One City Built to Last

The news is in: On November 7, 2014, the justices announced they would decide on a lawsuit claiming that the language of the Affordable Care Act doesn’t allow the government to provide tax-credits to low-and-moderate-income health insurance consumers using federally funded Obamacare exchanges operating in more than 30 states. Indeed, there’s a medical quagmire. And there is a lack of communication between doctors, staffing and patients. For example, the Affordable Care Act isn’t just about insurance coverage. The legislation is also about transforming the way health care is provided. In fact, it has brought in new competitors, services and business practices, which are in turn producing substantial industry shifts that affect all players along health care’s value chain. Read Amy Armstrongs story on page 16. On page 21, our reporter Judy Magness, profiles companies all over the country making incredible advances. Take a look at Functional Medicine and the driving breakthroughs in breast cancer while

The news is in: On November 7, 2014, the justices announced they would decide on a lawsuit claiming that the language of the Affordable Care Act doesn’t allow the government to provide tax-credits to low-and-moderate-income health insurance consumers using federally funded Obamacare exchanges operating in more than 30 states. Indeed, there’s a medical quagmire. And there is a lack of communication between doctors, staffing and patients. For example, the Affordable Care Act isn’t just about insurance coverage. The legislation is also about transforming the way health care is provided. In fact, it has brought in new competitors, services and business practices, which are in turn producing substantial industry shifts that affect all players along health care’s value chain. Read Amy Armstrongs story on page 16. On page 21, our reporter Judy Magness, profiles companies all over the country making incredible advances. Take a look at Functional Medicine and the driving breakthroughs in breast cancer while

