FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of<br />

Operating Results and Financial Condition<br />

order to improve operating efficiency, the <strong>Bank</strong> continues to<br />

manage its expenses by seeking out opportunities to reduce<br />

the overall costs and has nonetheless maintained the overall<br />

ratio of operating expenses to revenues below 50%.<br />

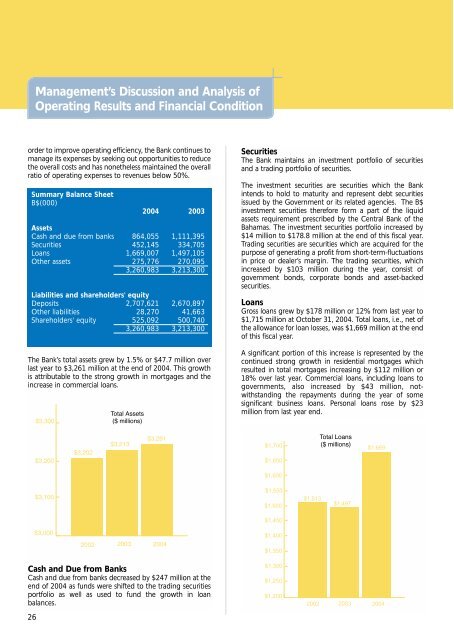

Summary Balance Sheet<br />

B$(000)<br />

2004 2003<br />

Assets<br />

Cash and due from banks 864,055 1,111,395<br />

Securities 452,145 334,705<br />

Loans 1,669,007 1,497,105<br />

Other assets 275,776 270,095<br />

3,260,983 3,213,300<br />

Liabilities and shareholders' equity<br />

Deposits 2,707,621 2,670,897<br />

Other liabilities 28,270 41,663<br />

Shareholders' equity 525,092 500,740<br />

3,260,983 3,213,300<br />

The <strong>Bank</strong>’s total assets grew by 1.5% or $47.7 million over<br />

last year to $3,261 million at the end of 2004. This growth<br />

is attributable to the strong growth in mortgages and the<br />

increase in commercial loans.<br />

Securities<br />

The <strong>Bank</strong> maintains an investment portfolio of securities<br />

and a trading portfolio of securities.<br />

The investment securities are securities which the <strong>Bank</strong><br />

intends to hold to maturity and represent debt securities<br />

issued by the Government or its related agencies. The B$<br />

investment securities therefore form a part of the liquid<br />

assets requirement prescribed by the Central <strong>Bank</strong> of the<br />

<strong>Bahamas</strong>. The investment securities portfolio increased by<br />

$14 million to $178.8 million at the end of this fiscal year.<br />

Trading securities are securities which are acquired for the<br />

purpose of generating a profit from short-term-fluctuations<br />

in price or dealer’s margin. The trading securities, which<br />

increased by $103 million during the year, consist of<br />

government bonds, corporate bonds and asset-backed<br />

securities.<br />

Loans<br />

Gross loans grew by $178 million or 12% from last year to<br />

$1,715 million at October 31, 2004. Total loans, i.e., net of<br />

the allowance for loan losses, was $1,669 million at the end<br />

of this fiscal year.<br />

A significant portion of this increase is represented by the<br />

continued strong growth in residential mortgages which<br />

resulted in total mortgages increasing by $112 million or<br />

18% over last year. Commercial loans, including loans to<br />

governments, also increased by $43 million, notwithstanding<br />

the repayments during the year of some<br />

significant business loans. Personal loans rose by $23<br />

million from last year end.<br />

$1,700<br />

$1,669<br />

$1,650<br />

$1,600<br />

$1,550<br />

$1,500<br />

$1,450<br />

$1,513<br />

$1,497<br />

$1,400<br />

$1,350<br />

Cash and Due from <strong>Bank</strong>s<br />

Cash and due from banks decreased by $247 million at the<br />

end of 2004 as funds were shifted to the trading securities<br />

portfolio as well as used to fund the growth in loan<br />

balances.<br />

26<br />

$1,300<br />

$1,250<br />

$1,200<br />

2002 2003 2004