2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>report</strong> <strong>2011</strong><br />

20. Financial information concerning the issuer’s<br />

assets, financial position and result<br />

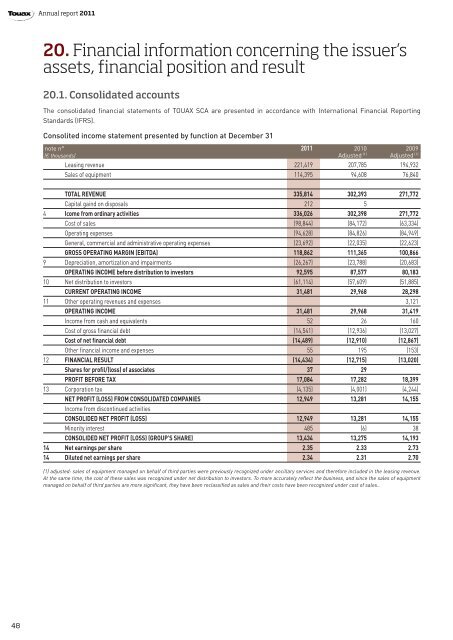

20.1. Consolidated accounts<br />

The consolidated financial statements of TOUAX SCA are presented in accordance with International Financial Reporting<br />

Standards (IFRS).<br />

Consolited income statement presented by function at December 31<br />

note n° <strong>2011</strong> 2010 2009<br />

(€ thousands) Adjusted (1) Adjusted (1)<br />

Leasing revenue 221,419 207,785 194,932<br />

Sales of equipment 114,395 94,608 76,840<br />

TOTAL REVENUE 335,814 302,393 271,772<br />

Capital gaind on disposals 212 5<br />

4 Icome from ordinary activities 336,026 302,398 271,772<br />

Cost of sales (98,844) (84,172) (63,334)<br />

Operating expenses (94,628) (84,826) (84,949)<br />

General, commercial and administrative operating expenses (23,692) (22,035) (22,623)<br />

GROSS OPERATING MARGIN (EBITDA) 118,862 111,365 100,866<br />

9 Depreciation, amortization and impairments (26,267) (23,788) (20,683)<br />

OPERATING INCOME before distribution to investors 92,595 87,577 80,183<br />

10 Net distribution to investors (61,114) (57,609) (51,885)<br />

CURRENT OPERATING INCOME 31,481 29,968 28,298<br />

11 Other operating revenues and expenses 3,121<br />

OPERATING INCOME 31,481 29,968 31,419<br />

Income from cash and equivalents 52 26 160<br />

Cost of gross financial debt (14,541) (12,936) (13,027)<br />

Cost of net financial debt (14,489) (12,910) (12,867)<br />

Other financial income and expenses 55 195 (153)<br />

12 FINANCIAL RESULT (14,434) (12,715) (13,020)<br />

Shares for profil/(loss) of associates 37 29<br />

PROFIT BEFORE TAX 17,084 17,282 18,399<br />

13 Corporation tax (4,135) (4,001) (4,244)<br />

NET PROFIT (LOSS) FROM CONSOLIDATED COMPANIES 12,949 13,281 14,155<br />

Income from discontinued activities<br />

CONSOLIDED NET PROFIT (LOSS) 12,949 13,281 14,155<br />

Minority interest 485 (6) 38<br />

CONSOLIDED NET PROFIT (LOSS) (GROUP’S SHARE) 13,434 13,275 14,193<br />

14 Net earnings per share 2.35 2.33 2.73<br />

14 Diluted net earnings per share 2.34 2.31 2.70<br />

(1) adjusted: sales of equipment managed on behalf of third parties were previously recognized under ancillary services and therefore included in the leasing revenue.<br />

At the same time, the cost of these sales was recognized under net distribution to investors. To more accurately reflect the business, and since the sales of equipment<br />

managed on behalf of third parties are more significant, they have been reclassified as sales and their costs have been recognized under cost of sales..<br />

48