thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THANK YOU FOR SHOPPING WITH US<br />

BR AND<br />

POWER<br />

<strong>Dixons</strong> <strong>Group</strong> plc Interim Statement 1999/2000<br />

<strong>Dixons</strong> <strong>Group</strong> plc<br />

M AY L A N D S AV E N U E , H E M E L H E M P S T E A D, HERTS H P2 7TG TEL 014 42 353 000 http:/ /www. d i x o n s - g r o u p - p l c . c o . u k

Financial Highlights<br />

T h rough all our brands we aim to provide unrivalled value to our<br />

c<strong>us</strong>tomers by the range and quality of our products, our<br />

competitive prices and our high standards of serv i c e .<br />

28 weeks<br />

ended<br />

13 November<br />

1999<br />

£million<br />

28 weeks<br />

ended<br />

14 November<br />

1998<br />

£million<br />

Change<br />

%<br />

We specialise in the sale of high technology consumer<br />

e l e c t ronics, personal computers, domestic appliances,<br />

photographic equipment, communications products and after<br />

sales service through <strong>Dixons</strong>, Currys, PC World, <strong>The</strong> Link,<br />

@ j a k a rta and Masterc a re. Elkjøp is the leading consumer<br />

e l e c t ronics retailer in the Nordic re g i o n . ● T h rough Fre e s e rv e ,<br />

we provide the UK’s leading internet service, offering fre e<br />

i n t e rnet connection, a comprehensive selection of UK content<br />

and e-commerc e . ● Our European Pro p e rty division, Codic, has<br />

established a reputation <strong>for</strong> high quality retail and off i c e<br />

developments in Belgium, Luxembourg and France.<br />

Our objective is to create value <strong>for</strong> our shareholders, care e r<br />

o p p o rtunities <strong>for</strong> our employees and the best value and service <strong>for</strong><br />

our c<strong>us</strong>tomers.<br />

Turnover 1,720.7 1,455.2 +18%<br />

Profit be<strong>for</strong>e taxation, exceptional items and Freeserve 92.5 81.4 +14%<br />

Profit on ordinary activities be<strong>for</strong>e<br />

taxation and exceptional items 83.9 80.9 +4%<br />

Profit on ordinary activities be<strong>for</strong>e taxation 299.4 68.9 +335%<br />

Pence Pence %<br />

Adj<strong>us</strong>ted diluted earnings per Ordinary share 12.8 13.2 -3%<br />

Diluted earnings per Ordinary share 56.7 11.3 +402%<br />

Dividends per Ordinary share 4.2 3.5 +20%<br />

● P rofit be<strong>for</strong>e taxation of £299.4 million<br />

● Underlying profit be<strong>for</strong>e taxation (be<strong>for</strong>e exceptional items and Fre e s e rv e<br />

losses) of £92.5 million, up 14%<br />

● Interim dividend 4.20 pence per Ord i n a ry share, up 20%<br />

● Retail sales up 18%, to £1,676 million, up 8% like <strong>for</strong> like<br />

● Successful flotation of Fre e s e rve yields £219 million exceptional profit. <strong>Dixons</strong><br />

G roup retains 80% stake in the UK’s largest internet b<strong>us</strong>iness<br />

● Over £30 million investment planned in e-commerce over the next two years<br />

● S h o rtly after the half-year end, the <strong>Group</strong> acquired Elkjøp, the leading<br />

consumer electronics retailer in the Nordic re g i o n<br />

Contents 1 Financial highlights 2 Chairman’s statement 6 Consolidated profit<br />

and loss account 7 Consolidated balance sheet 8 Consolidated cash flow<br />

statement 9 Notes to the interim financial report 16 Investor in<strong>for</strong>mation<br />

● Corporate re s t ructuring announced. £121 million to be re t u rned to<br />

s h a re h o l d e r s<br />

<strong>Dixons</strong> <strong>Group</strong> plc <strong>Dixons</strong> <strong>Group</strong> plc 1

Chairman’s Statement<br />

Results and Dividends<br />

Profit on ordinary activities be<strong>for</strong>e taxation<br />

<strong>for</strong> the 28 weeks ended 13 November<br />

1999 was £299.4 million (1998/99<br />

£68.9 million). Diluted earnings per<br />

Ordinary share were 56.7 pence (11.3<br />

pence).<br />

<strong>The</strong> exceptional credit of £215.5 million<br />

mainly relates to the profit arising from the<br />

sale of approximately 20 per cent of<br />

Freeserve. Excluding the exceptional profit<br />

and the loss incurred by Freeserve, the<br />

underlying profit be<strong>for</strong>e tax increased by<br />

14 per cent to £92.5 million (£81.4<br />

million).<br />

Despite the positive operating per<strong>for</strong>mance,<br />

adj<strong>us</strong>ted diluted earnings per<br />

share, which exclude exceptional items,<br />

fell slightly to 12.8 pence (13.2 pence),<br />

reflecting the <strong>Group</strong>'s share of Freeserve<br />

losses and an increase in the <strong>Group</strong>'s<br />

effective tax rate.<br />

<strong>The</strong> directors have declared an interim<br />

dividend of 4.20 pence per Ordinary share<br />

(3.50 pence), an increase of 20 per cent,<br />

payable on 6 March 2000 to shareholders<br />

registered on 4 February 2000.<br />

Retail<br />

<strong>The</strong> Retail division made an operating<br />

profit be<strong>for</strong>e exceptional items of £71.5<br />

million (£63.1 million), an increase of 13<br />

per cent. Total sales in the period<br />

increased by 18 per cent to £1,676 million<br />

(£1,426 million), <strong>with</strong> like <strong>for</strong> like sales 8<br />

