captive insurance - Reinsurance Focus

captive insurance - Reinsurance Focus

captive insurance - Reinsurance Focus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

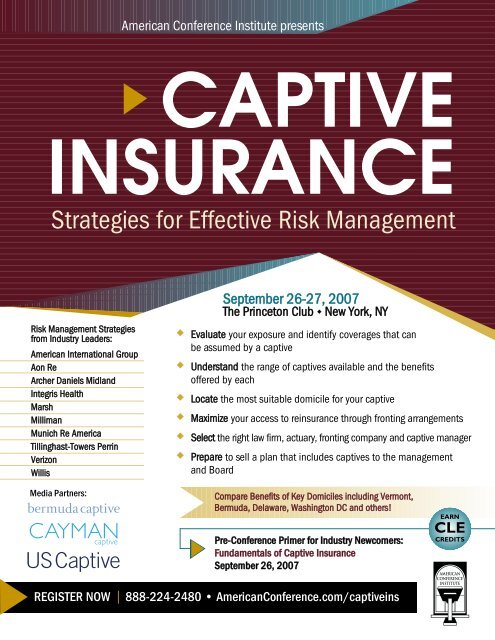

American Conference Institute presents<br />

CAPTIVE<br />

INSURANCE<br />

Strategies for Effective Risk Management<br />

Risk Management Strategies<br />

from Industry Leaders:<br />

American International Group<br />

Aon Re<br />

Archer Daniels Midland<br />

Integris Health<br />

Marsh<br />

Milliman<br />

Munich Re America<br />

Tillinghast-Towers Perrin<br />

Verizon<br />

Willis<br />

<br />

<br />

<br />

<br />

<br />

<br />

September 26-27, 2007<br />

The Princeton Club New York, NY<br />

Evaluate your exposure and identify coverages that can<br />

be assumed by a <strong>captive</strong><br />

Understand the range of <strong>captive</strong>s available and the benefits<br />

offered by each<br />

Locate the most suitable domicile for your <strong>captive</strong><br />

Maximize your access to re<strong>insurance</strong> through fronting arrangements<br />

Select the right law firm, actuary, fronting company and <strong>captive</strong> manager<br />

Prepare to sell a plan that includes <strong>captive</strong>s to the management<br />

and Board<br />

Media Partners:<br />

Compare Benefits of Key Domiciles including Vermont,<br />

Bermuda, Delaware, Washington DC and others!<br />

Pre-Conference Primer for Industry Newcomers:<br />

Fundamentals of Captive Insurance<br />

September 26, 2007<br />

EARN<br />

CLE<br />

CREDITS<br />

REGISTER NOW<br />

888-224-2480 • AmericanConference.com/<strong>captive</strong>ins

Businesses are improving their risk management<br />

programs through the use of <strong>captive</strong>s – is it time to<br />

reevaluate your <strong>insurance</strong> coverage?<br />

Effective risk management requires a thorough understanding of all your <strong>insurance</strong> and<br />

re<strong>insurance</strong> options. One option that continues to grow in popularity is <strong>captive</strong> <strong>insurance</strong>.<br />

While forming a <strong>captive</strong> may have once been considered an exotic venture, a growing number<br />

of businesses have found that their risk exposure can be better managed with the use of <strong>captive</strong>s. And as<br />

more states realize the benefits of having <strong>captive</strong>s domiciled within their boundaries, risk managers are<br />

presented with an increasingly attractive – and confusing – array of options.<br />

ACI’s Strategic Guide to Captive Insurance will provide you with valuable guidance on the mechanics of<br />

forming a <strong>captive</strong> <strong>insurance</strong> company. Experienced industry leaders will provide you with expert<br />

strategies on:<br />

<br />

<br />

<br />

<br />

Determining whether a <strong>captive</strong> would be beneficial for your circumstances<br />

Identifying what coverages could best be assumed by a <strong>captive</strong><br />

Finding the most appropriate domicile for your situation<br />

Recognizing what you need from consultants and <strong>captive</strong> management<br />

In addition, a special Fundamentals of Captive Insurance workshop will provide you with a thorough<br />

understanding of the complex rules and regulations that govern this area of the law. Don’t miss the<br />

opportunity to expand your knowledge through this valuable pre-conference tutorial.<br />

Take this opportunity to get practical, “real life” strategies for dealing with a difficult area. The conference<br />

will fill quickly – register now by calling 1-888-224-2480, or by faxing your registration to 1-877-927-1563.<br />

