2008 Annual Report - Jewish Foundation of Memphis

2008 Annual Report - Jewish Foundation of Memphis

2008 Annual Report - Jewish Foundation of Memphis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Linking Past, Present And Future<br />

<strong>Jewish</strong> tradition teaches that one <strong>of</strong> our key duties is to make the world<br />

a better place for future generations. Create Your <strong>Jewish</strong> Legacy is a<br />

three-year gift initiative designed to secure deferred gifts – gifts that take<br />

place after your lifetime–to support long-term funding needs <strong>of</strong> <strong>Memphis</strong>’<br />

<strong>Jewish</strong> agencies and institutions; the cornerstones <strong>of</strong> our community.<br />

Create Your <strong>Jewish</strong> Legacy is for<br />

every member <strong>of</strong> the <strong>Memphis</strong> <strong>Jewish</strong><br />

community. By including the <strong>Jewish</strong><br />

community in your estate plan, you<br />

can help ensure the future <strong>of</strong> the<br />

community; linking the traditions <strong>of</strong><br />

the past with the ideals that make us<br />

who we are today.<br />

Through the Create Your<br />

<strong>Jewish</strong> Legacy initiative, donors<br />

are encouraged to leave a legacy<br />

reflecting their priorities. The<br />

Turning Your Gift Into A Legacy<br />

Bequest<br />

A bequest is the simplest way to<br />

make a gift after your lifetime. You<br />

may name the <strong>Jewish</strong> <strong>Foundation</strong> <strong>of</strong><br />

<strong>Memphis</strong> or other <strong>Jewish</strong> agencies<br />

as beneficiaries in your will for a<br />

specific amount, or you may state the<br />

bequest in terms <strong>of</strong> a percentage <strong>of</strong><br />

your estate or in terms <strong>of</strong> the residue,<br />

or unused portion, <strong>of</strong> your estate.<br />

Your taxable estate is reduced by the<br />

amount <strong>of</strong> the charitable bequest.<br />

Life Income Gift<br />

If you wish to make a charitable gift<br />

but would like to provide income<br />

for yourself or a loved one, you may<br />

establish a charitable remainder<br />

trust or a charitable gift annuity<br />

to pay income to you or another<br />

beneficiary for life or a term <strong>of</strong> years.<br />

The trustee will then distribute the<br />

<strong>Jewish</strong> <strong>Foundation</strong> <strong>of</strong> <strong>Memphis</strong> is<br />

equipped to serve as a key resource,<br />

advisor, and guide throughout the<br />

process and can help donors<br />

identify community needs<br />

and potential beneficiaries.<br />

Ultimately, a donor’s<br />

legacy will be structured<br />

in a way that is most<br />

advantageous to<br />

their personal<br />

situation.<br />

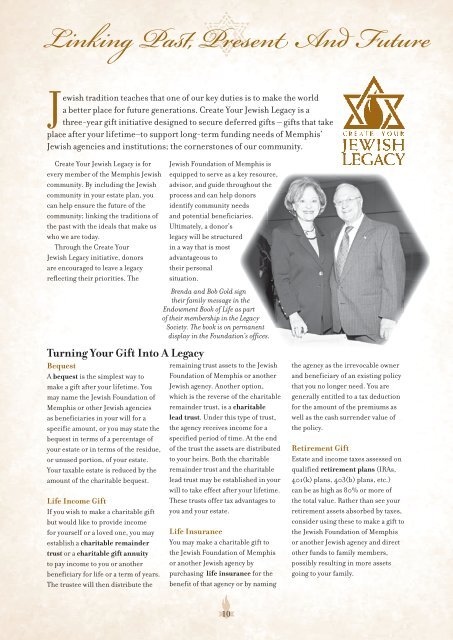

Brenda and Bob Gold sign<br />

their family message in the<br />

Endowment Book <strong>of</strong> Life as part<br />

<strong>of</strong> their membership in the Legacy<br />

Society. The book is on permanent<br />

display in the <strong>Foundation</strong>’s <strong>of</strong>fices.<br />

remaining trust assets to the <strong>Jewish</strong><br />

<strong>Foundation</strong> <strong>of</strong> <strong>Memphis</strong> or another<br />

<strong>Jewish</strong> agency. Another option,<br />

which is the reverse <strong>of</strong> the charitable<br />

remainder trust, is a charitable<br />

lead trust. Under this type <strong>of</strong> trust,<br />

the agency receives income for a<br />

specified period <strong>of</strong> time. At the end<br />

<strong>of</strong> the trust the assets are distributed<br />

to your heirs. Both the charitable<br />

remainder trust and the charitable<br />

lead trust may be established in your<br />

will to take effect after your lifetime.<br />

These trusts <strong>of</strong>fer tax advantages to<br />

you and your estate.<br />

Life Insurance<br />

You may make a charitable gift to<br />

the <strong>Jewish</strong> <strong>Foundation</strong> <strong>of</strong> <strong>Memphis</strong><br />

or another <strong>Jewish</strong> agency by<br />

purchasing life insurance for the<br />

benefit <strong>of</strong> that agency or by naming<br />

the agency as the irrevocable owner<br />

and beneficiary <strong>of</strong> an existing policy<br />

that you no longer need. You are<br />

generally entitled to a tax deduction<br />

for the amount <strong>of</strong> the premiums as<br />

well as the cash surrender value <strong>of</strong><br />

the policy.<br />

Retirement Gift<br />

Estate and income taxes assessed on<br />

qualified retirement plans (IRAs,<br />

401(k) plans, 403(b) plans, etc.)<br />

can be as high as 80% or more <strong>of</strong><br />

the total value. Rather than see your<br />

retirement assets absorbed by taxes,<br />

consider using these to make a gift to<br />

the <strong>Jewish</strong> <strong>Foundation</strong> <strong>of</strong> <strong>Memphis</strong><br />

or another <strong>Jewish</strong> agency and direct<br />

other funds to family members,<br />

possibly resulting in more assets<br />

going to your family.<br />

10