Carnaby - H2so.com

Carnaby - H2so.com

Carnaby - H2so.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Issue 2 Q2 2013<br />

MORE THAN<br />

Smoke And<br />

Mirrors<br />

The new<br />

Wellesley<br />

hotel<br />

THE SILVER LINING<br />

A BRIGHT FUTURE<br />

FOR HMS BELFAST<br />

<strong>Carnaby</strong><br />

IT’S NOT JUST ABOUT THE SHOPS<br />

making the<br />

crossrail<br />

connection<br />

Great<br />

Portland<br />

Estates<br />

H2SO.COM 1

wel<strong>com</strong>e<br />

020<br />

Wel<strong>com</strong>e to the latest<br />

issue of 020. Over the<br />

centuries, London has<br />

moved forward in bursts of<br />

cultural and <strong>com</strong>mercial<br />

development…<br />

H2SO founding partners (l-r):<br />

David Hanrahan, Rob Hayes, Paul Smith and John Olney<br />

The Georgians expanded the city<br />

westward; the Victorians tamed<br />

the Thames and built the great<br />

public buildings that characterise<br />

so much of the Capital. The<br />

“Swinging” 1960s embodied by<br />

<strong>Carnaby</strong> Street ushered in new<br />

personal freedoms – and an<br />

explosion of development.<br />

We believe that London now<br />

stands on the verge of another<br />

great leap forward. Crossrail<br />

is emblematic of how our Capital<br />

city will be transformed during<br />

the next decade. Whether it’s the<br />

preservation of the historic or the<br />

shock of the new, we think there<br />

are many reasons to be excited<br />

about London right now.<br />

We hope you enjoy this issue of 020<br />

and would be delighted to hear<br />

any <strong>com</strong>ments you may have.<br />

“Crossrail is one of the biggest<br />

infrastructure projects in<br />

London’s history, and a vivid<br />

example of the capital’s<br />

evolution” See page 04<br />

A Crossrail tunnelling machine is lowered into place at Tottenham Court Road

Walk down <strong>Carnaby</strong> Street and around Given the retail presence in the area, it’s The broadening base of occupiers<br />

the network of streets that lie between not surprising that Shaftesbury’s retailers includes financial giant, Blackstone,<br />

Regent Street and Soho and you will find a are also strongly represented amongst which has taken space in Shaftesbury’s<br />

fantastic range of shops, restaurants and their office occupiers. Kirk reports: new 36 <strong>Carnaby</strong> Street development.<br />

bars. But what is less obvious at first sight “Our offices have always appealed to<br />

is that the area is also home to a thriving our retailers. A lot of them have office Ed Betts of H2SO – who are the leasing<br />

– and growing – office <strong>com</strong>munity.<br />

showrooms above their shops so trade agents for <strong>Carnaby</strong> offices with Cushman<br />

buyers can <strong>com</strong>e to the shop, see the & Wakefield – <strong>com</strong>ments: “For a long time<br />

The iconic <strong>Carnaby</strong> Street and the<br />

product on sale, and then go upstairs, the offices in the area were almost like a<br />

12 streets that surround it are all owned see next year’s range and discuss buying. well-kept secret, but since Shaftesbury<br />

by Shaftesbury PLC – and are home<br />

took control and began repositioning the<br />

to more than 230,000 sq ft of offices. “Retailers like the proximity because office product, it has be<strong>com</strong>e one of the<br />

If you pass through the front doors it means that buyers don’t have to most desirable areas in the West End.<br />

that punctuate the shop fronts, you will trail off somewhere else to continue<br />

find office suites on the upper floors the business conversation.”<br />

“It was always popular with the broadcast<br />

occupied by a myriad of businesses.<br />

and creative sectors but we’re now also<br />

The area has also been a preserve for film seeing it attract all types of businesses,<br />

Having transformed the <strong>Carnaby</strong> retail, post-production <strong>com</strong>panies; the most including financial occupiers, who love<br />

food and leisure offer, Shaftesbury has notable probably being Molinare. More the eclectic mix”.<br />

also carried out a quieter revolution with recently <strong>Carnaby</strong> has also attracted PR<br />

its office holdings and now has plans to <strong>com</strong>panies, financial institutions, creative Shaftesbury is focused on engendering an<br />

create more space to meet the growing agencies and the specialists that serve integrated <strong>com</strong>munity of all the businesses<br />

demand in the area.<br />

the burgeoning digital and online world. in the village.<br />

Occupiers are drawn by the buzz of the<br />

Rob Kirk from Shaftesbury who is location – and its favourable rental profile. Kirk <strong>com</strong>ments: “It’s a different estate to<br />

responsible for <strong>Carnaby</strong> Village offices<br />

anywhere else. We have the advantages<br />

<strong>com</strong>ments: “Our offices range from <strong>Carnaby</strong> rents are very <strong>com</strong>petitive of the retail and the restaurant elements<br />

150 sq ft – pretty much enough for one <strong>com</strong>pared to rents on similar space west as an area. We try to work it as a village.<br />

person – through to floors of 4,000 sq ft. of Regent Street. Top rents for new space We have our own 24/7 security. We have<br />

at <strong>Carnaby</strong> have touched £65 per sq ft our own estate cleaning; we do our own<br />

“The average floorplate is 1,300 sq ft, <strong>com</strong>pared to rents of over £100 per sq ft in Christmas decorations. We have our own<br />

but we have a multitude of small offices.” Mayfair, but the bulk of the space is currently estate managers.”<br />

let at an average rent of around £47 per sq ft.<br />

Opposite: Decorations on <strong>Carnaby</strong> Street celebrating the Rolling Stones’ 50th anniversary<br />

12 020 ISSUE 2 Q2 2 0 13 H2SO.COM 13<br />

On November 29th 2011, Phil Reed left his redevelopment of the quayside ticket offi ce leases for 75-year old warships on the Thames”.<br />

offi ce on board HMS Belfast and crossed into a café, shop, admissions area and<br />

