You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

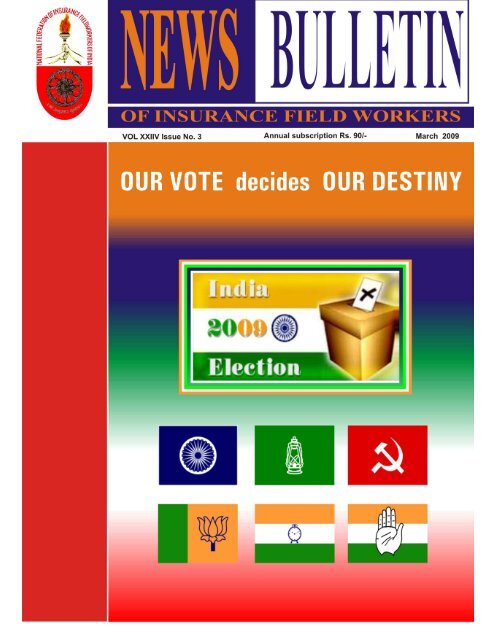

NEWS BULLETIN<br />

OF INSURANCE FIELD WORKERS<br />

Vol XXIV Book No 3 March 2009<br />

Chief Editor<br />

R. Jayprakash<br />

Associate Editors<br />

K. Venkatesh<br />

S. Sreekumar<br />

Editors<br />

J. Baburajan<br />

M. B. Vinod<br />

Editorial Board<br />

A. Gopakumar<br />

Shaji T Thelly<br />

P. K. Ajayakumar<br />

Hari T. Pillai<br />

Please send your<br />

suggestions, articles<br />

and contribution to<br />

CONTENTS<br />

Page No<br />

1. EDITORIAL 2<br />

2. VIEW POINT 4<br />

All India President<br />

3. PERSPECTIVE 5<br />

Secretary General’s Desk<br />

4. OPINION - Capitalism, Socialism and Crisis 12<br />

Prabhat Patnaik<br />

5. MEDIA WATCH 16<br />

The Editor<br />

News Bulletin<br />

Kalvit Bhavan<br />

Capital Heights<br />

Plamoodu, Pattom<br />

Trivandrum - 4<br />

or<br />

mail at<br />

editornf@gmail.com<br />

The views &<br />

opinion expressed<br />

in the articles need<br />

not necessarily be<br />

that of <strong>NFIFWI</strong>

News Bulletin March 2009<br />

EDITORIAL<br />

OUR VOTE decides OUR DESTINY<br />

The nation goes to poll in 5 phases from 5 th April to 13 th April to elect the 15 th Lok<br />

Sabha. The results will be declared on 16 th April. This is the world’s largest democratic<br />

exercise in action. It is also a tribute to the unwavering spirit and loyalty of the ordinary<br />

Indian citizen in democracy.<br />

This is perhaps the only time when the common man is made to feel like masters in<br />

this country. It is also a time when we get a chance to assert ourselves. An occasion to look<br />

back and analyse how we were governed. A rare moment to asses the policies and decisions<br />

that affected us. The political scenario in the country is fragmented and pasted along<br />

many weird lines that can be subjected to many interpretations. One point where we all<br />

invariably agree without dispute is the need to strengthen the public sector in insurance<br />

industry and protect LIC. The present economic scenario in India and the global economic<br />

crisis highlights this need much more than ever before. Nations world over are taking the<br />

path of nationalization and providing Govt. guarantee.<br />

Unfortunately, in India the Govt. seems to learn nothing from this crisis. They showed<br />

scant respect for democracy and disregarded all parliamentary ethics by introducing The<br />

Insurance Amendment Act and LIC Amendment Act in the fag end of the parliamentary<br />

session. The main provisions of the bills providing for 49% increase in FDI of Foreign<br />

Insurance Companies, to remove the Sovereign guarantee by Govt.of India to LIC policies<br />

and reduce the bonus payment to the policy holders by 5%.<br />

This will only lead to de nationalization and expose the public money to speculative<br />

business by multinational companies. This is at a time when even President Obama<br />

expressed outrage at the greed and recklessness of the US insurance giant AIG. Here, in<br />

India, a red carpet is rolled out to them shamelessly. When the entire world is reeling<br />

under the economic crisis, it was heartening to note the statements made by Madam Sonia<br />

Gandhi and Prime Minister that India is lucky to have strong public sector presence which<br />

really props up the country and such PSUs should be protected and strengthened rather<br />

than destroyed. But, soon, true to their colours, they proved that politicians seldom practice<br />

what they preach, by bringing the Insurance and LIC amendment Acts.<br />

Thanks to the sustained opposition of the Left parties, the bills were send to the<br />

standing committee for Finance. But the position is that, even if the standing committee<br />

disagrees with the bills and returns it, the Govt. can overrule that decision.<br />

So, it becomes very important who is in the Govt. or who influences it. It is not the<br />

politics that we are concerned about. National Federation is a non-political organization<br />

and will always continue to be so. But that does not deter us from taking a political stand<br />

for protecting the Dev. Officer class and LIC. It is clearly a non-political agenda which is<br />

to focus ONLY AND ENTIRELY on :<br />

1. strengthening the public sector in Insurance Industry<br />

4

News Bulletin March 2009<br />

2. save and protect LIC in the public sector<br />

3. protect the dignity and welfare of the Development Officer Class<br />

This must be our prime concern and paramount interest. All other considerations<br />

are immaterial. Let there be a strong campaign for that. We can create awareness among<br />

our Agents, our policyholders, all family members, other employees and everyone we<br />

know. Speak convincingly and from heart. Mobilise all support that for this justified<br />

cause.<br />

We are very emphatic that this support is not for any political party or political<br />

ideology. Our politics is only the politics of existence and survival. We can hope to change<br />

the policy decisions at the top only through this. The management’s anti-DO attitude will<br />

also get a fitting reply. The management’s ill-directed decisions can also be reversed by<br />

this. Our members should take a clear stand cutting across party lines to save and protect<br />

L.I.C of India and the industry as a whole.<br />

Wherever possible, we should meet the candidates or members of political parties<br />

explain to them the importance of this issue and request them to take a strong political<br />

stand on this. The election manifesto should clearly state with clarity the intentions and<br />

promises. The Left parties have included in their manifesto the reversal of increase in<br />

FDI in insurance and strengthening the public sector. Our aim is that all parties should<br />

acknowledge and take an open stand on this. There is a minority in the main political<br />

parties who also agree to our stand. Our endeavour is to strengthen their hands. This<br />

must become the overwhelming opinion across the political spectrum.<br />

They may agree with us or disagree with us, but they will never be able to ignore<br />

us. If our vote in this election will decide our destiny, then let us resolve to exercise our<br />

vote with caution and discretion because this organization is so dear to us.<br />

“only if this is there, every thing else is there,<br />

if this is not there, nothing else is there”<br />

ORGANISATIONAL ROUND-UP<br />

Biennial General Body meeting of Visakhapatnam Division was held at Visakhapatnam<br />

on 25.1.2009. Zonal President, Com. M. Vinay Babu, Zonal Secretary, Com. G. Nagesh, Zonal<br />

Joint Secretary, Com. PV. Krishna Reddy and President and General Secretary of Rajahmundry<br />

