Newsletter November 2012 - Society of Actuaries in Ireland

Newsletter November 2012 - Society of Actuaries in Ireland

Newsletter November 2012 - Society of Actuaries in Ireland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Newsletter</strong><br />

NOVEMBER <strong>2012</strong><br />

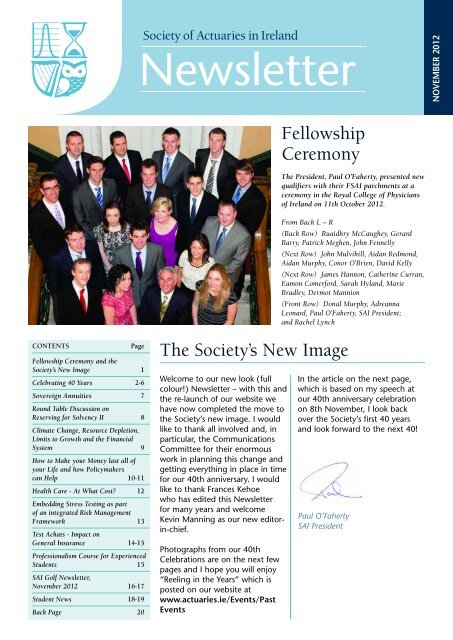

Fellowship<br />

Ceremony<br />

The President, Paul O’Faherty, presented new<br />

qualifiers with their FSAI parchments at a<br />

ceremony <strong>in</strong> the Royal College <strong>of</strong> Physicians<br />

<strong>of</strong> <strong>Ireland</strong> on 11th October <strong>2012</strong>.<br />

From Back L – R<br />

(Back Row) Ruaidhry McCaughey, Gerard<br />

Barry, Patrick Meghen, John Fennelly<br />

(Next Row) John Mulvihill, Aidan Redmond,<br />

Aidan Murphy, Conor O’Brien, David Kelly<br />

(Next Row) James Hannon, Cather<strong>in</strong>e Curran,<br />

Eamon Comerford, Sarah Hyland, Marie<br />

Bradley, Dermot Mannion<br />

(Front Row) Donal Murphy, Adreanna<br />

Leonard, Paul O’Faherty, SAI President;<br />

and Rachel Lynch<br />

CONTENTS<br />

Page<br />

Fellowship Ceremony and the<br />

<strong>Society</strong>’s New Image 1<br />

Celebrat<strong>in</strong>g 40 Years 2-6<br />

Sovereign Annuities 7<br />

Round Table Discussion on<br />

Reserv<strong>in</strong>g for Solvency II 8<br />

Climate Change, Resource Depletion,<br />

Limits to Growth and the F<strong>in</strong>ancial<br />

System 9<br />

How to Make your Money last all <strong>of</strong><br />

your Life and how Policymakers<br />

can Help 10-11<br />

Health Care - At What Cost? 12<br />

Embedd<strong>in</strong>g Stress Test<strong>in</strong>g as part<br />

<strong>of</strong> an <strong>in</strong>tegrated Risk Management<br />

Framework 13<br />

Test Achats - Impact on<br />

General Insurance 14-15<br />

Pr<strong>of</strong>essionalism Course for Experienced<br />

Students 15<br />

SAI Golf <strong>Newsletter</strong>,<br />

<strong>November</strong> <strong>2012</strong> 16-17<br />

Student News 18-19<br />

Back Page 20<br />

The <strong>Society</strong>’s New Image<br />

Welcome to our new look (full<br />

colour!) <strong>Newsletter</strong> – with this and<br />

the re-launch <strong>of</strong> our website we<br />

have now completed the move to<br />

the <strong>Society</strong>’s new image. I would<br />

like to thank all <strong>in</strong>volved and, <strong>in</strong><br />

particular, the Communications<br />

Committee for their enormous<br />

work <strong>in</strong> plann<strong>in</strong>g this change and<br />

gett<strong>in</strong>g everyth<strong>in</strong>g <strong>in</strong> place <strong>in</strong> time<br />

for our 40th anniversary. I would<br />

like to thank Frances Kehoe<br />

who has edited this <strong>Newsletter</strong><br />

for many years and welcome<br />

Kev<strong>in</strong> Mann<strong>in</strong>g as our new editor<strong>in</strong>-chief.<br />

Photographs from our 40th<br />

Celebrations are on the next few<br />

pages and I hope you will enjoy<br />

“Reel<strong>in</strong>g <strong>in</strong> the Years” which is<br />

posted on our website at<br />

www.actuaries.ie/Events/Past<br />

Events<br />

In the article on the next page,<br />

which is based on my speech at<br />

our 40th anniversary celebration<br />

on 8th <strong>November</strong>, I look back<br />

over the <strong>Society</strong>’s first 40 years<br />

and look forward to the next 40!<br />

Paul O’Faherty<br />

SAI President

Daichead Blia<strong>in</strong> ag Fás – Forty Years A-Grow<strong>in</strong>g<br />

The stated aims <strong>of</strong> 17 men - and yes<br />

they were all men - who founded the<br />

<strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> 40 years<br />

ago were:<br />

“to act as a forum for matters <strong>of</strong><br />

<strong>in</strong>terest to the actuarial pr<strong>of</strong>ession and<br />

to express the views <strong>of</strong> the pr<strong>of</strong>ession<br />

on matters <strong>of</strong> more general <strong>in</strong>terest”<br />

If the past is a foreign country, then it’s<br />

no surprise that the <strong>Ireland</strong>, <strong>in</strong>to which<br />

the <strong>Society</strong> was born, did th<strong>in</strong>gs very,<br />

very differently.<br />

Back then, you could still drive your<br />

Ford Capri down Grafton Street.<br />

Dr<strong>in</strong>k<strong>in</strong>g Black Tower was the zenith <strong>of</strong><br />

cont<strong>in</strong>ental sophistication. And curly<br />

wurlys were on their first <strong>in</strong>carnation.<br />

On a more serious note, by 1972<br />

<strong>in</strong>flation had already reached 9%, and<br />

<strong>in</strong> the years to follow would climb to<br />

20%. As a nation, our <strong>in</strong>come per head<br />

was just 60% <strong>of</strong> the European average.<br />

And it was only <strong>in</strong> 1972 that women<br />

no longer had to leave their jobs when<br />

they got married.<br />

The pace <strong>of</strong> change – technological,<br />

political, social, and cultural – has been<br />

amaz<strong>in</strong>g over the years.<br />

In 1972 the HP35 was cutt<strong>in</strong>g edge<br />

technology. This was the first pocket<br />

calculator that could do more than<br />

just add, subtract, multiply or divide.<br />

This was very important to any self<br />

respect<strong>in</strong>g actuary - we have always<br />

loved hard sums! And it was a snip at<br />

only $2,200 <strong>in</strong> current money terms.<br />

But the phone <strong>in</strong> your pocket or purse<br />

right now is nearly 1,000,000 times<br />

more powerful.<br />

Thanks to advances <strong>in</strong> medical and<br />

pharmaceutical research, a child born<br />

<strong>in</strong> <strong>Ireland</strong> today can expect to live eight<br />

years longer than if she were born <strong>in</strong><br />

1972. And a person retir<strong>in</strong>g today can<br />

expect to enjoy nearly five extra years<br />

<strong>of</strong> retirement.<br />

As actuaries, we tend to focus on the<br />

challenges associated with people liv<strong>in</strong>g<br />

longer. But we should never forget the<br />

bless<strong>in</strong>g it truly is.<br />

So how has our pr<strong>of</strong>ession fared over<br />

the past 40 years? And how well have<br />

we realised the aims <strong>of</strong> the orig<strong>in</strong>al<br />

founders? Ultimately, it is for others to<br />

judge how well we have delivered, and<br />

are deliver<strong>in</strong>g, on these aims.<br />

But <strong>in</strong> mak<strong>in</strong>g that judgment, the key<br />

role actuaries play <strong>in</strong> Irish f<strong>in</strong>ancial and<br />

economic life should be taken fully <strong>in</strong>to<br />

account. We have serious responsibilities<br />

which we have never taken lightly. We<br />

have, I believe, discharged our duties<br />

creditably. Though, as always, with the<br />

benefit <strong>of</strong> h<strong>in</strong>dsight there are th<strong>in</strong>gs we<br />