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

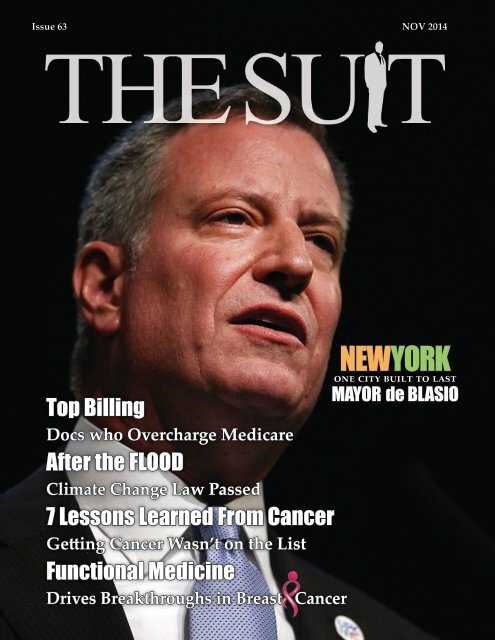

Issue 63 NOV 2014<br />

Top Billing<br />

Docs who Overcharge Medicare<br />

After the FLOOD<br />

Climate Change Law Passed<br />

7 Lessons Learned From Cancer<br />

Getting Cancer Wasn’t on the List<br />

Functional Medicine<br />

Drives Breakthroughs in Breast Cancer<br />

NEWYORK<br />

one city built <strong>to</strong> last<br />

mayor de blasio

<strong>Built</strong> for the road ahead.<br />

Designed for living. Engineered <strong>to</strong> last.<br />

Vertrek Crossover<br />

w/ Ford’s Kinetic Design<br />

Eco-Boost Engine<br />

Hybrid Regenerative Braking<br />

w/ Au<strong>to</strong>-S<strong>to</strong>p-Start Technology

publishers note<br />

ISSUE 63 | NOV 2014<br />

Publisher<br />

Erwin E. Kan<strong>to</strong>r<br />

Managing Edi<strong>to</strong>r<br />

Michael Gordon<br />

Edi<strong>to</strong>r in Chief<br />

Helen Moss<br />

Edi<strong>to</strong>rial<br />

Robert Jordan<br />

Sean Goldstein<br />

Rachel Feinstein<br />

Staff Writers<br />

L. A. Rivera<br />

Matt Camara<br />

David Gordon<br />

A. Marie Velthuizen<br />

Judy Magness<br />

Enid Burns<br />

Felix Badea<br />

Peter Suciu<br />

David Stein<br />

Amy M. Armstrong<br />

Annabelle Pres<strong>to</strong>n<br />

Illustra<strong>to</strong>rs<br />

Paul Kales<br />

Steve Delmonte<br />

Steve Smeltzer<br />

Norman Jung<br />

Marketing / Advertising<br />

Monica Link<br />

Sean Rome<br />

For subscription details, contact:<br />

edi<strong>to</strong>rialdept@thesuitmagazine.com<br />

For advertising inquiries, contact:<br />

advertising@thesuitmagazine.com<br />

No part of The Suit Magazine may be<br />

reproduced or transmitted in any form<br />

of by any means, without prior written<br />

consent of the edi<strong>to</strong>r.<br />

Due <strong>to</strong> the nature of the printing process,<br />

images can be subject <strong>to</strong> a variation of up<br />

<strong>to</strong> 15 per cent, therefore The Suit Magazine<br />

cannot be held responsible for such<br />

variation.<br />

MEDICAL QUAGMIRE?<br />

The news is in: On November<br />

7, 2014, the justices announced<br />

they would decide on a lawsuit<br />

claiming that the language of<br />

the Affordable Care Act doesn’t allow<br />

the government <strong>to</strong> provide tax-credits<br />

<strong>to</strong> low-and-moderate-income health<br />

insurance consumers using federally<br />

funded Obamacare exchanges operating<br />

in more than 30 states.<br />

Indeed, there’s a medical quagmire.<br />

And there is a lack of communication<br />

between doc<strong>to</strong>rs, staffing and patients.<br />

For example, the Affordable Care Act<br />

isn’t just about insurance coverage. The<br />

legislation is also about transforming<br />

the way health care is provided. In fact,<br />

it has brought in new competi<strong>to</strong>rs, services<br />

and business practices, which are<br />

in turn producing substantial industry<br />

shifts that affect all players along health<br />

care’s value chain. Read Amy Armstrongs<br />

s<strong>to</strong>ry on page 16.<br />

On page 21, our reporter Judy Magness,<br />

profiles companies all over the<br />

country making incredible advances.<br />

Take a look at Functional Medicine and<br />

the driving breakthroughs in breast<br />

cancer while looking at conventional<br />

and alternative healthcare approaches.<br />

In addition, we featured Scott Petinga,<br />

Chairman and CEO of The Scott Petinga<br />

Group.<br />

The article looks at the 7 business lessons<br />

learned from Cancer and his views<br />

on the way people commit <strong>to</strong> change,<br />

on page 14.<br />

Outside of Health, we look in<strong>to</strong> the<br />

problems of climate change. How New<br />

York <strong>City</strong> has embarked on an aggressive<br />

plan <strong>to</strong> curb the predicted impacts<br />

of global warming.<br />

In the end, as the clock winds down<br />

on 2014, we look forward <strong>to</strong> another<br />

year shaped with change and innovation<br />

in health and technology. It’s<br />

quite an issue. Take some time <strong>to</strong> read<br />

and learn from great innova<strong>to</strong>rs, entrepreneurs,<br />

and experts from around the<br />

country. And as always we invite you <strong>to</strong><br />

visit our website at www.thesuitmagazine.com<br />

and let us know what you<br />

think.<br />

Best,<br />

Erwin Kan<strong>to</strong>r<br />

Erwin Kan<strong>to</strong>r, Publisher

CONTENTS<br />

NOV 2014<br />

Issue 63 NOV 2014<br />

12<br />

NEWYORK<br />

one city built <strong>to</strong> last<br />

mayor deblasio<br />

Top Billing<br />

Docs who Overcharge Medicare<br />

After the FLOOD<br />

Climate Change Law Passed<br />

7 Lessons Learned From Cancer<br />

Getting Cancer Wasn’t on the List<br />

Functional Medicine<br />

Drives Breakthroughs in Breast Cancer<br />

FEATURES<br />

14<br />

I never set out <strong>to</strong> be a “survivor.” My life’s<br />

aspirations were pretty basic: become successful<br />

professionally, marry my soul mate, have two<br />

beautiful children and perhaps even retire early.<br />

Getting cancer certainly wasn’t on the list.<br />

7 Business Lessons learned from Cancer<br />

16 Physician Shortfall in the ACA<br />

Courts continue <strong>to</strong> hammer out whether the subsidies<br />

promised <strong>to</strong> low-income holders of health<br />

insurance benefits will be honored.<br />

8Top Billing: Meet the Docs who Charge<br />

Medicare Top Dollars for Office Visits<br />

Medicare paid for more than 200 million office visits for established<br />

patients in 2012. Overall, health professionals classified only 4 percent<br />

as complex enough <strong>to</strong> command the most expensive rates.<br />

HEALTH / TECHNOLOGY<br />

26<br />

Specializing for a Productive Business Venture<br />

A die-hard believer in specialization<br />

28<br />

Never Make the Same Mistake Twice<br />

The Affordable Care Act firmly entrenched and grossly over-complicated<br />

30 Seeking <strong>to</strong> Become a <strong>One</strong>-S<strong>to</strong>p Shop<br />

Ohio Medical Equipment Services Firm Launches Innovative<br />

“replacement-parts finance Program”<br />

32 Cyber-Connecting with Health<br />

International health plans a Corporate Family of Insurance<br />

33 Compliance is Key for Health Care Industry<br />

Affects more than just care providers while under PPACA<br />

18 New York’s Green Revolution<br />

New York <strong>City</strong> has embarked on an aggressive plan<br />

<strong>to</strong> curb the predicted impacts of global warming thus<br />

setting an example for other major metro areas <strong>to</strong> follow<br />

in their own respective efforts <strong>to</strong> thwart the threats<br />

caused by warmer ocean temperatures<br />

23 Functional Medicine<br />

Drives Breakthroughs in breast cancer. Just what is<br />

functional medicine? Perhaps it is better explained<br />

by also describing conventional and alternative<br />

healthcare approaches.<br />

16<br />

THE SUIT MAGAZINE - NOV 2014

BUSINESS / FINANCE<br />

34 Technology Services Tailored <strong>to</strong> client needs<br />

Consultants partner forming end-<strong>to</strong>-end solutions providing<br />

Dynamic Strategies<br />

37 Obamacare Fuels Compliance Industry<br />

Implementation of the Affordable Care Act<br />

38<br />

Helping Small Lenders<br />

transformative time for the financial industry’s<br />

lending segment<br />

40 Employee non-Competition Agreements:<br />

Fairness and Enforceability Should be the Benchmark<br />

Legal Target<br />

41 Independent But Connected<br />

An Independent Consultant Who Sees Her NETWORK<br />

as a Key <strong>to</strong> Success.<br />

42<br />

Everyone’s a Potential Client<br />

The limitations on Health Insureance<br />

46<br />

48<br />

Early identification of LD and ADHD<br />

Children’s Diagnostic Learning Tests<br />

49 The Business of Brightness<br />

Without the business of lighting, the world would be<br />

in a dark age<br />

50 Commitment <strong>to</strong> Community<br />

A Passion With a Purpose<br />

51 A straightline path <strong>to</strong> Retirement<br />

STOP the jargon, it’s <strong>to</strong>o confusing<br />

52<br />

Corners<strong>to</strong>nes of Honesty and Loyalty<br />

Putting Information Together in <strong>One</strong> Place<br />

54 Offsetting the Traditional Four % Rule<br />

Butler, Philbrick, Gordillo & Associates Group<br />

57<br />

Providing More than Just Health Insurance<br />

Alaska’s largest Affordable Care Act enroller<br />

Shifting Markets Demand Capability<br />

Taking defensive positions lessons learned from the<br />

2008 meltdown<br />

58 Wealth: It’s More than Just Money<br />

Looking beyond having the wealth needed <strong>to</strong> retire<br />

60 Making a Strong Case<br />

Expert witness views financial disputes<br />

62 Thinking the UNTHINKABLE:<br />

Envisioning the “What Ifs?” in business<br />

63<br />

Beyond Accounting<br />

Financial metrics improves credit-worthines<br />

64 Expert Witness Use on The Rise<br />

A rise in court cases requiring expert testimony is expected<br />

66 Familial Advice at Any Hour<br />

There for the just “in case of” planning for retirement<br />

67<br />

68 A Mission <strong>to</strong> Create Affordable Housing<br />

Putting partial blame on banks for the residential credit crisis<br />

71<br />

The Financial Cacoon<br />

Ensuring irreplaceable capital isn’t lost<br />

Guiding People Through Retirement<br />

Understanding the need <strong>to</strong> prepare for retirement<br />

72<br />

A Balance of Emotion and Economics<br />

Helping clients through financial hardship<br />

74<br />

A Uniform Fiduciary Standard?<br />

It Could Work - If Done Right<br />

THE SUIT MAGAZINE p.5

BUSINESS / FINANCE<br />

76<br />

Paladin a Different Methology<br />

Better than a knight in shining armor<br />

77 Guiding clients is Key<br />

Communication is crucial <strong>to</strong> ensuring client confidentiality<br />

78<br />

80<br />

82<br />

Retirment Looks Different for Everyone<br />

Blanket investment policies are gone<br />

Keeping Clients Poised on the Rollercoaster<br />

Expert Testimony From Registered Nurses<br />

An emerging career field making an impact<br />

84<br />

86<br />

Opportunity in Down Markets<br />

It is said that investing is not for the faint of heart<br />

Independent advice Based on own Experience<br />

Businesses searching for quality and independent advice

THE SUIT MAGAZINE p.7

Top Billing:<br />

Meet the Docs who Charge<br />

Medicare Top Dollar for Office Visits<br />

by charles ornstein and ryann grochowski jones, propublica<br />

Pho<strong>to</strong>: Javier Jaen<br />

Medicare paid for more than 200 million office visits for established patients in<br />

2012. Overall, health professionals classified only 4 percent as complex enough <strong>to</strong><br />

command the most expensive rates. But 1,800 providers billed at the <strong>to</strong>p level at<br />

least 90 percent of the time, a ProPublica analysis found. Experts question whether<br />

the charges are legitimate.<br />

Office visits are the<br />

bread and butter of<br />

many physicians'<br />

practices. Medicare<br />

pays for more than<br />

200 million of them<br />

a year, often <strong>to</strong> deal<br />

with routine problems like colds or high<br />

blood pressure. Most require relatively<br />

modest amounts of a doc<strong>to</strong>r's time or<br />

medical know-how.<br />

Not so for Michigan obstetrician-gynecologist<br />

Obioma Agomuoh. He charged<br />

THE SUIT MAGAZINE - NOV 2014<br />

for the most complex — and expensive<br />

— office visits for virtually every one of<br />

his 201 Medicare patients in 2012, his<br />

billings show. In fact, Medicare paid Agomuoh<br />

for an average of eight such visits<br />

per patient that year, a staggering number<br />

compared with his peers.<br />

Doc<strong>to</strong>rs and other health providers nationwide<br />

charged the <strong>to</strong>p rate in 2012 for<br />

just 4 percent of office visits for patients<br />

they had seen before. But Agomuoh was<br />

one of more than 1,800 health professionals<br />

nationwide who billed Medicare for<br />

the most expensive type of office visits<br />

at least 90 percent of the time that year,<br />

a ProPublica analysis of newly released<br />

Medicare data found.<br />

Dr. John Im, who runs a Florida urgent<br />

care center, charged the program at<br />

that level for all 2,376 visits by his established<br />

patients. Kaveh Farhoomand, an<br />

Oceanside, California, internist facing<br />

disciplinary charges from his state medical<br />

board, collected the highest rate <strong>to</strong> see<br />

almost all of his 301 Medicare patients an<br />

average of seven times each.