You can also register online at www.AmericanConference.com/<strong>captive</strong><strong>insurance</strong>.<br />

We look forward to seeing you in New York City in September.<br />

Who You<br />

Will Meet<br />

• Risk Managers<br />

• CFOs<br />

• Captive management<br />

• Attorneys specializing in <strong>insurance</strong><br />

and re<strong>insurance</strong><br />

• Consultants and actuaries<br />

• Insurance and re<strong>insurance</strong> brokers<br />

REGISTER NOW<br />

888-224-2480 • fax: 877-927-1563 • AmericanConference.com/<strong>captive</strong>ins

Wednesday, September 26, 2007<br />

10:00 Conference Registration<br />

1:00 Conference Chairs’ Opening Remarks<br />

Phil Giovine<br />

Senior Vice President<br />

American International Group (New York, NY)<br />

P. Bruce Wright, Esq.<br />

Partner<br />

LeBoeuf, Lamb, Greene & MacRae LLP (New York, NY)<br />

1:15 Deternining Whether a Captive Will Further Your<br />

Financial and Risk Management Objectives<br />

Bill Wandel<br />

System Vice President, Risk Management<br />

Integris Health (Oklahoma City, OK)<br />

Thomas M. Hermes<br />

Managing Principal<br />

Tillinghast-Towers Perrin (Weatogue, CT)<br />

David Robertson<br />

Managing Director<br />

Willis (Atlanta, GA)<br />

• How to analyze and evaluate business considerations<br />

that may drive your decision:<br />

- cost and availability of commercial <strong>insurance</strong><br />

- desire and ability to retain risk<br />

- access to re<strong>insurance</strong> market<br />

- tax burden<br />

- control of claims process and overhead costs<br />

• Cost/benefit analysis of commercial <strong>insurance</strong> versus<br />

<strong>captive</strong> <strong>insurance</strong><br />

• Determining how coverage to place in a <strong>captive</strong><br />

2:45 Refreshment Break<br />

3:00 Identifying the Appropriate Captive Structure<br />

Arthur Koritzinsky<br />

Managing Director<br />

Marsh USA Inc. (New York, NY)<br />

• Advantages and disadvantages of:<br />

- pure <strong>captive</strong>s, including single-parent, branch and<br />

special purpose<br />

- group <strong>captive</strong>s, including association, industrial insured<br />

and risk retention groups<br />

- protected cell, separate account and sponsored <strong>captive</strong>s<br />

• Specific issues that may impact your choice of structure:<br />

- capitalization requirements<br />

- investment restrictions<br />

- limitations on types of <strong>insurance</strong> that can be written<br />

- tax objectives<br />

4:00 Feasibility and Funding: Establishing the<br />

Viability of Your Captive<br />

Joel Chansky<br />

Principal<br />

Milliman, Inc. (Wakefield, MA)<br />

Donald J. Riggin<br />

Practice Leader, Alternative Risk<br />

Albert Risk Management Consultants (Needham, MA)<br />

• What to expect from an actuarial feasibility study –<br />

and what records you will need to provide<br />

• Importance of loss history and prior commercial premiums<br />

• Beyond running the numbers: non-actuarial factors<br />

that can impact feasibility<br />

- legal and operational considerations<br />

- risk management strategy<br />

- long-term business objectives<br />

• Determining what lines of business would be appropriate<br />

for a <strong>captive</strong><br />

• Calculating initial capitalization amounts that meet<br />

regulatory requirements – and protect you from<br />

unexpected losses<br />

• Layering: what to fund in the <strong>captive</strong> versus the<br />

commercial market<br />

• Professionals to include in the decision making process<br />

5:00 Conference Adjourns for the Day<br />

Thursday, September 27, 2007<br />

8:30 Continental Breakfast Q<br />

9:00 Conference Chair Opening Remarks<br />

9:15 Domiciling a Captive: How to Choose<br />

the Appropriate Venue<br />

Dana Sheppard<br />

Associate Commissioner, Risk Finance Bureau<br />

Department of Insurance, Securities and Banking<br />

(Washington, DC)<br />

REGISTER NOW<br />

888-224-2480 • fax: 877-927-1563 • AmericanConference.com/<strong>captive</strong>ins