could have done better.<br />

In any case, as we move forward<br />

manag<strong>in</strong>g risk is now at the core <strong>of</strong><br />

national and corporate decision-mak<strong>in</strong>g.<br />

Risk is the new black!<br />

As the “risk pr<strong>of</strong>essionals”, actuaries are<br />

ready to play a major role <strong>in</strong> this brave,<br />

new, risk-aware world. Increas<strong>in</strong>gly, we<br />

are be<strong>in</strong>g asked to play that role. And<br />

<strong>in</strong>creas<strong>in</strong>gly, we are ready to play it.<br />

It is difficult to consider the role <strong>of</strong><br />

actuaries as risk pr<strong>of</strong>essionals without<br />

touch<strong>in</strong>g on two topics <strong>of</strong> particular<br />

current relevance – topics for which<br />

understand<strong>in</strong>g and manag<strong>in</strong>g complex<br />

risks are key challenges.<br />

Firstly, even <strong>in</strong> the midst <strong>of</strong> our<br />

immediate, short-term problems, we<br />

cannot afford to ignore the mediumterm<br />

retirement crisis that looms ahead.<br />

The recent Actuarial Review <strong>of</strong> the<br />

Social Insurance Fund has raised serious<br />

questions about the susta<strong>in</strong>ability <strong>of</strong><br />

the state pension. This compounds the<br />

already well-flagged concerns about<br />

occupational pension adequacy and<br />

coverage. Serious reform <strong>of</strong> both pillars<br />

is not just necessary, but essential.<br />

The debate must start now, while we<br />

still have time.<br />

Secondly, the Solvency II project,<br />

which has dom<strong>in</strong>ated the <strong>in</strong>surance<br />

agenda for years, is uncerta<strong>in</strong>.<br />

Political support has waned. Its scope<br />

is be<strong>in</strong>g questioned. There is no clear<br />

implementation timel<strong>in</strong>e.<br />

Com<strong>in</strong>g after all the energy and<br />

resources Solvency II has already<br />

consumed, this is a huge disappo<strong>in</strong>tment.<br />

Few could argue conv<strong>in</strong>c<strong>in</strong>gly<br />

that our exist<strong>in</strong>g Solvency I standard<br />

meets the needs <strong>of</strong> an <strong>in</strong>creas<strong>in</strong>gly<br />

sophisticated market. If this uncerta<strong>in</strong>ty<br />

persists much longer it may be<br />

necessary for <strong>Ireland</strong> to contemplate<br />

an <strong>in</strong>terim system that more accurately<br />

reflects underly<strong>in</strong>g risks. Deliver<strong>in</strong>g on<br />

Solvency II would be far better.<br />

Our pr<strong>of</strong>ession has come a long way <strong>in</strong><br />

40 years. There are now 644 actuaries<br />

work<strong>in</strong>g <strong>in</strong> <strong>Ireland</strong> - that’s a yearly<br />

growth rate <strong>of</strong> just over 9% -9.39%<br />

actually - sorry, I couldn’t resist the two<br />

decimal places!<br />

In fact <strong>Ireland</strong> now has the highest<br />

number <strong>of</strong> actuaries per capita <strong>in</strong> the<br />

world. I guess you can’t have too much<br />

<strong>of</strong> a good th<strong>in</strong>g! This is thanks <strong>in</strong> no<br />

small way to the vibrant <strong>in</strong>ternational<br />

<strong>in</strong>surance presence <strong>in</strong> the IFSC.<br />

F<strong>in</strong>ally, I was delighted that 10 <strong>of</strong> the<br />

orig<strong>in</strong>al founders <strong>of</strong> the <strong>Society</strong> jo<strong>in</strong>ed<br />

us for the 40th birthday celebration.<br />

They were:<br />

Joe Byrne, Adrian Daly, Peter Delany,<br />

Brian Duncan, David K<strong>in</strong>gston,<br />

Paddy Maher, Michael O’Mahony,<br />

Piers Segrave-Daly, John White and<br />

Bob Willis.<br />

Gentlemen thank you aga<strong>in</strong> for your<br />

contribution to our pr<strong>of</strong>ession.<br />

Paul O’Faherty<br />

SAI President<br />

Pg 2 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

SAI Celebrat<strong>in</strong>g 40 Years!<br />

The <strong>Society</strong> was founded by<br />

17 actuaries on 3rd May<br />

1972 <strong>in</strong> the Russell Hotel,<br />

St. Stephen’s Green, Dubl<strong>in</strong>.<br />

The 17 Found<strong>in</strong>g Members were:<br />

William A. Honohan - deceased<br />

Robert P. Willis<br />

Cecil Ross - deceased<br />

Ge<strong>of</strong>frey Rowe - deceased<br />

Brian S. Redd<strong>in</strong> - deceased<br />

Bernard Harberd - deceased<br />

Joseph Byrne<br />

Patrick J. Maher<br />

Michael Rob<strong>in</strong>son - deceased<br />

Piers Segrave-Daly<br />

R. Peter Delany<br />

T. David K<strong>in</strong>gston<br />

Michael O’Mahony<br />

Brian Duncan<br />

John White<br />

Adrian D. Daly<br />

Brendan Hayes – deceased<br />

Paul O’Faherty, SAI President, address<strong>in</strong>g members and guests<br />

at the 40th Anniversary Celebrations on 8th Nov. <strong>2012</strong><br />

SAI Found<strong>in</strong>g Members at the <strong>Society</strong>’s 40th Celebration<br />

Left to right: Bob Willis, John White, Joe Byrne, Brian Duncan, Piers Segrave-Daly,<br />

Paddy Maher, David K<strong>in</strong>gston, Adrian Daly, Michael O’Mahony and Peter Delany.<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 3

John White, Peter Delany, Jonathan Goold<br />

Karel Goossens and Paul O'Faherty<br />

Micheal Brennan, Anne Maher, Patrick Maher, Paul Kenny<br />

Colm Guiry, Elena McIlroy De La Rosa, Padraic O'Malley<br />

Patrick Burke and Rachel Ingle<br />

Pol O'Bria<strong>in</strong>, Siobhan Gaid<strong>in</strong>er, Rafay Khan, Dave Kavanagh<br />

Pg 4 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

Liam Quigley, Sean O'Donovan, Kev<strong>in</strong> Reynolds<br />

Karl Alexander and George McCutcheon<br />

SAI <strong>2012</strong> Council<br />

Cather<strong>in</strong>e McBride and Tracy Gilbert<br />

Gerry Hassett and Dermot Corry<br />

Paul O'Faherty and John Corrigan<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 5

S<strong>in</strong>ead Clarke and Miriam Sweeney<br />

Kate McEvoy, Greg Murphy, Annemarie Nestor, Bella Daniels<br />

Anto<strong>in</strong>ette O’Faherty, Micheál O’Bria<strong>in</strong>, Maurice Whyms<br />