Division, Com. Murali Krishna and Com. A. Suresh and nearly 200 members from the 3 districts<br />

of the division attended the meeting. The following members were elected as office bearers<br />

for the term 2009 – 11:<br />

President : Com. B. Rama Rao, (Yellamanchili Branch)<br />

General Secretary : Com. T. Chandra Sekhar, (Shipyard Branch.)<br />

5

News Bulletin March 2009<br />

Dear comrades ,<br />

After suspension of agitation in may 2008,<br />

organization is waiting for concrete results from<br />

management on our issues of incentive formula,<br />

Work Rule, CLIA, and other pending issues. Hope<br />

management will become serious on ongoing<br />

situation of LICI. Organization has observed that<br />

the members at grass root level are unhappy and<br />

are showing their concern in a different and matured<br />

way . Therefore in 52 yrs of Corporation’s history,<br />

Life Insurance Corporation is showing huge minus,<br />

continuously from the beginning of this financial<br />

year. At the time of giving black proposal to<br />

federation on 12th Aug 04 the management had<br />

claimed that there will be 35% natural growth in<br />

business where Development Officer has no role<br />

to play. That market share will go up to 95% due<br />

to GOIB scheme and that due to gradation there<br />

will be huge net addition of agency.<br />

NF has always maintained its stand that<br />

these assumptions cannot be true. Unfortunately<br />

our resentment from 2004 has fallen on deaf ears<br />

and management is solely responsible for the<br />

disturbed condition of LIC of India today. Actually<br />

the global meltdown and recession is an opportunity<br />

for LIC of India. But unfortunately management<br />

dumped the enthusiasm, creativity, innovation,<br />

mobility and involvement of field force. Management<br />

is not paying heed and not utilizing the energy<br />

and strength of Development Officers. Management<br />

should provide all facility and right atmosphere<br />

to do aggressive marketing of life insurance. Time<br />

and again organization has appealed to management<br />

to come up with amicable solution on all concerned<br />

issues. It is solely in the hands of management to<br />

make every LICan including field force happy. The<br />

response from management is very slow almost at<br />

a snail’s speed<br />

NF has always been on the right path of<br />

truth and concerned about the interest of members,<br />

agents and policy holders. This pious work<br />

undertaken by the federation is always showered<br />

by the blessings of God and positive forces of<br />

nature. The recent fall in market , global economic<br />

VIEW POINT<br />

All India President<br />

meltdown have only indicated that we are on right<br />

path and the convention business has once again<br />

gained importance. History is a witness to the fact<br />

that convention business cannot be sold without<br />

Development Officers who are the backbone of<br />

three-tier system of life insurance marketing. In this<br />

time of struggle , perseverance is the need of hour.<br />

The active participation in Yogakshema march and<br />

Parliament march , and understanding our problems<br />

has had a direct impact on LIC and has resulted in<br />

its negative growth. This active participation has<br />

paved way for further struggle. Even after the global<br />

recession hitting the common man the government<br />

still seems to be ignorant and is sticking to the agenda<br />

of 49% FDI in life insurance. Though it has been<br />

time and again proved that whoever has touched<br />

this 49% FDI issue have paid for their mistakes.<br />

I realise the hardships and turbulence<br />

suffered by all the members. NF is proud of all its<br />

members for their tremendous sacrifice , patience<br />

and faith on organization and salutes to everybody<br />

for passing calmly through all odds. Organizational<br />

activities and financial discipline is also an important<br />

concern of organization. Hope all the General<br />

Bodies , branch visits and organizational tours are<br />

in order. All the dues , levies and subscriptions are<br />

taken care of. Reading of News Bulletin, Regular<br />

visits to our website will keep you updated on latest<br />

events.<br />

Organization congratulates our Secretary<br />

General for his appointment on IRDA advisory<br />

committee. We shall keep a tab on the latest situation<br />

and keep on marching forward .<br />

Victory is ours !!!<br />

Wishing you all , happy and<br />

prosperous days ahead !!!<br />

National Federation Zindabad …..!!!<br />

Workers Unity Zindabad ……!!!!!<br />

Yours lovingly<br />

Uttam Laxmanrao Jagdhane<br />

( All India President)<br />

6

News Bulletin March 2009<br />

PERSPECTIVE<br />

From the Secretary General’s Desk<br />

REPORT OF N.E.C MEETING HELD AT MYSORE ON 16-12-2008 & 17-12-2008<br />

The National Federation flag was hoisted<br />

by our National President Com Uttam Jagdhane.<br />

Com Putta Swamy, the dynamic divisional secretary<br />

of Mysore divisional federation welcomed the<br />

gathering and delivered his welcome address. Com<br />

Nagesh Murthy addressed the house and<br />

concluded the inaugural function by thanking the<br />

Federation for giving a chance to host the NEC at<br />

Mysore.<br />

Com.Vinay Babu President,South Central<br />

Zone welcomed all delegates on behalf of the zone<br />

and addressed the NEC delegates. The house<br />

placed on record the services rendered by Com.<br />

C.L.Chandok and observed two minutes silence<br />

to pay homage to Com C.L.Chandok, former<br />

Zonal Secretary of North Zone and former Central<br />

secretariat member.<br />

The minutes of the previous meeting was<br />

confirmed and passed. Our President Com.Uttam<br />

Jagdhane welcomed all the NEC delegates to the<br />

city of palace and gardens. Managements claim of<br />

increase in Agency force and premium proved<br />

negative by introduction of CLIA.The President<br />

requested the house to educate the membership<br />

on MOU,GOIB, CLIA and other issues. The<br />

President requested the Secretary General to<br />

present his report to the house.<br />

The Secretary General welcomed all<br />

members and congratulated new members and reelected<br />

members. The house observed two<br />

minutes silence to pay homage to our former Prime<br />

Minister V.P.Singh, Com R.K.Chandra Mauli,<br />

former Secretary Nellore Division and Joint<br />

Secretary S.C Zone and to all our comrades who<br />

died recently.The Secretary General’s report<br />

already circulated was placed before the house<br />

and while submitting the same, informed the house<br />

with regard to work norms and the continuing<br />

efforts to impress upon the management and<br />

government the difficulties faced by the cadre of<br />

Development officers and how the unilateral<br />

changes in Special rules (1989) will adversely affect<br />

Development officers. The following petitions were<br />

read for the benefit of members.<br />

(1)Petition to IRDA on CLIA (2) Petition<br />

to Government on CLIA (3)Petition to Petitions<br />

committee (4) Petition to Chairman, LIC and letter<br />

written to Government on the matter of wage,<br />

arrears for the purpose of Income Tax were also<br />

read in the house for the information. The legal<br />

opinion on CLIA was placed and explained in detail<br />

to the house. The issue of PLLI Quantum to<br />

Development Officers and also costing of PLLI was<br />

explained to the house. Matters of housing loan,<br />

increased mediclaim (Cashless process), second<br />

option for pension and the issue of confidential<br />

reports issue also explained by the Secretary<br />

General. Secretary General gave the gist of<br />

discussion held with management on 17-07-2008<br />

and 6 th September 2008 on the above issues. The<br />

gist of the statement of Accounts was also placed<br />

for information as part of the report. Before<br />

concluding the report to the house, newly elected<br />

and re-elected NEC Members and C.S Members,<br />

were introduced to the House.<br />

President requested the members to<br />

deliberate on Secretary General’s Report. Members<br />

deliberated on the report in which 46 members<br />

participated. The following were the matters raised<br />

for clarifications and as suggestions<br />

1) Basic membership seeking details about the<br />

position of special rules, national holidays out<br />

of costing, C.R for the purpose of promotion<br />

2) The rationale and logic behind Jeevan Aastha<br />

which is introduced to achieve the target.<br />

7

News Bulletin March 2009<br />

3) Work norms are more important than I.B<br />

and form a strategy to fight out the issue.<br />

4) Equitable relief for wage arrears<br />

5) Unscientific recruitment of Development<br />

Officers without infrastructure was brought<br />

to the notice of House.<br />

6) In Mussorie it was informed that<br />

management was positive and agitation will<br />

be reviewed within 3 months.<br />

