2013 benefits open enrollment guide - Jones Lang LaSalle

2013 benefits open enrollment guide - Jones Lang LaSalle

2013 benefits open enrollment guide - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MetLife<br />

+1 800 942 0854<br />

Ways to save on dental costs<br />

• Get regular exams and cleanings;<br />

they’re covered by the plan at 100<br />

percent, and regular check-ups may<br />

prevent future problems.<br />

• Use your HSA or FSA to pay for<br />

your out-of-pocket dental expenses.<br />

• Visit a dentist in the MetLife<br />

network to receive services at a<br />

discounted rate.<br />

• For more information and to register<br />

and create an account, go to http://<br />

welcometouhc.com/JLL.<br />

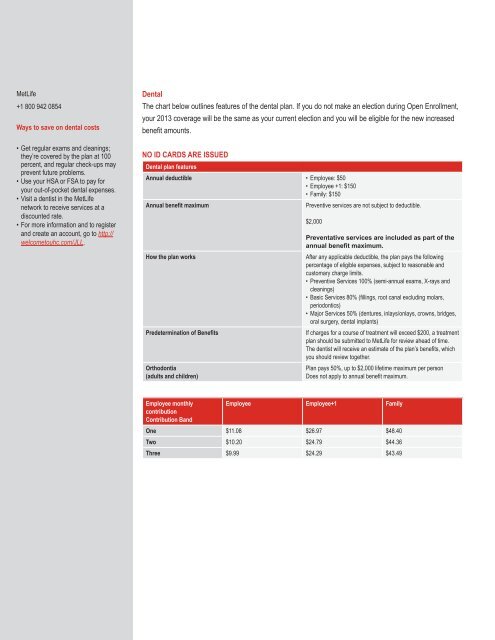

Dental<br />

The chart below outlines features of the dental plan. If you do not make an election during Open Enrollment,<br />

your <strong>2013</strong> coverage will be the same as your current election and you will be eligible for the new increased<br />

benefit amounts.<br />

NO ID CARDS ARE ISSUED<br />

Dental plan features<br />

Annual deductible • Employee: $50<br />

• Employee +1: $150<br />

• Family: $150<br />

Annual benefit maximum<br />

How the plan works<br />

Predetermination of Benefits<br />

Orthodontia<br />

(adults and children)<br />

Preventive services are not subject to deductible.<br />

$2,000<br />

Preventative services are included as part of the<br />

annual benefit maximum.<br />

After any applicable deductible, the plan pays the following<br />

percentage of eligible expenses, subject to reasonable and<br />

customary charge limits.<br />

• Preventive Services 100% (semi-annual exams, X-rays and<br />

cleanings)<br />

• Basic Services 80% (fillings, root canal excluding molars,<br />

periodontics)<br />

• Major Services 50% (dentures, inlays/onlays, crowns, bridges,<br />

oral surgery, dental implants)<br />

If charges for a course of treatment will exceed $200, a treatment<br />

plan should be submitted to MetLife for review ahead of time.<br />

The dentist will receive an estimate of the plan’s <strong>benefits</strong>, which<br />

you should review together.<br />

Plan pays 50%, up to $2,000 lifetime maximum per person<br />

Does not apply to annual benefit maximum.<br />

Employee monthly<br />

contribution<br />

Contribution Band<br />

Employee Employee+1 Family<br />

One $11.08 $26.97 $48.40<br />

Two $10.20 $24.79 $44.36<br />

Three $9.99 $24.29 $43.49<br />

Page 36