GAME OF DRONES

The drone revolution has finally entered the American psyche. In fact, in late-December, the Federal Aviation Administration revealed that they have chosen several sites in a number of states to test unmanned drones in order to integrate them into our national airspace. The climate has certainly changed and unmanned aerial vehicles, or drones - will be written by professional journalists, who offer a fresh perspective and an objective eye that will give you a well-rounded look at big topics. Our reporters L.A. Rivera, Amy Armstrong and Monica Link have chronicled a story dubbed, “Year Of The Drones,” which looks into the future of drones in America.

The drone revolution has finally entered the American psyche. In fact, in late-December, the Federal Aviation Administration revealed that they have chosen several sites in a number of states to test unmanned drones in order to integrate them into our national airspace. The climate has certainly changed and unmanned aerial vehicles, or drones - will be written by professional journalists, who offer a fresh perspective and an objective eye that will give you a well-rounded look at big topics. Our reporters L.A. Rivera, Amy Armstrong and Monica Link have chronicled a story dubbed, “Year Of The Drones,” which looks into the future of drones in America.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

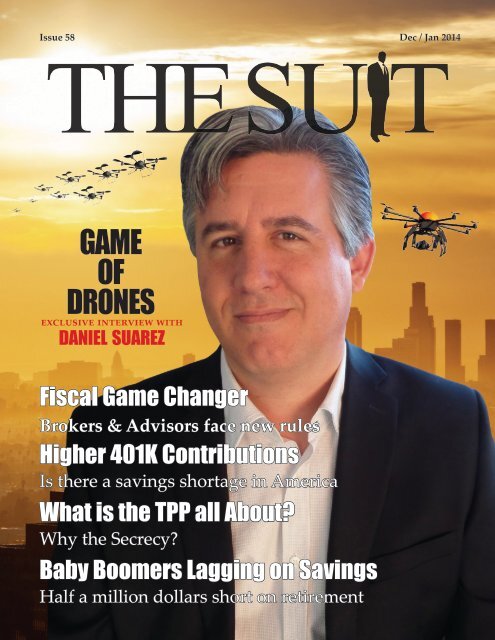

Issue 58 Dec / Jan 2014<br />

<strong>GAME</strong><br />

<strong>OF</strong><br />

<strong>DRONES</strong><br />

exclusive interview with<br />

daniel suarez<br />

Fiscal Game Changer<br />

Brokers & Advisors face new rules<br />

Higher 401K Contributions<br />

Is there a savings shortage in America<br />

What is the TPP all About?<br />

Why the Secrecy?<br />

Baby Boomers Lagging on Savings<br />

Half a million dollars short on retirement

Built for the road ahead.<br />

Designed for living. Engineered to last.<br />

Vertrek Crossover<br />

w/ Ford’s Kinetic Design<br />

Eco-Boost Engine<br />

Hybrid Regenerative Braking<br />

w/ Auto-Stop-Start Technology

publishers note<br />

ISSUE 58 | DEC / JAN 2014<br />

Publisher<br />

Erwin E. Kantor<br />

Managing Editor<br />

Michael Gordon<br />

Editor in Chief<br />

Helen Moss<br />

Editorial<br />

Robert Jordan<br />

Lisa Walker<br />

Sean Goldstein<br />

Staff Writers<br />

L. A. Rivera<br />

Monica Link<br />

Wendy Connick<br />

David Gordon<br />

Diane Alter<br />

A. Marie Velthuizen<br />

Judy Magness<br />

Maria Esposito<br />

Rich Monetti<br />

Edwin Camacho<br />

Peter Hocstein<br />

John Travis Taylor<br />

Amy Armstrong<br />

Rachel Velazquez<br />

Asst. Art Director<br />

Marienne Hilahan<br />

Illustrators<br />

Shafali R. Anand<br />

Mike Moss<br />

Marketing / Advertising<br />

Monica Link<br />

Sean Rome<br />

For subscription details, contact:<br />

info@thesuitonline.org<br />

For advertising inquiries, contact:<br />

advertising@thesuitmagazine.com<br />

A Drone Economy In America<br />

The drone revolution has finally<br />

entered the American psyche.<br />

In fact, in late-December, the<br />

Federal Aviation Administration revealed<br />

that they have chosen several<br />

sites in a number of states to test unmanned<br />

drones in order to integrate<br />

them into our national airspace. The<br />

climate has certainly changed and<br />

unmanned aerial vehicles, or drones<br />

- will be written by professional journalists,<br />

who offer a fresh perspective<br />

and an objective eye that will give<br />

you a well-rounded look at big topics.<br />

Our reporters L.A. Rivera, Amy<br />

Armstrong and Monica Link have<br />

chronicled a story dubbed, “Year Of<br />

The Drones,” which looks into the future<br />

of drones in America.<br />

Diane Alter covers Baby Boomers<br />

and how they’re behind on Savings<br />

for retirement. Apparently, it looks<br />

like the golden years will have to wait<br />

for scores of Americans. According<br />

to a recent survey by TD Ameritrade,<br />

the average baby boomer is roughly<br />

a half million dollars short on retirement<br />

savings. An estimated 74% of<br />

the survey participants said they’d<br />

be heavily dependent on Social Security.<br />

As a result, the IRS announced<br />

high contributions to 401-k Plans.<br />

She also reports on a Uniform Fiduciary<br />

Standard, eventually imposing<br />

tighter restrictions to broker-dealers<br />

and investment advisors, due to the<br />

2008 financial meltdown.<br />

Travis Taylor reports on the<br />

Trans-Pacific Partnership (TPP).<br />

The 12 Trans-Pacific countries —<br />

the United States, Canada, Mexico,<br />

Peru, Chile, Japan, Vietnam, Malaysia,<br />

Singapore, Brunei, Australia and<br />

New Zealand — together account for<br />

about 40 percent of the global economy.<br />

The TPP expansion sought<br />

to increase trade and reduce tariffs<br />

in the Asia-Pacific region. But with<br />

each round of negotiations between<br />

a growing list of countries, concerns<br />

about the true nature of this agreement<br />

continue to grow.<br />

In the mean time, 2014 will be an<br />

exciting year for The Suit Magazine.<br />

We celebrate eight years and we have<br />

a full slate of stories for our readers<br />

and special features for our clients.<br />

It feels good to give back to the community<br />

that has given so much to us.<br />

The coming year will bring exciting<br />

times. I wish all our readers a Happy<br />

New Year as we roll into 2014 with a<br />

fresh economic prospective.<br />

Best,<br />

Erwin Kantor<br />

Erwin Kantor, Publisher

CONTENTS<br />

DEC / JAN 2014<br />

16<br />

Issue 58 Dec / Jan 2014<br />

<strong>GAME</strong><br />

<strong>OF</strong><br />

<strong>DRONES</strong><br />

exclusive interview with<br />

daniel suarez<br />

6<br />

Baby Boomers Behind on Savings<br />

BUSINESS / FINANCE<br />

The Age of Cyber-Warfare<br />

Cyber Security Summit<br />

A Women’s Journey<br />

Unjust Dishonorable Discharge<br />

Stress In The Workplace<br />

Don’t Sweat the Small Stuff<br />

Arctic Seed Vault<br />

Preserving Agricultural Supply<br />

Indeed, according to a recent survey by TD Ameritrade, “Boomers<br />

and Retirement,” the average baby boomer is roughly a half million<br />

dollars short on retirement savings.<br />

FEATURES<br />

7 Higher 401k Contributions<br />

To be sure, there is a savings shortage in<br />

America, despite a bevy of programs aimed<br />

at encouraging stashing money away for retirement.<br />

Fiduciary Standards 8A great debate over fiduciary standards (the<br />

legal duty to act solely in another party’s best<br />

interest) – and their impact on consumers, broker-dealers<br />

and investment advisers –<br />

10 What is the TPP all About?<br />

With sacrifices seemingly outweighing<br />

gains, is the TPP worth the trouble? And<br />

why the secrecy?<br />

13 Lawyers Finding Happiness<br />

Active presence online pays off, thanks to<br />

YouTube, Facebook, Twitter and LinkedIn.<br />

14 2015 year of the Drones<br />

Over the last several years, the inevitability<br />

of unmanned drones soaring overhead in<br />

the U.S. skies has been a controversial subject<br />

for countless military / Gov. experts<br />

20 Monetta Financial Services, Inc.<br />

From Investment Club to Lipper Fund Award<br />

22 Housing Solutions<br />

Breaking Ground in the Affordable Housing Dilemma<br />

23 Abacus Planning Group<br />

Simplicity Matters<br />

30<br />

Ignite payments and First Data<br />

Consumers Drive Credit Card Needs<br />

24<br />

Customizing a Plan<br />

Guiding investors to financial security<br />

25 Divorce Resource Center of Colorado<br />

Divorce does not have to mean Financial Disaster<br />

26<br />

Integrated Financial Group<br />

An “Anti-Wall Street” Approach to Investing<br />

28<br />

de Visscher and Company, LLC<br />