per cent higher than in the first 28 weeks<br />

of 1998/99.<br />

New technology and price deflation were<br />

the key factors affecting the consumer<br />

e l e c t ronics market. Mobile phones,<br />

w i d e s c reen televisions and digital<br />

products including camcorders, minidisc<br />

and DVD players enjoyed strong growth.<br />

H o w e v e r, markets such as games<br />

consoles and VCRs suff e red fro m<br />

particularly heavy price deflation that was<br />

not fully offset by volume growth.<br />

Retail gross margin declined by 0.7<br />

p e rcentage points reflecting aggre s s i v e<br />

pricing action and the growth of lower<br />

margin areas of the b<strong>us</strong>iness such as PC<br />

World B<strong>us</strong>iness.<br />

<strong>The</strong> continuing downward pre s s u re on<br />

margins was partially offset by a reduction<br />

in costs as a proportion of sales. <strong>The</strong><br />

reduction of 0.5 percentage points<br />

reflected improved operating efficiencies<br />

and the benefits of leveraging the <strong>Group</strong>'s<br />

costs against the higher sales base. Retail<br />

rents remain a source of cost inflation,<br />

although there is some evidence that<br />

rents are moderating on new leases.<br />

<strong>Dixons</strong> sales, at £368 million (£334<br />

million), were up 10 per cent overall and 7<br />

per cent like <strong>for</strong> like. Sales of new<br />

technology products were strong, although<br />

the decline in the games console market,<br />

which fell by 25 per cent over the period,<br />

had an adverse effect. Eight stores were<br />

opened in the period and a further two<br />

were resited. A new concept store was<br />

trialled <strong>with</strong> an improved la<strong>you</strong>t and<br />

product merchandising designed <strong>for</strong> easier<br />

<strong>shopping</strong> <strong>for</strong> the c<strong>us</strong>tomer and more<br />

