906Annual Report 2008-09.pdf - Hindusthan National Glass ...

906Annual Report 2008-09.pdf - Hindusthan National Glass ...

906Annual Report 2008-09.pdf - Hindusthan National Glass ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited<br />

2, Red Cross Place, Kolkata – 700001<br />

www.hngindia.com<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited<br />

63rd Annual <strong>Report</strong> <strong>2008</strong>-09

Corporate information<br />

Chairman<br />

C. K. Somany<br />

Managing Director<br />

Sanjay Somany<br />

Joint Managing Director<br />

Mukul Somany<br />

Executive Director<br />

R. R. Soni<br />

Directors<br />

Kishore Bhimani<br />

Sujit Bhattacharya<br />

R. K. Daga<br />

Dipankar Chatterji<br />

S. K. Bangur<br />

I. K. Saha (Dr.)<br />

Late Supriya Gupta (upto February 7, 2009)<br />

Chief Financial Officer<br />

Nirmal Khanna<br />

Company Secretary<br />

Priya Ranjan<br />

Auditors<br />

Lodha & Co., Chartered Accountants<br />

Registered office<br />

2, Red Cross Place<br />

Kolkata – 700 001<br />

Phone: 033 2254 3100<br />

Registrar & Share Transfer Agent<br />

Maheshwari Datamatics Pvt. Ltd<br />

6, Mangoe Lane (Surendra Mohan Ghosh Sarani)<br />

Second floor, Kolkata – 700 001<br />

Works<br />

Rishra<br />

Bahadurgarh<br />

Rishikesh<br />

Puducherry<br />

Nashik<br />

Neemrana<br />

Banks/Financial institutions<br />

State Bank of India<br />

HDFC Bank Limited<br />

The Hongkong & Shanghai Banking Corporation Limited<br />

ICICI Bank Limited<br />

Bank of Baroda<br />

State Bank of Hyderabad<br />

Export Import Bank of India<br />

Life Insurance Corporation of India<br />

Across the pages<br />

Corporate identity 04 How we progressed in <strong>2008</strong>-09 08 Growth of our numbers 10<br />

Chairman’s thoughts 12 Management statement 20 Corporate responsibility and sustainability 22<br />

Directors’ <strong>Report</strong> 24 Management Discussion and Analysis 32 <strong>Report</strong> on Corporate Governance 40<br />

Auditors’ <strong>Report</strong> 51 Balance Sheet 54 Profit and Loss Account 55 Cash Flow Statement 56<br />

Schedules and Notes 57 Balance Sheet Abstract 77 Section 212 78 Subsidiary Accounts 79<br />

Consolidated Accounts 115<br />

Disclaimer<br />

This document contains statements about expected future events and<br />

financial and operating results of <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries<br />

Limited, which are forward-looking. By their nature, forward-looking<br />

statements require the Company to make assumptions and are subject<br />

to inherent risks and uncertainties. There is significant risk that the<br />

assumptions, predictions and other forward-looking statements will not<br />

prove to be accurate. Readers are cautioned not to place undue reliance<br />

A PRODUCT<br />

info@trisyscom.com<br />

on forward-looking statements as a number of factors could cause<br />

assumptions, actual future results and events to differ materially from<br />

those expressed in the forward-looking statements. Accordingly this<br />

document is subject to the disclaimer and qualified in its entirety by the<br />

assumptions, qualifications and risk factors referred to in the<br />

Management’s Discussion and Analysis Statement of the Annual <strong>Report</strong>,<br />

<strong>2008</strong>-09 of <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited.

Each time our customers are<br />

REPLENISHED.<br />

Each time our consumers are<br />

REFRESHED.<br />

Each time our employees are<br />

REJUVENATED.<br />

Each time our suppliers are<br />

REVITALISED.<br />

Each time our shareholders are<br />

REASSURED.

