Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Investment Policy Review - Rwanda - UNCTAD Virtual Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Investment</strong> <strong>Policy</strong> <strong>Review</strong> of <strong>Rwanda</strong><br />

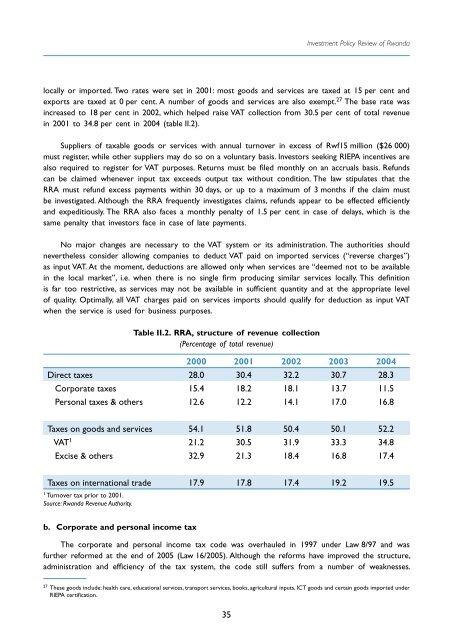

locally or imported. Two rates were set in 2001: most goods and services are taxed at 15 per cent and<br />

exports are taxed at 0 per cent. A number of goods and services are also exempt. 27 The base rate was<br />

increased to 18 per cent in 2002, which helped raise VAT collection from 30.5 per cent of total revenue<br />

in 2001 to 34.8 per cent in 2004 (table II.2).<br />

Suppliers of taxable goods or services with annual turnover in excess of Rwf15 million ($26 000)<br />

must register, while other suppliers may do so on a voluntary basis. Investors seeking RIEPA incentives are<br />

also required to register for VAT purposes. Returns must be filed monthly on an accruals basis. Refunds<br />

can be claimed whenever input tax exceeds output tax without condition. The law stipulates that the<br />

RRA must refund excess payments within 30 days, or up to a maximum of 3 months if the claim must<br />

be investigated. Although the RRA frequently investigates claims, refunds appear to be effected efficiently<br />

and expeditiously. The RRA also faces a monthly penalty of 1.5 per cent in case of delays, which is the<br />

same penalty that investors face in case of late payments.<br />

No major changes are necessary to the VAT system or its administration. The authorities should<br />

nevertheless consider allowing companies to deduct VAT paid on imported services (“reverse charges”)<br />

as input VAT. At the moment, deductions are allowed only when services are “deemed not to be available<br />

in the local market”, i.e. when there is no single firm producing similar services locally. This definition<br />

is far too restrictive, as services may not be available in sufficient quantity and at the appropriate level<br />

of quality. Optimally, all VAT charges paid on services imports should qualify for deduction as input VAT<br />

when the service is used for business purposes.<br />

Table II.2. RRA, structure of revenue collection<br />

(Percentage of total revenue)<br />

2000 2001 2002 2003 2004<br />

Direct taxes 28.0 30.4 32.2 30.7 28.3<br />

Corporate taxes 15.4 18.2 18.1 13.7 11.5<br />

Personal taxes & others 12.6 12.2 14.1 17.0 16.8<br />

Taxes on goods and services 54.1 51.8 50.4 50.1 52.2<br />

VAT 1 21.2 30.5 31.9 33.3 34.8<br />

Excise & others 32.9 21.3 18.4 16.8 17.4<br />

Taxes on international trade 17.9 17.8 17.4 19.2 19.5<br />

1<br />

Turnover tax prior to 2001.<br />

Source: <strong>Rwanda</strong> Revenue Authority.<br />

b. Corporate and personal income tax<br />

The corporate and personal income tax code was overhauled in 1997 under Law 8/97 and was<br />

further reformed at the end of 2005 (Law 16/2005). Although the reforms have improved the structure,<br />

administration and efficiency of the tax system, the code still suffers from a number of weaknesses.<br />

27<br />

These goods include: health care, educational services, transport services, books, agricultural inputs, ICT goods and certain goods imported under<br />

RIEPA certification.<br />

35