REFF london 07 (10pp) - Euromoney Institutional Investor PLC

REFF london 07 (10pp) - Euromoney Institutional Investor PLC

REFF london 07 (10pp) - Euromoney Institutional Investor PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

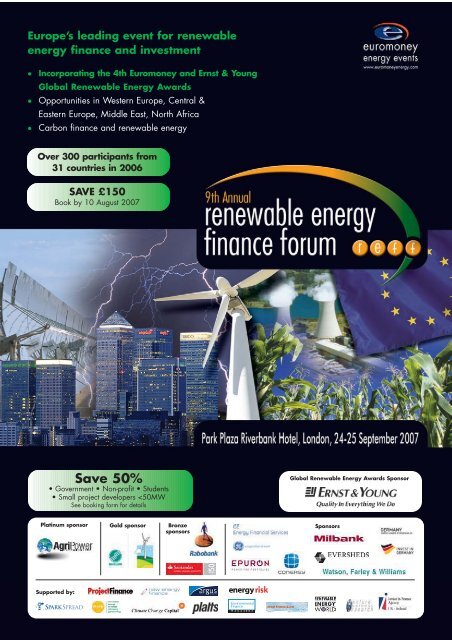

Europe’s leading event for renewable<br />

energy finance and investment<br />

●<br />

●<br />

●<br />

Incorporating the 4th <strong>Euromoney</strong> and Ernst & Young<br />

Global Renewable Energy Awards<br />

Opportunities in Western Europe, Central &<br />

Eastern Europe, Middle East, North Africa<br />

Carbon finance and renewable energy<br />

Over 300 participants from<br />

31 countries in 2006<br />

SAVE £150<br />

Book by 10 August 20<strong>07</strong><br />

Save 50%<br />

• Government • Non-profit • Students<br />

• Small project developers

Park Plaza Riverbank Hotel, London, 24-25 September 20<strong>07</strong><br />

As the leading European conference in its field, this year’s <strong>REFF</strong>-London takes place<br />

at an exciting time for the renewable energy industry. Some technologies, such as<br />

onshore wind power, have reached a mature stage and are becoming increasingly<br />

competitive. In other sectors, including biomass and offshore wind, technologies<br />

and financing mechanisms are developing side by side to create potentially huge<br />

markets. At the same time, carbon finance is starting to play a significant role in<br />