7) Election duty must be exempted and<br />

demanded exemption from costing.<br />

8) Demanded clear cut message to pass on to<br />

the members and suggest agitation.<br />

9) Court case on CLIA.<br />

10) Minutes of previous meeting must be read in<br />

the house and should be passed<br />

11) On work norms why we should fight for the<br />

Development Officers who are not working<br />

and attracting norms.<br />

12) The logic for empowerment. CLIA is a threat<br />

to development officers. The agitations must<br />

be implemented uniformally.<br />

13) On 20.11.2008 every body in LIC was on<br />

strike except Development Officers and now<br />

take a decision since cabinet cleared 3 bills<br />

affecting LIC.<br />

14) We got the legal position on CLIA. Even<br />

though we are strong, why there is no legal<br />

action taken.<br />

15) RCA gap of 4 must be withdrawn and cost<br />

ration must be 23% only<br />

16) CLIA was not dealt properly by Federation.<br />

How can any other person can give agency<br />

to the spouse of my agent without sitting<br />

arrangements ADO were posted in SSO.<br />

17) Management is desperately trying to make<br />

CLIA successful, Vision 2010 will be very<br />

easy for the management.<br />

18) Rumors are being unnecessarily spread by<br />

members including CS Members against<br />

Secretary General and leadership. This is<br />

damaging the organization and demanded<br />

strong action to stop it.<br />

19) Problems of CLIA, alternative channels and<br />

multi level marketing by “Sarath” was<br />

mentioned.<br />

20) Try for good wage revision.<br />

21) Position of attendance of SSO posted<br />

Development Officers.<br />

22) We must do our work as Divisional Leaders.<br />

The Parliament and Yogakshema March are<br />

the strength of the organization. We must<br />

inform all issues to the basic membership and<br />

give call to recruit more agents so that the<br />

doors will be closed to CLIA<br />

23) Leadership training demanded.<br />

24) Management is practicing double standards.<br />

They say about conventional plans and<br />

pressurizing for ULIPs.<br />

25) On special rules go for MOU to reduce the<br />

damage. On work norms if required we<br />

should go to court. 50% agency force at the<br />

beginning for rural credit and CR for<br />

development officer is bad. There must an<br />

escape for grading, demand functional<br />

allowances, CA and good wage revision.<br />

26) Management has vision to abolish this cadre.<br />

27) We should focus on conventional Insurance<br />

business.Let CLIA be scrapped.<br />

28) What ever we achieved in this adverse<br />

situation is not small thing and we should<br />

congratulate for the same. On CLIA don’t<br />

go to court.<br />

29) The Orrisa IT department is asking to deposit<br />

the tax from 1998.<br />

30) Management has cheated Development<br />

officers by not paying Big Leap competition?<br />

Demand salary cut for 5th, 15th and 30th<br />

only. For car we should ask for change of<br />

scheme and similar to scheme VI.<br />

31) In North Central Zone Branch Managers and<br />

Assistant Branch Managers are interested in<br />

8

News Bulletin March 2009<br />

CLIA only, since they are getting money. Let<br />

us fight,don’t fear and face the situations.The<br />

IB can be bifurcated into 2% ACA and<br />

10.5% IB.<br />

32) What we can inform the members after<br />

returning to the headquarters. What is the<br />

position of petitions? We must have vision to<br />

save this cadre. Recruit agents and sell<br />

conventional plans. We are not getting <strong>news</strong><br />

<strong>bulletin</strong>. Don’t go to court on CLIA. Fight<br />

for special rules and get an MOU and not<br />

unilateral changes.<br />

33) Cashless medical scheme demanded. We<br />

need some Hindi speeches.<br />

34) We are not getting <strong>news</strong> <strong>bulletin</strong> and<br />

demanded Hindi version also. Let us decide<br />

priorities and strategy. Decide whether<br />

management is friend or enemy.<br />

35) Give direction regarding issue of empowerment<br />

of Development Officers and removal<br />

of grading for ULIPs and single premium.<br />

36) Membership is waiting for quick results and<br />

leadership is working with petitions.<br />

37) No place to sit in the branches and new<br />

developmental officers are posted. SSO<br />

design must be changed to accommodate all<br />

developmental officers.<br />

38) Only revival credit and EOL achieved so far.<br />

Revival credit is from 2000 or 2004.CLIA<br />

agents giving agency to spouse by violating<br />

the existing rules. Growth condition in IB<br />

scheme must be withdrawn.<br />

39) Leadership is not able to deliver any thing to<br />

the cadre. 19 issues placed before<br />

management. Waiting for some relief in GOIB<br />

because of growth condition we are loosing<br />

heavily.<br />

40) If we don’t get solution by the existing<br />

petitions on CLIA let us go to court.<br />

41) EOL of 2004 not condoned. Bifurcation of<br />

Pune division done without consent and<br />

consideration of the area. After the resistance<br />

by 7 branches, management withdrew the<br />

bifurcation.<br />

42) Revival credit from 2004 circular came and<br />

not from 2001. In special rules we must<br />

discuss all the conditions and go for MOU.<br />

RCA Cap of 4 agents must be removed.<br />

43) Secretary’s report is elaborative and covered<br />

all the issues. The achievement of revival<br />

credit, tour mileage rates, EOL are not<br />

simple things in the present situations.<br />

44) Recruitment of Development Officers and<br />

heavy amounts are paid to the managers to<br />

the competitions and our Big Leap is not<br />

cleared.<br />

45) We must take a decision about posting of<br />

development officers and providing table and<br />

chair, It is not question of money but survival.<br />

Since it is a scenario of ULIPs demand for<br />

full credit for ULIPs and single premiums.<br />

In special rules demand for deletion of<br />

termination clause and increment cut.<br />

46) Anomalies in 2 wage revisions is not settled<br />

even today hence care must be taken for<br />

the present one.<br />

47) What is the result of positive attitude. Give<br />

direction we are prepared to fight.<br />

48) The CS should give direction to the NEC<br />

after taking the views of the speakers. In<br />

last NEC Secretary General informed to<br />

review the agitation after 3 months.<br />

49) CLIA is giving agency to spouse and<br />

diverting the business. Let there be<br />

continuous negotiations and also negotiate<br />

on recruitment and single premium credit.<br />

50) There should not be any debits to those who<br />

achieved cost. Because of unscientific<br />

recruitment most of the ADOs are going<br />

back.<br />

51) Late Com.Pawan Gaur has small kids and<br />

nobody to support the family. Let us fix a<br />

date for contribution. Try for more credit in<br />

the policies and plan for agitation for<br />

February and March to speed up solutions.<br />

52) What is the status of Development Officer<br />

today. Private companies came and<br />

9

News Bulletin March 2009<br />

snatching our agents. 2004 GOIB reduced<br />

our income, wage revision, equitable relief<br />

is not guaranteed. Single premium policies<br />

are the order of the day, so how to get on<br />

this situation.<br />

53) The leadership is doing what best they can<br />

do in this difficult situation. Demand for more<br />

recruitment and increase the cadre so that<br />

LIC will depend only on Development<br />

Officers.<br />

54) Supreme Court judgment that the<br />

development officers are work man is useful<br />

for the future. Right now plan for agitation<br />

like demonstrations and non co operations.<br />

55) Let us work for 3% ACA and allotment of<br />

agents, space for development officers in<br />

office.<br />

56) Why suspended agitation was not reviewed<br />

after 3 months. Congratulated for Bihar<br />

donations. What can we tell to members<br />

after returning to headquarters.<br />

57) Has CS discussed on special rules and the<br />

outcome. We have not received any<br />

information on FDI hike which is very<br />

dangerous. There is no discussion on GOIB<br />

and grading.<br />

After all the speakers completed their<br />

deliberations the President requested the Secretary<br />

General to give his response to the queries raised<br />

and clarify matters. .<br />

Secretary General in his reply thanked all<br />

the members for excellent deliberations. It was<br />

clarified that suspension of agitation is based on<br />

CS decision. In April, 2008 CS discussed and<br />

decided to take steps for breaking the ice and<br />

reopen the negotiations. After negotiations started<br />

on 22 nd May 08 the office bearers decided to<br />

suspend the agitation to reciprocate and work<br />

together to create a positive atmosphere. Though<br />

the resolution was proposed at Mussoorie for<br />

review after 3months, the NEC had decided to<br />

