Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

Overview of financial results - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group <strong>results</strong><br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis <strong>of</strong> <strong>financial</strong> <strong>results</strong> for the six months ended 30 June 2013<br />

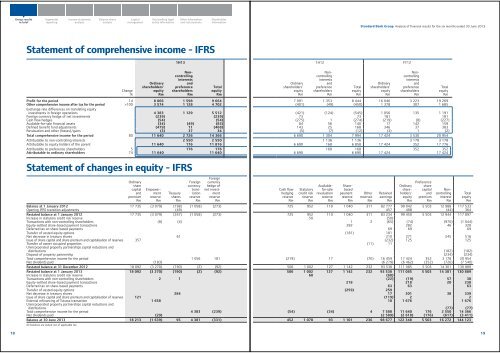

Statement <strong>of</strong> comprehensive income - IFRS<br />

1H13<br />

1H12<br />

FY12<br />

Change<br />

%<br />

Ordinary<br />

shareholders’<br />

equity<br />

Rm<br />

Noncontrolling<br />

interests<br />

and<br />

preference<br />

shareholders<br />

Rm<br />

Total<br />

equity<br />

Rm<br />

Pr<strong>of</strong>it for the period 14 8 066 1 598 9 664<br />

Other comprehensive income after tax for the period >100 3 574 1 128 4 702<br />

Exchange rate differences on translating equity<br />

investments in foreign operations 4 383 1 129 5 512<br />

Foreign currency hedge <strong>of</strong> net investments (239) (239)<br />

Cash flow hedges (54) (54)<br />

Available-for-sale <strong>financial</strong> assets (34) (49) (83)<br />

Defined benefit fund adjustments (479) 11 (468)<br />

Revaluation and other (losses)/gains (3) 37 34<br />

Total comprehensive income for the period 80 11 640 2 726 14 366<br />

Attributable to non-controlling interests 2 550 2 550<br />

Attributable to equity holders <strong>of</strong> the parent 11 640 176 11 816<br />

Attributable to preference shareholders 5 176 176<br />

Attributable to ordinary shareholders 74 11 640 11 640<br />

Ordinary<br />

shareholders’<br />

equity<br />

Rm<br />

Noncontrolling<br />

interests<br />

and<br />

preference<br />

shareholders<br />

Rm<br />

Total<br />

equity<br />

Rm<br />

Ordinary<br />

shareholders’<br />

equity<br />

Rm<br />

Noncontrolling<br />

interests<br />

and<br />

preference<br />

shareholders<br />

Rm<br />

Total<br />

equity<br />

Rm<br />

7 091 1 353 8 444 16 046 3 223 19 269<br />

(401) (49) (450) 1 378 307 1 685<br />

(421) (124) (545) 1 056 135 1 191<br />

73 73 181 181<br />

(275) 1 (274) (219) (8) (227)<br />

84 56 140 17 142 159<br />

143 25 168 346 37 383<br />

(5) (7) (12) (3) 1 (2)<br />

6 690 1 304 7 994 17 424 3 530 20 954<br />

1 136 1 136 3 178 3 178<br />

6 690 168 6 858 17 424 352 17 776<br />

168 168 352 352<br />

6 690 6 690 17 424 17 424<br />

Statement <strong>of</strong> changes in equity - IFRS<br />

Ordinary<br />

share<br />

capital<br />

and<br />

premium<br />

Rm<br />

Empowerment<br />

reserve<br />

Rm<br />

Treasury<br />

shares<br />

Rm<br />

Foreign<br />

currency<br />

translation<br />

reserve<br />

Rm<br />

Foreign<br />

currency<br />

hedge <strong>of</strong><br />

net investment<br />

reserve<br />

Rm<br />

Balance at 1 January 2012 17 735 (3 079) (198) (1 058) (273)<br />

Opening IFRS transition adjustments (49)<br />

Restated balance at 1 January 2012 17 735 (3 079) (247) (1 058) (273)<br />

Increase in statutory credit risk reserve<br />

Transactions with non-controlling shareholders (8) (4)<br />

Equity-settled share-based payment transactions<br />

Deferred tax on share-based payments<br />

Transfer <strong>of</strong> vested equity options<br />

Net decrease in treasury shares 61<br />

Issue <strong>of</strong> share capital and share premium and capitalisation <strong>of</strong> reserves 357<br />

Transfer <strong>of</strong> owner occupied properties<br />

Unincorporated property partnerships capital reductions and<br />

distributions<br />

Disposal <strong>of</strong> property partnership<br />

Total comprehensive income for the period 1 056 181<br />

Net dividends paid (183)<br />

Restated balance at 31 December 2012 18 092 (3 270) (190) (2) (92)<br />

Restated balance at 1 January 2013 18 092 (3 270) (190) (2) (92)<br />

Increase in statutory credit risk reserve<br />

Transactions with non-controlling shareholders 2 1<br />

Equity-settled share-based payment transactions<br />

Deferred tax on share-based payments<br />

Transfer <strong>of</strong> vested equity options<br />

Net decrease in treasury shares 284<br />

Issue <strong>of</strong> share capital and share premium and capitalisation <strong>of</strong> reserves 121<br />

External refinancing <strong>of</strong> Tutuwa transaction 1 658<br />

Unincorporated property partnerships capital reductions and<br />

distributions<br />

Total comprehensive income for the period 4 383 (239)<br />

Net dividends paid (29)<br />

Balance at 30 June 2013 18 213 (1 639) 95 4 381 (331)<br />

All balances are stated net <strong>of</strong> applicable tax.<br />

Cash flow<br />

hedging<br />

reserve<br />

Rm<br />

Statutory<br />

credit risk<br />

reserve<br />

Rm<br />

Availablefor-sale<br />

revaluation<br />

reserve<br />

Rm<br />

Sharebased<br />

payment<br />

reserve<br />

Rm<br />

Other<br />

reserves<br />

Rm<br />

Retained<br />

earnings<br />

Rm<br />

Ordinary<br />

shareholders’<br />

equity<br />

Rm<br />

Preference<br />

share<br />

capital<br />

and<br />

premium<br />

Rm<br />

Noncontrolling<br />

interest<br />

Rm<br />

Total<br />

equity<br />

Rm<br />

725 952 110 1 040 311 82 777 99 042 5 503 12 988 117 533<br />

457 408 (44) 364<br />

725 952 110 1 040 311 83 234 99 450 5 503 12 944 117 897<br />

50 (50)<br />

1 2 (65) (74) (970) (1 044)<br />

282 282 46 328<br />

69 69 69<br />

(181) 181<br />

210 271 245 516<br />

(232) 125 125<br />

(11) 11<br />

(182) (182)<br />

(234) (234)<br />

(219) 17 (70) 16 459 17 424 352 3 178 20 954<br />

(6 279) (6 462) (352) (726) (7 540)<br />

506 1 002 127 1 142 232 93 538 111 085 5 503 14 301 130 889<br />

506 1 002 127 1 142 232 93 538 111 085 5 503 14 301 130 889<br />

68 (68)<br />

(22) (19) 57 38<br />

218 218 20 238<br />

63 63 63<br />

(259) 259<br />

17 301 38 339<br />

(119) 2 2<br />

18 1 676 1 676<br />

(77) (77)<br />

(54) (34) 4 7 580 11 640 176 2 550 14 366<br />

(2 589) (2 618) (176) (617) (3 411)<br />

452 1 070 93 1 101 236 98 677 122 348 5 503 16 272 144 123<br />

18<br />

19