boosting renewable energy investment and market growth.<br />

THE <strong>REFF</strong> LONDON CONFERENCE AGENDA WILL FOCUS ON:<br />

● Government policy as a driver for renewable<br />

energy investment<br />

● M&A deals and trends in consolidation<br />

● IPO pipeline and investment climate<br />

● Fund management – drivers for market entry<br />

● Debt finance trends and lenders’ requirements<br />

● Managing commodity and market risk for biofuels producers<br />

● Strategies to address supply chain constraints for wind and<br />

solar manufacturers<br />

● Factoring carbon finance into project finance<br />

For full details and agenda updates visit www.euromoneyplc.com<br />

BENEFITS OF ATTENDING:<br />

● Network with over 350 delegates from the finance,<br />

project development and technology sectors<br />

● Major exhibition of leading renewable energy<br />

companies from across the world<br />

● Attend the <strong>Euromoney</strong> and Ernst & Young Global<br />

Renewable Energy Awards Dinner<br />

● Hear from the most high profile speakers in the business –<br />

a real opportunity to debate the future of the industry with<br />

the key players driving it forward<br />

● Expand your network and identify business<br />

opportunities at Europe's largest renewable energy finance<br />

conference<br />

WHO ATTENDS <strong>REFF</strong> LONDON<br />

● <strong>Investor</strong>s, fund managers, project financiers,<br />

analysts and advisors<br />

● Private equity investors, venture capitalists, and<br />

sector analysts<br />

● CEOs and CFOs of renewable energy<br />

manufacturers, project developers and operators<br />

● Major electricity generators, suppliers and infrastructure<br />

developers<br />

● Legal advisors, accountancy firms, consultants and<br />

regulatory bodies<br />

● Technology owners and developers in both new and<br />

established markets<br />

UNPARALLELED NETWORKING<br />

OPPORTUNITIES<br />

● Networking breaks, lunches and receptions built<br />

into the conference programme<br />

● <strong>Euromoney</strong> and Ernst & Young Global Renewable<br />

Energy Awards ceremony and Gala Dinner<br />

● Networking breakfast with roving microphone to<br />

help you identify further business contacts<br />

● Truly international audience – 31 countries were<br />

represented in 2006<br />

2

<strong>Euromoney</strong> Energy Events is pleased to announce the 4th <strong>Euromoney</strong> and Ernst & Young Global<br />

Renewable Energy Awards 20<strong>07</strong>, to be held on the evening of 24th September 20<strong>07</strong> as part of<br />

the 9th Annual <strong>REFF</strong> London event. We are pleased to welcome award-winning BBC journalist<br />

John Humphreys to host the event this year.<br />

The Awards Ceremony will take place during the course of the Gala Dinner hosted by Ernst &<br />

Young, starting at 7pm at the Park Plaza Riverbank Hotel. Admission to the Gala Dinner and Awards<br />

Ceremony is complimentary to all attendees at the 9th Annual Renewable Energy Finance Forum.<br />

Please indicate on Page 10 if you will be attending. Places are limited and reservation is essential to<br />

