Ensure Brochure Oct 2011

Ensure Brochure Oct 2011

Ensure Brochure Oct 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

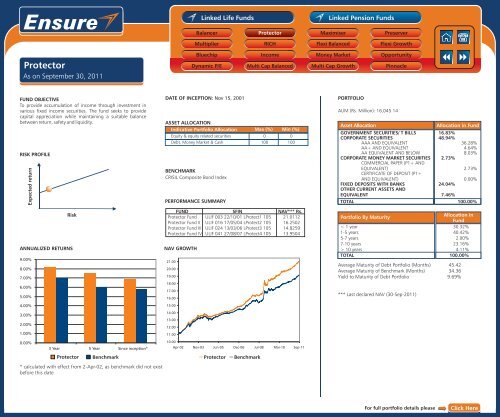

Protector<br />

As on September 30, <strong>2011</strong><br />

FUND OBJECTIVE<br />

To provide accumulation of income through investment in<br />

various fixed income securities. The fund seeks to provide<br />

capital appreciation while maintaining a suitable balance<br />

between return, safety and liquidity.<br />

RISK PROFILE<br />

Expected return<br />

Risk<br />

ANNUALIZED RETURNS<br />

9.00%<br />

8.00%<br />

7.00%<br />

6.00%<br />

5.00%<br />

4.00%<br />

3.00%<br />

2.00%<br />

1.00%<br />

0.00%<br />

3 Year 5 Year Since inception*<br />

Protector Benchmark<br />

* calculated with effect from 2-Apr-02, as benchmark did not exist<br />

before this date<br />

DATE OF INCEPTION: Nov 15, 2001<br />

ASSET ALLOCATION<br />

Indicative Portfolio Allocation Max (%) Min (%)<br />

Equity & equity related securities 0 0<br />

Debt, Money Market & Cash 100 100<br />

BENCHMARK<br />

CRISIL Composite Bond Index<br />

PERFORMANCE SUMMARY<br />

FUND SFIN NAV*** Rs.<br />

Protector Fund ULIF 003 22/10/01 LProtect1 105 21.0112<br />

Protector Fund II ULIF 016 17/05/04 LProtect2 105 16.2502<br />

Protector Fund III ULIF 024 13/03/06 LProtect3 105 14.8259<br />

Protector Fund IV ULIF 041 27/08/07 LProtect4 105 13.9504<br />

NAV GROWTH<br />

21.00<br />

20.00<br />

19.00<br />

18.00<br />

17.00<br />

16.00<br />

15.00<br />

14.00<br />

13.00<br />

12.00<br />

11.00<br />

10.00<br />

Linked Life Funds<br />

Balancer<br />

Multiplier<br />

Bluechip<br />

Dynamic P/E<br />

Apr-02 Nov-03 Jun-05 Dec-06 Jul-08 Mar-10 Sep-11<br />

Protector Benchmark<br />

Protector<br />

RICH<br />

Income<br />

Multi Cap Balanced<br />

Linked Pension Funds<br />

Maximiser<br />

Flexi Balanced<br />

Money Market<br />

Multi Cap Growth<br />

PORTFOLIO<br />

Preserver<br />

Flexi Growth<br />

Opportunity<br />

Pinnacle<br />

AUM (Rs. Million): 16,045.14<br />

Asset Allocation Allocation in Fund<br />

GOVERNMENT SECURITIES/ T BILLS 16.83%<br />

CORPORATE SECURITIES 48.94%<br />

AAA AND EQUIVALENT 36.28%<br />

AA+ AND EQUIVALENT 4.64%<br />

AA EQUIVALENT AND BELOW 8.03%<br />

CORPORATE MONEY MARKET SECURITIES 2.73%<br />

COMMERCIAL PAPER (P1+ AND<br />

EQUIVALENT) 2.73%<br />

CERTIFICATE OF DEPOSIT (P1+<br />

AND EQUIVALENT) 0.00%<br />

FIXED DEPOSITS WITH BANKS 24.04%<br />

OTHER CURRENT ASSETS AND<br />

EQUIVALENT 7.46%<br />

TOTAL 100.00%<br />

Portfolio By Maturity<br />

Allocation in<br />

Fund<br />

< 1 year 30.32%<br />

1-5 years 40.42%<br />

5-7 years 2.00%<br />

7-10 years 23.16%<br />

> 10 years 4.11%<br />

TOTAL 100.00%<br />

Average Maturity of Debt Portfolio (Months) 45.42<br />

Average Maturity of Benchmark (Months) 34.36<br />

Yield to Maturity of Debt Portfolio 9.69%<br />

*** Last declared NAV (30-Sep-<strong>2011</strong>)<br />

For full portfolio details please<br />

Click Here