You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

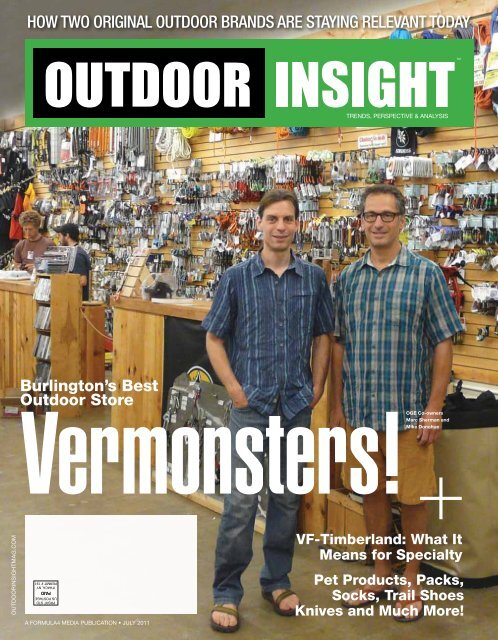

How Two original ouTdoor Brands are sTaying relevanT Today<br />

Burlington’s Best<br />

<strong>Outdoor</strong> <strong>Store</strong><br />

PRSRT STD<br />

US POSTAGE<br />

PAID<br />

ITHACA, NY<br />

PERMIT # 191<br />

ouTdoorinsighTMag.coM Vermonsters!<br />

A FormulA4 mediA PublicAtion • JulY 2011<br />

trends, PersPective & AnAlYsis<br />

OGE Co-owners<br />

Marc Sherman and<br />

Mike Donohue<br />

VF-Timberland: What It<br />

Means for Specialty<br />

Pet Products, Packs,<br />

Socks, Trail Shoes<br />

Knives and Much More!<br />

TM

WOOLRICH AD<br />

C2

TM<br />

OutdOOr InsIght<br />

outdoorinsightmag.com<br />

Editor in Chief<br />

mark sullivan<br />

msullivan@formula4media.com<br />

646-319-7878<br />

Managing Editor<br />

lou dzierzak<br />

ldzierzak@formula4media.com<br />

612-618-2780<br />

Editor at Large<br />

cara Griffin<br />

Art Director<br />

Francis Klaess<br />

Associate Art Director<br />

mary mcGann<br />

Contributing Editors<br />

mike Kennedy<br />

nancy ruhling<br />

tim sitek<br />

bob seligman<br />

Publisher<br />

Jeff nott<br />

jnott@formula4media.com<br />

516-305-4711<br />

Advertising<br />

beth Gordon<br />

bgordon@formula4media.com<br />

949-293-1378<br />

Jeff Gruenhut<br />

jgruenhut@formula4media.com<br />

404-467-9980<br />

troy leonard<br />

tleonard@formula4media.com<br />

352-624-1561<br />

sam selvaggio<br />

sselvaggio@formula4media.com<br />

212-398-5021<br />

Jess tendrick<br />

jtendrick@formula4media.com<br />

201-236-6324<br />

Production<br />

michael Jacobsen<br />

201-396-7005<br />

mjacobsen@formula4media.com<br />

Business Manager<br />

marianna rukhvarger<br />

516-305-4709<br />

mrukhvarger@formula4media.com<br />

Subscriptions<br />

store.formula4media.com<br />

Po box 23-1318<br />

Great neck, nY 11023<br />

Phone: 516-305-4710<br />

Fax: 516-305-4712<br />

Formula4 Media, LLC. Publications<br />

sports insight<br />

outdoor insight<br />

Footwear insight<br />

team insight<br />

textile insight<br />

running insight<br />

soccer insight<br />

<strong>Outdoor</strong> Insight TM<br />

is a trademark of<br />

Formula4media, llc. ©2011<br />

All rights reserved. the opinions<br />

expressed by authors and<br />

contributors to <strong>Outdoor</strong> Insight<br />

are not necessarily those of the<br />

editors or publishers. <strong>Outdoor</strong> Insight<br />

is not responsible for unsolicited<br />

manuscripts, photographs or artwork.<br />

Articles appearing in <strong>Outdoor</strong> Insight<br />

may not be reproduced in whole or in<br />

part without the express permission<br />

of the publisher. <strong>Outdoor</strong> Insight<br />

is published four times each year:<br />

January, February, July and August.<br />

Subscriptions: one year, $20.00<br />

(u.s. Funds) in the united states.<br />

All other countries, $54.00 (u.s. Funds).<br />

Postmaster: send address changes to<br />

outdoor insight, P.o. box 23-1318,<br />

Great neck, nY 11023<br />

<strong>Outdoor</strong> Insight is a<br />

proud member of oiA<br />

04 <strong>Outdoor</strong> Eye<br />

VF Corp buys Timberland; Decker to cease distributing Simple Shoes.<br />

08 Pet Products<br />

Man’s best friend deserves technical – and fun – equipment, too.<br />

10 BackPack Trends<br />

Vendors know that one size doesn’t fit all, so they are filling the need at retail.<br />

14 Knives<br />

A Sharp Sale. Emotional connections to knives create long-term demand.<br />

16 Hosiery<br />

Socks do sell, but brand loyalty is being challenged by new players.<br />

18 Footwear<br />

The Trail Evolves. Minimalism pushes outdoor and running brands footwear design.<br />

24 Apparel<br />

Lifestyle Apparel. <strong>Outdoor</strong> clothes are now ready to wear seven days a week.<br />

28 Original <strong>Outdoor</strong> Brands<br />

Woolrich and Filson stay relevant after more than a century in business.<br />

30 Retail<br />

<strong>Outdoor</strong> Gear Exchange finds success by following a different path.<br />