guarantee your place.<br />

Make your nominations online now and be entered into a prize draw for a<br />

luxury Fortnum & Mason hamper — Nominations close on 14th September.<br />

THE CATEGORIES FOR THIS YEAR’S<br />

AWARDS ARE:<br />

● IPO of the Year<br />

● M&A Deal of the Year<br />

● Infrastructure Equity Deal of the Year<br />

● Technology Equity Deal of the Year<br />

● Senior Debt Deal of the Year<br />

● Entrepreneurial Developer of the Year<br />

● Corporate Developer of the Year<br />

● Emerging Technology Promoter of the Year<br />

● Most Enterprising New Market Entrant<br />

of the Year<br />

● Legal Advisor of the Year<br />

● Climate Change Investment Programme of<br />

the Year<br />

● Sustainable Region/City of the Year<br />

Dress code: Smart business attire<br />

EUROMONEY AND ERNST & YOUNG<br />

GLOBAL RENEWABLE ENERGY AWARDS<br />

The Awards are designed to recognise the<br />

projects, companies and individuals who have<br />

contributed the most to take the industry<br />

forward and demonstrate best practice in<br />

renewable energy finance and development.<br />

THE 2006 EVENT WAS ATTENDED BY OVER 200 PEOPLE<br />

AND THE WINNERS WERE:<br />

● IPO of the Year - Suzlon Energy<br />

● M&A of the Year - Acciona<br />

● Private Equity Deal of the Year - Babcock & Brown<br />

● Senior Debt Deal of the Year - HVB<br />

● Entrepreneurial Developer of the Year - WPD AG<br />

● Corporate Developer of the Year - CLP Group<br />

● Emerging Technology of the Year - Shell/Choren<br />

● Most Enterprising New Market Entrant -<br />

BP Alternative Energy<br />

● Sustainable Region/City of the Year - Tamil Nadu, India<br />

A limited number of tables for 10 are<br />

available for £2500. Call Tom Plinston<br />

on +44 20 7779 8673 to reserve yours.<br />

Venue: Park Plaza Riverbank Hotel, London<br />

Further information regarding Ernst & Young renewable energy<br />

services can be found at www.ey.com/renewables<br />

3

conference programme<br />

”High-profile attendees from both the renewa<br />

DAY 1: MONDAY, 24 SEPTEMBER 20<strong>07</strong><br />

<strong>07</strong>30 Registration and coffee<br />

0800 Exhibition opens<br />

0850 Welcome and opening remarks<br />

Gerard Strahan, Managing Director,<br />

<strong>Euromoney</strong> Energy Events<br />

Chair:<br />

0900-1030: Session 1<br />

Policy keynotes<br />

As the renewable energy industry continues to<br />

mature and diversify, government policy and<br />

regulation remain the key drivers for investment and<br />

market development. The EU has set a target of 20%<br />

renewables in the European energy mix by 2020,<br />

and similar initiatives are being put in place<br />

around the world. The opening session will provide<br />

high-level insight into the policy initiatives that<br />

drive investment in renewable energy, and will set<br />

the scene and provide a context for subsequent<br />

sessions.<br />

Arthouros Zervos, President,<br />

European Renewable Energy Council<br />

KEY TOPICS<br />

■ The role of policy as a driver for the renewable<br />

energy industry<br />

■ UK renewable energy policy and implications of<br />

the 20<strong>07</strong> Energy White Paper<br />

■ The challenge of meeting EU 2020 targets for<br />

emissions and renewable energy<br />

■ German Federal Government support for<br />

renewable energy projects<br />

■ Renewable energy in the US: Domestic growth<br />

and impact on the world market<br />

■ Moving towards a national carbon trading system<br />

in the US<br />

1115-1245: Session 2<br />

Investment, capital markets and M&A activity<br />

Chair:<br />

During 2006-<strong>07</strong> the renewable energy industry has<br />

been characterised by a number of significant IPOs<br />

and M&A deals, with major utilities playing an<br />

increasingly active role. This session will provide an<br />

overview of this changing landscape, and will<br />

also examine the increasing interest in renewable<br />

energy from fund managers and the drivers for this<br />

interest.<br />

Michael Liebreich, Chairman and CEO,<br />

New Energy Finance<br />

KEY TOPICS<br />

■ Overview of investment in renewables by<br />

technology, geography and finance type<br />

■ Renewable energy M&A activity – landmark<br />

deals, sector trends and outlook<br />

■ Recent renewable energy IPOs and trends in<br />

capital markets funding<br />

■ Fund management considerations - drivers for<br />

including renewable energy as part of a<br />

sustainable investment portfolio<br />

■ Should renewable energy be treated as a<br />

separate asset class<br />

■ Impact of utility M&A activity on renewable<br />

energy companies<br />

Robert Mansley, Director, Investment Banking,<br />

Credit Suisse<br />

Read Gomm, Managing Director,<br />

Lexicon Partners<br />

Ronnie Lim, Morley Fund Management<br />

Sipko Schat, Member of the Executive Board,<br />

Rabobank<br />

Shai Weiss, Managing Partner, Virgin Fuels<br />

1245 Networking lunch<br />

Claire Durkin, Head of Energy Markets Unit,<br />

Department of Trade and Industry<br />

Commissioner John Geesman,<br />

California Energy Commission<br />

Nick Hurd MP, Member of the Environmental<br />

Audit Committee<br />

Matthias Machnig, State Secretary of the<br />

Federal Ministry for the Environment,<br />

Nature Conservation and Nuclear Safety,<br />

Germany<br />

1030 Extended networking break<br />

4<br />

”The best opportunity for meeting and understanding the current state of play in this