Each time someone turns to…<br />

A cola bottle for a drink.<br />

A jam bottle for a serving.<br />

A medicine bottle for a dose.<br />

A champagne bottle for a toast.<br />

A health supplement bottle for a dollop.<br />

For being protected<br />

by a product designed and<br />

manufactured by <strong>Hindusthan</strong><br />

<strong>National</strong> <strong>Glass</strong> & Industries Limited.<br />

The bottle.<br />

2 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 3

HNG is India’s largest container<br />

glass packaging solution<br />

provider (and among the world’s<br />

fastest growing).<br />

A status reflected in its Indian market share of about<br />

65 percent.<br />

A respect reflected in a number of multinational and domestic<br />

customers.<br />

A customer orientation reflected in a sectoral coverage of the<br />

food, pharmaceuticals, liquor, beer and beverage industries.<br />

A robustness of business model reflected in a post-tax profit in<br />

a challenging <strong>2008</strong>-09.<br />

4 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Vision<br />

To create a world-class glass<br />

manufacturing plant that pursues<br />

quality, cost reduction and<br />

productivity improvement measures in<br />

a truly holistic manner, leading to<br />

customers’, shareholders’, employees’<br />

and suppliers’ satisfaction; this<br />

integrated effort will result in the<br />

Company becoming an industry<br />

benchmark and a role model for its<br />

systems, processes and results.<br />

Potential<br />

The world’s population of 6.60 billion<br />

is expected to cross 8 billion in 12<br />

years.<br />

Two things will result.<br />

One, a billion people will graduate to<br />

the robustly consuming middle-class.<br />

Two, urban migration will increase to<br />

nearly 900 million.<br />

The result: An enhanced market of<br />

bottled products.<br />

At HNG, we are preparing for this<br />

growing market through proactive<br />

investments in capacity, portfolio,<br />

presence and efficiency.<br />

Enhancing value for consumers,<br />

community and the country.<br />

Identity<br />

The HNG Group was promoted by the<br />

Kolkata-based Somany family in 1952<br />

following the commissioning of<br />

India’s first fully-automated glass<br />

manufacturing plant at Rishra (near<br />

Kolkata).<br />

The Company is now the undisputed<br />

leader in India’s container glass<br />

industry with about 65 percent<br />

market share and several global<br />

multinationals among its brandenhancing<br />

customers.<br />

Spread<br />

The Company’s pan-India<br />

manufacturing operations are spread<br />

over Rishra, Bahadurgarh, Rishikesh,<br />

Puducherry, Nashik and Neemrana; its<br />

headquarter is located in Kolkata. Its<br />

products are also available in more<br />

than 20 countries.<br />

Asset quality<br />

The Company possesses an<br />

operational capacity of 11 furnaces<br />

and 43 production lines with fullyautomated<br />

IS machines, sourced<br />

from respected global centres of glass<br />

manufacturers like Europe<br />

and the US.<br />

This asset versatility translated into a<br />

container glass portfolio ranging from<br />

5 ml to 3,200 ml on the one hand<br />

and diverse colours (amber, flint and<br />

green) on the other.<br />

6 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

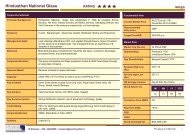

Plant location<br />

Installed capacity (MT per day)<br />

Rishra, West Bengal 740<br />

Bahadurgarh, Haryana 655<br />

Nashik, Maharashtra 320<br />

Rishikesh, Uttarakhand 356<br />

Neemrana, Rajasthan 180<br />

Puducherry 290<br />

Customers<br />

Hindustan Unilever, GlaxoSmithKline, Nestle, Koeleman,<br />

Global Green, Heinz and Dabur (foods); Pfizer, Cipla,<br />

GlaxoSmithKline, Reckitt Benckiser, Ranbaxy and Himalaya<br />

(pharmaceuticals); United Breweries, SABMiller, Asia Pacific<br />

Breweries and South Asia Breweries (beer); United Spirits,<br />

Pernod Ricard, Diageo, Radico and Bacardi (liquor) and Coca<br />

Cola and Pepsi (soft drinks).<br />

Certifications<br />

The Company’s ISO 9000:2000 quality certification resulted in<br />

a dependable product and process consistency. Besides, it is<br />

pursuing ISO 14000/18000/22000 certifications for<br />

comprehensive environmental compliance.<br />

Listing<br />

Our shares are listed on the <strong>National</strong> Stock Exchange, the<br />

Bombay Stock Exchange and the Calcutta Stock Exchange. Our<br />

Company enjoyed a Rs. 724.91 cr market capitalisation as on<br />

March 31, 2009.<br />

Global partners<br />

Batch houses from Zippe (Germany); furnaces from Sorg and<br />

Horn (Germany); Forehearths from Emhart (USA) and PSR<br />

(UK); IS machine control system from Botterro (Italy) and<br />

Futronics (UK); bottle transfer machines from Sheppee (UK)<br />

and Pennekamp (Germany); annealing lehrs from Pennekamp<br />

(Germany) and Carmet (USA); laboratory inspection machinery<br />

from AGR (USA) and bottle printing equipment from Strutz<br />

(USA) and Rosario (the Netherlands).<br />

RANBAXY<br />

LABORATORIES LIMITED<br />

Key financial metrics*<br />

Rs. 1,344.19 cr Rs. 235.91 cr Rs. 107.75 cr<br />

Total income Operating profit Post tax profit<br />

11.68 percent Rs. 475.97 Rs. 5<br />

ROCE (average) Book value Proposed dividend<br />

per share per share<br />

*Figures pertaining to <strong>2008</strong>-09<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 7

HOW WE<br />

PROGRESSED<br />

IN <strong>2008</strong>-09<br />

In the plants<br />

Undertook process improvements by upgrading<br />

technology to narrow-neck-press-and-blow (NNPB)<br />

technology to reduce production costs and wastages<br />

on the one hand and strengthen capacity utilisation<br />

on the other<br />

Deployed ERP and SAP to reduce costs and minimise<br />

disruptions in operations<br />

Developed CAD/CAM facilities to design a variety of<br />

bottles in different sizes, customised to the precise<br />

requirements of pharmaceutical, processed foods,<br />

liquor and soft drink industries<br />

In the marketplace<br />

Enlisted customers like InBev, Carlsberg and John<br />

Distilleries, among others<br />

Strengthened average realisations through<br />

reengineering and superior service<br />

In the numbers<br />

Turnover increased 25.28 percent from<br />

Rs. 1,148.34 cr in 2007-08 to Rs. 1,438.60 cr<br />

Net sales escalated 28.37 percent from<br />

Rs. 1,021.30 cr in 2007-08 to Rs. 1,311.04 cr<br />

EBIDTA strengthened 9.89 percent from<br />

Rs. 214.67 cr in 2007-08 to Rs. 235.91 cr<br />

8

OUR GLOBAL<br />

OPERATING<br />

FRAMEWORK<br />

The big picture<br />

Emerge as one of the world’s foremost container glass<br />

packaging solution providers<br />

Blueprint to realise the big picture<br />

•Strategic priority 1: Grow value of the HNG brand and<br />

widen product portfolio<br />

Values<br />

•Accountability<br />

•Customer-focused<br />

•Team-driven<br />

•Strategic priority 2: Transform our go-to-market model<br />

to improve efficiency and effectiveness<br />

•Strategic priority 3: Attract, develop and retain a highly<br />

talented and diverse workforce<br />

World-class<br />

capabilities<br />

•Revenue growth<br />

management<br />

•Supply chain<br />

•Sales and customer<br />

service<br />

Drive long-term<br />

consistent<br />

sustainable growth<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 9

Challenging times. Declining offtake.<br />

Total income (Rs. in cr) EBIDTA (Rs. in cr) Post-tax profit (Rs. in cr) Cash profit (Rs. in cr)<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

434.36<br />

426.70<br />

521.84<br />

1,028.19<br />

1,344.19<br />

75.59<br />

73.95<br />

103.25<br />

214.67<br />

235.91<br />

31.51<br />

23.95<br />

34.24<br />

160.34<br />

107.75<br />

61.41<br />

56.70<br />

69.27<br />

203.83<br />

182.49<br />

10 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

HNG selected a difficult year to post record numbers.<br />

EBIDTA margin (Percent)<br />

Earnings per share<br />

(basic) (Rs.)<br />

Debt-equity ratio (on<br />

long term loans)<br />

Rising book value per<br />

share (Rs.)<br />

Consistent dividend<br />

payout (Percent)<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

2004-05<br />

2005-06<br />

2006-07<br />

2007-08<br />

<strong>2008</strong>-09<br />

16.06<br />

15.57<br />

17.34<br />

18.69<br />

16.40<br />

28.53<br />

21.69<br />

31.01<br />

91.79<br />

61.68<br />

0.51<br />

0.58<br />

0.43<br />

0.18<br />

0.36<br />

125.04<br />

145.93<br />

175.80<br />

433.70<br />

475.97<br />

7<br />

7<br />

10<br />

40<br />

50<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 11

CHAIRMAN’S<br />

THOUGHTS<br />

HNG enjoyed another year of growth and success. We<br />

are proud to be regarded as India’s largest and one of<br />

the world’s leading container glass packaging<br />

companies, manufacturing products that are highly<br />

respected in the marketplace. The HNG brand’s<br />

presence is spread across the Far East, Middle East,<br />

Africa and America. We have worked hard to ensure<br />

that our brand stands for quality and value and<br />

represents the collective teamwork of our employees<br />

worldwide.<br />

12

One of our most visible customercentric<br />

achievements in <strong>2008</strong>-09<br />

comprised the creation of<br />

light-weight<br />

container glass<br />

bottles.<br />

Today, HNG is an industry vanguard, thanks to our decadesrich<br />

dedication to the simple principles of giving our<br />

customers what they want, when they want and how they<br />

want. This is what our corporate success has done to us: it has<br />

broadened our mission; it has made us more responsible and<br />

sensitive to customer demands; it has enabled us to firmly<br />

integrate with customer product innovation and development<br />

cycles, and in doing so, deeply embrace the relationship.<br />

This enhanced customer-centricity strengthened our<br />

organisational focus towards market-driving innovations and<br />

transformation. This constancy of purpose will accelerate<br />

global leadership and consequent wealth creation, benefiting<br />

all stake owners.<br />

Changing faster for the better<br />

At HNG, we believe in a simple dictum: transcendence<br />

through transformation. Transformation as in challenging<br />

conventions; transformation as in embracing businessimpacting<br />

change as a condition for forward movement;<br />

transformation as in inculcating a culture of innovation,<br />

defying all odds. At HNG, transformation has brought success<br />

– and success for us necessitates further transformation.<br />

Our transformation has done one more important thing to<br />

us: it has enhanced our commitment quotient – commitment<br />

to our customers, commitment to our employees, and<br />

commitment to the communities around our operational<br />

areas. Our customers have come to expect great products and<br />

services from us, which we are determined to deliver. Our<br />

employees have come to expect a fertile environment in which<br />

they can perform and a management structure that<br />

encourages, nurtures, values and rewards the creative process.<br />

Exploration of the possible – and sometimes the impossible –<br />

will always be encouraged.<br />

There is much uncertainty and unpredictability in the current<br />

global economic scenario, which has adversely affected<br />

people’s lives and ways in which business is being conducted.<br />

As a responsible and conscientious corporate, we are<br />

committed to harness the best available resources for our<br />

products, while upholding the highest standards of quality,<br />

integrity and customer-centricity.<br />

One of our most visible customer-centric achievements in<br />

<strong>2008</strong>-09 comprised the creation of light-weight container<br />

glass bottles. This was in view of our customers’ need to lower<br />

cost structures in an economy marked by declining consumer<br />

spends. Operational excellence lowered glass intake per tonne<br />

of bottles. A lighter and thinner bottle also offered our<br />

customers several advantages: one, optimum space utilisation<br />

during transportation; two, low transportation and handling<br />

costs; three, better asset and capacity utilisation through<br />

faster bottling operations, reflected in increased frequency of<br />

bottles filled per minute; four, lower wastage and bottle<br />

breakages owing to higher glass strength; and five,<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 13