However, there are now lease agreements in place<br />

the walkway that connected the ship to the fashionable roof-top bar. While it was hardly the which, as Reed puts it, will essentially apply as<br />

south bank of the Thames. The Imperial War circumstance in which Reed would have wanted long as the Belfast is moored on the river.<br />

Museum Director with responsibility for the to proceed with the works, he points out that<br />

warship tourist attraction was heading for a the silver lining is that it hastened work which The new £2m visitor centre was <strong>com</strong>pleted<br />

meeting in the West End, but before he had will be a long-term benefi t for the attraction. at the turn of the year and Reed is excited by<br />

reached that appointment the entire walkway<br />

the contribution it will make.<br />

he had just crossed crashed into the Thames. “The previous building was put up as a<br />

temporary structure more than 20 years ago “We wanted to redevelop to make more of it.<br />

He recalls: “We had decided to restore the and actually belonged to St Martin’s Property It will be more wel<strong>com</strong>ing to people than the old<br />

brow – most people would call it the gangplank Corporation, which has substantial ownerships structure. It’ll make clear the ship is a place to visit<br />

– which enabled visitors to get aboard from along this Southbank stretch of the Thames. – and it will help generate much needed in<strong>com</strong>e<br />

Queen’s Walk. We’d been doing restoration on<br />

to sustain the long-term future of the ship.<br />

its three separate sections and that day were “The other relevant party to getting the project<br />

working on the oldest section closest to the ship. off the ground was the Port of London Authority Although the ship is a designated National<br />

who basically control all moorings and access Museum it does not get any Government<br />

“The contractors were actually getting very points on the Thames.”<br />

funding so the Imperial War Museum has to<br />

close to fi nishing the job when someone<br />

subsidise, and the ship has got to earn its keep.<br />

inadvertently sawed through some metal Reed brought in Felix Fiennes of H2SO to After the opening of the new quayside building,<br />

work that they shouldn’t, and that was that.” negotiate new leases with St Martin’s and the the aim is for the attraction to be fully paying its<br />

PLA so that the future of Belfast’s mooring and way within fi ve to 10 years.<br />

The result was that the unique attraction was visitor centre would be secured. It was an unusual<br />

closed for six months, but the misfortune and sometimes <strong>com</strong>plex process. Fiennes points Prior to the brow collapse, around 250,000<br />

precipitated an already planned-for<br />

out: “There’s not much precedence for negotiating people had been visiting the ship each year.<br />