CAPTIVE INSURANCE<br />

Derick White<br />

Director of Captive Insurance<br />

Vermont Department of Banking, Insurance, Securities<br />

& Health Care Administration (Montpelier, VT)<br />

William P. White<br />

Captive Insurance Program Administrator<br />

Delaware Insurance Department (Wilmington, DE)<br />

Speaker To Be Announced<br />

Bermuda Monetary Authority (Hamilton, Bermuda)<br />

One of the most crucial steps in the process of setting up<br />

a <strong>captive</strong> is determining where it should be domiciled.<br />

The number of venues continues to increase and these<br />

domiciles are becoming more aggressive in their quest for<br />

<strong>captive</strong> <strong>insurance</strong> business. Why does your choice of venue<br />

make a difference? What considerations can really impact your<br />

business? This panel will feature representatives from leading<br />

domiciles, both within and outside of the United States.<br />

The moderator will engage them in a discussion addressing the<br />

factors you need to consider when selecting a domicile, including:<br />

• Regulatory and business climate<br />

• Existing infrastructure for <strong>captive</strong>s<br />

• Premium tax issues<br />

• Startup and operational costs<br />

• Industry-specific benefits<br />

10:30 Coffee Break Q<br />

10:45 Obtaining Re<strong>insurance</strong> Through the<br />

Use of Fronting Arrangements<br />

John E. Iannotti<br />

Executive Vice President<br />

American International Group, Inc. (New York, NY)<br />

• How and why fronting arrangements are being utilized<br />

to reinsure specific lines of business:<br />

- medical malpractice<br />

- construction defect<br />

- commercial automobile<br />

- professional liability<br />

- workers’ compensation<br />

- TRIA<br />

• Meeting collateral requirements<br />

• Current state of the market for fronting arrangements<br />

12:15 Networking Luncheon<br />

1:30 Onshore Versus Offshore: Tax Implications<br />

P. Bruce Wright, Esq.<br />

Partner<br />

LeBoeuf, Lamb, Greene & MacRae LLP (New York, NY)<br />

• Comparisons of onshore and offshore tax consequences<br />

• Deduction for premiums<br />

• State direct procurement taxes<br />

• Review of relevant regulatory and enforcement actions<br />

2:30 Refreshment Break<br />

2:45 Best Practices for Operating a Captive<br />

Michael Scott<br />

Manager of International Insurance<br />

Archer Daniels Midland Company (Decatur, IL)<br />

Sheila Small<br />

Assistant Treasurer – Risk Management and Insurance<br />

Verizon (Basking Ridge, NJ)<br />

• Essentials of running a successful <strong>captive</strong><br />

• Director responsibilities when the <strong>captive</strong> is underway<br />

• Ensuring your board meets reporting requirements<br />

• Supporting evidence that you are pursuing your stated<br />

business objective<br />

• Documenting the underwriting process<br />

• Establishing recordkeeping policies and procedures<br />

• Determining when to fund other coverages not funded<br />

at the time of startup<br />

3:45 Ask the Experts: Q&A on Current<br />

Strategies for Captives<br />

Phil Giovine<br />

Senior Vice President<br />

American International Group (New York, NY)<br />

Gregory Lang<br />

Director of Business Development<br />

Munich Re America (Princeton, NJ)<br />

Michael Scott<br />

Manager of International Insurance<br />

Archer Daniels Midland Company (Decatur, IL)<br />

Bill Wandel<br />

System Vice President, Risk Management<br />

Integris Health (Oklahoma City, OK)<br />

REGISTER NOW<br />

888-224-2480 • fax: 877-927-1563 • AmericanConference.com/<strong>captive</strong>ins

Strategies for Effective Risk Management<br />

Take advantage of this opportunity to interact with experienced<br />

risk managers, brokers, attorneys, and <strong>insurance</strong>/re<strong>insurance</strong><br />

professionals. They will discuss some of the latest trends in the<br />

<strong>captive</strong> <strong>insurance</strong> industry and will address other topics at your<br />

request. Among the issues raised will be:<br />

• How to sell your plan to use a <strong>captive</strong> to management<br />

and the Board<br />

• Who should handle supervision of the <strong>captive</strong> in<br />

your risk management group?<br />

• Placing employee benefit plans in <strong>captive</strong>s<br />

- ERISA v. non-ERISA<br />

- pension plans<br />

5:00 Conference Adjourns<br />

Wednesday, September 26, 2007<br />

9:00 a.m. – 12:00 p.m.<br />

(Registration opens at 8:30 a.m.)<br />

Workshop:<br />

Fundamentals of Captive Insurance<br />

Phil Giovine<br />

Senior Vice President<br />

American International Group (New York, NY)<br />

P. Bruce Wright, Esq.<br />

Partner<br />

LeBoeuf, Lamb, Greene & MacRae LLP (New York, NY)<br />

Single <strong>captive</strong>s, cell <strong>captive</strong>s, re<strong>insurance</strong> domiciles…Captive<br />