Conor O’Neill and Jerry Moriarty<br />

Carol<strong>in</strong>e Barlow and Pat Healy<br />

Members toast<strong>in</strong>g their guests<br />

Pg 6 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

Sovereign Annuities<br />

The first CPD meet<strong>in</strong>g after the<br />

summer break brought together a<br />

large gather<strong>in</strong>g <strong>of</strong> actuaries and<br />

lawyers for a jo<strong>in</strong>t meet<strong>in</strong>g between<br />

the SAI and the Association <strong>of</strong> Pension<br />

Lawyers <strong>in</strong> <strong>Ireland</strong> (APLI) to discuss<br />

sovereign annuities.<br />

Keith Burns kicked <strong>of</strong>f the meet<strong>in</strong>g<br />

by provid<strong>in</strong>g some background on<br />

the topic. The concept <strong>of</strong> sovereign<br />

annuities was first proposed <strong>in</strong> late<br />

2009 by the IAPF and SAI, the objective<br />

be<strong>in</strong>g to ensure fairer balance between<br />

pensioners and active/deferred members<br />

<strong>in</strong> def<strong>in</strong>ed benefit pension scheme and<br />

thereby improv<strong>in</strong>g scheme susta<strong>in</strong>ability.<br />

Described as a “warts and all” solution,<br />

it was recognised that sovereign<br />

annuities were not a solution to long<br />

term pension policy issues.<br />

Keith went on to expla<strong>in</strong> that unlike<br />

guaranteed annuities, the payments<br />

under sovereign annuities are l<strong>in</strong>ked<br />

directly to payments <strong>of</strong> a specified<br />

bond. If payments from the bond are<br />

reduced or don’t occur, payment <strong>of</strong><br />

the sovereign annuity can stop.<br />

Sovereign annuities can be on a “buy<br />

<strong>in</strong>” basis, where the sovereign annuity<br />

becomes an asset <strong>of</strong> the scheme; or a<br />

'buy out” basis, where it is owned by<br />

the member and the member bears<br />

the credit risk. Keith then illustrated the<br />

impact <strong>of</strong> hold<strong>in</strong>g sovereign annuities<br />

on schemes through a couple <strong>of</strong><br />

numerical examples. These highlighted<br />

the greater credit risk that the scheme<br />

takes on, the greater the cover is for<br />

active/deferred members.<br />

The issue <strong>of</strong> valu<strong>in</strong>g sovereign annuities<br />

only arises for those on a ”buy <strong>in</strong>” basis<br />

where they must be valued for the<br />

Actuarial Fund<strong>in</strong>g Certificate or Annual<br />

Statement by the scheme actuary.<br />

The actuarial guidance from the<br />

Pensions Board either is to value both<br />

the sovereign annuity and pension <strong>in</strong><br />

payment on current market basis<br />

which will be equal and match<strong>in</strong>g, or<br />

alternatively, to omit pensions <strong>in</strong><br />

payment and the annuity from both<br />

sides <strong>of</strong> the balance sheet.<br />

Keith went on to describe how schemes<br />

can <strong>in</strong>vest <strong>in</strong> sovereign bonds directly<br />

rather than sovereign annuities and still<br />

avail <strong>of</strong> the fund<strong>in</strong>g standard reduction.<br />

To do this, a scheme must formally<br />

resolve to purchase sovereign annuities<br />

on a w<strong>in</strong>d up and review this decision<br />

on an annual basis. Trustees also<br />

need to take advice on this strategy<br />

and communicate it to members and<br />

unions. The complex rules by which<br />

sovereign bonds are to be valued<br />

for schemes were described. This<br />

complexity may mean this option is<br />

not a popular one.<br />

Keith concluded with some general<br />

issues <strong>in</strong>clud<strong>in</strong>g the difficult decisions<br />

fac<strong>in</strong>g trustees; the potential reputation<br />

risk for pension <strong>in</strong>dustry and actuaries<br />

as advisors; what we should assume<br />

bond yields will look like at the end <strong>of</strong><br />

a typical fund<strong>in</strong>g proposal term and<br />

the suggestion that there may be better<br />

options available to address scheme<br />

susta<strong>in</strong>ability and equity.<br />

Sandra Rockett took the helm to<br />

discuss the <strong>in</strong>vestment case for<br />

sovereign annuities and highlighted<br />

some <strong>in</strong>vestment issues trustees may<br />

need to consider <strong>in</strong> the future. The<br />

<strong>in</strong>vestment decision is not one that<br />

can be made by just look<strong>in</strong>g at risk<br />

and reward, as it is overlaid with<br />

responsibility to consider best <strong>in</strong>terests<br />

<strong>of</strong> all scheme members. It is also likely<br />

that the decision will need to be made<br />

<strong>in</strong> conjunction with the employer. In<br />

each case there is no perfect solution<br />

and each solution needs to be assessed<br />

by reference to the specific details <strong>of</strong><br />

the <strong>in</strong>dividual scheme.<br />

The issue <strong>of</strong> what the return on Irish<br />

sovereign bonds would be for<br />

sovereign annuities was posed. The<br />

NTMA have said that future issues will<br />

reflect prevail<strong>in</strong>g market conditions.<br />

Sandra suggested a yield pickup might<br />

be expected to <strong>in</strong>centivise allocation <strong>of</strong><br />

capital to the state over a long period.<br />

The price <strong>of</strong> sovereign annuities is<br />

unknown as they have yet to be<br />

launched but it is thought that this<br />

will be closely correlated with the<br />

underly<strong>in</strong>g <strong>in</strong>vestment as the life<br />

company is not tak<strong>in</strong>g on <strong>in</strong>vestment<br />

risk. The def<strong>in</strong>ition <strong>of</strong> return was<br />

considered for both schemes <strong>in</strong> w<strong>in</strong>d<br />

up and on-go<strong>in</strong>g schemes.<br />

Sandra balanced the discussion on<br />

<strong>in</strong>vestment returns by highlight<strong>in</strong>g the<br />

three key <strong>in</strong>vestment risks <strong>of</strong> sovereign<br />

annuities: default, concentration and<br />

liquidity. In assess<strong>in</strong>g default risk,<br />

trustees need to consider the ability<br />

<strong>of</strong> a specific sovereign to meet its<br />

responsibilities. Sandra suggested that<br />

this cannot be deciphered from yields<br />

alone as these can be distorted by risk<br />

premia that are more related to<br />

currency convertibility. In discuss<strong>in</strong>g<br />

concentration risk, she <strong>in</strong>terest<strong>in</strong>gly<br />

po<strong>in</strong>ted out the fall <strong>in</strong> domestic debt<br />

from 78% to 21% <strong>in</strong> Irish pension<br />

funds from 1998 to 2011 has not<br />

been mirrored by other peripherals.<br />

The question <strong>of</strong> whether there is just<br />

one true counterparty for all sovereign<br />

debt <strong>in</strong> Europe was also posed.<br />

Sandra also touched on factors<br />

to consider when determ<strong>in</strong><strong>in</strong>g an<br />

<strong>in</strong>vestment strategy for a scheme.<br />

These <strong>in</strong>clude the cost fac<strong>in</strong>g the<br />

scheme sponsor, the strength <strong>of</strong> the<br />

employer covenant and balanc<strong>in</strong>g<br />

benefit levels with benefit security.<br />

In decid<strong>in</strong>g between sovereign<br />

annuities or bonds, trustees need to<br />

consider the fund<strong>in</strong>g position <strong>of</strong> the<br />

scheme; the future <strong>of</strong> the scheme; and<br />

the need for liquidity.<br />

Philip Smith from Arthur Cox and the<br />

APLI opened his section <strong>of</strong> this even<strong>in</strong>g<br />

with a bold statement that potentially<br />

no one would use sovereign annuities.<br />

Philip looked at sovereign annuities<br />

from a trustee’s perspective <strong>in</strong>clud<strong>in</strong>g<br />

whether they should be used; if so,<br />

when; the duties <strong>of</strong> the trustees; and<br />

the risks. It was questioned whether a<br />

sovereign annuity was fit for purpose to<br />

provide a pension given pension is an<br />

<strong>in</strong>come for life. The audience was also<br />

asked the difficult question whether<br />

any <strong>of</strong> them buy one for their mother.<br />

Philip rem<strong>in</strong>ded trustees <strong>of</strong> their duties<br />

to act as a prudent bus<strong>in</strong>ess person and<br />

to act <strong>in</strong> the members’ best f<strong>in</strong>ancial<br />

<strong>in</strong>terest. The risk was highlighted that<br />

members could potentially claim aga<strong>in</strong>st<br />

trustees cit<strong>in</strong>g mal-adm<strong>in</strong>istration,<br />

breach <strong>of</strong> trust or loss. The issue <strong>of</strong> if<br />

and when sovereign annuities should<br />

be used was explored with some<br />

<strong>in</strong>terest<strong>in</strong>g examples. These led to<br />

the conclusion that the decision was<br />

scheme and situation dependent.<br />

A cautionary note was added as history<br />

shows that courts are less likely to<br />

punish conservative decisions.<br />

The even<strong>in</strong>g concluded with a large<br />

number <strong>of</strong> questions and comments<br />

<strong>in</strong>clud<strong>in</strong>g some on Personal Insolvency<br />

Payment Schemes, risks faced by<br />

Trustees and potential changes to<br />

scheme priority rules.<br />

S<strong>in</strong>éad Carty<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 7

Round table discussion on Reserv<strong>in</strong>g<br />

for Solvency II<br />

On Monday 10 September <strong>2012</strong>,<br />

the <strong>Society</strong> was delighted to welcome<br />

Susan Dreksler, non-life actuary <strong>in</strong><br />

PWC who also chairs the Solvency II<br />

Technical Provisions General Insurance<br />

Work<strong>in</strong>g Party, and Jerome Kirk, Head<br />

<strong>of</strong> Actuarial Services with<strong>in</strong> Lloyd's<br />

Market Reserv<strong>in</strong>g & Capital department,<br />

to present on the topic <strong>of</strong> Solvency II<br />

Technical Provisions.<br />

Susan Dreksler started with an<br />

<strong>in</strong>troduction to the work<strong>in</strong>g party which<br />

she chairs and some <strong>of</strong> their ma<strong>in</strong><br />

objectives which are around education,<br />

rais<strong>in</strong>g awareness and provid<strong>in</strong>g helpful<br />

<strong>in</strong>sight <strong>in</strong>to Solvency II Technical<br />

Provisions. At the moment the work<strong>in</strong>g<br />

party is focus<strong>in</strong>g on br<strong>in</strong>g<strong>in</strong>g people<br />