34 Trend Insight<br />

Stand-up paddleboarding is becoming a cool category for outdoor specialty.<br />

July 2011<br />

“The folding<br />

knife market<br />

will always be<br />

evolving and<br />

changing.<br />

The customer<br />

will always<br />

be asking<br />

what’s new.”<br />

Bill Raczkowski<br />

Fiskars <strong>Outdoor</strong><br />

Americas, Gerber<br />

July 2011 • outdoor insight • 3

outdoor eye<br />

VF-TIMBy...<br />

It’s not how big, but how the company can serve the smaller retailer<br />

VF Corp says it agreed to<br />

buy Timberland to “make a big<br />

brand bigger.” But its ultimate<br />

success in the outdoor market<br />

will depend on its ability to<br />

make the big brand relevant to<br />

specialty retailers.<br />

By most accounts, the deal<br />

is a win-win. It’s a win for VF,<br />

which adds another plum brand<br />

to its outdoor and action sports<br />

portfolio joining The North Face,<br />

Vans, Jansport, Eagle Creek,<br />

Reef and Kipling. And it’s a<br />

win for Timberland, a global<br />

power brand, but one that has<br />

struggled at times with market<br />

segmentation, sourcing and<br />

apparel — all things that its new<br />

daddy is real good at it.<br />

VF reported sales<br />

of $7.7 billion and<br />

announced plans<br />

to grow to $12 billion<br />

in five years.<br />

Despite racking up annual<br />

revenue of $1.4 billion in its<br />

last fiscal year, Timberland<br />

has had its problems. Its first<br />

quarter earnings were down 30<br />

percent from its previous year<br />

and despite its growth over the<br />

past two decades, the company<br />

has struggled with its identity<br />

at times. About 10 years ago,<br />

Timberland got red hot as an<br />

inner city brand, but company<br />

management had trouble<br />

managing the growth. It loved<br />

the sales bump, but seemed<br />

unclear on how to embrace its<br />

new urban customer. When<br />

the urban trend cooled down<br />

for the brand, it had nothing in<br />

the pipeline to replace it and as<br />

a result Timberland lost some<br />

credibility with independent<br />

shoe stores and outdoor<br />

specialty retailers. The North<br />

Face, on the other hand, has<br />

also had a decade of explosive<br />

growth. Its soft shell jackets<br />

have become the uniform for<br />

urban and suburban teens alike.<br />

But TNF managed the growth<br />

and expanded distribution very<br />

well. For example, in New York<br />

City, TNF was featured in a fullpage,<br />

four-color ad in The New<br />

York Times for Bloomingdales<br />

and highlighted in the windows<br />

of numerous boutiques on lower<br />

Broadway that appeal to college<br />

students at nearby New York<br />

University. Meanwhile, TNF<br />

has also put resources behind<br />

supporting the brand in core<br />

outdoor stores and running<br />

specialty retailers, developing<br />

product and marketing<br />

programs to support these<br />

channels. If VF can provide<br />

the same sort of channel<br />

segmentation for Timberland,<br />

the brand will certainly benefit.<br />

On the plus side, Timberland<br />

was an industry leader in<br />

green and corporate social<br />

responsibility. In 2008,<br />

Timberland released a long term<br />

four prong plan of Corporate<br />

Social Responsibility that<br />

focused on Service, Product,<br />

Energy and Workplaces. And<br />

even prior to that, the company<br />

led a number of service<br />

initiatives that focused on giving<br />

back to communities in which<br />

It’s a win for VF<br />

which adds another<br />

plum brand to its<br />

outdoor and action<br />

sports portfolio.<br />

it did business. The company<br />

also created a Path of Service<br />

Program that allowed for 40<br />

hours a year of paid leave so<br />

employees could do community<br />

service. Occasionally, those<br />

initiatives became flashpoints<br />

for retailers, employees and<br />

investors during the times when<br />

the company’s profitability<br />

sagged, but few have doubted<br />

Jeffrey Swartz’s sincerity. He<br />

personally is involved in many<br />

charitable endeavors and with<br />

an estimated $63 million take<br />

from the sale, he is in position<br />

to continue those efforts, or, as<br />

some have speculated launch a<br />

career in politics.<br />

Over the years, Timberland<br />

has also had trouble<br />

building continuity in senior<br />

management. Many top<br />

executives in the industry<br />

spent time at Timberland, but<br />

ended up leaving and moving<br />

on to other companies. New<br />

Balance is rife with former<br />

Timberland execs in key<br />

positions. Timberland COO<br />

Ken Pucker left the company<br />

several years ago and now<br />

works with investment groups<br />

that have stakes in MBT and<br />

other brands in the outdoor<br />

lifestyle space. Doug Clark,<br />

Timberland’s Chief Innovation<br />

Officer, left the company in<br />

2008 and formed New England<br />

Footwear, which then acquired<br />

the GoLite footwear license<br />

from Timberland. VF has proven<br />

it can develop talent internally<br />

and tends to promote from<br />

within. When Mike Ejeck, the<br />

president of The North Face,<br />

was promoted to head up<br />

VF’s outdoor brand coalition in<br />

2004, he was succeeded by<br />

Steve Rendle, who has since<br />

been promoted to a larger role.<br />

The North Face did not miss<br />

a beat during that transition.<br />

Timberland should benefit from<br />

the infusion of VF talent into its<br />

management ranks.<br />

Timberland acquired<br />

SmartWool in December<br />

of 2005 in what has been a<br />

well regarded move.<br />

SmartWool has been a leader<br />

in the “natural” fiber movement,<br />

expanding from socks into<br />

sweaters and other apparel<br />

categories, and SmartWool<br />

should benefit greatly from<br />

the support of VF’s apparel<br />

expertise and sourcing clout.<br />

Timberland has struggled<br />

with its brand in the apparel<br />

category, and in 2007 licensed<br />

the name to PVH, the huge<br />

apparel conglomerate that<br />

produces sportswear under<br />

license from Calvin Klein,<br />

Donna Karan, Kenneth Cole<br />

and other brands. For its last<br />

fiscal year, VF reported sales<br />

of $7.7 billion and announced<br />

plans to grow to $12 billion in<br />

five years. With The Timberland<br />

acquisition, the company is<br />

already a third of the way there.<br />

VF has apparel expertise in<br />

everything from underwear to<br />

denim to outdoor performance<br />

apparel. They will no doubt<br />

apply that to Timberland’s<br />

apparel business quickly. l<br />

4 • outdoor insight • July 2011 outdoorinsightmag.com

AD<br />

5

outdoor eye<br />

The<br />

Simple<br />

brand was<br />

launched<br />

in 1991<br />

Deckers To Cease Simple, Emphasize Sanuk<br />

Deckers <strong>Outdoor</strong> says it has made the strategic decision to cease distribution of its<br />

Simple Shoes brand. In a statement, Angel Martinez, president, CEO and chair of the<br />

Board of Directors, commented: “Simple Shoes was the first brand to prove it’s<br />

possible to make eco-conscious footwear, and we’re proud to have accomplished<br />

all that we have. Given that there is some degree of overlap between Simple and Sanuk<br />

consumers, and Sanuk’s positive outlook and global appeal, we make this difficult decision<br />

knowing it is in the best interests of the brands, the company and its shareholders.” The<br />

move will take effect December 31, 2011. l<br />

Princeton<br />

Tec products<br />

are made in<br />

the USA<br />

Princeton Tec Introduces Customization Program<br />

Product customization that caters to consumers’ desire for unique and personalized<br />

products has achieved a certain status in the sewn goods world. Manufacturers such<br />

as Nike, Vans, Keds, Timbuk2 and Rickshaw have successfully tapped into consumer<br />

demand for originality. Meanwhile, the customization trend has largely remained<br />

unexplored for more technical hard goods.<br />

Princeton Tec has introduced The Spectrum, a consumer-direct customization<br />

platform providing hundreds of design options for their Fuel and Remix headlamps.<br />

The first program of its kind in the outdoor lighting industry, Princeton Tec’s new<br />

customization platform will give consumers creative control to self-select and<br />

design their headlamps by mixing and matching from ten body colors, four<br />

button colors and two strap options — providing hundreds of options.<br />

Once configured, the headlamps will be assembled in Princeton Tec’s domestic<br />

production facility. There are no minimum quantities required so consumers can order<br />

a single customized headlamp to fit their specific needs and applications.<br />

The consumer customization site is planned to go live September 1, 2011 with beta<br />