keeping it all in The Family<br />

30 Adams Hall Wealth Advisors<br />

With Your Goals in Mind<br />

31 Hawkes Wealth Management<br />

A Conservative Approach to Asset Management<br />

32<br />

Balaced Asset Strategies, Ltd.<br />

Lending an Ear to Investors establishing a good relations<br />

33 Business Nerds<br />

Analytical nerdiness gets the job done<br />

THE SUIT MAGAZINE - DEC / JAN 2014

34 Group 50<br />

Why companies need a strategic consultant<br />

36 Vion Receivable Investments<br />

A Receivables Expert Interested in Consumer<br />

Protection<br />

38 Metroway Properties<br />

Renting Your Way to Home Ownership<br />

38 Maxele Advisors<br />

Maxele advisors promise undivided loyalty to<br />

their clients<br />

39 Capitol Risk Solutions<br />

Cybercriminals Shake Up Insurance Industry<br />

40 Life Certain Wealth Strategies<br />

Valuing Professional Advice<br />

42<br />

Axiom Capital Group<br />

Helping the Underdog Overachieve<br />

43 Synthesis Advisors<br />

Friendship for Successful Investment Advice<br />

43 Oak Creek Insurance Industry<br />

Looking out for the green industry<br />

44 Fieldstone Financial Management<br />

Offering Financial Advice – Not Products Real Financial<br />

46 Newamerican Funding<br />

No Loose Standards Keeps Lending Tidy<br />

47 dsf Group<br />

Experience Pulls Ahead of Competition<br />

48 Cowan Financial Group, Inc.<br />

Invest Only After a Thorough Examination<br />

49 SS&G Wealth Management<br />

Financial planning with honesty<br />

50 Benford Cost Segregation<br />

Tax Savings Realized, Capturing Benefits of<br />

Detailed Engineering Analysis<br />

52<br />

ShorePoint Capital Partners<br />

Singles and Doubles for Rounding the Financial Diamond<br />

54 Engineered Risk Advisory<br />

When You Think You’ve Thought of Everything<br />

55 Fitzgerald Financial Partners<br />

Without a Financial Plan it’s Just Luck It’s Not What You<br />

Make; It’s What You Keep<br />

55<br />

Freshman & McGlynn<br />

Collaborative Divorce: Leaving Families in Control<br />

56 Provenance Wealth Advisors<br />

Helping People Successfully Plan for the Future<br />

57 Partners in Financial Planning<br />

Conscious of Risk Open to Opportunity<br />

58 Financial Recovery Technologies<br />

Capturing Past Security Losses with Attention to Detail<br />

60 Clarendon Capital Management LLC<br />

Investing for Those Under 50<br />

61 Intrepid Capital Funds<br />

A Lone Wolf Among Sheepish Money Managers<br />

62 Cabot Money Management, Inc.<br />

Emphasis on Emerging Markets<br />

64 Compass Capital Management, LLC<br />

Keeping Clients From Unnecessary Risk<br />

TECHNOLOGY & INNOVATION<br />

Tech Advocate Group<br />

65<br />

Personalized Software Solutions Allowing for Small Companies<br />

to Compete With the Big Wigs<br />

66 NEM Technology<br />

Effective Training Delivery/Cloud Computing IT Business<br />

Whitham Group<br />

67<br />

Renewable Energy, Sustainable Executives<br />

LAW<br />

Collaborative Practice and Mediation Sevc.<br />

68<br />

Walking Couples Through Divorce-o-nomics<br />

69<br />

Grossman & Grossman P.A.<br />

A More Therapeutic Alternative<br />

70<br />

Kaman & Cusimano, LLC<br />

“Communicate, Don’t Litigate” Representing Comm. Ass.<br />

71<br />

Walter Weiss, A Law Corporation<br />

Attorney, Advocate and Bit of a Rebel<br />

72<br />

73<br />

Hall Law Group, PC<br />

Putting the Children First<br />

Emery Law & Mediation, P.A.<br />

Real Estate, Practiced with Conscience<br />

THE SUIT MAGAZINE p.5

y diane e. alter<br />

BABY BOOMERS<br />

BEHIND ON SAVINGS<br />

It looks like the golden years will have to wait for scores of Americans<br />

Indeed, according to a recent survey<br />

by TD Ameritrade, “Boomers<br />

and Retirement,” the average<br />

baby boomer is roughly a half<br />

million dollars short on retirement<br />

savings. Moreover, 74% of survey<br />

participants say they need to rely heavily<br />

on Social Security in their retirement<br />

years. That’s a sobering thought,<br />

especially with talks of Social Security<br />

soon becoming insolvent. And, the average<br />

Social Security check is $1,230 a<br />

month – leaving little, if anything, for<br />

emergency expenses.<br />

Because they need more money,<br />

more and more people are delaying<br />

retirement, continuing to work past 65.<br />

Data from the 2010 Census showed the<br />

share of workers 65 and older in the labor<br />

force rose to 16%, up from 12% two<br />

decades earlier.<br />

The National Foundation for Credit<br />

Counseling (NFCC), which assists<br />

THE SUIT MAGAZINE - DEC / JAN 2014<br />

people who are having trouble paying<br />

their bills, reports one-third of its 3 million<br />

clients nationwide in 2012 were 55<br />

or older, a 7% increase over two years.<br />

Plus, nearly 15% of those were over 65.<br />

An equally dismal picture comes from<br />

American Consumer Credit Counseling,<br />

which reports 25% of its clients are<br />

55 and older. Unquestionably, a growing<br />

number of seniors are headed into<br />

retirement saddled with debt, running<br />

the gamut from mortgages to credit<br />

card debt to student loan obligations.<br />

Just to make ends meet, they have raided<br />

retirement accounts and exhausted<br />

savings. Blame the dot.com boom and<br />

bust, the real estate bubble and the extended<br />

and elevated unemployment<br />

level for these troubling findings:<br />

• A survey by the Employee<br />

Benefit Research Institute found that<br />

most workers polled said they have no<br />

savings or investments<br />

• 37% of those polled in the 2012<br />

Retirement Confidence Survey said<br />

they believe they will have to wait until<br />

after age 65 to retire<br />

• According to an AARP survey,<br />

34% of older Americans use credit<br />

cards to pay for basic living expenses.<br />

Their average credit card debt is<br />

$8,248, and about half have been called<br />

by debt collectors.<br />

“Economists have many explanations<br />

for what determines savings behavior<br />

and what has caused the U.S.<br />

savings rate to decline beginning in the<br />

1980s, but none of these explanations<br />

receives good support from the actual<br />

numbers,” Steven Pressman, Professor<br />

of Economics at Monmouth University<br />

in Long Branch, NJ, told “The Suit.”<br />

“As for the (money) problems faced<br />

by seniors, there are many explanations<br />

here too,” Pressman continued. “But<br />

the explanations here do considerably

etter. In short, pensions have changed. They are now defined<br />

contributions rather than defined benefit plans. The<br />

economy has changed. The largest fraction of middle-class<br />

savings in the U.S. has been in the form of home equity, and<br />

home prices have declined significantly since 2007. And,<br />

Social Security has changed in two important ways. First,<br />

the age to collect full Social Security benefits was gradually<br />

increased from 65, resulting in lower benefits for those who<br />

retire and begin to collect benefits at age 65. Second, people<br />

can now collect Social Security benefits at age 62, although<br />

they get a lower amount if they collect earlier. Many have<br />

elected to do this.”<br />

In sum, Pressman added, “The three pillars supporting<br />

people in old age are shaky and less reliable today than<br />

they were several decades ago.”<br />

There is no easy fix. Some seniors will take on part-time<br />

job, some will alter retirement goals, and many will do<br />

without. Without question, there is going to be an increased<br />

need for more financial planners and consumer organizations.<br />

The big question facing most baby boomers today<br />

isn’t at what age they will retire, but at what income.<br />

I<br />

R<br />

S<br />

Higher Contributions<br />

To 401(k) Plans<br />