together to talk about the areas where<br />

Solvency II is vague with the goal <strong>of</strong><br />

build<strong>in</strong>g a consensus view.<br />

The first topic was premium provision,<br />

which is probably one <strong>of</strong> the biggest<br />

changes for general <strong>in</strong>surers under<br />

Solvency II as it now requires<br />

companies to project future cashflows<br />

from the unexpired risk allow<strong>in</strong>g for<br />

premiums, claim <strong>in</strong>demnity costs and<br />

expenses on a best estimate basis.<br />

A lively debate was sparked on this<br />

topic by look<strong>in</strong>g at the ma<strong>in</strong> challenges<br />

around:<br />

• The claims liability (underwrit<strong>in</strong>g<br />

versus accident year, which loss<br />

ratio to use, payment patterns<br />

regard<strong>in</strong>g re<strong>in</strong>surance).<br />

• Data granularity and allocation<br />

issues, not<strong>in</strong>g that there is a<br />

potentially contentious issue <strong>of</strong><br />

whether it is fair to allow for full<br />

<strong>in</strong>vestment management expenses<br />

when only credit<strong>in</strong>g risk free rates<br />

<strong>of</strong> return.<br />

• Expense Allocations, not<strong>in</strong>g the<br />

challenges <strong>in</strong> understand<strong>in</strong>g how<br />

expenses should be allocated and<br />

rais<strong>in</strong>g an even more fundamental<br />

question <strong>of</strong> whether expense<br />

allocations really fit <strong>in</strong>to the<br />

actuarial function.<br />

Jerome Kirk then moved onto the<br />

topic <strong>of</strong> validation and <strong>in</strong> particular<br />

what should be validated, when and<br />

by whom? He talked briefly about<br />

bootstrapp<strong>in</strong>g and how this could be<br />

used to support the assessment <strong>of</strong> back<br />

test<strong>in</strong>g results. However as with<br />

all methods there are some pitfalls.<br />

In particular, Jerome noted that<br />

bootstrapp<strong>in</strong>g is not a perfect method<br />

and may require validation itself, and<br />

that it normally results <strong>in</strong> shift<strong>in</strong>g the<br />

mean to replicate the best estimate.<br />

The topic was then open to the floor<br />

with some <strong>in</strong>terest<strong>in</strong>g po<strong>in</strong>ts raised<br />

around data validation:<br />

• Do <strong>in</strong>surers’ current validation<br />

processes need to be improved<br />

under Solvency II?<br />

• Where should the validation sit?<br />

For example, should it sit with<strong>in</strong> the<br />

actuarial function (not<strong>in</strong>g potential<br />

issues with a function validat<strong>in</strong>g<br />

itself), or with<strong>in</strong> a different function<br />

such as risk management or <strong>in</strong>ternal<br />

audit?<br />

• Is it possible to have a standard<br />

validation process for all companies?<br />

• Do companies need to get better at<br />

document<strong>in</strong>g th<strong>in</strong>gs?<br />

Susan then presented the next topic<br />

on b<strong>in</strong>ary events, start<strong>in</strong>g with the<br />

def<strong>in</strong>ition from Groupe Consultatif:<br />

“Best Estimate is the average <strong>of</strong> all<br />

possible scenarios. Some weight has to<br />

be given to losses with low probability<br />

but high cost – we call these B<strong>in</strong>ary<br />

Events. Examples <strong>of</strong> b<strong>in</strong>ary events <strong>in</strong>clude<br />

the occurrence <strong>of</strong> a new type <strong>of</strong> latent<br />

claims or a change <strong>in</strong> legislation<br />

impact<strong>in</strong>g claims payment retrospectively<br />

or a high <strong>in</strong>flation environment.”<br />

Susan mentioned that b<strong>in</strong>ary events<br />

are probably the th<strong>in</strong>gs you haven’t<br />

seen before <strong>in</strong> your data and hence are<br />

difficult to allow for. She also noted<br />

that there is little or no reference<br />

anywhere <strong>in</strong> the Solvency II directive<br />

to b<strong>in</strong>ary events. In fact QIS5 was<br />

generous and assumed you were<br />

already allow<strong>in</strong>g for them. It is clear<br />

that even though there are mixed views<br />

on how to allow for b<strong>in</strong>ary events that<br />

it is an issue that can’t be ignored and<br />

that companies will have to justify what<br />

they’ve done.<br />

Susan then <strong>in</strong>vited comments from the<br />

floor which prompted an <strong>in</strong>terest<strong>in</strong>g<br />

discussion with a variety <strong>of</strong> op<strong>in</strong>ions<br />

expressed. Part <strong>of</strong> the audience felt<br />

that b<strong>in</strong>ary events should be ignored<br />

<strong>in</strong> calculat<strong>in</strong>g technical provisions, as<br />

otherwise a best estiamte would not<br />

really be a “best estimate”. An allowance<br />

for b<strong>in</strong>ary events could perhaps be<br />

made <strong>in</strong> the capital requirements<br />

<strong>in</strong>stead. Others suggested that<br />

benchmark<strong>in</strong>g was a good approach,<br />

however Susan warned that care<br />

was needed <strong>in</strong> choos<strong>in</strong>g what to<br />

benchmark aga<strong>in</strong>st.<br />

Others felt that there should be more<br />

guidance on this topic suggest<strong>in</strong>g that<br />

there should ultimately be consistency<br />

between <strong>in</strong>surers. For the f<strong>in</strong>al topic,<br />

re<strong>in</strong>surance, Jerome moved on to say<br />

that under Solvency II there is a<br />

requirement for a separate calculation<br />

<strong>of</strong> gross and net <strong>of</strong> re<strong>in</strong>surance<br />

technical provisions on a cashflow<br />

basis. He noted that, even though<br />

there are already a lot <strong>of</strong> hurdles to<br />

overcome on the gross calculation, the<br />

re<strong>in</strong>surance calculation <strong>in</strong>troduces even<br />

more uncerta<strong>in</strong>ty, with companies<br />

need<strong>in</strong>g to allow for considerations<br />

such as possible settlement delays and<br />

disputes. A simple but widespread<br />

approach for calculat<strong>in</strong>g re<strong>in</strong>surance<br />

separately would be to use net to gross<br />

ratios. Jerome then raised a challeng<strong>in</strong>g<br />

question: if you are not us<strong>in</strong>g a<br />

stochastic approach how good will<br />

the numbers be?<br />

After a survey <strong>of</strong> the audience, Jerome<br />

found that no one is us<strong>in</strong>g stochastic<br />

models for re<strong>in</strong>surance. Jerome then<br />

left the audience with the open<br />

question <strong>of</strong> whether the reason that<br />

stochastic models are not be<strong>in</strong>g<br />

widely used is that companies have not<br />

yet got to this topic under Solvency II<br />

or whether it felt that stochastic<br />

calculation were just not required for<br />

re<strong>in</strong>surance.<br />

After a very <strong>in</strong>formative and thought<br />

provok<strong>in</strong>g meet<strong>in</strong>g I th<strong>in</strong>k it is fair to<br />

say that it was felt there was still a long<br />

way to go <strong>in</strong> achiev<strong>in</strong>g a consensus on<br />

some <strong>of</strong> the Solvency II topics.<br />

Ger Bradley then closed the meet<strong>in</strong>g<br />

on behalf <strong>of</strong> the <strong>Society</strong> by thank<strong>in</strong>g<br />

Jerome and Susan for the excellent<br />

presentation and the audience for their<br />

significant feedback.<br />

Sarah Byrne<br />

Pg 8 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

Climate Change, Resource Depletion, Limits to<br />

Growth and the F<strong>in</strong>ancial System<br />

Oliver Bettis from the UK Pr<strong>of</strong>ession’s<br />

Resource and Environment member<br />

<strong>in</strong>terest group, gave an <strong>in</strong>formative talk<br />

entitled ‘Resource and Environmental<br />

Limits to Economic Growth’ at<br />

lunchtime on Friday 21st September.<br />

The presentation focused on economic<br />

growth, <strong>in</strong> particular the environmental<br />

impacts <strong>of</strong> the rapid growth over the<br />

last couple <strong>of</strong> hundred years. Along<br />

with the benefits <strong>of</strong> this growth for<br />

society, there has also been a<br />

downside, <strong>in</strong> particular the changes <strong>in</strong><br />

our environment and depletion <strong>of</strong><br />

resources. Oliver asked whether<br />

improved technology and the skills<br />

<strong>of</strong> actuaries can help to manage the<br />

downside <strong>of</strong> economic growth.<br />

Oliver began by <strong>in</strong>troduc<strong>in</strong>g the term<br />

“Anthropocene World” that describes<br />

the world we currently live <strong>in</strong>, where<br />

human actions have now <strong>in</strong>fluenced<br />

the earth’s ecosystem. The world’s<br />

population and GDP had rema<strong>in</strong>ed<br />

relatively stable over the years until the<br />

Industrial Revolution began around<br />

1750. S<strong>in</strong>ce then both population and<br />

GDP have significantly <strong>in</strong>creased.<br />

Oliver po<strong>in</strong>ted out that as the world<br />

economy grew, there have been “bads”<br />

that have <strong>in</strong>creased together with the<br />

benefits <strong>of</strong> economic growth.<br />

Healthcare, education, sanitation,<br />

hous<strong>in</strong>g and technology are a few <strong>of</strong><br />

the “goods” that have improved with<br />

the develop<strong>in</strong>g economy. While these<br />

“goods” have improved the lives <strong>of</strong><br />

most people, there has also been an<br />

<strong>in</strong>crease <strong>in</strong> the “bads” such as the high<br />

carbon dioxide levels <strong>in</strong> the atmosphere.<br />

Some <strong>of</strong> our vital resources are be<strong>in</strong>g<br />

seriously depleted as the economy<br />

grows. We are still highly dependent<br />

on fossil fuels, with very little energy<br />

com<strong>in</strong>g from renewable and<br />

hydroelectric sources but oil discoveries<br />

have decreased dramatically <strong>in</strong> the last<br />

couple <strong>of</strong> decades. Not only are fossil<br />

fuels appear<strong>in</strong>g to reach a limit, Oliver<br />

outl<strong>in</strong>ed a number <strong>of</strong> areas <strong>in</strong> which<br />