efficient management. Initial results are<br />

encouraging.<br />

Currys sales were £688 million (£629<br />

million), an increase of 9 per cent in total<br />

and 4 per cent like <strong>for</strong> like. Currys gained<br />

market share in the period <strong>with</strong> particularly<br />

s t rong perf o rmances in domestic<br />

appliances and widescreen televisions.<br />

Excl<strong>us</strong>ive brands allow Currys to offer the<br />

widest available range of pro d u c t s<br />

supported by a market leading service<br />

proposition. This was further enhanced by<br />

the availability of next day delivery, seven<br />

days a week on some 2,000 product lines.<br />

In June, Currys piloted a range of fitted<br />

kitchens in four stores, offering the<br />

consumer a wide range of quality kitchens<br />

in conjunction <strong>with</strong> the widest selection of<br />

appliances in the UK. <strong>The</strong> trial stores have<br />

achieved good sales levels. As a result,<br />

kitchens have been rolled out to a further<br />

20 stores <strong>with</strong> further expansion planned.<br />

Currys continued to increase both the<br />

number of stores (7 Superstores opened<br />

during the period) and the size of stores,<br />

<strong>with</strong> 3 stores extended and a further 5<br />

resited into larger units.<br />

PC World sales, at £454 million (£362<br />

million), increased by 26 per cent overall<br />

and 8 per cent like <strong>for</strong> like. PC World's<br />

growth in sales and market share reflects<br />

its combination of market beating prices,<br />

the widest product range and an unrivalled<br />

service proposition. PC Health Check has<br />

been introduced into all stores, offering<br />

c<strong>us</strong>tomers the opportunity to have their PC<br />

per<strong>for</strong>mance optimised and upgraded. A<br />

further 11 new Superstores were opened.<br />

Of these, 3 were in a new <strong>for</strong>mat of around<br />

12,000 square feet designed <strong>for</strong> smaller<br />

markets. <strong>The</strong>ir success confirms PC<br />

World's potential to expand its store base<br />

into smaller towns.<br />

Despite a cautio<strong>us</strong> b<strong>us</strong>iness market<br />

ahead of the millennium, PC Wo r l d<br />

B<strong>us</strong>iness continued to achieve stro n g<br />

growth <strong>with</strong> sales up 35 per cent at £53<br />

million.<br />

<strong>The</strong> Link sales were £125 million (£71<br />

million), an increase of 77 per cent in total<br />

and 43 per cent on a like <strong>for</strong> like basis. 20<br />

new stores were opened, taking the total<br />

to 195. <strong>The</strong> Link benefited from the strong<br />

growth in pre-pay mobile phones. <strong>The</strong>re is<br />

now a vast combination of handsets,<br />

tariffs and networks available, rein<strong>for</strong>cing<br />

the need <strong>for</strong> a specialist communications<br />

store. To assist the c<strong>us</strong>tomer, <strong>The</strong> Link<br />

has installed, EasyLink, an advanced<br />

computer facility that, on the basis of each<br />

c<strong>us</strong>tomer's individual re q u i re m e n t s ,<br />

recommends the most appro p r i a t e<br />

selection of tariff, network and handset.<br />

E-commerce<br />

<strong>The</strong> <strong>Group</strong> continues to develop its e-<br />

commerce strategy. Total on-line sales in<br />

the first half, although a very small<br />

proportion of turnover, were six times<br />

higher than the same period last year. This<br />

t rend accelerated over the Christmas<br />

period.<br />

@jakarta, the <strong>Group</strong>'s combined 'bricks<br />

and mortar' and e-commerce games and<br />

s o f t w a re retailer successfully launched<br />

its transactional web site<br />

(www.jakarta.co.uk). In November, the site<br />

was incorporated <strong>with</strong>in the games<br />

channel on Freeserve, supported by an<br />

extensive advertising campaign.<br />

Downloadable software was also made<br />

available shortly thereafter.<br />

2 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 3

<strong>The</strong> <strong>Group</strong> believes that software is a<br />

category in which on-line sales will capture<br />

a large share of the market. It is less clear<br />

how many c<strong>us</strong>tomers will be willing to<br />

purchase other products <strong>with</strong>out seeing<br />

them and obtaining appropriate advice and<br />

after sales back up. However, e-commerce<br />

will take a share of traditional retail sales<br />

<strong>with</strong>in an expanding retail market.<br />

C<strong>us</strong>tomers will <strong>us</strong>e the net to assist in<br />

making product decisions and <strong>for</strong> after<br />

sales service in<strong>for</strong>mation.<br />

<strong>The</strong> <strong>Group</strong> aims to be a market leader both<br />

in ‘bricks and mortar’ retailing and e-<br />

commerce. It will exploit the opportunities<br />

to provide enhanced c<strong>us</strong>tomer service and<br />

i n c rease market share through both<br />

mediums. <strong>The</strong> <strong>Group</strong> expects to invest in<br />

excess of £30 million over the next two<br />

years in developing its e-commerc e<br />

activities. <strong>The</strong> <strong>Group</strong>'s expertise, marketleading<br />

brands and links <strong>with</strong> Freeserve<br />

give it a unique position to cre a t e<br />

additional profit streams from e-<br />

commerce.<br />

Elkjøp<br />

Shortly after the end of the half-year, the<br />

<strong>Group</strong> acquired, <strong>for</strong> £444 million, Elkjøp<br />

ASA, the leading consumer electronics<br />

retailer in the Nordic region. Elkjøp is a<br />

profitable and fast growing company <strong>with</strong><br />

over 150 stores in 5 countries. We<br />

believe that this growth can be further<br />

enhanced as part of the <strong>Dixons</strong> <strong>Group</strong>.<br />

<strong>The</strong> acquisition represents a significant<br />

step in the <strong>Group</strong>'s European expansion<br />

strategy.<br />

Freeserve<br />

Freeserve strengthened its position as the<br />

UK's leading internet company. By the end<br />

of the period it had 1.575 million active<br />

<strong>us</strong>ers, an increase of almost 400,000<br />

since the beginning of the financial year.<br />

Total minutes on-line in the first half were<br />

4.1 billion. In line <strong>with</strong> Fre e s e rv e ' s<br />

strategy of building on its position as the<br />

UK's largest ISP to become the UK's<br />

leading internet portal, page impressions<br />

increased to 110 million in November, an<br />

increase of 72 per cent from the beginning<br />

of the half year. Total revenue was £7.2<br />

million, an increase of 184 per cent on the<br />

second half of last year. In line <strong>with</strong><br />

expectations, advertising and e-commerce<br />

have now grown to 50 per cent of total<br />

revenue.<br />

On 26 July 1999, the <strong>Group</strong> made an<br />

Initial Public Offering of a minority interest<br />

in Freeserve. Approximately 20 per cent<br />

of the shares were made available in the<br />

offer, <strong>with</strong> <strong>Dixons</strong> retaining 80 per cent. Of<br />

the £242 million raised net of fees and<br />

stamp duty, £123 million went directly to<br />

F re e s e rve to fund its growth and<br />

investment plans.<br />

European Property<br />

<strong>The</strong> European Property division made an<br />

operating profit of £6.3 million (£4.0<br />

million) on sales of £39 million (£29<br />

million). <strong>The</strong> 58 per cent increase in<br />

profits on lower operating assets reflects<br />

the success of the re-foc<strong>us</strong> of activity into<br />

Belgium, Luxembourg and France, where<br />

Codic has a strong record of successful<br />

projects.<br />

Financial position<br />

At the end of the period, net funds,<br />

excluding amounts held under tr<strong>us</strong>t to<br />

fund extended warranty liabilities and<br />

funds held by Fre e s e rve, were £403<br />

million (£32 million). <strong>The</strong> increase on last<br />

year reflects the funds raised <strong>for</strong> <strong>Dixons</strong><br />