testing starting in June and continuing throughout the summer. l<br />

textile report<br />

GE Wins<br />

Contract WIth<br />

Italian Military<br />

Manufacturers<br />

GE Energy has won<br />

a contract to supply<br />

PTFE membrane to<br />

Italian military garment<br />

manufacturers.<br />

GE’s waterproof/<br />

breathable membrane,<br />

known as eVent<br />

protective membrane,<br />

has been selected by<br />

Lovers Srl and Tessitura<br />

Majocchi Srl as the<br />

preferred waterproof/<br />

breathable supplier for<br />

the Italian Army.<br />

Lovers has been<br />

awarded the contract<br />

to supply waterproof/<br />

breathable camouflage<br />

jackets and pants,<br />

and a windproof vest<br />

to the Italian Army<br />

for the fourth year in<br />

a row. The company<br />

has supplied 210,000<br />

sets to the army and<br />

will deliver 57,600 sets<br />

as part of the latest<br />

contract. Majocchi has<br />

been selected as the<br />

lamination provider as<br />

part of the contract.<br />

GE will supply PTFE<br />

membrane to Majocchi.<br />

Together, the group of<br />

companies will work<br />

to produce one of<br />

the most waterproof/<br />

breathable outfits a<br />

soldier can wear.<br />

“We’re pleased to<br />

use our expertise to<br />

create dependable,<br />

protective garments<br />

for the Italian Army<br />

supporting Lovers and<br />

Majocchi,” said Glenn<br />

Crowther, product line<br />

leader for performance<br />

fabrics at GE.<br />

GE also supplies<br />

PTFE membrane to<br />

companies supplying<br />

the United States<br />

military and the<br />

People’s Republic of<br />

Korea military.<br />

PrimaLoft<br />

Reinforces<br />

European<br />

Sales Network<br />

PrimaLoft has hired<br />

Bartosz Lassak as<br />

sales agent for the<br />

Eastern European<br />

market. Lassak will<br />

head up sales and<br />

marketing, managing<br />

all represented<br />

PrimaLoft brands,<br />

as well as dealers<br />

in Eastern Europe<br />

and Russia.<br />

Lassak served as a<br />

sales representative<br />

for W.L. Gore in<br />

Eastern Europe since<br />

2001. In June 2002,<br />

Lassak founded<br />

his own successful<br />

sales and marketing<br />

agency, representing<br />

Nokia and a number<br />

of other notable<br />

brands and clients.<br />

Hyosung<br />

Introduces<br />

Key Directions<br />

for 2013<br />

Hyosung, one of<br />

the world’s largest<br />

producers of nylon,<br />

polyester, and<br />

spandex fibers, will<br />

co-exhibit with mill<br />

partners such as<br />

Samsung trading,<br />

Mikwang, Pucheon,<br />

Paka and Ifits to<br />

feature trend right,<br />

performance fabrics<br />

for backpacks,<br />

outerwear, and<br />

active apparel. The<br />

key directions going<br />

forward for Spring<br />

2013, are endurance,<br />

fast track, unity and<br />

motion. Hyosung<br />

also will introduce<br />

Mipan AquaX for<br />

cool touch, moisture<br />

management, and UV<br />

protection and wind/<br />

water resistance in<br />

wovens. l<br />

6 • outdoor insight • July 2011 outdoorinsightmag.com

Polartec Announces 2011<br />

North American APEX Award Winners<br />

Polartec, the developer, manufacturer and marketer of<br />

Polartec performance fabrics, announced the North American<br />

APEX Award winners for 2011. This award is presented<br />

to select Polartec-based garments that will be available to<br />

consumers in the fall of 2011. A panel of judges selected<br />

the winners based on the style, function and fit of the<br />

garments as well as innovative and appropriate uses of<br />

Polartec fabrics in the designs. The judges selected 13<br />

North American APEX winners. In addition to a Tiffany crystal<br />

award the manufacturers can participate in a custom hangtag<br />

program promoting the winning garments at the consumer<br />

level. Polartec also provides additional marketing support<br />

through product placement with media and events. l<br />

Winners include:<br />

Patagonia Northwall Jacket and Pants<br />

BARE SB System Midlayer<br />

Cabela’s Thermal Zone<br />

Special Op Forces Protective Combat Uniform<br />

Westcomb Apoc<br />

Marmot Zion<br />

Athleta Tagalong<br />

Orvis Targhee Full Zip Fleece<br />

Dragonfur Polartec Power Dry FR Hi-Viz Shirt<br />

Tyndale Polartec Baselayer Thermal Top & Bottom<br />

Big Bill Polartec Power Shield FR Jacket<br />

The North Face Jammu Jacket<br />

LL Bean Bean’s Insulated Fleece Jacket<br />

SEA EVIL AD<br />

7<br />

Marmot men’s<br />

Zion Jacket<br />

designed by<br />

Aubrey Vaughan<br />

MSRP: $375<br />

Tagalong<br />

designed by<br />

Amy McCusker<br />

MSRP: $79

Pet Products<br />

Dog<br />

products<br />

continue to<br />

sell well at<br />

outdoor<br />

specialty<br />

Man’s Best Friend<br />

Today’s campers and hikers may have names like Scamp, Scout<br />

and Benji. These four-legged canine adventurers offer outdoor<br />

specialty retailers opportunities for incremental sales even in<br />

a flat economy. Americans certainly love their pets. Overall<br />

sales of pet related products have reached $50 billion in the<br />

United States.<br />

“That number surprises a lot of people. It is an area that many outdoor<br />

channels have not capitalized on,” explains Lanette Fidrych, owner of Cycle<br />

Dog. “It is often an afterthought, but given the size of the market, it is a huge<br />

opportunity for outdoor retailers. The retailers that do focus on it usually<br />

have owners or buyers who are pet people, and they do quite well.”<br />

While the majority of that $50 billion in sales comes from products outside<br />

of the recreation-related items, brands have taken notice of the opportunity.<br />

“The pet industry as whole is getting more competitive, but there are still only<br />

a handful of companies that really specialize in outdoor or technical gear for<br />

dogs that join their people on hiking and camping expeditions,” says Kristen<br />

Smith, Planet Dog’s brand ambassador.<br />

Susan Strible, director of marketing, Ruffwear reports the brand’s<br />

outdoor specialty partners are expanding their selection of the brand’s<br />

products. Even a slow economy hasn’t blunted interest in dog products.<br />

“The pet industry is relatively bullet proof. The industry as a whole is<br />

definitely growing. We find that the more you have to offer, the more the<br />

store owners will order,” says Jill Nazimek, owner of Katie’s Bumpers.<br />

“The outdoor industry has finally taken notice of their customers dogs.<br />

There are dog friendly outdoor stores everywhere.”<br />

D-Fa’s Angela Hook comments,” Successful retailers commit to the category<br />

and work to sell through the idea and the product. Those who are less<br />

successful are ones that don’t support their stock with point-of-sale or<br />

training and aren’t using their knowledge of their existing customers to drive<br />

sales. In essence the pet category is no different to any other in outdoor. It is<br />

not a “Field of Dreams” (i.e., stock it and they will come), but when added to<br />

the sales line it can make a difference to the bottom line.<br />

Impulse or Planned Purchase?<br />

Dog products range from organic snacks, brightly colored toys, collars and<br />

leashes to technical packs with as much attention to detail as the packs the<br />

dog’s owner carries. Pet owners will make spur of the moment purchases as<br />

well as compare feature sets across brands.<br />

At Ruffwear, Strible reports an uptick in sales of collars and leashes.<br />

”People like to refresh colors and designs and they are low price points. We<br />

are seeing a lot more sales in those areas.”<br />

Toys are also selling well. “Once you find a food that your pet likes,<br />

you stick to it. But toys are different. We all want new toys. So, if there is<br />

something new, consumers have a tendency to try the ‘new thing’ if it suits<br />

their needs,” says Nazimek. “We try to bring out new toys so our customers<br />

stay with our brand and buy our new toys.”<br />

Brand managers note that over time even lower-priced products garner<br />

scrutiny. “When it comes to smaller items, definitely impulse buying is there,”<br />

says Hook. “And to a certain extent even the bigger items are a little impulse<br />

at first. Maybe that is because it’s still unexpected and so there is a moment<br />

of impulse. However, people are quite discerning when it comes to choosing<br />

specific products to do the right job for their dog.”<br />

Technical gear like dog panniers, booties and flotation receive more<br />

attention and product comparison. “<strong>Outdoor</strong> gear products tend to be<br />

considered purchases. They know their lifestyle and seek out items that allow<br />

their pet to join their outdoor adventures,” says Smith.<br />

Supporting Retailers<br />

Like most outdoor product categories, merchandising plays a critical<br />

role in attracting consumer interest and sales. Ruffwear offers a branded<br />

freestanding display unit for retailers. The modular design can be used to<br />

create a store within a store.<br />

Planet Dog has introduced a new tabletop display that helps retailers<br />

merchandise a variety of Orbee-Tuff products. The display won the Best in<br />

Show Point of Purchase Display at the 2011 Global Pet Expo in Orlando, FL. l<br />

Left to right: Planet Dog Orbee, Ruffwear Beacon, Planet Dog Woodchuck, Ruffwear Sqwash.<br />

8 • outdoor insight • July 2011 outdoorinsightmag.com

CARPE<br />

TRENDEM<br />

TRENDINSIGHT<br />

iNsighT AND ANAlysis oN CoNsuMER TRENDs iN ouTDooR PuRChAsEs<br />

Friday, August 5, 2011 / 7:15 AM – 9:00 AM<br />

Marriott Salt Lake City Downtown, Deer Valley Salon<br />

Speaker: Julia Day, Leisure Trends Group<br />

Moderator: Lou Dzierzak, Managing Editor, <strong>Outdoor</strong> Insight<br />

Knowing who is coming into your store and what is driving them there is key to meeting their needs and ultimately getting<br />

them to buy. Perfectly timed for the start of Day 2 of the OR Summer Market, <strong>Outdoor</strong> Insight gives attendees a birds-eye view<br />

of the latest consumer shopping trends of the outdoor consumer. Presented by Julia Day of the Leisure Trends Group, with data<br />

gleaned from their point-of-sale data combined with a quarterly poll of 1,000 American adults aged 16 and over, attendees<br />

will hear about current trends in outdoor apparel, footwear and accessories to more effectively shop the Summer Market.<br />

Light breakfast served. Seating is limited. Retailers and manufacturers welcome.<br />

