DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

DIGITAL MARKETING HUB v2.0 - AdExchanger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Digital Marketing Hub <strong>v2.0</strong><br />

BMO Capital Markets<br />

dia access control (MAC) address and obfuscates or “hashes” the number to ensure anonymity.<br />

Other potential solutions are also being attempted by start-ups such as Mobile Future<br />

Group’s AD-X or MobileAppTracking, which use proprietary technology to primarily help<br />

provide app download attribution.<br />

Mobile attribution plays a highly important role in cross-channel attribution. Because it’s<br />

the fastest growing category of IP devices, mobile is a vital piece of the holistic view of consumers.<br />

Over time we expect more integration between mobile attribution solutions and other<br />

cross-channel initiatives like Nielsen’s Cross-Platform Campaign Ratings, which aims to<br />

bring common measurement to television and online video.<br />

Watch Your Wall Street Analogies<br />

As programmatic buying has come to advertising, many in the industry are looking to<br />

Wall Street for a template; however the comparisons have their limits. With the industries<br />

largely based in the same metropolitan hubs – starting with New York and London – and<br />

many similarities in their marketplaces, the association is fair. For example, both industries<br />

saw the rise of scalable, self-service business models early in the internet era. While Google’s<br />

AdWords also created an entirely new type of advertising, like E*Trade, it aimed from the<br />

outset to be easy-to-learn, and improved over time as power users developed. Furthermore,<br />

investment banks and agencies play similar roles. Both offer scaled business services to augment<br />

their clients’ in-house staff. Both traditionally make most of their fees from Fortune<br />

1000 companies, giving advice on capital allocation, design of financial products/advertising<br />

creative, and execution of transactions. In part because of the investment banking business’<br />

shift to trading-driven business models, many in the advertising industry are talking about<br />

ideas like proprietary trading.<br />

Seeing as they are the most visible, stock markets are often where comparisons are<br />

drawn; commodity futures are a better fit, but still not great. Both stock and commodity<br />

futures markets are much, much larger than the global advertising market and have significantly<br />

better transparency, with real-time pricing data a foundation of both today. Where<br />

commodity futures are more similar than stocks is that ~75% of transactions are entered by<br />

humans and then traded electronically, while stocks see ~70% of volume traded over highfrequency<br />

and algorithmic platforms.<br />

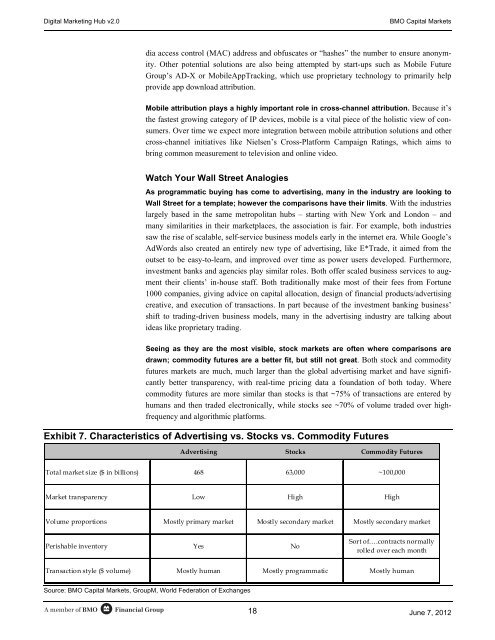

Exhibit 7. Characteristics of Advertising vs. Stocks vs. Commodity Futures<br />

Advertising Stocks Commodity Futures<br />

Total market size ($ in billions) 468 63,000 ~100,000<br />

Market transparency Low High High<br />

Volume proportions Mostly primary market Mostly secondary market Mostly secondary market<br />

Perishable inventory Yes No<br />

Sort of….contracts normally<br />

rolled over each month<br />

Transaction style ($ volume) Mostly human Mostly programmatic Mostly human<br />

Source: BMO Capital Markets, GroupM, World Federation of Exchanges<br />

A member of BMO<br />

Financial Group<br />

18<br />

June 7, 2012