<strong>Group</strong> plc from the flotation of Freeserve<br />

together <strong>with</strong> cash generated fro m<br />

operations. Working capital was tightly<br />

managed, <strong>with</strong> average stock weeks cover<br />

falling by 14 per cent, whilst stock<br />

availability improved.<br />

Net interest receivable increased to £16.1<br />

million (£14.3 million), reflecting the<br />

higher cash balances, largely offset by<br />

lower year on year interest rates.<br />

On 13 December 1999, the <strong>Group</strong> paid a<br />

special interim dividend of 7.5 pence per<br />

Ordinary share. In order to qualify <strong>for</strong> this<br />

dividend, over 75 per cent of the holders<br />

of the Convertible Pre f e rence share s<br />

elected to convert their holdings into<br />

O rd i n a ry shares. <strong>The</strong> balance has<br />

subsequently been converted resulting in<br />

the total conversion of 177 million<br />

C o n v e rtible Pre f e rence shares into 47<br />

million Ordinary shares.<br />

It was announced on 28 June 1999 that,<br />

following the flotation of Freeserve, <strong>Dixons</strong><br />

was considering a corporate restructuring<br />

to give greater strategic and financial<br />

flexibility and a capital structure more<br />

appropriate to its needs. It has now been<br />

decided to proceed. As part of the<br />

restructuring, the Board intends to return<br />

25 pence per Ord i n a ry share to<br />

shareholders, equivalent to £121 million<br />

in aggregate. <strong>The</strong>re will also be a share<br />

split.<br />

Year 2000<br />

<strong>The</strong> extensive programme, started in<br />

1997, to ensure that the <strong>Group</strong>'s systems<br />

and operations were Year 2000 compliant<br />

has cost approximately £10 million. No<br />

material problems or failures were<br />

identified over the New Year period.<br />

Christmas trading<br />

Over the Christmas period, the growth of<br />

digital technology and lower prices<br />

ensured sales remained strong, although<br />

there was a further reduction in gross<br />

margins. Retail sales <strong>for</strong> the first eight<br />

weeks of the second half to 8 January<br />

2000 increased by 15 per cent in total and<br />

5 per cent on a like <strong>for</strong> like basis.<br />

Maylands Avenue Sir Stanley Kalms<br />

Hemel Hempstead<br />

Chairman<br />

Hert<strong>for</strong>dshire HP2 7TG 12 January 2000<br />

4 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 5

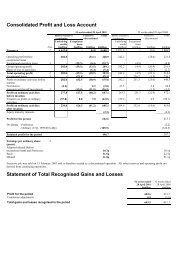

Consolidated Profit and Loss Account<br />

Note<br />

Turnover 2 1,720.7 - 1,720.7 1,455.2 3,156.3<br />

Operating profit from<br />

continuing operations 2 67.8 (4.9) 62.9 54.6 195.7<br />

Exceptional profit on partial sales 3 - 220.4 220.4 - 7.5<br />

Profit on ordinary activities be<strong>for</strong>e interest 67.8 215.5 283.3 54.6 203.2<br />

Net interest 4 16.1 - 16.1 14.3 28.1<br />

Profit on ordinary activities be<strong>for</strong>e<br />

taxation 83.9 215.5 299.4 68.9 231.3<br />

<strong>Dixons</strong> <strong>Group</strong> (excluding Freeserve) 92.5 215.5 308.0 69.4 232.8<br />

Freeserve (8.6) - (8.6) (0.5) (1.5)<br />

83.9 215.5 299.4 68.9 231.3<br />

Taxation on profit on ordinary activities 5 (19.6) 0.7 (18.9) (13.9) (42.1)<br />

Profit on ordinary activities after<br />

taxation 64.3 216.2 280.5 55.0 189.2<br />

Equity minority interests (1.5) - (1.5) (0.3) (3.0)<br />

Profit <strong>for</strong> the period 62.8 216.2 279.0 54.7 186.2<br />

Dividends - Preference 6 (2.2) (4.7) (8.9)<br />

- Ordinar y 6 (56.6) (15.1) (66.3)<br />

Retained profit <strong>for</strong> the period 220.2 34.9 111.0<br />

Earnings per Ordinary share (pence)<br />

Be<strong>for</strong>e<br />

exceptional<br />

items<br />

£million<br />

Exceptional<br />

items<br />

£million<br />

28 weeks<br />

ended<br />

13 November<br />

1999<br />

Total<br />

£million<br />

Basic 7 62.9p 11.6p 41.1p<br />

Adj<strong>us</strong>ted basic 7 13.8p 13.7p 41.7p<br />

Diluted 7 56.7p 11.3p 38.2p<br />

Adj<strong>us</strong>ted diluted 7 12.8p 13.2p 38.7p<br />

Statement of Total Recognised Gains and Losses<br />

28 weeks<br />

ended<br />

14 November<br />

1998<br />

Total<br />

£million<br />

52 weeks<br />

ended<br />

1 May<br />

1999<br />

Total<br />

£million<br />

Consolidated Balance Sheet<br />

Fixed assets<br />

Intangible assets 3.4 - -<br />

Tangible assets 387.1 363.2 363.8<br />

Investments 14.6 1.1 1.9<br />

Current assets<br />

Note<br />

405.1 364.3 365.7<br />

Stocks 8 609.9 643.0 427.3<br />

Debtors 292.0 291.9 288.0<br />

Investments 864.9 573.9 746.3<br />

Cash at bank and in hand 185.1 16.7 11.0<br />

Creditors - due <strong>with</strong>in one year<br />

1,951.9 1,525.5 1,472.6<br />

Borrowing (46.7) (57.8) (42.9)<br />

Other creditors (873.4) (731.7) (620.1)<br />

(920.1) (789.5) (663.0)<br />

Net current assets 1,031.8 736.0 809.6<br />

Total assets less current liabilities 1,436.9 1,100.3 1,175.3<br />

Creditors - due after more than one year<br />

13 November<br />

1999<br />

£million<br />

14 November<br />

1998<br />

£million<br />

1 May<br />

1999<br />

£million<br />

Borrowing (199.3) (227.6) (202.5)<br />

Other creditors (182.4) (166.3) (173.7)<br />

(381.7) (393.9) (376.2)<br />

Provisions <strong>for</strong> liabilities and charges (34.7) (24.4) (34.4)<br />