accelerated product roll-out to meet customer deadlines. Over<br />

2009-10, a complete switchover to the state-of-the-art NNPB<br />

(narrow-neck-press-and-blow) technology will enable us to<br />

further reduce glass consumption per tonne of bottles,<br />

strengthening customer relationships.<br />

Conscientious corporate<br />

As we worked towards our goals, we relied on our core<br />

strengths – people, operational excellence, innovation and<br />

integrity – to respond to the rapidly evolving market realities.<br />

Our growth and future prospects depend on customer loyalty,<br />

which we have earned through hard work in the past and<br />

which will continue to determine our road ahead.<br />

In a significant development in <strong>2008</strong>-09, which will have a<br />

substantial bearing in 2009-10, the <strong>Glass</strong> Manufacturers<br />

Association of India, led by HNG, advocated greater consumer<br />

awareness by stamping the glass bottle’s year of manufacture<br />

on the bottle itself, quite similar to information labels stuck<br />

around bottles. This social initiative in terms of strengthening<br />

health and hygiene standards will have a two-fold impact on<br />

our business:<br />

One, enhance cullet (broken glass) availability through<br />

improved old bottle recycling. This initiative will enable<br />

conscious consumers to dispose of old bottles for<br />

recycling, enhancing overall critical raw material<br />

availability.<br />

Two, shorten the bottle reusability cycle substantially<br />

from around 25 times now, growing product demand and<br />

accelerating profitable business growth.<br />

Outlook<br />

To retain market leadership, we will continue to cultivate<br />

a culture that does not fear failure. In 2009-10, we are<br />

undertaking container glass capacity increments through a<br />

sizeable expansion in installed capacity.<br />

We invite you to be a part of a Company that is not only<br />

India’s largest, but is strategising to emerge as one of the<br />

world’s largest container glass packaging companies.<br />

Sincerely<br />

CK Somany<br />

Chairman<br />

14 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Our growth and<br />

future prospects<br />

depend on customer<br />

loyalty, which we<br />

have earned through<br />

hard work in the past<br />

and which will<br />

continue to determine<br />

our road ahead.<br />

15

LOCALLY<br />

MANUFACTURED<br />

BOTTLES.<br />

GLOBALLY<br />

BENCHMARKED<br />

STANDARDS.<br />

Customer<br />

The Global Green Company Limited (GGCL) is a part of the<br />

diversified USD 3 billion Avantha Group. GGCL possesses<br />

multiple plants across India and Europe to process gherkins.<br />

Customer objectives<br />

GGCL desired to evolve its product sourcing with the following<br />

objectives in mind: indigenise jars complying with<br />

international standards on the one hand and reduce costs on<br />

the other.<br />

Our response<br />

HNG designed and developed customised jars in line with the<br />

customer’s needs. It imported new hot-end coating<br />

equipment for the first time in India and revamped its coldend<br />

coating technology. These proactive investments<br />

translated into a number of benefits: a compliance with<br />

international bottling standards and requirements, coat layer<br />

permanence, enhanced scratch resistance, increased bottle<br />

strength and improved bottle surface lubrication.<br />

Customer benefits<br />

The improved product immediately translated into a superior<br />

performance at the customer’s packaging line in the following<br />

ways:<br />

Accelerated production by nearly 40 jars per minute<br />

Enhanced packing line efficiency by over 22 percent<br />

Reduced wastages/bottle loss from 1 percent to less than<br />

0.5 percent<br />

Customer satisfaction<br />

“The gherkin jars developed by HNG, helped us achieve<br />

the desired objectives — the quality of jars continues to meet<br />

international standards and line performance has seen a<br />

substantial improvement. We are eager to maintain a steady<br />

long-term relationship with HNG, not only for this line<br />

of products, but other SKUs as well!” Santosh Nair,<br />

16 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Vice President, Procurement, Global Green Company Limited*<br />

* Global Green is a multinational food company, engaged in<br />

the growth, manufacture, distribution and sale of pickled<br />

cucumbers (gherkins, cornichons, pickles and relish), sweetcorn,<br />

silverskin onions, peppers (jalapeño and paprika),<br />

cherries, capers and mixed vegetables.<br />

HNG imported new hot-end<br />

coating equipment for the<br />

first time<br />

in India<br />

and revamped its cold-end<br />

coating technology.<br />

17

ENHANCING<br />

AESTHETICS.<br />

OPTIMISING<br />

COSTS.<br />

Customer<br />

The Coimbatore-based Shiva Distilleries Limited is engaged in the production<br />

of a range of India Made Foreign Liquor with an annual production capacity of<br />

6.6 million cases, leading to a Rs. 405-cr turnover.<br />

18

Customer objectives<br />

Some time ago, a company approached HNG with the<br />

following needs:<br />

To graduate to a fresh bottle design, optimise line<br />

speeds, improve productivity and reduce marketing time<br />

To strengthen brand equity in a competitive marketplace<br />

Our response<br />

HNG responded with the following initiatives: it designed a<br />

180 ml bottle with its principal axis set to enhance bottle<br />

compactness, improved glass distribution, enhanced tensile<br />

strength, reduced breakages and augmented line efficiencies.<br />

Customer benefits<br />

Our customer enjoyed the following benefits:<br />

Improved overall line efficiencies<br />

Reduced wastages<br />

Aesthetically differentiated product, leading to a<br />

competitive edge<br />

Customer speak<br />

“The 180 ml bottle developed by HNG helped us meet our<br />

desired objectives. The breakage level for this bottle vis-à-vis a<br />

standard bottle reduced substantially with an overall<br />

improvement in line performance. We look forward to<br />

working on more designs with HNG to improve our brand<br />

equity and achieve cost optimisation benefits.<br />

Dr. S.V. Balasubramaniam, Chairman, Bannari Amman<br />

Group*<br />

*Shiva Distilleries Limited, a part of the Bannari Amman<br />

Group, was established in 1983 at Coimbatore, Tamil Nadu.<br />

The company is engaged in the production of a range of<br />

Indian Made Foreign Liquor (IMFL) and possesses the largest<br />

market share in Tamil Nadu.<br />

HNG designed a 180 ml bottle with<br />

its principal axis set to<br />

enhance bottle<br />

compactness,<br />

improved glass distribution,<br />

enhanced tensile strength etc.<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 19

MANAGEMENT<br />

STATEMENT<br />

The Management of <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong><br />

& Industries Limited discusses how the Company’s<br />

customer focus helped navigate it through<br />

the <strong>2008</strong>-09 slowdown as well as the road ahead.<br />

At HNG, we reported a successful<br />

<strong>2008</strong>-09 in an environment of<br />

financial and industrial uncertainties,<br />

which makes our performance all the<br />

more creditable.<br />

At HNG, we believe that it is customer-centricity<br />

that will align us with evolving market<br />

requirements leading to proactive product<br />

development; we believe that it is customercentricity<br />

that will protect our existing relationships<br />

leading to the prospect of a stable and sustainable<br />

income; we believe that it is customer-centricity<br />

that will enable us to grow our topline and cover<br />

our fixed costs more effectively, leading to<br />

enhanced margins and profits. As a result, we see<br />

customer-centricity as the basic driver of our<br />

leadership position within India’s container glass<br />

industry.<br />

We see<br />

customercentricity<br />

as the basic driver of<br />

our leadership position<br />

within India’s container<br />

glass industry.<br />

During the last financial year, the biggest challenge<br />

was a decline in the offtake of products<br />

manufactured by our customers leading to a<br />

greater need for them to reduce costs. As a<br />

responsive organisation, we addressed this reality<br />

directly through the development of the narrowneck-press-and-blow-technology<br />

(NNPB) for<br />

container glass bottles. This advanced container<br />

glass manufacturing technology helped rationalise<br />

bottle weight from 15 percent to 35 percent<br />

without in any way compromising glass<br />

consistency and tensile strength on the one hand.<br />

Much of this benefit was passed on to the<br />

customer. So we would like to state with<br />

20

satisfaction that in a year when the market environment<br />

turned challenging for most companies, HNG helped its<br />

customer emerge more competitive.<br />

In 2007-08, we merged ACE <strong>Glass</strong> Containers Limited with our<br />