To be sure, there is a savings shortage in America,<br />

despite a bevy of programs aimed at encouraging<br />

stashing money away for retirement.<br />

On Oct. 31, 2103, the Internal Revenue Service<br />

announced cost-of-living adjustments affecting<br />

dollar limit contributions for pension plans and other retirement-related<br />

savings vehicles for tax year 2014.<br />

Participants’ 401(k) contribution limit remains at $17,500,<br />

and the catch-up contribution stays at $5,500, but the annual<br />

defined contribution limit from all sources rises to $52,000<br />

from $51,000. Also increasing is the amount of employee<br />

compensation that can be considered in calculating contributions<br />

to defined contribution plans. The new amount rises<br />

to $260,000 from $255,000.<br />

These increases give participants the potential for getting<br />

a little more a “bang” out of the plan – at least if their employers<br />

want to give them more money, retirement planning<br />

firm Van Iwaarden Associates noted in an online commentary.<br />

The primary benefit of the recent changes is that “individuals<br />

who have very large DB benefits (shareholders in<br />

a professional firm’s cash balance plan) could see a deduction<br />

increase if their benefits were previously constrained<br />

by the [Internal Revenue Service Code Section 415] dollar<br />

limit,” Van Iwaarden wrote.<br />

Also left unchanged is the limit on annual contributions<br />

to an individual retirement account (IRA), which remains at<br />

$5,500. The additional catch-up contribution for those over<br />

50 stays at $1,000. For a Roth IRA, the adjusted gross income<br />

(AGI) phase-out range for taxpayers making contributions<br />

rises to $181,000-$191,000 for married couples filing jointly.<br />

That’s up from $178,000-$188,000 in 2013. For singles and<br />

heads of household, the income phase-out range jumps to<br />

$114,000-$129,000, up from $112,000-$127,000.<br />

Contributing enough to a retirement plan is perhaps the<br />

best way to take control of a financial future. Undeniably,<br />

the more money that is put in a retirement account, the<br />

more there is to help investments grow. For employees of<br />

organizations that match retirement plan contributions, not<br />

contributing enough to get the full match is akin to refusing<br />

extra money for the future. One of the greatest advantages<br />

of increasing contributions is that it’s one of the few<br />

elements an individual can control when it comes to retirement<br />

planning.<br />

There are a number of retirement tax breaks, including<br />

contributing to retirement plans. The IRS wants taxpayers<br />

to take advantage of them, yet many fail to do so. One solution,<br />

according to John Friedman, an assistant professor of<br />

public policy at Harvard’s John<br />

F. Kennedy School of Government,<br />

is to implement an automatic<br />

retirement contribution<br />

policy or default plan. Friedman<br />

believes it would be an effective<br />

way to get people to save more.<br />

And, the monetary impact of<br />

such a policy on the government<br />

would be less than it currently<br />

spends on a wide variety of tax<br />

incentives.<br />

THE SUIT MAGAZINE p.7

Uniform Fiduciary Standards Moving Forward<br />

A<br />

great debate over fiduciary standards (the legal<br />

duty to act solely in another party’s best<br />

interest) – and their impact on consumers,<br />

broker-dealers and investment advisers – has<br />

been raging ever since the confidence-shattering<br />

2008 financial meltdown.<br />

In the summer of 2013, the Securities and Exchange Commission<br />

fielded suggestions and comments from industry<br />

professionals regarding the possibility of initiating a uniform<br />

fiduciary standard. Wall Street’s regulatory board<br />

was prompted by numerous studies revealing the fact that<br />

a great many retail investors are confused by the different<br />

roles played by investment advisers and brokers. Additionally,<br />

calls from myriad consumer groups for this type of uniform<br />

standard continue to rise.<br />

Both the SEC and the Financial Markets Association, the<br />

main lobbying group for Wall Street firms, oppose such a<br />

recommendation, citing legal headwinds. Such a move aims<br />

to apply to brokers laws written for investment advisers.<br />

The organizations’ endorsement is for brokers – who give<br />

customers recommendations to buy, sell or hold a security<br />

but don’t provide advice – not to be held to a fiduciary duty.<br />

Brokers would only have to comply with the less stringent<br />

standard of investment suitability. Meanwhile, those who<br />

hold themselves out as investment advisers, “based either<br />

on the titles they use or the manner in which they market<br />

their services” should have a fiduciary duty.<br />

The big push for a uniform standard is mainly coming<br />

from investment advisers, who pride themselves on acting<br />

out of duty and loyalty. They claim that, during the process<br />

of executing orders for customers, brokers can actually wind<br />

up providing advice, and thus should be held to the same<br />

strict standards that they themselves follow. Independent<br />

advisers have long worried that their so-called fiduciary<br />

standards could be diminished or diluted by the actions of<br />

brokers. Brokers fear they won’t be able to sell mutual funds<br />

without falling under tougher standards, even when dealing<br />

with customers who merely want to execute an investment<br />

transaction and are not looking for investment advice.<br />

The primary goal, regardless of the outcome, is to prevent<br />

abusive sales practices.<br />

Just before Thanksgiving, the Investment Advisory Committee,<br />

which is advising the SEC on the regulation of securities<br />

products, unanimously voted to recommend that the<br />

SEC set a uniform fiduciary standard for most brokers and<br />

registered investment advisers for acting in the best interest<br />

of their clients whenever they give financial advice. While<br />

the vote doesn’t mean that the SEC will adopt the IAC’s recommendation,<br />

it is a big step in that direction. With Wall<br />

Street’s reputation sorely sullied from the financial crisis,<br />

the Bernie Madoff Ponzi scheme and the Allen Stanford<br />

scandal, a uniform fiduciary standard would definitely add<br />

some sorely needed improvement to the industry’s image.<br />

THE SUIT MAGAZINE - DEC / JAN 2014

• Handling of Project Cargo<br />

• Handling of General Cargo<br />

• Dry Docking<br />

• Crew Services<br />

• Immigration Consultancy<br />

• Stores & Medical Assistance<br />

• Bunkering<br />

• Commercial Fishing<br />

• Customs Brokerage Services<br />

• Freight Forwarding<br />

• Transport<br />

Lall & Company Ltd<br />

“Quality service never goes out of style”<br />

Providing our customers with the peace of mind that comes with knowing their<br />

clearance and shipping procedures are handled quickly and efficiently<br />

Call today to speak to one of our qualified logistics specialists.<br />

(868) 623 8084<br />

www.lallandcoltd.com

y travis taylor<br />

A summit with leaders of the member states of the Trans-Pacific Strategic Economic Partnership Agreement (TPP). Pictured, from left,<br />

are Naoto Kan (Japan), Nguyễn Minh Triết (Vietnam), Julia Gillard (Australia), Sebastián Piñera (Chile), Lee Hsien Loong (Singapore),<br />

Barack Obama (United States), John Key (New Zealand), Hassanal Bolkiah (Brunei), Alan García (Peru), and Muhyiddin Yassin (Malaysia).<br />

Six of these leaders represent countries that are currently negotiating to join the group.<br />

What is the Trans-Pacific Partnership All About?<br />

With sacrifices seemingly outweighing gains, is the TPP worth the trouble? And why the secrecy?<br />

