Aberdeen Property Investors - Aberdeen Asset Management

Aberdeen Property Investors - Aberdeen Asset Management

Aberdeen Property Investors - Aberdeen Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Operations<br />

The value chain – how value is created<br />

In today’s more demanding investment<br />

climate the difference between skilled<br />

and less skilled investment managers<br />

will become increasingly apparent, and<br />

investors will need to be even more<br />

careful in choosing managers they<br />

can trust.<br />

A changing market environment<br />

Over recent years, more and more investors have come to<br />

realise the benefits of property. When credit was readily and<br />

cheaply available, investment in property benefited from a<br />

positive yield gap. As a consequence the yields on property<br />

gradually moved towards the financing cost. At the same<br />

time, with few exceptions occupier markets were generating<br />

sluggish to moderate rental growth. Despite modest rental<br />

growth, property returns were very good as a result of<br />

compressing yields. Yield compression affected property<br />

markets widely and explains why it has been relatively easy<br />

to earn good returns from property.<br />

As the availability of credit has decreased and the pricing<br />

of risk has moved out, this equation is changing. The market<br />

effect stemming from a broad re-pricing of the asset class is<br />

at an end. From now on, returns to property will not be driven<br />

by yield compression but will have to be generated from the<br />

income side.<br />

Moving from beta to alpha<br />

The re-pricing of property is a fact – as it is for other asset<br />

classes – and is a function of the increased transparency and<br />

accessibility of property as well as a greater understanding<br />

of its potential and limitations. This re-pricing is also a<br />

consequence of property’s integration with the wider financial<br />

markets and its development as an accessible asset class at<br />

an international level. Thus, the strong performance of<br />

property in the recent past has been driven by underlying<br />

structural market factors: i.e. strong beta. The difference<br />

between skilled and not so skilled managers (alpha) has been<br />

relatively small.<br />

As the effect of integration – both within the property<br />

investment markets and with the wider financial markets –<br />

loses momentum, the investment manager’s skill in adding<br />

value will grow in importance. The ability to improve cash<br />

flows from property will be crucial, and this will increase the<br />

differential between managers and their performance.<br />

How to create value<br />

We strongly believe that property will continue to offer value<br />

to investors, but that this value will have to be earned through<br />

intelligent and hard work. Creating investor value begins with<br />

a robust, proven investment and asset management process:<br />

one that <strong>Aberdeen</strong> has developed and refined over many years.<br />

It is supported by our top-class research capability and can be<br />

applied consistently to all property sectors and extended to<br />

new countries, regions and cities.<br />

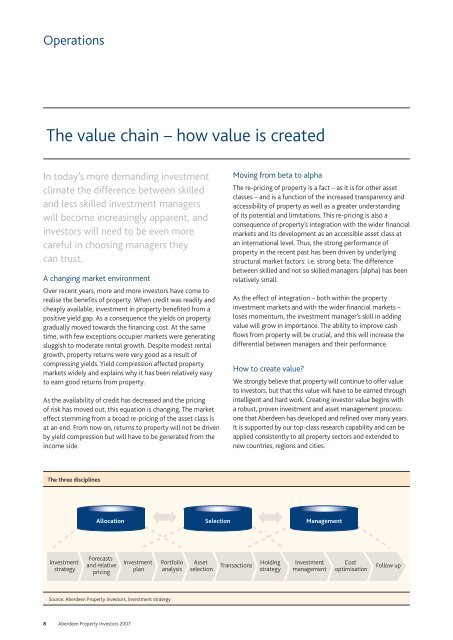

The three disciplines<br />

Allocation Selection <strong>Management</strong><br />

Investment<br />

strategy<br />

Forecasts<br />

and relative<br />

pricing<br />

Investment<br />

plan<br />

Portfolio<br />

analysis<br />

<strong>Asset</strong><br />

selection<br />

Transactions<br />

Holding<br />

strategy<br />

Investment<br />

management<br />

Cost<br />

optimisation<br />

Follow up<br />

Source: <strong>Aberdeen</strong> <strong>Property</strong> <strong>Investors</strong>, Investment strategy<br />

8 <strong>Aberdeen</strong> <strong>Property</strong> <strong>Investors</strong> 2007