Executive Director's Report - Illinois Student Assistance Commission

Executive Director's Report - Illinois Student Assistance Commission

Executive Director's Report - Illinois Student Assistance Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

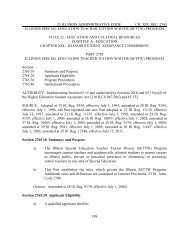

ILLINOIS STUDENT ASSISTANCE COMMISSION<br />

COLLEGE ILLINOIS!<br />

Total Program Performance<br />

July 2003 -- FY 2004<br />

APPROXIMATE INVESTMENT RETURN, 07/31/03<br />

Ending<br />

Market Value<br />

Fiscal<br />

Year-to-date<br />

Since<br />

Inception<br />

Inception<br />

Date***<br />

Total Program $349,979,911 0.7% 0.1% 7/6/99<br />

Policy Benchmark* 0.4% 0.8%<br />

Actuarial Assumption ** 0.6% 7.9%<br />

Domestic Equity $195,963,254 2.9% -6.0% 7/6/99<br />

William Blair 46,536,932 4.3% -14.9% 7/7/00<br />

Russell 1000 Growth 2.5% -20.4%<br />

Osprey Partners 59,071,338 1.9% -7.4% 9/7/01<br />

Russell 1000 Value 1.5% -2.4%<br />

State Street S&P 500 Index Fund 53,802,559 1.8% -6.6% 7/6/99<br />

S&P 500 Index 1.8% -6.4%<br />

Wasatch Advisors 36,552,425 4.5% 7.8% 9/7/01<br />

Russell 2000 6.3% 2.3%<br />

International Equity $20,280,351 1.2% 13.7%<br />

Jarislowsky Fraser 20,280,351 1.2% 13.7% 10/4/02<br />

MSCI EAFE 2.4% 19.8%<br />

Domestic Fixed Income $128,521,591 -2.6% 7.6% 7/6/99<br />

Banc One Investment Advisors 77,274,576 -2.6% -2.6% 7/1/03<br />

Lehman Aggregate Index -3.4% -3.4%<br />

Richmond Capital Management 51,247,015 -2.6% 2.6% 10/7/02<br />

Lehman Intermediate Government/Credit -2.7% 3.6%<br />

Cash Account $5,214,715 0.4% 3.8%<br />

T-Bills 0.1% 3.4%<br />

Note: Returns are preliminary and subject to revision pending the September 30, 2003 quarterly report.<br />

* As of November, 2002 the Policy Benchmark is 45% S&P500, 10% Russell 2000, 5% MSCI EAFE, 25% Lehman<br />

Aggregate, 13% Lehman Intermediate Government/Credit, and 2% T-bills. Previously, the benchmark was 50% S&P500,<br />

10% Russell 2000, 38% Lehman Aggregate and 2% T-bills (from October, 2001 through October, 2002) and 50%<br />

S&P500, 47% Lehman Aggregate and 3% T-bills (prior to October, 2001).<br />

** Actuarial assumption was revised to 7.75% effective 7/01/02. Prior to 7/01/02 the assumption was 8%.<br />

*** Benchmark returns are as of the beginning of the month.<br />

NUMBER AND DOLLAR VALUE OF PLANS, 07/31/03<br />

Number of Plans<br />

Plans Paid in Full 17,859<br />

Active Plans 14,760<br />

Cancelled Plans 3,564<br />

Suspended Plans 69<br />

Total Number of Plans 36,252<br />

Purchased Value of all Plans $618,210,006<br />

Active Plan:<br />

Cancelled Plan:<br />

Plan which has been approved and contract payments are being made.<br />

Plan that has been terminated either at the request of the purchaser or involuntarily due to<br />

delinquency, fraud, etc.<br />

Suspended Plan: Plan with an incomplete application or other outstanding omissions; a plan with this status<br />

is inactive.