review it in the next NEC. We must review and<br />

take a decision today about whether to restart the<br />

agitation. The decision of suspension of agitation<br />

was ratified by the NEC. Let us analyse and think<br />

with our mind and heart whether we got something<br />

or not. EOL came after lot of persuasion and we<br />

have not surrendered the image of the organization.<br />

Revival credit and Granting of agency to direct<br />

agents Spouse was the demand of the organization.<br />

Our philosophy is to resist unilateral changes and<br />

adversely affecting development officers, fight<br />

against alternate channels and private companies.<br />

We are very frequently visiting Central Office,<br />

following up matters and discussing all the issues<br />

and it is not possible to publish all the things.<br />

On special rules our demand is to continue<br />

the existing work norms. We demand for<br />

improvements like automatic absorption to class-<br />

III,100% credit for all policies and removal of<br />

National holidays,election duty days and maternity<br />

leave from costing. Across the negotiating table<br />

we negotiated on all aspects of Special rules. We<br />

have represented to management and government<br />

that the existing work norms itself is very harsh and<br />

that many ADO’s and PDO’s are terminated based<br />

on special rules 1989.<br />

We are opposing the proposed bills of FDI<br />

hike and increase of the capital to 100 crores. The<br />

amendment to increase the capital is very<br />

dangerous, as a loophole is being created which<br />

may lead to issue of IPO’s in future.<br />

In GOIB we have represented to the<br />

management and government what we want, and<br />

we are pursuing for settlement of the GOIB issue.<br />

The major points of our dispute has already been<br />

informned to all of us.<br />

We have demanded for scraping of CLIA<br />

and called upon members to implement the<br />

guidelines to protect the interests of our agents and<br />

development officers. On CLIA let us wait for the<br />

disposal of the petitions and decide in the next NEC.<br />

We have placed a number of issues and<br />

got few issues cleared. We continue to negotiate<br />

on all the issues. Stop believing rumors. We have<br />

put all the issues before you today and if you feel it<br />

10

News Bulletin March 2009<br />

is negative attitude we are free to review and take<br />

a decision to restart agitation if felt necessary.<br />

On recruitment our policy is for continuous<br />

scientific recruitment and we can demand to post<br />

DOs in SSOs along with infrastructure and seating<br />

arrangements.<br />

On wage revision we submitted charter of<br />

demands after discussion in NEC at Siliguri. We<br />

are demanding a good wage revision commensurate<br />

to the hike for central government employees based<br />

on sixth pay commission. Our pension is directly<br />

linked to salary and therefore a good salary is the<br />

need of the hour. The incentives are not secured.<br />

We have already represented about exempting<br />

wage arrears from costing and removal of<br />

anomalies in the wage revision. Housing loan,<br />

mediclaim, RMES and other aspects have been<br />

represented.<br />

During Parliament and Yogakshema<br />

March we have raised our protest against FDI hike<br />

and ammendments to Insurance bills. We sought<br />

the support of all the political parties and unions.<br />

We had protested and were not party to the<br />

decision of 20th August’08 strike and hence our<br />

decision not to join in 20 th August ’08 strike.<br />

Now business is going down and all are<br />

worried. In News <strong>bulletin</strong> failure to print in bilingual<br />

(Hindi and English),we will try to print in bilingual.<br />

In News <strong>bulletin</strong> we are not advocating any<br />

ideology but only projecting the social; and national<br />

issues which is affecting the common man and all<br />

of us. Printing of only circulars in News <strong>bulletin</strong><br />

was criticised previously hence we are giving only<br />

information about circulars. We are trying to make<br />

it a excellent News Bulletin in every aspect. Only<br />

93 divisions addresses were updated and sent to<br />

us. We are printing sufficient copies to reach all<br />

members. If anyone is not getting the News <strong>bulletin</strong><br />

we have directed that “the member should first<br />

check the address in the list with the divisional<br />

secretary and then if correct give a complaint to<br />

the local post office with a copy to secretary<br />

general”.<br />

Regarding expenses we are taking all steps<br />

for need based expenditure. The fund position of<br />

the organization has to improve. We have to build a<br />

good base fund so that the interest from it will enable<br />

the organization to meet various expenses other than<br />

routine expenses. Today as a organization we cannot<br />

respond to any demand for emergency relief like<br />

that in Assam, Bihar, or for our comrades. We are<br />

not in a well equipped position to fight continuous<br />

legal battles engaging good advocates or carry out<br />

rigorous PR activities. We cannot go on collections<br />

every time we need funds. Even contributions for<br />

Late Com.Pawan Gaur relief fund is pathetic. Only<br />

few divisions have contributed. This situation is not<br />

appreciable. Organisation will have to decide in the<br />

near future to create a good fund for our organization.<br />

All divisions were asked to clear the long pending<br />

dues. We appreciate the members and divisions who<br />

contributed generously to the Bihar relief fund.<br />

In tough times we are trying to get the best<br />

and not surrendering any issue. Subscription is a<br />

must and there is no other way. Members have to<br />

be told clearly that subscription is meant for the day<br />

to day running of the organization. Our organization<br />

is a must for our protection and to resist all offensive<br />

decisions of Management and Government. It is<br />

only because of <strong>NFIFWI</strong> that we all are continuing<br />

to go ahead in Life strongly. CS, NEC’s, Council<br />

meetings are all regular constitutional and<br />

organizational requirements to conduct the affairs<br />

of the organisation systematically. Members cannot<br />

be expecting only benefits after every meeting.<br />

Benefits will come to members as and when issues<br />

are settled. The meetings are for reporting, analyzing,<br />

reviewing matters and deciding on our stand and<br />

strategies. Leaders should have confidence that we<br />

are going strong and taking up all the issues and the<br />

<strong>NFIFWI</strong> The direction is not to give any<br />

commitment for any activity except for the<br />

existing marketing activity. As and when any<br />

official communication received by us we will discuss<br />

and decide further.<br />

On Federal Council members suggested for<br />

3 days FCM, restriction of veteran Leaders and if<br />

allowed time limit for speech, appointment of<br />

11

News Bulletin March 2009<br />

election officer and printing of ballot papers in<br />

advance with names after withdrawal, restriction<br />

to delegates only, announcement of valid<br />

nominations on the first day of the meeting etc. Even<br />

one member suggested that ours is trade union and<br />

need not give so much importance for elections.<br />

The Secretary General informed the house that all<br />

suggestions are taken in to consideration and come<br />

with proposal to the next NEC after discussing the<br />

same in CS meeting at the time of NEC.<br />

On constitutional amendments let us<br />

concretize in the coming NEC and present to FCM<br />

2010. Some constitutional requirements are lacking<br />

and hence ammendment is required and requested<br />

the delegates to send their recommendations so<br />

that we can concretize in the next NEC.<br />

On fund position Secretary General<br />

requested to clear Late Com.Pawan Gour<br />

contributions immediately before leaving the<br />

meeting hall. Requested to clear all the dues of<br />

subscriptions and News <strong>bulletin</strong> and they can<br />

deposit directly in the bank also. Zonal level and<br />

Central level financial support is a must and<br />

requested to clear all the outstanding dues as per<br />

the list circulated.Review of agitation is not required<br />

as on date and if needed the same will be informed.<br />

In the Organizational matters Secretary General<br />

directed the Organization not to believe the<br />

rumors,negative propaganda against the decisions<br />

of the organization. Informed the House about the<br />

decision of CS Meeting with due respects to the<br />

veteran leaders it was decided not to invite such<br />

people who speak against the organization and<br />

decisions and NEC accepted the proposal.<br />

Secretary General directed the divisional Units to<br />

register under Trade Union act and the information<br />