Company, whose full benefit was reflected in the Company’s<br />

working. ACE <strong>Glass</strong> Containers Limited was the second largest<br />

Indian container glass manufacturer after us with a capacity of<br />

0.37 million TPA across Rishikesh, Puducherry and Nashik. The<br />

merger widened our margin-accretive product portfolio,<br />

enhanced our economies-of-scale and strengthened our<br />

customer service flexibility. This immediately translated into<br />

enhanced visibility. For instance, our Company was ranked<br />

307th among the top 1,000 companies – ranked on the basis<br />

of net sales and other financial parameters – by Business<br />

Standard in March 2009, the only company from our industry<br />

to figure in the list. Our Company was also rated the best<br />

Indian company in the ‘<strong>Glass</strong> & Ceramics’ category by Dun &<br />

Bradstreet, strengthening our brand.<br />

packaging demand will drive the demand for container glass<br />

over plastic alternatives.<br />

We are passing through a period of economic uncertainty. In<br />

this environment, there will be some local or global acquisition<br />

opportunities around an attractive price-value. We must<br />

apprise our stakeholders that we will address those<br />

opportunities with adequate prudence and entrepreneurial<br />

alertness but only after we are adequately convinced that the<br />

addition will enhance our overall organisational value.<br />

We also expect to complete the implementation of the NNPB<br />

technology across all our manufacturing units. The total<br />

implementation of SAP across our organisation will enhance<br />

accurate information availability and reinforce our customercentricity<br />

and market-responsiveness.<br />

As a proactive organisation, we have already commenced the<br />

seed marketing of imported float glass under guided technical<br />

specifications through our existing distributor network in<br />

Gujarat, Rajasthan and Madhya Pradesh. We expect to widen<br />

our presence across the rest of western and northern India as<br />

well as exports.<br />

Container glass enjoys its own importance in the packaging<br />

industry, despite the rapid development of packaging<br />

alternatives for an important reason: established environment<br />

friendliness reflected in its biodegradability and recyclability.<br />

We see an attractive scope in our business on account of the<br />

fact that 10–12 percent of all food and beverages are packed<br />

in glass containers in India, whereas the corresponding figure<br />

is 40–50 percent across developed countries. Besides, the<br />

growing awareness on account of benign and hygienic<br />

21

CORPORATE<br />

RESPONSIBILITY<br />

AND SUSTAINABILITY<br />

AT HNG<br />

22 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Our true wealth at HNG is not what is reflected in the<br />

size of our bottomline but in the respect that we evoke<br />

among the stakeholders and communities associated<br />

with us. This respect is derived from the broad<br />

responsibility of our actions, which makes our business<br />

truly sustainable for the benefit of all those associated<br />

with us. The various initiatives to do so comprise the<br />

following: grow the HNG brand; expand the product<br />

portfolio; improve efficiency and effectiveness; attract,<br />

develop and retain a talented workforce and align our<br />

operating model with the best environmental<br />

standards.<br />

For each of these priorities, we have developed corresponding focus<br />

areas and aligned those against stakeholder expectations. We are also<br />

working to embed sustainability into our business processes through<br />

various initiatives. We have designated managers – for internal and<br />

external CSR engagement – who work with our subject matter experts to<br />

track progress against our targets and oversee data-gathering process for<br />

reporting purposes. These managers also work closely with our key<br />

external stakeholders to ensure that our efforts are in line with<br />

expectations. We ensure that all our employees complete a training in<br />

ethics; we also ensure that our sales and management representatives<br />

undergo competition law and industry codes training as a part of our<br />

CSR endeavour.<br />

We have focused on four CSR areas – critical to our business and key for<br />

our stakeholders – comprising the following:<br />

Water stewardship<br />

Sustainable packaging and recycling<br />

Energy conservation and climate change<br />

Productivity gains and improvements<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 23

DIRECTORS'<br />

REPORT<br />

We are delighted to present the Annual <strong>Report</strong> together with the audited accounts of our business and operations for the<br />

year ended March 31, 2009.<br />

Financial Highlights<br />

(Rs. in lacs)<br />

Year ended March 31, 2009 Year ended March 31, <strong>2008</strong><br />

Gross sales (including excise duty) 1,43,860 1,14,834<br />

Profit before interest, depreciation and tax 23,591 21,467<br />

Interest and finance charges 4,345 2,347<br />

Profit before depreciation and tax 19,246 19,120<br />

Depreciation 7,474 7,013<br />

Profit before Tax 11,772 12,107<br />

Provision for Tax 997 (3,927)<br />

Profit after Tax 10,775 16,034<br />

Balance brought forward from previous year 1,072 706<br />

Amount available for appropriation 11,847 16,740<br />

Appropriation<br />

General Reserve 7,000 14,850<br />

Debenture Redemption Reserve 1,250 –<br />

Proposed Dividend 873 699<br />

Tax on Dividend 148 9,271 119 15,668<br />

Balance carried forward to the next year 2,575 1,072<br />

24 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Review<br />

There was a revenue growth of 25% during the financial year<br />

<strong>2008</strong>-09 as against 21% in the last year. PBIT recorded a growth<br />

of 11.51% despite of there being global economic meltdown<br />

and general recession. This is attributable to efficient cost<br />

management and prudent operating practices.<br />

Dividend<br />

In view of your Company’s satisfactory performance, the<br />

Directors recommend a dividend of 50% i.e. Rs. 5 per equity<br />

share for the financial year ended March 31, 2009.<br />

Outlook<br />

India continues to be one of the fastest growing economies of<br />

the world. A number of factors like growing disposable income<br />

coupled with change in the demographic pattern of the<br />

population will help in generating more demand for packaged<br />

goods, hence creating better opportunities for the Company.<br />

Further, the growth in beer, pharma, food, liquor and other<br />

high-end sectors will drive revenue growth and translate into<br />

profitability. Your Company is well-equipped to grow and<br />

prosper with the opportunities associated with expanding<br />

markets. However, your Company faces substitution threats<br />

from PET bottles and other such alternatives.<br />

Directors<br />

The Board wishes to place on record its sincere appreciation and<br />

gratitude for the unstinted support and guidance received from<br />

Supriya Gupta who has left for his heavenly abode.<br />

During the year under review, the Board appointed Shri. R. R.<br />

Soni as Executive Director w.e.f. October 27, <strong>2008</strong>.<br />

Shri. Kishore Bhimani, Shri. Sujit Bhattacharya and Shri. S. K.<br />

Bangur, retire by rotation and being eligible, offer themselves<br />

for re-appointment.<br />

Trust Shares<br />

Pursuant to amalgamation of Ace <strong>Glass</strong> Containers Limited<br />

with the Company, 2141448 shares and 1368872 shares were<br />

issued to HNG Trust and Ace Trust respectively. In terms of<br />

an undertaking given to the Bombay Stock Exchange, the<br />

Company is required to make disclosures pertaining to utilisation<br />

of proceeds of shares allotted to the said Trusts until they are<br />

extinguished. During the financial year ended on March 31,<br />

2009, no shares lying in the account of the Trusts were<br />

disposed off.<br />

Fixed Deposits<br />

The Company did not accept any deposits from the public during<br />

the financial year <strong>2008</strong>-09.<br />

Consolidated Financial Statements<br />

Consolidated Financial Statements are prepared in accordance<br />

with Accounting Standard 21 read with Accounting Standard<br />

23, issued by the ICAI and forms part of this Annual <strong>Report</strong>.<br />

Auditors’ <strong>Report</strong><br />

The Auditors’ <strong>Report</strong> read with notes to accounts is selfexplanatory.<br />