le energy industry and the finance world”<br />

1400-1530 Parallel Sessions<br />

1400-1530: Parallel Session 3A<br />

Wind power: Global investment, supply<br />

chain and market trends<br />

Co-Chair: Evan Stergoulis, Partner,<br />

Watson Farley & Williams<br />

Co-Chair: Christian Kjaer, CEO,<br />

European Wind Energy Association<br />

■ Wind market investment trends, outlook and deal pipeline<br />

■ Can onshore wind be regarded as a mature market<br />

■ Wind turbine supply chain constraints – Addressing<br />

inventory backlog to drive growth<br />

■ What are the challenges of financing offshore wind<br />

and how can they be addressed<br />

■ M&A deals and consolidation in the wind industry<br />

Max Ter Linden, Director Power & Utilities<br />

M&A Group, ABN AMRO Bank<br />

Per Hornung Pedersen, CEO, Suzlon Energy<br />

Ilkka Hakala, President & CEO, Moventas<br />

OR<br />

Chair:<br />

1400-1530: Parallel Session 3B<br />

Biomass and biogas: Opportunities in<br />

new markets<br />

Guiliano Grassi, Secretary General,<br />

EU Biomass Industry Association<br />

■ Market overview – Major players, investment and M&A<br />

trends, technologies and the potential for market growth<br />

■ The role of the waste management industry in<br />

renewable energy generation<br />

■ Current and future technologies in biomass, biogas,<br />

and energy from waste<br />

■ Addressing the financing challenges for biogas projects<br />

Steve Hazelton, Director, Waste, Renewables and<br />

Clean Energy Group, Ernst & Young<br />

Frank Esslinger, Director, Ethos Partners Limited<br />

Ulrich Schmack, Managing Director, Schmack Biogas<br />

Barry J. Berman, CEO, AgriPower<br />

Senior Representative, Veolia Environmental Services<br />

1530 Extended networking break<br />

1615-1745: Parallel Session 4A<br />

Biofuels: Integrating energy and<br />

commodity markets<br />

■ Outlook for the European biofuels industry and<br />

challenges for producers<br />

■ Is there a genuine place for an independent<br />

biofuels industry between the agriculture and oil and<br />

gas sectors<br />

■ Second generation biofuels – Pilot stage or rapid<br />

commercialisation<br />

■ Strategies to address commodity risk for biofuels<br />

producers<br />

Anthony Doherty, Biofuels Business Development<br />

Director, Bioverda<br />

Philip New, President, BP Global Biofuels<br />

Josu Arlaban, Financial Director, Acciona<br />

OR<br />

1615-1745: Parallel Session 4B<br />

Solar power: Global demand outlook and<br />

upstream constraints<br />

Chair: Ernesto Macías, Vice-president, European<br />

Photovoltaic Industry Association<br />

■ Growth potential for the European solar PV industry<br />

■ How are upstream constraints affecting<br />

manufacturers and how can they be addressed<br />

■ Construction of large scale Solar PV facilities,<br />

reaching giga watt scale<br />

■ Solar thermal power – Global market potential<br />

■ Where is growth happening and what will be the next<br />

big market<br />

Andrew Marsden, Managing Director,<br />

GE Energy Financial Services<br />

Julien Maumont, Senior Project Manager,<br />

Energy, Dexia Credit Local<br />

Nikolaus Krane, COO, Conergy<br />

Marco Antonio Northland,<br />

General Manager Europe, SunPower<br />

1800 CHAMPAGNE<br />

RECEPTION<br />

hosted by<br />

Conergy<br />

1900<br />

tel:+44 20 7779 8673<br />

constantly changing market” 5

”Excellent program with very knowledge<br />

e: information@euromoneyplc.com<br />

0800 Exhibition opens<br />

DAY 2: TUESDAY, 25 SEPTEMBER 20<strong>07</strong><br />

0800 Networking breakfast with roving microphone Hosted by<br />

Delegates will have the opportunity to briefly introduce themselves to fellow<br />

conference attendees, allowing them to identify additional business contacts.<br />

