Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Get set for a liquidity rally - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

<strong>DBS</strong> Group Research Equity 21 Oct 2010<br />

In search of higher yields<br />

• QE2 will probably be announced on November 3<br />

• Asia markets are benefiting from ample <strong>liquidity</strong><br />

but impact to be short-lived<br />

• Improving US growth outlook brought about by<br />

QE2 to keep markets firm<br />

• Reflationary trade is back – commodity and<br />

property are prime beneficiaries<br />

• Look <strong>for</strong> valuation gaps to secure upside<br />

As <strong>the</strong> G3 central banks continue to push <strong>for</strong> QE2, <strong>the</strong><br />

flood in <strong>liquidity</strong> will continue to search <strong>for</strong> higher yielding<br />

as<strong>set</strong>s. Asia equities market will be <strong>the</strong> choice destination<br />

<strong>for</strong> <strong>liquidity</strong> flows on relative growth appeal.<br />

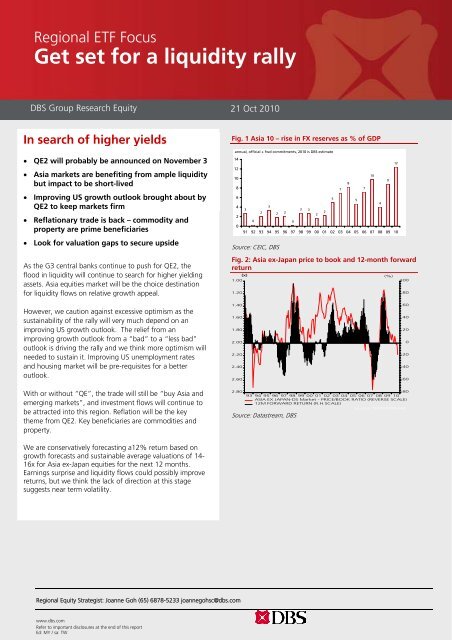

Fig. 1 Asia 10 – rise in FX reserves as % of GDP<br />

annual, official + fwd commitments, 2010 is <strong>DBS</strong> estimate<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

3<br />

0<br />

2<br />

3<br />

2 2<br />

0<br />

3 3<br />

2<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: CEIC, <strong>DBS</strong><br />

Fig. 2: Asia ex-Japan price to book and 12-month <strong>for</strong>ward<br />

return<br />

(x)<br />

1.00<br />

1.20<br />

2<br />

5<br />

7<br />

8<br />

5<br />

7<br />

10<br />

4<br />

9<br />

(%)<br />

12<br />

100<br />

80<br />

However, we caution against excessive optimism as <strong>the</strong><br />

sustainability of <strong>the</strong> <strong>rally</strong> will very much depend on an<br />

improving US growth outlook. The relief from an<br />

improving growth outlook from a “bad” to a “less bad”<br />

outlook is driving <strong>the</strong> <strong>rally</strong> and we think more optimism will<br />

needed to sustain it. Improving US unemployment rates<br />

and housing market will be pre-requisites <strong>for</strong> a better<br />

outlook.<br />

1.40<br />

1.60<br />

1.80<br />

2.00<br />

2.20<br />

2.40<br />

2.60<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

With or without “QE”, <strong>the</strong> trade will still be “buy Asia and<br />

emerging markets”, and investment flows will continue to<br />

be attracted into this region. Reflation will be <strong>the</strong> key<br />

<strong>the</strong>me from QE2. Key beneficiaries are commodities and<br />

property.<br />

2.80 -80<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

ASIA EX JAPAN-DS Market - PRICE/BOOK RATIO (REVERSE SCALE)<br />

12M FORWARD RETURN (R.H.SCALE)<br />

Source: DATASTREAM<br />

Source: Datastream, <strong>DBS</strong><br />

We are conservatively <strong>for</strong>ecasting a12% return based on<br />

growth <strong>for</strong>ecasts and sustainable average valuations of 14-<br />

16x <strong>for</strong> Asia ex-Japan equities <strong>for</strong> <strong>the</strong> next 12 months.<br />

Earnings surprise and <strong>liquidity</strong> flows could possibly improve<br />

returns, but we think <strong>the</strong> lack of direction at this stage<br />

suggests near term volatility.<br />

Regional Equity Strategist: Joanne Goh (65) 6878-5233 joannegohsc@dbs.com<br />

www.dbs.com<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

Ed: MY / sa: TW

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

In search of higher yields ( Joanne Goh, joannegohsc@dbs.com)<br />

The impact from QE2 is two fold, both of which are positive<br />

<strong>for</strong> equities. Firstly, <strong>the</strong> markets will be flushed with <strong>liquidity</strong>.<br />

Asian as<strong>set</strong>s thriving under higher economic growth rates,<br />

attractive yield gaps and currency appreciation are<br />

destinations of choice. Secondly, Fed’s policy of inflation<br />

targeting should favour equities as an as<strong>set</strong> class as a<br />

=beneficiary of reflation.<br />

2011 – a <strong>liquidity</strong> driven year ….<br />

As in 2009 when <strong>the</strong> Fed and major central banks were<br />

committed to as<strong>set</strong> purchases, we believe 2011 will be<br />

ano<strong>the</strong>r <strong>liquidity</strong> driven year. With <strong>the</strong> possible US$1 trillion<br />

targeted <strong>for</strong> as<strong>set</strong> purchases, which is sizeable compared to<br />

US$1540bn previously pumped in, we expect Asia equities<br />

to benefit from <strong>the</strong> <strong>liquidity</strong> flows.<br />

Indeed Asia markets were up by close to 100% from QE1<br />

(March 08 – 1Q10). Since <strong>the</strong>n Asia markets have been in a<br />

tight trading range, and only broke out of <strong>the</strong> 6-month<br />

trading range when signs of a possible QE2 emerged in<br />

September.<br />

Asia and US market per<strong>for</strong>mance with timeline of QE1<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Nov '08:<br />

MBS<br />

purchase<br />

Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10<br />

Source: Datastream, <strong>DBS</strong><br />

Q1'10: QE1 complete<br />

Mar '09: Expand MBS<br />

program to $1.25t and<br />

US$300b LT secs<br />

MSCI Asia ex-Japan S&P 500<br />

Fundamentals needed <strong>for</strong> follow through<br />

Most <strong>liquidity</strong> rallies which were not supported by<br />

fundamentals ended in tears as in 1993, 1997 and 2007.<br />

The sudden outflow of <strong>liquidity</strong> driven by monetary<br />

tightening (1994), overheating and leading to hedge funds<br />

speculative attack (1997), and overheating leading to credit<br />

crisis (2007) were <strong>the</strong> main reasons in <strong>the</strong> sudden change in<br />

sentiment.<br />

Possible speed bumps ahead<br />

We do not believe <strong>the</strong> markets will rise in a straight line next<br />

year, as what was witnessed during QE1. Firstly, <strong>the</strong><br />

uncertainty in <strong>the</strong> US growth outlook is still threatening <strong>the</strong><br />

global recovery. Whe<strong>the</strong>r this is a pure <strong>liquidity</strong> <strong>rally</strong> or that<br />

supported by earnings growth remains to be seen. Since <strong>the</strong><br />

<strong>rally</strong> to 11000 on <strong>the</strong> Dow, markets are refocusing yet again<br />

on <strong>the</strong> corporate earnings season ahead. The outlook <strong>for</strong><br />

earnings growth is conservative, and upside risk remains to<br />

be seen.<br />

Secondly, <strong>the</strong> Japan experience of a long-term deflationary<br />

environment has raised concerns as to whe<strong>the</strong>r QE2 will<br />

really work in stemming deflationary fears. But who wants a<br />

lost decade It is gene<strong>rally</strong> believed that G3 central banks<br />

will avoid that scenario. The central bank “put“ is powerful<br />

enough to institute <strong>the</strong> belief that <strong>liquidity</strong> will be <strong>the</strong>re <strong>for</strong><br />

<strong>the</strong> long term.<br />

Thirdly, <strong>the</strong> weak USD outlook (as a result of QE2) is leaving<br />

uncom<strong>for</strong>table reminiscences that <strong>the</strong> <strong>liquidity</strong> rush involves<br />

a lot of carry trades and speculative positions in risky as<strong>set</strong>s,<br />

as in 2007. There is higher inflationary pressure stemming<br />

from competition from <strong>for</strong>eign money <strong>for</strong> goods, such as<br />

property and discretionary items; and rising commodity<br />

prices as a result of excessive speculation. The side effects of<br />

<strong>the</strong> increased capital flow on <strong>the</strong> real economy cannot be<br />

ignored.<br />

Fourthly, on <strong>the</strong> financial markets, rising valuations as a<br />

result of <strong>liquidity</strong> flows will lead to extended valuations.<br />

However valuations are subjective and everything looks<br />

cheap if <strong>the</strong> cost of capital is zero!<br />

Bond market bubble but not equities .. current valuations<br />

are sustainable and has room <strong>for</strong> re-rating<br />

There are reasons to believe that <strong>liquidity</strong> flows are<br />

benefiting <strong>the</strong> bond market more than <strong>the</strong> equities markets<br />

in <strong>the</strong> past six months. We have seen falling bond yields and<br />

currency appreciation but no re-rating in P/E valuations. Net<br />

<strong>for</strong>eign buying amounted to about US$712m a day (daily<br />

average since September) based on <strong>the</strong> 6 countries<br />

(Thailand, Indonesia, Philippines, Korea, Taiwan and India)<br />

where official data are available. However, <strong>the</strong> amount<br />

bought to date barely covers what was sold off during <strong>the</strong><br />

financial crisis.<br />

Page 2

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Cumulative net <strong>for</strong>eign inflow<br />

US$bil<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

03 04 05 06 07 08 09 10<br />

Source: Datastream, <strong>DBS</strong><br />

As a classic example, <strong>DBS</strong> fixed income strategist argues that<br />