2 1,020.5 682.0 764.7<br />

Shareholders’ funds 9 986.0 674.9 754.9<br />

Equity minority interests 34.5 7.1 9.8<br />

1,020.5 682.0 764.7<br />

28 weeks<br />

ended<br />

13 November<br />

1999<br />

£million<br />

28 weeks<br />

ended<br />

14 November<br />

1998<br />

£million<br />

52 weeks<br />

ended<br />

1 May<br />

1999<br />

£million<br />

Profit <strong>for</strong> the period 279.0 54.7 186.2<br />

Translation adj<strong>us</strong>tments (0.2) - 0.1<br />

Prior period adj<strong>us</strong>tment - 2.4 2.4<br />

Total gains recognised in the period 278.8 57.1 188.7<br />

6 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 7

Consolidated Cash Flow Statement<br />

Net cash inflow/(outflow) from operating activities 11 140.9 (0.5) 300.8<br />

Returns on investments and servicing of finance<br />

Interest received 24.4 21.7 45.4<br />

Interest paid (1.8) (0.6) (19.7)<br />

Preference dividends paid (2.2) (4.4) (8.9)<br />

Note<br />

20.4 16.7 16.8<br />

Taxation paid (1.0) (1.4) (58.7)<br />

Capital expenditure and financial investment<br />

Purchase of fixed asset investments (13.0) - -<br />

Purchase of tangible fixed assets (64.6) (58.9) (88.8)<br />

Sale of tangible fixed assets 10.1 1.2 3.3<br />

Acquisitions and disposals<br />

(67.5) (57.7) (85.5)<br />

Cash consideration <strong>for</strong> acquisitions (2.2) (18.0) (18.0)<br />

Net cash acquired <strong>with</strong> subsidiary 0.1 - -<br />

Cash consideration <strong>for</strong> partial sales of subsidiaries 3 242.2 7.5 7.5<br />

240.1 (10.5) (10.5)<br />

Equity dividends paid (53.4) (42.1) (57.3)<br />

Net cash inflow/(outflow) be<strong>for</strong>e management of liquid<br />

28 weeks<br />

ended<br />

13 November<br />

1999<br />

£million<br />

28 weeks<br />

ended<br />

14 November<br />

1998<br />

£million<br />

52 weeks<br />

ended<br />

1 May<br />

1999<br />

£million<br />

resources and financing 279.5 (95.5) 105.6<br />

Notes to the Interim Financial Report<br />

1 Basis of preparation<br />

<strong>The</strong> interim financial report has been prepared <strong>us</strong>ing accounting policies consistent <strong>with</strong> those set<br />

out in the financial statements <strong>for</strong> the 52 weeks ended 1 May 1999. During the period, Financial<br />

Reporting Standard 15 (FRS 15) “Tangible Fixed Assets” was adopted by the <strong>Group</strong>. This has not<br />

resulted in any material change in the <strong>Group</strong>’s treatment of fixed assets.<br />

<strong>The</strong> interim financial report does not constitute statutory accounts <strong>with</strong>in the meaning of section<br />

240 of the Companies Act 1985. It is unaudited but has been reviewed by the auditors. <strong>The</strong>ir<br />

report is on page 15.<br />

<strong>The</strong> financial in<strong>for</strong>mation <strong>for</strong> the 52 weeks ended 1 May 1999 has been extracted from the financial<br />

statements <strong>for</strong> that period. Those statements, which contain an unqualified auditors’ report, have<br />

been delivered to the Registrar of Companies.<br />

<strong>The</strong> Interim Statement <strong>for</strong> the 28 weeks ended 13 November 1999 was approved by the directors<br />

on 12 January 2000.<br />

2 Segmental analysis of turnover and operating profit<br />

28 weeks 1999/00<br />

Turnover<br />

£million<br />

Operating<br />

profit<br />

£million<br />

Turnover<br />

£million<br />

28 weeks 1998/99<br />

Operating<br />

profit<br />

£million<br />

Turnover<br />

£million<br />

52 weeks 1998/99<br />

Operating<br />

profit<br />

£million<br />

Retail - base 1,675.7 71.5 1,425.9 63.1 3,089.9 202.5<br />

- exceptional - (4.9) - (12.0) - (13.3)<br />

European Property 38.6 6.3 29.3 4.0 64.1 8.0<br />

Freeserve 7.2 (10.0) 0.2 (0.5) 2.7 (1.5)<br />

Intragroup adj<strong>us</strong>tments (0.8) - (0.2) - (0.4) -<br />

1,720.7 62.9 1,455.2 54.6 3,156.3 195.7<br />

Management of liquid resources<br />

(Increase)/decrease in current asset investments (117.7) 42.6 (131.7)<br />

Financing<br />

Issue of Ordinary share capital 11.1 5.0 8.8<br />

Decrease in debt due <strong>with</strong>in one year (1.8) (7.0) (12.1)<br />

(Decrease)/increase in debt due after more than one year (3.3) 7.9 (15.8)<br />

6.0 5.9 (19.1)<br />

Increase/(decrease) in cash in the period 12 167.8 (47.0) (45.2)<br />

Segmental analysis of net assets<br />

13 November<br />

1999<br />

£million<br />

14 November<br />

1998<br />

£million<br />

1 May<br />

1999<br />

£million<br />

Retail 295.2 383.6 275.8<br />

European Property 61.1 116.8 88.5<br />

Freeserve 10.4 (0.3) (1.5)<br />

Net operating assets 366.7 500.1 362.8<br />

Net non-operating liabilities (150.2) (123.3) (110.0)<br />

Net funds 804.0 305.2 511.9<br />

Net assets 1,020.5 682.0 764.7<br />

8 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 9

Notes to the Interim Financial Report continued<br />

Net funds include investments of £304.0 million (14 November 1998 £273.0 million) held under tr<strong>us</strong>t to fund<br />

extended warranty liabilities, resulting in a net free cash balance of £500.0 million (14 November 1998 £32.2<br />

million).<br />

All turnover and operating profit are derived from continuing operations.<br />

<strong>The</strong> Retail division operates in the United Kingdom and the Republic of Ireland. <strong>The</strong> European Property<br />

division operates mainly in Belgium, Luxembourg, Germany and France. Freeserve operates in the United<br />