scientists believe there is the potential<br />

for humanity to significant impact our<br />

environment. These are:<br />

- Climate Change<br />

- Ocean Acidification<br />

- Stratosphere Ozone Depletion<br />

- Nitrogen Cycle<br />

- Phosphorus Cycle<br />

- Global Freshwater Use<br />

- Change <strong>in</strong> Land Use<br />

- Biodiversity loss<br />

- Atmospheric Aerosol load<strong>in</strong>g<br />

- Chemical Pollution<br />

Of these, the earth has already reached<br />

hazardous levels for Climate Change,<br />

the Nitrogen Cycle and Biodiversity<br />

Loss. For example, carbon dioxide<br />

levels <strong>in</strong> the atmosphere have reached<br />

the highest level ever. The temperature<br />

<strong>in</strong> the atmosphere is highly correlated<br />

with the carbon dioxide level, lead<strong>in</strong>g<br />

to <strong>in</strong>creased temperatures. Along with<br />

this, the ice caps are melt<strong>in</strong>g at an<br />

<strong>in</strong>creased rate lead<strong>in</strong>g to a ris<strong>in</strong>g sea<br />

level.<br />

Climate change, loss <strong>of</strong> biodiversity, oil<br />

depletion etc. can all be attributed to<br />

<strong>in</strong>creased consumption by humans as a<br />

result <strong>of</strong> the exponential growth <strong>of</strong> the<br />

population and the global economy<br />

s<strong>in</strong>ce the 1700s. Oliver po<strong>in</strong>ted out<br />

growth may not always be for the best,<br />

whether on an <strong>in</strong>dividuals’ waistl<strong>in</strong>e or<br />

<strong>in</strong> the global economy! There is a limit<br />

to growth and we need to consider<br />

what will happen when we reach that<br />

limit. Will technological progress<br />

facilitate an <strong>in</strong>crease <strong>in</strong> the earth’s<br />

capacity to susta<strong>in</strong> further economic<br />

growth? Will the economy grow<br />

beyond the earth’s capability to susta<strong>in</strong><br />

it and then fall to a ‘steady state’? Will<br />

both the economy and the earth’s<br />

capacity to susta<strong>in</strong> it collapse together?<br />

Will there be an energy/environmental<br />

crunch?<br />

Some argue that technology can solve<br />

this problem for us. If so, we need to<br />

start develop<strong>in</strong>g that technology now<br />

with huge <strong>in</strong>vestment needed to<br />

develop new technologies.<br />

Oliver also discussed the concept <strong>of</strong><br />

Gross Domestic Product as an economic<br />

growth <strong>in</strong>dicator. We have seen rich<br />

countries grow enormously <strong>in</strong> GDP<br />

terms while poorer countries struggle<br />

to improve healthcare, education,<br />

sanitation and hous<strong>in</strong>g. Once these<br />

basic material needs are met, <strong>in</strong>creased<br />

GDP has little effect on life satisfaction.<br />

Should governments aim for a stable<br />

level <strong>of</strong> GDP and focus on people’s<br />

happ<strong>in</strong>ess rather than cont<strong>in</strong>ued<br />

growth?<br />

<strong>Actuaries</strong>’ skills <strong>in</strong> understand<strong>in</strong>g risk<br />

and uncerta<strong>in</strong>ty, exponential growth,<br />

scientific methodology and our ability<br />

to base decisions on data, all while<br />

ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g a prudential overview<br />

mean that actuaries could be an<br />

important factor <strong>in</strong> help<strong>in</strong>g to resolve<br />

many <strong>of</strong> these issues. In light <strong>of</strong> this<br />

there has been a “Wider Fields”<br />

member <strong>in</strong>terest group set up by the<br />

<strong>Society</strong> to discuss such topics.<br />

On the Discussion Forum on the<br />

<strong>Society</strong>’s website members can keep<br />

up to date with developments and<br />

contribute their views at:<br />

www.actuaries.ie/discussion forums/<br />

General Discussion-SAI Members<br />

Shauna McHugh<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 9

How to Make your Money last all <strong>of</strong> your Life and<br />

how Policymakers can Help<br />

Paul O'Faherty chaired our recent<br />

Pensions Conference which was<br />

scheduled as part <strong>of</strong> the <strong>Society</strong>'s 40th<br />

anniversary celebrations. The speakers<br />

were selected to tackle the <strong>in</strong>creas<strong>in</strong>gly<br />

<strong>in</strong>dividualised challenge that is<br />

retirement sav<strong>in</strong>gs. The certa<strong>in</strong>ty <strong>of</strong><br />

def<strong>in</strong>ed benefit is fad<strong>in</strong>g fast to be<br />

replaced by a world where we all have<br />

to take <strong>in</strong>dividual responsibility for<br />

our lifetime f<strong>in</strong>ancial plann<strong>in</strong>g. It is a<br />

considerable challenge.<br />

The key themes to emerge from the<br />

morn<strong>in</strong>g were as follows:<br />

Study after study has shown that most<br />

people have very little awareness <strong>of</strong><br />

their retirement benefits, even those<br />

with<strong>in</strong> 10 years <strong>of</strong> their expected<br />

retirement age. Alan Barrett's recent<br />

f<strong>in</strong>d<strong>in</strong>gs from the TILDA participants<br />

were a stark rem<strong>in</strong>der that no amount<br />

<strong>of</strong> communication or f<strong>in</strong>ancial literacy<br />

<strong>in</strong>terventions will enable the average<br />

participant to engage with and<br />

understand the issues. The concepts <strong>of</strong><br />

long term sav<strong>in</strong>gs are simply beyond<br />

the complexity threshold <strong>of</strong> most<br />

people lead<strong>in</strong>g busy lives <strong>in</strong> other fields.<br />

This means that policymakers and<br />

employers cannot just hand<br />

responsibility over to members and<br />

expect reasonable outcomes. Some<br />

guard rails are required to ensure a<br />

m<strong>in</strong>imum level <strong>of</strong> future provision<br />

and sound <strong>in</strong>vestment choices.<br />

L to R: Rob<strong>in</strong> Webster, Aisl<strong>in</strong>g Kennedy, John Deely,<br />

Paul O’Flaherty, Niall O’Callaghan and Patrick Cosgrave<br />

Auto enrolment at a m<strong>in</strong>imum is an<br />

essential design feature <strong>of</strong> any national<br />

sav<strong>in</strong>gs framework.<br />

Patrick Cosgrave went on to review<br />

the <strong>in</strong>centives <strong>in</strong>herent <strong>in</strong> the current<br />

Irish pension system. Us<strong>in</strong>g a F<strong>in</strong>ancial<br />

Incentives Index (FII) methodology, he<br />

illustrated the progressive nature <strong>of</strong><br />

the Irish system, especially for Pillar 1<br />

pensions where benefits are capped but<br />

contributions apply on all <strong>in</strong>come. He<br />

highlighted the danger <strong>of</strong> standard<br />

rat<strong>in</strong>g current tax reliefs and showed<br />

<strong>in</strong>ternational comparisons where even<br />

mandatory sav<strong>in</strong>gs systems such as<br />

Australia and S<strong>in</strong>gapore are supported<br />

by a strong framework <strong>of</strong> <strong>in</strong>dividual<br />

<strong>in</strong>centives. The decision to defer<br />

consumption for 30 years or more is a<br />

serious act <strong>of</strong> faith <strong>in</strong> the future and is<br />

only realistically possible with<strong>in</strong> the<br />

context <strong>of</strong> positive <strong>in</strong>centives.<br />

Niall O'Callaghan rem<strong>in</strong>ded us all <strong>of</strong><br />

the Marshmallow Test used with 4 year<br />

olds to assess their capacity to delay<br />

gratification. This has proved highly<br />

predictive <strong>of</strong> later academic and<br />

bus<strong>in</strong>ess success and highlights aga<strong>in</strong><br />

that the need for <strong>in</strong>centives is hard<br />

coded <strong>in</strong>to our DNA. Niall outl<strong>in</strong>ed a<br />

fasc<strong>in</strong>at<strong>in</strong>g example <strong>of</strong> the lifetime<br />

wealth difference between a "BMW<br />

family" and a "Volkswagen family"<br />

which amounted to €860,000 for the<br />

car purchas<strong>in</strong>g decisions over our lives.<br />

Not many <strong>of</strong> us understand the long<br />

term wealth impact <strong>of</strong> our rout<strong>in</strong>e<br />

consumption choices. Everyth<strong>in</strong>g needs<br />

to be simplified <strong>in</strong>to tangible examples<br />

like this one to make the complexity <strong>of</strong><br />

lifetime f<strong>in</strong>ancial plann<strong>in</strong>g accessible to<br />

the average worker.<br />

M<strong>in</strong>ister for Social Protection, Joan Burton T.D., address<strong>in</strong>g the Conference.<br />