is available on our web site.<br />

Based on the discussions the following<br />

resolutions were proposed. Com. Sankyan Zonal<br />

Secretary placed the proposed resolutions for<br />

approval of NEC<br />

1. On special rules 1989<br />

2. On CLIA scheme<br />

3. On GOIB 2007<br />

4. On unscientific recruitment<br />

5. On Big leap competition<br />

6. Condonation of EOL pending from 2004<br />

7. Condonation of EOL of Ahmedabad and Delhi<br />

8. On confidential reports for promotion and<br />

increment<br />

The copy of resolutions sent to Chairman<br />

is enclosed alongwith.<br />

Com R Venkateswara rao Joint Secretary<br />

proposed vote of thanks and specially thanking<br />

Mysore Comrades under the leadership of Com<br />

Puttaswamy and Nagesh Murthy for excellent<br />

arrangements and hospitality.<br />

The President adjourned the meeting after<br />

National Anthem.<br />

Comradely Your’s<br />

R.Jayprakash<br />

Secretary General<br />

<strong>NFIFWI</strong><br />

<strong>NFIFWI</strong> Zindabad…….<br />

<strong>NFIFWI</strong> Zindabad……<br />

<strong>NFIFWI</strong> Zindabad……..<br />

NEWS BULLETIN thanks<br />

Com. Himanshu Pandya,<br />

Com. H. R. Narasimhan,<br />

Com. Rajiv Gulati,<br />

for contributing to this issue of NEWS BULLETIN<br />

12

News Bulletin March 2009<br />

RESOLUTIONS ADOPTED BY NEC OF NATIONAL FEDERATION<br />

Ref: Resolutions adopted by National Federation<br />

of Insurance Field Workers of India at our<br />

National Executive Meeting held at Mysore on 16 th<br />

and 17 th of December 2008<br />

Dear Sir,<br />

The Federal council meeting held on the 16 th and<br />

17 th of December 2008 at Mysore had indepth<br />

deliberations on various matters concerning LIC,<br />

Insurance sector and Development officers. The<br />

house expressed it’s unhappiness and anger over<br />

many issues which are yet to find a solution from<br />

your end and government. The house discussed ,<br />

moved and adopted the following resolutions. We<br />

place before you the resolutions for your kind<br />

consideration and necessary action for favorable<br />

solutions at the earliest.<br />

RESOLUTIONS<br />

This NEC Meet held at Mysore on 16 th and 17 th<br />

December 2008 unanimously resolved<br />

1. That, looking into the worldwide Economic Market<br />

recession, nose diving sensex, stiff competition<br />

from the private players, hardship of the policy<br />

holders in running the existing policies and cut<br />

throat competition prevailing in the insurance<br />

market, the present service conditions (special<br />

Rules-1989) itself has become very tough.<br />

Therefore any negative changes to special rules<br />

1989 will make matters very difficult for the<br />

Development officers. We call upon LIC<br />

management and Government, to not make any<br />

negative changes in the special rules 1989. This<br />

will boost the morale of the Dev officers who are<br />

already disturbed and help them in performance<br />

of their duties with better efficiency. We also call<br />

upon the management to suggest for positive<br />

change or amendment as per the suggestions made<br />

by the <strong>NFIFWI</strong>, which should be done through<br />

bilateral discussions resulting into an MOU.<br />

2. That, the introduction of CLIA scheme has made<br />

a dent in the relationship between Dev.Officers<br />

and agents spoiling the atmosphere of the branch<br />

offices and reduction in individual business of<br />

CLIA is not in the interest of LIC. Moreover<br />

the practice adopted by CLIAs is contrary to the<br />

Agents Regulation 1972 and IRDA Agents Reg,<br />

2000. The house is of the firm opinion that<br />

withdrawal of CLIA scheme is in the larger<br />

interest of the organization, otherwise the entire<br />

marketing force will be continued to be disturbed<br />

and trust amongst the Dev.Officers and agents<br />

which is existing will be lost forever. The CLIA<br />

scheme has been destroying the fabric of the<br />

most successful channel of Development officers<br />

and Tied agents.<br />

3. That, the amendments in the GOIBS -2007 should<br />

be made immediately as per the suggestions<br />

made by the NF to address the concerns of the<br />

class of the Dev.Officers and LIC to pave the<br />

way for aggressive marketing. It is further<br />

resolved that in the absence of reimbursement<br />

of Marketing and conveyance expenses it is<br />

extremely difficult to carry out the marketing<br />

activities to the desired levels.<br />

4. That, the hap-hazard and unscientific recruitment<br />

of ADOs is a financial loss to the corporation<br />

due to huge termination creating a band of orphan<br />

and unskilled agents. It is not desired from a<br />

PSU like LIC to adopt “hire and fire policy”.<br />

The house suggests that the recruitment of ADOs<br />

should be based on the socio- economic profile<br />

of the place and the previous system of<br />

consultation with the representatives of NF at<br />

the divisional level to identify the vacant pockets<br />

as per the guidelines of our former MD<br />

Sri.Chidambaram. Further, total infrastructure<br />

needed for a Dev.Officer should be provided in<br />

all offices of posting.<br />

5. That, the long pending awards of “Big Leap<br />

Competitions” should be released immediately.<br />

This is also to motivate the Dev.Officers to<br />

participate with full belief in the ongoing and<br />

future competitions. The <strong>NFIFWI</strong> sought the<br />

path of agitation which had absolutely no agenda<br />

affecting the business performance or<br />

participation in “BIG Leap Competition” hence<br />

depriving the qualified Dev.Officer is unjust and<br />

unfair practice on the part of Management.<br />

6. That, the condonation of EOL’s pending in the CO<br />

pertaining to various parts of the country is long<br />

awaited. The house calls upon the management<br />

to condone the EOL’s to generate a team spirit<br />

and set right the anomalies arising out of it.<br />

7. That, the issue of condonation of unfair EOL’s<br />

imposed in Ahmedabad and Delhi -1 should be<br />

sorted out amicably across the table.<br />

With Best Wishes and Regards,<br />

Yours Sincerely<br />

R.Jayprakash<br />

Secretary General<br />

13

News Bulletin March 2009<br />

CAPITALISM, SOCIALISM AND CRISIS<br />

Prabhat Patnaik<br />

A COMMON view of the current financial<br />

crisis of capitalism holds that it is essentially<br />

an aberration. Some attribute this aberration<br />

to specific mistakes committed in the past, for<br />

instance by the US Federal Reserve with<br />

regard to monetary policy. Some hold the lack<br />

of adequate regulatory mechanism as being<br />

responsible for this aberration. Paul Krugman,<br />

the current year’s Nobel laureate, blames it on<br />

insufficient supervision of the financial system.<br />

And even Joseph Stiglitz, the well-known radical<br />

economist and Nobel laureate, characterises<br />

it as a “system failure”, a term which makes<br />

the crisis a phenomenon that in principle could<br />

have been avoided with impunity. This entire<br />

perception however is untenable. The crisis is<br />

a result not of the failure of the system but of<br />

the system itself; it is a part of the mode of<br />

operation of contemporary capitalism rather<br />

than being unrelated or extraneous to it.<br />

MASSIVE SPECULATION<br />

In a “free market” regime, asset markets tend<br />

to be subject to speculation. Speculators buy<br />

assets not because of the yield on these<br />

assets but because they expect its price to<br />

appreciate in the coming days. They have no<br />

long term interest in the assets and are<br />

concerned exclusively with capital gains. Since<br />

buying today to sell tomorrow entails carrying<br />

the asset during the intervening period for<br />

which a “carrying cost” has to be incurred, the<br />

assets most suitable for speculation are those<br />

whose carrying costs are low; and these are<br />

typically financial assets which have virtually<br />

zero carrying costs (requiring only a few taps<br />

on computer keys to effect all necessary<br />

transactions). Financial asset markets<br />

therefore are always subject to massive<br />

speculation.<br />

Speculation generates bouts of euphoria or<br />

“speculative excitement” which have the<br />

cumulative effect of pushing up asset prices.<br />

An initial rise in some asset prices, caused no<br />

matter how, gives rise to expectations of a<br />

further rise, and hence to an increase in the<br />

demand for the assets in question which<br />

actually raises their prices further; and so the<br />

process feeds upon itself and we have asset<br />

price “bubbles”. Such “bubbles” typically<br />

characterise financial assets, which, as already<br />

mentioned, are particularly prone to speculation;<br />

but they are not confined to financial assets<br />

alone (as the housing market “bubble” in the<br />

United States has just demonstrated).<br />