By exposing such massive variations in<br />

how doc<strong>to</strong>rs bill the nation's health program<br />

for seniors and the disabled, experts<br />

said, ProPublica's analysis shows Medicare<br />

could—and should—be doing far more <strong>to</strong><br />

use its own data <strong>to</strong> sniff out cost-inflating<br />

errors and fraud.<br />

"I think this is a smoking gun," said Dr.<br />

Robert Berenson, a former senior Medicare<br />

official who is now a fellow at the Urban<br />

Institute, a Washing<strong>to</strong>n, D.C., think tank.<br />

"Who's asleep at the switch here?"<br />

The Centers for Medicare and Medicaid<br />

Services, which runs Medicare, declined an<br />

interview request and said in a statement<br />

that it could not comment on ProPublica's<br />

analysis because it had not seen it.<br />

"CMS is working <strong>to</strong> ensure that physicians<br />

and health care providers appropriately<br />

bill" for office visits, part of a category<br />

known as evaluation and management<br />

(E&M) services, the agency said. "Some<br />

providers have sicker patients, thus are<br />

more likely <strong>to</strong> bill at E&M coding levels<br />

that carry higher payments. Every day we<br />

work with providers <strong>to</strong> make patient care<br />

the priority, and at the same time ensure<br />

they use E&M codes that reflect the level of<br />

service provided."<br />

The agency also said "it would be highly<br />

unusual for a provider <strong>to</strong> knowingly<br />

use the highest E&M billing code for all or<br />

nearly all of his or her outpatient visits."<br />

American Medical Association President<br />

Dr. Ardis Dee Hoven cautioned that billing<br />

data can be misleading without considering<br />

further details about doc<strong>to</strong>rs' practices.<br />

Even those who handle medical billing<br />

professionally sometimes disagree about<br />

the right way <strong>to</strong> classify a visit.<br />

Agomuoh, Im and Farhoomand insist<br />

that they treat older, sicker or more difficult<br />

patients than their peers. Agomuoh<br />

also suggested that the Medicare data contained<br />

errors; the agency stands behind it.<br />

Individually, office visits for established<br />

patients cost taxpayers little, ranging from<br />

an average of $14 for the simplest cases <strong>to</strong><br />

more than $100 for the most extensive. But<br />

collectively, they add up. Medicare shelled<br />

out more than $12 billion for them in 2012.<br />

Agomuoh received $174,000 for the visits<br />

he billed at the <strong>to</strong>p rate alone, tens of thousands<br />

of dollars more than he would have<br />

taken in if his charges were more in line<br />

with his peers'.<br />

In April, Medicare released data showing<br />

2012 payments for outpatient services,<br />

and for the first time specified how much<br />

money went <strong>to</strong> individual health provid-<br />

ers. Since then, most of the attention<br />

has focused on doc<strong>to</strong>rs who made the<br />

most from the program.<br />

Looking at raw numbers, though,<br />

can unfairly flag some doc<strong>to</strong>rs who<br />

have multiple providers billing under<br />

their IDs or who justifiably use expensive<br />

services. It can be more revealing<br />

<strong>to</strong> look at which procedures doc<strong>to</strong>rs are<br />

performing and how frequently, and<br />

how their billings compare with those<br />

of their peers.<br />

Office visits are a case in point. Doc<strong>to</strong>rs<br />

or their staffs determine how <strong>to</strong><br />

bill for a visit based on a variety of fac<strong>to</strong>rs,<br />

including the thoroughness of the<br />

review of a patient's medical his<strong>to</strong>ry,<br />

the comprehensiveness of the physical<br />

exam, and the complexity of medical<br />

decision-making involved. The AMA's<br />

coding system gives them five options.<br />

An uncomplicated visit, typically of<br />

short duration, should be coded a "1"; a<br />

visit that involves more intense examination<br />

and often consumes more time<br />

should be coded a "5." The most common<br />

code for visits is in the middle, a<br />

"3."<br />

ProPublica focused its analysis on the<br />

329,500 physicians and other providers<br />

who charged for at least 100 office visits<br />

for established patients. (Medicare<br />

did not release data on services that a<br />

provider performed on fewer than 11<br />

patients.)<br />

We found that while most providers<br />

had a tiny percentage of level 5 cases,<br />

more than 1,200 billed exclusively at<br />

the highest level. Another 600 did it<br />

more than 90 percent of the time. About<br />

20,000 health professionals billed only<br />

at levels 4 or 5.<br />

The AMA's Hoven warned that the<br />

data could reflect errors or attribute<br />

high-priced visits <strong>to</strong> one doc<strong>to</strong>r when<br />

the services were actually provided by<br />

another. Further, she said, because a<br />

growing number of seniors have multiple<br />

chronic conditions and complex<br />

medical his<strong>to</strong>ries, more level 4 or 5 office<br />

visits may be justified.<br />

But other health industry leaders<br />

called the billing patterns identified by<br />

our analysis troubling.<br />

"I can't see a situation where every<br />

visit would be a level 5, especially on<br />

an established patient," said Cyndee<br />

Wes<strong>to</strong>n, executive direc<strong>to</strong>r of the American<br />

Medical Billing Association, an industry<br />

trade group. "I was trying <strong>to</strong> talk<br />

THE SUIT MAGAZINE p.9

myself in<strong>to</strong> it, but I just can't see it."<br />

She said such providers "would be ripe<br />

for audit," because they are outliers.<br />

Medicare has long known that office<br />

visits are susceptible <strong>to</strong> fraud and what's<br />

known as "upcoding," or billing for a<br />

more expensive service than was actually<br />

performed.<br />

A May 2012 report from the U.S. Department<br />

of Health and Human Services'<br />

inspec<strong>to</strong>r general found that doc<strong>to</strong>rs are<br />

choosing higher codes more often for<br />

evaluation and management services, the<br />

broad category that includes office visits.<br />

The proportion of level 4 visits by established<br />

patients increased by 15 percentage<br />

points from 2001 <strong>to</strong> 2010, while level<br />

3 visits dropped by 8 points.<br />

The HHS inspec<strong>to</strong>r general recommended<br />

that Medicare educate doc<strong>to</strong>rs,<br />

ask its contrac<strong>to</strong>rs <strong>to</strong> review E&M billings,<br />