Please RsVP to jnott@formula4media.com<br />

outdoorinsightmag.com

ackpacks<br />

One Size Doesn’t Fit All<br />

outdoor enthusiasts are clearly gear junkies, always on the<br />

hunt for the next best new piece of equipment to take on<br />

their next adventure. Central to this accumulation of stuff is<br />

a backpack to carry everything in.<br />

As consumer’s preferences swing back and forth between<br />

tightly focused application specific packs to multi-purpose<br />

one-size-fits all models backpack brands are expanding their product lines<br />

to accommodate both interests.<br />

“We have a lot of application or use-specific packs and that part of our<br />

line has grown. But the attractiveness of a ‘quiver of one’ style pack is very<br />

relevant,” says Gareth Martins director of marketing for Osprey packs.<br />

“Osprey’s customers are looking for both styles.”<br />

John Sears, Gregory’s director of new product development says,<br />

“Consumers are certainly looking for more versatile packs. They are looking<br />

for innovative features and value.”<br />

Black Diamond’s customer is still purchasing packs specific to the end<br />

use. “Most of the people we are selling to have at least a summer and<br />

winter pack. If they are into backpacking that’s an additional pack. Maybe<br />

a hydration backpack too,” reports Nathan Kuder, softgoods category<br />

director, Black Diamond Equipment. “Like shoes and helmets, they tend to<br />

buy packs for specific seasonal use.”<br />

With a proliferation of brands and models, backpack manufacturers<br />

are taking care to differentiate themselves in the eyes of consumers and<br />

deuter will promote the<br />

new 2012 Aircontact packs<br />

with a free gift with<br />

purchase promotion.<br />

this savant is designed for overnight<br />

trips and trekking, offering a<br />

full, traditional feature set without<br />

excess clutter.<br />

Backpack<br />

designs<br />

evolve to<br />

match user<br />

preferences<br />

specialty retailers.<br />

Suspension designs, ventilations details and construction materials are<br />

important elements that separate brands.<br />

“Granite Gear has never used an aluminum stay that is so common in other<br />

manufacturer’s multi-day pack. Most of our packs throughout the years have<br />

used a molded 3-dimensional frame sheet. The philosophy behind that allows<br />

the pack to follow the contours of your<br />

back so you don’t have pressure points,”<br />

explains Dave Johnson, sales manager at<br />

Consumers<br />

are looking<br />

for innovative<br />

features and<br />

value.”<br />

Granite Gear. “We’ve also been a pioneer<br />

in the use of materials. Extensive in-house<br />

testing of materials has given us an edge in<br />

picking materials that are very light but as<br />

durable as they can be. We are not a me-too<br />

company. We don’t change a product or<br />

introduce a new product unless we feel we<br />

John Sears, Gregory’s<br />

can introduce something that we feel is a<br />

significant innovation.”<br />

Well-known in European markets, Deuter is committed to raising its brand<br />

presence in North America. Keeping backpackers cool with ventilation<br />

technology is brand’s central value propositions.<br />

“Deuter has been building packs since 1898. We believe we are one the<br />

bigger players. We’ve earned our wings. Deuter has been building packs<br />

s s s<br />

DEuTER GREGORy ARC’TERyx<br />

the Kata series are<br />

designed for all-mountain<br />

versatility for climbing,<br />

trekking or travel.<br />

10 • outdoor insight • July 2011 outdoorinsightmag.com

INTEGRITy<br />

11

ackpacks<br />

since 1898,” says Christian Mason, director of sales and marketing, Deuter<br />

USA. “We invented the ventilated back panel and offer users a value<br />

proposition of reducing perspiration by 25 percent.”<br />

Like all outdoor product categories, positive price/value equations<br />

attract consumers. <strong>Mountain</strong>smith follows this business approach. “If<br />

you were to split outdoor products into A, B and C level, we strive to<br />

bring A quality product to the market at a B level price. This results in a<br />

huge value to the customer and when we define value, it means delivering<br />

product that outperforms its price tag,” explains Jay Getzel, director of<br />

sales and marketing.<br />

“Product design is spawned out of<br />

three main research projects for us.<br />

First is sales representative and dealer<br />

feedback. Second competitive analysis<br />

that allows us to identify potential soft<br />

spots or holes in the market and third<br />

sales trends both internally and on an<br />

industry wide level make up the third<br />

component of the research involved in<br />

our development process.”<br />

Go Lite has carved a market niche<br />

s s s<br />

BLACK DIAmOND ARC’TERyx GO LITE<br />

the new black diamond women’sspecific<br />

onyx uses Active Frame<br />

technology and features the new<br />

ergoActiv XP suspension.<br />

There’s both<br />

specificity and<br />

generalization<br />

and I think you<br />

can have both.<br />

Dave Furman, Mammut USA<br />

by focusing on lightweight packs. Like Osprey, paying attention to<br />

environmental issues has also helped differentiate Go Lite. “We have<br />

always been about lightweight packs that are not overbuilt. The most<br />

significant evolution we have made in the last several years was using<br />

mostly sustainable materials in all our packs, “ notes sales director Kevin<br />

Volz. “The industry is evolving and finally catching up to us in terms of<br />

their focus on lightweight and sustainability.”<br />

With experienced gained from previous pack purchases, brand education<br />

the nozone series are<br />

mountain-focused packs that can<br />

be stripped of certain features<br />

for specific activities.<br />

Go lite is introducing the new<br />

literail At series. these packs<br />

have full adjustability and weigh<br />

well under four pounds.<br />

tools and retailer sales people backpackers have become more<br />

sophisticated in evaluating backpack suspensions and bag designs.<br />

“Consumers understand the technology. The onus is on us to describe<br />

and sell that to the consumer,” says Martins. “We believe that a good<br />

technical suspension that transfers the weight on to the hips and across<br />

the back and carries comfortably is far better than something that is so<br />

stripped down and light that it doesn’t carry well.”<br />

Sears adds, “Consumers are becoming more educated and discerning<br />

about what’s comfortable and what’s not. The extreme lightweight trend<br />

that we saw come and go happened because it is all about comfort. It takes<br />

the right amount of build in the suspension to give the consumer the ultra<br />

comfortable experience. Finding the balance between the weight of the<br />

bag and the suspension build is something consumers are getting more<br />

sophisticated about. Consumers are purchasing products that carry well.”<br />

One backpack or three?<br />

Weekend backpackers, ultra-distance thru-hikers and climbers all look for<br />

distinct features in the backpacks they use. <strong>Outdoor</strong> brands have offered<br />

broader selections to fit every consumer niche and application, but are<br />

consumers being overwhelmed with choices? Can’t one pack do it all?<br />

The North Face builds packs for a wide range of enthusiasts and<br />

applications. “We know that there isn’t a one-size-fit all pack solution<br />

for our customers, so I think where The North Face excels is with the<br />

sheer number of options we have available,” notes Scott McGuire The<br />

North Face director of equipment. “Since our packs are athlete tested<br />

and expedition proven, we have something for you whether you’re<br />

headed to the top of Mount Everest, running 100 miles of trail or heading<br />

out on a day hike.”<br />

At the other end of the spectrum, Dave Furman, Mammut USA’s hardgood<br />

12 • outdoor insight • July 2011 outdoorinsightmag.com

expert, offers a commonly heard consumer appeal. “Why do I need five<br />

different packs for the things I want to do? I’d like to have two and do<br />

everything with those.” Furman responds to that question. “That opens<br />

up some room for people who want to generalize. There’s both specificity<br />

and generalization and I think you can have both at the same time.”<br />

Harder core enthusiasts are willing to pay for narrowly defined feature<br />

sets.” At the higher price points, activity-specific packs are really<br />

strong players. These include backcountry<br />

snow packs or trail running hydration<br />

packs,” explains Derick Noffsinger, Jansport<br />

technical outdoor designer.<br />

The lines between multi-purpose technical<br />

daypacks and backpacking packs are getting<br />

very blurred. “The challenge is making<br />

sure your product is targeted to the right<br />

customer so you aren’t putting on extra<br />

features that a backpacking person would<br />

want on a hiking pack where the customer<br />

doesn’t need them,” notes Kuder. “With any<br />

The industry<br />

has evolved<br />

over the last<br />

20 years.<br />

Jay Getzel<br />

<strong>Mountain</strong>smith<br />

movement in the market you still have to maintain the more traditional<br />

styles in the line because those were your bread and butter.”<br />

Another important influence on backpack design is the time enthusiasts<br />

are committing to their adventures. “I think the industry has evolved<br />

over the last 20 years,” says Jay Getzel, director of sales and marketing,<br />

<strong>Mountain</strong>smith. “Our windows of an industry once based on backpacking,<br />

has gone through transitions in its target demographic and key styles that<br />

had us into basecamping and family camping then into the done in a day<br />

mode and most recently almost to a ‘done in an hour’ mode.”<br />

One feature that has changed in recent seasons is the decline in average<br />

backpack volumes. “Our windows of playtime are shrinking as a culture<br />

and packs have followed this trend,” reports Getzel. “There is significantly<br />

less business being done in the 5-7000 c.i. range. I heard a stat that 65<br />

percent of all packs sold now are under 2500 c.i. When we redesigned<br />

our pack line two years ago, we certainly focused on the one to three and<br />

three to five day sizes more than the larger packs”<br />

Noffsinger agrees,” We have seen a drop in pack volumes due to these<br />

functionally specific bags and a move away from the larger, do-it-all packs.”<br />