Such “bubbles” have an obvious impact on the<br />

real economy. The rise in asset prices fed by<br />

speculative euphoria improves for individuals<br />

who own these assets the estimation of their<br />

wealth position, and hence causes an increase<br />

in their consumption expenditure, and thereby<br />

in employment. Likewise such a rise in asset<br />

prices, where the assets in question are<br />

producible, causes an increase in investment<br />

expenditure on these assets, which leads to<br />

their larger production, and hence to larger<br />

employment. In short, speculative euphoria in<br />

the asset markets makes the boom in the real<br />

economy, stimulated by whatever had caused<br />

the initial rise in asset prices, more pronounced<br />

and prolonged.<br />

Precisely because of this however if for some<br />

reason the asset price increase wanes or<br />

comes to a halt, speculators attempt to get out<br />

of the assets in question causing a crash in<br />

the asset prices. This causes a fall in aggregate<br />

expenditure on goods and services; a collapse<br />

in the state of credit, as banks face insolvency;<br />

and a possible collapse even in the inclination<br />

of depositors for holding bank deposits (since<br />

they fear banks’ insolvency), as had happened<br />

during the Great Depression. In short there is a<br />

collapse of the state of confidence all around,<br />

and hence a corresponding increase in liquidity<br />

preference; i.e. there is a disinclination to hold<br />

any asset other than pure cash, or in extreme<br />

14

News Bulletin March 2009<br />

cases only currency, and of course claims<br />

upon the government, which is considered to<br />

be the only safe and reliable borrower. Not all<br />

crises display this severity; but to a greater or<br />

lesser extent these features mark any crisis.<br />

Speculation therefore has the effect of making<br />

the boom more pronounced and prolonged; but<br />

it has also the effect of precipitating a severe<br />

crisis, as distinct from a mere cyclical<br />

downturn. In the absence of speculation the<br />

boom in the real economy will be a much more<br />

truncated and tame affair. But precisely<br />

because it is not a tame affair, it is followed by<br />

a crisis.<br />

Two conclusions follow from the above<br />

analysis. First, since speculation is endemic<br />

to modern capitalism, where financial markets<br />

play a major role, speculation-engendered<br />

euphoria and the consequent pronounced<br />

booms, together with the crises that invariably<br />

follow, are also endemic to modern capitalism.<br />

“Bubbles” constitute in other words the mode<br />

of operation of the system. “Bubbles”, together<br />

with the crises that follow their collapse, are<br />

not a “system-failure”; they are the system.<br />

Secondly, if “bubbles” are to be eliminated and<br />

speculation is to be curbed, then it is not enough<br />

to put in place some regulatory mechanisms;<br />

an alternative instrument for generating<br />

pronounced booms in the real economy has<br />

to be found, for otherwise the economy would<br />

remain perennially sunk in stagnation and largescale<br />

mass unemployment.<br />

The alternative instrument suggested by John<br />

Maynard Keynes, the well-known English<br />

economist, was State intervention through fiscal<br />

measures to ensure that the level of demand<br />

remained as close to full employment as<br />

possible. Keynes’ suggestion, made in the<br />

1930s during the Great Depression, was<br />

strongly opposed by finance capital, which<br />

always opposes all State intervention that does<br />

not promote its own exclusive interest. The<br />

Keynesian remedy got accepted only in the<br />

post-war period when the balance of class<br />

forces had shifted, with the working class,<br />

which had made immense sacrifices during the<br />

war, acquiring greater social and political weight,<br />

and finance capital, experiencing a<br />

corresponding weakening of its position, forced<br />

to make concessions.<br />

Over time however this balance changed once<br />

again. “Centralisation of capital” and the<br />

formation of larger and larger blocs of finance<br />

capital, during the period of Keynesian demand<br />

management itself, forced open the barriers<br />

imposed on cross border financial flows.<br />

Finance capital consequently acquired the<br />

nature of international finance capital, through<br />

a process of “globalisation of finance”. Since<br />

the whims of international finance capital<br />

necessarily had to triumph over the<br />

autonomous predilections the nation-State, in<br />

order to avoid capital flight, Keynesian “demand<br />

management” was rejected, and neo-liberal<br />

capitalism emerged triumphant again, bringing<br />

back the era of speculative financial crises,<br />

leading to real crises, in the capitalist world. This<br />

is the phenomenon we are currently<br />

witnessing, a phenomenon that has been<br />

compared with the Great Depression of the<br />

1930s.<br />

SOCIALIST ECONOMY IMMUNE TO CRISES<br />

One of the hallmarks of the 1930s Great<br />

Depression is that the Soviet Union, the only<br />

socialist economy of the time, had been<br />

completely unaffected by it. In fact, when<br />

capitalism had been afflicted by the severe<br />

crisis, the Soviet Union had experienced such<br />

unprecedented economic construction that it<br />

had completely got rid of unemployment. This<br />

fact, as is well-known, had so impressed a<br />

whole generation of Indian freedom fighters like<br />

E M S Namboodiripad that they had embraced<br />

Communism because of it.<br />

This contrast arises owing to a fundamental<br />

difference between the mode of operation of<br />

the two systems. A socialist economy is<br />

fundamentally immune not just to speculationinduced<br />

crises but to all crises arising from a<br />

deficiency of aggregate demand. This fact is<br />

15

News Bulletin March 2009<br />

recognised even by staunch opponents of<br />

socialism like the Hungarian economist Janos<br />

Kornai who calls capitalism a “demandconstrained<br />

system” and socialism a “resourceconstrained<br />

system” where the available<br />

resources are fully utilised without being<br />

constrained by insufficient demand.<br />

A socialist economy of course has the usual<br />

fiscal instrument suggested by Keynes for<br />

overcoming deficiency of aggregate demand,<br />

unlike a capitalist economy where the use of<br />

this instrument requires overcoming opposition<br />

from finance capital, and where, even when the<br />

instrument is perchance used, there is a limit<br />

to its use arising from the fact that the system,<br />

being based on antagonism, needs a<br />

sufficiently large reserve army of labour to<br />

prevent inflation and maintain “work discipline”.<br />

But even apart from this, a socialist economy<br />

can overcome deficiency of aggregate demand<br />

in another way which brings out its basic<br />

character.<br />

In any economy where in any period the money<br />

wages are given, the production of a certain<br />

output requires a certain unit cost of production<br />

to be incurred. The term “deficiency of<br />

aggregate demand” or “insufficient demand”<br />

simply means that the level of demand in the<br />

economy is such that this output can be sold<br />

only at a price that falls below this unit cost of<br />

production plus the customary profit margin.<br />

When this happens, then in a capitalist economy<br />

firms cut back on output, so that there is<br />

unemployment; and this gives rise to a further<br />

reduction in demand since the workers’ demand<br />

shrinks owing to unemployment; and this<br />

causes a further reduction in output and<br />

employment; and so the process, referred to<br />

as the “multiplier” effect of the initial output/<br />

employment decline, goes on and the economy<br />

is caught in a crisis.<br />

In a socialist economy however since firms are<br />

socially owned, the State can issue a directive<br />

asking them to lower prices when they initially<br />

find that the demand for output at the base price,<br />

i.e. at the price equal to the unit cost plus profit<br />

margin, is less than the output. While issuing<br />

this directive it can assure the firms that any<br />

losses they make will be covered from the State<br />

budget. In such a case, firms simply lower their<br />

prices to clear the market, and there is no<br />

question of any unemployment to start with, and<br />

hence no question of any “multiplier effect”.<br />

Putting it differently, in a capitalist economy any<br />

decrease in demand gives rise to “output<br />

adjustment” and hence “employment<br />

adjustment”; in a socialist economy it can give<br />

rise only to “price adjustment” and keep output<br />

unchanged.<br />

Why does this difference arise? When price<br />

adjusts downwards, since the money wage rate<br />