and conduct detailed reviews of<br />

physicians who consistently bill for higher-level<br />

visits. CMS administra<strong>to</strong>r Marilyn<br />

Tavenner agreed with the first two<br />

recommendations but only committed<br />

the agency <strong>to</strong> reviewing a small number<br />

of the highest billers.<br />

She noted that the return on investment<br />

<strong>to</strong> check billings for visits wasn't<br />

great. The average error cost Medicare<br />

$43, but the program paid $30 <strong>to</strong> $55 <strong>to</strong><br />

review each claim.<br />

Using a sample of Medicare data, nonprofit<br />

investigative group the Center for<br />

Public Integrity found a similar trend in<br />

upcoding office and emergency room<br />

visits across the country in an analysis<br />

it published in September 2012. And a<br />

Medicare report from 2013estimated that<br />

established patient visits had a 7 percent<br />

improper payment rate, accounting for<br />

approximately $965 million in 2012.<br />

"That's real money coming out of the<br />

Treasury," the Urban Institute's Berenson<br />

said. "Some doc<strong>to</strong>rs are robbing the commons<br />

for themselves."<br />

By looking at provider-level data, patients<br />

can evaluate their doc<strong>to</strong>rs' billing<br />

patterns. The providers flagged by Pro-<br />

Publica stand out from others in their<br />

specialties and states. Some were senior<br />

doc<strong>to</strong>rs at prominent teaching hospitals<br />

who may disproportionately care for<br />

complex cases; most were not.<br />

Explore Obioma Agomuoh's provider profile<br />

Agomuoh was one of 790 Michigan<br />

obstetrician-gynecologists who billed<br />

Medicare for established patient visits<br />

in 2012. Together, these doc<strong>to</strong>rs billed<br />

THE SUIT MAGAZINE - NOV 2014<br />

for about 61,000 office visits, of which<br />

7 percent were classified as level 5. By<br />

contrast, 97 percent of Agomuoh's office<br />

visits were at the highest level. His level<br />

5 visits accounted for 35 percent of those<br />

for all ob-gyns in Michigan.<br />

In an interview, Agomuoh said he does<br />

not believe the data is accurate, even<br />

though Medicare says it is. Agomuoh<br />

also said he takes on <strong>to</strong>ugh patients other<br />

providers won't see in the impoverished<br />

community of Hamtramck, Michigan,<br />

outside Detroit.<br />

"Most of these patients have been rejected<br />

by other doc<strong>to</strong>rs," he said. "I'm<br />

probably the only one taking care of<br />

them."<br />

But Agomuoh's Medicare billings were<br />

unusual in other ways, <strong>to</strong>o, ProPublica's<br />

analysis showed.<br />

The program paid for wheezing evaluations<br />

for every one of his patients in<br />

2012, at $50 a pop. On average, each of<br />

his patients was checked for wheezing<br />

eight times. Almost all of his patients<br />

also received an average of seven ultrasounds<br />

of arteries in the legs (at $149 per<br />

test) and seven ultrasounds of arteries in<br />

the arms (at $144 per test). Most of his<br />

peers rarely, if ever, billed for these services.<br />

All <strong>to</strong>ld, Medicare paid Agomuoh<br />

$769,000 in 2012.<br />

Agomuoh has a long his<strong>to</strong>ry of discipline<br />

against his medical licenses and<br />

has been sanctioned for negligence, making<br />

false statements, failing <strong>to</strong> pay child<br />

support and lying about it. He has surrendered<br />

his license in New York, agreed<br />

not <strong>to</strong> renew his license inConnecticut,<br />

withdrawn his application for a license in<br />

Ohio and was once on probation in Michigan.<br />

Agomuoh, who is running for governor<br />

of a state in Nigeria, where he was<br />

born, said his billings reflect that many<br />

of his patients have asthma, chronic obstructive<br />

pulmonary disease and drug<br />

addictions. He initially said a reporter<br />

could visit his office but then changed his<br />

mind a day later, referring further questions<br />

<strong>to</strong> his lawyer, Fred Freeman.<br />

"Why are you bothering him?" Freeman<br />

asked. "You're not being fair <strong>to</strong> him<br />

at all. He has nothing <strong>to</strong> say <strong>to</strong> you."<br />

Medicare declined <strong>to</strong> answer questions<br />

about Agomuoh, or about other<br />

individual practitioners, and there's no<br />

indication that program officials have<br />

challenged his billings. Medicare officials<br />

have said that their data may not take<br />

in<strong>to</strong> account money collected by a provider<br />

and subsequently returned <strong>to</strong> CMS,<br />

or payments that "may have been withheld<br />

after claims were already processed<br />

but prior <strong>to</strong> release <strong>to</strong> the provider."<br />

Medicare did question the billing practices<br />

of Im, the doc<strong>to</strong>r who coded 100 percent<br />

of his visitsas level 5. Im runs Exceptional<br />

Urgent Care in The Villages, a huge<br />

retirement community in central Florida,<br />

and said that because of his training as an<br />

emergency room physician, his center attracts<br />

sicker patients than others do.<br />

He said that after being contacted by<br />

Medicare officials last year, he <strong>to</strong>ok "voluntary<br />

tu<strong>to</strong>ring and counseling" and now

estimates that around 90 percent of his<br />

office visits are level 5.<br />

"Yes it was inaccurate in 2012," he conceded,<br />

blaming his coding problems, in<br />

part, on Medicare's lack of billing categories<br />

tailored <strong>to</strong> urgent care. "Medicare<br />

gave us a call. 2013 is going <strong>to</strong> be a lot<br />

more accurate."<br />

Experts, however, said that it was<br />

implausible that an urgent care doc<strong>to</strong>r<br />

would never see patients with minor ailments.<br />

Other urgent care centers in the<br />

region, including some run by emergency<br />

specialists, have lower proportions<br />

of level 5 visits, ProPublica's analysis<br />

showed.<br />

"Bring in the logic police," said Shelley<br />

C. Safian, who teaches medical billing<br />

and has written textbooks on the <strong>to</strong>pic.<br />

"Even an emergency room in a hospital,<br />

not everybody is a level 5."<br />

Im earned $237,600 from the government<br />

for his level 5 visits in 2012, plus<br />

patient copays. Im is still a Medicare provider<br />

in good standing, according <strong>to</strong> the<br />

program'sPhysician Compare website,<br />

and Medicare declined <strong>to</strong> respond <strong>to</strong><br />

questions about him.<br />

Farhoomand offered a similar explanation<br />

<strong>to</strong> Im's for why his patient visits<br />

were predominantly coded at the <strong>to</strong>p<br />

level. All <strong>to</strong>ld, the San Diego-area internist<br />

billed Medicare for more than 2,100<br />

level 5 visits, one of the highest tallies in<br />

the nation.<br />

"I have a predominantly geriatric population,<br />

and I do mostly chronic critical<br />

illness, so all of my patients have, like,<br />

multi-organ failure, heart failure, diabetes<br />

with multiple complications, etc.<br />

etc.," he said. "I'm savvy enough that I<br />

handle most of their issues myself, and<br />

I use specialists only for procedures and<br />

such things."<br />

Farhoomand is facing a 2013 accusation<br />

by the California medical board of<br />

gross negligence in his prescribing of<br />

controlled substances, a charge he denies.<br />

"No good deed goes unpunished," he<br />

said. "I wind up managing most of their<br />

chronic pain."<br />

He said he is in talks with the board <strong>to</strong><br />

settle the accusation.<br />

Experts say there are plenty of flaws<br />

with the way Medicare reimburses doc<strong>to</strong>rs.<br />

The program pays a premium for<br />

hands-on procedures, such as inserting<br />

a pacemaker, but undervalues the decision-making<br />

at office visits <strong>to</strong> sort out<br />

the cause of a complaint and the proper<br />

treatment, some say.<br />

Dr. Christine Sinsky, a Dubuque,<br />

Iowa, internist has shadowed more<br />

than 50 physician practices <strong>to</strong> assess the<br />

way they are organized and has written<br />

about the <strong>to</strong>pic. She said she worries that<br />

as Medicare imposes more rules and requirements,<br />

the focus is shifting away<br />

from patients' needs and <strong>to</strong>ward checking<br />

boxes on electronic health records.<br />

These systems are designed <strong>to</strong> keep better<br />

track of doc<strong>to</strong>rs' services but have<br />

been linked <strong>to</strong> upcoding.<br />

"Physicians are very afraid of being an<br />

outlier," Sinsky said. "I have a lot of compassion<br />

for physicians who are struggling<br />

with the billing rubric, because it is<br />

sometimes a force pushing us away from<br />

what we know is best for our patients."<br />

Indeed, some health professionals<br />

blamed billing issues on electronic health<br />

systems. Arizona op<strong>to</strong>metrist Serge<br />

Wright was surprised <strong>to</strong> learn that 959 of<br />

his 2012 office visits were coded as level<br />

5 — and that he'd charged the <strong>to</strong>p rate<br />

more than all the other op<strong>to</strong>metrists in<br />

the state put <strong>to</strong>gether.<br />

"Wow, that sounds dis<strong>to</strong>rted," he said.<br />

Wright speculated that the coding<br />

could reflect a switch <strong>to</strong> a new electronic<br />

medical record system a couple of years<br />

ago.<br />

"I don't think I ever used a 99215 [level<br />

5 visit code]" until then, he said, noting<br />

that the new system is supposed <strong>to</strong> check<br />

whether enough documentation has<br />

been entered <strong>to</strong> justify each charge. "In<br />

the past, without the electronic records,<br />

it <strong>to</strong>ok more time <strong>to</strong> keep track of all of<br />