Kingdom as an internet service provider and portal. <strong>The</strong>re were no material exports from the locations in<br />

which the <strong>Group</strong> operates.<br />

<strong>The</strong> Retail exceptional item <strong>for</strong> the 28 weeks ended 13 November 1999 includes a charge of £1.6 million<br />

(28 weeks ended 14 November 1998 £1.7 million, 52 weeks ended 1 May 1999 £3.0 million) <strong>for</strong> the cost of<br />

ensuring that the <strong>Group</strong>’s computer and other operating systems are able to function effectively in the Year<br />

2000 and beyond. <strong>The</strong> 1998/99 Retail exceptional items also include a charge of £10.3 million <strong>for</strong> the<br />

post-acquisition integration of the retail b<strong>us</strong>iness of Seeboard plc <strong>with</strong> the Retail division.<br />

A further £3.3 million exceptional charge has been incurred on additional integration costs of prior years’<br />

acquisitions.<br />

3 Exceptional profit on partial sales of subsidiaries<br />

On 26 July 1999 the <strong>Group</strong> made an Initial Public Offering of a minority interest in Freeserve plc and on 2<br />

Aug<strong>us</strong>t 1999 Freeserve plc was admitted to the London Stock Exchange and Nasdaq. Net proceeds of<br />

£242.2 million were received after deducting all issue costs, flotation fees, expenses and marketing costs.<br />

A consolidated net gain of £219.3 million arises after deduction of minority interests.<br />

A further consolidated net gain of £1.1 million arose on the deemed disposal in respect of shares issued by<br />

Freeserve plc as part of the purchase consideration <strong>for</strong> Babyworld.com Limited acquired on 6 Aug<strong>us</strong>t 1999.<br />

As at 13 November 1999 <strong>Dixons</strong> <strong>Group</strong> plc owned 80.04% of the issued share capital of Freeserve.<br />

In the 52 weeks ended 1 May 1999 an exceptional credit of £7.5 million was recognised in respect of further<br />

consideration receivable on the sale of 40% of <strong>The</strong> Link <strong>Stores</strong> Limited in 1997/98.<br />

6 Dividends<br />

Per Ordinary share<br />

Special interim of 7.5 pence paid (1998/99 nil) 36.3 - -<br />

Interim of 4.2 pence proposed (1998/99 3.5 pence) 20.3 15.1 15.1<br />

Final <strong>for</strong> 1998/99 of 11.8 pence paid 51.2<br />

Ordinary dividends paid and proposed 56.6 15.1 66.3<br />

Preference dividends paid 2.2 4.7 8.9<br />

58.8 19.8 75.2<br />

As a result of the conversion of the Preference shares into Ordinary shares the Preference dividend paid on 31<br />

July 1999 will be the final such payment.<br />

7 Earnings per Ordinary share<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Profit <strong>for</strong> the period 279.0 54.7 186.2<br />

Preference dividends (2.2) (4.7) (8.9)<br />

Basic earnings 276.8 50.0 177.3<br />

Preference dividends 2.2 4.7 8.9<br />

Diluted earnings 279.0 54.7 186.2<br />

million million million<br />

Basic weighted average number of shares 439.8 431.0 431.7<br />

4 Net interest<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Convertible Preference shares 42.2 47.3 47.3<br />

Employee share options and incentive schemes 9.8 3.7 8.8<br />

Diluted weighted average number of shares 491.8 482.0 487.8<br />

Interest receivable and similar income 26.4 22.8 44.5<br />

Interest payable (10.6) (9.8) (18.4)<br />

15.8 13.0 26.1<br />

Interest capitalised 0.3 1.3 2.0<br />

5 Taxation on profit on ordinary activities<br />

16.1 14.3 28.1<br />

<strong>The</strong> taxation charge on profit on ordinary activities be<strong>for</strong>e exceptional items is based on the estimated effective<br />

rate of taxation of 23.4 per cent <strong>for</strong> the 52 weeks ending 29 April 2000. <strong>The</strong>re is an exceptional tax credit of<br />

£0.7 million in respect of the charges <strong>for</strong> Year 2000 costs and integration costs.<br />

pence pence pence<br />

Basic earnings per Ordinary share 62.9 11.6 41.1<br />

Exceptional items, net of taxation (49.1) 2.1 0.6<br />

Adj<strong>us</strong>ted basic earnings per Ordinary share 13.8 13.7 41.7<br />

Diluted earnings per Ordinary share 56.7 11.3 38.2<br />

Exceptional items, net of taxation (43.9) 1.9 0.5<br />

Adj<strong>us</strong>ted diluted earnings per Ordinary share 12.8 13.2 38.7<br />

Adj<strong>us</strong>ted earnings per Ordinary share exclude exceptional items.<br />