H2SO.COM 25<br />

Contents<br />

Re-make,<br />

re-model:<br />

a Soho story<br />

Our cover shows the December 2012 decorations<br />

on <strong>Carnaby</strong> Street which celebrated the Rolling<br />

Stones’ 50th anniversary of rocking<br />

Connecting<br />

with Crossrail<br />

Much more than<br />

smoke & mirrors<br />

04<br />

Connecting with Crossrail<br />

Great Portland Estates’ Toby Courtauld and<br />

Neil Thompson talk about what Crossrail will<br />

mean to London<br />

08<br />

Much more than smoke & mirrors<br />

London has a new luxury hotel – and one<br />

of the world’s great cigar collections.<br />

020 spoke to the man behind both<br />

12<br />

<strong>Carnaby</strong><br />

It’s not just about the shops<br />

<strong>Carnaby</strong> Street will always be associated<br />

with fashion and great shopping but it’s<br />

also home to a lot of offices<br />

CARNABYW1<br />

IT’S NOT JUST ABOUT THE SHOPS<br />

A GROWING NUMBER OF BUSINESSES ARE CHOOSING ONE OF<br />

THE WORLD’S MOST ICONIC SHOPPING LOCATIONS TO BASE<br />

THEIR OFFICES. DUNCAN LAMB FOUND OUT WHY…<br />

16<br />

Turning the tables: Graham Ruddick<br />

We turn the tables on the Daily Telegraph’s<br />

Graham Ruddick to find out what makes<br />

him tick<br />

18<br />

Re-make, re-model: a Soho story<br />

It used to be home to the Football Association<br />

but now 25 Soho Square is one of the most<br />

stylish buildings in the West End<br />

24<br />

A bright future for HMS Belfast<br />

Disaster has been turned to triumph<br />

at one of London’s most iconic<br />

tourist attractions<br />

You can’t just<br />

present a ship,<br />

you need<br />

much more<br />

interpretation<br />

Phil Reed, Museum Director<br />

HMS Belfast<br />

28<br />

London Rocks<br />

Can you name where the album covers<br />

were shot and win some fizz?<br />

30<br />

020 Real Estate<br />

News and <strong>com</strong>mentary from London’s<br />

T office market H E<br />

S I L V 30: News E R<br />

LINING Deals, developments and intelligence<br />

WHEN THE WALKWAY CONNECTING HMS BELFAST TO THE SOUTHBANK<br />

OF THE THAMES COLLAPSED, IT CLOSED THE HUGELY POPULAR TOURIST<br />

ATTRACTION FOR SIX MONTHS. BUT SOME GOOD HAS COME FROM THE<br />

CALAMITY AND SIGNALLED A BRIGHTER FUTURE FOR THE WARSHIP.<br />

The Market<br />

35: Office Agency<br />

36: Investment<br />

37: Lease Advisory<br />

33<br />

The ‘Lost Offices’ of London’s West End<br />

The latest research on the office-to-residential<br />

conversion trend<br />

2 020 Issue 2 Q2 2013 H2SO.COM 3

“We are big believers in<br />

Crossrail; it is going<br />

to be a major catalyst<br />

for change.”<br />

Toby Courtauld GPE<br />

CONNECTING<br />

CROSSRAIL<br />

Great Portland Estates is one of London’s<br />

leading property developers. It is also positioned<br />

to benefit from the biggest infrastructure<br />

project in the Capital’s history. Duncan Lamb<br />

spoke to the <strong>com</strong>pany’s chief executive and<br />

portfolio director about the importance of<br />

making the Crossrail connection.<br />

WITH<br />

When calculating the likely usage of a<br />

train or underground station, Transport<br />

for London analyses an 800-metre<br />

catchment area around each location.<br />

Great Portland Estates currently<br />

has 17 development projects either<br />

underway or planned in London and<br />

more than 80% of the floorspace that<br />

these schemes create will be within<br />

800m of a new Crossrail station.<br />

So the correlation between GPE’s<br />

3.5m sq ft development programme<br />

and the major transport benefits<br />

that Crossrail will deliver is clear.<br />

When talking to the <strong>com</strong>pany’s Chief<br />

Executive, Toby Courtauld, and its<br />

Portfolio Director, Neil Thompson, the<br />

conversation soon turns to Crossrail.<br />

Courtauld points out: “The reason we<br />

think Crossrail is so significant is not<br />

just that it will improve the Capital’s<br />

transport infrastructure but also<br />

that it will increase London’s railway<br />

capacity by 10%. That is a huge<br />

proportion. Not only is it big in terms<br />

of number of passenger movements<br />

but it’s also where those people are<br />

being taken to that’s significant.<br />

“For the first time ever you will have<br />

the situation where people are getting<br />

on trains in the outskirts of London<br />

and beyond and <strong>com</strong>ing right in to<br />

the West End. The linkage of the four<br />

main <strong>com</strong>mercial areas in London –<br />

Canary Wharf, the City, the West End<br />

and Heathrow – by a single railway is<br />

almost unique in the world. We are<br />

big believers in Crossrail; it is going<br />

to be a major catalyst for change.”<br />

Crossrail is the biggest engineering<br />

project in Europe and will connect<br />

37 stations, including Heathrow<br />

Airport and Maidenhead in the west<br />

with Canary Wharf, Abbey Wood and<br />

Shenfield in the east. Its aim is to<br />

make travelling in the region easier and<br />

quicker, and help to reduce crowding<br />

on London’s transport network. It will<br />

place an additional 1.5m people within<br />

a 45-minute <strong>com</strong>mute into London.<br />

For many years, the project seemed<br />

a pipe-dream and even when it was<br />

given the go-ahead some observers<br />

feared that the recession would<br />

curtail or <strong>com</strong>promise the scope of<br />

the scheme. However, Courtauld and<br />

Thompson have absolute confidence<br />

that it will be delivered.<br />

Six years of shrewd buying around<br />

Hanover Square – where the eastern<br />

entrance of the new Bond Street<br />

Crossrail station will be located – has<br />

seen GPE assemble a development<br />

site which will enable the <strong>com</strong>pany to<br />

build more than 200,000 sq ft of offices<br />

together with shops and apartments.<br />

Perhaps the best illustration of the<br />

potential of <strong>com</strong>bining a large scale<br />

development site in the West End in<br />

close proximity to a Crossrail station<br />

is that by March 2012, the Hanover<br />

Square holdings were the <strong>com</strong>pany’s<br />

best performing assets showing a<br />

37% uplift in value.<br />

However, work on the project will<br />

not be possible until 2015 when<br />

the Crossrail station builders are<br />

finished in the square. In the nearer<br />

term, the focus switches to another<br />

project which GPE expects to feel<br />

the Crossrail halo effect.<br />

In September 2011, the <strong>com</strong>pany<br />

paid Royal Mail £120m for a 2.3-acre<br />

site on Rathbone Place just north of<br />

Oxford Street. The site is a short walk<br />

from the new Tottenham Court Road<br />

underground/Crossrail interchange<br />

station. It came with a planning<br />

consent for a development providing<br />

380,000 sq ft of offices, residential<br />

^<br />

4 020 Issue 2 Q2 2013 H2SO.COM 5

“London does have this incredible ability to evolve but<br />

also hold on to what is special about it.” Toby Courtauld GPE<br />

Clockwise from top left / CGI of pedestrian square linking Bond Street to Hanover Square / CGI of new Tottenham Court Road entrance<br />

/ Tunnel eyes at Royal Oak Station near Paddington / Construction underway at the Dean Street ticket hall which will serve Tottenham Court Road station<br />