In 2010, the Trans-Pacific Partnership<br />

(TPP) began to take shape. An<br />

expansion of the 2005 Trans-Pacific<br />

Strategic Economic Partnership<br />

Agreement, or TPSEP, the TPP expansion<br />

sought to increase trade and reduce<br />

tariffs in the Asia-Pacific region.<br />

But with each round of negotiations<br />

between a growing list of countries,<br />

concerns about the true nature of this<br />

agreement continue to grow.<br />

TPSEP was initially a trade agreement<br />

between Brunei, Chile, New<br />

Zealand and Singapore. It sought to<br />

expand the goals first set forth by<br />

APEC, the Asia-Pacific Economic Cooperation,<br />

which were further economic<br />

growth through trade and investment.<br />

For the TPSEP agreement,<br />

the founding countries were looking<br />

to strengthen friendships between the<br />

countries, create and secure markets<br />

for all of their goods and promote<br />

common frameworks within Asia.In<br />

2008, the United States expressed an<br />

interest in joining the negotiations. By<br />

2010, TPSEP had expanded into the<br />

TPP, today encompassing more than<br />

a dozen countries, including the U.S.,<br />

Mexico, Canada, Japan and Vietnam.<br />

Those countries make up 40 percent of<br />

the world’s economy with a total GDP<br />

of $27.5 trillion.Once the basic idea of<br />

the TPP changed, so did its alleged list<br />

of goals – alleged because all of the negotiations<br />

between the participating<br />

countries are held in secret. The Australian<br />

government recently refused to<br />

give their Senate access to the text of<br />

the deal. The official response from the<br />

Australian government was that the<br />

document would only be made public<br />

after it was signed.<br />

In the U.S., President Obama wants<br />

to push the completed deal through<br />

Congress with only an up or down<br />

vote. An up or down vote forces a bill<br />

past committees who would review it,<br />

through potential legislation designed<br />

to delay or stop it and onto a floor vote.<br />

Members of Congress – 130 of them –<br />

asked the White House for more transparency<br />

on TPP but their request was<br />

denied.<br />

The intention of the TPP was to settle<br />

agreements on trade in competition<br />

policies, intellectual property, and<br />

goods and services. So far, special interest<br />

groups, such as those who pushed<br />

for the Stop Online Piracy Act (SOPA)<br />

and the Protect Internet Protocol Act<br />

(PIPA), have been allowed access. Both<br />

SOPA and PIPA sought to give the<br />

federal government the ability to stop<br />

websites with copyright infringement<br />

issues. SOPA was for both foreign and<br />

domestic sites, while PIPA was just<br />

foreign sites. If a site was found to be<br />

in violation, a court could order that<br />

THE SUIT MAGAZINE - DEC / JAN 2014

it be taken down.<br />

The controversy lay<br />

in fact that the court<br />

could rule without<br />

hearing from the site<br />

or its owner, giving<br />

them no chance to<br />

defend themselves.<br />

From leaked TPP<br />

documents, it appears<br />

that the agreement<br />

somewhat<br />

curtails sovereign independence<br />

to institute<br />

more standardized<br />

global rules. To<br />

put it in perspective,<br />

there is the possibility<br />

that these global<br />

rules could violate<br />

parts of the U.S. Constitution<br />

– and the<br />

U.S. would have no<br />

choice but to follow<br />

suit. Also, leaked sections<br />

of the IP chapter<br />

of the agreement<br />

appear to severely<br />

limit freedom of<br />

speech online.<br />

Several copies of<br />

leaked drafts of these secret negotiations<br />

show that two of the biggest focal<br />

points of the meeting have been about<br />

IP and the environment. Even the<br />

World Wildlife Fund has taken steps<br />

to influence the TPP negotiations. The<br />

group held an event in Washington,<br />

D.C. with other environmental groups.<br />

The goal was to showcase their support<br />

of the U.S. in achieving new measures<br />

for environmental protection.<br />

From the website of the Office of the<br />

United States Trade Representative,<br />

Ambassador Michael Froman said,<br />

“Over the past decades, the United<br />

States has been a pioneer in leveraging<br />

comprehensive trade agreements to<br />

promote and enhance environmental<br />

protection on the ground in our partner<br />

countries. The United States views<br />

the TPP as an opportunity to build on<br />

our existing relationships by targeting<br />

some of most pressing regional environmental<br />

challenges, such as conserving<br />

wildlife and forests, and protecting<br />

our oceans and marine resources.”<br />

The overall secrecy of the TPP along<br />

with the potential agreements from<br />

leaked documents has led to myriad<br />

outcries. One of the loudest has come<br />

from Dean Baker, co-director of the<br />

Center for Economic and Policy Research.<br />

On a recent appearance on<br />

Bill Moyers’ TV program, “Moyers<br />

& Company,” Baker said, “This really<br />

is a deal that’s being negotiated<br />

by corporations for corporations, and<br />

any benefit it provides to the bulk of<br />

the population of this country will be<br />

purely incidental.”<br />

According to Baker, concerning different<br />

parts of the treaty – be it Internet,<br />

drugs or the environment – the industries<br />

themselves are invited to the<br />

negotiations. Instead of environmental<br />

groups, oil and gas companies have<br />

added their thoughts as to what these<br />

new regulations should be.<br />

Of the documents leaked, merely<br />

five of the 29 chapters of the agreement<br />

actually address trade issues. What has<br />

been leaked includes allowing drug<br />

companies to raise the prices of drugs<br />

while at the same time lengthening the<br />

life of patents. By lengthening patents,<br />

the time frame is lengthened before<br />

any type of generic drug can appear on<br />

the market – a direct hit on consumers'<br />

pocketbooks.<br />

“If this were really about trade, we’d<br />

be going, ‘How can we bring [drug]<br />

prices down?’” Baker said on “Moyers<br />

& Company.” “But instead, you have<br />

the drug companies there and they’re<br />

not talking about bringing them down.<br />

They’re talking about how to bring<br />

them up.”<br />

With all of this bad news leaking out,<br />

is there anything good about the TPP?<br />

The Asian Developmental Bank has<br />

estimated that a majority of the participating<br />

countries will see an economic<br />

gain. According to the Office of the<br />

United States Trade Representative,<br />

the U.S. is looking to gain $77 billion<br />

per year in generated income. By 2025,<br />

U.S. exports are expected to reach<br />

$123.5 billion.<br />

Globally, world exports are predicted<br />

to generate $305 billion per year by<br />

2025, as well as $223 billion in what has<br />

been called income benefits.<br />

As with any agreement, there is always<br />

a certain amount of give and<br />

take. But the big question is, does the<br />

TPP take away too much?<br />

Currently in negotiations<br />

Announced interest in joining<br />

Potential future members<br />

THE SUIT MAGAZINE p.11

y judy magness<br />

Yes, Virginia, even Lawyers can Find Happiness Online.<br />

Vincent LoTempio, a patent attorney<br />

with the law firm of Kloss,<br />

Stenger and LoTempio based<br />

near Buffalo, New York, received a call<br />

from a gentleman in Alaska interested<br />

in obtaining a patent. LoTempio asked<br />

the caller, “How did you find me?” The<br />

caller laughed and said, “Well, I found<br />

your blog first, then I watched a few of<br />

your videos and a few other things – I<br />

liked you and decided to call.” How<br />

did the phone conversation end? Lo-<br />

Tempio wrote a patent application for<br />

his new client. “Just that one application<br />

paid for a year’s worth of blogging,”<br />

said LoTempio who, in addition<br />

to writing the “LoTempio Law Blog,”<br />

also has a YouTube channel, a Facebook<br />

page and an active presence on Twitter<br />

and LinkedIn.<br />

Since LoTempio is a federally registered<br />

patent attorney, he can work<br />

with clients from anywhere in the U.S.,<br />

which is the reason he includes a tollfree<br />

telephone number on his blog. It<br />

pays off – he receives inquiries from all<br />

over the country. “Without social media,<br />

how would I get calls from almost<br />

every state? My phone isn’t ringing off<br />

the wall, but people are finding me,”<br />

said LoTempio, whose blog is published<br />

by LexBlog, Inc., the premier<br />

blogging network dedicated to the legal<br />

profession. It boasts over 8,000 lawyers<br />

from around the world, including<br />

lawyers from almost half of the 200<br />

largest law firms in the U.S.<br />

Kevin O’Keefe is CEO and publisher<br />

of LexBlog, Inc. He and LoTempio<br />

agree about the power of traditional<br />

word-of-mouth marketing as a valuable<br />

networking tool within the legal<br />

profession. As social media emerged,<br />

however, both saw the potential to<br />

reach people in a way they never could<br />

before.<br />

“Lawyers have always gotten their<br />

best work by virtue of relationships and<br />

their word-of-mouth reputations. The<br />

Internet hasn’t change that, it has accelerated<br />

it!” exclaimed O’Keefe. “Those<br />

lawyers who are wise enough to look at<br />

the computer on their desk and realize<br />

that it is a way to network with everybody<br />

else who has a computer on their<br />

desks or in their pockets, are going to<br />

nurture and build new relationships<br />

and grow their reputations – and grow<br />

their businesses.” He points to Peter<br />

Mahler, a partner with the law firm of<br />

Farrell Fritz who has cultivated a significant<br />

number of new relationships,<br />

and ultimately new clients, through his<br />

blog, “New York Business Divorce” focusing<br />

on business dissolutions in New<br />

York state.<br />

And then there is Staci Riordan, a<br />