Regarding Auditor’s observation at Point No. 2 of<br />

their report that no approval from the Central Government was<br />

obtained for carrying out transactions with M/s Mould<br />

Equipment, a firm in which the Directors of the Company are<br />

indirectly interested, it is clarified that the Company is already in<br />

process of obtaining the approval of the Central Government.<br />

Listing on the Stock Exchanges<br />

During the year, the Company’s shares were listed at the<br />

<strong>National</strong> Stock Exchange (NSE). Besides, the Company’s shares<br />

continue to be listed at the Bombay and Calcutta stock<br />

exchanges respectively.<br />

The annual listing fees for the financial year 2009-10 have been<br />

paid to all these exchanges.<br />

Auditors<br />

M/s Lodha & Company, Chartered Accountants, retire at the<br />

conclusion of the ensuing Annual General Meeting and have<br />

confirmed their eligibility and willingness to accept the office of<br />

the Statutory Auditors for the financial year 2009-10, if reappointed.<br />

M/s Singhi & Co., Chartered Accountants, retire at the<br />

conclusion of the ensuing Annual General Meeting and have<br />

confirmed their eligibility and willingness to accept the office of<br />

the Branch Auditors for the financial year 2009-10, if reappointed.<br />

Directors’ Responsibility Statement pursuant to<br />

Section 217(2AA) of the Companies Act, 1956<br />

The Directors hereby confirm that:<br />

i) in the preparation of the Annual Accounts for the financial<br />

year <strong>2008</strong>-09, the applicable Accounting Standards have been<br />

followed and that there are no material departures;<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 25

ii) they have selected such accounting policies and applied them<br />

consistently and made judgments and estimates that are<br />

reasonable and prudent so as to give a true and fair view of the<br />

state of affairs of the Company and of the profit of the Company<br />

for the financial year ended on March 31, 2009;<br />

iii) they have taken proper and sufficient care for the<br />

maintenance of adequate accounting records in accordance<br />

with the provisions of the Companies Act, 1956 for safeguarding<br />

the assets of the Company and for preventing and detecting<br />

fraud and other irregularities;<br />

iv) they have prepared the Annual Accounts on a ‘going concern’<br />

basis.<br />

Corporate Governance<br />

The report on Corporate Governance along with the Certificate<br />

of the Statutory Auditors, M/s. Lodha & Co., confirming the<br />

compliance of conditions of Corporate Governance as stipulated<br />

under Clause 49 of the Listing Agreement forms part of this<br />

Annual <strong>Report</strong>.<br />

Subsidiary companies<br />

Particulars relating to subsidiary companies as required under<br />

Section 212 of the Companies Act, 1956 are annexed hereto<br />

and forms part of this Annual <strong>Report</strong>. The Consolidated Financial<br />

Statements include the financial information of its subsidiaries.<br />

Exports<br />

During the year, direct export turnover of the Company was<br />

Rs. 5,773 lacs, compared to Rs. 4,032 lacs achieved during the<br />

preceding financial year. Continuous efforts are ongoing to tap<br />

the export market for which there exists great potential.<br />

Personnel and Industrial relations<br />

Your Company is strengthening and developing human<br />

resources and systems to improve overall efficiency and<br />

motivation. The principal initiatives undertaken by the Company<br />

comprised skill development and acquisition programmes and<br />

yoga classes, to name a few. Industrial relations continued to<br />

remain cordial during the year.<br />

217(2A) of the Companies Act, 1956 and rules framed<br />

thereunder, forms part of this Annual <strong>Report</strong>.<br />

Conservation of energy, technology absorption<br />

and foreign exchange earning and outgo<br />

The statement containing the required particulars under Section<br />

217(1) (e) of the Companies Act, 1956, read with the Companies<br />

(Disclosure of Particulars in the <strong>Report</strong> of Board of Directors)<br />

Rules, 1988 are annexed hereto and forms part of this report.<br />

Corporate Social Responsibility<br />

Your Company endeavours blending optimally its business<br />

senses with corporate care and instill an utmost commitment to<br />

social responsibilities either directly or through its affiliates.<br />

Your Company has established at Bahadurgarh, the Bal Bharti<br />

School where not only the children of the Company’s employees<br />

are benefited but also those residing in peripheral areas of the<br />

Bahadurgarh Plant. It has also promoted healthcare benefits by<br />

contributing to corpus funds of hospitals and setting up special<br />

programs viz. eye testing campaigns, heart treatment for<br />

children etc. Parks and gardens such as the McPherson Square,<br />

now called Maharana Pratap Udyan in South Kolkata are<br />

continuing to be maintained by the Company to provide an<br />

environment where citizens can relax and take in fresh air amidst<br />

the city’s chaos.<br />

Social responsibility and social accounting remain at the core of<br />

your Company’s business model.<br />

Acknowledgments<br />

The Directors wish to express their sincere appreciation for the<br />

continued support and co-operation received from the financial<br />

institutions, banks, government authorities, customers,<br />

shareholders and stakeholders. The Directors also place on<br />

record their deep appreciation for the valuable contribution of<br />

its employees at all levels and look forward to their continued cooperation<br />

in realisation of the corporate goals in the years<br />

ahead.<br />

For and on behalf of the Board<br />

Statement of employees<br />

Statement of particulars of employees as required under Section<br />

Kolkata<br />

June 20, 2009<br />

C. K. Somany<br />

Chairman<br />

26 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

ANNEXURE TO<br />

THE DIRECTORS’<br />

REPORT<br />

Information pursuant to Section 217(1)(e) read with Companies<br />

(Disclosure of Particulars in the <strong>Report</strong> of Board of Directors)<br />

Rules, 1988 and forming a part of the Directors’ <strong>Report</strong> for the<br />

year ended March 31, 2009.<br />

I. Conservation of Energy<br />

Energy conservation measures taken<br />

1. Increased power factor from 0.97 to 0.99 by installing the<br />

Capacitors.<br />

2. Energy savings by routing dry air to Furnaces.<br />

3. Side Insulation done to reduce LPG consumption.<br />

4. Construction of stand by Thickner in Sand Plant for water<br />

conservation by recycling the used water.<br />

5. Replacement of 250 watt High Power sodium vapor Lamp<br />

with 108 watt CFL Lamp.<br />

6. Your Company contemplates making such investments as and<br />

when suitable to reduce energy consumption. The material<br />

impact of such measures on the production cost therefore<br />

cannot be quantified at this stage.<br />

FORM - A<br />

Disclosure of particulars with respect to Conservation of Energy<br />

Particulars Unit Year ended <strong>2008</strong>-09 Year ended 2007-08<br />

A. Power and fuel consumption<br />

1. Electricity<br />

a) Purchased unit 000 KWH 1,75,513 1,52,102<br />

Total amount Rs. in lacs 6,638.21 5,424.10<br />

Average rate/unit Rs. 3.78 3.57<br />

b) Own generation<br />

Through diesel/H.P.S oil / Furnace oil<br />

By generator unit 000 KWH 27,059 17,531<br />

Units per litre of oil 3.91 4.31<br />

Average rate/unit Rs. 6.58 5.58<br />

c) Own generation (through L.D.O.)<br />

By generator unit 000 KWH – 15,490<br />

Units per litre of oil – 3.73<br />

Average rate/unit Rs. – 4.81<br />

d) Own generation (through LNG)<br />

By generator unit KWH 5,06,64,690 4,25,44,484<br />

Units per litre of MMBTU of LNG 103.72 106.64<br />

Average rate/unit Rs. 2.88 2.22<br />

2. F-oil /RFO<br />

Quantity KL 76,409 51,809<br />

Total amount Rs. in lacs 19,199.43 9,856.65<br />

Average rate/unit Rs. 25,127 19,025<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 27

