European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

European small and mid caps-Stock picks Q4 2007-Q1 2008 - Fourlis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mid cap<br />

<strong>European</strong> <strong>small</strong> <strong>and</strong> <strong>mid</strong> <strong>caps</strong><br />

17 October <strong>2007</strong><br />

abc<br />

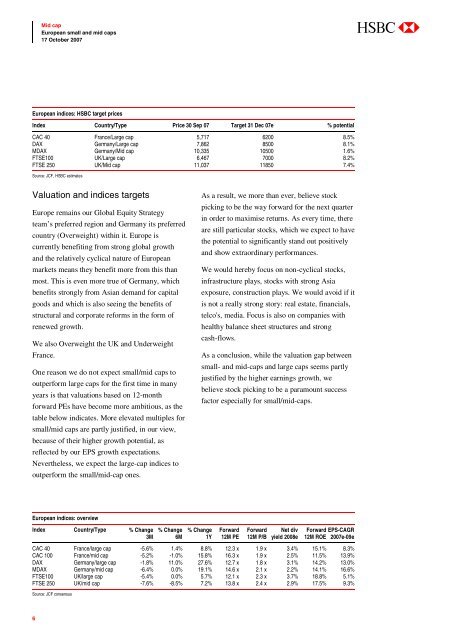

<strong>European</strong> indices: HSBC target prices<br />

Index Country/Type Price 30 Sep 07 Target 31 Dec 07e % potential<br />

CAC 40 France/Large cap 5,717 6200 8.5%<br />

DAX Germany/Large cap 7,862 8500 8.1%<br />

MDAX Germany/Mid cap 10,335 10500 1.6%<br />

FTSE100 UK/Large cap 6,467 7000 8.2%<br />

FTSE 250 UK/Mid cap 11,037 11850 7.4%<br />

Source: JCF, HSBC estimates<br />

Valuation <strong>and</strong> indices targets<br />

Europe remains our Global Equity Strategy<br />

team’s preferred region <strong>and</strong> Germany its preferred<br />

country (Overweight) within it. Europe is<br />

currently benefiting from strong global growth<br />

<strong>and</strong> the relatively cyclical nature of <strong>European</strong><br />

markets means they benefit more from this than<br />

most. This is even more true of Germany, which<br />

benefits strongly from Asian dem<strong>and</strong> for capital<br />

goods <strong>and</strong> which is also seeing the benefits of<br />

structural <strong>and</strong> corporate reforms in the form of<br />

renewed growth.<br />

We also Overweight the UK <strong>and</strong> Underweight<br />

France.<br />

One reason we do not expect <strong>small</strong>/<strong>mid</strong> <strong>caps</strong> to<br />

outperform large <strong>caps</strong> for the first time in many<br />

years is that valuations based on 12-month<br />

forward PEs have become more ambitious, as the<br />

table below indicates. More elevated multiples for<br />

<strong>small</strong>/<strong>mid</strong> <strong>caps</strong> are partly justified, in our view,<br />

because of their higher growth potential, as<br />

reflected by our EPS growth expectations.<br />

Nevertheless, we expect the large-cap indices to<br />

outperform the <strong>small</strong>/<strong>mid</strong>-cap ones.<br />

As a result, we more than ever, believe stock<br />

picking to be the way forward for the next quarter<br />

in order to maximise returns. As every time, there<br />

are still particular stocks, which we expect to have<br />

the potential to significantly st<strong>and</strong> out positively<br />

<strong>and</strong> show extraordinary performances.<br />

We would hereby focus on non-cyclical stocks,<br />

infrastructure plays, stocks with strong Asia<br />

exposure, construction plays. We would avoid if it<br />

is not a really strong story: real estate, financials,<br />

telco's, media. Focus is also on companies with<br />

healthy balance sheet structures <strong>and</strong> strong<br />

cash-flows.<br />

As a conclusion, while the valuation gap between<br />

<strong>small</strong>- <strong>and</strong> <strong>mid</strong>-<strong>caps</strong> <strong>and</strong> large <strong>caps</strong> seems partly<br />

justified by the higher earnings growth, we<br />

believe stock picking to be a paramount success<br />

factor especially for <strong>small</strong>/<strong>mid</strong>-<strong>caps</strong>.<br />

<strong>European</strong> indices: overview<br />

Index Country/Type % Change<br />

3M<br />

% Change<br />

6M<br />

% Change<br />

1Y<br />

Forward<br />

12M PE<br />

Forward<br />

12M P/B<br />

Net div<br />

yield <strong>2008</strong>e<br />

Forward EPS-CAGR<br />

12M ROE <strong>2007</strong>e-09e<br />

CAC 40 France/large cap -5.6% 1.4% 8.8% 12.3 x 1.9 x 3.4% 15.1% 8.3%<br />

CAC 100 France/<strong>mid</strong> cap -5.2% -1.0% 15.8% 16.3 x 1.9 x 2.5% 11.5% 13.9%<br />

DAX Germany/large cap -1.8% 11.0% 27.6% 12.7 x 1.8 x 3.1% 14.2% 13.0%<br />

MDAX Germany/<strong>mid</strong> cap -6.4% 0.0% 19.1% 14.6 x 2.1 x 2.2% 14.1% 16.6%<br />

FTSE100 UK/large cap -5.4% 0.0% 5.7% 12.1 x 2.3 x 3.7% 18.8% 5.1%<br />

FTSE 250 UK/<strong>mid</strong> cap -7.6% -8.5% 7.2% 13.8 x 2.4 x 2.9% 17.5% 9.3%<br />

Source: JCF consensus<br />

6