partner at Fox Rothschild LLP, who<br />

built a national, if not international,<br />

reputation as a fashion law expert<br />

through her popular “Fashion Law<br />

Blog” in conjunction with a Twitter and<br />

Facebook presence.<br />

O’Keefe’s marketing premise is simple.<br />

He says that you have to go where<br />

the people are and tell them something<br />

useful. “Having influence is invaluable<br />

as a lawyer. If you’re not positioning<br />

yourself as an expert through blogging,<br />

or if you’re not using Twitter or Facebook<br />

– how do you remain relevant<br />

when you’re not going to where the<br />

people are? If you’re not relevant, how<br />

do you build relationships? How do<br />

you get work?” he poses.<br />

Larry Bodine, editor-in-chief of<br />

Lawyers.com, a leading consumer-focused<br />

legal website, reports that law<br />

firms and attorneys are warming up<br />

to social media. In a recent post on his<br />

“LawMarketing Blog” he shared some<br />

statistics from the American Bar Association’s<br />

2013 Technology Survey Report.<br />

There has been a slow but steady<br />

rise in law firms maintaining a social<br />

media presence, from 17% in 2010 to<br />

59% in 2013 and law firms with blogs<br />

rose from 14% to 27%, respectively.<br />

LinkedIn is the clear winner with 98%<br />

of individual attorneys reporting that<br />

they use this professional social media<br />

networking tool. And while celebrities<br />

may use Twitter to post their latest selfie<br />

(a photograph one takes of oneself),<br />

19% of the survey respondents said that<br />

their firms use this dynamic platform, a<br />

6% jump from last year.<br />

On Twitter, O’Keefe positions himself<br />

as an “intelligence agent” for news<br />

in specific areas, and suggests that lawyers<br />

do the same by sharing relevant<br />

information that people find interesting<br />

enough to want to share with other<br />

people. “If you are a trusted source of<br />

news and information on a niche that<br />

relates to what you practice in law,<br />

you are only one inch away from being<br />

hired – or at least one inch from getting<br />

a phone call. So with Twitter, think<br />

about the power of that.”<br />

O’Keefe, whose firm offers turnkey<br />

online marketing services in addition<br />

to providing a blogging platform, predicts<br />

a shift in the mindset of the larger<br />

firms to move towards empowering<br />

and educating partners to build a social<br />

media platform. “Those firms are going<br />

to shine and be the firms that flourish.<br />

They’ll be the firms where people want<br />

to work. They’ll get the lateral hires and<br />

attract young people because they are<br />

empowering the individual.”<br />

LoTempio concluded, “Lawyers are<br />

inherently conservative and loath to try<br />

anything new. But it’s hard to ignore<br />

what everyone else is doing on the Internet<br />

– and it’s not surprising that law<br />

firms want a piece of the social media<br />

pie.”<br />

www.klosslaw.com<br />

THE SUIT MAGAZINE p.13

2015:<br />

Year of the Drones<br />

U.S. Technology Flourishes despite Fears<br />

Reported by L.A. Rivera, Amy Armstrong and Monica Link<br />

Over the last several years, the<br />

inevitability of unmanned<br />

drones soaring overhead<br />

in the U.S. skies has been<br />

a controversial subject for countless<br />

military and governmental experts,<br />

as well as many technology and policy<br />

analysts in this country. In fact, last<br />

February Congress ordered the Federal<br />

Aviation Administration to open up<br />

the skies to drones by September 2015.<br />

But imagine a cluster of metallic<br />

birds hovering everywhere in the U.S.<br />

skies, whizzing across urban cities and<br />

rural areas alike, causing chaos and<br />

alarming the masses. Techno-thriller<br />

writer Daniel Suarez, in his novel “Kill<br />

Decision,” tells the story of a group<br />

of rebels who produce robotic drones<br />

that can recognize enemies and make<br />

the premeditated decision to kill them<br />

without human intervention.<br />

For over two decades, the former IT<br />

consultant said that he designed logistics<br />

systems for major corporations<br />

and the military in the Silicon Valley<br />

and throughout the U.S. Today, Suarez<br />

is close to being a drone expert.<br />

“Drone technology is a technology<br />

whose time has come,” says the former<br />

the tech-head, from his home in California.<br />

“Like most new technologies,<br />

we have to figure out how to incorporate<br />

it into our society without radically<br />

altering society. We have done that<br />

with many things: cell phones, radios,<br />

the Internet and email, and we grappled<br />

with these things.” Suarez continues,<br />

“It’s always complex, but we<br />

still need to adopt these (new) things.<br />

I think corporate systems will be used,<br />

and I think many companies that will<br />

have the most success and receive the<br />

least public resistance will use it internally.<br />

One industry is precision agriculture,<br />

where they will be helping to<br />

maintain crops in very rural places.”<br />

He added, “Where there aren't many<br />

people who will be disturbed by their<br />

presence.”<br />

However, Suarez said that corporate<br />

America has already embraced the<br />

new technology. “I think it will be used<br />

in logistics by many corporations. But I<br />

think internally it will be used in automated<br />

warehouses. Amazon proposed<br />

using drones to deliver packages.” he<br />

explains. “I don’t see that as a realistic<br />

(goal), because I see tremendous complications.<br />

There are liability issues.<br />

For example, a 55-pound drone could<br />

fall on somebody’s head,” he pauses.<br />

“But they will use them in the warehouse<br />

(distribution centers).”<br />

According to Suarez, one problematic<br />

issue surrounding the use of drones<br />

is that the impetus for automated warfare<br />

seems inevitable. “There are a<br />

number of people within the Defense<br />

Department who have a problem with<br />

it,” he added. “Back in November of<br />

last year, the Pentagon said that human<br />

beings must be in the loop when<br />

a lethal decision has to be made with<br />

a drone or with automatic sniper stations.<br />

That’s why I wrote ‘Kill Decision,’<br />

” he remarked.<br />

On the international front, however,<br />

the Middle East continues to be a sorely<br />

troubled spot. In Pakistan, for example,<br />

U.S. assassination drone strikes<br />

THE SUIT MAGAZINE - DEC / JAN 2014

persist to violate international Pakistani<br />

rule, according to Prime Minister<br />

Nawaz Sharif. Pakistan is expected to<br />

present the issue to the United Nation<br />

as a “case of violation of sovereignty.”<br />

Launching a bloodless war by sending<br />

out missions using drones could<br />

inevitably be detrimental to the U.S,<br />

even in the near future, Suarez noted.<br />

“Right now the U.S. has the most<br />

advanced drones,” he said. “ But 70<br />

other nations are developing drones<br />

which can (escalate) cyber-espionage.<br />

That’s because technology has a tendency<br />

of spreading out throughout<br />

modern societies that are data-driven.<br />

Individuals with substantial data trails<br />

can move through society, using cell<br />

phones, telephone records and email.<br />

And it’s these trails that killer drones<br />

would be able to filter, particularly in<br />

autocratic societies. For example, in<br />

dictatorships, they can use these machines<br />

and set them loose (into a society),”<br />

he added.<br />

Suarez said he supports the Campaign<br />

to Stop Killer Robots sponsored<br />

by Human Rights Watch. The organization<br />

calls for a preemptive prohibition<br />

on fully autonomous robotic weapons.<br />

“I think we have to act ahead of time<br />

before these robots are released,” he<br />

said. Some experts predict that these<br />

autonomous weapons could be fully<br />

operational in 20 or 30 years.<br />

Meanwhile, Suarez believes that the<br />

drone revolution is alive and well –<br />

and functioning largely for the good of<br />

mankind.<br />

For example, a “heavy drone-zone”<br />

is flourishing in Alaska. Not only<br />

are they up on the technology, but<br />

the drones have plenty of terrain to<br />

roam. And they’re finding their way<br />

into many aspects of life in Alaska, on<br />

what’s known as “The Last Frontier.”<br />

From mapping shorelines near oil<br />

field exploration to monitoring the<br />

health of sea lion rookeries located on<br />

isolated Aleutian Islands – rocks in the<br />

Gulf of Alaska cropping out of some<br />

of the stormiest water on the planet –<br />

drones play a role in making what is a<br />

big, big place seem just a little bit more<br />

manageable. Alaska comprises 586,000<br />

square miles, dwarfing Texas, the nation’s<br />

second largest state but the most<br />

massive one within the contiguous<br />

states. It’s often joked, in Alaska, that<br />

if Alaska could be cut in half, Texas<br />

would then become the third largest<br />

state – and by a fairly significant margin<br />

at that. Because of its size, rough<br />

terrain, extreme weather conditions<br />

and rural nature, Alaska has always<br />

been an aviation-centric state. A lot of<br />

good pilots notwithstanding, there’s<br />

plenty of territory to cover in Alaska<br />

and drones are taking their place in<br />

making things happen.<br />

At the Geophysical Institute located<br />

at the University of Alaska Fairbanks,<br />

Greg Walker heads up the team comprising<br />

the Alaska Center for Unmanned<br />

Aircraft Systems Integration,<br />

a federal program. Its name has been<br />

associated with mapping glaciers in<br />

Chile, locating ancient burial sites in<br />

Iceland and tracking poachers in South<br />

Africa, by piloting the center’s various<br />

diversified “airplanes” – as Walker<br />

THE SUIT MAGAZINE p.15

likes to call them. Within the United<br />

States, those “airplanes” have helped<br />

track wildfire patterns, searched for<br />

missing hikers, identified the size of<br />