<strong>the</strong> Indon bond market has extended beyond its<br />

fundamentals as <strong>the</strong> yield curve is too flat( see “Indonesia<br />

interest rate strategy: inflows drown fundamentals”, Jens<br />

Lauschke, 9 October 2010, included in this report), while<br />

<strong>DBS</strong> economist thinks that <strong>the</strong> economy is not yet<br />

overheated ( see “Indonesia: inflows & monetary policy”,<br />

Ma Tieying, 13 October 2010, included in this report) .<br />

Meanwhile, <strong>the</strong> Indonesia P/E is capped at 14x, which is<br />

within its long-term re-rating trend. It was only very recently<br />

that equity flows exceeded bond flows with <strong>the</strong> equities<br />

market going past 14x P/E. Hence, we believe current<br />

valuations are sustainable <strong>for</strong> Asia markets and has room <strong>for</strong><br />

re-rating.<br />

Foreign flows into Indonesian stock and bond markets<br />

IDR trillion<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

Bonds<br />

Stocks<br />

Jun-09 Dec-09 Jun-10 Dec-10<br />

Source: CEIC<br />

Asia valuations cheap on PEG and P/E, expensive on<br />

P/B<br />

Valuations in Asia can be argued as cheap when using <strong>the</strong><br />

PEG model. It stands at 0.86x, which is still about 10%<br />

below historical average of 0.95x. This corresponds with<br />

Asia being a growth region, and <strong>the</strong> higher valuations<br />

(when compared to <strong>the</strong> US) are justified. However when<br />

using <strong>the</strong> P/B model, which is more of a predictive model <strong>for</strong><br />

12-month return, Asia ex-Japan is extremely expensive!<br />

Asia ex-Japan PEG ratio<br />

(x)<br />

2.5<br />

2<br />

1.5<br />

1<br />

0.5<br />

0<br />

N/A<br />

due to<br />

ve gro<br />

93 95 97 99 01 03 05 07 09<br />

Source: Datastream, <strong>DBS</strong><br />

Asia ex-Japan 12-month <strong>for</strong>ward P/E<br />

(x)<br />

21<br />

19<br />

17<br />

15<br />

13<br />

11<br />

9<br />

7<br />

00 01 02 03 04 05 06 07 08 09 10<br />

Source: Datastream, <strong>DBS</strong><br />

Earnings growth supports only 12% return <strong>for</strong> 2011<br />

With valuations at fair levels and 12% earnings growth <strong>for</strong><br />

2012 (we use a <strong>for</strong>ward P/E model), return expectations <strong>for</strong><br />

Asia equities are conservative at 12% <strong>for</strong> 2011. Ample<br />

<strong>liquidity</strong> will push valuations higher.<br />

Page 3

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

On stretched valuations to +1SD of 10-year average<br />

valuations, potential returns can be 17% from current<br />

levels. That said re-rating drivers from <strong>liquidity</strong> will render<br />

valuations expensive. We believe rotational interest into<br />

value laggards will bring about <strong>the</strong> re-rating, and a<br />

convergence towards 14x P/E will be <strong>the</strong> likely re-rating<br />

path. We thus prefer Thailand and Korea as potential<br />

candidates <strong>for</strong> re-rating, Indonesia and China <strong>for</strong> growth<br />

surprises.<br />

We are underweight in Taiwan on potential earnings<br />

disappointment and India on de-rating from higher<br />

valuations.<br />

High price to book will cap upside<br />

One reservation we have <strong>for</strong> more upside is high price to<br />

book value multiples.<br />

Our valuation study has found that price to book is one of<br />

<strong>the</strong> better indicators <strong>for</strong> projecting 12-month <strong>for</strong>ward<br />

returns. Current levels indicate a negative return <strong>for</strong> <strong>the</strong> next<br />

12 months.<br />

Asia price to book vs 12-month <strong>for</strong>ward per<strong>for</strong>mance<br />

1.00<br />

1.20<br />

1.40<br />

1.60<br />

1.80<br />

2.00<br />

2.20<br />

2.40<br />

2.60<br />

(x)<br />

2.80 -80<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

ASIA EX JAPAN-DS Market - PRICE/BOOK RATIO (REVERSE SCALE)<br />

12M FORWARD RETURN (R.H.SCALE)<br />

Source: Datastream, <strong>DBS</strong><br />

(%)<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

Source: DATASTREAM<br />

Upside surprise from growth needs fur<strong>the</strong>r catalysts<br />

At this juncture we do not see upside surprise from growth<br />

projections. After a strong economic year in 2010, <strong>DBS</strong><br />

economist refers to next year’s growth as more normalised<br />

with a return to growth trend. A gloomy outlook <strong>for</strong> <strong>the</strong> US<br />

and Europe hinders a more optimistic outlook <strong>for</strong> <strong>the</strong><br />

region.<br />

QE2 and reflation<br />

We believe <strong>the</strong> direct beneficiaries <strong>for</strong> QE2 will be<br />

commodities and properties. QE2 will help bring interest<br />

rates down with <strong>the</strong> purchase of long term securities. At<br />

Asia market economic growth and earnings growth<br />

<strong>for</strong>ecasts<br />

GDP growth, % YoY Earnings growth, % YoY<br />

2010f 2011f 2010f 2011f<br />

US 2.8 2.4 39.7 13.8<br />

Japan 2.7 1.6 79.5 17.1<br />

Eurozone 1.7 1.5 35.3 16.0<br />

Indonesia* 6.0 5.8 17.3 14.6<br />

Malaysia* 8.0 5.5 16.8 14.3<br />

Philippines 6.2 5.0 22.3 12.4<br />

Singapore* 15.0 4.5 18.8 12.8<br />

Thailand* 9.0 4.0 19.5 13.9<br />

China* 10.0 9.5 13.9 11.8<br />

Hong Kong* 7.0 4.5 15.8 13.7<br />

Taiwan 9.5 3.8 90.3 9.2<br />

Korea 6.2 3.9 55.3 6.3<br />

India 8.8 8.5 23.4 22.3<br />

Source: <strong>DBS</strong> <strong>for</strong>ecasts (GDP), IBES (earnings growth) except <strong>for</strong><br />

markets marked with *s which are <strong>DBS</strong><strong>Vickers</strong> coverage.<br />

Earnings growth <strong>for</strong> Hong Kong refers to HSI and China refers<br />

to H-share universe<br />

<strong>the</strong> same time with inflation targeting real interest rates will<br />

also fall. Commodities are good inflation and weak USD<br />

hedge. But we are selective on Asia property sector as an<br />

inflation hedge due to tightening fears in Asia.<br />

Interest rate tightening in Asia, however<br />

In Asia interest rate hikes will be <strong>the</strong> main concern. In 3Q10,<br />

Asia central banks showed <strong>the</strong>ir confidence on growth with<br />

rate hikes. Due to very strong domestic demand and<br />

inflows, inflation in Asia continued to rise, pressurising<br />

central banks to raise raises.<br />

<strong>DBS</strong> economists believe that rate hikes will continue in<br />

4Q10. Singapore tightened its grip on monetary policies by<br />

steepening and widening <strong>the</strong> SGD NEER currency band to<br />

allow <strong>for</strong> more and faster appreciation in early October.<br />

That was followed by RRR hikes and interest rate hikes in<br />

China. We expect most o<strong>the</strong>r Asia countries to follow suit.<br />

That said, <strong>the</strong> strategy team believes that Asia central banks<br />

are facing a dilemma in balancing growth and inflation. As<br />

such a rate hike should signal confidence ra<strong>the</strong>r being seen<br />

as restrictive on growth. On <strong>the</strong> o<strong>the</strong>r hand, central banks<br />

might send <strong>the</strong> wrong signal if rates are not raised, ei<strong>the</strong>r<br />

being perceived as non-independent or too complacent, or<br />

lack of confidence in growth.<br />

Interest rate normalisation, at least hiking towards mid point<br />

of <strong>the</strong> precrisis level, should be taken as a healthy move<br />

towards prevention of a build up of inflationary<br />

expectations. The strategy team believes most Asia countries<br />

will slow <strong>the</strong> interest rate normalisation process.<br />

Page 4

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Table of Contents<br />

In search of higher yields 2<br />

Asia economic focus: ano<strong>the</strong>r day, ano<strong>the</strong>r<br />

$2bn inflow 6<br />

Forex: Pause first 9<br />

Asia equity ETF Investment ideas 11<br />

Singapore-listed ETFs at a glance 13<br />

Hong Kong-listed ETFs at a glance 14-15<br />

Singapore market outlook 16<br />

Hong Kong / China market outlook 18<br />

China economic outlook: 21<br />

Forex: Chinese yuan 23<br />

India market outlook 24<br />

India economic outlook 25<br />

Korea market outlook 28<br />

Korea economic outlook: 29<br />

Taiwan market outlook 32<br />

Taiwan economic outlook 33<br />

Indonesia market outlook 36<br />

Indonesia economic outlook 38<br />

Indonesia interest rate strategy 41<br />

Thailand market outlook 43<br />

Malaysia market outlook 45<br />

Page 5

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Asia economic Focus: ano<strong>the</strong>r day, ano<strong>the</strong>r $2bn inflow (David Carbon,<br />

davidcarbon@dbs.com, re-published from same name report, 1 October)<br />

• Since Apr09, inflows have been pouring into Asia to<br />

<strong>the</strong> tune of $2bn per day. Foreign reserves have risen<br />

by $962bn, or 13% of GDP, significantly faster than<br />

any time in history<br />

• It is no coincidence that, over <strong>the</strong> same time period,<br />

<strong>the</strong> Fed injected $1500bn of <strong>liquidity</strong> into markets via<br />

purchases of Treasuries and housing securities (MBS<br />

and agency paper)<br />

• Washington howls at currency intervention. But<br />

quantitative easing and currency intervention are both<br />

just <strong>liquidity</strong> injections. Who’s really intervening, <strong>the</strong><br />

