non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

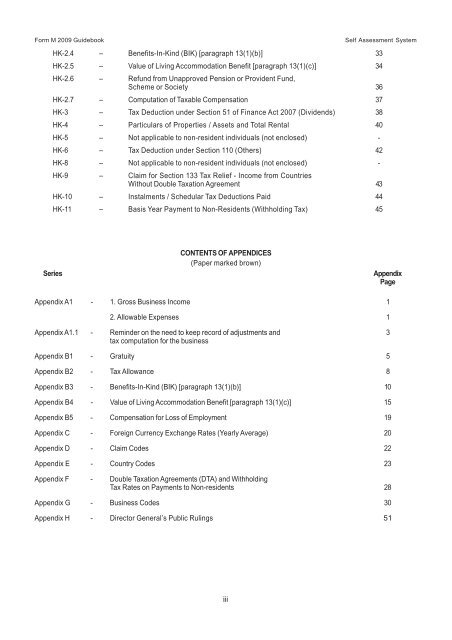

Form M 2009 Guidebook Self Assessment System<br />

HK-2.4 – Benefits-In-Kind (BIK) [paragraph 13(1)(b)] 33<br />

HK-2.5 – Value of Living Accommodation Benefit [paragraph 13(1)(c)] 34<br />

HK-2.6 – Refund from Unapproved Pension or Provident Fund,<br />

Scheme or Society 36<br />

HK-2.7 – Computation of Taxable Compensation 37<br />

HK-3 – Tax Deduction under Section 51 of Finance Act 2007 (Dividends) 38<br />

HK-4 – Particulars of Properties / Assets and Total Rental 40<br />

HK-5 – Not applicable to <strong>non</strong>-<strong>resident</strong> <strong>individual</strong>s (not enclosed) -<br />

HK-6 – Tax Deduction under Section 110 (Others) 42<br />

HK-8 – Not applicable to <strong>non</strong>-<strong>resident</strong> <strong>individual</strong>s (not enclosed) -<br />

HK-9 – Claim for Section 133 Tax Relief - Income from Countries<br />

Without Double Taxation Agreement 43<br />

HK-10 – Instalments / Schedular Tax Deductions Paid 44<br />

HK-11 – Basis Year Payment to Non-Residents (Withholding Tax) 45<br />

Series<br />

CONTENTS OF APPENDICES<br />

(Paper marked brown)<br />

Appendix<br />

Page<br />

Appendix A1 - 1. Gross Business Income 1<br />

2. Allowable Expenses 1<br />

Appendix A1.1 - Reminder on the need to keep record of adjustments and 3<br />

<strong>tax</strong> computation for the business<br />

Appendix B1 - Gratuity 5<br />

Appendix B2 - Tax Allowance 8<br />

Appendix B3 - Benefits-In-Kind (BIK) [paragraph 13(1)(b)] 10<br />

Appendix B4 - Value of Living Accommodation Benefit [paragraph 13(1)(c)] 15<br />

Appendix B5 - Compensation for Loss of Employment 19<br />

Appendix C - Foreign Currency Exchange Rates (Yearly Average) 20<br />

Appendix D - Claim Codes 22<br />

Appendix E - Country Codes 23<br />

Appendix F - Double Taxation Agreements (DTA) and Withholding<br />

Tax Rates on Payments to Non-<strong>resident</strong>s 28<br />

Appendix G - Business Codes 30<br />

Appendix H - Director General’s Public Rulings 51<br />

iii