In the last six or seven years there has been a shift downward in size.<br />

Pack manufacturers are shifting their model lines as the volume sizes have<br />

decreased. “The sweet spot in the multi-day backpack market used to be<br />

5000 c.i. or more,” says Johnson. “Now, we don’t even have a pack offered<br />

in that size range. Now the sweet spot is 3600-4000 ci.”<br />

While shorter time frames have significantly influenced backpack<br />

volumes, an interest in lighter weight gear and equipment has also played<br />

a role. “More and more you see folks who are less serious backpackers<br />

who are dialing in with lighter weight tents and equipment,” says Martins.<br />

A few years ago there was a trend toward ultra lightweight packs. “The<br />

lightweight market is not just people who are doing the thru hikes that are<br />

buying these packs. Hikers are also looking for the lightest pack to meet<br />

their needs,” reports Johnson.<br />

While embraced by some backpackers, others have taken a more<br />

moderate approach to shaving ounces. “A lot of people have tried going<br />

really lightweight and figured out this stuff doesn’t necessarily last as long<br />

and maybe I don’t want to be quite as anal-retentive about what I bring.<br />

People are realizing there’s a happy medium where most users fit in,”<br />

notes Furman. l

trends<br />

A Sharp Sale<br />

Emotional connections<br />

to knives create<br />

long-term demand<br />

Knives have been called one of man’s earliest tools. In the 21st<br />

century, sharp blades still have a strong emotional attraction<br />

for outdoor enthusiasts.<br />

“I don’t fully understand why knives are so emotionally<br />

connected to people but I absolutely adore that that’s<br />

the case. I love hearing the personal stories that tell me ‘I<br />

remember my first knife. It was a right of passage,’” says CJ Buck, CEO of<br />

Buck Knives. “There’s very much an emotional connection. That drives the<br />

thinking process. People shifting away from disposable product to product<br />

that’s capable of being passed down to another generation. Knives offer a<br />

basic dependability and are as useful now as they were was 40 years ago.<br />

There’s a sense of legacy involved.”<br />

Thomas Welk, national sales manager at Kershaw, believes the emotional<br />

connection plays a vital role in knife sales. “If you don’t have an emotional<br />

attachment, it’s difficult for someone to understand a knife purchase. It’s<br />

important to have the generational hand-down. There is something very<br />

personal and intimate about owning a knife,” he says.<br />

Knives definitely play a role across generations. “Your first camping outing<br />

with your dad, it’s in your glove compartment, it’s in your pocket, it takes<br />

you from your youth through your life experiences,” notes Dennis Piretra,<br />

Wenger’s director of marketing.<br />

Over time, campers have augmented knives with multitools. While<br />

becoming a practical addition to many campers gear lists, multitools don’t<br />

seem to have the same emotional apparel. “Knives are very emotional.<br />

People will buy a knife because it has an emotional appeal to it,” notes Bill<br />

Raczkowski, category manager, Fiskars <strong>Outdoor</strong> – Americas, Gerber. “A tool<br />

is a more utilitarian device. I have a need for a screwdriver, bottle opener or<br />

pliers. Tool purchaser needs a tool. Knives are definitely more specialized.<br />

They all do the exact same thing — cut, scrape and pry. Users want specifics,<br />

but they want the emotional appeal of a knife.”<br />

Stable Market<br />

Brand managers report knife sales remained flat or dipped slightly after<br />

the economy faltered but seem to have recovered. “The knife market<br />

definitely took a dip but we are seeing growth over the last six to eight<br />

months,” explains Piretra. “We feel that the last three or four years a knife<br />

purchase was relatively low on a consumer’s priority list.”<br />

At present, the knife industry is surprisingly healthy despite the economy.<br />

“Spyderco has recently experienced our best months of sales in the history<br />

of the company,” reports Joyce Laituri, marketing manager, Spyderco<br />

Knives.<br />

Renewed interest in outdoor activities like hiking and camping are bringing<br />

a broader group of people into the knife market. “They need daily life tools as<br />

Buck: The Buck Bantam Pocket Knife is a medium size,<br />

lightweight, mid-lockback knife with easy 1-handed opening.<br />

Benchmade: The 915 Triage is a dynamic triple utility tool<br />

that includes a knife, safety hook and glass breaker. The<br />

Triage uses highly corrosion resistant blade steel.<br />

they go on these adventures. They want to be self-reliant,” says Buck. “I think<br />

the market is growing again. With all the anxiety and chaos in the world there<br />

is a renewed interest in self-reliance. Having knives and multi-tools around is<br />

part of that perspective.”<br />

Cable shows like “Man vs. Wild” depicting difficult environments and<br />

survival situations have also contributed to knife sales. “We believe the market<br />

is growing with the advent of people like Bear Grylls being on television,”<br />

says Raczkowski. “People are interested in survival themes. They may never<br />

be in the wilderness survival situation, but they believe that yes with I knife I<br />

can survive the wilds.” Multitool brands are also benefitting from this appeal.<br />

“People want a little bit of everything because they are not sure what will come<br />

against. Women are getting more active outdoors and are recognizing a knife<br />

or tool is something they need to have in their kit,” notes Jason Carpenter,<br />

product manager, Leatherman Tool Group.<br />

Single Purpose vs. Multiple Applications<br />

For decades, outdoor enthusiasts have had a choice between folding and<br />

fixed blade knives. While both styles remain popular, opinions differ about<br />

which approach addresses consumer’s needs best.<br />

Twenty years ago everyone carried a pocket-folding knife. It was an everyday<br />

carry knife. Small and compact to bring out as needed,” recalls Raczkowski.<br />

“The folding knife market will always be evolving and changing. The customer<br />

will always be going into the outdoor retailer and be asking what’s new.”<br />

Since your grandfather’s knife, folding knives have evolved to include a wide<br />

range of blades and tools. “As a design team we will look at enthusiasts and<br />

determine which features are important to them,” reports Welk. “Some are<br />

looking for lighter weight or how they carry the knife. We’re trying to attract<br />