Fed or Asia<br />

• With QE1 inflows not having run <strong>the</strong>ir course and QE2<br />

already in <strong>the</strong> wings, talk of “one-way bets” in Asian<br />

markets is on <strong>the</strong> rise. Appropriately so<br />

The world may or may not be at war on <strong>the</strong> currency front.<br />

But, as Milton Friedman said, it’s <strong>the</strong> “as if” part that<br />

matters. The pool shark may not know a thing about <strong>the</strong><br />

laws of physics but if he plays as if he does, he can make a<br />

lot of waves. Thus <strong>the</strong> Fed pushes <strong>the</strong> dollar down with<br />

$1.5 trn of quantitative easing between Mar08 and Mar09<br />

(QE1). Japan pushes back by intervening in currency<br />

markets. Washington cringes: QE is kosher, CI (currency<br />

intervention) is not. The Fed counters, all but announcing<br />

QE2, ano<strong>the</strong>r $500bn to $1000bn of <strong>liquidity</strong> injections.<br />

Japan recoils, but creatively. If CI is out, no problem: it<br />

prepares its own QE and fingers <strong>the</strong> trigger. If Bernanke<br />

launches, <strong>the</strong> BoJ will too, be<strong>for</strong>e <strong>the</strong> Fed’s missles can land.<br />

CI, as Japan has so aptly shown, is not very much in<br />

practical terms. Both inject <strong>liquidity</strong> into <strong>the</strong> larger pool of<br />

wet stuff that flows across all markets – <strong>the</strong>y just do it via<br />

different doors. But plainly, <strong>the</strong> water’s just as high on <strong>the</strong><br />

currency side of <strong>the</strong> pool as it is on <strong>the</strong> money/bond side of<br />

<strong>the</strong> pool. The only difference between QE and CI would<br />

seem to be <strong>the</strong> time it takes <strong>for</strong> <strong>the</strong> water to flow from one<br />

side of <strong>the</strong> pool to <strong>the</strong> o<strong>the</strong>r. And in today’s high-tech<br />

markets packed with all kinds of traders, that’s not very<br />

long.<br />

Liquid is as liquid does<br />

By hook or by crook – QE or CI – <strong>the</strong> Fed is flooding markets<br />

with <strong>liquidity</strong>, Japan is flooding <strong>the</strong> markets with <strong>liquidity</strong><br />

and <strong>the</strong> UK is flooding markets with <strong>liquidity</strong>. The trouble<br />

is, a lot of that money isn’t staying where it was put.<br />

Growth in <strong>the</strong> G3 is subpar and most expect it to remain<br />

that way <strong>for</strong> a couple years if not <strong>for</strong> longer. So a big chunk<br />

of those G3 injections is heading <strong>for</strong> o<strong>the</strong>r shores, where<br />

growth and returns are expected to be higher.<br />

A lot of it has gone to Asia, and <strong>for</strong> good reason. Asia<br />

didn’t stop growing just because <strong>the</strong> US and Japan and<br />

Europe did. Output (GDP) in Asia is 10% higher than it was<br />

in 3Q08. Consumption (private) is 18% higher than it was<br />

in 3Q08. In <strong>the</strong> G3, consumption has not grown a bit.<br />

O<strong>the</strong>r things equal, faster growth means higher returns and<br />

it’s little wonder that that a lot of that G3 <strong>liquidity</strong> is flowing<br />

to Asia in an attempt to capture <strong>the</strong>m.<br />

Real global consumption<br />

Asia 10: Equity markets<br />

3Q08=100, seas adj<br />

simple avg of Asia-10 national indices, Jan08=100, weekly data, eop [1]<br />

110<br />

Nov07: 104<br />

100<br />

Oct10: 102.8<br />

120<br />

116<br />

Asia-10<br />

90<br />

112<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11<br />

Mutually assured destruction Not if you’re an Asian equity<br />

market. In fact, a lot of investors are saying, if this is war,<br />

bring it on. Why Because <strong>the</strong> difference between QE and<br />

108<br />

104<br />

100<br />

96<br />

Sep-<br />

08<br />

Dec-<br />

08<br />

Mar-<br />

09<br />

Jun-<br />

09<br />

Sep-<br />

09<br />

The growth that<br />

came "from<br />

nowhere"<br />

Dec-<br />

09<br />

Mar-<br />

10<br />

Jun-<br />

10<br />

US, JP<br />

EU16<br />

Page 6

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Momentum<br />

In <strong>the</strong> short-run, everyone succeeds. As <strong>the</strong> chart on <strong>the</strong><br />

page 1 shows, equity markets have, on average, risen by<br />

20% since May (and 16% since <strong>the</strong> start of <strong>the</strong> year).<br />

Markets have doubled in value since early-2009, on average,<br />

and are now only about 1% shy of fully recovering <strong>the</strong>ir<br />

pre-crisis highs of Nov07.<br />

Asia – currency appreciation<br />

%, 2010 to date<br />

10 9 9<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

6<br />

6<br />

5<br />

MYR THB SGD PHP IDR INR TWD KRW CNY<br />

As one would expect, and much to <strong>the</strong> chagrin of local<br />

central banks, currencies are appreciating too. Since<br />

January, Asian currencies have risen by 6% on average<br />

4<br />

4<br />

3<br />

2<br />

against <strong>the</strong> dollar. The ringgit and baht are leading <strong>the</strong><br />

region with year-to-date appreciation of 9%, followed by<br />

<strong>the</strong> Singapore dollar <strong>the</strong> Philippine peso (6%), <strong>the</strong> rupiah<br />

(5%) and <strong>the</strong> rupee, won and TWD at about 4%. China<br />

continues to intervene <strong>the</strong> most in currency markets<br />

allowing only 2% appreciation of <strong>the</strong> yuan against <strong>the</strong><br />

dollar this year.<br />

Who’s “intervening”: Asia or <strong>the</strong> Fed<br />

China’s intervention in currency markets is of course <strong>the</strong><br />

source of much irritation to US politicians. How much<br />

intervention has <strong>the</strong>re been Since April of 2009, when<br />

inflows into Asia really started to pick up, China’s <strong>for</strong>eign<br />

reserves have risen by some $535bn. That’s a little more<br />

than half (56%) of <strong>the</strong> total increase in <strong>for</strong>eign reserves<br />

($962bn) by Asia’s central banks since <strong>the</strong>n (chart below<br />

left).<br />

That’s a lot of inflow and a lot of intervention – $2bn per<br />

day to be precise and and it works out to some 13% of one<br />

year’s GDP <strong>for</strong> Asian economies on average (chart below<br />

right). It’s easy to see why Asian markets are rising and why<br />

Asian currencies are rising. And why US politicians are a<br />

little piqued.<br />

Asia – rise in <strong>for</strong>eign reserves<br />

g<br />

USD bn, including fwd commitments, Apr09-Aug10 [2]<br />

600<br />

535<br />

500<br />

400<br />

300<br />

200<br />

118<br />

100<br />

77 68 67<br />

44<br />

27 21<br />

6<br />

0<br />

CH KR SG HK TW TH PH ID MY<br />

Asia – rise in <strong>for</strong>eign reserves<br />

g<br />

% of GDP, including fwd commitments, Apr09-Aug10 [2]<br />

35 33<br />

30<br />

25<br />

24<br />

20<br />

15<br />

13<br />

12 12<br />

11<br />

10<br />

8<br />

5<br />

3 2<br />

0<br />

SG HK TW TH PH KR CH ID MY<br />

Page 7

Regional ETF Guide<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

But should <strong>the</strong>y really be up<strong>set</strong> If you take <strong>the</strong> view that<br />

QE and CI (currency intervention) are both just <strong>liquidity</strong><br />

injections <strong>the</strong> question <strong>the</strong>n becomes: who is really<br />

intervening, <strong>the</strong> US or China/Asia The answer is a lot less<br />

clear than what you’d ga<strong>the</strong>r from reading <strong>the</strong> papers every<br />

day.<br />

Between Feb09 and Aug10, <strong>the</strong> Fed pumped $1540bn into<br />

markets via its purchases of Treasuries and housing<br />

securities (MBS+agency paper). Since Apr09, Asia’s <strong>for</strong>eign<br />

reserves have soared by $962bn. Not only is <strong>the</strong> Fed’s<br />

intervention $600bn larger than Asia’s, but Asia’s chicken<br />

sure looks to have hatched from <strong>the</strong> Fed’s egg.<br />

One way bet<br />

Irrespective of who’s doing <strong>the</strong> intervening, Asia is being<br />

inundated with inflows. At 13% of GDP on average, <strong>the</strong><br />

accumulation of <strong>for</strong>eign reserves is significantly higher than<br />

at any time in history (chart below). That includes <strong>the</strong> early-<br />

90’s when <strong>for</strong>eign inflows into Asia led to soaring equity<br />

markets, too-low interest rates, high leverage, over<br />

investment, excess capacity, property bubbles and ultimately<br />

<strong>the</strong> blowout known as <strong>the</strong> Asian financial crisis of 1997/98.<br />

Asia 10 – rise in FX reserves as % of GDP<br />

annual, official + fwd commitments, 2010 is <strong>DBS</strong> estimate<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

3<br />

0<br />

2<br />

3<br />

2 2<br />

0<br />

3 3<br />

2<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

In previous research [3], we argued at some length that <strong>the</strong><br />

next 5-10 years in Asia is likely to look very much like <strong>the</strong> 5-<br />

10 years that led up to <strong>the</strong> Asian financial crisis. Much of<br />