0850 Welcome and opening remarks<br />

Chris Knowland, Conference Manager,<br />

<strong>Euromoney</strong> Energy Events<br />

Chair:<br />

0900-1030: Session 5<br />

Carbon finance - Legislation, emissions<br />

trading and their impact on renewables<br />

Christopher Norton, Partner,<br />

Baker & McKenzie LLP<br />

In Europe, the impending start of EU ETS Phase II and<br />

the 2020 greenhouse gas reduction target have<br />

heightened investors’ interest in the carbon markets.<br />

Such developments, both in Europe and worldwide,<br />

have a significant impact on the renewables industry.<br />

This session will examine how carbon finance<br />

impacts on renewable energy and what further<br />

opportunities are being created.<br />

■ Integrating carbon finance with project finance for<br />

renewable energy projects<br />

■ Commercial appetite for investing in carbon<br />

management<br />

■ How will climate change awareness influence the<br />

renewable energy sector<br />

■ Overview of JI markets in Eastern Europe and Russia<br />

■ Carbon markets in Japan<br />

■ The emergence of the voluntary carbon market as<br />

a new pillar of global carbon finance<br />

Tom Delay, CEO, Carbon Trust<br />

Takashi Hongo, Director General and Special<br />

Advisor for Kyoto, Japan Bank for International<br />

Co-operation<br />

Matthew Shaw, Executive Director, Carbon<br />

Trade & Finance<br />

Richard Ham, Senior Associate, Eversheds<br />

1030 Extended networking break<br />

1115-1245: Parallel Sessions<br />

Please select your choice of session on page 10<br />

1115-1245: Parallel Session 6A<br />

Northern and Western Europe: Utility<br />

scale generation<br />

Chair: Ed Feo, Partner, Milbank Tweed Hadley & McCloy LLP<br />

■ Regional and state-level policy drivers and<br />

investment incentives for renewable energy<br />

■ Offshore wind projects and financing structures<br />

■ Domestic market drivers, export opportunities and<br />

growth outlook<br />

■ Case studies – perspectives across different<br />

countries and technologies<br />

Rick Squires, Chairman, Eclipse Energy Company Limited<br />

Ángeles Santamaría, Director of Markets and<br />

Prospective, Iberdrola Renewables<br />

Adrian Katzew, Global Head of the Energy Sector,<br />

Santander Structured Finance<br />

Nikolai Dobrott, Director, Renewable Energies &<br />

Resources, Invest in Germany<br />

OR<br />

1115-1245: Parallel Session 6B<br />

Central and Eastern Europe: Opportunities<br />

in the new European growth markets<br />

Chair:<br />

Dr Armin Sandhövel, Managing Director,<br />

Allianz Climate Solutions, and Chair, UNEP<br />

Finance Initiative Climate Change Group<br />

■ Regional and state-level policy drivers and<br />

investment incentives for renewable energy<br />

■ Project pipeline and potential for market expansion<br />

■ Carbon finance incentives<br />

■ Investment incentives for renewable energy projects<br />

■ What are the main characteristics and challenges of<br />

20<strong>07</strong> deals<br />

■ Case studies – isolating the factors that create success<br />

Arjan Visser, Director, Ecofys Bulgaria<br />

Simon Erritt, Director, Citigroup<br />

6<br />

”8th <strong>REFF</strong> provided a very good look at current issues and trends as well as excellent n

able speakers and, with the large audience, excellent networking opportunities”<br />

1245 CARBON MARKET NETWORKING LUNCH<br />

The World Bank estimates that in 2006, carbon trading across the world trebled in value to $30bn. This<br />

networking event will provide the opportunity for delegates to meet active players in the global carbon markets,<br />

and to identify where current investment opportunities lie.<br />

Each delegate will be presented with a booklet containing details of active renewable energy investment and<br />

carbon credit opportunities around the world.<br />

During the lunch you will be able to make contact with representatives of national CDM and JI authorities,<br />

technology providers and project developers, to further expand their network within this rapidly growing market.<br />