Particulars Unit Year ended <strong>2008</strong>-09 Year ended 2007-08<br />

3. L.N.G.<br />

Quantity MMBTU 1,20,365 17,12,334<br />

Total amount Rs. in lacs 3,591.89 4,052.35<br />

Average rate/unit Rs. 298 234<br />

4. i) L.P.G.<br />

Quantity MT 9,473 8,421<br />

Total amount Rs. in lacs 3,906.90 2,998.09<br />

Average rate/unit Rs. 41,242 35,602<br />

ii) L.D.O.<br />

Quantity KL – 7.54<br />

Total amount Rs. lacs – 2.29<br />

Average rate/unit Rs. – 30,348<br />

iii) H.S.D.<br />

Quantity KL 127 1,477<br />

Total amount Rs. in lacs 41.79 425.29<br />

Average rate/unit Rs. 32,964 28,801<br />

iv) H.P.S. oil<br />

Quantity KL 116 20,882<br />

Total amount Rs. lacs 33.83 4,439.64<br />

Average rate/unit Rs. 29,108 21,261<br />

B. Consumption per unit of production<br />

<strong>Glass</strong> containers and tumblers MT 7,67,971 6,91,359<br />

Electricity KWH 330 329<br />

L.P.G. KG 12.34 12.18<br />

L.D.O. LTR 0.00 0.01<br />

F-Oil/ RFO / Equv.Oil LTR 99.50 74.94<br />

LNG MMBTU 1.57 2.48<br />

H.S.D LTR 0.17 2.14<br />

H.P.S. LTR 0.15 30.20<br />

Notes:<br />

1. The Company manufactures only container glass.<br />

2. Variation in consumption of power and fuel is attributable to enhanced production capacity.<br />

28 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

FORM B<br />

II. Disclosure of particulars with respect to<br />

technology absorption<br />

A. Research and Development (R&D)<br />

Research & Development continues to remain a focal point in<br />

our efforts towards improvement. Energy consumption and<br />

absorption have been principal areas of action. As the Company<br />

does not have any exclusive R&D facilities, it carries out its<br />

developmental activities for process innovation and product<br />

development as a part of its business process.<br />

Benefits Derived<br />

As a result of Company’s continuous growth in Research &<br />

Development, there had been reduction in cost of production.<br />

Future plans of action<br />

The Global Economic scenario makes the year ahead<br />

challenging. The Company is relying on its innovative strengths<br />

in the face of challenges to create strong differentiators for its<br />

customers.<br />

Your Company will continue to invest in R & D activities to<br />

enhance productivity and operational efficiency to create savings<br />

for its customers and increase its profitability.<br />

Expenditure on R&D<br />

During the year, expenditure incurred on Research and<br />

Development are as enumerated below:<br />

(Rs. in lacs)<br />

<strong>2008</strong>-09 2007-08<br />

a. Capital – –<br />

b. Recurring 38.26 7.91<br />

c. Total 38.26 7.91<br />

d. Total R & D expenditure as<br />

a percentage of the turnover Insignificant Insignificant<br />

B. Technology Absorption, Adaptation and Innovation<br />

Your Company continues to focus on daily innovations in shape<br />

and quality of its product and in energy saving devices. To name<br />

a few, the initiatives taken by the Company and the benefits<br />

derived therefrom in the year under review are:<br />

Two IS Machines which were replaced with latest AIS triple<br />

gob 12 section Machine, optimised Plant performance.<br />

Two New Vacuum Pumps which were installed improved<br />

quality and productivity.<br />

Automatic Moisture Measurement System installed in batch<br />

houses for measurement and correction of silica sand moisture.<br />

On line Oxygen Measurement and Automatic FO/ Combustion<br />

Air Ratio Correction System from STG, were installed to conserve<br />

Furnace oil consumed.<br />

Developed its top geared CAD/CAM facilities to design bottles<br />

in various shapes customised to the requirements of<br />

pharmaceutical, cosmetic, processed food, liquor and soft drinks<br />

industries.<br />

Modern ERP application software like SAP is being installed to<br />

reduce cost and minimise disruptions in the Company’s<br />

operations.<br />

III. Foreign Exchange Earnings and Outgo<br />

Your Company has taken initiatives to strengthen its strategic<br />

presence globally by constantly accessing new sale avenues in<br />

overseas markets of Bangladesh, USA, South Africa, Kenya,<br />

Australia, Hong Kong, to name a few. During the financial year<br />

<strong>2008</strong>-09 the Company had recorded an increase in export by<br />

Rs. 17.41 Crores. The foreign exchange earnings and outgo of<br />

the Company is detailed below<br />

(Rs. in lacs)<br />

Current year Previous year<br />

(i) Earnings in foreign exchange 5,772.77 4,032.46<br />

(excluding indirect exports of<br />

Rs. 6,538.14 lacs; previous year<br />

Rs. 3,009.80 lacs and exports<br />

to Nepal Rs. 1,419.95 lacs;<br />

previous year Rs. 169.19 lacs)<br />

(ii) Expenditure incurred in<br />

foreign exchange<br />

1. Raw materials 6,489.33 5,698.52<br />

2. Capital goods 5,131.73 1,939.26<br />

3. Components, spare parts 4,894.01 1,497.50<br />

and repairs<br />

4. Other expenses 384.84 272.24<br />

Kolkata<br />

June 20, 2009<br />

For and on behalf of the Board<br />

C. K. Somany<br />

Chairman<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 29

The Board of Directors, at its meeting held on October 31, 2005 had appointed Mr. Sanjay Somany (Managing Director), Mr. Mukul<br />

Somany (Joint Managing Director) as Chief Executive Officers (CEO) of the Company. Further, w.e.f. February 20, 2009 Mr. N. Khanna<br />

was appointed as the Senior Vice President (Finance) & Chief Financial Officer (CFO) of the Company.<br />

CEO & CFO Certification<br />

We, Sanjay Somany, Managing Director; Mukul Somany, Joint Managing Director and Nirmal Khanna, Sr. Vice President (Finance)<br />

and Chief Financial Officer, responsible for the finance function certify that-<br />

(a) We have reviewed the Financial Statements and the Cash Flow Statement for the year ended March 31, 2009 and to the best of<br />

our knowledge and belief:<br />

(i) these statements do not contain any materially untrue statements or omit any material fact or contain statements that might<br />

be misleading;<br />

(ii) these statements together present a true and fair view of the Company’s affairs and are in compliance with existing Accounting<br />

Standards, applicable laws and regulations.<br />

(b) To the best of our knowledge and belief, no transactions entered into by the Company during the financial year ended March<br />

31, 2009 are fraudulent, illegal or violating the Company’s code of conduct.<br />

(c) We accept responsibility for establishing and maintaining internal controls for financial reporting and we have evaluated the<br />

effectiveness of internal control systems of the Company pertaining to financial reporting. Deficiencies in the design or operation of<br />

such internal controls, if any, of which we are aware have been disclosed to the Auditors and the Audit Committee and steps have<br />

been taken to rectify those deficiencies.<br />

(d) We have indicated to the Auditors and the Audit Committee:<br />

(i) That there has not been any significant change in internal control over financial reporting during the year under review;<br />

(ii) That there has not been any significant change in accounting policies during the financial year <strong>2008</strong>-09 requiring disclosure<br />

in the notes to the financial statements; and<br />

(iii) That during the year under review, we are not aware of any instance of significant fraud and involvement therein of the<br />

management or any employee having a significant role in the Company’s internal control system over financial reporting.<br />

Nirmal Khanna Mukul Somany Sanjay Somany<br />

Senior Vice President (Finance) Joint Managing Director Managing Director<br />

Chief Financial Officer (Chief Executive Officer) (Chief Executive Officer)<br />

Kolkata<br />

June 20, 2009<br />

30 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Particulars of Employees in Terms of Section<br />

217(2A) of The Companies Act, 1956<br />

Sl. Age Qualification Date of Designation Gross Last Employment<br />

No. Name (Years) & Experience Appointment (Nature of Remuneration held (Designation)<br />

in years Duties) (Rs.)<br />

1 Mr. Sanjay Somany 50 B. Com. Dip. 01.10.2005 Managing 1,35,01,378 <strong>Glass</strong> Equipment<br />

In Diesel Engg. Director (India) Ltd.<br />

29 years (To Manage the (Managing Director)<br />

affairs of the<br />

Company on day<br />

to day basis)<br />

2 Mr. Mukul Somany 43 B. Com (Hons.) 01.10.2005 Jt Managing 1,37,73,534 None<br />

22years<br />

Director (To manage<br />

the affairs of the<br />

Company on day<br />

to day basis)<br />

3 Mr. R. R. Soni 50 B.Com (Hons) 27.10.<strong>2008</strong> Executive Director 26,33,585 Grasim Industries Ltd.<br />

F.C.A.<br />

(Sr. Vice President)<br />

27 years<br />

Notes:<br />

1. Remuneration includes Salary, Commission, and contribution to P.F. Gratuity and other facilities.<br />

2. Mr.C.K.Somany is related to both Mr.Sanjay Somany and Mr.Mukul Somany and both of them are also related to each other.<br />