<strong>the</strong> reason, we argued, was that inflows into Asia seemed<br />

likely to rise sharply, partly due to long-term “structural”<br />

reasons (Asia is where <strong>the</strong> world’s new demand is being<br />

generated) and partly <strong>for</strong> cyclical reasons – namely, <strong>the</strong><br />

outflow of G3 QE quantitative easing programs into higher<br />

yielding economies / regions such as Asia.<br />

2<br />

5<br />

7<br />

8<br />

5<br />

7<br />

10<br />

4<br />

9<br />

12<br />

Without a doubt, <strong>the</strong> cyclical flows have been more<br />

aggressive than even we imagined a year ago. And with <strong>the</strong><br />

US, Japan and England now on <strong>the</strong> verge of ano<strong>the</strong>r round<br />

of QE it is little wonder that most strategists now predicts<br />

fur<strong>the</strong>r gains in Asian equities, bonds and currencies. Who<br />

would dare stand in <strong>the</strong> way of a QE2 freight train pointed<br />

straight down <strong>the</strong> tracks at Asia when <strong>the</strong> effects of QE1<br />

have yet to run <strong>the</strong>ir course Most seem happy to climb<br />

aboard what is increasingly regarded as a one-way bet.<br />

Of course one-way bets never stay that way <strong>for</strong>ever. And,<br />

yes, <strong>the</strong>y often end in tears. But our view, expressed a year<br />

ago [3] is that Asia has spent <strong>the</strong> last ten years deleveraging<br />

and thus seems well placed to wea<strong>the</strong>r a multi-year period<br />

of re-leveraging. And though it is true that things are<br />

developing more rapidly than we imagined a year ago, it<br />

still seems as though this train has barely left <strong>the</strong> station.<br />

With <strong>the</strong> trillions of dollars of QE1 coal yet to be burned<br />

through and ano<strong>the</strong>r trillion of QE2 seemingly on <strong>the</strong> way,<br />

it’s surely going to take more than a few weeks or months<br />

or quarters be<strong>for</strong>e this train comes to rest.<br />

Notes<br />

1. Asia10: CH, HK, TW, KR, SG, MY, TH, ID, PH, IN<br />

2. “Effective reserves” include not just actual dollar holdings<br />

but also commitments to purchase dollars at a future date in<br />

<strong>the</strong> <strong>for</strong>ward market. Such intervention is now reported by<br />

most IMF member countries as part of <strong>the</strong> re<strong>for</strong>ms<br />

introduced in <strong>the</strong> aftermath of <strong>the</strong> Asian financial crisis of<br />

1997/98. Forward market intervention has <strong>the</strong> same impact<br />

on <strong>the</strong> currency as spot purchases even though it does not<br />

(yet) appear in official reserve figures. This earlier lack of<br />

transparency was judged to have contributed to <strong>the</strong> crisis,<br />

particularly in <strong>the</strong> case of Thailand, where reported reserves<br />

appeared substantial but were, in effect, already zero<br />

because <strong>the</strong>y had been sold <strong>for</strong>ward in <strong>the</strong> <strong>for</strong>ward currency<br />

market.<br />

3. “Asia-vu: back to <strong>the</strong> ‘90s”, <strong>DBS</strong> Economics-Markets-<br />

Strategy, 17Sep09.<br />

Page 8

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Forex: Pause first (Philip Wee, philipwee@dbs.com, re-published and extracted from same name report in “<br />

Economics-Markets-Strategy, 11 Sep 2010)<br />

November is an important month<br />

The most important month in 4Q 2010 is probably<br />

November, which houses many key events that look <strong>set</strong> to<br />

politicize <strong>the</strong> Chinese yuan issue again. Unlike June, <strong>the</strong>re<br />

appears to be a bias by <strong>the</strong> US and o<strong>the</strong>r major economies<br />

to lean towards <strong>the</strong> carrot ra<strong>the</strong>r than <strong>the</strong> stick to achieve<br />

more progress on <strong>the</strong> yuan.<br />

• US Treasury Currency Report (mid-October)<br />

The semiannual Currency Report was last delayed in<br />

April to “encourage” China to free its yuan from <strong>the</strong> US<br />

dollar. China announced yuan re<strong>for</strong>ms on June 19 to<br />

introduce flexibility into its exchange rate. The Treasury<br />

finally released <strong>the</strong> report on July 8 without naming<br />

China a currency manipulator.<br />

The next Currency Report is unlikely to be released on<br />

schedule in mid-October owing to <strong>the</strong> US midterm<br />

elections. China is unlikely to be named a manipulator<br />

when it is eventually published. The Ministry of<br />

Commerce in China has already started to take steps to<br />

increase imports. The USD/CNY trading band is also<br />

likely to be widened nearer <strong>the</strong> G20 summit.<br />

• US midterm elections (November 2)<br />

According to US undersecretary of State Robert Hormats<br />

on September 3, US lawmakers have become impatient<br />

with a lack of progress by China to address currency and<br />

trade issues. With <strong>the</strong> economy and jobs topping voter<br />

concerns ahead of <strong>the</strong> US midterm elections in<br />

November, risks have increased <strong>for</strong> US lawmakers to<br />

become more protectionist.<br />

A key committee in <strong>the</strong> US House of Representatives is<br />

scheduled to hold a hearing on September 15 to<br />

determine if <strong>the</strong> undervalued yuan has provided unfair<br />

advantages to Chinese companies against US Inc. Owing<br />

to <strong>the</strong>ir interdependency, Washington and Beijing are<br />

likely to continue cooperating to avoid <strong>the</strong> political<br />

pitfalls linked to legislation.<br />

• G20 summit (November 11-12)<br />

Unlike <strong>the</strong> last G20 summit in June, <strong>the</strong> US is unlikely to<br />

strongly <strong>rally</strong> emerging countries to pressure China on<br />

<strong>the</strong> yuan. First, emerging countries are less tolerant of<br />

currency appreciation because of <strong>the</strong> second half<br />

slowdown story amidst concerns that US double-dip<br />

recession risks are no longer zero. Second, <strong>the</strong> IMF fiveyear<br />

review, which is likely to be held alongside <strong>the</strong> G20<br />

summit, is expected to boost <strong>the</strong> voting power of<br />

emerging economies. The job now is to persuade China<br />

to live up to its global responsibility to address<br />

imbalances with its new clout.<br />

Looking ahead, <strong>the</strong> G20 summits in 2011 have more<br />

scope to renew <strong>the</strong> dollar’s depreciation. France, who<br />

will be assuming <strong>the</strong> G20 presidency in 2011, has voiced<br />

its desire to re<strong>for</strong>m <strong>the</strong> current international monetary<br />

system modelled around <strong>the</strong> US dollar to reflect an<br />

increasingly multipolar global economy.<br />

• IMF five-year review (November)<br />

According to IMF managing director Dominique Strauss-<br />

Kahn on June 27, <strong>the</strong> increase in China’s voting power<br />

in <strong>the</strong> IMF is expected to be “ra<strong>the</strong>r big”. An agreement<br />

to shift more (5% or more) voting power in <strong>the</strong> IMF to<br />

under-represented emerging economies was reached at<br />

<strong>the</strong> G20 summit in late September 2009. This was <strong>the</strong><br />

summit that <strong>for</strong>malized <strong>the</strong> G20 as <strong>the</strong> world’s premier<br />

economic <strong>for</strong>um.<br />

Compared to a year ago, Eurozone no longer appears as<br />

keen to share power in <strong>the</strong> IMF today. After <strong>the</strong> EU<br />

fiscal/debt crisis in 2Q, Eurozone was unhappy that <strong>the</strong><br />

US placed its recovery over EU’s need to emphasize fiscal<br />

austerity, as well as China’s slow progress in allowing<br />

yuan appreciation. None<strong>the</strong>less, Eurozone is expected to<br />

eventually honor its earlier commitment. If so, China is<br />

expected to overtake France and UK to become <strong>the</strong><br />

fourth loudest voice in <strong>the</strong> IMF, after <strong>the</strong> US, Japan and<br />

Germany.<br />

Page 9

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

More flexible CNY is also USD – sensitive<br />

Voting power in IMF – SDR vs BRIC economies<br />

90<br />

6.84<br />

25<br />

% of total votes<br />

88<br />

86<br />

84<br />

82<br />

DXY (USD) index<br />

(lhs)<br />

USD/CNY (rhs)<br />

6.83<br />

6.82<br />

6.81<br />

6.80<br />

6.79<br />

6.78<br />

20<br />

15<br />

10<br />

19.55<br />

16.77<br />

SDR: EUR, USD, JPY, GBP<br />

BRIC: CNY, RUB, INR, BRL<br />

80<br />

78<br />

76<br />

Jan-10 Mar-10 May-10 Jul-10 Sep-10<br />

6.77<br />

6.76<br />

6.75<br />

6.74<br />

5<br />

0<br />

6.02<br />

4.86<br />

3.66<br />

2.69<br />

1.89<br />

1.33<br />

EU US Japan UK China Russia India Brazil<br />

The yuan is, however, unlikely to be included in <strong>the</strong><br />

Special Drawing Right (SDR) <strong>for</strong> this IMF review. The<br />

yuan needs to be closer to <strong>the</strong> SDR basket of currencies<br />

(US dollar, euro, British pound and <strong>the</strong> Japanese yen) in<br />

two regards. The yuan needs to be more marketdetermined<br />

and more convertible on <strong>the</strong> capital account.<br />

4Q 2010 – a tough transition towards a sustainable<br />

global recovery<br />

In summary, <strong>the</strong> final quarter is likely to comprise two halves.<br />

Until economic data improves, especially <strong>for</strong> <strong>the</strong> US, global<br />

slowdown worries should dominate and support <strong>the</strong> US<br />

dollar as a safe haven currency.<br />

China’s <strong>for</strong>eign reserves breakdown<br />

November should be closely watched as a potential turning<br />

point <strong>for</strong> <strong>the</strong> US dollar to depreciate again. Hopefully by<br />

<strong>the</strong>n, most economies would have exhibited signs of<br />

returning to a more sustainable moderate growth path,<br />

preferably with China allowing more yuan appreciation. If so,<br />

this should <strong>set</strong> <strong>the</strong> stage <strong>for</strong> risk appetite to return on <strong>the</strong><br />

back of a broad-based depreciation in <strong>the</strong> US dollar.<br />

If 2009/10 was about emerging from <strong>the</strong> (US/EU) global<br />

crisis, 2011 and <strong>the</strong> next few years will be about moving<br />

towards a more sustainable global recovery. When this<br />

happens, expect more diversification out of US dollars.<br />

Weights of basket currencies in SDR<br />

GBP, 5%<br />

JPY, 3%<br />

JPY, 15%<br />

EUR, 26%<br />

GBP, 10%<br />

USD, 45%<br />

USD, 65%<br />

EUR, 29%<br />

Sources:<br />

Sources <strong>for</strong> all charts and tables are Bloomberg . Forecasts are <strong>DBS</strong> Group Research.<br />