Chair:<br />

1415-1545: Parallel Session 7A<br />

Technology insight: Developments in new<br />

and existing markets<br />

Jürgen Lottman, Managing Director,<br />

Mountain Cleantech AG<br />

■ Outlook for capital markets funding for European<br />

renewable energy technology companies<br />

■ How will technology players influence the development<br />

of the renewables sector<br />

■ Marine power – technology and investment update,<br />

and the potential for market growth<br />

■ Geothermal energy projects – Investment prospects<br />

and case studies<br />

■ Appetite for private finance, investor expectations,<br />

debt and equity requirements<br />

Estelle Lloyd, CEO and Founder,<br />

Venture Business Research<br />

Ásgeir Margeirsson, CEO, Geysir Green Energy<br />

Julia Balandina, Vice President, AIG Sustainable<br />

Investment Group<br />

Christian Huber, Managing Director, Cowatec GmbH<br />

OR<br />

Chair:<br />

Fabrizio Donini Ferretti, Director, Dexia<br />

■ Regional and state-level policy drivers and investment<br />

incentives for renewable energy<br />

■ New markets for established technologies, partnering<br />

and market entry strategies<br />

■ Carbon finance incentives<br />

■ Feed-in tariffs<br />

■ Overview: VC deal flow by sector, geography and<br />

investment strategy<br />

■ Where are the current and future investment<br />

hotspots<br />

1415-1545: Parallel Session 7B<br />

Greece, Turkey,<br />

Middle East, North Africa<br />

Vernon Z. Tan, Director, AES Asia & Middle East<br />

Climate Change & Technology Development Group<br />

Steven Geiger, Director of Special Projects, Masdar<br />

Kostas Liapis, CEO, Lion Energy<br />

Ali Tunga, Chairman, Petco Energy Inc<br />

Can Levent Seckin, Vice President, Investment,<br />

Support and Promotion Agency of Turkey<br />

1545 Networking refreshment break<br />

w:www.euromoneyplc.com<br />

etworking opportunities” 7

tel:+44 20 7779 8673<br />

1615-1715: Session 8<br />

Leadership panel and Crystal Ball session<br />

This session will unite senior figures from business,<br />

finance and the public sector, to debate the broad-scale<br />

drivers shaping the future of renewable energy.<br />

It will ask both speakers and delegates to look into the<br />

crystal ball and see how the industry will develop over<br />

the next decade, incorporating trends in business,<br />

finance, policy, and public opinion.<br />

Chair:<br />

Jonathan Johns, Head of Renewables,<br />

Ernst & Young<br />

■ What are the broader drivers that shape the<br />

renewable energy industry<br />

■ How will the renewable energy industry look in 10<br />

years’ time – major sectors, investment flows, key<br />

factors affecting the industry<br />

■ Renewable energy in the retail industry: which<br />

technologies will be required, and how will this<br />

affect demand<br />

■ How does renewable energy fit into the broader<br />

energy mix in the UK, Europe and world wide, and<br />

how is this likely to change in the next 10 years<br />

■ Is renewable energy economically compatible with<br />

nuclear energy as part of a sustainable long-term<br />

generating mix<br />

■ Corporate responsibility as a driver for the<br />

renewables industry: how will changes in corporate<br />

strategy affect demand and industry perception<br />

Henry Derwent, Director, International Climate<br />

Change, Air and Analysis, Defra<br />

Keith Aughwane, Engineering Director, Tesco<br />

Ian Simington, Group Development Director, NTR Plc<br />

Emma Howard Boyd, Head of Socially Responsible<br />

Investment, Director at Jupiter Asset Management<br />

1715 Chair's closing remarks and close of conference<br />

1730-1830<br />

Post-conference networking party<br />

The chance to consolidate business contacts made during <strong>REFF</strong>-London and to continue the discussion over a<br />

farewell drink in the main exhibition area.<br />

FORTHCOMING EVENTS<br />

<strong>Euromoney</strong> Energy Events organises a series of high profile conferences for the energy industry world wide, focussing on<br />

the financial and commercial aspects of a range of industry sectors, as well as examining broader topics such as<br />

emissions trading and carbon finance. In 20<strong>07</strong>-08 our events will include:<br />