and retail together with substantial public<br />

realm improvements and a pedestrian<br />

square connecting Newman Street through<br />

to Rathbone Place and Charlotte Street.<br />

However, Courtauld and his team are<br />

now reworking the development vision.<br />

Neil Thompson reports: “We’ll get vacant<br />

possession in June this year and will have<br />

submitted a new planning application<br />

before that.<br />

“Demolition will be <strong>com</strong>plete in the early<br />

part of 2014, and construction takes us<br />

through to 2016. The first building should<br />

be delivered in the first half of that year.”<br />

This will be two years ahead of the 2018<br />

best-case scenario for the <strong>com</strong>pletion of<br />

Crossrail, but the duo believes that by<br />

that time the market will be alive to the<br />

benefits that Crossrail will bring. Thompson<br />

observes: “Even at this early stage, we are<br />

thinking not only about how the scheme<br />

will relate to its location but also how it<br />

will integrate with Crossrail: thinking about<br />

the pedestrian routes across the site,<br />

orientation of the buildings, etc”.<br />

In terms of its potential, Courtauld believes<br />

the area en<strong>com</strong>passing Rathbone Place<br />

and the eastern end of Oxford Street to be<br />

“the most exciting in London right now”,<br />

and is clearly aware that it presents a<br />

“placemaking” opportunity which is<br />

above and beyond any of the schemes<br />

that GPE has delivered to date.<br />

“This is a piece of land that just about<br />

everybody in the property game has looked<br />

at for as long as you can remember, and all<br />

said that one day something exciting has<br />

to happen,” he says.<br />

“It’s one of those rare opportunities: the<br />

quality of the location, the ability to take<br />

what is basically virgin land and create<br />

very high quality space off a base cost<br />

that gives you options.”<br />

The GPE Chief Executive sees what is<br />

happening in this corner of the Capital<br />

as emblematic of London’s constant<br />

reinvention.<br />

“I grew up in Asia so I’m used to seeing<br />

an environment change far more rapidly<br />

than London does, but London does have<br />

this incredible ability to evolve but also<br />

hold on to what is special about it.<br />

“It’s one of the things that people love<br />

about London – its elegance, its heritage.<br />

These are the characteristics that attract<br />

people from around the world to visit,<br />

work and live.”<br />

Homes will be a substantial <strong>com</strong>ponent<br />

of the scheme but, although the Capital’s<br />

residential market is arguably the hottest<br />

it has ever been, the developer is not<br />

getting carried away with Rathbone<br />

Place’s potential.<br />

“For us to go and chase residential<br />

values which are £3,000-£4,000 per<br />

sq ft would be the wrong thing to do,”<br />

says Thompson.<br />

“What we are looking at delivering is<br />

aimed at the mid-market bracket: making<br />

sure that we get the quality right, the<br />

layout right and the specification right,<br />

to ensure that we deliver good quality<br />

units that the market wants.”<br />

The site acquisition price reflected a<br />

base cost of £313 per sq ft which – even<br />

allowing for substantial development and<br />

infrastructure costs – should give GPE<br />

some elbow room to do something special<br />

with all the <strong>com</strong>ponent parts of the project.<br />

Courtauld does not seem fazed by the<br />

broader canvas on which Rathbone<br />

Place will be created: “We have done<br />

public realm projects on a small scale<br />

and we have also done them on a much<br />

bigger scale. A good example is the<br />

Kent House project we did near Great<br />

Titchfield Street. GPE joined forces with<br />

Westminster; both of whom put some<br />

money in to improve the experience for<br />

shoppers and restaurant users around<br />

Market Place and the immediate vicinity.<br />

“We did a similar thing in Portman Square<br />

where we joined forces with the Portman<br />

Estate, British Land and others to improve<br />

the pedestrianisation around the square.<br />

Rathbone Place will be on a different scale<br />

but it’s the same basic concept.”<br />

Continuing on the theme of partnership,<br />

he also does not rule out working with a<br />

funding partner – “it is sizeable and we<br />

may look to bring in third-party capital to<br />

help us deliver it – but before that there<br />

is much to do. You have got to start off<br />

on the right footing.”<br />

Creating major office developments within<br />

walking distance of a transport system<br />

that will carry 200m passengers every<br />

year seems like a good place to start.<br />

More information at: gpe.co.uk<br />

and crossrail.co.uk<br />

6 020 Issue 2 Q2 2013<br />

H2SO.COM 7

Much more than<br />

smoke &<br />

mirrors<br />

Is it a hotel or the most luxurious, beautifully<br />

designed cigar box in the world? 020 headed to<br />

Knightsbridge to find out more about the new<br />

Wellesley Hotel and the man behind it, Khalid Affara<br />

Khalid Affara loves creating<br />

buildings and he loves cigars.<br />

So, The Wellesley – the new hotel<br />

he has opened on Knightsbridge –<br />

is a perfect convergence of these<br />

two passions.<br />

Affara has been closely involved<br />

in the City & Country Hotels<br />

development since its inception.<br />

It provides everything you<br />

would expect and more from<br />

London’s latest five-star hotel,<br />

but at its heart is the biggest<br />

cigar humidor in the world, and<br />

in that humidor is around £1m<br />

worth of the finest cigars.<br />

It is a collection that has been<br />

painstakingly assembled by Affara<br />

through years of selective buying<br />

plus numerous visits to Cuba and<br />

the country’s producers of the<br />

finest cigars.<br />

“It is the best cigar collection ever<br />

opened up to be sold,” reports<br />

the man who is best known in the<br />

