Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

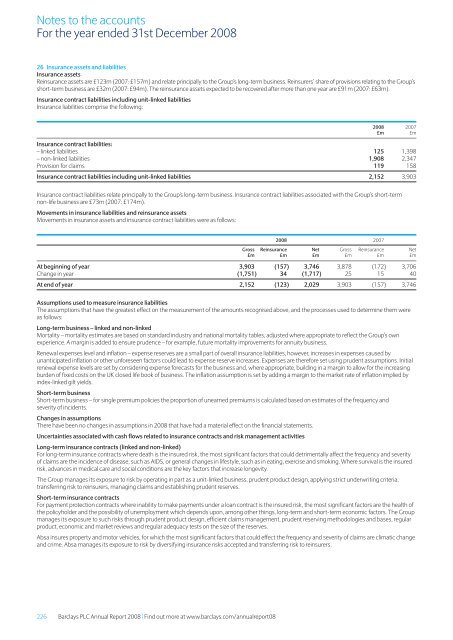

26 Insurance assets and liabilities<br />

Insurance assets<br />

Reinsurance assets are £123m (2007: £157m) and relate principally to the <strong>Group</strong>’s long-term business. Reinsurers’ share of provisions relating to the <strong>Group</strong>’s<br />

short-term business are £32m (2007: £94m). <strong>The</strong> reinsurance assets expected to be recovered after more than one year are £91m (2007: £63m).<br />

Insurance contract liabilities including unit-linked liabilities<br />

Insurance liabilities comprise the following:<br />

<strong>2008</strong> 2007<br />

£m £m<br />

Insurance contract liabilities:<br />

– linked liabilities 125 1,398<br />

– non-linked liabilities 1,908 2,347<br />

Provision for claims 119 158<br />

Insurance contract liabilities including unit-linked liabilities 2,152 3,903<br />

Insurance contract liabilities relate principally to the <strong>Group</strong>’s long-term business. Insurance contract liabilities associated with the <strong>Group</strong>’s short-term<br />

non-life business are £73m (2007: £174m).<br />

Movements in insurance liabilities and reinsurance assets<br />

Movements in insurance assets and insurance contract liabilities were as follows:<br />

<strong>2008</strong> 2007<br />

Gross Reinsurance Net Gross Reinsurance Net<br />

£m £m £m £m £m £m<br />

At beginning of year 3,903 (157) 3,746 3,878 (172) 3,706<br />

Change in year (1,751) 34 (1,717) 25 15 40<br />

At end of year 2,152 (123) 2,029 3,903 (157) 3,746<br />

Assumptions used to measure insurance liabilities<br />

<strong>The</strong> assumptions that have the greatest effect on the measurement of the amounts recognised above, and the processes used to determine them were<br />

as follows:<br />

Long-term business – linked and non-linked<br />

Mortality – mortality estimates are based on standard industry and national mortality tables, adjusted where appropriate to reflect the <strong>Group</strong>’s own<br />

experience. A margin is added to ensure prudence – for example, future mortality improvements for annuity business.<br />

Renewal expenses level and inflation – expense reserves are a small part of overall insurance liabilities, however, increases in expenses caused by<br />

unanticipated inflation or other unforeseen factors could lead to expense reserve increases. Expenses are therefore set using prudent assumptions. Initial<br />

renewal expense levels are set by considering expense forecasts for the business and, where appropriate, building in a margin to allow for the increasing<br />

burden of fixed costs on the UK closed life book of business. <strong>The</strong> inflation assumption is set by adding a margin to the market rate of inflation implied by<br />

index-linked gilt yields.<br />

Short-term business<br />

Short-term business – for single premium policies the proportion of unearned premiums is calculated based on estimates of the frequency and<br />

severity of incidents.<br />

Changes in assumptions<br />

<strong>The</strong>re have been no changes in assumptions in <strong>2008</strong> that have had a material effect on the financial <strong>statements</strong>.<br />

Uncertainties associated with cash flows related to insurance contracts and risk management activities<br />

Long-term insurance contracts (linked and non-linked)<br />

For long-term insurance contracts where death is the insured risk, the most significant factors that could detrimentally affect the frequency and severity<br />

of claims are the incidence of disease, such as AIDS, or general changes in lifestyle, such as in eating, exercise and smoking. Where survival is the insured<br />

risk, advances in medical care and social conditions are the key factors that increase longevity.<br />

<strong>The</strong> <strong>Group</strong> manages its exposure to risk by operating in part as a unit-linked business, prudent product design, applying strict underwriting criteria,<br />

transferring risk to reinsurers, managing claims and establishing prudent reserves.<br />

Short-term insurance contracts<br />

For payment protection contracts where inability to make payments under a loan contract is the insured risk, the most significant factors are the health of<br />

the policyholder and the possibility of unemployment which depends upon, among other things, long-term and short-term economic factors. <strong>The</strong> <strong>Group</strong><br />

manages its exposure to such risks through prudent product design, efficient claims management, prudent reserving methodologies and bases, regular<br />

product, economic and market reviews and regular adequacy tests on the size of the reserves.<br />

Absa insures property and motor vehicles, for which the most significant factors that could effect the frequency and severity of claims are climatic change<br />

and crime. Absa manages its exposure to risk by diversifying insurance risks accepted and transferring risk to reinsurers.<br />

226 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08