the salmon population on Idaho’s<br />

dam-laden Snake River, monitored<br />

dome activity in what is left of the<br />

Mount St. Helens volcano in southern<br />

Washington and demonstrated search<br />

and rescue mapping capabilities in interior<br />

Alaska at temperatures ranging<br />

from lows of minus 20 to minus 30 degrees<br />

Fahrenheit.<br />

His team has nine different platforms<br />

– the more technical term for unmanned<br />

aircraft of various types and<br />

sizes.<br />

Walker's smallest, weighing in at<br />

3 to 5 pounds, is capable of carrying<br />

a highly-sensitive camera into some<br />

tight spots. One of the most important<br />

of these is the North Slope oil field operations,<br />

where thousands of miles of<br />

intricate pipes contains oil before being<br />

piped more than 800 miles across the<br />

state’s wilderness to the port of Valdez,<br />

where it is shipped to lower 48 refineries.<br />

Even the smallest of leaks is costly,<br />

as British Petroleum painfully learned<br />

in March 2006, when a dime-sized hole<br />

leaking for five days spilled 212,252<br />

gallons of crude oil on 1.9 acres. This<br />

cost BP $66 million between the $20<br />

million fine under the U.S. Clean Water<br />

Act, a $25 million civil penalty to the<br />

state of Alaska and reimbursements to<br />

other oil producers for the time period<br />

the pipeline was shut down.<br />

“A little leak – and it was a little leak<br />

in terms of the size of the hole – can<br />

cause a lot of environmental damage,”<br />

Walker said. In 2006, humans on the<br />

ground checked pipeline integrity.<br />

Today, drones are being tested and<br />

demonstrated for the task.<br />

Other applications include flying<br />

drones at ten feet above sea ice – far<br />

closer than even the most sophisticated<br />

traditional airplane can safely manage<br />

– to track how much solar radiation the<br />

ice is absorbing, as well as measuring<br />

the depth of ice. That second parameter<br />

has major financial implications for<br />

transportation as increases in cross-polar<br />

shipping traveling via the Arctic<br />

Ocean between Asian and European<br />

ports includes icebreakers shepherding<br />

large cargo ships through treacherous<br />

conditions.<br />

If drones can prove successful in<br />

measuring sea ice depth ahead of the<br />

ice breakers, capable of directing them<br />

to areas with thinner ice, the savings<br />

in the cost of fuel alone will make this<br />

northern shipping lane even more viable<br />

and its reach global. Using drones<br />

could also save human lives. Three<br />

Canadian Coast Guardsmen died in<br />

Sept. 2013 from exposure after their<br />

helicopter crashed in McClure Strait<br />

in the Canadian Arctic Ocean while<br />

monitoring ice depth for a Canadian<br />

icebreaker.<br />

For now, Walker’s program is focused<br />

on developing unmanned<br />

aircraft that can perform civilian or<br />

commercial-oriented tasks. It’s challenging,<br />

as each type of terrain; each<br />

weather condition has its own specifications.<br />

“Initially, these aircraft were built<br />

for military surveillance in the desert<br />

in the Middle East,” Walker said.<br />

“Something that was designed to basically<br />

be a glider in the desert isn’t<br />

going to work in other environments<br />

such as we have here in Alaska and<br />

other parts of the world. So we have<br />

to find ways to adapt the technology.”<br />

In fact, the UAF program was<br />

named as one of six national test sites<br />

by the Federal Aviation Administration<br />

on Dec. 30, 2013 as part of the<br />

administration’s effort toward its current<br />

stated goal of allowing commercial<br />

unmanned aircraft in the nation’s<br />

airspace by 2015.<br />

Actually, small and large drones<br />

have been used for years to aid top-secret<br />

military missions, but today small<br />

business owners are also finding new<br />

ways to use drones – small flying<br />

remote-controlled objects that are<br />

equipped with cameras – to shoot aerial<br />

photos and videos.<br />

***<br />

In fact, in the city of Detroit an innovative<br />

entrepreneur is already<br />

making his mark, using his version<br />

of drone technology to aid police and<br />

fire departments in financially cashstrapped<br />

municipalities. Harry Arnold,<br />

founder of Detroit Drone, has<br />

always loved flying radio-controlled<br />

airplanes. As a young boy, it was one<br />

THE SUIT MAGAZINE - DEC / JAN 2014

of his favorite hobbies. Detroit Drone<br />

allows Arnold to combine his love for<br />

flying model airplanes with his love for<br />

photography.<br />

“I've always wanted to get involved<br />

with technology that would help get<br />

cool camera shots,” Arnold said. “I like<br />

working with drones because the shots<br />

are unique. The pictures the drones<br />

take are not the same as a traditional<br />

camera. They are very different.”<br />

Arnold is developing a program that<br />

would allow first responders to deploy<br />

drones to an emergency situation prior<br />

to their arrival. “Firefighters would<br />

be able to see footage and know how<br />

a fire is burning before arriving on the<br />

scene,” Arnold said.<br />

Arnold is a part of a growing trend<br />

among small and large business owners<br />

using drone technology to take aerial<br />

photos from high above building<br />

rooftops. Drone flights last between<br />

four and five minutes and have the ability<br />

to capture high resolution shots to<br />

be used for research and development.<br />

The technology in small drones has<br />

been rapidly growing. Small drones<br />

that use GPS technology to find locations<br />

are currently being developed. In<br />

a recent interview with CBS “60 minutes,”<br />

Jeff Bezos, CEO of Amazon.com,<br />

said that the company is researching<br />

ways to implement drone technology<br />

to fly packages weighing five pounds<br />

or less from its fulfillment centers to<br />

customer homes. The drones Amazon<br />

proposes using would have a flying<br />

range of 10 miles or less, requiring permission<br />

from the FAA.<br />

The U.S. military is also looking at<br />

ways to expand its hefty lead in deploying<br />

drone technology. Some of the<br />

latest developments include electric<br />

and fuel powered versions of drones<br />

that can be used for defense purposes.<br />

While some larger businesses can offer<br />

the use of drone technology, small business<br />

owners or struggling municipalities<br />

can't afford to pay the cost of using<br />

it. Harry Arnold is launching a $20,000<br />

crowd funding campaign in 2014 to<br />

fund more equipment so he can lease<br />

his drones to the city of Detroit and<br />

to small businesses, who wish to use<br />

drones for other research purposes.<br />

“Big companies who provide drone<br />

service can cost up to $100,000.” Arnold<br />

said. “People should support an independent<br />

effort to help first responders.<br />

As an independent business I can make<br />

drones much more affordable. These<br />

drones are something that<br />

can help Detroit since they<br />

are going through financial<br />

problems.” As for the future<br />

of drone technology,<br />

Arnold agrees with Amazon<br />

CEO Bezos.<br />

“In the next five to 10<br />

years, I see the use of drones<br />

expanding.” Arnold said.<br />

“I wouldn't be surprised if<br />

mail will start being delivered<br />

by drones.”<br />

***<br />

Meanwhile, thousands of civilian<br />

drones are expected to<br />

crowd the U.S. skies within a<br />

few years, raising much concern that<br />

they can be used for corporate spying.<br />

“It’s not difficult to create essentially<br />

a flying hacking platform,” Suarez<br />

argues. “I saw one installed in an old<br />

gunnery drone from the 1980s, which<br />

was used in the military. They were<br />

able to put in a 4-5 pound tracking system<br />

and use it to intercept cell phones.<br />

And when the drone was done. It was<br />

able to fly away,” he added: “Basically,<br />

eliminating the evidence.”<br />

Jay Stanley, a Policy Analyst for<br />

the American Civil Liberties Union<br />

(ACLU), said that the stirring controversy<br />

surrounding drones and the issue<br />

of privacy has been hotly debated<br />

amongst lawmakers, policy analysts<br />

and law enforcement officials. “Our<br />

biggest concern is that drones potentially<br />

might be used in mass surveillance<br />

and could track an entire city,”<br />

Stanley explains. “We want to ensure<br />

that we adopt privacy regulations, so<br />

privacy invasions don’t happen.”<br />

Now the drone revolution has landed<br />

squarely in middle America. In a small<br />

rural town in Colorado’s Eastern Plains,<br />

Mayor Frank Fields has declared war<br />

on drones. The town of Deer Trail plans<br />

to pass an ordinance in April 2014 to<br />

begin issuing drone-hunting licenses.<br />

“The ordinance was to prohibit drones<br />

in our airspace and in the town limits,”<br />

Fields said. “It was more of a novelty<br />

to generate a little money for a community<br />

center,” he added. “People in our<br />

town are leery. So it kind of opened up<br />

people's eyes to drones.”<br />

If the mayor of Deer Trail spots a<br />

cluster of drones airborne in the sky<br />

will he shoot to kill? “No, because I<br />

haven’t bought my license yet,” he says<br />

with sly chuckle.<br />

THE SUIT MAGAZINE p.17

Excerpt of “Influx” by Daniel Suarez<br />

Reprinted by arrangement with DUTTON, a member of Penguin Group (USA) LLC, A Penguin Random<br />

House Company. Copyright © Daniel Suarez, 2014.<br />

In addition to his book “Kill Decision,” about drones, Suarez is also the author of “Daemon,” “Freedom,” and<br />

the upcoming tale, “Influx,” which will be released on February 20, 2014.<br />

His new opus chronicles particle physicist Jon Grady and his team. Together, they create a device that can reflect<br />

gravity. Their research will revolutionize the field of physics – the crowning achievement for Grady and<br />

his crackerjack team. Now Grady expects widespread acclaim and perhaps even the Nobel Prize. Instead, his<br />

