon. Recognising the relatively long-term horizon, we endeavour to<br />

outperform the JSE’s All Share Index (ALSI) on a rolling basis and, in so<br />

doing, deliver returns that ensure real growth in investors’ wealth. The<br />

portfolio manager does not make use of gearing or derivative instruments to<br />

achieve the investment objective. <strong>Asset</strong> class risk must be managed by<br />

investors outside of the fund.<br />

INVESTMENT COMMENTARY<br />

The FTSE–JSE All Share Index rallied 5.7 percent in January, producing the best<br />

start to the year since 2006. The market rally has been fuelled by a string of positive<br />

economic data releases, as well as positive action taken by the European Central<br />

bank to ally investors’ fears about events in the Eurozone. The <strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong><br />

has begun the year in an equally impressive fashion returning 5.8 percent for the<br />

month. We are encouraged by this strong beginning to the year, which builds on<br />

the good result we had at the end of 2011. However, we are cognisant of the threats<br />

presented by structural changes that are taking place in developed market<br />

economies, as well as the fresh drivers in place in new, dynamic markets. As such,<br />

we expect 2012 to remain a challenging environment for investors. The fund is well<br />

positioned given this backdrop.<br />

A significant contributor to the portfolio’s January performance was Pinnacle<br />

Technology Holdings, which ranks amongst the portfolio’s largest holdings. The<br />

stock price gained 18.5% during the month, on the back of a remarkably positive<br />

trading update. Pinnacle is the largest distributor of information technology<br />

products in South Africa, and has all the characteristics that make a great<br />

investment; high quality; a great management team; positive momentum in terms<br />

of earnings growth and stock market activity; and, most importantly, very attractive<br />

value multiple. As noted, the company released a positive trading update, stating<br />

that headline earnings are expected to be at least 45 percent higher than the results<br />

of the comparative period last year.<br />

The <strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong> remains committed to investing in high quality<br />

companies, with sound leadership, healthy prospect and that offer deep valuation<br />

discounts, of which Pinnacle Technology Holdings is such an example.<br />

PERFORMANCE METRICS<br />

<strong>Fund</strong> Benchmark<br />

Return Since Inception (% cumulative)<br />

Return Since Inception (% annualised)<br />

150.04<br />

14.04<br />

183.73<br />

17.14<br />

High Water Mark (cpu) 247.84 286.02<br />

Low Water Mark (cpu) 98.78 100.00<br />

% of Positive Months 61.54 58.97<br />

CANNON EQUITY FUND VS ALSI (J203T)<br />

Performance Annualised Benchmark Cumulative Benchmark<br />

1 Year 5.08% 10.83% 5.08% 10.83%<br />

2 Years<br />

3 Years<br />

11.15%<br />

18.13%<br />

15.64%<br />

21.20%<br />

23.54%<br />

64.85%<br />

33.71%<br />

78.06%<br />

Volatility<br />

1 Year 15.19% 18.50%<br />

2 Years<br />

3 Years<br />

13.90%<br />

15.98%<br />

17.78%<br />

19.61%<br />

Correlation<br />

1 Year 0.73 1.00<br />

2 Years<br />

3 Years<br />

0.74<br />

0.73<br />

1.00<br />

1.00<br />

FUND FACTS<br />

<strong>Fund</strong> Manager<br />

Dr Adrian Saville<br />

Classification<br />

Domestic <strong>Equity</strong> - General<br />

Universe (Benchmark)<br />

ALSI (J203T)<br />

Objective<br />

Capital Appreciation<br />

Risk<br />

Aggressive<br />

Year End<br />

December<br />

<strong>Fund</strong> Inception 01 July 2005<br />

<strong>Fund</strong> Size<br />

R80 million<br />

Lump Sum (Minimum) R10 000<br />

Recurring (Minimum)<br />

R500<br />

Current Unit Price<br />

219.35cpu<br />

Total Expense Ratio 1.48<br />

Please note: the TER has been calculated using data from 1 st October 2010 till 30 th<br />

September 2011. The TER is disclosed as % of the average Net <strong>Asset</strong> Value of the<br />

portfolio that were incurred as charges, levies and fees related to the management<br />

of the portfolio and underlying portfolios.<br />

A higher TER ratio does not necessarily imply a poor return, nor does a low<br />

TER imply a good return. The current TER cannot be regarded as an indication<br />

of future TERs.<br />

Income Declarations 30 June & 31 December<br />

Income 7 January 2010 1.83cpu<br />

7 July 2010 0.68cpu<br />

7 January 2011 2.23cpu<br />

7 July 2011 0.55cpu<br />

FAIS CONFLICT OF INTEREST DISCLOSURE<br />

Please note that in most cases where the Broker is a related party to <strong>Cannon</strong> <strong>Asset</strong><br />

<strong>Managers</strong> (Pty) Ltd and /or Metropolitan, <strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd<br />

and/or distributor earns additional fees apart from the Broker’s client advisory<br />

fees. It is the Broker’s responsibility to disclose additional fees to you as the client.<br />

Such fees are paid out of the portfolio’s service charge and ranges between (excl<br />

VAT)<br />

Annual<br />

Upfront<br />

Metropolitan Up to 0.35% Up to 0.25%<br />

<strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd Up to 0.925% Nil<br />