29-30 November 20<strong>07</strong><br />

New Delhi<br />

18-19 February 2008<br />

London<br />

May 2008<br />

Beijing<br />

June 2008<br />

New York<br />

For further details and updates please see our website at<br />

www.euromoneyplc.com<br />

”An excellent opportunity to network” 8

”Effective and to the point”<br />

SPONSORSHIP AND EXHIBITION OPPORTUNITIES<br />

AT <strong>REFF</strong>-LONDON<br />

Enhance your market position at Europe’s largest renewable energy<br />

finance conference<br />

SPONSORSHIP OPPORTUNITIES<br />

Sponsorship at <strong>REFF</strong>-London offers you significant brand<br />

exposure to a senior level audience. Our delegates come<br />

from finance, industry and the professional services, and<br />

<strong>REFF</strong>-London has become established as the ‘must-attend’<br />

event for the renewable energy finance sector.<br />

By becoming the sponsor of a dynamic networking<br />

event, or by branding conference facilities or an individual<br />

session, you can create significant brand awareness and<br />

ensure your exposure to the European renewable<br />

energy market.<br />

Sponsorship options available include:<br />

• Sponsored lunches<br />

• Cocktail parties<br />

• Session sponsorships<br />

• Gold, Silver or Bronze sponsorships<br />

• Audience Response System Sponsorship<br />

Platinum sponsor Bronze sponsors Global Renewable<br />

Energy Awards<br />

Sponsor<br />

Sponsors<br />

Gold<br />

sponsor<br />

EXHIBITION STANDS<br />

<strong>REFF</strong>-London will feature a major exhibition<br />

running alongside the conference programme.<br />

Taking a stand is the most direct form of marketing<br />

for your business, as the exhibition area will act as<br />

a central meeting area and focal point for<br />

delegates.<br />

Shaded stands have already<br />

been reserved<br />

Stand spaces are available in 6sqm, 9sqm, and<br />

18sqm packages, including exposure in exhibition<br />

manuals. This is the ideal opportunity to establish<br />

new business contacts and promote your business<br />

to the renewable energy and finance industries.<br />

For further information and to receive detailed<br />

sponsorship package or stand details, please<br />

contact Tom Plinston on (+44) 20 7779 8915 or at<br />

tplinston@euromoneyplc.com.<br />

tel:+44 20 7779 8673<br />

9

9 th <strong>REFF</strong> – LONDON REGISTRATION FORM<br />

24-25 SEPTEMBER 20<strong>07</strong><br />

Four<br />

other ways<br />

to register<br />

The easiest way to register is online at www.reff-<strong>london</strong>.com<br />

Email:<br />

information@euromoneyplc.com<br />

(quoting brochure ref:)<br />

please quote<br />

this reference<br />

Fax:<br />

+44 20 7246 5200<br />

Ref: EEE WEB<br />

Telephone:<br />

+44 20 7779 8673<br />

(quoting brochure ref:)<br />

Post:<br />

<strong>Euromoney</strong><strong>PLC</strong>.Com<br />

Nestor House, Playhouse Yard<br />

London EC4V 5EX, UK<br />

The conference fee includes: Attendance at all conference sessions,<br />

conference documentation, lunches, refreshments and <strong>Euromoney</strong> and Ernst &<br />

Young Global RE Awards Dinner.<br />

IT IS IMPORTANT TO FILL OUT ALL THE INFORMATION BELOW<br />

Please photocopy this form for multiple bookings<br />

STANDARD RATE<br />

Delegates By 10 August After 10 August Discount<br />

■ 1 st £1299+VAT = £1526.33 £1449+VAT = £1702.78<br />

■ 2 nd £1299+VAT = £1526.33 £1449+VAT = £1702.78<br />

■ 3 rd + £974 + VAT = 1144.45 £1085+VAT = £1274.88 25%<br />

SPECIAL RATE*: For Small developers less than 50MW, Government, Not for Profit and Students<br />

£725+VAT = £851.88<br />

Discount<br />

50%<br />

*Concessions are awarded to Govt/Non profit organisations, students and<br />

small project developers whose total installed generating capacity is less than<br />

50MW. These rates are at the sole discretion of <strong>Euromoney</strong> Energy Events.<br />

Documentation only £399 ■ Hard copy<br />

■ Soft copy<br />

INFORMATION Please tick appropriate box ✓<br />

■ I would like to attend the <strong>Euromoney</strong> and Ernst & Young<br />

Global RE Gala Awards Dinner<br />

■ Please contact me with details on how to purchase a table at the Dinner<br />

■ Please provide me with the conference sponsorship and exhibition options<br />

Places at the Awards Dinner are limited and reservation is<br />

essential to guarantee your place.<br />

Organisation details<br />

Company Name_______________________________________________________________________<br />

Please supply your company description for the delegate profile directory<br />

Company Activity (EXAMPLE: Power GenCo operates three 200MW power plants)<br />

(15-20 words)<br />

____________________________________________________________________________<br />

____________________________________________________________________________<br />

Address _______________________________________________________________________________<br />

