Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

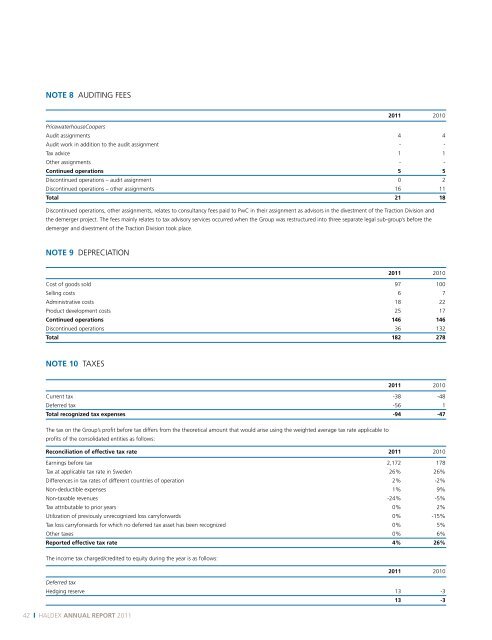

note 8 audItInG FeeS<br />

PricewaterhouseCoopers<br />

42 | <strong>Haldex</strong> <strong>annual</strong> report <strong>2011</strong><br />

<strong>2011</strong> 2010<br />

audit assignments 4 4<br />

audit work in addition to the audit assignment - -<br />

tax advice 1 1<br />

other assignments - -<br />

Continued operations 5 5<br />

discontinued operations – audit assignment 0 2<br />

discontinued operations – other assignments 16 11<br />

total 21 18<br />

discontinued operations, other assignments, relates to consultancy fees paid to pwC in their assignment as advisors in the divestment of the traction division and<br />

the demerger project. the fees mainly relates to tax advisory services occurred when the Group was restructured into three separate legal sub-group’s before the<br />

demerger and divestment of the traction division took place.<br />

note 9 depReCIatIon<br />

<strong>2011</strong> 2010<br />

Cost of goods sold 97 100<br />

Selling costs 6 7<br />

administrative costs 18 22<br />

product development costs 25 17<br />

Continued operations 146 146<br />

discontinued operations 36 132<br />

total 182 278<br />

note 10 taxeS<br />

<strong>2011</strong> 2010<br />

Current tax -38 -48<br />

deferred tax -56 1<br />

total recognized tax expenses -94 -47<br />

the tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate applicable to<br />

profits of the consolidated entities as follows:<br />

reconciliation of effective tax rate <strong>2011</strong> 2010<br />

earnings before tax 2,172 178<br />

tax at applicable tax rate in Sweden 26% 26%<br />

differences in tax rates of different countries of operation 2% -2%<br />

non-deductible expenses 1% 9%<br />

non-taxable revenues -24% -5%<br />

tax attributable to prior years 0% 2%<br />

utilization of previously unrecognized loss carryforwards 0% -15%<br />

tax loss carryforwards for which no deferred tax asset has been recognized 0% 5%<br />

other taxes 0% 6%<br />

reported effective tax rate 4% 26%<br />

the income tax charged/credited to equity during the year is as follows:<br />

<strong>2011</strong> 2010<br />

Deferred tax<br />

Hedging reserve 13 -3<br />

13 -3