the elements of an exam <strong>to</strong> code it. I think<br />

everyone was undercoding at that point,<br />

myself included."<br />

THE SUIT MAGAZINE p.13

7<br />

Business Lessons<br />

Learned from Cancer<br />

By Scott Petinga<br />

I<br />

never set out <strong>to</strong> be a “survivor.”<br />

My life's aspirations were pretty<br />

basic: become successful professionally,<br />

marry my soul mate,<br />

have two beautiful children and perhaps<br />

even retire early. Getting cancer<br />

certainly wasn’t on the list. But there<br />

I was, lying on the operating table the<br />

day of my surgery, shivering - not<br />

knowing how much longer I actually<br />

had <strong>to</strong> live and hoping that, when I<br />

opened my eyes, I would awaken from<br />

the nightmare. It didn’t happen. Cancer<br />

was a cold, hard reality that has<br />

certainly changed me. I look different,<br />

feel different and act different. Besides<br />

indelibly altering my outlook on life,<br />

cancer taught me hard-learned lessons<br />

on how <strong>to</strong> conduct business and realize<br />

success in a more significant and<br />

gratifying way.<br />

Here are 7 business lessons I learned<br />

from cancer that can help others in<br />

their own professional endeavors:<br />

1. Fight for what you believe in.<br />

I have a tat<strong>to</strong>o on my left forearm that<br />

says, in Chinese, “<strong>to</strong> turn defeat in<strong>to</strong><br />

vic<strong>to</strong>ry.” That is how important the<br />

concept is <strong>to</strong> me. If you don’t take a<br />

stand for those issues that really matter<br />

<strong>to</strong> you, someone else is going <strong>to</strong><br />

make the decision for you. Regardless<br />

of how extremely difficult a business<br />

or workplace challenge might appear<br />

in the moment, it's only temporary. It<br />

is human nature <strong>to</strong> question our own<br />

ability, especially when we are facing<br />

a challenge that is taxing, difficult,<br />

new or involves opposition or criticism<br />

from others. When you have a<br />

viable position that bucks the status<br />

quo, don’t be afraid <strong>to</strong> take a stand in<br />

line with your vision and values. And,<br />

be prepared. Base your position on<br />

facts, figures and well-researched information<br />

rather than trying <strong>to</strong> make<br />

emotional appeals. Anticipate objections<br />

and backlash and be prepared <strong>to</strong><br />

counter with an even stronger argument.<br />

Be as transparent as possible so<br />

that there is no seemingly clandestine<br />

agenda or bias <strong>to</strong> be exposed later on.<br />

And, most importantly, hold steadfast<br />

<strong>to</strong> your standards and ideals all along<br />

the way.<br />

2. If you don’t love what you do,<br />

quit doing it. Love what you do, and<br />

be surrounded by people who share<br />

your passion. No matter your age,<br />

education, or tenure in the business<br />

world, NOW is the time <strong>to</strong> focus on<br />

what you're passionate about. Don't<br />

wait for conditions <strong>to</strong> be perfect or for<br />

your life <strong>to</strong> be threatened. Don’t just go<br />

through the motions half-ass. Find the<br />

gasoline that lights your fire. Quench<br />

your thirst for learning and investigate<br />

outside of your comfort zone. Empower<br />

yourself <strong>to</strong> make decisions and take<br />

actions, and uncover the value in your<br />

effort even when you fail. Then try<br />

again.<br />

3. Make life better for those<br />

around you. I now understand that the<br />

quality and happiness of life directly<br />

impacts quality of work. Ask yourself<br />

‘what can I do <strong>to</strong> help’—whether in<br />

relation <strong>to</strong> a colleague, an employee,<br />

a boss, a business partner. And, don’t’<br />

expect anything in return. A spirit<br />

of altruism is the best way <strong>to</strong> proffer<br />

help without any level of expectation,<br />

so there will be no disappointments in<br />

kind. If you’re an employer, discern<br />

how you can go over and above <strong>to</strong> help<br />

an employee apparently struggling<br />

with a personal issue, which could include<br />

paying for their health insurance<br />

premium for a period and giving them<br />

paid time off <strong>to</strong> deal with a difficult life<br />

situation. If you’re an employee, offer<br />

<strong>to</strong> grab coffee or lunch for your boss<br />

or a colleague “on your dime.” S<strong>to</strong>ck<br />

the employee break room with pastries<br />

“just because.” Call a business partner<br />

THE SUIT MAGAZINE - NOV 2014

or prospect just <strong>to</strong> say “hi” and don’t<br />

talk any business. Even more simply,<br />

greet people with positivity. Encourage<br />

them. Compliment them. Lend<br />

them a helping hand. Notice their<br />

progress, cheer them on and make<br />

them smile. The more happiness and<br />

success you help others find, the more<br />

fulfillment you will realize every single<br />

day of your life. If it makes the<br />

world a better place, even for a fleeting<br />

moment, you have succeeded.<br />

4. Do your own thing and do it<br />

your way. The concept of going your<br />

own way and doing your own thing<br />

is not new. The problem is, most<br />

people don’t do it because it bucks<br />

tradition and goes against the grain,<br />

and frankly, it scares the s#%! out of<br />

most people. But on the other hand,<br />

it can provide you with a hell of a lot<br />

of freedom, and provide you a lifelong<br />

exemption from blindly or reluctantly<br />

following pro<strong>to</strong>col. Mavericks<br />

live according <strong>to</strong> their own agenda<br />

and goals and, even in the corporate<br />

world, there is more latitude <strong>to</strong> blaze<br />

new trails in business than you might<br />

think. The key is <strong>to</strong> look at each task<br />

be consumed with remorse for what<br />

“could have been.” Now is the time <strong>to</strong><br />

capitalize on opportunities that present.<br />

Make it so.<br />

6. Live life like a two year old. In<br />

other words, fall down often, screw up<br />

for the opportunities they present.<br />

Sure, there may be a “perfectly fine”<br />

or traditional way of doing something<br />

<strong>to</strong> achieve a good result. But, when<br />

you have a better approach or process<br />

in mind that can achieve an even<br />

more desirable result, it may just be<br />

time <strong>to</strong> go rogue. In <strong>to</strong>day’s cut-throat<br />

culture, originality is perhaps your<br />

greatest gift. Use it.<br />

5. Risk it right now. At this very<br />

moment you have everything you<br />

need. Sound impossible? It happens<br />

<strong>to</strong> be true, you just may not appreciate<br />

it. Do you have food, clothing and<br />

shelter? Then you have everything<br />

you need and, once you live by this<br />

simple philosophy, taking risks becomes<br />

far easier. The most important<br />

part of this notion is that most business<br />

opportunities don’t wait around,<br />

so take action now. Don’t make the<br />

mistake of waiting on someone or<br />

something <strong>to</strong> come along <strong>to</strong> make<br />

taking that leap of faith more viable.<br />

“Perfect timing” is a fallacy—there<br />

are few if any such moments in life.<br />

Don’t wait so long that you can’t take<br />

a risk even when you want <strong>to</strong>, only <strong>to</strong><br />

repeatedly and occasionally be defiant.<br />

Children are extremely resilient and,<br />

as adults, we lose this enviable quality.<br />

Throughout our career we proverbially<br />

fall down, get bruised and even<br />

skin our knees. We might even literally<br />

shed a few tears. But, perseverance and<br />

tenacity, honed with hindsight-based<br />

perspective so as <strong>to</strong> not repeat the same<br />

mistakes, are key <strong>to</strong> staying the course up<br />

the ladder of achievement.<br />

7. Forecast regrets <strong>to</strong> reorganize.<br />

When someone is on their death bed,<br />

they never say “I wish I had worked<br />

more”. They regret not spending more<br />

time on the things that matter the most.<br />

That said, not all regrets would be related<br />

<strong>to</strong> your personal life. If, hypothetically,<br />

you had two less working hours every<br />

day, what would you cut out? You’d cut<br />

out the least important tasks and focus<br />

more energy on the endeavors you are<br />

confident would impact the bot<strong>to</strong>m line<br />

or your career trajec<strong>to</strong>ry the most. Don’t<br />

wait for a major adverse event or unforeseen<br />

time crunch <strong>to</strong> reorganize your<br />

work life. Project your thoughts in<strong>to</strong> a<br />

problematic “what if” scenario <strong>to</strong> prioritize,<br />

downsize, re-allocate, offset, delegate<br />

and downright omit whatever you<br />

can <strong>to</strong> expedite your climb up the ladder<br />

of success.<br />

They say cancer has a way of changing<br />

people. This is true, but there’s no need<br />

for an threatening medical diagnosis <strong>to</strong><br />

be the catalyst for needed change. An<br />

emotional “reboot” can pay dividends at<br />

any time and in anyone’s life, <strong>to</strong> most certainly<br />

include business matters. The key<br />

is <strong>to</strong> tap in<strong>to</strong>, and harness, a mindset of<br />