London property scene as the boss<br />

of Arab Investments. “It’s taken<br />

me longer to build up the cigar<br />

collection than it has to build the<br />

hotel,” he adds laughing.<br />

“The best cigars <strong>com</strong>e from a<br />

very specific place in Cuba called<br />

Pinar where everything is right:<br />

temperature, humidity, light,<br />

soil. People have tried taking<br />

the tobacco plants and growing<br />

them elsewhere but it just doesn’t<br />

produce the same quality.”<br />

The Wellesley humidor – a<br />

meticulously designed room<br />

with stunning high gloss lacquer<br />

walls – is able to store up 20,000<br />

“sticks” as Affara refers to cigars in<br />

collector’s parlance. The humidor<br />

provides private “keeps” – optimum<br />

environment storage in which<br />

individuals can store the cigars<br />

they have bought from the hotel.<br />

For the best and rarest cigars, you<br />

can pay around £3,000 a “stick”, but<br />

Affara believes that it is personal<br />

taste which counts rather than retail<br />

value. It was about 10 years ago that<br />

he was introduced to the pleasures<br />

of cigar smoking by a friend and<br />

soon became an aficionado.<br />

“A friend of mine smokes cigars and<br />

he kept saying ‘Have a smoke, have<br />

a smoke’. So I had a cigar and it was<br />

very enjoyable. But I understood<br />

very early on that it’s not just the<br />

actual smoking which makes it a<br />

good experience: you have got to<br />

get everything right.<br />

“You’ve got to be in a good mood,<br />

have good <strong>com</strong>pany. Perhaps you’ve<br />

just had a beautiful meal. And then<br />

at the end of the evening you find<br />

yourself saying – not just that the<br />

cigar was great – but the whole<br />

evening was great. You sit down,<br />

you talk; you laugh and have a<br />

great time.<br />

“Ultimately, you maybe don’t<br />

remember the cigar you smoked,<br />

but you remember the whole<br />

evening and how great it was.”<br />

This is very much the philosophy<br />

he is bringing to The Wellesley.<br />

“The Wellesley is something that I<br />

have been passionate about and<br />

I am putting a lot of myself into it.<br />

I wanted to create something that<br />

I can say: ‘OK this is what I am<br />

looking for in a hotel. This has got<br />

everything that I would want in<br />

a hotel’. Hopefully other people<br />

will feel the same way.”<br />

He recounts a story of being in one<br />

of the best hotels in Cannes and<br />

wanting to eat – and also smoke<br />

a cigar: “They told me I could eat<br />

in the dining room but not smoke<br />

there – or I could smoke out on the<br />

terrace but not eat!”<br />

At The Wellesley there is a terrace<br />

where you can both eat and smoke,<br />

but it would be wrong, to portray<br />

the hotel as being aimed solely at<br />

the cigar-smoking cognoscenti.<br />

The 36-bedroom hotel has been<br />

created out of the old Pizza on the<br />

Park building facing Hyde Park<br />

where, coincidentally, Affara used<br />

to have his office on an upper floor.<br />

Aside from the quality of the<br />

interior, the man behind it is<br />

most focused on the service<br />

that the hotel provides.<br />

8 020 Issue 2 Q2 2013 H2SO.COM 9

“It is the best cigar<br />

collection ever opened<br />

up to be sold. It’s taken<br />

me longer to build up the<br />

cigar collection than it<br />

has to build the hotel”<br />

“It’s a five-star hotel but I want to<br />

provide six-star service,” he states<br />

emphatically.<br />

“If people start <strong>com</strong>plaining about<br />

service then we haven’t succeeded.<br />

It’s all about the service. It’s all<br />

about what the customer wants<br />

and how we are going to keep<br />

the customer happy.<br />

“We want it to feel like home<br />

when you’re in London. Every room<br />

<strong>com</strong>es with butler service. Every<br />

room <strong>com</strong>es with its own mobile<br />

phone: people can call you at The<br />

Wellesley and we will transfer that<br />

call anywhere in the UK directly on<br />

to your phone. It’s not going to cost<br />

you anything. If you want to make<br />

a local call it’s free of charge, and if<br />

you want to make an international<br />

call well then that’s even cheaper<br />

to make it from your Wellesley<br />

phone than it is to make the call<br />

from your normal mobile phone.”<br />

Affara realises that to deliver great<br />

service you have to incentivise the<br />

staff and, for this reason, all service<br />

charges go straight to the staff and<br />

are divided between all the different<br />

areas of the hotel: front of house,<br />

restaurant, bars etc.<br />

“When you have a customer<br />

maybe staying on until 5am and<br />

the bill for the whole night is going<br />

to be £10-£15,000, the staff will go<br />

that extra mile because they know<br />

that they will directly benefit from<br />

the service charge that will <strong>com</strong>e<br />

from that.”<br />

There is fine dining in the Oval Room<br />

restaurant and music in the Jazz<br />

Room which both stay open until<br />

3am. The Crystal Bar has a “Whisky<br />

Wall”, the oldest bottle of cognac<br />

in London (dating from 1770) and<br />

a massive crystal chandelier which<br />

weighs more than 1,000lbs.<br />

The opening of The Wellesley will<br />

inevitably put Affara in the spotlight,<br />

but although he is an influential figure<br />

on the London property scene, he<br />

does not court publicity. Born in<br />

Yemen and brought up in Scotland<br />

after his family moved there when he<br />

was nine, he graduated in business<br />

studies at Nottingham University<br />

with an MBA and started in the family<br />

property investment business as soon<br />

as he left college 20 years ago.<br />

Arab Investments is well known for<br />

the large scale buying and selling<br />

of property, but it is development<br />

which Affara personally enjoys most:<br />

“I get so much more pleasure from<br />

building. So much more.<br />

“You are creating something, you are<br />