<strong>insurance</strong> can be extremely confusing to navigate – especially<br />

for risk managers, treasurers, CFOs and attorneys who are new<br />

to the area. In this special workshop you will get a firm grasp of<br />

the basic of <strong>captive</strong> <strong>insurance</strong> and be thoroughly prepared for<br />

the more advanced discussions to follow in the main conference.<br />

Topics will include:<br />

• How a <strong>captive</strong> operates and why it is utilized<br />

• What kinds of businesses are forming <strong>captive</strong>s<br />

• Types of <strong>insurance</strong> that are being placed into <strong>captive</strong>s<br />

• Different <strong>captive</strong> structures and what criteria will determine<br />

your choice of structure<br />

• Domiciles and what impact they have on your <strong>captive</strong><br />

• Role of the professionals involved in the creation and<br />

management of a <strong>captive</strong><br />

• Legal, regulatory and tax issues you need to be aware<br />

of before forming a <strong>captive</strong><br />

Continuing Legal Education Credits<br />

Accreditation will be sought in those jurisdictions requested<br />

by the registrants which have continuing education<br />

requirements. This transitional course is appropriate<br />

for both experienced and newly admitted attorneys.<br />

To request credit, please check the appropriate box on the<br />

Registration Form.<br />

ACI certifies that the activity has been approved for CLE credit<br />

by the New York State Continuing Legal Education Board in the<br />

amount of the 11.0 hours. An additional 3.5 hours will apply to<br />

workshop participation.<br />

ACI certifies that this activity has been approved for CLE credit by<br />

the State Bar of California in the amount of 9.5 hours. An additional<br />

3.0 hours will apply to workshop participation.<br />

Global Sponsorship Opportunities<br />

CLE<br />

CREDITS<br />

ACI, along with our sister organization based in London,<br />

C5 Conferences, works closely with sponsors in order to create<br />

the perfect business development solution catered exclusively to<br />

the needs of any practice group, business line or corporation.<br />

With over 350 conferences in the United States, Europe,<br />

the Commonwealth of Independent States (CIS) and China,<br />

ACI/C5 Conferences provides a diverse portfolio of first-class<br />

events tailored to the senior level executive spanning multiple<br />

industries and geographies.<br />

For more information about this program or our global portfolio<br />

of events, please contact:<br />

Benjamin Greenzweig<br />

Regional Sales Director,<br />

US, Europe, CIS and China,<br />

American Conference Institute/C5 Conferences<br />

(646) 520-2202 • bg@AmericanConference.com<br />

American Conference Institute:<br />

The leading networking and information resource for counsel and senior executives.<br />

Each year more than 21,000 in-house counsel, attorneys in<br />

private practice and other senior executives participate in ACI<br />

events – and the numbers keep growing.<br />

Guaranteed Value Based on Comprehensive Research<br />

ACI’s highly trained team of attorney-producers are<br />

dedicated, full-time, to developing the content and scope of<br />

our conferences based on comprehensive research with you and others<br />

facing similar challenges. We speak your language, ensuring that our<br />

programs provide strategic, cutting edge guidance on practical issues.<br />

Unparalleled Learning and Networking<br />

ACI understands that gaining perspectives from – and building relationships<br />

with – your fellow delegates during the breaks can be just as valuable as the<br />

structured conference sessions. ACI strives to make both the formal and<br />

informal aspects of your conference as productive as possible.<br />

© American Conference Institute, 2007<br />

REGISTER NOW<br />

888-224-2480 • fax: 877-927-1563 • AmericanConference.com/<strong>captive</strong>ins

American Conference Institute presents<br />

CAPTIVE<br />

INSURANCE<br />

Strategies for Effective Risk Management<br />

September 26-27, 2007<br />

New York, NY<br />

Pre-Conference Primer for<br />

Industry Newcomers:<br />

Fundamentals of Captive Insurance<br />

September 26, 2007<br />

PRIORITY SERVICE CODE:<br />

782I08.WEB<br />

REGISTRATION FORM<br />

ATTENTION MAILROOM: If undeliverable to addressee,<br />

please forward to: Risk Management Department, Insurance/Re<strong>insurance</strong> Practice Group<br />