3. Mr. R. R. Soni who was designated as Sr. President & Chief Financial Officer, was appointed as the Executive Director w.e.f. from<br />

October 27, <strong>2008</strong>.<br />

4. All appointments of the above employees are contractual.<br />

For and on behalf of the Board<br />

Kolkata<br />

June 20, 2009<br />

C. K. Somany<br />

Chairman<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 31

MANAGEMENT<br />

DISCUSSION<br />

AND ANALYSIS<br />

Indian packaging industry<br />

Indian packaging industry is estimated at US$ 14 billion and<br />

growing at a rate of more than 15% annually. These figures<br />

indicate a change in the industrial and consumer set up.<br />

World glass container per capita consumption (Kg.)<br />

The Indian fascination for rigid packaging remains intact.<br />

It is estimated that more than 80% of the total packaging in<br />

India constitutes rigid packaging, the oldest and the most<br />

conventional form of packaging. The remaining 20% comprises<br />

flexible packaging.<br />

India's per capita packaging consumption is less than US$ 15<br />

against world wide average of nearly US$ 100.<br />

The large and growing Indian middle class, along with the<br />

growth in organised retail in the country, are driving demand in<br />

the packaging industry. Another factor, providing substantial<br />

stimulus to the packaging industry, is the rapid growth of<br />

exports, requiring superior packaging standards for the<br />

international market. [Source: IBEF]<br />

Container glass industry<br />

Overview<br />

The Indian container glass market is estimated at 320 million<br />

euro accounting for 12% of the packaging industry. The market<br />

for container glass has been growing at a rate of 8% over the<br />

last five years. The demand in the container glass industry is<br />

driven by a growth in end-user segment like processed foods<br />

(FMCG), beverages, beer, liquor, pharmaceutical and retail.<br />

Advantage glass<br />

Environment friendly<br />

Natural product<br />

Lowest pollution (total life cycle) – emissions at various recycling<br />

levels are lower in glass compared to aluminium and PET<br />

Light and convenient<br />

Inertness to heat<br />

Inertness to ultra-violet rays<br />

Visibility of product<br />

Lowest cost (per life cycle)<br />

Longer re-cyclability<br />

Versatility of design<br />

32 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

The recycling loop<br />

<strong>Glass</strong> recycling<br />

Save energy in manufacturing for each tonne of cullet<br />

(recyclable glass) used, energy consumption is reduced by 2.5%<br />

Reduces emissions (including CO 2 )<br />

Preserves raw materials and landscapes<br />

Each tonne of cullet used means<br />

1 tonne less of land fill<br />

Over 1 tonne less of natural resources depletion<br />

Growth drivers<br />

Growing food processing industry<br />

The Indian food market, according to the 'India Food <strong>Report</strong><br />

<strong>2008</strong>', is estimated at over US$ 182 billion, and accounts for<br />

about two thirds of the total Indian retail market. Further,<br />

according to consultancy firm McKinsey, the retail food sector in<br />

India, is likely to grow from around US$ 70 billion in <strong>2008</strong> to<br />

US$ 150 billion by 2025, accounting for a large chunk of the<br />

world food industry. This would grow from US$ 175 billion to<br />

US$ 400 billion by 2025, driving the demand for packaging<br />

alternatives, especially glass containers. [Source: IBEF]<br />

Increasing rural consumption<br />

The FMCG industry in India was worth around US$ 16. 03 billion<br />

as on August <strong>2008</strong>, and the rural market accounted for a robust<br />

57% share of the total FMCG market in India, overtaking the<br />

urban market (43%). The rural per capita consumption of<br />

FMCGs would equal to current urban levels by 2017. Industry<br />

analysts also expect the FMCG sector in rural areas to grow 40%<br />

against 25% in urban. [Source: IBEF]<br />

Growing beer consumption<br />

The Indian beer industry has been witnessing steady growth of<br />

7-9% per year over the last 10 years. The rate of growth<br />

remained steady in recent years, with volumes passing from<br />

mere 70 million cases in 2002 to 155 million cases in <strong>2008</strong>. The<br />

Indian beer market is dominated by strong beers (>5% alcohol<br />

by volume), which accounts for 70% of the total beer industry.<br />

The premium beer market is a mere 5% of the total but this<br />

segment is rapidly expanding, touching a growth rate between<br />

35-40%. As a result, the demand for container bottle will surge.<br />

[Source: All India Brewers’ Association]<br />

Outlook<br />

The Indian economy is projected to achieve a sustainable GDP<br />

growth of around 6.5% whereas the annual growth of the<br />

packaging industry is expected to double to around 20-25%.<br />

The container glass industry, which grew at a compounded<br />

annual growth rate (CAGR) of 8% over five years, is expected to<br />

grow over 8% in the future. [Source: IBEF]<br />

The demand for container glass will grow on account of the<br />

forecasts that packaging material for beverages will mainly be of<br />

glass, especially for high quality packaging. <strong>Glass</strong> container plants<br />

will improve technology levels to produce thin and light-weighted<br />

bottles. Beer bottles should be made in more specifications,<br />

meeting the demands of customers at various levels. Based on<br />

the analysis of the current market demands at home and abroad,<br />

tubular vials for antibiotic use will increase gradually, although<br />

injection vials will still remain in the greatest demand.<br />

Business driver – 1<br />

Raw material resource management<br />

At HNG, corporate sustainability is derived from an ability to<br />

steady raw material cost structures across various market cycles<br />

either by tying up with new vendors or through acquiring lease<br />

rights. The Company’s principal raw materials comprises sand<br />

(quartz), limestone (calcite), cullet (broken recyclable glass), soda<br />

ash, dolomite and feldspar. Soda ash prices constituted 49<br />

percent of the total raw material cost (value wise), followed by<br />

cullet (25 percent), sand (12 percent) and other raw material<br />

(14 percent). The Company’s priority in this regard continued<br />

an emphasis on modest raw material cost combined with<br />

anytime availability leading to efficient, uninterrupted<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 33