Page 10

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Asia equity ETF Investment ideas (Joanne Goh, joannegohsc@dbs.com)<br />

Over <strong>the</strong> last two months mid caps stocks have stolen <strong>the</strong><br />

limelight. Big caps and main indices were stuck in a trading<br />

range as broad macro factors were uncertain and lagging in<br />

per<strong>for</strong>mance.<br />

We believe that as <strong>the</strong> uncertainty dissipates, coupled with<br />

<strong>the</strong> <strong>liquidity</strong> boost by central banks, large caps will have a<br />

lot of catch up to do.<br />

We recommend buying into ETFs to capture <strong>the</strong> upside as<br />

<strong>the</strong> equities market recovery becomes broad based. QE2 will<br />

probably be announced on November 3 which could drive<br />

ano<strong>the</strong>r <strong>liquidity</strong> <strong>rally</strong>.<br />

Our currency strategist points to November as an important<br />

month to watch (See “Forex: Pause first” included in this<br />

report). As far as Asia equities are concerned, we believe<br />

<strong>for</strong>ex volatility with a streng<strong>the</strong>ning bias should be positive<br />

<strong>for</strong> Asia markets. However, with Asia currencies and Asia<br />

equities up by 3.9% and 10% respectively since 1 Sep, we<br />

see <strong>the</strong> possibility that November will be a month of<br />

consolidation be<strong>for</strong>e <strong>the</strong> next leg up. Any weakness is a<br />

buying opportunity in our view.<br />

“Buy Asia and Emerging markets”<br />

The debate over whe<strong>the</strong>r QE2 will be successful is irrelevant<br />

to <strong>the</strong> “Buy Asia and emerging markets” <strong>the</strong>me as Asia will<br />

still be <strong>the</strong> growth region. Under a moderate US growth<br />

environment and continuation of low rates policy, Asia<br />

markets could potentially mirror <strong>the</strong> early 1990s’ where<br />

investments will lead growth in <strong>the</strong> next decade.<br />

ETFs exposed to Asia ex-Japan markets<br />

ETF Ticker Mkt Cap Country/ Underlying<br />

(US$ m) Region Index<br />

Tracker<br />

Singapore listed ETFs<br />

CIMBFTASEAN40 ASEAN SP Equity 209 ASEAN ASEAN40<br />

Lyxor APEX50 APEX SP Equity 13 Asia ex-Jap MXAPEXA<br />

Lyxor Asia AEJ SP Equity 139 Asia Pac ex-Jap MXAPJ<br />

DBXT MS Asia X-JP XAXJ SP Equity 508 Asia ex-Jap NDUECAXJ<br />

DBXT MSCI EM Asia XMAS SP Equity 7 Asia Pac ex-Jap NDUEEGFA<br />

DBXT MSCI Pacific ex Japan XPXJ SP Equity 43 Pac ex-Jap NDDUPXJ<br />

Hong Kong listed ETFs<br />

iShares APEX50 3010 HK Equity 43 APAC ex-J MXAPEXA<br />

iShares APEX Mid Cap 3032 HK Equity 21 APAC ex-J MXAPEXAM<br />

iShares APEX Small Cap 3004 HK Equity 13 APAC ex-J MXAPEXAS<br />

Lyxor MSCI Asia ex-Japan 2815 HK Equity 68 APAC ex-J MXAPJ<br />

iShares Emerging Asia 2802 HK Equity 28 Asia MXMS<br />

DBXT Emerging Mkts Asia 3035 HK Equity 8 Asia NDUEEGFA<br />

DBXT Pacific ex Japan 3043 HK Equity 43 Pac x Jap NDDUPXJ<br />

SPDR FTSE Greater China ETF 3073 HK Equity 72 HK/Taiwan GPSSG239<br />

Source: Datastream<br />

Singapore STI to break out of its trading range<br />

<strong>DBS</strong><strong>Vickers</strong>’ strategist <strong>for</strong> Singapore, Janice Chua, believes<br />

that <strong>the</strong> Singapore market is ready to break out of its<br />

trading band and sees <strong>the</strong> STI trading up to 3500 in <strong>the</strong> next<br />

12 months. (See report “Singapore strategy : All boats rise<br />

with <strong>the</strong> tide”, 13 October, 2010”). She recommends going<br />

<strong>for</strong> big large caps laggards. As good news gets reflected in<br />

<strong>the</strong> valuation of a handful of current market leaders, <strong>the</strong>re is<br />

room <strong>for</strong> future <strong>liquidity</strong> inflows to benefit <strong>the</strong> rest of <strong>the</strong><br />

index laggards as <strong>the</strong>y play catchup. Our target is 3500 <strong>for</strong><br />

year end 2011, suggesting 10% upside.<br />

Multi-year <strong>rally</strong> awaits <strong>the</strong> Thai market<br />

We also believe that a multi-year <strong>rally</strong> awaits <strong>the</strong> Thai<br />

market. As seen from <strong>the</strong> following relative per<strong>for</strong>mance<br />

chart, Thailand has been lagging its regional peers in local<br />

currency and USD terms <strong>for</strong> <strong>the</strong> past 20 years! If politics is<br />

one of one of <strong>the</strong> key reasons <strong>for</strong> <strong>the</strong> P/E de-rating, <strong>the</strong><br />

easing of political tension from its peak should see <strong>the</strong> stock<br />

market re-rate back to historical average.<br />

While short-term valuation opportunities have become<br />

harder to identify following <strong>the</strong> recent <strong>rally</strong> in Thailand, it is<br />

still one of <strong>the</strong> cheapest markets in <strong>the</strong> region. The SET<br />

index could potentially trade towards <strong>the</strong> upper limit of its<br />

historical P/E range in <strong>the</strong> last 10 years.<br />

Thai relative per<strong>for</strong>mance to MSCI Asia ex-Japan<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Datastream<br />

Local currency<br />

USD<br />

Source: DATASTREAM<br />

Page 11

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Thai P/E band<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Malaysia – market uptrend intact<br />

<strong>DBS</strong> Malaysia strategist believes that <strong>the</strong> market uptrend is<br />

intact and is targeting 1650 on KLCI by end 2011 –11%<br />

upside from current levels. Budget 2011 is private sector<br />

friendly and Malaysia’s PM reaffirmed commitment to <strong>the</strong><br />

RM40bn high impact MRT project that will start in 2011.<br />

We believe <strong>the</strong> project, if completed, will be instrumental in<br />

trans<strong>for</strong>ming Malaysia to a high income nation and benefit<br />

many private sectors.<br />

ASEAN – back to 1990’s<br />

9<br />

96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Datastream<br />

Indonesia – no overheating in <strong>the</strong> stock market<br />

Source: DATASTREAM<br />

Although it has re-rated to 14.3x we don’t see <strong>the</strong> JCI<br />

market being overheated. JCI’s per<strong>for</strong>mance to date is in<br />

line with past years per<strong>for</strong>mance and flows to Indonesia<br />

weren’t any larger. Notably this year we see a lot of capital<br />

raising to absorb <strong>the</strong> demand, both domestic and <strong>for</strong>eign,<br />

which should bode well <strong>for</strong> <strong>the</strong> longer sustainability of <strong>the</strong><br />

<strong>rally</strong>.<br />

With <strong>the</strong> index now trading at 14.8x 12-month <strong>for</strong>ward P/E<br />

we expect consolidation in <strong>the</strong> market be<strong>for</strong>e <strong>the</strong> next leg<br />

up. Accordingly our conservative approach to valuations of<br />

14x P/E (no re-rating) and 20% growth could bring <strong>the</strong> JCI<br />

to 4125 by <strong>the</strong> end of 2011, which represents only 10% rise<br />

from current levels.<br />

9<br />

We believe that ASEAN markets will continue to outper<strong>for</strong>m<br />

<strong>the</strong> Asia ex-Japan benchmark led by many investment<br />

initiatives, strong domestic demand and a low interest rate<br />

environment. A diversified portfolio can be achieved<br />

through investing in CIMB ASEAN40 ETF listed in Singapore.<br />

Hong Kong / China to continue to outper<strong>for</strong>m<br />

China and China related H-share index outper<strong>for</strong>med <strong>the</strong><br />

regional index by 3-9% and <strong>the</strong> 2823 HK now trades at a<br />

premium of 8% to its NAV.<br />

We continue to see that China A- share should benefit<br />

directly from RMB revaluation. China related ETFs continue<br />

to draw interest, with a combined turnover of US$360mil a<br />

day among those listed in Hong Kong and Singapore.<br />

The A-share ETF traded at a premium to NAV, reflecting<br />

strong demand <strong>for</strong> A-shares amid limited supply. The Hang<br />

Seng Index A-H premium index has rebounded from <strong>the</strong> low<br />

since we highlighted it in our last report, but it’s still about<br />

20% from <strong>the</strong> high, suggesting that A-shares still look<br />

attractive.<br />

Meanwhile <strong>the</strong> index heavyweights like <strong>the</strong> Banks and Oil<br />

companies have been lagging in terms of per<strong>for</strong>mance. We<br />

expect easing concerns on policy uncertainty and firming oil<br />

prices to benefit <strong>the</strong>se two sectors; and an influx of <strong>liquidity</strong><br />

to benefit <strong>the</strong> big caps.<br />

Page 12

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Fig. 8: Singapore listed ETF<br />

ETF Ticker Mkt Cap Style Country/ Underlying Ask Bid NAV/ Premium/ Avg Daily Avg Daily<br />

