Managing IT Investments in the High-performance ... - Accenture

Managing IT Investments in the High-performance ... - Accenture

Managing IT Investments in the High-performance ... - Accenture

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

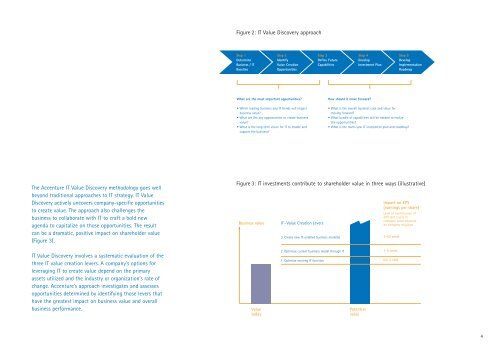

Figure 2: <strong>IT</strong> Value Discovery approach<br />

Step 1<br />

Determ<strong>in</strong>e<br />

Bus<strong>in</strong>ess / <strong>IT</strong><br />

Basel<strong>in</strong>e<br />

Step 2<br />

Identify<br />

Value Creation<br />

Opportunities<br />

Step 3<br />

Def<strong>in</strong>e Future<br />

Capabilities<br />

Step 4<br />

Develop<br />

Investment Plan<br />

Step 5<br />

Develop<br />

Implementation<br />

Roadmap<br />

What are <strong>the</strong> most important opportunities<br />

• Which lead<strong>in</strong>g bus<strong>in</strong>ess and <strong>IT</strong> trends will impact<br />

bus<strong>in</strong>ess value<br />

• What are <strong>the</strong> key opportunities to create bus<strong>in</strong>ess<br />

value<br />

• What is <strong>the</strong> long term vision for <strong>IT</strong> to enable and<br />

support <strong>the</strong> bus<strong>in</strong>ess<br />

How should it move forward<br />

• What is <strong>the</strong> overall bus<strong>in</strong>ess case and value for<br />

mov<strong>in</strong>g forward<br />

• What bundle of capabilities will be needed to realize<br />

<strong>the</strong> opportunities<br />

• What is <strong>the</strong> multi-year <strong>IT</strong> <strong>in</strong>vestment plan and roadmap<br />

The <strong>Accenture</strong> <strong>IT</strong> Value Discovery methodology goes well<br />

beyond traditional approaches to <strong>IT</strong> strategy. <strong>IT</strong> Value<br />

Discovery actively uncovers company-specific opportunities<br />

to create value. The approach also challenges <strong>the</strong><br />

bus<strong>in</strong>ess to collaborate with <strong>IT</strong> to craft a bold new<br />

agenda to capitalize on those opportunities. The result<br />

can be a dramatic, positive impact on shareholder value<br />

(Figure 3).<br />

<strong>IT</strong> Value Discovery <strong>in</strong>volves a systematic evaluation of <strong>the</strong><br />

three <strong>IT</strong> value creation levers. A company’s options for<br />

leverag<strong>in</strong>g <strong>IT</strong> to create value depend on <strong>the</strong> primary<br />

assets utilized and <strong>the</strong> <strong>in</strong>dustry or organization’s rate of<br />

change. <strong>Accenture</strong>’s approach <strong>in</strong>vestigates and assesses<br />

opportunities determ<strong>in</strong>ed by identify<strong>in</strong>g those levers that<br />

have <strong>the</strong> greatest impact on bus<strong>in</strong>ess value and overall<br />

bus<strong>in</strong>ess <strong>performance</strong>.<br />

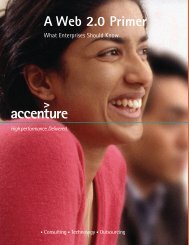

Figure 3: <strong>IT</strong> <strong>in</strong>vestments contribute to shareholder value <strong>in</strong> three ways (illustrative)<br />

Bus<strong>in</strong>ess value<br />

Value<br />

today<br />

<strong>IT</strong> -Value Creation Levers<br />

3. Create new <strong>IT</strong>-enabled bus<strong>in</strong>ess model(s)<br />

2.<br />

2. Optimize current bus<strong>in</strong>ess model through <strong>IT</strong><br />

1.<br />

1. Optimize exist<strong>in</strong>g <strong>IT</strong> function<br />

Potential<br />

value<br />

Impact on EPS<br />

(earn<strong>in</strong>gs per share)<br />

Level of contribution of<br />

different levers to<br />

company value depends<br />

on company situation<br />

2-50 cents<br />

1-5 cents<br />

0.5 -1 cent<br />

4