production at all times.<br />

Highlights, <strong>2008</strong>-09<br />

Leveraged a decades-rich relationship with soda ash vendors<br />

like Magadi (East Africa), Tata Chemicals, Gujarat Heavy<br />

Chemicals and Nirma leading to stable supplies<br />

Widened supply sources through the enlistment of a chemical<br />

soda ash supplier from Iran<br />

Imported around 50 percent of its annual soda ash<br />

requirement of 100,000 tons<br />

Hedged against unforeseen supply disruptions through an<br />

average 20 days inventory for raw materials available in vicinity<br />

of 250 kms and 30 days inventory for other critical raw materials<br />

Reinforced the price-value proposition through relatively stable<br />

raw material sourcing despite price revisions<br />

Used natural soda ash over chemical soda ash with a<br />

corresponding price advantage of around 10 percent<br />

Road ahead<br />

To increase quantity of imported Soda Ash from 50% to 70%<br />

Proposed entry into long-term (annual) contracts with vendors<br />

leading to win-win situations<br />

Proposed organised cullet collection from vendors, improving<br />

availability<br />

Proposed optimisation of logistic costs through silica<br />

procurement from captive mines located within 250 km of each<br />

plant (Prospecting Licenses applied for)<br />

Business driver – 2<br />

Manufacturing and operations<br />

At HNG, our competitive edge is derived from an ability to<br />

service the growing needs of customers. In turn, this advantage<br />

is derived from its position as the largest Indian container glass<br />

manufacturer with planned growing capacities.<br />

Our six manufacturing facilities<br />

Rishra<br />

Bahadurgarh<br />

Rishikesh<br />

Puducherry<br />

Nashik<br />

Neemrana<br />

Automated<br />

batch-mixing<br />

facility<br />

IS<br />

manufacturing<br />

lines<br />

On-site bottle<br />

printing facility<br />

On-site mould<br />

repair shop and<br />

design facility<br />

Amber, flint<br />

and green glass<br />

manufacturer<br />

Three furnaces<br />

IS manufacturing<br />

lines<br />

On-site bottle<br />

printing facility with<br />

four decorating lines<br />

Foundry and mould<br />

workshop<br />

100% energy feed<br />

through captive power<br />

generating facility<br />

Amber, flint and<br />

green glass<br />

manufacturer<br />

Two furnaces<br />

Furnace II used<br />

for Green glass<br />

manufacture<br />

Off-site printing<br />

facility with three<br />

decorating lines<br />

One furnace<br />

Fully automated<br />

batch-mixing facility<br />

On-site printing<br />

facility with three<br />

decoration lines<br />

On-line automatic<br />

OI inspection<br />

machines<br />

On-site modern<br />

finished goods<br />

warehouse<br />

Sand beneficiation<br />

plant, foundry and<br />

mould workshop<br />

One Furnace<br />

IS manufacturing<br />

lines<br />

On-site bottle<br />

printing facility<br />

with three<br />

decorating lines<br />

Mould workshop<br />

for product design<br />

and manufacture<br />

One<br />

furnace<br />

34 | <strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited

Highlights, <strong>2008</strong>-09<br />

Implemented vacuum pumps in production lines, enhancing<br />

output rate, quality and energy efficiency.<br />

Added a booster in a Bahadurgarh furnace, enhancing<br />

capacity and reducing power consumption.<br />

Reduced bottle weight on an average 15 percent through<br />

innovative redesign; the weight of 180 ml mcd-1 bottles<br />

declined 13 percent from 217 grams to 189 grams, 377 mcd-1<br />

bottles declined 15 percent from 352 grams to 300 grams, 750<br />

mcd bottles declined 16.08 percent from 628 grams to 527<br />

grams, pickle bottles declined 7.50 per cent from 200 grams to<br />

185 grams and glucose bottles declined 10 percent.<br />

Drove continuous change in container bottle design,<br />

developing new products.<br />

Introduced Japanese technology to shrink job change and<br />

stabilisation time, enhancing capacity utilisation<br />

Commenced hot end and cold end coating through lubrication<br />

for scratch resistant bottle manufacture, which increased bottle<br />

strength and longevity<br />

Developed new moulds and casts to reinforce moulding and<br />

casting operations<br />

Changed mould metal mix from cast iron to Minox (bronze),<br />

which increased machine speed, enhanced quality and reduced<br />

defects<br />

Virtually eliminated storage breakage from an erstwhile 0.1<br />

percent through efficient pallet stacking.<br />

Implemented ERP to integrate operations, planning and<br />

decision-making.<br />

The benefits of light weighting<br />

Consumer benefit<br />

Enhanced availability<br />

Reduced transportation cost<br />

Accelerated bottling process<br />

Increased bottles per ton<br />

Reduced price per bottle<br />

Improved bottle quality<br />

Enhanced bottle transparency<br />

Increased strength following uniform<br />

and optimum wall thickness<br />

Company benefit<br />

Faster production rate (productivity increased by 8–10 percent)<br />

Optimum raw material use<br />

Overall cost reduction<br />

Increase in profitability<br />

The science of light weighting<br />

Existing bottle glass is analysed<br />

Analysis result leads to conclusion of how much weight<br />

reduction is possible<br />

Bottle design is drawn such that during forming, no glass<br />

distribution related issues should arise; should have a<br />

smoothened profile making blowing easier and increasing<br />

forming efficiency<br />

Once the design is approved engineering commences and<br />

sample mould casting is sent for<br />

Internal trial is conducted (bottle performance check in the<br />

lines)<br />

Customer approval is sought<br />

After approval receipt, commercial production commences<br />

Road ahead<br />

Proposed implementation of the vacuum pump across all<br />

production lines by 2009-10<br />

Proposed capacity expansion by 50 tonnes and 100 tonnes<br />

through the re-building of Bahadurgarh furnaces in 2009-10<br />

Proposed Rs. 170 cr capacity expansion from 600 TPD to 800-<br />

850 TPD in 2009-10, estimated to operationally break-even by<br />

2010-11<br />

Proposed commercialisation of narrow-neck-press-and-blow<br />

(NNPB) operations across all plants leading to enhanced light<br />

weighting by 25–30 percent<br />

Projected commissioning of Rs. 600-cr greenfield float glass<br />

manufacturing facility in Vadodara (Gujarat) by September<br />

2009<br />

<strong>Hindusthan</strong> <strong>National</strong> <strong>Glass</strong> & Industries Limited | 35

Business driver – 3<br />

Quality<br />

At HNG, quality is not an intangible virtue, but represents the<br />

convergence of all product attributes to enhance durability and<br />

progressively evolve from breakdown-maintenance to preventive<br />

maintenance philosophy.<br />

The Company’s ISO 9000:2000 certification vindicates its quality<br />

brilliance, catering to customer specifications with inspection<br />

across 140 defect parameters, which are well within customer<br />

tolerance levels.<br />

Highlights, <strong>2008</strong>-09<br />

Tightened supervisory control on job change to enhance<br />

product quality<br />

Received ISO 22000 certification for food safety management<br />

systems for the Rishra and Puducherry plants<br />

Implemented three Six Sigma projects on quality<br />

improvements<br />

Conducted extensive research on customer requirements<br />

to obtain data on quality, packaging, light weighting,<br />

bottling speed and pressure, capping facility, etc; around 50<br />

customer plants were visited to provide superior quality and<br />

customisation.<br />

Formed a six-member team for pre-dispatch inspection (PDI)<br />

ensuing packaging inspection and proper loading.<br />

Road ahead<br />

Commence more Six Sigma projects for further quality<br />

enhancements<br />

Automate quality inspection for quality excellence<br />

Start ‘clean room production’ for pharmaceutical bottles,<br />

complying with US-FDA norms<br />

Business driver – 4<br />

Marketing and distribution<br />

At HNG, dependability is derived from an ability to demonstrate<br />

container glass packaging options that are superior than<br />

competing companies and packaging alternatives on<br />

the one hand as well as making timely product deliveries<br />

on the other, leading to customer delight. This ability is derived<br />

from an ongoing quest for R&D-driven excellence and plant<br />

positions in customer-proximate locations - a holistic delivered<br />

solution.<br />

Highlights, <strong>2008</strong>-09<br />

Enhanced net value of revenue from customers<br />

Enhanced quality designs, service and value-for-money, driving<br />

overall sales volume by 10 percent<br />

Accelerated bottle light-weighting, reducing material and<br />

logistic costs<br />

Customised products and widened the product mix,<br />

strengthening the customer experience<br />

Successfully addressed the design challenge for the<br />

sophisticated ‘Gorbatschow’ liquor bottle<br />

Added several brand-enhancing clients like Carlsberg and John<br />

Distilleries, among others, to its formidable customer list.<br />

Enhanced its global footprint through a deeper presence in<br />

Europe, Asia and America<br />

Road ahead<br />

Proposed market share expansion through product<br />

development, bottle light-weighting and enhanced NNPB<br />

product proportion in the corporate portfolio<br />

Increased export share through an entry into new geographies<br />

as well as a consolidation in the existing ones<br />

Proposed increase in installed capacity by around 14 percent<br />

to service growing market and consumer needs<br />

Business driver – 5<br />

Safety, health and environment<br />

At HNG, manufacturing process involves several operations<br />

which can adversely impact employee safety, employee health<br />

and the surrounding environment, warranting investments in<br />

safety equipment, processes, practices and people. The<br />

Company deputed a professionally qualified safety, health and<br />

environment officer in each of its manufacturing facilities.<br />

Highlights, <strong>2008</strong>-09<br />