emotional vulnerability for a new-found<br />

perspective that can help you recalibrate<br />

and generally fine tune your approach <strong>to</strong><br />

achievement so that you can not only get<br />

there faster—but in a more meaningful<br />

and fulfilling way. As far as I am concerned,<br />

that is the true measure of success.<br />

Scott Petinga is Chairman and CEO of The Scott<br />

Petinga Group. He is a pioneer in developing businesses<br />

with lasting impact in the fields of communications,<br />

sustainable real estate, business acceleration<br />

and philanthropy. Through his flagship company<br />

AKQURACY—a full-service, data-fueled communications<br />

agency – he earned a spot on the prestigious<br />

2012 Inc. magazine list of fastest-growing private<br />

companies. He may be reached online at www.<br />

ScottPetinga.com<br />

THE SUIT MAGAZINE p.15

y amy m. armstrong<br />

Physician Shortfall<br />

in the<br />

Affordable Care Act<br />

A Problem of Supply and Demand<br />

As courts continue <strong>to</strong> hammer<br />

out whether the subsidies<br />

promised <strong>to</strong> low-income<br />

holders of health<br />

insurance benefits via the Affordable<br />

Care Act are legal and will be honored,<br />

the looming question of just how all of<br />

these new medical stakeholders will<br />

be serviced has yet <strong>to</strong> be answered.<br />

America is one year in<strong>to</strong> these<br />

ground-breaking changes in health<br />

care, with a second round of enrollments<br />

kicking off Nov. 15, 2014 and<br />

scheduled <strong>to</strong> last three months. This<br />

first year’s enrollment and successful<br />

payment of premiums by approximately<br />

7.3 million Americans was announced<br />

in August. It was significantly<br />

lower than the 12 million enrollees/<br />

payees that the Obama Administration<br />

hoped for a year ago. Yet, based<br />

on the roll-out glitches with online<br />

health care exchanges, administration<br />

officials characterized August’s<br />

announcement as a positive step forward.<br />

As of now, the American medical<br />

system has 7.3 million more people<br />

eligible for basic health services.<br />

If they have not found one already,<br />

they are currently seeking primary<br />

THE SUIT MAGAZINE - NOV 2014<br />

health care providers. This means that<br />

7.3 million more cases of the flu, the<br />

common cold, high blood pressure or<br />

things more complicated such as cancer,<br />

heart conditions and stroke may<br />

be coming through the doors of clinics<br />

and hospitals.<br />

All are eligible for basic services.<br />

But are there enough providers <strong>to</strong> go<br />

around? And will the shortfall even<br />

create additional cases for the legal<br />

system as the newly insurance-entitled<br />

add litigation <strong>to</strong> the experience<br />

when their medical expectations have<br />

not been met?<br />

Just ask the leaders in the medical<br />

and legal industries, and they will vehemently<br />

tell you there is a big problem<br />

looming on the horizon.<br />

“With the implementation of the<br />

ACA, the biggest challenge is that,<br />

while in principal we are providing<br />

greater access <strong>to</strong> all Americans,<br />

the number of health care providers<br />

qualified <strong>to</strong> provide this care is disproportionate<br />

<strong>to</strong> the number of people<br />

eligible,” said Suzanne Arragg, a<br />

certified legal nurse consultant and<br />

owner of SEA & Associates in Ventura,<br />

California. Her firm evaluates the<br />

merit of medical cases from the perspective<br />

of the nursing staff, who interact<br />

with patients significantly more<br />

often than doc<strong>to</strong>rs. “To make matters<br />

even worse,” she said, “The number of<br />

qualified providers is also disproportionate<br />

<strong>to</strong> the reimbursement offered<br />

under ACA for the care and services<br />

provider.”<br />

Arragg forecasts a landslide of legal<br />

actions as patients get fed up with lack<br />

of access or with the treatment errors<br />

that are bound <strong>to</strong> occur in an overwhelmed<br />

system.<br />

She is not alone.<br />

<strong>Last</strong> fall, the Association of American<br />

Medical Colleges warned that the<br />

nation’s inven<strong>to</strong>ry of qualified doc<strong>to</strong>rs<br />

had dropped nearly 20,000 from the<br />

previous year. More than half of the<br />

doc<strong>to</strong>rs still practicing are older than<br />

50 and headed <strong>to</strong>ward retirement, according<br />

<strong>to</strong> the AAMC. Looking ahead,<br />

the AAMC indicated a shortfall of<br />

45,000 primary care doc<strong>to</strong>rs by 2020<br />

unless a major increase in enrollment,<br />

graduation and successful completion<br />

of internships occurs. That was<br />

a conservative estimate – and did not<br />

include an expected deficit of 46,000<br />

medical professionals who handle<br />

specialties.

Arragg also sees the nation’s already<br />

crowded emergency rooms being<br />

forced <strong>to</strong> take up the slack, as patients<br />

unable <strong>to</strong> get care from a primary physician<br />

resort <strong>to</strong> a place where they cannot<br />

be turned away.<br />

Devon M. Herrick, a senior fellow at<br />

the National Center for Policy Analysis<br />

in Dallas also forecasts that trend, especially<br />

for Medicare patients. According<br />

<strong>to</strong> the Obama Administration, more<br />

than six million new enrollees opted<br />

for Medicare and the Children’s Health<br />

Insurance Program – neither of which<br />

are tied in<strong>to</strong> the ACA health care exchanges<br />

– during the same time period<br />

that Obamacare had its first enrollment<br />

phase. The trouble is, the government<br />

isn’t quite sure yet about that six million<br />

number. The Center for Disease<br />

Control and the Census Bureau both<br />

released varying numbers in August.<br />

While the numbers differ, the effect<br />

remains the same. Because Obamacare<br />

lowers the dollar amount physicians<br />

are reimbursed for Medicare patients,<br />

it is quite likely that Medicare patients<br />

who do have a primary care physician<br />

may have trouble getting an appointment,<br />

especially if the practice limits<br />

the number of patients that can be seen<br />

within the economic demographic. Or,<br />

worse yet, doc<strong>to</strong>rs within the community<br />

will simply s<strong>to</strong>p accepting Medicare.<br />

“With limited resources, more<br />

Medicare patients will turn <strong>to</strong> the<br />

emergency room,” Herrick said.<br />

He sees yet another access issue<br />

looming. Doc<strong>to</strong>rs, noting the laws of<br />

supply and demand, may opt <strong>to</strong> not<br />

only limit the type of insurance they<br />

accept, but may also begin charging<br />

patients a retainer fee <strong>to</strong> remain in their<br />

practice.<br />

“There aren’t enough doc<strong>to</strong>rs <strong>to</strong> treat<br />

all the new enrollees,” he said. “The<br />

ones most likely <strong>to</strong> suffer are those<br />

whose insurers pay the lowest reimbursements.”<br />

The government itself admits a possible<br />

supply and demand problem exists.<br />

Its own statistics from the Health Resources<br />

and Services Administration<br />

– the federal agency whose mission is<br />

<strong>to</strong> improve access <strong>to</strong> health care – indicate<br />

that 20 percent of Americans<br />

currently live in geographic areas with<br />

an insufficient number of primary care<br />

doc<strong>to</strong>rs. This is determined via federal<br />

guidelines dictating that each primary<br />

care doc<strong>to</strong>r should have no more than<br />

3,500 patients. Federal guidelines for<br />

dental and mental health professionals<br />

are even larger: a 5,000 patient limit for<br />

dentists and no more than 30,000 patients<br />

for mental health providers.<br />

According <strong>to</strong> the same agency, in addition<br />

<strong>to</strong> those who living in areas with<br />

an insufficient number of primary care<br />

doc<strong>to</strong>rs, sixteen percent live in areas<br />

with <strong>to</strong>o few dentists and a whopping<br />

30 percent are in areas that are short of<br />

mental health providers.<br />

How this plays out, remains <strong>to</strong> be<br />

seen.<br />

THE SUIT MAGAZINE p.17

y amy m. armstrong<br />

NEWYORK’S<br />

GREEN REVOLUTION<br />

New York <strong>City</strong> has embarked on an<br />

aggressive plan <strong>to</strong> curb the predicted<br />

impacts of global warming thus setting<br />

an example for other major metro<br />

areas <strong>to</strong> follow in their own respective<br />

efforts <strong>to</strong> thwart the threats caused by<br />

warmer ocean temperatures, melting<br />

glaciers, rising coastal waters and<br />

greater inclement, dramatic changes<br />

in weather patterns.<br />

THE SUIT MAGAZINE - NOV 2014

As of Sept. 2014, NYC is now the<br />

world’s largest city making a public<br />

commitment <strong>to</strong> lower its greenhouse<br />

gas emissions by 80 percent<br />

over 2005 levels by 2050. It is a<br />

benchmark environmentalists say<br />

could make a significant difference<br />

in the plight of the planet. It is also<br />

a benchmark analyst of industries<br />

supporting green construction and<br />

sustainable retrofitting consider<br />

possible if the powers that be put<br />

their money where their respective<br />

carbon footprint would be otherwise.<br />

“Climate change is an existential<br />

threat <strong>to</strong> New Yorkers and our<br />

planet. Acting now is nothing short<br />

of a moral imperative,” NYC Mayor<br />

Bill de Blasio said as he unveiled<br />

the program’s lofty goals on Sept.<br />

21 during Climate Week NYC as the<br />

United Nations held its annual climate<br />

summit at its NYC headquarters.<br />

“New York <strong>City</strong> must continue<br />

<strong>to</strong> set the pace and provide the bold<br />

leadership that’s needed – and becoming<br />

the world’s largest city <strong>to</strong><br />

commit <strong>to</strong> an 80 percent reduction<br />

in emissions by 2050 is central <strong>to</strong><br />

that commitment. By retrofitting all<br />

of our public buildings with significant<br />

energy use in the next ten years,<br />

we’re leading by example; and by<br />

partnering with the private sec<strong>to</strong>r,<br />

we’ll reduce emissions and improve<br />

efficiency while generating billions<br />

in savings and creating thousands<br />

of jobs for New Yorkers who need it<br />

most.”<br />

It’s dubbed “<strong>One</strong> <strong>City</strong> <strong>Built</strong> <strong>to</strong><br />

<strong>Last</strong>” and even though it is de Blasio<br />

functioning as the talking head and<br />

most recently making the appearances<br />

at the installation of solar panels<br />

at the Kennedy Campus housing<br />

seven borough high schools – officially<br />

, where the carbon reduction<br />

is slated <strong>to</strong> hit the city’s emissions<br />

rates, it is NYC First Deputy Mayor<br />

Anthony E. Shorris, who is in charge.<br />

He is the city’s second-in -command<br />

and in charge of the day-<strong>to</strong>-day operation<br />

of city government and the<br />

provision of core services across the<br />

five boroughs. Yet, this new environmentally-conscious<br />

and possibly<br />

economically beneficial – at least<br />

for the providers of the goods and<br />

services required <strong>to</strong> make it reality –<br />

program may possibly be what puts<br />

the final feather in his decades-long<br />

career as a municipal servant.<br />

As protes<strong>to</strong>rs from every imaginable<br />

environmentally-oriented<br />

cause not only lined, but flooded<br />

NYC streets for the People’s Climate<br />

March, deBlasio joined in with<br />

them promoting “<strong>One</strong> <strong>City</strong>” as the<br />

answer <strong>to</strong> the Big Apple’s problems<br />

and perhaps a blueprint for other<br />

cities <strong>to</strong> adopt.<br />

According <strong>to</strong> this year’s annual<br />

Greenhouse Gas Inven<strong>to</strong>ry conducted<br />

by city officials, nearly<br />

three-quarters of NYC greenhouse<br />

gas emissions result from the current<br />

energy demand <strong>to</strong> heat, cool<br />

and power buildings. It is a segment<br />

of the city’s environmental problems<br />

that deBlasio says can be fixed<br />

by first retrofitting more than 3,000<br />

public-owned buildings with energy-efficient<br />

upgrades in the HVAC<br />

system and installing solar energy<br />

systems at more than 300 public<br />

buildings. <strong>One</strong> <strong>City</strong> calls for retrofitting<br />