10 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 11

Notes to the Interim Financial Report continued<br />

8 Stocks<br />

13 November<br />

1999<br />

£million<br />

14 November<br />

1998<br />

£million<br />

1 May<br />

1999<br />

£million<br />

10 Reconciliation of movements in shareholders’ funds<br />

13 November<br />

1999<br />

£million<br />

14 November<br />

1998<br />

£million<br />

1 May<br />

1999<br />

£million<br />

Finished goods and goods <strong>for</strong> resale 565.6 586.7 378.4<br />

Properties held <strong>for</strong> development or resale 44.3 56.3 48.9<br />

9 Shareholders’ Funds<br />

609.9 643.0 427.3<br />

At 1 May 1999 43.4 125.1 - 409.1 8.9 168.4<br />

Retained profit <strong>for</strong> the period 220.2<br />

Translation adj<strong>us</strong>tments (0.2)<br />

Ordinary shares issued:<br />

Ordinary<br />

share<br />

capital<br />

£million<br />

Share<br />

premium<br />

account<br />

£million<br />

Share options - employees 0.3 10.8<br />

Capital<br />

reserve<br />

£million<br />

Profit<br />

and loss<br />

account<br />

£million<br />

- employee tr<strong>us</strong>ts 15.5 (15.5)<br />

Conversion of Preference shares 4.7 4.2 168.4 (8.9) (168.4)<br />

Transfer to capital reserve 104.7 (104.7)<br />

Preference<br />

share<br />

capital<br />

£million<br />

At 13 November 1999 48.4 155.6 104.7 677.3 - -<br />

Total shareholders’ funds at 13 November 1999 are £986.0 million (1 May 1999 £754.9 million).<br />

Special<br />

reserve<br />

£million<br />

By 13 November 1999, Preference shareholders had received compulsory notice to convert their shareholdings<br />

into Ordinary shares and conversion took place shortly thereafter. <strong>The</strong> above note shows the conversion into<br />

Ordinary shares as if it had taken place prior to 13 November 1999.<br />

<strong>The</strong> transfer to a capital reserve represents the profit on the deemed disposals relating to the issue of shares by<br />

Freeserve.<br />

Opening shareholders’ funds 754.9 635.0 635.0<br />

Profit <strong>for</strong> the period 279.0 54.7 186.2<br />

Dividends - Preference (2.2) (4.7) (8.9)<br />

- Ordinary (56.6) (15.1) (66.3)<br />

220.2 34.9 111.0<br />

Other recognised gains and losses relating to the period (0.2) - 0.1<br />

Ordinary shares issued:<br />

Share options 11.1 5.0 8.8<br />

Conversion of Preference shares 8.9 - -<br />

Preference shares converted (8.9) - -<br />

Net additions to shareholders’ funds 231.1 39.9 119.9<br />

Closing shareholders’ funds 986.0 674.9 754.9<br />

11 Net cash inflow/(outflow) from operating activities<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Operating profit be<strong>for</strong>e exceptional operating items 67.8 66.6 209.0<br />

Utilisation of provisions <strong>for</strong> exceptional costs (5.4) (11.0) (18.5)<br />

Depreciation 40.3 37.0 73.2<br />

Amortisation of goodwill 0.2 - -<br />

Amortisation of own shares 0.2 0.3 0.7<br />

Shares retained in lieu of income tax liability - - (1.2)<br />

(Increase)/decrease in stocks (183.5) (204.0) 9.3<br />

Increase in debtors (3.8) (21.8) (13.9)<br />

Increase in creditors 225.1 132.4 42.2<br />

140.9 (0.5) 300.8<br />

12 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 13

Notes to the Interim Financial Report continued<br />

12 Reconciliation of net cash flow to movement in net funds<br />

Increase/(decrease) in cash in the period 167.8 (47.0) (45.2)<br />

Cash movement from increase/(decrease) in current asset 117.7 (42.6) 131.7<br />

investments<br />

Cash movement from decrease in debt due <strong>with</strong>in one year 1.8 7.0 12.1<br />

Cash movement from decrease/(increase) in debt due after 3.3 (7.9) 15.8<br />

more than one year<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Increase/(decrease) in net funds resulting from cash movements 290.6 (90.5) 114.4<br />

Other adj<strong>us</strong>tments 1.2 - (1.6)<br />

Translation adj<strong>us</strong>tments 0.3 (2.7) 0.7<br />

Movement in net funds in the period 292.1 (93.2) 113.5<br />

Opening net funds 511.9 398.4 398.4<br />

Closing net funds 804.0 305.2 511.9<br />

Independent Review Report by the Auditors<br />

to <strong>Dixons</strong> <strong>Group</strong> plc<br />

Introduction<br />

We have been instructed by the Company to review the financial in<strong>for</strong>mation set out on pages 6 to 14 and we have<br />

read the other in<strong>for</strong>mation contained in the interim report and considered whether it contains any apparent<br />

misstatements or material inconsistencies <strong>with</strong> the financial in<strong>for</strong>mation.<br />

Directors’ responsibilities<br />

<strong>The</strong> interim report, including the financial in<strong>for</strong>mation contained therein, is the responsibility of, and has been approved<br />

by, the directors. <strong>The</strong> Listing Rules of the London Stock Exchange require that the accounting policies and presentation<br />

applied to the interim figures should be consistent <strong>with</strong> those applied in preparing the preceding annual accounts<br />

except where any changes, and the reasons <strong>for</strong> them, are disclosed.<br />

Review work per<strong>for</strong>med<br />

We conducted our review in accordance <strong>with</strong> guidance contained in Bulletin 1999/4 issued by the Auditing Practices<br />

Board. A review consists principally of making enquiries of group management and applying analytical procedures to<br />

the financial in<strong>for</strong>mation and underlying financial data and based thereon, assessing whether the accounting policies<br />

and presentation have been consistently applied unless otherwise disclosed. A review excludes audit procedures such<br />

as tests of controls and verification of assets, liabilities and transactions. It is substantially less in scope than an audit<br />

per<strong>for</strong>med in accordance <strong>with</strong> Auditing Standards and there<strong>for</strong>e provides a lower level of assurance than an audit.<br />

Accordingly, we do not express an audit opinion on the financial in<strong>for</strong>mation.<br />