leaving something behind. You drive<br />

by one day and can say ‘I built that’.<br />

I get a much bigger buzz from that<br />

than the trading side.”<br />

London is the focus of the<br />

<strong>com</strong>pany’s activities – it has just<br />

finished projects in the Square<br />

Mile at Gracechurch Street and<br />

Gresham Street, but is also currently<br />

developing a 2m sq ft shopping mall<br />

in the centre of Berlin.<br />

The Wellesley is his second hotel<br />

development in London – he was<br />

also behind the 10 Manchester Street<br />

boutique hotel, and there are plans<br />

underway for creating a high quality,<br />

more family-orientated country clubstyle<br />

hotel at Langley in Berkshire.<br />

“It will have one of the biggest spas<br />

in the UK,” he reports. “It will be<br />

geared up for families on Sundays<br />

so you can <strong>com</strong>e and spend a<br />

whole day by the pool, have a<br />

barbecue and just relax. It’ll be<br />

a fantastic wedding location –<br />

there’s a huge fountain which will<br />

make a tremendous backdrop.”<br />

But for the moment, his whole focus<br />

is on The Wellesley which opened its<br />

doors in December ahead of a grand<br />

opening. He apologises for bringing<br />

the interview to a close but is due to<br />

be at The Wellesley: “If you want to<br />

get everything right,” he says, “you<br />

have to be <strong>com</strong>pletely involved”.<br />

More information at:<br />

www.thewellesley.co.uk<br />

“It’s a five-star hotel but I want<br />

to provide six-star service”<br />

10 020 Issue 2 Q2 2013 H2SO.COM 11

CARNABYW1<br />

It’s not just about the shops<br />

A growing number of businesses are choosing one of<br />

the world’s most iconic shopping locations to base<br />

their offices. Duncan Lamb found out why…<br />

Walk down <strong>Carnaby</strong> Street and around<br />

the network of streets that lie between<br />

Regent Street and Soho and you will find a<br />

fantastic range of shops, restaurants and<br />

bars. But what is less obvious at first sight<br />

is that the area is also home to a thriving<br />

– and growing – office <strong>com</strong>munity.<br />

The iconic <strong>Carnaby</strong> Street and the<br />

12 streets that surround it are all owned<br />

by Shaftesbury PLC – and are home<br />

to more than 230,000 sq ft of offices.<br />

If you pass through the front doors<br />

that punctuate the shop fronts, you will<br />

find office suites on the upper floors<br />

occupied by a myriad of businesses.<br />

Having transformed the <strong>Carnaby</strong> retail,<br />

food and leisure offer, Shaftesbury has<br />

also carried out a quieter revolution with<br />

its office holdings and now has plans to<br />

create more space to meet the growing<br />

demand in the area.<br />

Rob Kirk from Shaftesbury who is<br />

responsible for <strong>Carnaby</strong> Village offices<br />

<strong>com</strong>ments: “Our offices range from<br />

150 sq ft – pretty much enough for one<br />

person – through to floors of 4,000 sq ft.<br />

“The average floorplate is 1,300 sq ft,<br />

but we have a multitude of small offices.”<br />

Given the retail presence in the area, it’s<br />

not surprising that Shaftesbury’s retailers<br />

are also strongly represented amongst<br />

their office occupiers. Kirk reports:<br />

“Our offices have always appealed to<br />

our retailers. A lot of them have office<br />

showrooms above their shops so trade<br />

buyers can <strong>com</strong>e to the shop, see the<br />

product on sale, and then go upstairs,<br />

see next year’s range and discuss buying.<br />

“Retailers like the proximity because<br />

it means that buyers don’t have to<br />

trail off somewhere else to continue<br />

the business conversation.”<br />

The area has also been a preserve for film<br />

post-production <strong>com</strong>panies; the most<br />

notable probably being Molinare. More<br />

recently <strong>Carnaby</strong> has also attracted PR<br />

<strong>com</strong>panies, financial institutions, creative<br />

agencies and the specialists that serve<br />

the burgeoning digital and online world.<br />

Occupiers are drawn by the buzz of the<br />

location – and its favourable rental profile.<br />

<strong>Carnaby</strong> rents are very <strong>com</strong>petitive<br />

<strong>com</strong>pared to rents on similar space west<br />

of Regent Street. Top rents for new space<br />

at <strong>Carnaby</strong> have touched £65 per sq ft<br />

<strong>com</strong>pared to rents of over £100 per sq ft in<br />

Mayfair, but the bulk of the space is currently<br />

let at an average rent of around £47 per sq ft.<br />

The broadening base of occupiers<br />

includes financial giant, Blackstone,<br />

which has taken space in Shaftesbury’s<br />

new 36 <strong>Carnaby</strong> Street development.<br />

Ed Betts of H2SO – who are the leasing<br />

agents for <strong>Carnaby</strong> offices with Cushman<br />

& Wakefield – <strong>com</strong>ments: “For a long time<br />

the offices in the area were almost like a<br />

well-kept secret, but since Shaftesbury<br />

took control and began repositioning the<br />

office product, it has be<strong>com</strong>e one of the<br />

most desirable areas in the West End.<br />

“It was always popular with the broadcast<br />

and creative sectors but we’re now also<br />

seeing it attract all types of businesses,<br />

including financial occupiers, who love<br />

the eclectic mix”.<br />

Shaftesbury is focused on engendering an<br />

integrated <strong>com</strong>munity of all the businesses<br />

in the village.<br />

Kirk <strong>com</strong>ments: “It’s a different estate to<br />

anywhere else. We have the advantages<br />

of the retail and the restaurant elements<br />

as an area. We try to work it as a village.<br />

We have our own 24/7 security. We have<br />

our own estate cleaning; we do our own<br />

Christmas decorations. We have our own<br />

estate managers.”<br />

Opposite: Decorations on <strong>Carnaby</strong> Street celebrating the Rolling Stones’ 50th anniversary<br />