<strong>to</strong> be completed by 2025.<br />

<strong>City</strong> officials estimate the retrofit<br />

project <strong>to</strong> result in a $1.4 billion<br />

energy cost saving by 2025 with the<br />

potential of the city experiencing a<br />

savings of $8.5 billion by 2050 – the<br />

<strong>One</strong> <strong>City</strong> target date for the 80 percent<br />

reduction in greenhouse gases.<br />

More importantly <strong>to</strong> the pocket<br />

books of New Yorkers, the retrofitting<br />

of privately-owned buildings<br />

through an expanded partnership<br />

THE SUIT MAGAZINE p.19

etween the U.S. Department of<br />

Housing and Urban Development<br />

and the NYC Housing Authority providing<br />

building owners with financial<br />

incentives for retrofit ought <strong>to</strong> result<br />

in lower utility bills, deBlasio said.<br />

“High energy costs take a disproportionate<br />

<strong>to</strong>ll on lower-income residents<br />

who typically live in less-efficient<br />

buildings and must pay a higher<br />

share of their income for energy,” de-<br />

Blasio said. “The <strong>City</strong>’s plan aims <strong>to</strong><br />

protect New Yorkers from rising utility<br />

bills while reducing emissions and<br />

poor air quality.”<br />

Private building owners not retrofitting<br />

will eventually find themselves<br />

and their buildings in conflict with<br />

NYC city officials as retrofit mandates<br />

and non-compliance penalties kick in<br />

during <strong>One</strong> <strong>City</strong>’s later years.<br />

Environmentalists are expecting results<br />

– and with good reason.<br />

<strong>One</strong> <strong>City</strong> is based on the NYC Clean<br />

Heat program that since 2011 has<br />

helped the city’s then nearly 10,000<br />

buildings still burning heavy oil for<br />

heating purposes <strong>to</strong> convert <strong>to</strong> cleaner<br />

fuels thus dropping sulfur dioxide<br />

particulate levels in the air by 69 percent<br />

since its 2008 measuring, according<br />

<strong>to</strong> the NYC Clean Heat website.<br />

“America’s #1 city will show the way<br />

<strong>to</strong> the big cuts in climate pollution we<br />

need,” said Fred Krupp, President of<br />

Environmental Defense Fund. “I congratulate<br />

Mayor de Blasio for his leadership<br />

– especially the Mayor’s plan<br />

<strong>to</strong> upgrade buildings so they waste<br />

far less energy – and his plan for cutting<br />

costs for families and businesses,<br />

cleaning the air, and delivering jobs.”<br />

Key components of the “<strong>One</strong> <strong>City</strong> <strong>Built</strong> <strong>to</strong> <strong>Last</strong>” include:<br />

•Requiring owners of all buildings more than 25,000 sq. ft. <strong>to</strong> measure and disclose energy use annually, conduct<br />

energy assessments, and upgrade lighting. This replaces the previous city mandate limiting the energy disclosure<br />

requirements <strong>to</strong> owners of buildings more than 50,000 sq. ft. in size.<br />

•Energy upgrades in 450 schools over the next five years – including 325 comprehensive lighting upgrades and 125<br />

boiler replacements <strong>to</strong> improve energy efficiency and improve indoor air quality.<br />

•Create a green grant program for affordable housing that will fund efficiency upgrades in exchange for regula<strong>to</strong>ry<br />

agreements <strong>to</strong> preserve affordability. Deploy with local partners in neighborhoods – particularly the poorest<br />

neighborhoods where utility bills take a higher percentage of resident income – and where preservation and rehab<br />

of affordable housing is needed and where energy efficiency can reduce the load on the electric grid.<br />

<strong>City</strong> officials estimate <strong>One</strong> <strong>City</strong> <strong>to</strong><br />

create at least 3,500 new jobs in construction<br />

and require training programs<br />

for the more than 7,775 building<br />

staff that will learn new operating<br />

skills. The new construction, retrofit<br />

work and energy improvements are<br />

expected <strong>to</strong> pump at least $750 million<br />

in related spending per year in <strong>to</strong> the<br />

NYC economy.<br />

Perhaps one of the most beneficial effects<br />

of <strong>One</strong> <strong>City</strong> is its indirect support<br />

of emerging entrepreneurs and the financial<br />

reason for office space owners<br />

<strong>to</strong> expand their offerings thus giving<br />

the real estate market a boost. As with<br />

all things new, <strong>One</strong> <strong>City</strong> is bound <strong>to</strong><br />

attract movers and shakers in the clean<br />

energy space. For some companies,<br />

the hook has already set. <strong>One</strong> example<br />

is the Urban Future Lab opening<br />

its down<strong>to</strong>wn Brooklyn 10,000 square<br />

foot space in March of this year. The<br />

firm is already running out of room<br />

and seeking more space <strong>to</strong> continue<br />

its research in clean technology as well<br />

as providing exhibit space <strong>to</strong> educate<br />

consumers. Clean technology innova<strong>to</strong>rs<br />

tend <strong>to</strong> require larger work spaces<br />

than other businesses. <strong>One</strong> <strong>City</strong> plans<br />

<strong>to</strong> address this need in a partnership<br />

with the NYC Economic Development<br />

Corporation <strong>to</strong> build a 75,000 square<br />

foot “step-out space” facility providing<br />

temporary office space until<br />

firms can secure more permanent<br />

larger offices.<br />

As <strong>One</strong> <strong>City</strong> begins its work, deBlasio<br />

sees opportunity and potential<br />

and not the challenges and limits often<br />

associated with environmental<br />

challenges.<br />

“Realizing this vision will not be<br />

easy. The change will come building<br />

by building, block by block, and<br />

neighborhood by neighborhood,”<br />

deBlasio said. “It will require new<br />

technologies and innovative thinking.<br />

But New Yorkers are the world’s most<br />

skilled architects, engineers, real estate<br />

developers, academics, construction<br />

workers and building opera<strong>to</strong>rs. The<br />

solutions we develop <strong>to</strong>gether will<br />

change our city, and they can change<br />

cities across the world.”<br />

Learn more about <strong>One</strong> <strong>City</strong> <strong>Built</strong> <strong>to</strong><br />

<strong>Last</strong> online at www.nyc.gov/html/<br />

built<strong>to</strong>last/assets/downloads/pdf/<br />

<strong>One</strong><strong>City</strong>.pdf.

