addendum 2

addendum 2

addendum 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

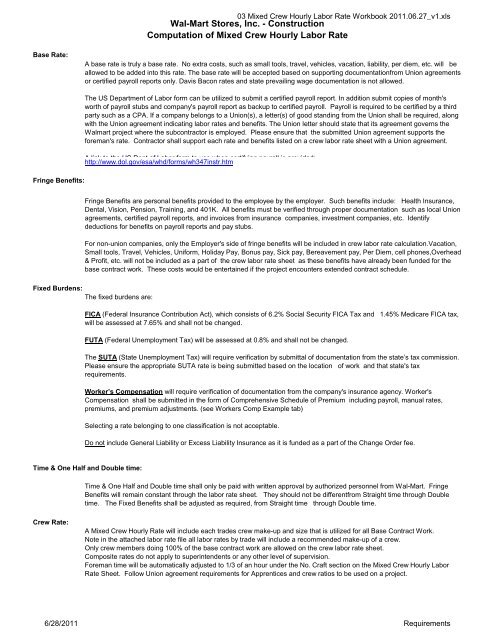

03 Mixed Crew Hourly Labor Rate Workbook 2011.06.27_v1.xls<br />

Wal-Mart Stores, Inc. - Construction<br />

Computation of Mixed Crew Hourly Labor Rate<br />

Base Rate:<br />

A base rate is truly a base rate. No extra costs, such as small tools, travel, vehicles, vacation, liability, per diem, etc. will be<br />

allowed to be added into this rate. The base rate will be accepted based on supporting documentationfrom Union agreements<br />

or certified payroll reports only. Davis Bacon rates and state prevailing wage documentation is not allowed.<br />

Fringe Benefits:<br />

The US Department of Labor form can be utilized to submit a certified payroll report. In addition submit copies of month's<br />

worth of payroll stubs and company's payroll report as backup to certified payroll. Payroll is required to be certified by a third<br />

party such as a CPA. If a company belongs to a Union(s), a letter(s) of good standing from the Union shall be required, along<br />

with the Union agreement indicating labor rates and benefits. The Union letter should state that its agreement governs the<br />

Walmart project where the subcontractor is employed. Please ensure that the submitted Union agreement supports the<br />

foreman's rate. Contractor shall support each rate and benefits listed on a crew labor rate sheet with a Union agreement.<br />

A link to the US Dept of Labor form to use when certifying payroll is provided:<br />

http://www.dol.gov/esa/whd/forms/wh347instr.htm<br />

Fringe Benefits are personal benefits provided to the employee by the employer. Such benefits include: Health Insurance,<br />

Dental, Vision, Pension, Training, and 401K. All benefits must be verified through proper documentation such as local Union<br />

agreements, certified payroll reports, and invoices from insurance companies, investment companies, etc. Identify<br />

deductions for benefits on payroll reports and pay stubs.<br />

For non-union companies, only the Employer's side of fringe benefits will be included in crew labor rate calculation.Vacation,<br />

Small tools, Travel, Vehicles, Uniform, Holiday Pay, Bonus pay, Sick pay, Bereavement pay, Per Diem, cell phones,Overhead<br />

& Profit, etc. will not be included as a part of the crew labor rate sheet as these benefits have already been funded for the<br />

base contract work. These costs would be entertained if the project encounters extended contract schedule.<br />

Fixed Burdens:<br />

The fixed burdens are:<br />

FICA (Federal Insurance Contribution Act), which consists of 6.2% Social Security FICA Tax and 1.45% Medicare FICA tax,<br />

will be assessed at 7.65% and shall not be changed.<br />

FUTA (Federal Unemployment Tax) will be assessed at 0.8% and shall not be changed.<br />

The SUTA (State Unemployment Tax) will require verification by submittal of documentation from the state’s tax commission.<br />

Please ensure the appropriate SUTA rate is being submitted based on the location of work and that state's tax<br />

requirements.<br />

Worker’s Compensation will require verification of documentation from the company's insurance agency. Worker's<br />

Compensation shall be submitted in the form of Comprehensive Schedule of Premium including payroll, manual rates,<br />

premiums, and premium adjustments. (see Workers Comp Example tab)<br />

Selecting a rate belonging to one classification is not acceptable.<br />

Do not include General Liability or Excess Liability Insurance as it is funded as a part of the Change Order fee.<br />

Time & One Half and Double time:<br />

Time & One Half and Double time shall only be paid with written approval by authorized personnel from Wal-Mart. Fringe<br />

Benefits will remain constant through the labor rate sheet. They should not be differentfrom Straight time through Double<br />

time. The Fixed Benefits shall be adjusted as required, from Straight time through Double time.<br />

Crew Rate:<br />

A Mixed Crew Hourly Rate will include each trades crew make-up and size that is utilized for all Base Contract Work.<br />

Note in the attached labor rate file all labor rates by trade will include a recommended make-up of a crew.<br />

Only crew members doing 100% of the base contract work are allowed on the crew labor rate sheet.<br />

Composite rates do not apply to superintendents or any other level of supervision.<br />

Foreman time will be automatically adjusted to 1/3 of an hour under the No. Craft section on the Mixed Crew Hourly Labor<br />

Rate Sheet. Follow Union agreement requirements for Apprentices and crew ratios to be used on a project.<br />

6/28/2011 Requirements