lab is locked down by a shadowy organization.<br />

Here is a brief excerpt from “Influx”:<br />

The man motioned for his visitor to come forward. “Mr.<br />

Grady, it’s good to finally meet you. I’ve read so much<br />

about your life and work. I feel I know you. Please, sit.<br />

Can we get you anything?”<br />

Jon Grady still stood twenty feet away. “Uh. I’m…I’m<br />

just trying to understand what’s going on.”<br />

The man nodded. “It can be disorienting, I know.”<br />

“Who…who are you again? Why am I here?”<br />

“My name is Graham Hedrick. I’m the director of the<br />

Federal Bureau of Technology Control. I must congratulate<br />

you, Jon – may I call you Jon?”<br />

Grady nodded absently. “Sure. I …hold it. The Federal<br />

Bureau of what now?”<br />

“The Federal Bureau of Technology Control. We’ve been<br />

monitoring your work with great interest. Anti-gravity.<br />

Now that is a tremendous achievement. One might<br />

say a singular achievement. Likely the most important<br />

innovation of modern times. You have every reason to be<br />

proud.”<br />

A male voice spoke just to his right, startling him. “Your<br />

water, Mr. Grady.”<br />

Grady turned to see a humanoid robot standing next to<br />

him – a graceful creature with soft, rubber coated fingers<br />

whose body was clad in a carapace of white plastic. Its<br />

face consisted only of beautiful tourmaline eyes, glowing<br />

softly. Looking at him expectantly.<br />

Grady glanced down to see a glass of water in its hand.<br />

“Uh…” He gingerly accepted the water and held it with<br />

increasing numbness.<br />

Hedrick watched him closely. “You really should sit<br />

down, Jon. You don’t look well.”<br />

Grady nodded and moved toward a chair in front of the<br />

great desk. “What the hell is this place?”<br />

“I told you, Jon. This is the Bureau of Technology Control—the<br />

BTC. We’re the federal agency charged with<br />

monitoring promising technologies, foreign and domestic;<br />

assessing their social, political, environmental, and economic<br />

impacts with the goal of preserving social order.”<br />

“Preserving social order.”<br />

“We regulate innovation. Because, in fact, humanity is<br />

far more technologically advanced than you know. It’s<br />

human nature that remains in the Dark Ages. The BTC is a<br />

safeguard against humanity’s worst impulses.”<br />

Hedrick continued, “Mankind was on the moon in the<br />

1960’s, Jon. That was half a century ago. Nuclear power.<br />

The transistor. The laser. All existed even back then. Do<br />

you really think the pinnacle of innovation since that time<br />

is Facebook? In some ways, what the previous generation<br />

accomplished is more impressive than what we do now.<br />

They designed the Saturn V rocket with slide rules. That<br />

they could make it work at all. So many parts. So many<br />

points of failure. They were the great ones. We’re just<br />

standing on their shoulders.”<br />

Grady turned forward again. “What does any of this have<br />

to do with me? Why am I here?”<br />

THE SUIT MAGAZINE - DEC / JAN 2014

y judy magness<br />

From Investment Club<br />

to Lipper Fund Award<br />

Robert S. Bacarella reminisced<br />

about the investment club he<br />

started in 1979. “We were five<br />

guys in a basement and we each put<br />

in $250,” he said. “We named the club<br />

‘Monetta,’ which is a take-off on the<br />

Latin word for money, ‘moneta.’”<br />

The five club members asked friends<br />

and relatives to invest, too, and before<br />

long there were over 100 people.<br />

“When you have family money, you<br />

have to do well – or you know what<br />

happens,” quipped Bacarella. So the<br />

“fab five” decided to form a limited<br />

partnership that was the basis for<br />

starting a mutual fund. “We started<br />

the process in 1984 and by 1986,<br />

we launched the Monetta Fund. This<br />

eventually led to the establishment<br />

of the Young Investor Fund, and one<br />

other mutual fund we have today.”<br />

The other fund that Bacarella references,<br />

is the Orion/Monetta Intermediate<br />

Bond Fund. Together, along<br />

with the flagship Monetta Fund and<br />

the award-winning Young Investor<br />

Fund, they comprise the Monetta<br />

Family of Mutual Funds managed by<br />

Monetta Financial Services, Inc. Together,<br />

along with the flagship Monetta<br />

Fund and the award-winning<br />

Young Investor Fund, they comprise<br />

the Monetta Family of Mutual Funds<br />

managed by Monetta Financial Services,<br />

Inc.<br />

Monetta’s equity investment strategy<br />

is to identify and invest early on<br />

in growth companies, while following<br />

changing investor sentiment and<br />

market trends. Their fixed-income<br />

strategy seeks high current income<br />

and preserves capital, primarily<br />

through investment quality bonds.<br />

The family of funds offer diversified<br />

investment opportunities, low minimum<br />

investments*, retirement accounts<br />

and investing programs for<br />

children.<br />

“We are money managers – we are<br />

not investment advisors or financial<br />

planners,” said Bacarella, who was<br />

well prepared to lead Monetta Financial<br />

Services as the firm’s chief executive<br />

officer. After college, he worked<br />

in the treasury department of a Fortune<br />

500 company responsible for<br />

investing excess cash, commercial paper<br />

and treasuries. As he moved up<br />

in rank, he oversaw more than one<br />

billion dollars in assets, handled by<br />

several pension fund managers within<br />

the company.<br />

Monetta’s mission is to assist shareholders<br />

in reaching the financial goals<br />

they set for themselves and their families.<br />

They do this by creating a range<br />

of investment products and striving<br />

to generate above-average performance<br />

results by using an active<br />

team-managed investment approach.<br />

The Young Investor Fund, which invests<br />

approximately 50% of its assets<br />

in exchange traded funds (“ETF’s”)<br />

and other funds that track the S&P<br />

500 Index, seeks to control risk relative<br />

to the market through the Index<br />

weightings.<br />

“In all the different approaches<br />

I’ve tried throughout my career, I am<br />

most comfortable with this. I feel I can<br />

control and minimize risk relative to<br />

the market with this innovative passive<br />

and active approach,” Bacarella<br />

said. “I have my kids, grandkids and<br />

other family members in it and I’m<br />

excited about the fund’s long-term<br />

prospects.” And there is good reason<br />

to be excited about it. The Young<br />

Investor Fund was the recipient of<br />

the 2013 Lipper Fund Award for the<br />

best Multi-Cap Core Fund based on<br />

consistent risk-adjusted performance<br />

among 214 funds over a five-year period,<br />

ending November 30, 2012.<br />

Bacarella not only derives professional<br />

satisfaction from being fund<br />

manager of the Young Investor Fund,<br />

but also personal fulfillment, in fact in<br />

2008 his son Robert J. Bacarella joined<br />

the firm. The fund exemplifies his belief<br />

in a family approach to investing<br />

and in the importance of promoting<br />

investment education at a very early<br />

age. “We have a whole program on<br />

financial literacy and education for<br />

children to open their minds to the<br />