Maximum Broker Fee Up to 0.50% Up to 3.00%<br />

Total Service Charge 1.25%<br />

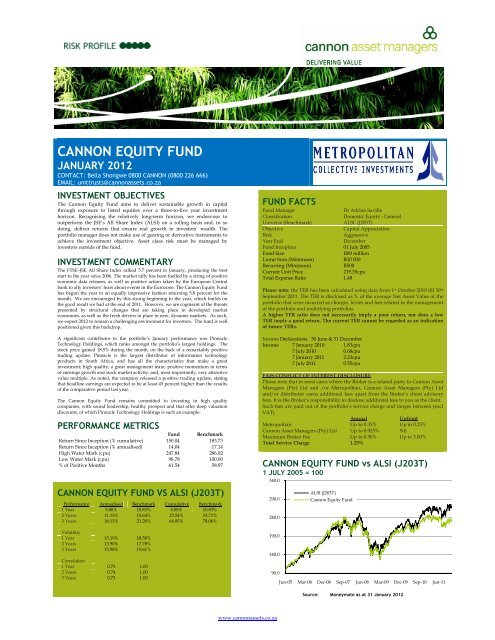

CANNON EQUITY FUND vs ALSI (J203T)<br />

1 JULY 2005 = 100<br />

340.0<br />

290.0<br />

240.0<br />

190.0<br />

140.0<br />

90.0<br />

ALSI (J203T)<br />

<strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong><br />

Jun-05 Mar-06 Dec-06 Sep-07 Jun-08 Mar-09 Dec-09 Sep-10 Jun-11<br />

Source: Moneymate as at 31 January 2012<br />

www.cannonassets.co.za

CANNON EQUITY FUND<br />

JANUARY 2012<br />

CONTACT: Bella Shongwe 0800 CANNON (0800 226 666)<br />

EMAIL: unittrusts@cannonassets.co.za<br />

SECTOR ALLOCATION<br />

TOP TEN HOLDINGS<br />

Basic Materials<br />

Financials<br />

Industrials<br />

Oil & Gas<br />

Consumer Goods<br />

Technology<br />

10.30<br />

7.53<br />

7.08<br />

19.15<br />

21.51<br />

28.37<br />

Sasol Ltd 10.30<br />

Anglo American Plc 10.27<br />

Exxaro Resources Ltd 6.48<br />

Old Mutual Plc 6.29<br />

AECI Ltd 6.07<br />

African Rainbow Minerals 5.54<br />

Pinnacle Technology 4.81<br />

Steinhoff Int Hld Ltd 4.80<br />

Aveng Limited 4.24<br />

Lewis Group Ltd 3.93<br />

Consumer Services<br />

5.89<br />

TOTAL 62.73<br />

Cash<br />

0.18<br />

ADMINISTRATION<br />

If your complaint has not been resolved to your<br />

satisfaction, kindly contact our Complaints<br />

Resolution Committee: Tel: (021) 940 5880,<br />

Fax:(021) 940 6205<br />

Email: emoruck@metropolitan.co.za or metunit@metropolitan.co.za<br />

Custodian: Standard Executors & Trustees: Tel (021) 401-2286. Metropolitan Collective<br />

Investments Limited PO Box 925 Bellville 7535 Tel (021) 940-5981 Fax (021) 940-5885 Call<br />

Centre, Tel: 0860 100 279 Registration No 1991/03741/06<br />

Collective Investments are generally medium to long term investments. The<br />

value of participating interests may go down as well as up and past<br />

performance is not necessarily a guide to the future. Collective Investments are<br />

traded at ruling prices and can engage in scrip lending. Forward pricing is<br />

used. A schedule of fees and charges and maximum commissions is available<br />

on request from <strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong>. Commission and incentives may be<br />

paid and if so, are included in the overall cost. This fund may be closed to new<br />

investors. Graphs and performance figures are sourced from Morningstar for<br />

lump sum investments including income distribution, at NAV to NAV basis<br />

and do not take any initial fees into account. Income is reinvested on the exdividend<br />

date. Actual investment performance will differ based on the initial<br />

fees applicable, the actual investment date and the date of reinvestment of<br />

income. Collective Investment prices are calculated on a net asset value basis<br />

and auditor’s fees, bank charges and trustee fees are levied against the<br />

portfolio. The portfolio manager may borrow up to 10% of portfolio NAV to<br />

bridge insufficient liquidity. The performance fee FAQ document is kept as a<br />

public document at Metropolitan Head office. Metropolitan Collective<br />

Investments Ltd is a Full member of the Association for Savings & Investments<br />

SA (ASISA). The reason that we are no longer FAIS registered is that CIS<br />

managers are exempt from FAIS as we are regulated by CISCA and the FSB.<br />

FURTHER CONTACT DETAILS<br />

<strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd<br />

First Floor, Building B,<br />

Bryanston Corner,<br />

18 Ealing Crescent<br />

Bryanston, 2194.<br />

PO Box 70997,<br />

Bryanston, 2021<br />

Unit 2 Rydall Vale Crescent,<br />

Rydall Vale Park,<br />

La Lucia Ridge, 4019.<br />

PO Box 5200,<br />

Rydall Vale Park, 4019.<br />

Authorised Financial Services Provider #736.<br />

www.cannonassets.co.za