Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Annual Report cb smile - Jet Airways

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

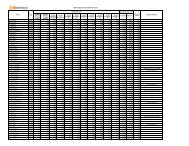

Significant Accounting Policies and Notes to Accounts (contd.)<br />

(b) The foreign currency exposures that have not been hedged by any derivative instrument or otherwise as on<br />

31st March, 2010 are as follows:<br />

Particulars INR Equivalent USD Equivalent<br />

(Rs. in lakhs) (USD in lakhs)<br />

Current Assets 37,294 831<br />

(82,664) (1,630)<br />

Current Liabilities 99,847 2,224<br />

(99,496) (1,962)<br />

Interest accrued but not due on Loans 2,752 61<br />

(3,745) (74)<br />

Long Term Loans for purchase of Aircraft* 734,339 16,355<br />

(904,823) (17,840)<br />

Other Loans payable 36,428 811<br />

(Figures in brackets indicate 31<br />

(41,150) (811)<br />

st March, 2009 figures)<br />

*Includes Loans payable after 5 years – Rs. 430,591 lakhs (Previous year Rs. 585,847 lakhs).<br />

5) a) The Company has equity and preference investments aggregating to Rs.164,500 lakhs in <strong>Jet</strong> Lite (India)<br />

Limited, a wholly owned subsidiary, and an amount of Rs. 68,207 lakhs advanced as interest free loan as on<br />

31st March, 2010. The said subsidiary has improved its financial position by earning a profit for the year ending<br />

31st March, 2010, however, the Company continues to show a negative net-worth. A reputed valuer has<br />

recently valued the equity interest in the subsidiary based on its business plans, which supports the carrying<br />

value of such investment and loan outstanding. The Company continues to provide financial support to<br />

subsidiary’s operations to further such business plans and expects improved performance in the future.<br />

Accordingly, the financial statements of the subsidiary company have been prepared on “Going Concern” basis<br />

and no provision is considered necessary at this stage in respect of its investments and loans outstanding from<br />

the said subsidiary company at the year end.<br />

(b) (i) In the year 2007-08, the Company acquired 100% shares of Sahara Airlines Limited (SAL) (Now known<br />

as <strong>Jet</strong> Lite (India) Limited) as per Share Purchase agreement with erstwhile shareholders of SAL (“Selling<br />

Shareholders”) and ‘Consent Terms and Consent Award’ for a lump-sum price of Rs. 146,500 lakhs, out<br />

of which, Rs. 91,500 lakhs was paid on or before the acquisition date. The balance Rs. 55,000 lakhs was<br />

payable in four interest free annual equal installments commencing on or before 30th March, 2008. Out<br />

of Rs. 55,000 lakhs, two annual installments aggregating Rs. 18,792 lakhs have been paid after deducting<br />

Rs. 8,708 lakhs, which the Company had paid to income tax department in respect of demands on SAL<br />

for periods prior to the execution of the Share Purchase Agreement. The installment due on or before<br />

30th March, 2010 for Rs. 13,750 lakhs has been deposited with the registry of Bombay High Court as per<br />

the order passed by the Honorable Bombay High Court.<br />

Balance installment payable of Rs. 13,750 lakhs as on 31 st March, 2010 has been disclosed under the<br />

separate head “Deferred payment liability towards Investment in wholly owned subsidiary company”.<br />

Aggrieved by such deduction from 1 st and 2 nd installments due under the Consent Terms and Consent<br />

Award dated 12 th April, 2007, the Selling Shareholders on 30 th March, 2009 filed an Execution Application<br />

for recovery of an amount of Rs. 99,958 lakhs. The claim by Selling Shareholders of Rs. 99,958 lakhs<br />

includes acceleration of three installments each of Rs. 13,750 lakhs plus deduction of Rs. 3,708 lakhs<br />

made from 1st installment paid in March, 2008 and demanding further Rs. 55,000 lakhs towards increase<br />

in lump-sum purchase consideration for the breach of the Consent Terms in payment of installments by<br />

the Company after deducting tax dues of earlier years of SAL.<br />

63