Aisl<strong>in</strong>g Kennedy talked about the<br />

challenges and opportunities presented<br />

by longer work<strong>in</strong>g lives. Most people<br />

rema<strong>in</strong> <strong>in</strong> denial that current retirement<br />

expectations are totally misaligned with<br />

current lifestyles and sav<strong>in</strong>gs rates.<br />

Aisl<strong>in</strong>g produced a simple model which<br />

showed age 73 as the retirement age<br />

which matches those current lifestyles<br />

Pg 10 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

“Longer lives are only<br />

valuable to the extent we<br />

have the capacity to enjoy<br />

them.”<br />

and sav<strong>in</strong>gs rates. She made the strong<br />

po<strong>in</strong>t that we should be focus<strong>in</strong>g<br />

as much on healthy age<strong>in</strong>g as the<br />

f<strong>in</strong>ancial aspects. Longer lives are only<br />

valuable to the extent we have the<br />

health capacity to enjoy them.<br />

Aisl<strong>in</strong>g f<strong>in</strong>ished with the provocative<br />

suggestion that, given the uncerta<strong>in</strong>ty<br />

<strong>in</strong>herent <strong>in</strong> long term sav<strong>in</strong>gs, we<br />

might <strong>in</strong>deed be better <strong>of</strong>f <strong>in</strong>vest<strong>in</strong>g <strong>in</strong><br />

our health and capability rather than<br />

sav<strong>in</strong>g for the future.<br />

Invest<strong>in</strong>g <strong>in</strong> our own capability led<br />

neatly to the career transition talk by<br />

John Deely. Longer work<strong>in</strong>g lives will<br />

almost certa<strong>in</strong>ly depend on successful<br />

career transitions. It was very useful to<br />

hear John outl<strong>in</strong>e the underly<strong>in</strong>g<br />

process and habits he has observed <strong>in</strong><br />

successful transitions. Busy lives can<br />

lead to a reflection deficit and our<br />

career satisfaction should always rema<strong>in</strong><br />

under review. We don't want to spend<br />

retirement haunted by "should have"<br />

regrets. Once aware <strong>of</strong> the need for<br />

transition, we need to appreciate that it<br />

is typically a three to five year journey.<br />

Network<strong>in</strong>g is a critical part <strong>of</strong> f<strong>in</strong>d<strong>in</strong>g<br />

new horizons and we need to<br />

cont<strong>in</strong>uously nurture our personal and<br />

bus<strong>in</strong>ess networks. F<strong>in</strong>ancial resources<br />

also matter as transitions are rarely<br />

possible without short term <strong>in</strong>come<br />

reductions. Change is always difficult<br />

but John helped to demystify the<br />

process with clear examples from his<br />

own client experience.<br />

We were then jo<strong>in</strong>ed by M<strong>in</strong>ister Joan<br />

Burton, who freed herself from Leader’s<br />

questions <strong>in</strong> the Dail (and a media<br />

scrum around the Rois<strong>in</strong> Shortall<br />

resignation) to jo<strong>in</strong> the Conference.<br />

She reassured the audience that<br />

despite the grave fiscal backdrop, the<br />

Government was keenly aware <strong>of</strong> the<br />

long term importance <strong>of</strong> the retirement<br />

sav<strong>in</strong>gs framework. She emphasised the<br />

need for widespread confidence <strong>in</strong> the<br />

system for citizens to will<strong>in</strong>gly commit<br />

L to R: Patrick Cosgrave, M<strong>in</strong>ister Joan Burton T.D.,<br />

Paul O’Flaherty, and Alan Barrett<br />

to the long term sav<strong>in</strong>gs process. She<br />

expressed the clear desire on the part<br />

<strong>of</strong> Government for more <strong>in</strong>vestment <strong>in</strong><br />

<strong>Ireland</strong> by the pensions <strong>in</strong>dustry,<br />

assum<strong>in</strong>g the right risk and reward<br />

opportunities can be made available.<br />

Her presence added significantly to<br />

the event.<br />

Time deprived us <strong>of</strong> an extensive panel<br />

discussion but we did have a valuable<br />

contribution from Rob<strong>in</strong> Webster, CEO<br />

<strong>of</strong> Age Action <strong>Ireland</strong>. He rem<strong>in</strong>ded us<br />

that age - discrim<strong>in</strong>ation is <strong>in</strong>creas<strong>in</strong>gly<br />

pervasive with all <strong>of</strong> us fall<strong>in</strong>g prey to<br />

"elderly" stereotypes. Age is merely a<br />

label and we need new language<br />

around the later phases <strong>in</strong> life. We may<br />

lose some <strong>of</strong> our physical capability as<br />

we get older but this can be ably<br />

compensated by <strong>in</strong>creas<strong>in</strong>g experience,<br />

wisdom and <strong>in</strong>sight.<br />

All <strong>in</strong> all, it was a stimulat<strong>in</strong>g morn<strong>in</strong>g<br />

and a timely rem<strong>in</strong>der <strong>of</strong> the eclectic<br />

contribution actuaries can make to this<br />

central issue fac<strong>in</strong>g every developed<br />

society. Def<strong>in</strong>ed Benefit may <strong>in</strong>deed be<br />

<strong>in</strong> decl<strong>in</strong>e but the capacity <strong>of</strong> actuaries<br />

to make f<strong>in</strong>ancial sense <strong>of</strong> the future<br />

will enable us to rema<strong>in</strong> at the centre<br />

<strong>of</strong> the lifetime sav<strong>in</strong>gs challenge.<br />

Donal Casey<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 11

Health Care – At What Cost?<br />

Despite <strong>in</strong>tensive regulation, Dutch<br />

health care expenditure has <strong>in</strong>creased<br />

dramatically from 10% to 13% <strong>of</strong> GDP<br />

<strong>in</strong> the last 10 years and this trend is<br />

expected to cont<strong>in</strong>ue. He predicted<br />

that more out <strong>of</strong> pocket payments,<br />

benefit restrictions and improvements<br />

to the f<strong>in</strong>anc<strong>in</strong>g system will be required<br />

to address <strong>in</strong>flation. He left us with the<br />

sober<strong>in</strong>g thought that the design <strong>of</strong><br />

the health care system itself is not the<br />

driver <strong>of</strong> quality and efficiency – the<br />

success <strong>of</strong> any health care system<br />

depends on how it is managed.<br />

L to R: Oliver O’Connor, David Costello, Paul O’Faherty, Piet Stam and Jo Buckle<br />