12 020 Issue 2 Q2 2013 H2SO.COM 13

“It’s a different estate<br />

to anywhere else…<br />

We try to work it as<br />

a village”<br />

Rob Kirk, Shaftesbury PLC<br />

Pictured outside 36 <strong>Carnaby</strong> Street<br />

“That feeds into how we market the offices:<br />

that it’s managed as a <strong>com</strong>munity. Whether<br />

it’s linking the retail to the restaurants, or<br />

the flats or the offices we try and make<br />

sure they are a <strong>com</strong>munity.”<br />

Anyone who works in <strong>Carnaby</strong> Village<br />

as part of a business that pays rent to<br />

Shaftesbury – whether they are a CEO or<br />

a kitchen porter – gets a loyalty privilege<br />

card which gives them 10% off in most<br />

of the shops and restaurants.<br />

“We have about 4,000 cardholders at<br />

present, but if you’re in the village there<br />

are a lot of unstated benefits which that<br />

brings. If you get a coffee in the same<br />

place every day and the staff know you,<br />

you’ll probably get the occasional freebie if<br />

you are a regular customer. That’s quite a<br />

rare thing in central London and you get it<br />

at <strong>Carnaby</strong> because of the village feel.”<br />

To suit the type of occupiers that are<br />

attracted to the area, Shaftesbury aims to<br />

keep leases flexible and straightforward. Kirk<br />

explains: “We have many inclusive leases so<br />

tenants know exactly what they have to pay<br />

to us and they don’t have a service charge<br />

to worry about. Covenant strength is not the<br />

main priority in a letting to us, unlike other<br />

property <strong>com</strong>panies, as long as we have<br />

a rent deposit. We know the businesses<br />

will <strong>com</strong>e and grow and move on and<br />

their place will be taken by others.<br />

Many leases are for five years, some<br />

with a break option after three years.<br />

He <strong>com</strong>ments: “No matter how the<br />

market improves or doesn’t, businesses<br />

still want that flexibility and you just have<br />

to reflect it in the overall terms”.<br />

Shaftesbury’s approach across all its London<br />

holdings is to engage with its occupier<br />

customers and <strong>com</strong>mit to <strong>com</strong>munication.<br />

“We are a landlord that doesn’t hide<br />

away,” says Kirk. “If you do have issues<br />

you know where we are.<br />

“Whenever we agree Heads of Terms<br />

the first thing I do is to contact the main<br />

person at the in<strong>com</strong>ing business. I drop<br />

them a quick note to say hi and that if<br />

they have any issues down the line then<br />

I’m the person to deal with. You start a<br />

relationship right then. I don’t claim that<br />

we are always going to get on with every<br />

single tenant but I like to think we can.<br />

And they know who we are if they need<br />

to talk to us.”<br />

Given the demographic of the office<br />

occupier <strong>com</strong>munity, the estate is a<br />

useful barometer of what is going on<br />

in the West End market generally.<br />

Kirk reports that 2012 was perhaps the<br />

“strangest year” that he has experienced:<br />

“From January to March we had a lot of<br />

viewings but literally no offers, nothing.<br />

Then something changed. I don’t know<br />

what – maybe the prospect of the<br />

Olympics and getting things decided<br />

before then – but suddenly every viewing<br />

was creating an offer and from March<br />

onwards we had people practically fighting<br />

over office space. That produced quicker<br />

deals and rental growth”.<br />

The project at 36 <strong>Carnaby</strong> Street which<br />

created 9,000 sq ft of new offices was the<br />

first substantial development of its kind on<br />

the estate for several years and Shaftesbury<br />

is now looking at further projects.<br />

More development to the rear of<br />

36 <strong>Carnaby</strong> Street on Kingly Street will<br />

provide another 7,000 sq ft of space<br />

while refurbishment adjacent to Kingly<br />

Court – the courtyard scheme that sits<br />

between Kingly Street and <strong>Carnaby</strong><br />

Street – will provide around 9,000 sq ft.<br />

Redevelopment of 22 Ganton Street will<br />

create a further 19,000 sq ft of offices.<br />

New offices will bring new occupiers but<br />

Kirk does not believe <strong>Carnaby</strong>’s office<br />

<strong>com</strong>munity will lose its distinctive identity.<br />

“I don’t think it will change massively to<br />

be honest. It’s Soho and it’s always had<br />

that artistic and creative feel to it and<br />

I don’t think that will change.<br />

“There will be other types of businesses<br />

who want to be alongside that energy and<br />

feed off the buzz that it generates, but<br />

you’ll always have that creative core.”<br />

More information at:<br />

carnabyoffices.<strong>com</strong> and carnaby.co.uk<br />

14 020 Issue 2 Q2 2013

Graham Ruddick has been writing about property, industry, cars and professional services<br />

at the Daily Telegraph since 2007 and is now also covering the retail sector. 020 caught<br />