is given, there is an increase in the real wage<br />

rate. So, a socialist economy, faced with a<br />

decline in aggregate demand, gets rid of it by<br />

raising real wages of workers, i.e. by raising the<br />

demand of the workers. But a capitalist<br />

economy, precisely because it is based on class<br />

antagonism, where the slightest increase in the<br />

wage rate is bitterly opposed by capitalists, will<br />

never raise real wages to get rid of demand<br />

deficiency. This is why any such deficiency gives<br />

rise to output adjustment, and hence mass<br />

unemployment.<br />

But now we come to the real crux of the matter.<br />

It was mentioned above that the socialist State,<br />

while directing firms to reduce prices to clear<br />

markets, would assure them that any losses<br />

they incur would be covered by the State budget,<br />

i.e. that they would get a State subsidy to cover<br />

their losses. The question may be asked: how<br />

does the State finance these losses? And the<br />

answer interestingly is that for all the firms taken<br />

together there will be no losses. In other words,<br />

while the State issues this directive it will never<br />

be actually called upon to make any additional<br />

budgetary provisions for subsidies. True, firms<br />

in the aggregate will make less profits after price<br />

adjustment than they otherwise would have done<br />

in the absence of the original deficiency of<br />

aggregate demand; but they will make profits in<br />

the aggregate all the same. The State may at<br />

the most have to divert the profits of some firms<br />

to cover the losses of others, but it will have to<br />

16

News Bulletin March 2009<br />

make no additional provisions. This follows from<br />

the fact that since profits in any period in a<br />

socialist economy are more or less<br />

synonymous with the savings of the economy,<br />

and since (ignoring external borrowing/lending),<br />

investment in any period must equal savings,<br />

as long as investment remains positive, profits<br />

in the aggregate must remain positive no<br />

matter what the level of aggregate demand.<br />

A socialist economy, being both free of<br />

antagonism (so that real wages can be raised)<br />

and free of anarchy (so that some firms’ profits<br />

can be diverted to cover others’ losses), has<br />

thus a mode of functioning that makes it in<br />

principle immune to crises, caused by the<br />

deficiency of aggregate demand, which afflict<br />

capitalism.<br />

IN THE PRESENT CONTEXT<br />

So far we have discussed the inner workings<br />

of a socialist economy that is unconnected<br />

with world capitalism through trade and<br />

financial relations. Since the Soviet Union in the<br />

1930s was unconnected with world capitalism,<br />

and even later had only tenuous links, it<br />

remained actually immune to crises of<br />

aggregate demand. But what can be said of a<br />

socialist economy that is closely linked to the<br />

capitalist world through trade and financial<br />

relationships? Does such an economy<br />

continue to remain immune to crises of<br />

aggregate demand, especially those emanating<br />

from the capitalist world?<br />

In an economy where all important means of<br />

production are socially owned, the answer in<br />

principle should still be “yes”. When exports of<br />

such an economy decline, it is always open to<br />

it to raise domestic demand, either through the<br />

fiscal route suggested to capitalism by Keynes,<br />

i.e. through larger State expenditure, or through<br />

larger workers’ consumption via a rise in the<br />

real wage rate, caused by the lowering of prices<br />

for a given money wage rate, as discussed<br />

above. Since the rationale of the socialist<br />

economy’s participation in the world market is<br />

that it has generally lower prices than the<br />

capitalist world (at the prevailing exchange rate),<br />

which after all is why it is able to out-compete<br />

the capitalist countries and have burgeoning<br />

trade with them, any further lowering of its<br />

domestic prices in response to the reduced<br />

demand owing to world recession, should<br />

cause no “leakages” in the form of larger<br />

imports. Such reduction in other words should<br />

boost its own domestic demand, and, if<br />

anything, even help somewhat in countering<br />

export decline. Likewise, if it provided a larger<br />

fiscal stimulus, as China has announced it<br />

would, then the main impact of such a stimulus<br />

should be on its own domestic demand. In short<br />

the socialist weapons against crises mentioned<br />

earlier remain intact even when the socialist<br />

country has trade relations with the capitalist<br />

world.<br />

Of course switching from export production to<br />

production for the home market may take some<br />

time, during which there may be transitional<br />

unemployment, but this is very different from<br />

the unemployment encountered in capitalist<br />

countries during a crisis.<br />

The problem however may arise from a different<br />

source, namely when in the process of entering<br />

into relations with capitalist countries, the<br />

socialist economy has also accommodated<br />

within its midst a large private sector, owned<br />

by powerful capitalists from home and abroad.<br />

There would be resistance from them to the<br />

use of the standard socialist weapons against<br />

crises, just as there is resistance from<br />

capitalists in capitalist countries to the use of<br />

similar weapons, and indeed for the very same<br />

reasons. It follows in such a case that the<br />

capacity of the socialist economy to thwart a<br />

crisis arising from the deficiency of aggregate<br />

demand, depends upon the strength of the<br />

socialist State in confronting the opposition of<br />

the internal capitalists to the socialist measures<br />

against the crisis.<br />

[The author is a noted economist and<br />

Deputy Chairman of the Kerala State<br />

Planning Commission]<br />

17

News Bulletin March 2009<br />

MEDIA WATCH<br />

Life cos should focus on traditional biz for<br />

stability -Shri. T.S. Vijayan LIC Chairman.<br />

The Economic Times ;23 Feb 2009,<br />

When India Inc faced credit crunch, the only<br />

institution that had the money to invest was Life<br />

Insurance Corporation of India (LIC).<br />

With expected total premium income of over Rs<br />

1,70,000 crore for the current fiscal (FY09), the<br />

corporation is the country’s largest institutional<br />

investor.<br />

Recently, LIC helped bridge the gap between<br />

investors looking for guaranteed returns and<br />

corporates trying to raise long-term funds by<br />

launching Jeevan Aastha, a single-premium<br />

guaranteed returns policy, which mopped nearly<br />

Rs 10,000 crore.<br />

In an interview with Mayur Shetty, LIC<br />

chairman TS Vijayan explains why traditional<br />

policies are here to stay.<br />

LIC’s Jeevan Aastha has taken the market by<br />

surprise. What made you launch a guaranteed<br />

traditional product?<br />

We launched Jeevan Aastha when interest rates<br />

were falling. We were sure that rates prevailing then<br />

would be unsustainable. That’s why we decided on<br />

a single-premium product.<br />

There was also a tendency, among insurers, to bring<br />

out a capital-guaranteed product on the unit-linked<br />

platform. We thought that Jeevan Aastha would be<br />

a better alternative to capital guarantee because the<br />

product guarantees capital as well as returns.<br />

The option was to either design it on a unit-linked<br />

platform or a non-unit-linked platform. Because of<br />

the guaranteed returns, we thought it was better to<br />

launch it on the traditional platform (where<br />

investments are directed by the regulator and<br />

invested largely in debt). Since the rates prevailing<br />

then were not sustainable, we thought of keeping it<br />

open only for a short period.<br />

Has the launch helped in regaining market<br />

share?<br />

IRDA is still to come out with business figures for<br />

January. But I expect that our market share should<br />

cross 60% with Jeevan Aastha. Year-on-year, there<br />

may not be any growth in new business premium,<br />

but our total premium (new business and renewals)<br />

growth is very robust.<br />

Till January 2009, we have grown 13% with a total<br />

premium of Rs 1,09,000 crore. This shows that our<br />

conservation ratio is very high. I am not sure what<br />

these figures are for the industry since other life<br />

companies do not publish their renewal premia.<br />

Do you see the market reverting to traditional<br />

endowment policies?<br />

We have brought out another guaranteed-returns<br />

product - Jeevan Varsha - on the traditional platform.<br />

We do have our Ulip product, but it’s not doing as<br />

well as last year because of the current market<br />

condition. But there is a huge market for non-unitlinked<br />

traditional products that was vacated by<br />