It may have been a sign <strong>of</strong> new and<br />

excit<strong>in</strong>g career opportunities to see<br />

more than 50 actuaries attend the<br />

health care conference <strong>in</strong> the Conrad<br />

Hotel on 17th October. The sem<strong>in</strong>ar<br />

also provided an opportunity for<br />

actuaries to showcase our expertise <strong>in</strong><br />

this challeng<strong>in</strong>g area, to the attendees<br />

from outside the pr<strong>of</strong>ession.<br />

Our chairman for the day, Paul<br />

O’Faherty, opened the conference with<br />

a collage <strong>of</strong> the many column <strong>in</strong>ches<br />

occupied by the health care sector<br />

with<strong>in</strong> the past week, but rem<strong>in</strong>ded us<br />

<strong>of</strong> the successful features <strong>of</strong> our health<br />

care system. He questioned whether<br />

general perceptions regard<strong>in</strong>g our<br />

health care system are fair, consider<strong>in</strong>g<br />

enviable advances made <strong>in</strong> life<br />

expectancy and disease management.<br />

The first speaker <strong>of</strong> the day was<br />

Jo Buckle, an actuary with Milliman,<br />

based <strong>in</strong> London. She has a wealth <strong>of</strong><br />

experience work<strong>in</strong>g with health care<br />

providers across several cont<strong>in</strong>ents.<br />

She shared with the audience her global<br />

experiences <strong>of</strong> successes and failures <strong>in</strong><br />

manag<strong>in</strong>g medical cost <strong>in</strong>flation. She<br />

<strong>in</strong>troduced us to a formula to predict<br />

medical <strong>in</strong>flation (formulas are always<br />

popular with actuaries!) based on price<br />

<strong>in</strong>flation, GDP growth and technology<br />

trends. She emphasised that medical<br />

<strong>in</strong>flation is not always bad – higher<br />

spend<strong>in</strong>g on health care can be justified<br />

as valid social policy with a good return<br />

on <strong>in</strong>vestment, if the additional spend<br />

results <strong>in</strong> better quality and outcomes,<br />

not just higher utilisation. Her case<br />

study on the enhanced recovery<br />

programme used with<strong>in</strong> the NHS was<br />

described as nirvana by one audience<br />

member, comb<strong>in</strong><strong>in</strong>g pre-op assessment,<br />

post op early mobilisation and daily<br />

patient specific care plans from a<br />

multi-discipl<strong>in</strong>ary team.<br />

David Costello is head <strong>of</strong> actuarial<br />

with Allianz Worldwide Care. He began<br />

by highlight<strong>in</strong>g the wide variation <strong>in</strong><br />

utilisation and claim costs around the<br />

world, even between neighbour<strong>in</strong>g<br />

countries. He commented on the<br />

opportunity this provides for medical<br />

tourism. He highlighted the stark<br />

difference <strong>in</strong> typical health care costs<br />

by age and drew a comparison with<br />

the pensions crisis before giv<strong>in</strong>g us a<br />

very helpful summary <strong>of</strong> Obamacare.<br />

F<strong>in</strong>ally, he shared with us some ideas<br />

on conta<strong>in</strong><strong>in</strong>g health care costs,<br />

<strong>in</strong>clud<strong>in</strong>g some enterta<strong>in</strong><strong>in</strong>g stories<br />

<strong>in</strong> medical <strong>in</strong>surance fraud.<br />

Piet Stam is an econometrician with<br />

a doctorate <strong>in</strong> risk equalisation.<br />

The audience was very <strong>in</strong>terested <strong>in</strong><br />

hear<strong>in</strong>g about the much lauded Dutch<br />

health care system and Piet’s views<br />

on our government’s direction<br />

toward universal health <strong>in</strong>surance.<br />

He described the enviable features <strong>of</strong><br />

the Dutch system: mandatory private<br />

health <strong>in</strong>surance for every citizen with<br />

subsidies for low and middle <strong>in</strong>come<br />

people, yearly free choice <strong>of</strong> <strong>in</strong>surer,<br />

community rat<strong>in</strong>g, standardised benefit<br />

packages, all underp<strong>in</strong>ned by a<br />

comprehensive risk equalisation system.<br />

He described the aim <strong>of</strong> risk equalisation<br />

to achieve solidarity <strong>in</strong> a competitive<br />

market, but discussed the difficulty <strong>of</strong><br />

ensur<strong>in</strong>g that only factors that reflect<br />

underly<strong>in</strong>g health status are equalised.<br />

Oliver O’Connor is an <strong>in</strong>dependent<br />

bus<strong>in</strong>ess consultant, specialis<strong>in</strong>g <strong>in</strong><br />

health f<strong>in</strong>ance, <strong>in</strong>novation and public<br />

policy. From 2001 to 2010, he was<br />

a senior Special Adviser <strong>in</strong> the<br />

Government, work<strong>in</strong>g for Mary Harney.<br />

He started by giv<strong>in</strong>g us a fasc<strong>in</strong>at<strong>in</strong>g<br />

<strong>in</strong>sight <strong>in</strong>to the day to day politics <strong>of</strong><br />

health care <strong>in</strong> <strong>Ireland</strong>. He discussed the<br />

trend <strong>of</strong> medical <strong>in</strong>flation but reassured<br />

us that no country has ever gone<br />

bankrupt due to medical costs!<br />

He drew comparisons with F<strong>in</strong>land <strong>in</strong><br />

the early 1990s and wondered if it will<br />

also take <strong>Ireland</strong> 20 years to restore<br />

previous levels <strong>of</strong> health care spend.<br />

He provided a useful breakdown <strong>of</strong><br />

medical <strong>in</strong>flation, show<strong>in</strong>g that age<strong>in</strong>g<br />

contributes a small proportion, with the<br />

biggest drivers be<strong>in</strong>g <strong>in</strong>come growth<br />

and technology. He discussed the<br />

imperfect but highly effective tool <strong>of</strong><br />

budget caps to conta<strong>in</strong> <strong>in</strong>flation. He<br />

highlighted the difficulties <strong>of</strong> high fixed<br />

costs. He gave comparisons <strong>of</strong> Irish<br />

and <strong>in</strong>ternational medical costs to<br />

demonstrate that <strong>Ireland</strong> is expensive,<br />

even compared to countries with a<br />

similar social pr<strong>of</strong>ile. There was a gasp<br />

at the low start<strong>in</strong>g salary <strong>of</strong> a medical<br />

consultant <strong>in</strong> Spa<strong>in</strong>! He took us through<br />

a breakdown <strong>of</strong> the HSE’s spend and<br />

commended the recent deal on<br />

pharmaceutical costs.<br />

A lively discussion followed, with many<br />

questions for the speakers, particularly<br />

explor<strong>in</strong>g lessons that could be learned<br />

from other countries and applied to<br />

<strong>Ireland</strong>. Anyone who came look<strong>in</strong>g for<br />

a silver bullet may not have found it,<br />

but will have found the content <strong>of</strong> the<br />

sem<strong>in</strong>ar to be comprehensive and<br />

thought-provok<strong>in</strong>g. In particular the<br />

sem<strong>in</strong>ar emphasised the valuable role<br />

that the <strong>Society</strong> can play <strong>in</strong> facilitat<strong>in</strong>g<br />

and shap<strong>in</strong>g debate and analysis <strong>of</strong><br />

these complex issues.<br />

Joyce Brennan<br />

Pg 12 <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> | NOVEMBER <strong>2012</strong>

Embedd<strong>in</strong>g Stress Test<strong>in</strong>g as part <strong>of</strong> an Integrated<br />

Risk Management Framework<br />

On the 24th October <strong>2012</strong>, the ERM<br />

committee <strong>of</strong> the <strong>Society</strong> hosted an<br />

even<strong>in</strong>g meet<strong>in</strong>g on the topic <strong>of</strong><br />

‘Embedd<strong>in</strong>g Stress Test<strong>in</strong>g as part <strong>of</strong><br />

an Integrated Risk Management<br />

Framework’. The speakers, Alistair<br />

Clarkson and David Hare, were both<br />

work<strong>in</strong>g for Standard Life when their<br />

paper was first presented at the<br />

Actuarial Pr<strong>of</strong>ession’s Life Conference<br />

<strong>in</strong> <strong>November</strong> 2011 – Alistair <strong>in</strong> the risk<br />

function and David <strong>in</strong> the actuarial<br />

function.<br />

The presentation got <strong>of</strong>f to a lively<br />

start with pictures <strong>of</strong> items such as<br />

motorbikes, airplanes and pencils be<strong>in</strong>g<br />

stress tested <strong>in</strong> different ways. Alistair’s<br />

message was that we should look for<br />

a bus<strong>in</strong>ess benefit <strong>in</strong> carry<strong>in</strong>g out the<br />

stress tests. He described the ERM<br />

framework with<strong>in</strong> his company where<br />

risk appetite sett<strong>in</strong>g is part <strong>of</strong> the<br />

bus<strong>in</strong>ess plann<strong>in</strong>g process. In general,<br />

risk should be at the heart <strong>of</strong> this<br />

process, or as Alistair remarked ‘What is<br />

the po<strong>in</strong>t <strong>of</strong> mak<strong>in</strong>g a pr<strong>of</strong>it if it is not<br />

susta<strong>in</strong>able?’<br />

The two key metrics he uses are excess<br />

work<strong>in</strong>g capital and shareholder value,<br />

which can sometimes be <strong>in</strong> conflict<br />

with each other. In this situation,<br />

judgement is required to decide<br />

which is the more important <strong>in</strong> the<br />

circumstances. He noted that<br />

shareholder value at risk is similar to<br />

the Standard Capital Requirement<br />

under Solvency II. He recommended<br />

express<strong>in</strong>g the risk appetite <strong>in</strong> terms<br />

<strong>of</strong> pre-def<strong>in</strong>ed stresses. A statement like<br />

