SDOT2 Product Disclosure Statement - Stockland

SDOT2 Product Disclosure Statement - Stockland

SDOT2 Product Disclosure Statement - Stockland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7.<br />

About<br />

<strong>Stockland</strong><br />

31<br />

7.1 Overview of <strong>Stockland</strong><br />

<strong>Stockland</strong> is one of Australia’s largest diversified listed<br />

property groups, with a market capitalisation of<br />

approximately $7.5 billion as at 15 June 2005.<br />

<strong>Stockland</strong> owns and manages an investment portfolio<br />

valued at $7.7 billion as at 31 December 2004.<br />

<strong>Stockland</strong> is rated A- (stable) by Standard & Poor’s<br />

(refer to Section 15.10).<br />

<strong>Stockland</strong> has two business components, <strong>Stockland</strong><br />

Trust and <strong>Stockland</strong> Corporation. <strong>Stockland</strong> Trust owns<br />

investment assets across Australia and New Zealand<br />

comprising commercial office, shopping centre,<br />

industrial and office park properties. <strong>Stockland</strong><br />

Corporation operates a real estate management and<br />

development business in Australia spanning<br />

residential estates, apartments, hotels, retail projects<br />

and large mixed use sites. <strong>Stockland</strong> Corporation also<br />

operates nine hotels around Australia under the<br />

Saville brand.<br />

The Unlisted Property Funds division of <strong>Stockland</strong> is<br />

responsible for the establishment and the ongoing<br />

management of funds and syndicates to provide both<br />

wholesale and retail investors with direct property<br />

investment opportunities across each of the major<br />

property sectors.<br />

<strong>Stockland</strong>’s Commercial and Industrial Property<br />

division has specialist expertise in commercial<br />

property acquisition and disposal, asset management,<br />

development, leasing, engineering services, finance,<br />

property administration and property management. It<br />

currently owns 55 properties valued at $2.6 billion as<br />

at 31 December 2004. <strong>Stockland</strong> Trust intends to hold<br />

at least a 31% indirect interest in the Property on<br />

Lease Commencement through its investment in<br />

MPT and also intends to hold a further indirect<br />

interest through a 5% investment in the Trust.<br />

<strong>Stockland</strong>’s vision as an owner and manager is to<br />

provide a high level of integrated property<br />

management services, where tenants deal directly<br />

with the property owner.<br />

<strong>Stockland</strong> is a significant participant in the Macquarie<br />

Park property market (it owns six properties in<br />

Macquarie Park) and closely follows the movements<br />

in the demand and supply cycles for office space and<br />

property values.<br />

Further information about <strong>Stockland</strong> can be obtained<br />

from its internet site: www.stockland.com.au.<br />

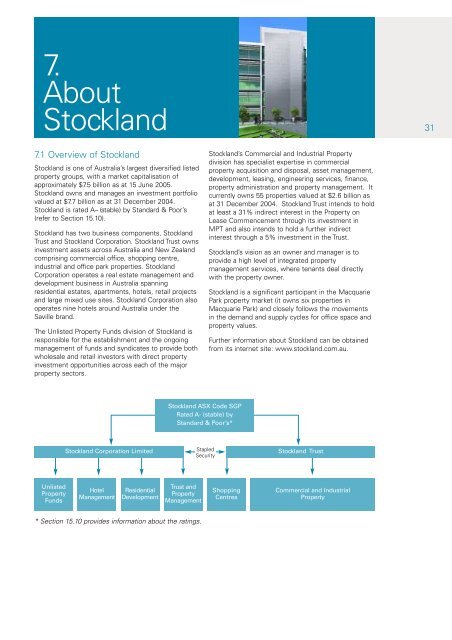

<strong>Stockland</strong> ASX Code SGP<br />

Rated A- (stable) by<br />

Standard & Poor’s*<br />

<strong>Stockland</strong> Corporation Limited<br />

Stapled<br />

Security<br />

<strong>Stockland</strong> Trust<br />

Unlisted<br />

Property<br />

Funds<br />

Hotel<br />

Management<br />

Residential<br />

Development<br />

Trust and<br />

Property<br />

Management<br />

Shopping<br />

Centres<br />

Commercial and Industrial<br />

Property<br />

* Section 15.10 provides information about the ratings.