Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Significant Accounting Policies and Notes to Accounts (contd.)<br />

j) Income Tax demands which are under appeals are Rs. 1,386 lakhs (Previous Year Nil).<br />

The Company is a party to various legal proceedings in the normal course of business and does not expect the<br />

outcome of these proceedings to have any adverse effect on its financial conditions, results of operations or cash<br />

flows.<br />

3) During the year the Company purchased and sold Current Investments in Debt Schemes of various Mutual Funds<br />

as detailed below :<br />

Mutual Fund No. of Units Face Value Cost of Units<br />

(in lakhs) (Rupees) (in lakhs)<br />

SBI Mutual Fund 31,576 10 631,850<br />

Reliance Mutual Fund 368 10 7,701<br />

Barclays Global Investors Mutual Fund<br />

- EURO 10 1 Euro 675<br />

-USD 352 1 USD 17,010<br />

-GBP 315 1 GBP 23,359<br />

4) DISCLOSURE ON DERIVATIVES<br />

(a) The Company has entered into certain derivative contracts viz. interest rate swaps (IRS), currency options, IRS<br />

cum currency swaps, etc in order to hedge and manage its foreign currency exposures towards future export<br />

receivables and foreign currency borrowings. Such derivative contracts which are in the nature of firm<br />

commitments and highly probable forecast transactions are entered into by the company for hedging purposes<br />

only and does not use the same for trading or speculation purposes.<br />

Nominal amounts of derivatives contracts entered into by the Company and outstanding as on 31st March, 2010<br />

amount of Rs. 126,036 lakhs (Previous Year Rs. 165,638 lakhs). The category-wise break-up thereof is as<br />

under:<br />

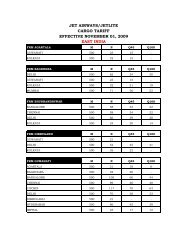

Amount (Rs. in lakhs)<br />

Particulars 2009-10 2008-09<br />

No. of Amount No. of Amount<br />

Contracts Contracts<br />

Interest Rate Swaps 3 106,413 3 120,206<br />

Currency Options 1 12,123 1 18,259<br />

Currency Swaps - - 1 12,173<br />

IRS cum Currency Swaps 1 7,500 2 15,000<br />

Based on the Announcement of The Institute of Chartered Accountants of India “Accounting for Derivatives”<br />

along with the principles of prudence as enunciated in Accounting Standard (AS-1) “Disclosure of Accounting<br />

Polices” the Company has accounted for outstanding derivative contracts at fair values as at the balance sheet<br />

date.<br />

On that basis, the fair value of the derivative instruments as at 31st March, 2010 aggregating to Rs. 7,045 lakhs<br />

has been credited (Previous Year Rs. 10,073 lakhs has been debited) to the Profit and Loss Account and<br />

disclosed as exceptional item in the current year. The (credit) / charge on account of derivative (gains)/losses<br />

has been computed on the basis of MTM values based on the confirmations from the counter parties.<br />

62