(US$ m) Region Index Price Price INAV Discount Volume Value (US$m)<br />

Tracker 15-Oct 15-Oct (latest) (20 day) (20 day)<br />

EQUITIES<br />

Global / Regional Funds - Ex Asia<br />

Lyxor World WLD SP Equity 25 Global Fund Global MXWO 1.22 1.23 1.23 -0.2% 6,233 0.007<br />

DBXT MSCI World XMWO SP Equity 5 Global Fund Global NDDUWI 2.93 2.94 2.96 -0.9% 16,716 0.049<br />

DBXT DJ Stoxx Gl Dvd XGSD SP Equity 423 Global Fund Global SDGP 26.86 26.86 27.64 -2.8% 636 0.017<br />

DBXT MSCI Europe XMEU SP Equity 1120 Region Fund Europe NDDUE15 44.75 44.75 45.64 -2.0% 1,470 0.064<br />

Lyxor MSCI Europe MEU SP Equity 6 Region Fund Europe MXEU 12.95 13.03 12.98 0.0% 3,040 0.038<br />

DBXT DJ Euro Stoxx XESX SP Equity 2669 Region Fund Europe SX5E 41.59 41.59 40.77 2.0% 802 0.033<br />

Lyxor Emerg.Markets LEM SP Equity 66 Region Fund Emerg. Mkt MXEF 11.27 11.32 11.26 0.3% 8,392 0.089<br />

DBXT Emerg. Mkts XMEM SP Equity 6 Region Fund Emerg. Mkt NDUEEGF 4.23 4.12 4.20 -0.6% 574 0.002<br />

Lyxor Eastern Europe CEC SP Equity 12 Region Fund East Europe CECEEUR 5.92 5.94 5.95 -0.3% 11,975 0.066<br />

Lyxor Latin America LTM SP Equity 25 Region Fund Latin America MXLA 9.21 9.21 9.22 -0.1% 11,720 0.102<br />

Country Funds - OECD<br />

Lyxor NASDAQ-100 NDX SP Equity 27 Growth US NDX 8.27 8.29 8.22 0.7% 400 0.003<br />

DBXT S&P Short XSPS SP Equity 233 Contrarian US SPXTS 48.84 48.84 48.74 0.2% 3,662 0.184<br />

Lyxor DJIA DJI SP Equity 7 Country Fund US INDU 11.12 11.14 11.12 0.1% 1,866 0.020<br />

DBXT MSCI USA XMUS SP Equity N/A Country Fund US NDDLUS 26.68 26.75 27.69 -3.5% - N/A<br />

DBXT S&P 500 K6K SP Equity N/A Country Fund US SPTR500N 18.47 18.47 18.42 0.3% 1,650 0.030<br />

Lyxor Japan JPN SP Equity 24 Country Fund Japan TPX 1.03 1.03 1.03 0.2% 32,725 0.034<br />

DBXT MSCI Japan LF2 SP Equity 389 Country Fund Japan NDDUJN 37.53 37.81 37.60 0.2% 3,000 0.111<br />

DBXT S&P/ ASX 200 LF1 SP Equity 151 Country Fund Australia ASA51 33.12 33.36 33.23 0.0% 6,055 0.194<br />

Country Funds - Emerging (Non-Asia)<br />

DBXT MSCI Brazil XMBR SP Equity 9 Country Fund Brazil NDUEBRAF 7.49 7.62 7.43 1.7% 2,952 0.021<br />

Lyxor Russia RUS SP Equity 33 Country Fund Russia RU10D 4.02 4.04 4.05 -0.5% 15,009 0.059<br />

DBXT Russia Capped XMRC SP Equity 8 Country Fund Russia MXRUC25P 3.10 3.11 3.10 0.1% 4,063 0.012<br />

Regional Funds - Asia x Japan<br />

CIMBFTASEAN40 ASEAN SP Equity 209 Region Fund ASEAN ASEAN40 10.24 10.28 10.26 0.0% 12,130 0.123<br />

Lyxor APEX50 APEX SP Equity 13 Region Fund Asia ex-Jap MXAPEXA 4.19 4.22 4.21 -0.1% 12,690 0.051<br />

Lyxor Asia AEJ SP Equity 139 Region Fund Asia Pac ex-Jap MXAPJ 4.71 4.72 4.71 0.1% 470,922 2.108<br />

DBXT MS Asia X-JP XAXJ SP Equity 508 Region Fund Asia ex-Jap NDUECAXJ 32.73 32.96 32.91 -0.2% 402 0.000<br />

DBXT MSCI EM Asia XMAS SP Equity 7 Region Fund Asia Pac ex-Jap NDUEEGFA 3.87 3.83 3.82 0.7% 1,155 0.004<br />

DBXT MSCI Pacific ex Japan XPXJ SP Equity N/A Region Fund Pac ex-Jap NDDUPXJ N/A N/A 4.35 N/A - N/A<br />

Country Funds - North Asia<br />

Lyxor China H ASI SP Equity 80 Country Fund China HSCEI 17.52 17.68 17.61 -0.1% 14,451 0.234<br />

DBXT FTChina25 XX25 SP Equity 377 Country Fund China TXINOU 33.44 33.44 33.65 -0.6% 9,283 0.302<br />

United SSE 50 China S$ USSE50 SP Equity 104 Country Fund China SSE50 2.23 2.24 2.00 11.9% 386,320 0.532<br />

DBXT CSI300 Index XCSI SP Equity 37 Country Fund China SHSZ300 10.88 11.16 9.77 12.8% 116,015 1.155<br />

DBXT MSCI China LG9 SP Equity 6 Country Fund China NDEUCHF 13.23 13.34 13.30 -0.1% 8,650 0.109<br />

Lyxor HangSeng HSI SP Equity 26 Country Fund Hong Kong HSI 3.07 3.09 3.08 0.0% 10,773 0.032<br />

Lyxor Korea KRW SP Equity 66 Country Fund South Korea MXKR 4.76 4.79 4.78 -0.1% 54,066 0.245<br />

DBXT MSCI Korea XMKO SP Equity 247 Country Fund South Korea MXKR 53.73 54.05 54.00 -0.2% 8,397 0.428<br />

DBXT MSTaiwan XMTW SP Equity 160 Country Fund Taiwan NDEUSTW 17.36 17.48 17.47 -0.3% 15,347 0.265<br />

Lyxor Taiwan TWN SP Equity 62 Country Fund Taiwan TAMSCI 0.97 0.97 0.98 -1.0% 87,010 0.084<br />

Country Funds - South Asia<br />

IS MSCI INDIA INDIA SP Equity 1038 Country Fund India MXIN 8.35 8.37 8.35 0.1% 554,305 4.503<br />

Lyxor MS India INR SP Equity 303 Country Fund India MXIN 18.63 18.63 18.51 0.6% 863 0.016<br />

DBXT MSCI India LG8 SP Equity 4 Country Fund India NDEUSIA 11.63 11.68 11.77 -1.0% 17,386 0.198<br />

DBXT Nifty XNIF SP Equity 534 Country Fund India NIFTY 140.81 141.67 141.43 -0.1% 4,508 0.627<br />

Lyxor India Nifty S$ LNFU SP Equity 46 Country Fund India NIFTY 18.06 18.30 18.01 0.9% 1,813 0.022<br />

Country Funds - South East Asia<br />

Streetracks STI ETF S$ STTF SP Equity 153 Country Fund Singapore FSSTI 3.25 3.26 3.27 -0.5% 193,400 0.424<br />

<strong>DBS</strong> STI ETF S$ <strong>DBS</strong>STI SP Equity 32 Country Fund Singapore FSSTI 3.23 3.25 3.22 0.5% 48,840 0.106<br />

Lyxor Malaysia MAL SP Equity 31 Country Fund Malaysia MXMY 8.96 9.04 8.96 0.4% 108,764 0.946<br />

DBXT MSCI Malaysia LG6 SP Equity 4 Country Fund Malaysia NDDUMAF 12.23 12.32 12.32 -0.4% 3,905 0.047<br />

DBXT MSCI Thailand LG7 SP Equity 25 Country Fund Thailand NDEUTHF 15.76 15.86 15.84 -0.2% 28,493 0.429<br />

DBXT MSCI Indonesia XMIN SP Equity 96 Country Fund Indonesia NDEUINF 14.46 14.60 14.41 0.8% 202,166 2.900<br />

DBXT FTSE Vietnam XFVT SP Equity 248 Country Fund Vietnam FVTTE 37.37 37.37 36.64 2.0% 30,746 1.128<br />

FIXED INCOME<br />

ABF SG BOND S$ SBIF SP Equity 227 Total Return Singapore N/A 1.16 1.17 1.14 1.8% 30,400 0.025<br />

DBXT USD My Mkt XUSD SP Equity N/A Money Market US DBMMFED1 N/A N/A 170.88 N/A - N/A<br />

DBXT Infl Lkd Treasuries XUIT SP Equity N/A Sovereign US DBLNUSD 245.50 245.50 246.75 -0.5% 1,331 0.316<br />

DBXT iBoxx Treasuries XUTD SP Equity 28 Sovereign US ITRROV 192.96 192.96 191.95 0.5% 3 0.000<br />

DBXT SG Mny Mkt S$ XSGO SP Equity N/A Money Market Singapore DBMMSGDO N/A N/A 107.75 N/A - N/A<br />

DBXT iBoxx Korea KT2 SP Equity 30 Total Return South Korea ABUTKOGO 125.00 125.00 125.69 -0.5% 2,047 0.270<br />

DBXT AU Mny Mkt A$ KV5 SP Equity 22 Money Market Australia DBMMAUDO 188.37 188.37 189.07 -0.4% - N/A<br />

DBXT AU Mny Mkt US$ KV6 SP Equity 7 Money Market Australia DBMMAUDO 182.71 182.71 188.44 -3.0% 8 0.001<br />

DBXT AU Mny Mkt S$ KV7 SP Equity 7 Money Market Australia DBMMAUDO 242.60 242.60 243.83 -0.5% 357 0.060<br />

