BAE-annual-report-2014

BAE-annual-report-2014

BAE-annual-report-2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strategic Report<br />

FINANCIAL<br />

REVIEW<br />

CONTINUED<br />

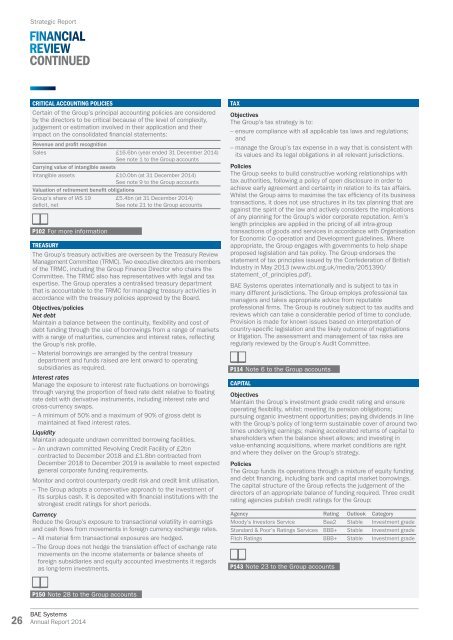

CRITICAL ACCOUNTING POLICIES<br />

Certain of the Group’s principal accounting policies are considered<br />

by the directors to be critical because of the level of complexity,<br />

judgement or estimation involved in their application and their<br />

impact on the consolidated financial statements:<br />

Revenue and profit recognition<br />

Sales £16.6bn (year ended 31 December <strong>2014</strong>)<br />

See note 1 to the Group accounts<br />

Carrying value of intangible assets<br />

Intangible assets £10.0bn (at 31 December <strong>2014</strong>)<br />

See note 9 to the Group accounts<br />

Valuation of retirement benefit obligations<br />

Group’s share of IAS 19<br />

deficit, net<br />

P102 For more information<br />

£5.4bn (at 31 December <strong>2014</strong>)<br />

See note 21 to the Group accounts<br />

TREASURY<br />

The Group’s treasury activities are overseen by the Treasury Review<br />

Management Committee (TRMC). Two executive directors are members<br />

of the TRMC, including the Group Finance Director who chairs the<br />

Committee. The TRMC also has representatives with legal and tax<br />

expertise. The Group operates a centralised treasury department<br />

that is accountable to the TRMC for managing treasury activities in<br />

accordance with the treasury policies approved by the Board.<br />

Objectives/policies<br />

Net debt<br />

Maintain a balance between the continuity, flexibility and cost of<br />

debt funding through the use of borrowings from a range of markets<br />

with a range of maturities, currencies and interest rates, reflecting<br />

the Group’s risk profile.<br />

– Material borrowings are arranged by the central treasury<br />

department and funds raised are lent onward to operating<br />

subsidiaries as required.<br />

Interest rates<br />

Manage the exposure to interest rate fluctuations on borrowings<br />

through varying the proportion of fixed rate debt relative to floating<br />

rate debt with derivative instruments, including interest rate and<br />

cross-currency swaps.<br />

– A minimum of 50% and a maximum of 90% of gross debt is<br />

maintained at fixed interest rates.<br />

Liquidity<br />

Maintain adequate undrawn committed borrowing facilities.<br />

– An undrawn committed Revolving Credit Facility of £2bn<br />

contracted to December 2018 and £1.8bn contracted from<br />

December 2018 to December 2019 is available to meet expected<br />

general corporate funding requirements.<br />

Monitor and control counterparty credit risk and credit limit utilisation.<br />

– The Group adopts a conservative approach to the investment of<br />

its surplus cash. It is deposited with financial institutions with the<br />

strongest credit ratings for short periods.<br />

Currency<br />

Reduce the Group’s exposure to transactional volatility in earnings<br />

and cash flows from movements in foreign currency exchange rates.<br />

– All material firm transactional exposures are hedged.<br />

– The Group does not hedge the translation effect of exchange rate<br />

movements on the income statements or balance sheets of<br />

foreign subsidiaries and equity accounted investments it regards<br />

as long-term investments.<br />

TAX<br />

Objectives<br />

The Group’s tax strategy is to:<br />

– ensure compliance with all applicable tax laws and regulations;<br />

and<br />

– manage the Group’s tax expense in a way that is consistent with<br />

its values and its legal obligations in all relevant jurisdictions.<br />

Policies<br />

The Group seeks to build constructive working relationships with<br />

tax authorities, following a policy of open disclosure in order to<br />

achieve early agreement and certainty in relation to its tax affairs.<br />

Whilst the Group aims to maximise the tax efficiency of its business<br />

transactions, it does not use structures in its tax planning that are<br />

against the spirit of the law and actively considers the implications<br />

of any planning for the Group’s wider corporate reputation. Arm’s<br />

length principles are applied in the pricing of all intra-group<br />

transactions of goods and services in accordance with Organisation<br />

for Economic Co-operation and Development guidelines. Where<br />

appropriate, the Group engages with governments to help shape<br />

proposed legislation and tax policy. The Group endorses the<br />

statement of tax principles issued by the Confederation of British<br />

Industry in May 2013 (www.cbi.org.uk/media/2051390/<br />

statement_of_principles.pdf).<br />

<strong>BAE</strong> Systems operates internationally and is subject to tax in<br />

many different jurisdictions. The Group employs professional tax<br />

managers and takes appropriate advice from reputable<br />

professional firms. The Group is routinely subject to tax audits and<br />

reviews which can take a considerable period of time to conclude.<br />

Provision is made for known issues based on interpretation of<br />

country-specific legislation and the likely outcome of negotiations<br />

or litigation. The assessment and management of tax risks are<br />

regularly reviewed by the Group’s Audit Committee.<br />

P114 Note 6 to the Group accounts<br />

CAPITAL<br />

Objectives<br />

Maintain the Group’s investment grade credit rating and ensure<br />

operating flexibility, whilst: meeting its pension obligations;<br />

pursuing organic investment opportunities; paying dividends in line<br />

with the Group’s policy of long-term sustainable cover of around two<br />

times underlying earnings; making accelerated returns of capital to<br />

shareholders when the balance sheet allows; and investing in<br />

value-enhancing acquisitions, where market conditions are right<br />

and where they deliver on the Group’s strategy.<br />

Policies<br />

The Group funds its operations through a mixture of equity funding<br />

and debt financing, including bank and capital market borrowings.<br />

The capital structure of the Group reflects the judgement of the<br />

directors of an appropriate balance of funding required. Three credit<br />

rating agencies publish credit ratings for the Group:<br />

Agency Rating Outlook Category<br />

Moody’s Investors Service Baa2 Stable Investment grade<br />

Standard & Poor’s Ratings Services BBB+ Stable Investment grade<br />

Fitch Ratings BBB+ Stable Investment grade<br />

P143 Note 23 to the Group accounts<br />

P150 Note 28 to the Group accounts<br />

26<br />

<strong>BAE</strong> Systems<br />

Annual Report <strong>2014</strong>