5 Easy Ways to Register<br />

<br />

℡<br />

<br />

<br />

<br />

MAIL<br />

American<br />

Conference Institute<br />

41 West 25th Street<br />

New York, NY 10010<br />

PHONE 888-224-2480<br />

FAX 877-927-1563<br />

ONLINE<br />

AmericanConference.com/<strong>captive</strong>ins<br />

EMAIL<br />

CustomerCare<br />

@AmericanConference.com<br />

CONFERENCE CODE: 782I08-NYC<br />

YES! Please register the following delegate(s) for the<br />

THE STRATEGIC GUIDE TO CAPTIVE INSURANCE<br />

NAME ___________________________________________ POSITION _________________________<br />

APPROVING MANAGER ____________________________ POSITION _________________________<br />

ORGANIZATION _____________________________________________________________________<br />

ADDRESS __________________________________________________________________________<br />

CITY ____________________________ STATE ________________ ZIP CODE __________________<br />

TELEPHONE ________________________________ FAX ___________________________________<br />

EMAIL _________________________________TYPE OF BUSINESS __________________________<br />

I wish to receive CLE Credits in ______________________ (state)<br />

Register and Pay on or before July 15, 2007 — SAVE $200<br />

Conference Only $1695 $1895<br />

Conference and Workshop $2295 $2495<br />

<br />

<br />

<br />

I would like to add__copies of the conference materials on CD-ROM to my order - $299 each<br />

I cannot attend but would like information regarding conference publications<br />

Please send me information about related conferences<br />

PAYMENT<br />

Please charge my ❏ VISA ❏ MasterCard ❏ AMEX ❏ Please invoice me<br />

Number __________________________________________ Exp. Date _______________________<br />

Signature _________________________________________________________________________<br />

(for credit card authorization and opt-in marketing)<br />

❏ I have enclosed my check for $___________________ made payable to<br />

American Conference Institute (T.I.N.—98-0116207)<br />

After July 15<br />

PAYMENT MUST BE RECEIVED PRIOR TO THE CONFERENCE<br />

<br />

Hotel Information<br />

VENUE: The Princeton Club<br />

ADDRESS: 15 W 43rd St<br />

New York, NY 10036<br />

A limited number of rooms are available at a discounted rate.<br />

To make your hotel reservation please visit<br />

www.globalexec.com/aci. If you need assistance please call<br />

Global Executive on 800-516-4265 or email aci@globalexec.com.<br />

The hotel will not be able to make or change your reservation directly.<br />

Registration Fee<br />

The fee includes the conference, all program materials,<br />

continental breakfasts, lunches and refreshments.<br />

Cancellation and Refund Policy<br />

Substitution of participants is permissible without prior notification.<br />

If you are unable to find a substitute, please notify American<br />

Conference Institute (ACI) in writing up to 10 days prior to the<br />

conference date and a credit voucher will be issued to you for the<br />

full amount paid, redeemable against any other ACI conference.<br />

If you prefer, you may request a refund of fees paid less a 15%<br />

service charge. No credits or refunds will be given for<br />

cancellations received after 10 days prior to the conference date.<br />

ACI reserves the right to cancel any conference it deems necessary<br />

and will, in such event, make a full refund of any registration fee, but<br />

will not be responsible for airfare, hotel or other costs incurred by<br />

registrants. No liability is assumed by ACI for changes in program<br />

date, content, speakers or venue.<br />

Incorrect Mailing Information<br />

If you would like us to change any of your details please fax<br />

the label on this brochure to our Database Administrator at<br />

1-877-927-1563, or email data@AmericanConference.com.<br />

CONFERENCE PUBLICATIONS<br />

To reserve your copy or to receive a catalog<br />

of ACI titles go to www.aciresources.com<br />

or call 1-888-224-2480.<br />

SPECIAL DISCOUNT<br />

We offer special pricing for groups and government<br />

employees. Please email or call for details.<br />

Promotional Discounts May Not Be Combined. ACI<br />

offers financial scholarships for government employees,<br />

judges, law students, non-profit entities and others. For<br />

more information, please email or call customer care.

![202 Folio No 734 Neutral Citation Number: [2006] EWHC 1345 (QB ...](https://img.yumpu.com/50015000/1/184x260/202-folio-no-734-neutral-citation-number-2006-ewhc-1345-qb-.jpg?quality=85)