An Introduction to Error Correction Models An Introduction to ECMs ...

An Introduction to Error Correction Models An Introduction to ECMs ...

An Introduction to Error Correction Models An Introduction to ECMs ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

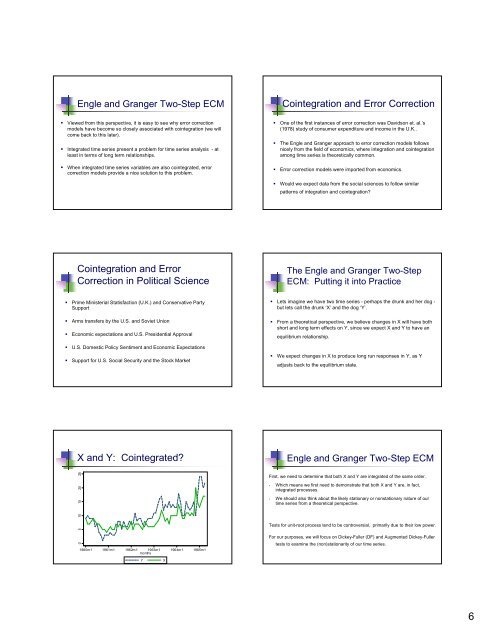

Engle and Granger Two-Step ECM<br />

� Viewed from this perspective, it is easy <strong>to</strong> see why error correction<br />

models have become so closely associated with cointegration (we will<br />

come back <strong>to</strong> this later).<br />

� Integrated time series present a problem for time series analysis - at<br />

least in terms of long term relationships.<br />

� When integrated time series variables are also cointegrated, error<br />

correction models provide a nice solution <strong>to</strong> this problem.<br />

Cointegration and <strong>Error</strong><br />

<strong>Correction</strong> in Political Science<br />

� Prime Ministerial Statisfaction (U.K.) and Conservative Party<br />

Support<br />

� Arms transfers by the U.S. and Soviet Union<br />

� Economic expectations and U.S. Presidential Approval<br />

� U.S. Domestic Policy Sentiment and Economic Expectations<br />

� Support for U.S. Social Security and the S<strong>to</strong>ck Market<br />

X and Y: Cointegrated?<br />

0 5 10 15 20 25<br />

1960m1 1961m1 1962m1 1963m1 1964m1 1965m1<br />

months<br />

Y X<br />

Cointegration and <strong>Error</strong> <strong>Correction</strong><br />

� One of the first instances of error correction was Davidson et. al.’s<br />

(1978) study of consumer expenditure and income in the U.K..<br />

� The Engle and Granger approach <strong>to</strong> error correction models follows<br />

nicely from the field of economics, where integration and cointegration<br />

among time series is theoretically common.<br />

� <strong>Error</strong> correction models were imported from economics.<br />

� Would we expect data from the social sciences <strong>to</strong> follow similar<br />

patterns of integration and cointegration?<br />

The Engle and Granger Two-Step<br />

ECM: Putting it in<strong>to</strong> Practice<br />

� Lets imagine we have two time series - perhaps the drunk and her dog -<br />

but lets call the drunk ‘X’ and the dog ‘Y’.<br />

� From a theoretical perspective, we believe changes in X will have both<br />

short and long term effects on Y, since we expect X and Y <strong>to</strong> have an<br />

equilibrium relationship.<br />

� We expect changes in X <strong>to</strong> produce long run responses in Y, as Y<br />

adjusts back <strong>to</strong> the equilibrium state.<br />

Engle and Granger Two-Step ECM<br />

First, we need <strong>to</strong> determine that both X and Y are integrated of the same order.<br />

• Which means we first need <strong>to</strong> demonstrate that both X and Y are, in fact,<br />

integrated processes.<br />

• We should also think about the likely stationary or nonstationary nature of our<br />

time series from a theoretical perspective.<br />

Tests for unit-root process tend <strong>to</strong> be controversial, primarily due <strong>to</strong> their low power.<br />

For our purposes, we will focus on Dickey-Fuller (DF) and Augmented Dickey-Fuller<br />

tests <strong>to</strong> examine the (non)stationarity of our time series.<br />

6