Review concl<strong>us</strong>ion<br />

On the basis of our review we are not aware of any material modifications that should be made to the financial<br />

in<strong>for</strong>mation as presented <strong>for</strong> the 28 weeks ended 13 November 1999.<br />

13 Analysis of movement in net funds<br />

1 May<br />

1999<br />

£million<br />

Cash flow<br />

£million<br />

Other<br />

adj<strong>us</strong>tments<br />

£million<br />

Translation<br />

adj<strong>us</strong>tments<br />

£million<br />

13 November<br />

1999<br />

£million<br />

Hill Ho<strong>us</strong>e<br />

Deloitte & Touche<br />

1 Little New Street Chartered Accountants<br />

London EC4A 3TR 12 January 2000<br />

Cash at bank and in hand 11.0 174.1 - - 185.1<br />

Overdrafts (17.9) (6.3) - - (24.2)<br />

167.8<br />

Current asset investments 746.3 117.7 1.3 (0.4) 864.9<br />

Debt due <strong>with</strong>in one year (25.0) 1.8 - 0.7 (22.5)<br />

Debt due after more than one year (202.5) 3.3 (0.1) - (199.3)<br />

Net funds 511.9 290.6 1.2 0.3 804.0<br />

14 Post balance sheet event<br />

On 29 November 1999 the <strong>Group</strong> announced a recommended cash offer <strong>for</strong> 100% of the share capital of<br />

Elkjøp ASA, the leading consumer electronics retailer in the Nordic region, at a price of NOK160 per share. This<br />

values Elkjøp at £444 million.<br />

Retail Sales Analysis<br />

28 weeks<br />

1999/00<br />

£million<br />

<strong>Dixons</strong> 368.4 333.7 10 7<br />

Currys 688.4 629.1 9 4<br />

PC World 454.2 361.9 26 8<br />

<strong>The</strong> Link 125.3 70.7 77 43<br />

@jakarta 2.4 - N/A N/A<br />

Other 37.0 30.5 21 N/A<br />

1,675.7 1,425.9 18 8<br />

Retail Store Data Number of stores Sales area<br />

13 Nov e m b e r<br />

1 9 9 9<br />

28 weeks<br />

1998/99<br />

£million<br />

Change since<br />

1 May 1999<br />

Change<br />

%<br />

13 Nov e m b e r<br />

1 9 9 9<br />

000 sq. ft.<br />

Like <strong>for</strong><br />

like change<br />

%<br />

Change since<br />

1 May 1999<br />

000 sq.ft.<br />

<strong>Dixons</strong> 353 7 885 22<br />

Currys – Superstores 262 6 3,101 118<br />

– High Street 138 (1) 248 (1)<br />

PC World 77 11 1,391 166<br />

<strong>The</strong> Link 195 20 175 18<br />

@jakarta 5 - 11 -<br />

1,030 43 5,811 323<br />

14 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 15

Investor In<strong>for</strong>mation<br />

Registrars and transfer office<br />

IRG plc<br />

Balfour Ho<strong>us</strong>e<br />

390/398 High Road<br />

Il<strong>for</strong>d<br />

Essex IG1 1NQ<br />

Tel: 0181 639 2000<br />

Registered office<br />

Maylands Avenue<br />

Hemel Hempstead<br />

Hert<strong>for</strong>dshire HP2 7TG<br />

Registered No. 333031<br />

Low cost share dealing service<br />

Cazenove & Co. operates a low cost share<br />

dealing service <strong>for</strong> private investors who<br />

wish to buy or sell the Company’s shares.<br />

Details are available from Cazenove & Co.<br />

Tel: 0171 606 1768<br />

Internet<br />

<strong>The</strong> 1998/99 Annual Report and other<br />

in<strong>for</strong>mation is available through the internet<br />

on http://www.dixons-group-plc.co.uk<br />

Dividend Reinvestment Plan<br />

<strong>The</strong> <strong>Group</strong> operates a Dividend Reinvestment<br />

Plan, details of which are available from the<br />

Registrars.<br />

Dividend mandate<br />

Shareholders who wish dividends to be paid<br />

directly into a bank or building society<br />

account should contact the Registrars <strong>for</strong> a<br />

dividend mandate <strong>for</strong>m.<br />

16 <strong>Dixons</strong> <strong>Group</strong> plc<br />

This method of payment reduces the risk<br />

of delay or loss of dividend cheques in<br />

the post and ensures the account is<br />

credited on the dividend payment date.<br />

Individual Savings Account<br />

A corporate ISA is available <strong>for</strong> investors<br />

wishing to take advantage of preferential<br />

tax treatment in relation to their<br />

shareholdings. Details are available from<br />

Brewin Dolphin Bell Lawrie Limited.<br />

Tel: 0131 225 2566 and ask <strong>for</strong> the<br />

<strong>Dixons</strong> <strong>Group</strong> helpline.<br />

ADR depositary<br />

<strong>The</strong> company’s ordinary shares are<br />

available in the <strong>for</strong>m of American<br />

Depositary Receipts (ADRs). <strong>The</strong><br />

company’s depositary is Bank of New<br />

York. Tel: 001 212 815 2051 (from the<br />

United States of America 888-BNY-ADRS<br />

toll-free).<br />

Financial calendar<br />

Interim Ordinary dividend record date<br />

4 February 2000<br />

Payment of Interim Ordinary dividend<br />

6 March 2000<br />

1999/2000 preliminary results<br />

announcement<br />

July 2000<br />

1999/2000 annual report publication<br />

Aug<strong>us</strong>t 2000<br />

Annual general meeting<br />

6 September 2000<br />

Payment of 1999/2000 final dividend<br />

October 2000