____________________________________________________________________________________________________<br />

Postcode __________________________ Country__________________________________<br />

VAT is charged at the standard rate for the U.K. 17.5%. Companies<br />

operating inside the EU may be able to claim the VAT back, please check<br />

with your local excise authority.<br />

1 st Delegate details<br />

Mr/Mrs/Ms ______ First name ___________________________________________________________<br />

Surname ________________________________________________________________________________<br />

Job title__________________________________________________________________________________<br />

Tel________________________________________ Fax __________________________________________<br />

Email ____________________________________________________________________________________<br />

2 nd Delegate details<br />

Mr/Mrs/Ms ______ First name ___________________________________________________________<br />

Surname ________________________________________________________________________________<br />

Job title__________________________________________________________________________________<br />

Tel________________________________________ Fax __________________________________________<br />

Email ____________________________________________________________________________________<br />

3 rd Delegate details<br />

Mr/Mrs/Ms ______ First name ___________________________________________________________<br />

Surname ________________________________________________________________________________<br />

Job title__________________________________________________________________________________<br />

25% DISCOUNT<br />

Tel________________________________________ Fax __________________________________________<br />

Email ____________________________________________________________________________________<br />

HOTEL BOOKING: For hotel bookings please contact the Park Plaza<br />

Riverbank Hotel on 020 7034 48<strong>07</strong>. The best rate will be offered subject to<br />

availability, early reservation is advised. Please mention that you are<br />

attending the Renewable Energy Finance Forum.<br />

PAYMENT<br />

Payment may be made in one of three ways - please tick appropriate box ✓<br />

■ 1. Please debit my CREDIT CARD No.<br />

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■<br />

Visa/Master/Euro ■ Amex ■ (no other cards accepted)<br />

Expiry date ■ ■ / ■ ■<br />

Signed......................................................................................................<br />

■ 2. Payment by BANK TRANSFER should be made through Lloyds TSB Bank plc,<br />

PO Box 72, Bailey Drive. Gillingham Business Park, Gillingham, Kent, ME8 0LS,<br />

account number 1083711, sort code: 30-00-02 all charges to be paid by sender<br />

■ 3. CHEQUES should be drawn on a UK Bank and made payable to<br />

<strong>Euromoney</strong> Energy Events Ltd. A receipted invoice will be sent to all delegates.<br />

Please complete and return this form together with a copy of your credit card<br />

number, bank transfer or cheque, payable in £ to <strong>Euromoney</strong> Energy Events Ltd, and<br />

send by post or fax to: <strong>Euromoney</strong> Energy Events Ltd, Nestor House,<br />

Playhouse Yard, London EC4V 5EX, UK<br />

Fax: +44 20 7246 5200<br />

information@euromoneyplc.com www.euromoneyplc.com<br />

CANCELLATIONS<br />

Conference fee: All cancellations must be received in writing by 28 August 20<strong>07</strong> for a full refund, less a 10% administration charge. We cannot accept verbal<br />

cancellations. Cancellations received after 28 August 20<strong>07</strong> are liable for the full conference fee. However, substitutions can be sent to attend in your place at no<br />

extra charge. If owing to a force majeure, <strong>Euromoney</strong> Energy Events is obliged to postpone or cancel the event, <strong>Euromoney</strong> Energy Events will not be liable for any<br />

travel or accommodation expenses incurred by delegates or their organisations.<br />

Data protection: The information that you provide will be safeguarded by <strong>Euromoney</strong> Energy Events Ltd, a division of <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong> group, whose subsidiaries may use it<br />

to keep you informed of relevant products and services. We occasionally allow reputable companies outside the <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong> group to contact you with details of products that<br />

may be of interest to you. As an international group, we may transfer your data on a global basis for the purposes indicated above. If you object to contact by telephone ■ fax ■ or email ■ please<br />

tick the relevant box. If you do not want us to share your information with other reputable companies, please tick this box ■<br />

10