14 • outdoor insight • July 2011 outdoorinsightmag.com

Gerber: The Metolius Pocket Folder is a thin,<br />

strong, every-day-carry knife crafted from<br />

stainless steel for good balance and strength.<br />

The Metolius Pocket Folder features a TacHide<br />

handle inlay for secure grip in all conditions.<br />

younger customer with technology features and colors showing knives as<br />

tools with features and designs that resonate with them. Interest in the<br />

old-timers and grandpa’s knives of yesterday are decreasing. Our focus has<br />

been on the younger user.”<br />

Knives have also evolved to address tightly focused and specific<br />

applications. Models for climbers, paddlers and campers offer feature<br />

sets tailored to those activities. Gerber’s Bear Grylls survival knife and<br />

Wenger’s Mike Horn-inspired Ranger Series and new Ueli Steck climbing<br />

knife are examples. These hybrids include blades and tools. “Bang for the<br />

buck is an overriding theme. The Ranger and Expedition models are like a<br />

Swiss Army Knife on steroids. Specialty knives like the Ueli Steck climbing<br />

knife are purpose built,” explains Piretra. “We see higher ticket knives<br />

doing very well and much better than we expected.”<br />

With so many options available, outdoor enthusiasts are now<br />

purchasing multiple knives. “The climbers seem to prefer very light,<br />

very small folders, paddlers gravitate more to fixed blades and general<br />

outdoor enthusiasts seem to carry mid-size models,” explains Laituri.<br />

“At <strong>Outdoor</strong> Retailer we see people who come by carrying a Spyderco<br />

knife and tell us they bought it for backpacking and end up carrying<br />

it everyday but have they fixed blade or micro-folder on their PFD or<br />

climbing harness. They are discovering the everyday usefulness of<br />

knives outside of sporting activities. People ask for one-hand open<br />

operation, lightweight, a long-lasting sharpened edge, and clip carry. It’s<br />

all about convenience and reliable high performance.”<br />

Lighter weights are also attracting buyers. “Consumers are gravitating<br />

towards lightweight knives and reducing carry weight without sacrificing<br />

functionality has been key for the consumer,” reports Mike Dolmage,<br />

director of product development at Buck Knives. “There is also a trend<br />

towards smaller lightweight fixed blades as well as lock back/mid lock<br />

folders. Both knives offer excellent functionality and safety benefits for<br />

the consumer.”<br />

Regardless of model or application, reliability is key. “There is a basic<br />

shift to a sense of foundational dependability. People are shying away from<br />

too much specialization. If you overspecialize you almost limit yourself,”<br />

reports Buck. Consumers are looking for general utility with multiple<br />

functionality. There are times when the fixed blade will be the best option,<br />

other times the less conspicuous folding knife will be more appropriate.<br />

Feature sets continue to evolve. There is a cautionary feeling that knives<br />

with multiple parts that can be lost are inherently less dependable. What’s<br />

the use if you lose the part? l

Hosiery<br />

Technical socks may not be the most glamorous product<br />

found at an outdoor retailer, but the category is experiencing<br />

the same competitive pressures, drive for innovation and<br />

consumer loyalty as backpacks and trail running shoes.<br />

“It’s definitely a competitive market. Everyone wants a<br />

bigger piece of the consumer’s dollar,” reports Fox River<br />

brand manager Jennifer Whitley. “With shoe and apparel companies<br />

jumping into the sock market there are a lot of choices for consumers<br />

out there.”<br />

Market leader SmartWool has seen competition increase. “When you<br />

look at the sock category today, compared to when we entered the<br />

category, it’s a completely differently ball game. Before SmartWool, socks<br />

were an afterthought,” says Amy Beck, director of SmartWool U.S. sales.<br />

“Now people actually go to the retailers and<br />

ask for us by name. Socks have become a<br />

critical part of the outdoor experience and<br />

rightly so. There isn’t much you can do<br />

outside if your feet aren’t comfortable.”<br />

A flood of new product offering is<br />

challenging legacy brands like Wigwam<br />

that boast more than a century of sock<br />

production. “The market has exploded.<br />

Every Tom, Dick and Harry wants to be<br />

in the sock biz,” says Natalie Stangl, field<br />

marketing manager at Wigwam. We make<br />

our own product in Sheboygan, WI, and<br />

Brand loyalty<br />

challenged by<br />

new category<br />

players<br />

1 1 2 3 4 5<br />

Socks<br />

Do Sell<br />

Every Tom,<br />

Dick and<br />

Harry wants<br />

to be in the<br />

sock biz.<br />

Natalie Stangl<br />

Wigwam<br />

therefore we are able to have better quality control and be very hands on.<br />

We’ve been manufacturing socks in the USA for 106 years.”<br />

New products are coming from sock-specific companies as well<br />

as footwear brands extending their product lines. The competitive<br />

atmosphere is hot.<br />

“Many shoe and apparel brands want to jump into this successful<br />

market. It’s good to remember that the best socks come from core sock<br />

brands with core expertise,” notes Mercedes Marchand, VP of design and<br />

merchandising at Goodhew.<br />

Innovations in cushioning, fit, color options and application specific<br />

models are contributing to growth and consumer’s willingness to try<br />

new brands. “<strong>Outdoor</strong> enthusiasts are always looking for the next best<br />

thing. What’s going to give them a better experience or performance,”<br />

says Whitley. “We do get feedback from<br />

consumers and retailers. There’s a push<br />

towards more color, technology and fit focus<br />

on socks.”<br />

Bruce Barrows, Lorpen’s North American<br />

sales manager comments,” We do see growth<br />

in the categories we are in. Retailers and<br />

consumers are looking for innovation. That<br />

drives interest in a fairly mundane category.”<br />

There is a growing demand for socks<br />

segmented by sport and season. “In running<br />

and everyday wear, people are getting more<br />

into the type of shoe they are looking for,”<br />

Being a<br />

sustainable<br />

business is<br />

simply the<br />

entry point.<br />

Mercedes Marchand<br />

Goodhew<br />

says Peter Duke, founder Point 6. “They are looking for a closer fit so when<br />

making a sock we have to accommodate the space available.”<br />

Brand managers reports strong sales even during the economic<br />

downturn. “History has proven that socks are recession proof, you can get<br />

the best of something for under $20,” reports Marchand.<br />

Are consumers brand loyal?<br />

It’s not hard to identify outdoor gear and apparel brands that generate<br />

passionate loyalty from users. Does that loyalty include technical outdoor<br />

socks?<br />

“We feel we have the most passionate, dedicated and loyal fans in the<br />

world. Fortunately for us, they also like to tell their friends. Our research<br />

shows that more than 90 percent of our fans tell their friends about us,”<br />

says Beck. “Our consumers connect with us on a rational level in that<br />

they know they can trust our products to deliver the comfort they need<br />

to do what they love to do. However, they also connect with us on a much<br />

more emotional level. We are authentic in everything we do in that we<br />

believe more joy can be found outside. This resonates with our consumers<br />

because they believe this too.”<br />

“Our customers are not buying price-driven cheap socks. There is<br />

loyalty to quality, value, and USA Made products,” says Stangl.<br />

New brands breaking into the technical sock category have to overcome<br />

consumer loyalty to get their brands noticed. “Consumers are fiercely<br />

loyal. We’ve had a big hurdle [to overcome]. People are very loyal to<br />

specific brands and we have the same issue with retailers. They see the<br />

brand loyalty of their consumers that’s driving their decisions,” notes<br />

Wood Talkington, brand manager, FITS Sock Co. “They want to stick with<br />

what’s working. You have to get the socks on their feet and then they will<br />

make their decisions from there.”<br />

While its clear outdoor enthusiasts may have a go-to sock brand, there<br />

is definitely room for experimentation with new brand. “To a large degree<br />

they are loyal. The flip side is that socks are a relatively inexpensive<br />

impulse purchase,” notes Ric Cabot, owner and founder of Darn Tough. “If<br />

something that catches your eye it’s not a big investment to try something<br />

16 • outdoor insight • July 2011 outdoorinsightmag.com

6 7 8 9 10 11<br />

new. A lot of the new things on the market are almost art for art sake.<br />

You will see bells and whistles just for the sake of putting something on<br />

the sock. When people realize that that is mostly cosmetic they go back<br />

to the brands they are comfortable with,” says Cabot. “Just become its<br />

shiny and new, doesn’t mean that the socks are comfortable, durable or<br />

fit well. People have more sock choices then they have ever had and they<br />

are definitely getting more educated about socks.”<br />

Barrows agrees. “I think that there is some loyalty to the legacy brands<br />

that have been around for a long time. At the same time, since there is now<br />

such a proliferation of brands, I think there is a lot of brand switching.”<br />

