ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

ANNUAL REPORT & ACCOUNTS - Somero Enterprises

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

disclosed at fair value in the financial statements on a recurring basis. Certain aspects of SFAS<br />

157 were effective as of January 1, 2008 and affected certain note disclosures. We do not<br />

anticipate that the adoption of the deferred portion of SFAS 157 will have a material impact on<br />

the Company’s financial condition, results of operations or cash flows.<br />

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets<br />

and Financial Liabilities (“SFAS 159”). SFAS 159 provides reporting entities an option to<br />

report selected financial assets and liabilities at fair value. SFAS 159 establishes presentation<br />

and disclosure requirements designed to facilitate comparisons between companies that choose<br />

different measurement attributes for similar types of assets and liabilities. SFAS 159 also<br />

requires additional information to aid financial statement users' understanding of a reporting<br />

entity's choice to use fair value on its earnings and also requires entities to display the fair value<br />

of those affected assets and liabilities in the primary financial statements. SFAS 159 is effective<br />

as of the beginning of a reporting entity's first fiscal year beginning after November 15, 2007.<br />

Application of the standard is optional and any impacts are limited to those financial assets and<br />

liabilities to which SFAS 159 would be applied. The Company adopted SFAS 159 effective<br />

January 1, 2008 and has elected not to measure any of its current eligible financial assets or<br />

liabilities at fair value.<br />

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and<br />

Hedging Activities. This statement requires companies to provide enhanced disclosures about<br />

(a) how and why they use derivative instruments, (b) how derivative instruments and related<br />

hedged items are accounted for under SFAS No. 133 and its related interpretations, and (c) how<br />

derivative instruments and related hedged items affect a company’s financial position, financial<br />

performance, and cash flows. SFAS No.161 is effective for financial statements for fiscal years<br />

and interim periods beginning after November 15, 2008. The Company will adopt the new<br />

disclosure requirements in the period beginning January 1, 2009. We do not believe the<br />

adoption of SFAS No.161 will have a material impact on the disclosure of the Company’s<br />

Derivative Instruments and Hedging Activities.<br />

In June 2008, the FASB ratified EITF Issue No. 08-3, Accounting for Lessees for Maintenance<br />

Deposits Under Lease Arrangements (EITF 08-3). EITF 08-3 provides guidance for accounting<br />

for nonrefundable maintenance deposits. It also provides revenue recognition accounting<br />

guidance for the lessor. EITF 08-3 is effective for fiscal years beginning after December 15,<br />

2008. We are currently assessing the impact of EITF 08-3 on our financial position and results<br />

of operations.<br />

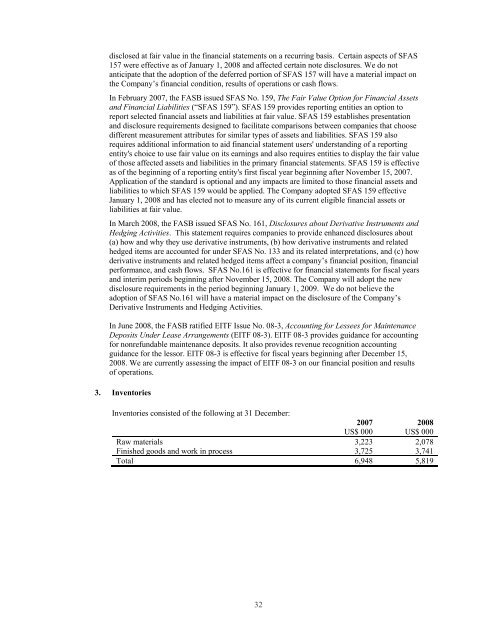

3. Inventories<br />

Inventories consisted of the following at 31 December:<br />

2007 2008<br />

US$ 000 US$ 000<br />

Raw materials 3,223 2,078<br />

Finished goods and work in process 3,725 3,741<br />

Total 6,948 5,819<br />

32