DBXT iBoxx SG Govt S$ KV4 SP Equity 29 Sovereign Singapore ABTRSGGO 122.91 122.91 120.46 2.0% 1,805 0.151<br />

DBXT DBLCI-OY Balanced J0S SP Equity N/AAs<strong>set</strong> Allocation Australia DBLCBUTN 36.77 36.95 30.32 N/A - N/A<br />

DBXT AU Bonds K6Y SP Equity 34 Debt Australia DBLNSSAB 154.83 154.83 152.48 1.5% 154 0.019<br />

COMMODITIES<br />

SPDR Gold Trust GLD SP Equity 33713 Commodities Global GOLDLNPM 134.76 134.87 134.62 0.1% 34,618 4.510<br />

Lyxor CRB Non Energy CRN SP Equity 30 Commodities Global CRYNETR 2.77 2.78 2.77 0.2% 3,747 0.010<br />

Lyxor Commodity CRB SP Equity 108 Commodities Global CRYTR 2.90 2.91 2.90 0.2% 22,358 0.062<br />

DBXT DJUBS Comm Index L5F SP Equity 5 Commodities Global DBCMDCTU 34.07 34.24 33.67 1.5% 60 0.002<br />

DBXT Light Energy L5G SP Equity 5 Commodities Global DBCMBUTN 20.48 20.59 20.00 2.7% 90<br />

Source: Bloomberg. Price and NAV in USD unless indicated o<strong>the</strong>rwise in ETF column<br />

0.002<br />

Page 13

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Fig. 9: Hong Kong listed ETFs<br />

ETF Ticker Mkt Cap Style Country/ Underlying Ask Bid NAV/ Premium/ Avg Daily Avg Daily<br />

(US$ m) Region Index Price Price INAV Discount Volume Value<br />

Tracker 15-Oct 15-Oct (latest) (20 day)<br />

('000)<br />

(20 day)<br />

(US$m)<br />

EQUITIES<br />

Global / Regional Funds - Ex Asia<br />

Lyxor World 2812 HK Equity 25.2 Global Fund Global MXWO 9.55 9.49 9.54 -0.2% 14 0.017<br />

DBXT MSCI World 3019 HK Equity 5.5 Global Fund Global NDDUWI 23.25 23.10 22.97 0.9% 0 0.000<br />

Lyxor Emerging Mkts 2820 HK Equity 65.7 Emerg. Mkt Int'l MXEF 88.00 87.25 87.94 -0.4% 2 0.022<br />

DBXT Emerging Mkts 3009 HK Equity 6.5 Emerg. Mkt Int'l NDUEEGF 33.05 32.90 32.61 1.1% 0 0.002<br />

Country Funds - OECD<br />

Lyxor NASDAQ-100 2826 HK Equity 26.9 Geographically<br />

Focused Fund US NDX 64.50 64.10 64.21 0.1% 1 0.006<br />

Lyxor RAFI Europe 2806 HK Equity 12.8 Growth & Inc. EZ FREU 49.85 49.60 49.65 0.2% 7 0.043<br />

Lyxor RAFI US 2803 HK Equity 12.6 Growth & Inc. US FR10 41.50 40.70 40.93 0.4% 6 0.033<br />

DBXT USA 3020 HK Equity 1810.9 Country Fund US NDDLUS 216.40 215.80 214.85 0.6% 0 0.001<br />

Lyxor Japan Topix 2814 HK Equity 23.7 Country Fund Japan TPX 8.02 7.98 7.99 0.1% 114 0.116<br />

Country Funds - Emerging (Non-Asia)<br />

DBXT MSCI Brazil 3048 HK Equity 8.8 Country Fund Brazil NDUEBRAF 58.80 58.55 57.64 1.8% 15 0.112<br />

Lyxor Russia 2831 HK Equity 32.3 Country Fund Russia RU10D 31.80 31.10 31.58 -0.4% 47 0.185<br />

DBXT MSCI Russia 3027 HK Equity 8.2 Country Fund Russia MXRUC25P 24.20 24.05 24.08 0.2% 2 0.007<br />

Regional Funds - Asia x Japan<br />

iShares APEX50 3010 HK Equity 47.9 Region Fund APAC ex-J MXAPEXA 38.95 38.70 38.84 0.0% 6 0.030<br />

iShares APEX Mid Cap 3032 HK Equity 23.5 Region Fund APAC ex-J MXAPEXAM 45.75 45.50 45.60 0.1% 4 0.023<br />

iShares APEX Small Cap 3004 HK Equity 14.7 Region Fund APAC ex-J MXAPEXAS 47.60 47.35 47.50 -0.1% 3 0.016<br />

Lyxor MSCI Asia ex-Japan 2815 HK Equity 139.4 Country Fund APAC ex-J MXAPJ 36.80 36.65 36.70 0.1% 162 0.755<br />

iShares Emerging Asia 2802 HK Equity 31.7 Emerg. Mkt Asia MXMS 43.90 43.85 43.55 0.7% 22 0.118<br />

DBXT Emerging Mkts Asia 3035 HK Equity 6.7 Region Fund Asia NDUEEGFA 30.30 30.15 29.68 1.8% 1 0.003<br />

DBXT Pacific ex Japan 3043 HK Equity 47.1 Region Fund Pac x Jap NDDUPXJ 33.95 33.80 33.78 0.3% 0 0.002<br />

Country Funds - North Asia<br />

Hang Seng H-Share IDX 2828 HK Equity 2908.1 Growth Fund China HSCEI 137.30 137.20 137.36 -0.1% 1,839 21.061<br />

Hang Seng FTChina 25 2838 HK Equity 36.2 Country Fund China XIN0I 205.40 204.20 205.09 -0.1% 2 0.035<br />

iShares A50 China Tracker 2823 HK Equity 8622.7 Country Fund China XIN50 14.24 14.22 13.19 7.9% 115,759 192.483<br />

iShares MSCI China 2801 HK Equity 185.4 Country Fund China MXCN 23.60 23.50 23.62 -0.3% 194 0.550<br />

WISE CSI 300 China 2827 HK Equity 912.7 Country Fund China SHSZ300 37.40 37.25 33.58 11.1% 2,182 9.840<br />

WISE SSE 50 China 3024 HK Equity 68.0 Country Fund China SSE50 23.50 23.40 21.11 11.1% 51 0.136<br />

DBXT FT Xin China 25 3007 HK Equity 377.2 Country Fund China TXINOU 261.60 259.80 261.20 -0.2% 0 0.013<br />

VALUE CHINA ETF 3046 HK Equity 51.3 Country Fund China GPVP002 42.50 42.15 42.55 -0.5% 134 0.676<br />

ISHARES CSI 300 INDEX 2846 HK Equity 203.4 Country Fund China CSIR0300 32.15 32.05 31.02 3.5% 768 2.957<br />

CICC-SZSE 100 INDEX TRACKE 3051 HK Equity 23.9 Country Fund China SI100 43.75 43.60 40.13 8.8% 1 0.003<br />

DBXT CSI 300 Index 3049 HK Equity 299.2 Country Fund China SHSZ300 8.63 8.62 7.83 10.2% 42,756 42.891<br />

Paragon CSI RAFI 50 2818 HK Equity 34.8 Country Fund China SH000925 34.05 33.75 29.61 14.5% 12 0.046<br />

SPDR FTSE Greater China ETF 3073 HK Equity 71.7 Country Fund China GPSSG239 26.65 26.40 24.94 6.4% 24 0.081<br />

Lyxor MSCI Korea 2813 HK Equity 66.1 Country Fund S. Korea MXKR 37.10 36.85 37.08 -0.3% 62 0.282<br />

DBXT MSCI Korea 2848 HK Equity 247.7 Country Fund S. Korea MXKR 419.60 418.40 418.93 0.0% 0 0.017<br />

Lyxor MSCI Taiwan 2837 HK Equity 62.6 Country Fund Taiwan TAMSCI 7.54 7.51 7.60 -1.0% 160 0.153<br />

DBXT MSCI Taiwan 3036 HK Equity 161.6 Country Fund Taiwan NDEUSTW 136.00 135.20 135.52 0.1% 1 0.010<br />

POLARIS TAIWAN TOP50 3002 HK Equity 25.9 Country Fund Taiwan TW50 12.20 12.18 12.43 -1.9% 40 0.062<br />

Hang Seng Index ETF 2833 HK Equity 3820.2 Growth Fund HK HSI 241.20 240.80 240.97 0.0% 89 0.853<br />

WISE CSI HK Tracker 2825 HK Equity 20.8 Growth Fund HK CSIHHK 20.45 20.15 20.36 -0.3% 1 0.004<br />

Tracker Fund of HK 2800 HK Equity 6452.7 Growth Fund HK HSI 24.35 24.30 24.33 0.0% 18,137 54.448<br />

Country Funds - South Asia<br />

iShares Sensex Tracker 2836 HK Equity 289.9 Country Fund India SENSEX 20.45 20.30 20.25 0.6% 1,234 3.126<br />

Lyxor MSCI India 2810 HK Equity 301.0 Country Fund India MXIN 145.30 144.70 143.54 1.0% 6 0.106<br />

DBXT S&P CNX Nifty 3015 HK Equity 534.7 Country Fund India NIFTY 1100.00 1095.00 1097.47 0.0% 0 0.068<br />

Country Funds - South East Asia<br />

DBXT FTSE Vietnam 3087 HK Equity 248.0 Country Fund Vietnam FVTTE 290.60 289.80 284.55 2.0% 30 1.124<br />

FIXED INCOME<br />

ABF HK Bond Index Fund 2819 HK Equity 306.1 Total Return N/A N/A 104.00 103.00 103.47 0.0% 3 0.037<br />

ABFPan-Asia Bd Idx Fd US$ 2821 HK Equity 2370.8 Total Return N/A ABTRPAUH 124.95 124.10 124.25 0.2% 4 0.552<br />