Sock designs now cover very specific applications like skiing,<br />

backpacking and trail running. Ultimately, the user’s experience will<br />

influence future purchases. “Consumers are looking for brands with<br />

meaning. The product must perform and the consumer wants to<br />

feel good about the brands they are<br />

supporting,” says Marchand. “If they find<br />

this combination they will keep coming<br />

back. Goodhew is focusing on building<br />

brand loyalty through our everyday<br />

technical performance combined with<br />

fresh design and color.”<br />

Fashion is important but function<br />

still rules the day. “When the product no<br />

longer functions or starts to fail through a<br />

Left to Right:<br />

1 Darn Tough Tulip Shorty Plum<br />

2 Darn Tough Flame<br />

3 Point 6 Hiking Tech<br />

4 Point 6 Lotus Extra Light<br />

5 Smartwool 708<br />

6 Fox River Trail Quarter<br />

7 FITS Women’s Low<br />

8 Lorpen XTRW Steel Blue<br />

9 Smartwool 875<br />

10 Smartwool 874<br />

11 Point 6 Half Stack Light Crew<br />

durability issue then the consumer becomes disenchanted with their once<br />

go to sock and start to look for a different brand that meets their standards,”<br />

offers Duke. “The most important thing to a consumer who is serious about<br />

their sport is function. l

Footwear<br />

The Trail Evolves<br />

Minimalism pushes outdoor and<br />

running brand’s footwear design<br />

Trail running has earned its place in outdoor recreation.<br />

Creation of the Endurance Zone section on the <strong>Outdoor</strong><br />

Retailer Summer Market show floor offers an example of the<br />

category’s importance to outdoor specialty retailers.<br />

Following lifecycles of many product categories, trail<br />

running has splintered into multiple product segments<br />

targeting specific kinds of trail running enthusiasts. “The trail market has<br />

evolved a lot in the last five years. Previously known as multi-function,<br />

if you look at the typology of the shoes that<br />

dominated the market at the start they tended to<br />

be great versatile, multi-function outdoor shoes<br />

but with pretty mediocre runnability,” notes<br />

Tom Berry, VP of global sales, marketing and<br />

merchandising for the Tecnica Group. “Today<br />

there are at least three categories. You still have<br />

the multi-function category, then shoes with<br />

better runnability, and third, the trend toward<br />

minimalism. The Holy Grail is to be able to have<br />

the versatility of multi-function but with the<br />

more runnability.”<br />

Adopted early by outdoor enthusiasts,<br />

trail running is attracting more traditional<br />

roadrunners. “The trail market is emerging as<br />

running grows. Running is becoming a lot of<br />

people’s primary fitness activity. When that<br />

Everyone<br />

is trying to<br />

get off of<br />

manmade<br />

surfaces<br />

and onto<br />

natural<br />

surfaces.<br />

Kirk Richardson<br />

Montrail<br />

happens they are looking for ways to break up the monotony of running<br />

around the block,” says Carson Caprara, Brooks Sports running footwear<br />

product line manager.<br />

“Runners are exploring different kinds of running shoes, workouts, and<br />

ultimately different running routes and terrain. The moderate trails are<br />

s<br />

SAuCONy<br />

the saucony Pro Grid Peregrine 2<br />

is designed for the trail runner<br />

looking for lighter weight footwear.<br />

more accessible to runners and they are exploring them.”<br />

The definition of trail running has also broadened to include more<br />

than just Rocky <strong>Mountain</strong> locations. Packed dirt paths in urban parks<br />

and crushed limestone rails to trails conversions are becoming popular<br />

venues.<br />

“The one thing you have to say about the trail market and running in<br />

general is that everyone is trying to get off of manmade surfaces and onto<br />

natural surfaces,’ says Kirk Richardson, business director of Montrail.<br />

“There’s a much stronger understanding that getting off road has myriad<br />

benefits for people who are running as a principle form of fitness and<br />

reaction. Trail running has become a much more sought after aspect of<br />

the whole running experience.”<br />

As more users enter the market, footwear brands are designing trail<br />

shoes for different kinds of terrain and running preferences.<br />

“The product has evolved into lighter more flexible product by<br />

lowering midsole heights, adding more flex grooves and using less upper<br />

materials combined with a more simple construction,” reports Brice<br />

Newton, footwear product marketing manager at ASICS. “Our footwear<br />

team is constantly striving to reduce overall weight through alternate<br />

constructions and materials, but at the same time ensuring protection for<br />

the runner.”<br />

The Minimalism Influence<br />

After exploding on the road running environment, minimalism design<br />

influences are being seen in trail running footwear. “The idea of how<br />

do you make runners more efficient is something that adidas and other<br />

companies have been working on for a long time,” reports Greg Thomsen,<br />

managing director at Adidas <strong>Outdoor</strong> USA. “It’s not something new.<br />

We’ve all known that lighter weight, more stability, more traction and<br />

durability come into the equation. What I like about the minimalist side<br />

18 • outdoor insight • July 2011 outdoorinsightmag.com

ECCO<br />

19

Footwear<br />

SAuCONy<br />

saucony sees minimalism as an<br />

interesting test lab as the brand<br />

continues to expand our trail line.<br />

saucony Xodos 3.0 features a<br />

vibram sole for off-road traction.<br />

BROOKS<br />

brooks believes there is a<br />

definitely a market for shoes that<br />

are a little more secure, supportive<br />

and durable. the brooks true Grit<br />

is a lightweight trail shoe.<br />

mERRELL<br />

merrell’s women’s dash glove<br />

continues its commitment<br />

to minimalist footwear.<br />

of the business right now is that it is bringing<br />

more focus to running and to new design<br />

concepts. Even though many runners swear<br />

by the minimalist technology others have<br />

experienced negative results. But overall,<br />

the exploration of this design concept and<br />

new directions for improving an athlete’s<br />

performance will continue to push the<br />

creative boundaries of product development.<br />

That’s really positive.”<br />

Merrell has fully embraced minimalist<br />

running principles. The trail market is<br />

ever evolving. With the fast pace of the<br />

barefoot movement, many traditional athletic<br />

brands are entering the market with their<br />

interpretation of a minimal trail running shoe,”<br />

says Craig Throne, VP- global marketing at<br />

Merrell. “In Spring 2012, we bet we will see<br />

the majority of outdoor and athletic brands<br />

approaching trail running in a much more<br />

minimal design focus.”<br />

Throne continues, “The minimalist trend<br />

has influenced the way that we are designing<br />

our entire range of Merrell Barefoot. A<br />

common design thread in Merrell Barefoot<br />

design is our BareForm approach that<br />

encourages a natural midfoot landing in a<br />

foot-shaped forefoot design offering ample<br />

foot splay and ground feel.”<br />

Opinions about the potential of minimalist<br />

designs in trail running footwear vary<br />

significantly across outdoor and traditional<br />

running shoe brand executives.<br />

“There’s a lot of one-sided dialogue going<br />

on. Lot of people saying there is a right and<br />

wrong way to run. Those shoes aren’t healthy<br />

for you. There’s a lot of confusion for the<br />

every day runner. They don’t know what’s<br />

right or wrong,” says Caprara. “At Brooks,<br />

we’ve don’t see anything wrong with a shoe<br />

that provides you with a lot of protection as<br />

long as there is functionality built into the<br />

shoe that works with the body. There is definitely<br />

still a market for these shoes that are<br />

a little more secure, supportive and durable.<br />

It’s not that there is a right or wrong. Different<br />

shoes will provide different experiences.”<br />

Even with differing perspective there<br />

appears to be room for growth for both<br />

competitive approaches. “The minimal trend<br />

is creating new energy in the category,” says<br />

Bryan Gothie, product manager, New Balance.<br />

“Minimal product is one end of the spectrum.<br />

The definition of what was traditional in the<br />

past is moving toward minimal and redefining<br />

what’s normal. We’re seeing lighter weight<br />

and lower to the ground.”<br />

Minimalism has allowed brands to evaluate<br />

the geometry and engineering of trail shoes.”<br />

Minimalism has been an interesting test lab<br />

as we continue to expand our trail line,’<br />

says Patrick O’Malley, SVP of global product,<br />

Saucony. Minimalism has allowed us to<br />

provide more options to runners. We’ve been<br />

20 • outdoor insight • July 2011 outdoorinsightmag.com<br />

s<br />

s<br />

s

able to expand our line and let the runner decide<br />

which is their number one priority.”<br />

Runners are looking for ways to connect with the<br />

physical experience of running. “They want ground<br />

contact and to be involved in the experience. A shoe<br />

with a lot of protection can take away from that,”<br />

notes Caprara. “There’s an emerging mindset of<br />

runners who want to feel every step they take and<br />

be in touch with the ground underneath their feet<br />

and activate their proprioception. Those runners<br />

are looking for product that is lighter, more flexible<br />

and lower profile that allows that experience.”<br />

The trend of lightweight will influence ASICS<br />

trail running product in a very similar way as it<br />

has influenced ASICS road running products. “This<br />

product will be considerably lighter, more flexible<br />

and include different variations of ASICS popular<br />

no-sew upper construction. We will also see more<br />

color and brighter colors,” explains Newton. “The<br />

difference with the trail product is that it still needs<br />

to provide protection and excellent traction. Traditional trail running product<br />