n<br />

HORMONE<br />

AVERTi HEALTHY BREAST PROGRAM<br />

OPTIMIZATION<br />

NUTRITION &<br />

DIGESTION<br />

OPTIMIZATION<br />

LYMPHATIC NUTRITION &&<br />

VASCULAR<br />

DIGESTION<br />

CIRCULATION<br />

OPTIMIZATION<br />

INTERVENTION<br />

PERSONALIZED CLINICAL<br />

ASSESS & MEASURE<br />

RISK<br />

ENVIRONMENTAL<br />

NUTRITION &<br />

TOXIN EXPOSURE<br />

DIGESTION<br />

& RESPONSE<br />

PERSONALIZED OPTIMIZATION CLINICAL<br />

INTERVENTION<br />

AVERTi HEALTHY BREAST PROGRAM<br />

OPTIMIZATION<br />

HORMONE<br />

RESILIENCE<br />

RE-MEASURE RISK<br />

& PROGRESS<br />

STRESS<br />

PERSONALIZED CLINICAL<br />

INTERVENTION<br />

OPTIMIZATION<br />

RE-MEASURE RISK<br />

& PROGRESS<br />

DIGESTION<br />

NUTRITION &<br />

ASSESS & MEASURE<br />

RISK<br />

RESILIENCE<br />

Fig. 1. AVERTI Healthy Breast Program (AHBP) ©2012 AVERTi, Inc.<br />

INTERVENTION ENVIRONMENTAL<br />

LYMPHATIC &<br />

TOXIN EXPOSURE<br />

VASCULAR<br />

& RESPONSE<br />

RE-MEASURE CIRCULATION RISK<br />

AVERTi HEALTHY BREAST<br />

AVERTi HEALTHY BREAST PROGRAM<br />

PERSONALIZED CLINICAL<br />

INTERVENTION<br />

STRESS<br />

ENVIRONMENTAL<br />

ASSESS & MEASURE<br />

RISK<br />

AVERTi HEALTHY BREAST PROGRAM<br />

& RESPONSE<br />

ASSESS & MEASURE<br />

RISK<br />

TOXIN EXPOSURE<br />

PTIMIZATION<br />

DIGESTION<br />

NUTRITION &<br />

& PROGRESS<br />

RE-MEASURE RISK<br />

ENVIRONMENTAL<br />

TOXIN EXPOSURE<br />

& RESPONSE<br />

VERTi HEALTHY BREAST PROGRAM<br />

VERTi HEALTHY BREAST PROGRAM<br />

ITION &<br />

ESTION<br />

IMIZATION<br />

RITION &<br />

GESTION<br />

TIMIZATION<br />

NUTRITION &<br />

DIGESTION<br />

LYMPHATIC &<br />

VASCULAR<br />

CIRCULATION<br />

LYMPHATIC &<br />

ENVIRONMENTAL<br />

LYMPHATIC &<br />

ENVIRONMENTAL<br />

VASCULAR<br />

TOXIN EXPOSURE<br />

VASCULAR<br />

TOXIN EXPOSURE<br />

CIRCULATION<br />

CIRCULATION<br />

& RESPONSE<br />

& RESPONSE<br />

ASSESS & MEASURE<br />

RISK<br />

& RESPONSE<br />

TOXIN EXPOSURE<br />

PERSONALIZED ASSESS & MEASURE CLINICAL<br />

ENVIRONMENTAL<br />

OPTIMIZATION<br />

Fig. 1. AVERTI Healthy Breast Program (AHBP) ©2012 AVERTi, Inc.<br />

ENVIRONMENTAL<br />

TOXIN EXPOSURE<br />

& RESPONSE<br />

ASSESS & MEASURE<br />

RISK<br />

PERSONALIZED CLINICAL<br />

INTERVENTION<br />

RE-MEASURE RISK<br />

RE-MEASURE RISK<br />

& ASSESS PROGRESS & MEASURE<br />

& PROGRESS<br />

RISK<br />

AVERTi HEALTHY BREAST PROGRAM<br />

NUTRITION HORMONE &<br />

INTERVENTION<br />

RISK<br />

PERSONALIZED RE-MEASURE CLINICAL RISK<br />

INTERVENTION<br />

& PROGRESS<br />

RE-MEASURE RISK<br />

& PROGRESS<br />

Fig. 1. AVERTi Healthy Breast Program (AHBP) ©2012 AVERTi, Inc.<br />

Fig. 1. AVERTI Healthy Breast Program (AHBP) ©2012 AVERTi, Inc.<br />

Fig. 1. AVERTI Healthy Breast Program (AHBP) ©2012 AVERTi, Inc.<br />

PERSONALIZED CLINICAL<br />

OPTIMIZATION<br />

& PROGRESS<br />

HORMONE<br />

ISK<br />

HORMONE<br />

ENVIRONMENTAL<br />

OPTIMIZATION<br />

TOXIN EXPOSURE<br />

& RESPONSE<br />

HORMONE<br />

ASSESS & MEASURE<br />

RISK<br />

PERSONALIZED CLINICAL<br />

INTERVENTION<br />

RE-MEASURE RISK<br />

& PROGRESS<br />

TION<br />

D CLINICAL<br />

ESS & MEASURE<br />

RISK<br />

AVERTi HEALTHY BREAST PROGRAM<br />

HORMONE<br />

OPTIMIZATION<br />

HORMONE<br />

OPTIMIZATION<br />

DIGESTION<br />

NUTRITION &<br />

OPTIMIZATION<br />

STRESS<br />

RESILIENCE<br />

CIRCULATION<br />

VASCULAR<br />

LYMPHATIC &<br />

RESILIENCE<br />

STRESS<br />

HORMONE<br />

OPTIMIZATION<br />

STRESS<br />

RESILIENCE<br />

STRESS<br />

& RESPONSE<br />

ERTI Hea<br />

IN EXPOSURE<br />

AVERTi<br />

OPTIMIZATION<br />

DIGESTION<br />

OPTIMIZATION<br />

HEALTHY BREAST PROGRAM<br />

RESILIENCE<br />

AV<br />

RISK<br />

TION<br />

D CLINICAL<br />

SS & MEASURE<br />

RISK<br />

& RESPONSE<br />

TOXIN EXPOSURE<br />

ENVIRONMENTAL<br />

MENTAL<br />

NUTRITION STRESS LYMPHATIC & HORMONE &<br />

DIGESTION<br />

RESILIENCE VASCULAR<br />

OPTIMIZATI<br />

OPTIMIZATION CIRCULATION<br />

Fig. 1. AVERTI Healthy Breast Program<br />

S<br />

GRAM<br />

LYMPHATIC &<br />

VASCULAR<br />

LYMPHATIC STRESS &<br />

VASCULAR<br />

RESILIENCE

y judy scinta magness<br />

reported by<br />

amy m. armstrong<br />

Functional Medicine Drives<br />

Breakthroughs in Breast Cancer<br />

Just what is functional medicine?<br />

Perhaps it is better explained by also<br />

describing conventional and alternative<br />

healthcare approaches.<br />

“Conventional or<br />

traditional medicine<br />

is what is taught in<br />

medical schools. It is<br />

as an authoritative<br />

approach <strong>to</strong> managing<br />

symp<strong>to</strong>ms primarily with<br />

the use of scientifically<br />

proven assessment<br />

<strong>to</strong>ols, medications, and<br />

surgeries.” explains<br />

Sandra Muran, PhD,<br />

a digestive health and<br />

nutrition specialist.<br />

Along with her husband,<br />

Peter Muran, MD, they<br />

operate AVERTi Inc.,<br />

and Longevity Healthcare<br />

based in California.<br />

Both are also functional<br />

medicine practitioners.

Alternative medicine emerged as<br />

consumers looked for new, less invasive<br />

ways <strong>to</strong> manage their health,<br />

and for options that would help<br />

them recover instead of just treating symp<strong>to</strong>ms.<br />

“But not all alternative medicine has<br />

a scientific basis. That’s where functional medicine fits in <strong>to</strong><br />

meeting both worlds,” said Muran.<br />

“Functional medicine integrates the newest scientific biomedical<br />

discoveries <strong>to</strong> focus on resolving the underlying causes<br />

of individual health needs,” said Muran. “It engages the patient<br />

and practitioner in designing a personally tailored health<br />

management program. It uses pharmaceutical science, changes<br />

in an individual’s environment, diet, and lifestyle <strong>to</strong> support<br />

their full genetic potential for vitality and longevity.” She<br />

emphasized that individuals are empowered <strong>to</strong> manage their<br />

own health and points <strong>to</strong> Functional Medicine Co- Founder,<br />

Jeffery S. Bland, PhD and popular television medical guru, Dr.<br />

Mehmet Oz as using a functional approach <strong>to</strong> medicine.<br />

In the creation of AVERTi, an anagram for Advanced Verified<br />

Early Risk Technology, doc<strong>to</strong>rs Sandra and Peter Muran<br />

applied the Functional Medicine approach <strong>to</strong> the prevention<br />

of breast cancer. AVERTi is a comprehensive breast health<br />

program using a proven estrogen metabolite labora<strong>to</strong>ry test <strong>to</strong><br />

measure a women’s early risk for breast cancer before disease<br />

ever occurs. For those shown <strong>to</strong> be at risk, the AVERTi Breast<br />

Health Program engages women in a personalized clinical<br />

and life style intervention <strong>to</strong> measurably reduce her risk. A<br />

breakthrough, in not only letting women know if they are at<br />

risk; but the AVERTi approach providing a way <strong>to</strong> confidently<br />

reduce the risk by measuring the reduction.<br />

National statistics report that one out of every eight women<br />

will encounter breast cancer in her lifetime. The Murans were<br />

motivated by their female patients who were not satisfied in<br />

waiting around <strong>to</strong> see if they would become that “one.” They<br />

wanted <strong>to</strong> help women proactively reduce their risk.<br />

About four years ago, the husband and wife team uncovered15-year-old,<br />

well-documented research conducted by El-<br />

THE SUIT MAGAZINE - NOV 2014

eanor Rogan, PhD and Ercole Cavalieri, D. Sc, collecting dust<br />

at the University of Nebraska. These researchers had invented<br />

an estrogen metabolite labora<strong>to</strong>ry test <strong>to</strong> measure a woman’s<br />

risk for breast cancer which had only been available for<br />

research endeavors. This labora<strong>to</strong>ry measures the metabolites<br />

of estrogen that represent estrogen which has “gone down an<br />

inflamma<strong>to</strong>ry pathway” becoming the precursor <strong>to</strong> damaging<br />

a woman’s DNA in a way that can result in breast cancer.<br />