DB X-TRACKERS USD MONEY M3011 HK Equity 49.7 Global Fund N/A DBMMFED1 170.90 170.80 170.88 0.0% - N/A<br />

COMMODITIES<br />

Lyxor Commodity CRB 2809 HK Equity 107.1 Commodities Global CRYTR 22.60 22.45 22.51 0.1% 56 0.155<br />

SPDR Gold Trust 2840 HK Equity 57310.6 Commodities Global GOLDLNPM 1046.00 1045.00 1044.76 0.1% 21 2.744<br />

Source: Bloomberg. Price and NAV in HKD unless indicated o<strong>the</strong>rwise in ETF column<br />

Page 14

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Fig. 9 cont’d: Hong Kong listed ETFs<br />

ETF Ticker Mkt Cap Style Country/ Underlying Ask Bid NAV/ Premium/ Avg Daily Avg Daily<br />

(US$ m) Region Index Price Price INAV Discount Volume Value<br />

Tracker 15-Oct 15-Oct (latest) (20 day)<br />

('000)<br />

(20 day)<br />

(US$m)<br />

Sector Funds<br />

C-TRACKS Bldg/ Constr. 10800 HK Equity 0.1 Sector Funds China TWSECON N/A N/A 3.25 N/A - N/A<br />

C-TRACKS Hang Seng ChinaH 10828 HK Equity N/A Sector Funds China H-FIN N/A N/A 17.45 N/A - N/A<br />

C-TRACKS Hang Seng Property 10829 HK Equity N/A Sector Funds China HSP N/A N/A 2.86 N/A - N/A<br />

C-TRACKS S&P Financials 10816 HK Equity N/A Sector Funds China SP5TFINL N/A N/A 2.85 N/A - N/A<br />

C-TRACKS TAIEX Electronics 10801 HK Equity 0.0 Sector Funds Taiwan TWSEELEC N/A N/A 3.39 N/A - N/A<br />

C-TRACKS TAIEX Finance 10802 HK Equity 0.1 Sector Funds Taiwan TWSEBKI 9.64 9.50 8.85 0.08 - N/A<br />

iShares CSI Materials 3039 HK Equity 102.1 Sector Funds China CSIR0909 17.64 17.56 16.54 6.4% 211 0.410<br />

iShares CSI Financials 2829 HK Equity 164.8 Sector Funds China CSIR0914 13.90 13.88 12.71 9.3% 391 0.635<br />

iShares CSI Infra Index 3006 HK Equity 42.7 Sector Funds China CSIR0950 14.42 14.38 13.31 8.2% 15 0.026<br />

iShares CSI Energy 3050 HK Equity 67.8 Sector Funds China CSIR0908 15.06 15.02 14.05 7.0% 157 0.257<br />

DBXT CSI300 Banks 3061 HK Equity 45.5 Sector Funds China SH000951 10.90 10.88 9.80 11.1% 4,533 5.483<br />

DBXT CSI300 Real Estate 2816 HK Equity 44.5 Sector Funds China SH000952 11.30 11.28 10.26 10.0% 3,837 4.842<br />

DBXT CSI300 Materials 3062 HK Equity 55.6 Sector Funds China SH000909 9.29 9.28 8.36 11.1% 2,860 2.835<br />

DBXT CSI300 Consumer 3025 HK Equity 47.3 Sector Funds China SH000911 10.84 10.82 9.79 10.6% 1,718 2.248<br />

DBXT CSI300 Health Care 3057 HK Equity 28.2 Sector Funds China SH000913 15.52 15.50 14.00 10.8% 1,947 3.970<br />

DBXT CSI300 Transportation 3063 HK Equity 17.2 Sector Funds China N/A 4.48 4.46 4.10 9.0% 2,214 1.132<br />

DBXT CSI300 Energy 3017 HK Equity 27.0 Sector Funds China SH000908 10.08 10.04 9.17 9.7% 3,138 3.375<br />

DBXT CSI300 Utilities 3052 HK Equity 18.3 Sector Funds China SH000917 4.94 4.93 4.48 10.2% 1,692 0.978<br />

DBXT CSI300 Industrials 3005 HK Equity 20.8 Sector Funds China SH000910 7.33 7.32 6.66 10.0% 1,597 1.337<br />

DBXT CSI300 Financials 2844 HK Equity 33.9 Sector Funds China SH000914 11.46 11.44 10.34 10.7% 4,028 5.023<br />

DCI CSI China Consumer 3071 HK Equity 24.5 Sector Funds China SH000942 11.90 11.60 11.07 6.1% 69 0.103<br />

iShares CSI Cons Disc 3001 HK Equity 79.5 Sector Funds China SH000911 20.90 20.75 19.15 8.7% 82 0.208<br />

iShares CSI Cons Staples 2841 HK Equity 82.2 Sector Funds China SH000912 21.25 21.15 19.01 11.5% 103 0.282<br />

Source: Bloomberg. Price and NAV in HKD unless indicated o<strong>the</strong>rwise in ETF column<br />

Page 15

Regional ETF Focus<br />

<strong>Get</strong> <strong>set</strong> <strong>for</strong> a <strong>liquidity</strong> <strong>rally</strong><br />

Singapore – Neutral (Joanne Goh, Group Research compilation)<br />

More upside <strong>for</strong> STI despite 3Q GDP moderation<br />

Fig. 10: Straits Times Index (daily)<br />

Singapore’s 3Q GDP advanced released this Thursday<br />

confirmed a sequential drop in GDP closed to 20% QoQ<br />

saar. Volatility in <strong>the</strong> pharmaceutical sector is <strong>the</strong> major<br />

contributing factor.<br />

We believe investors should take <strong>the</strong> 3Q moderation, and<br />

even a possible “technical recession” in strides as <strong>the</strong><br />

slowdown was widely anticipated after a very strong 1H.<br />

Being <strong>the</strong> strongest growth region in <strong>the</strong> world coupled<br />

with a appreciating currency bias, it should continue to<br />

attract fund flows to drive a re-rating. Meanwhile STI is a<br />

laggard in Asia and has room to ‘catch up’.<br />

Straits Times Index Technical Outlook (Yeo Kee Yan,<br />

<strong>DBS</strong><strong>Vickers</strong>)<br />

We raise STI’s technical objective to 3438. While near-term<br />

resistance remains at 3250, we see minor pullback<br />

supported at <strong>the</strong> 15-day exponential moving average<br />

(currently at 3124) and <strong>the</strong> index should eventually surpass<br />

3250.<br />

We believe <strong>the</strong> <strong>rally</strong> that started from 2900 in end August is<br />

sustainable because: 1) The rise has been accompanied by<br />

healthy market participation from small caps and large caps<br />

2) The rise is accompanied by a rise in volume and value of<br />

shares traded 3) Our economist sees more <strong>liquidity</strong> inflow<br />

into Asia sustaining in <strong>the</strong> months ahead<br />

The rise above <strong>the</strong> 3030 level to make a fresh YTD high<br />

looks ‘impulsive’. Impulse has its implications: 1) The rise is<br />

sustainable 2) Technical oscillators such as <strong>the</strong> 14-day RSI<br />

and <strong>the</strong> daily stochastics can stay around <strong>the</strong> overbought<br />

line <strong>for</strong> weeks or even months. The 14-day RSI currently<br />

reads 66while <strong>the</strong> stochastics is at 69. 3) We can apply<br />

major technical projections to identify upside objective <strong>for</strong><br />

<strong>the</strong> STI.<br />

The chart below shows our preferred wave count. By<br />

projecting <strong>the</strong> amplitude of wave 1 (395pts) above <strong>the</strong> high<br />

of wave 1 (@ STI 3043), we attain a technical objective of<br />

3438. We reference <strong>the</strong> near-term support at <strong>the</strong> 15-day<br />

EMA that has held intact since <strong>the</strong> start pf September. It is<br />

currently at 3124. Major support is at <strong>the</strong> 65-day EMA,<br />

currently near 3030.<br />

Source: <strong>DBS</strong> Research<br />

19% drop in 3Q GDP (Irvin Seah, <strong>DBS</strong> Group Research)<br />

Third quarter advance GDP estimates are within expectation<br />

as <strong>the</strong> economy grew by 10.3% YoY (<strong>DBS</strong>f: 10.4%;<br />

Consensus: 10.8%). But on a sequential basis, <strong>the</strong> economy<br />

contracted sharply by 19.8% QoQ saar (<strong>DBS</strong>f: 17.0%;<br />

Consensus: 15.7%) as an upward revision in 2Q10 GDP<br />

fur<strong>the</strong>r amplify <strong>the</strong> quarterly drop (see table).<br />

Singapore GDP growth<br />

3Q09 4Q09 2009 1Q10 2Q10 3Q10(a)<br />

Overall GDP (%QoQ saar) 11.1 -1.0 - 45.9 27.3 -19.8<br />

Overall GDP (%YoY) 1.8 3.8 -1.3 16.9 19.6 10.3<br />

Manufacturing 7.6 2.2 -4.1 38.1 46.1 12.1<br />

Construction 11.7 11.5 16.2 9.7 11.5 6.7<br />

Services producing -1.1 3.7 -1.4 11.4 11.8 10.2<br />

And as we had mentioned in our earlier article “It’s<br />

payback time” dated 11 Oct10, this is a record sequential<br />

contraction and one that is worse than <strong>the</strong> supposedly<br />

“free-fall” in GDP experienced in <strong>the</strong> recent US financial<br />

crisis, <strong>the</strong> slump during <strong>the</strong> dot.com bust as well as <strong>the</strong><br />

doldrum during <strong>the</strong> Asia financial crisis. Indeed, growth<br />

wouldn’t have fallen by more dramatic fashion than this<br />

considering that we had a record expansion not too long<br />

ago in <strong>the</strong> first quarter. Sharp pullbacks in production from<br />

<strong>the</strong> volatile pharmaceutical segment have brought down<br />

overall industrial production in recent months. And <strong>the</strong><br />