will continue to be important because there is still a group of consumers<br />

that will not be able to transition into the lighter weight product and another<br />

segment that will use the light weight product as an alternate shoe or fast<br />

paced shoe.”<br />

Footwear brands that come from an outdoor orientation see the<br />

BAFFIN<br />

21<br />

s<br />

ASICS<br />

Gel-trail sensor 5<br />

the lightweight trend will influence<br />

Asics trail running product in a<br />

very similar way as it has influenced<br />

Asics road running products.<br />

minimalism a bit differently. “Minimalism has created more interest in the<br />

trail and that’s a good thing. We’re trying to leverage our experience in<br />

technology in trail and take it in as many meaningful directions as we can,”<br />

says Kyle Rackiewicz, product development director at Vasque. “We are<br />

not going to emulate what the latest trend is if its not in our tool belt of<br />

experience and technology in how we build footwear. We look at minimalism

Footwear<br />

the new oboz lightning bdry<br />

is a waterproof breathable version<br />

of the lighting trail running shoe.<br />

the lightning bdry offers<br />

all-around performance and<br />

durability for running on a full<br />

spectrum of surfaces, including the<br />

most rugged and rocky trails.<br />

Gel-trabuco 14<br />

the Asics footwear team is<br />

constantly striving to reduce<br />

overall weight through alternate<br />

constructions and materials, but<br />

at the same time ensuring<br />

protection for the runner.<br />

the north Face single track<br />

Hayasa. the north Face is<br />

finding better foams, better<br />

cushioning properties, new welded<br />

technologies and lighter weight<br />

fabrications to create their trail<br />

running shoes.<br />

as a good thing for the industry overall and we<br />

will wade into it as we learn and are able to do<br />

it right by leveraging our experience building<br />

shoes.”<br />

The minimalist trend has had some<br />

influence on the trail footwear market.<br />

“You see lots of brands with lower profile<br />

minimalist shoes but I think the jury is still<br />

out whether people are going to buy them<br />

or not,” says Jonathan Lantz, president, La<br />

Sportiva N.A. “You see a lot of shoes the<br />

walls but when you look at what’s turning.<br />

With hard-core trail runners no one has fully<br />

embraced the minimalist trail market from<br />

what I see. If a runner is already interested<br />

in minimalist will buy.”<br />

Not all trail running brands are jumping<br />

into the minimalist segment.<br />

“Minimalism is going to contribute to a<br />

disconnect with runners. My feeling is that<br />

the initial market reaction to minimalism is<br />

going to slow down or even out as people<br />

recognize that a minimalist shoe is not<br />

perfect for every condition, situation and<br />

trail,” suggests Josh Fairchilds, founder of<br />

Oboz. “We’re not going after the minimalist<br />

market. Our feeling is that while there is a<br />

tremendous amount of validity in training feet<br />

to be stronger we know from focus groups<br />

that we have done with trail and mountain<br />

runners in Montana they are looking for<br />

durability and protection and they are still<br />

looking to the traditional model for trail<br />

running shoes. We’re sticking with that. We<br />

don’t think the traditional trail running shoe<br />

isn’t going away any time soon.”<br />

Fairchilds adds, “At the same time,<br />

minimalism has educated people a great deal<br />

about foot strength. It’s not just a matter<br />

of just buying the right shoe and that shoe<br />

will solve all your running problems. It’s<br />

about training correctly and an important<br />

component of that should be foot strength.<br />

Minimalist shoes are a great way to do that<br />

while still protecting your feet.”<br />

From models offering maximum protection<br />

from exposed roots and rocks on wilderness<br />

ultra-distance trails to minimalist-inspired<br />

trail racing shoes, runners benefit from more<br />

trail running options than ever before.<br />

“The pendulum is always swinging. Now<br />

we have the minimalist trend. People want<br />

to try that out. There’s more acceptance of<br />

lighter weight more minimal product,” says<br />

Richardson. “There is a strong consumer<br />

preference to experience the less is more<br />

product. But there’s sort of a balance. On the<br />

one hand there are a lot of biomechanical<br />

advantages to that but you need to be<br />

prudent and thoughtful on how fast you make<br />

the transition from conventional running<br />

and trail running shoes to the uber minimal<br />

products. The universe of product choices is<br />

getting more robust for the trail runner. The<br />

22 • outdoor insight • July 2011 outdoorinsightmag.com<br />

OBOz<br />

s<br />

ASICS<br />

s<br />

THE NORTH FACE<br />

s

eadth of product offerings will continue to evolve.”<br />

JP Borod, product director of footwear at The North Face comments,<br />

“Its’ good that brands have a multitude of options for different<br />

runners, different activities and from different biomechanical builds.<br />

From our standpoint we don’t want to ask you to change your gait.<br />

We think that if you are on trail you do need a level of support and<br />

protection. Retailers will need a wide variety of options to fit their<br />

customers. There’s not a one size fits all solution.”<br />

Ultimately, minimalism is driving runners into specialty retailers<br />

filled with questions about which is the most appropriate trail<br />

running shoe for their interests. “Our sales have been up month over<br />

month consistently. We’re still continuing to grow and evolve. New<br />

people continue to come in, “ says Lauren Barra, product category<br />

manager, Salomon Footwear. “Any type of innovation in the market is<br />

a good thing. That allows all brands to be innovative. The minimalism<br />

story is another step. It’s exciting for the market. It’s led to a lot of<br />

new product that we haven’t seen come as quickly before.”<br />

<strong>Mountain</strong> Brands vs. Traditional Running Brands<br />

<strong>Outdoor</strong> brands with climbing heritages approach trail running<br />

differently from traditional road shoe brands. Early in the trail<br />

running market’s evolution, those differences were distinct. That’s<br />

not necessarily the case today.<br />

“In the trail running market, we still see outdoor brands having<br />

the upper hand as we have always focused on the outdoor experience<br />

and trail terrain with a ‘groundwork’<br />

approach,” says Throne. “The<br />

Merrell approach is simple, we work<br />

Minimalism<br />

has educated<br />

people a<br />

great deal<br />

about foot<br />

strength.<br />

Josh Fairchilds, Oboz<br />

outdoorinsightmag.com<br />

from the ground up knowing that the<br />

closer a runner is to his or her terrain,<br />

the more ground feel a runner<br />

experiences and the better a runner’s<br />

form. It will be interesting to see<br />

the approach that traditional running<br />

brands bring to trail running in light<br />

of the barefoot movement. It is going<br />

to be a crowded space with many different<br />

options.”<br />

O’Malley adds, “A lot of mountain<br />

brands have gotten really aggressive in trail. For us, it’s running first.<br />

Moving to trail has been a really easy transition for us. Now, the<br />

retailers are reducing the amount of brands on the wall and going<br />

with running brands that they trust.”<br />

Both perspectives have learned from their competitor’s approach.<br />

The result is a hybrid of design philosophies. “I don’t know if the<br />

lines are as distinct now. They are more gray than ever,” says Gothie.<br />

“Everyone can make a great shoe now. The doors are more open now<br />

for companies to come in without being tagged by a personification that<br />

‘you can’t make a lightweight shoe’ or ‘you can’t make a running shoe.’”<br />

<strong>Outdoor</strong> brands have become much more sophisticated in our<br />

levels of development. “We’ve also attracted a lot of talent from the<br />

running industry. Today there is a big conversion of road technology<br />

in trail that enables us to make our shoes far better performing than<br />

they were before,” says Borod. “We’re finding better foams, better<br />

cushioning properties, new welded technologies and lighter weight<br />

fabrications. When you go to trail events and people are still wearing<br />

their road shoes but they are starting to learn about the benefits<br />

outdoor brands are bringing to road shoes. Whether it’s minimalism<br />

or product sophistication, you are seeing outdoor brands building<br />

shoes with a less is more philosophy.”<br />

Trail running continues to attract enthusiasts and attention from<br />

outdoor specialty retailers. With expanding model lines responding<br />