private players, either for capital constraints or for<br />

some other reasons.<br />

However, I believe that a life company, which looks<br />

for stability, has to look at traditional business —<br />

both for profitability of the business and strength of<br />

the business. Once private players start making<br />

profits, I think they will also seriously promote<br />

traditional products.<br />

Internationally, the share of traditional and nontraditional<br />

is 50:50. In India, pension is just picking<br />

up. But in other countries, insurance companies have<br />

a large annuity basket for which you have to look<br />

for a large portion of fixed income. If companies do<br />

not do that, they can see wild swings, which is<br />

happening to companies, globally.<br />

But investment guidelines on traditional products<br />

would reduce your flexibility to invest... It will only<br />

help. What companies are looking for today is largely<br />

debt. There are no fresh equity issuances. Debt is<br />

what companies need today and traditional policies<br />

are able to support that.<br />

For instance, if an infrastructure company has an<br />

outlook for 15-20 years, it cannot be supported by<br />

equity, it needs long-term debt. As of today, we have<br />

enough headroom. There is also ample supply of<br />

paper. In addition to corporates, public sector banks,<br />

which are growing their business, are now issuing<br />

tier-II bonds to raise their capital adequacy.<br />

18

News Bulletin March 2009<br />

Satyam has stunned institutional investors.<br />

What are you doing to protect your investment<br />

and other exposures?<br />

With agencies working in tandem to revive the<br />

company, we are confident. Satyam is a fraud that<br />

has happened. There are two things that need to<br />

be done. First, we have to look at how to review<br />

the company and take care of investors and<br />

employees.<br />

Secondly, we also have to look at what has<br />

contributed to this and what are the early warning<br />

signals that can be caught by institutions and<br />

regulators. This is a big lesson for both. There must<br />

be some early warning signals that must be caught<br />

so that such frauds cannot be perpetrated again.<br />

What is the size of investments LIC is looking<br />

at in the current fiscal?<br />

We are targeting Rs 1,75,000 crore of total premium<br />

income for this fiscal. The figure may be slightly<br />

lower because of the slowdown. We will have<br />

around Rs 30,000-40,000 crore of investment<br />

income. Against this, there will be an outgo towards<br />

death and maturity claims. Last year, the outgo was<br />

around Rs 35,000 crore. This year, the figure will<br />

be higher. There will be some outgo towards pension<br />

annuities.<br />

But our investment income should balance the<br />

outgo. Of our investments, 25% has to be invested<br />

in G-secs, another 25% in state government bonds,<br />

15% has to go to infrastructure and the remaining<br />

35% is for other corporate investments. This would<br />

include investments in banks, etc. Equity<br />

investments may absorb around Rs 30,000 crore<br />

and we may invest more than 50% of our funds in<br />

G-secs.<br />

Our assets under management may cross around<br />

Rs 9,50,000 crore by the year end and Rs 14,00,000<br />

crore in three years.<br />

Outraged Obama goes after AIG bonus<br />

payment<br />

WASHINGTON (Reuters) - President Barack<br />

Obama sought to claw back bonuses paid to<br />

employees of insurer AIG on Monday, expressing<br />

outrage that taxpayer money was used to reward<br />

executives at the bailed-out firm.<br />

Though the insurance giant is being kept alive on a<br />

government bailout of up to $180 billion, it is now<br />

paying out $165 million in bonuses.<br />

“This is a corporation that finds itself in financial<br />

distress due to recklessness and greed,” Obama said.<br />

“Under these circumstances, it’s hard to understand<br />

how derivative traders at AIG warranted any<br />

bonuses, much less $165 million in extra pay,” he<br />

said at the White House.<br />

“How do they justify this outrage to the taxpayers<br />

who are keeping the company afloat?”<br />

Obama said he had ordered Treasury Secretary<br />

Timothy Geithner to pursue “every single legal<br />

avenue” to cancel the bonuses and a Treasury official<br />

said later it would modify a planned $30 billion capital<br />

infusion for American International Group to try to<br />

recoup the bonuses.<br />

White House spokesman Robert Gibbs said the<br />

Treasury could impose rules on the $30 billion loan<br />

facility for AIG but declined to go into specifics or<br />

spell out ways the legal avenues available to the<br />

administration to block the payments.<br />

Obama said Geithner was working on the problem.<br />

“I want everybody to be clear that Secretary<br />

Geithner’s been on the case. He’s working to resolve<br />

this matter with the new CEO, Edward Liddy, who,<br />

by the way, everybody needs to understand, came<br />

on board after the contracts that led to these bonuses<br />

were agreed to last year,” Obama said.<br />

Liddy told Geithner in a letter the insurer was legally<br />

obliged to fulfill 2008 employee retention payments<br />

but had agreed to revamp its system for future<br />

bonuses.<br />

Obama said overall financial regulatory reform was<br />

vital to ensure this did not occur again.<br />

He said the government needed “some form of<br />

resolution mechanism in dealing with troubled<br />

financial institutions, so that we’ve got greater<br />

authority to protect American taxpayers and our<br />

financial system in cases such as this.”<br />

Pausing to cough, Obama said he was “choked up<br />

with anger.”<br />

“We don’t have all the ... Regulatory power that we<br />

need. And this is something that I expect to work<br />

with Congress to deal with in the weeks and months<br />

to come.”<br />

19

News Bulletin March 2009<br />

LIC raises State Bank stake to 9.16%<br />

Friday, 13 March , 2009<br />

Mumbai: State-run Life Insurance Corp of<br />

India has raised its stake in top bank State Bank<br />

of India by 2.12 per cent to 9.16 per cent<br />

through market purchases, the state-run<br />

lender said in a stock exchange filing. LIC<br />

bought 13.46 million shares between mid<br />

November and early March, the filing showed.<br />

Last month, India’s second largest bank, ICICI<br />

Bank, said LIC had increased its stake in the<br />

private lender to 9.38 per cent.<br />

LIC hikes stake in Gail India to 9.98 pct<br />

Mumbai: Life Insurance Corporation of India has<br />

hiked its stake to 9.98 per cent in state-run Gail<br />

through open-market transaction as well as bonus<br />

allotment.<br />

In a disclosure on the Bombay Stock Exchange, Gail<br />

India said LIC has purchased over 5.92 crore shares<br />

representing two per cent stake in the company<br />

between March 21, 2007, and February 13 this year.<br />

LIC bought 7.38 crore shares worth Rs 1,132.97<br />

crore and sold 1.46 crore shares for Rs 546.77 crore,<br />

resulting in a net acquisition of 5.92 crore shares (2<br />

per cent), the filing added.<br />

Out of the 5.92 crore shares, over 3.88 crore were<br />

bonus shares, Gail added.<br />

Prior to the transactions, LIC held 7.98 per cent<br />

stake, which has increased to 9.98 per cent<br />

representing over 12.66 crore shares in Gail India.<br />

Shares of Gail India were trading at Rs 196.65, down<br />

1.75 per cent on the BSE.<br />

LIC hikes stake in IOB to 9.96 pct<br />

Mar 16, 2009<br />

Mumbai: The country’s biggest insurance service<br />

provider, LIC, has hiked its stake in Indian Overseas<br />

Bank (IOB) to 9.96 per cent after purchasing<br />

additional shares worth Rs 57.65 crore through openmarket<br />

transaction.<br />

Life Insurance Corp has purchased over 1.56 crore<br />

additional shares representing 2.86 per cent stake in<br />

the bank between February 19 and March 3, 2009,<br />

IOB said in a disclosure to the Bombay Stock<br />

Exchange.<br />

Prior to the aforesaid purchase, LIC held 7.09 per<br />

cent stake and now it holds over 5.4 crore shares<br />

representing 9.96 per cent stake in IOB.<br />

Shares of IOB were trading at Rs 44.10, up 1.85<br />

per cent on the BSE.<br />

Insurance regulator plans steps to check<br />

malpractices<br />

11 March , 2009<br />

Chennai: India’s insurance regulator now appears<br />

to be following the corporate sector’s credo - tough<br />

times are the right time to take difficult decisions.<br />

The Insurance Regulatory and Development<br />

Authority (IRDA) is drawing up plans to strictly<br />

monitor insurers’ expenses and premium charged<br />

for group and guaranteed return policies. “We are<br />

contemplating making insurers get all the payments<br />

made to a company over a threshold limit certified<br />

by an external auditor,” R. Kannan, member<br />

(actuary) of IRDA, told IANS on phone from<br />

Hyderabad. The certificate should also specify the<br />