concept of investing,” Bacarella said.<br />

“We know that children are technology<br />

savvy, so we connect with them on<br />

our website by providing a page that<br />

features numerous games and activi-<br />

THE SUIT MAGAZINE - DEC / JAN 2014

ties to educate them about money and investing. They also<br />

receive an entertaining quarterly newsletter to fill out. They<br />

learn something – that’s the whole idea.”<br />

“This emphasis on families and kids is important to us,”<br />

said Bacarella. “We reach out to investors and families to<br />

help them understand how money should be managed and<br />

we help people develop the life skills that they will need to<br />

do well over time.” Promoting financial literacy is so important<br />

to Bacarella and his Illinois-based firm, that he authored<br />

a 24-chapter investment workbook that is currently<br />

given to Monetta fund investors and their children, and is<br />

also being used in some Chicago area high schools to teach<br />

students basic investment concepts.<br />

Helping families start early to invest for a child’s college<br />

education is also a part of the Monetta mission. They created<br />

a gift registry for the children of their investors. After<br />

parents enroll their children in the registry, then family<br />

members can contribute to that account for the child’s college<br />

education with a debit or credit card.<br />

Monetta Family of Mutual Funds<br />

1776-A S. Naperville Rd., Suite 100<br />

Wheaton, IL 60189<br />

1-800-MONETTA<br />

Phone: 630.462.9800<br />

www.monetta.com<br />

Monetta Financial Services, Inc. paid to have this article<br />

produced.<br />

* An account may be opened with a minimum deposit<br />

of $100 and a monthly automatic investment<br />

plan deposit of at least $25, or with a $1,000 deposit.<br />

An Automatic Investment Plan does not assure, and<br />

does not protect against, a loss in declining markets.<br />

Such a plan involves continuous investment in securities<br />

regardless of fluctuating price levels and investors<br />

should consider their financial ability to continue<br />

purchases through periods of low price levels.<br />

The fund’s investment objectives, risks,<br />

charges and expenses must be considered<br />

carefully before investing. The summary<br />

and statutory prospectuses contains this<br />

and other important information about<br />

the investment company, and may be obtained<br />

by calling 1-866-964-4683, or visiting<br />

www.younginvestorfund.com. Read it<br />

carefully before investing.<br />

All investments, including mutual funds, have risks<br />

and principal loss is possible. Mid-sized companies<br />

and mid-cap stocks may be more volatile than<br />

large-cap stocks. The Funds may invest in foreign<br />

securities which tend to be more volatile and less<br />

liquid than investments in U.S. securities and may<br />

lose value because of adverse political, social, or<br />

economic developments overseas. In addition, foreign<br />

investments may be subject to regulatory and<br />

accounting standards that differ from those of the<br />

U.S. The Funds may make short-term investments,<br />

without limitation, for defensive purposes, which<br />

investments may provide lower returns than other<br />

types of investments.<br />

The Monetta Young Investor Fund invests approximately<br />

50% of its assets in exchange traded funds<br />

(ETF’s) or other funds that track the S&P 500 Index.<br />

The cost of investing in the shares of ETF’s will generally<br />

be lower than investing in other mutual funds<br />

that track an index, which will be subject to certain<br />

risks which are unique to tracking the Index. However,<br />

if the Fund invests in other mutual funds that<br />

track an index, your cost of investing will generally<br />

be higher.<br />

The S&P 500 Index is a broad based unmanaged index<br />

of 500 stocks, which is widely recognized as representative<br />

of the equity market in general. Since indices<br />

are unmanaged, it is not possible to invest in them.<br />

A Lipper Fund Award is awarded to one fund in each<br />

Lipper classification for achieving the strongest trend<br />

of consistent risk-adjusted performance against its<br />

classification peers over a three, five or ten-year<br />

period. Although Lipper makes reasonable efforts<br />

to ensure the accuracy and reliability of the data<br />

contained herein, the accuracy is not guaranteed by<br />

Lipper. Users acknowledge that they have not relied<br />

upon any warranty, condition, guarantee, or representation<br />

made by Lipper. Any use of the data for<br />

analyzing, managing, or trading financial instruments<br />

is at the user`s own risk. This is not an offer to buy or<br />

sell securities. Lipper Analytical Services, Inc. is an independent<br />

mutual fund research and rating service.<br />

The Lipper Fund Awards are part of the Thomson Reuters<br />

Awards for Excellence, a global family of awards<br />

that celebrate exceptional performance throughout<br />

the professional investment community. The<br />

Thomson Reuters Awards for Excellence recognize<br />

the world’s top funds, fund management firms, sellside<br />

firms, research analysts, and investor relations<br />

teams. The Thomson Reuters Awards for Excellence<br />

also include the Extel Survey Awards, the StarMine<br />

Analyst Awards, and the StarMine Broker Rankings.<br />

For more information, please contact markets.<br />

awards@thomsonreuters.com or visit excellence.<br />

thomsonreuters.com.<br />

Opinions expressed are subject to change, are not<br />

guaranteed and should not be considered recommendations<br />

to buy or sell any security.<br />

Past performance is no guarantee of future results.<br />

Distributed by Quasar Distributors, LLC.<br />

THE SUIT MAGAZINE p.21

y diane e. alter<br />

CREATING SUCCESSFUL COMMUNITIES<br />

Breaking Ground in the Affordable Housing Dilemma<br />

Housing costs vary greatly across the United States,<br />

but a serious lack of affordable housing affects<br />

low-income and low-wage workers in every corner<br />

of the country. According to the National Housing Trust<br />

Fund, in order to close the gap between the swollen demand<br />

for affordable housing and the limited supply, the U.S.<br />

would need to add 4.5 million units affordable to extremely<br />

low income households.<br />

At first blush, that sounds like a daunting task. But, “with<br />

funding and creativity, anything is possible,” Thomas E.<br />

Nutt-Powell, owner of Capital Needs Unlimited, told “The<br />

Suit.”<br />

also directed the Manufactured Housing Research Program<br />

of the Harvard-MIT Joint Center for Urban Studies. In addition,<br />

Nutt-Powell has worked with agencies in some of the<br />

country’s most devastated housing markets including Detroit,<br />

Las Vegas, Pittsburgh, Atlanta, Chicago, Washington,<br />

DC, Boston, Phoenix and East St. Louis.<br />

Nutt-Powell explained, “I like providing practical and<br />

sustainable solutions today for tomorrow’s pressing housing<br />

needs. The key is to get the community to work together<br />

to support quality, healthy neighborhoods with a range of<br />

housing options so that families of all income levels have<br />

an opportunity to thrive. But our job doesn’t stop there.<br />

Based in Brookline, MA, Capital Needs Unlimited is a<br />

consortium of national planning and development experts<br />