‘we want to be able to survive a<br />

30% market value fall’ is one that a<br />

company’s board can understand. It is<br />

more accessible than say<strong>in</strong>g ‘we want<br />

to be able to withstand a 30% fall <strong>in</strong><br />

shareholder value.’<br />

A picture <strong>of</strong> a fly<strong>in</strong>g cow was used to<br />

<strong>in</strong>troduce the idea <strong>of</strong> an emerg<strong>in</strong>g risk -<br />

a new or <strong>in</strong>creas<strong>in</strong>g risk that has a low<br />

probability and an uncerta<strong>in</strong> outcome<br />

but could have a significant impact on<br />

the company’s ability to deliver its<br />

strategy or on its key risk exposures.<br />

Consideration <strong>of</strong> emerg<strong>in</strong>g risks can<br />

encourage the use <strong>of</strong> creative th<strong>in</strong>k<strong>in</strong>g<br />

to come up with scenarios for ‘reverse<br />

stress test<strong>in</strong>g’ or extreme scenario<br />

test<strong>in</strong>g. It is important to consider<br />

‘What can we do now to improve our<br />

position <strong>in</strong> the light <strong>of</strong> these extreme<br />

scenario test results?’ and not just<br />

‘What would we do <strong>in</strong> the event <strong>of</strong><br />

these scenarios com<strong>in</strong>g to pass?’<br />

David then took over and began to<br />

tease out some <strong>of</strong> the tensions that can<br />

arise <strong>in</strong> the Actuarial Function Holder<br />

(AFH) role. The AFH is required to<br />

advise on both the statutory valuation<br />

and on risks. There is some overlap<br />

with the systems and controls function<br />

(an FSA controlled function referred to<br />

as CF28) which is also concerned with<br />

risk. The FSA stopped short <strong>of</strong> requir<strong>in</strong>g<br />

a separate risk function although that<br />

was <strong>in</strong>itially proposed <strong>in</strong> 2010. Instead,<br />

CF28 allows for the possibility <strong>of</strong> a<br />

separate risk assessment function which<br />

forms part <strong>of</strong> the systems and controls<br />

function. However, under Solvency II<br />

separate actuarial and risk functions<br />

will be required.<br />

David emphasised the need for<br />

collaboration between the risk and<br />

actuarial functions to avoid any<br />

difficulties or stand <strong>of</strong>fs. He also<br />

emphasised the need to get the<br />

numbers done with enough time to<br />

consider them, <strong>in</strong>terpret them and<br />

provide <strong>in</strong>sights to the Board. Stress<br />

test<strong>in</strong>g should then be used to help the<br />

Board and management to understand<br />

the possible evolution <strong>of</strong> the Company’s<br />

balance sheet over time.<br />

David noted that as part <strong>of</strong> their rat<strong>in</strong>gs<br />

analysis work S&P check to see if an<br />

ERM framework is really at a ‘Group’<br />

level. The th<strong>in</strong>k<strong>in</strong>g here is that the<br />

framework and <strong>in</strong>itial scenarios should<br />

be group wide with the flexibility to<br />

select additional local vulnerabilities at<br />

the bus<strong>in</strong>ess unit level.<br />

David’s successful <strong>in</strong>teraction with the<br />

risk function had enabled him turn<br />

his F<strong>in</strong>ancial Condition Report <strong>in</strong>to a<br />

holistic document with emphasis on<br />

operational risks as well as f<strong>in</strong>ancial risks<br />

– it had become an ORSA style report<br />

that gave a ‘complete picture’.<br />

Alistair then came back <strong>in</strong> to sum up.<br />

He noted that the key to us<strong>in</strong>g stress<br />

tests <strong>in</strong> runn<strong>in</strong>g the bus<strong>in</strong>ess is buy-<strong>in</strong><br />

from executives and also from people<br />

whose primary focus is not risk. Risk is,<br />

after all, about human behaviour.<br />

In conclusion, we were treated to a<br />

picture <strong>of</strong> a dead fish! The presenters<br />

encouraged us not to become one –<br />

clearly the dead fish’s stress test<strong>in</strong>g<br />

programme was not effective.<br />

A lively discussion followed. When<br />

respond<strong>in</strong>g to a question on competitor<br />

behaviour, the speakers were keen to<br />

po<strong>in</strong>t out that they would not take<br />

comfort from their competitors be<strong>in</strong>g<br />

equally affected by a particular risk.<br />

However, if their company was more<br />

affected than others by a particular risk<br />

then they would want to understand<br />

why.<br />

There was some discussion about<br />

whether the actuarial function<br />

belonged <strong>in</strong> the first or second l<strong>in</strong>e <strong>of</strong><br />

defence and whether or not it should<br />

be <strong>in</strong>tegrated with the f<strong>in</strong>ance or the<br />

risk function. There was also a question<br />

from the audience about <strong>in</strong>clud<strong>in</strong>g<br />

pension scheme risks <strong>in</strong> stress tests.<br />

The speakers were asked about<br />

Solvency II. Based on his UK experience<br />

with Individual Capital Assessments<br />

(ICA), David felt it had been successful<br />

<strong>in</strong> provid<strong>in</strong>g a common currency for<br />

non-f<strong>in</strong>ancial people to discuss risk. He<br />

was less conv<strong>in</strong>ced about the benefits<br />

<strong>of</strong> a market consistent approach across<br />

27 countries where <strong>in</strong> some cases there<br />

is no market e.g. <strong>in</strong> very long term<br />

bonds.<br />

A copy <strong>of</strong> the presentation slides and<br />

the podcast are available on the<br />

<strong>Society</strong>’s website. These won’t <strong>in</strong>clude<br />

the visual effects <strong>of</strong> fly<strong>in</strong>g cows and<br />

dead fish that we saw on the night but<br />

are still well worth a read or a listen.<br />

Carmel Brennan<br />

NOVEMBER <strong>2012</strong> | <strong>Society</strong> <strong>of</strong> <strong>Actuaries</strong> <strong>in</strong> <strong>Ireland</strong> Pg 13

Test Achats: Impact on General Insurance<br />

On a ra<strong>in</strong>y September even<strong>in</strong>g,<br />

James Grennan, Tony Culley and Karl<br />

Niemann presented and led an<br />

enthusiastic panel discussion <strong>of</strong> Test<br />

Achats and the practical implications<br />

<strong>of</strong> the EU Gender Directive for general<br />

<strong>in</strong>surance bus<strong>in</strong>ess.<br />

James started the presentation by<br />

giv<strong>in</strong>g some history <strong>of</strong> Test Achats;<br />

some practical consequences <strong>of</strong> the<br />

Gender Directive; and discuss<strong>in</strong>g the<br />

issue <strong>of</strong> <strong>in</strong>direct discrim<strong>in</strong>ation,<br />

implications for advertis<strong>in</strong>g and the<br />

fallout from breach<strong>in</strong>g the gender rules.<br />

The Gender Directive enforces the<br />

equal treatment <strong>of</strong> men and women<br />

<strong>in</strong> access to goods and services. Article<br />

5(1) <strong>of</strong> the Directive prohibits the use<br />

<strong>of</strong> gender as a factor <strong>in</strong> calculat<strong>in</strong>g<br />

premiums and benefits for new<br />

contracts sold after 21 December 2007,<br />

only if the use <strong>of</strong> gender <strong>in</strong> the<br />

calculation results <strong>in</strong> a difference <strong>in</strong><br />

premiums or benefits between the<br />

sexes. One could understandably<br />

ask why gender is aris<strong>in</strong>g as an issue<br />

now <strong>in</strong> <strong>2012</strong>, consider<strong>in</strong>g the rul<strong>in</strong>g<br />

date above. <strong>Ireland</strong> availed <strong>of</strong> an<br />

exemption permitted under Article 5(2)<br />

<strong>of</strong> the Directive which stated that<br />

proportionate differences <strong>in</strong> <strong>in</strong>dividual<br />

premiums and benefits were permitted<br />

only if the difference was based on<br />

relevant and accurate actuarial and<br />

statistical data.<br />

A number <strong>of</strong> years ago, Test Achats<br />

(a Belgian consumer association) took<br />

an action that the exemption was<br />

<strong>in</strong>valid under the terms <strong>of</strong> the Directive<br />

and on 1 March 2011 the European<br />

Court <strong>of</strong> Justice deemed that Article<br />

5(2) would become <strong>in</strong>valid on<br />

21 December <strong>2012</strong>, due to it be<strong>in</strong>g<br />

contrary to the charter <strong>of</strong> fundamental<br />

rights.<br />

James raised two practical issues that<br />

<strong>in</strong>surance companies would need to<br />

grapple with post 21 December, namely<br />

active selection by astute policyholders<br />

and <strong>in</strong>direct discrim<strong>in</strong>ation. There is a<br />

risk that an <strong>in</strong>surer could stray <strong>in</strong>to the<br />

territory <strong>of</strong> <strong>in</strong>direct discrim<strong>in</strong>ation by<br />

attempt<strong>in</strong>g to use proxies for gender <strong>in</strong><br />

sett<strong>in</strong>g the premiums and benefits <strong>of</strong> its<br />

policies. If a pric<strong>in</strong>g factor puts one sex<br />

at a particular disadvantage and that<br />

factor cannot be objectively justified<br />

by ‘a legitimate aim and the means <strong>of</strong><br />

achiev<strong>in</strong>g that aim are appropriate and<br />

necessary’ then the company could be<br />

expos<strong>in</strong>g itself to legitimate legal action<br />

from policyholders and consumer<br />

groups. In this event, the policyholder<br />

only needs to demonstrate that the<br />