up with him and turned the tables with a few choice questions…<br />

Graham Ruddick<br />

How did you get into<br />

journalism?<br />

I always wanted to be a journalist and<br />

won a place on the Telegraph graduate<br />

scheme after leaving university.<br />

Does working at the<br />

Telegraph mean you have<br />

to vote Conservative?<br />

When I joined the organisation I was<br />

told it had only one political allegiance<br />

– to the United Kingdom.<br />

First big scoop?<br />

Paul Reichmann selling out of Canary<br />

Wharf in 2009 springs to mind.<br />

What property stories<br />

get you interested?<br />

Big deals and big personalities always<br />

get us interested. But we also love a bit<br />

of history at the Telegraph, so a small<br />

deal or development can be<strong>com</strong>e a<br />

cracking story if there is a story behind<br />

the property. For example, I remember<br />

doing a piece on the former London home<br />

of John Pierpont Morgan being sold.<br />

How does the property<br />

business <strong>com</strong>pare with the<br />

other sectors you deal with?<br />

The entrepreneurialism and passion<br />

in property stands out. Compared to<br />

industry or retail, a relatively small group<br />

of people are responsible for an incredibly<br />

important and financially valuable part of<br />

the economy.<br />

Ever been tempted to get<br />

involved in a bit of <strong>com</strong>mercial<br />

property investment?<br />

Yes. Buy low, sell high: it’s easy isn’t it? I’m<br />

still looking for the right sovereign wealth<br />

fund to finance my aspirations though.<br />

Information gathering:<br />

long lunch or quick coffee?<br />

The modern demands of 24-hour<br />

journalism and the internet mean it’s<br />

increasingly a quick coffee. However,<br />

when time allows, long lunches tend<br />

to be far more valuable and enjoyable.<br />

You also write about the<br />

motor trade: what’s the<br />

best car you’ve sat behind<br />

the wheel of?<br />

Aston Martin Rapide. Once you have<br />

driven an Aston Martin on the open road it<br />

is difficult to imagine driving anything else.<br />

The Ford Focus sat at home is much less<br />

appealing these days.<br />

You write for a living:<br />

got a novel in you?<br />

I think every journalist has aspirations<br />

of writing a book at some stage in their<br />

career, but whether it would be any good<br />

is a different matter. I think I’m more<br />

likely to write a book about the history<br />

of football tactics.<br />

Ah yes, you’re a big Man<br />

United fan: time for Sir Alex<br />

to hang up his boots after the<br />

Champions League fiasco?<br />

The only person who had a Champions<br />

League fiasco was the referee. Sir Alex<br />

proved he still has the passion for the<br />

big games. There are a few more seasons<br />

in him yet.<br />

Favourite London building?<br />

The Olympic Stadium. It represents<br />

everything that is good about London and<br />

the UK. Until West Ham move in anyway.<br />

Anyone special in your life<br />

or are you wedded to work?<br />

Well, I’m single at the moment so I<br />

guess that means I’m wedded to work.<br />

I’m only 27 though.<br />

London Olympic Stadium<br />

16 020 Issue 2 Q2 2013 H2SO.COM 17

Matt Yeoman and Paul White<br />

of BuckleyGrayYeoman<br />

Re -make,<br />

re -model:<br />

a Soho story<br />

For many years, 25 Soho Square was home to the<br />

Football Association and a backdrop to TV shots<br />

of contrite footballers arriving to hear their<br />

disciplinary fate. It has now been transformed<br />

into a building which reflects the new Soho.<br />

We spoke to the architects behind the project<br />

“Soho is the original ‘creative cluster’<br />

that we now see being emulated<br />

all over London,” says Paul White<br />

as he looks out from the recently<br />

<strong>com</strong>pleted 25 Soho Square.<br />

“It is home to some of the city’s<br />

greatest creative and media<br />

<strong>com</strong>panies and offers social and<br />

cultural experiences that are second<br />

to none. When Crossrail opens, this<br />

building will be half an hour, doorto-door,<br />

from Heathrow.”<br />

White and Matt Yeoman are<br />

directors of BuckleyGrayYeoman,<br />

the architectural practice that<br />

designed Aviva Investors’<br />

<strong>com</strong>prehensive remodelling of<br />

the 43,000 sq ft office building.<br />

BGY is a refreshingly diverse<br />

practice. At a time when many<br />

architects tend to plough a single<br />

furrow, BGY prides itself on variety.<br />

On its website projects such as a new<br />

Nando’s in Dundee (unlike any other<br />

Nando’s you’ve ever seen) sit next to<br />

a business park in Warwickshire and<br />

a sleek office project in Mayfair.<br />

Yeoman explains: “The thing that<br />

gets us up in the morning is the<br />

fact that we can do a project like<br />

Soho Square or a private school<br />

or a Fred Perry store in Munich or<br />

masterplan a development in East<br />

London. We are quite a broad church<br />

and we think that has contributed<br />

to our recent success. The only<br />

<strong>com</strong>mon denominator in our work<br />

is design and the care we take on<br />

all our projects.”<br />

At 25 Soho Square, there was<br />

no blank canvas to work on. The<br />

building’s frame dates from the<br />

1920s and the legacy of the Football<br />

Association’s occupation had left it<br />

with a very corporate feel.<br />

“By the time the FA was leaving the<br />

building, Soho was changing,” says<br />

White. “It had be<strong>com</strong>e a much more<br />

buzzy place with a lot of creative<br />

businesses <strong>com</strong>ing into the area.<br />

Before we pitched for the job, we<br />

spoke to Paul Smith at H2SO who<br />

was instructed on the scheme,<br />

and it struck us that you could do<br />

something far more interesting<br />

without just lashing up the services<br />

and pretending it’s funky.<br />

“We considered each area of the<br />

building. When you’re working<br />

with an existing building you can’t<br />

just throw out ideas. Before we<br />

presented to the client we spoke<br />

to a structural engineer, a services<br />

engineer and even building control<br />

at Westminster to see what we could<br />

actually design and deliver. So when<br />

we presented they knew we’d done<br />

our homework – that it wasn’t just<br />

blue sky thinking.”<br />

18 020 Issue 2 Q2 2013 H2SO.COM 19

For many occupiers,<br />

outside space is a<br />

must-have and we<br />

have been able<br />

to provide some<br />

fantastic terraces<br />

Simon Davies of Aviva Investors<br />

<strong>com</strong>ments: “We were looking for<br />

architects who could create a design<br />

that responded to the envelope of<br />

the building, the changing nature of<br />

the location and the occupiers Soho<br />

is now attracting. We believe the<br />

collaboration between ourselves,<br />

BGY, the letting agents and the<br />

whole 25 Soho Square team has<br />

produced a building which perfectly<br />

suits the location and the market”.<br />

Framed by a huge bronze portal,<br />

the new double-height entrance<br />

to the building has given it a much<br />

more emphatic presence on the<br />

square. The raw concrete walls and<br />

terrazzo flooring of the entrance<br />

lobby leads to three new lifts and<br />

a feature staircase.<br />

The refurbishment has added floorto-ceiling<br />

glazing on the side and<br />

rear elevations, resulting in naturally<br />

lit, open internal spaces. The new<br />

design has retained elements of<br />

the existing structure, including the<br />

concrete core and brick façade,<br />

while extending the upper three<br />

floors and creating a series of<br />

four high-level outdoor terraces.<br />

The terraces are a major plus for<br />

the building. “The top floors used<br />

to be quite <strong>com</strong>promised in terms<br />

of floorplate and are now more<br />

generous with the terracing,”<br />

observes White, “For many<br />

occupiers, outside space is a<br />

must-have and we have been able<br />

to provide some fantastic terraces<br />

at the top of the building”.<br />

Paul Smith of H2SO – who are letting<br />

the building with Jones Lang LaSalle<br />

– reports: “The contemporary feel of<br />

the remodelled building – using raw<br />

materials in a refined way – seems<br />

to have hit the nail on the head for<br />

occupiers looking for something<br />

different to suspended ceilings and<br />

inset lighting.<br />

“The exposed, ceiling-mounted, air<br />

conditioning has been a major factor<br />

in this respect. Not only does it<br />

provide the necessary cooling, it also<br />

brings form and volume to what could<br />

have been just functional space.”<br />

The BGY duo are confident that what<br />

has been created is in step with the<br />

new Soho. White observes: “25 Soho<br />

Square is the right building, in the<br />

right place, and there’s never been a<br />

better time to do business in Soho.”<br />

Regular business travel outside<br />

London and across Europe gives<br />

him an opportunity to assess the<br />

Capital and its changing identity:<br />

“The thing that never ceases to<br />

amaze me is how design conscious<br />

and focused London is in terms<br />

of what it produces. There is a real<br />

hunger for well-designed products<br />

and buildings”.<br />

He believes that projects like 25<br />

Soho Square – the transformation<br />

of an existing building – is going to<br />

be<strong>com</strong>e an important strand of what<br />

is happening to London’s property<br />

landscape.<br />

“The shift I have seen in the last five<br />

years or so is this move away from<br />

new build and towards the re-use<br />

of buildings. I think that is going to<br />

be very much the theme for <strong>com</strong>ing<br />

years: looking at buildings and<br />

seeing how we can get the most out<br />

of them and how they can work.”<br />

He cites the example of BGY’s<br />

own offices in The Tea Building in<br />

Shoreditch: “It’s a beautiful, classic<br />

old warehouse building that used<br />

to house tea that is adaptable, is an<br />

interesting space to work in, and has<br />

lots of character. If you translate what<br />

we have got in this building through<br />

London then there are real pointers<br />

as to what can be achieved”.<br />

The adaptation of The Tea Building was<br />

carried out by Derwent London with<br />

whom BGY are working on one of their<br />

next projects to <strong>com</strong>plete: the Buckley<br />

Building in Clerkenwell. The building’s<br />

name <strong>com</strong>memorates Richard Buckley<br />

– one of BGY’s founders who died<br />

tragically while on holiday in 2008.<br />

The development involves the<br />

conversion of former factory units and<br />

will provide 100,000 sq ft of offices<br />

when it <strong>com</strong>pletes in the Spring.<br />

BGY’s ability to adapt and transform<br />

existing buildings – to “re-make,<br />

re-model” – looks like it will be<br />

keeping them busy in the Capital<br />

for some time.<br />

More information at: ASOHOSTORY.COM<br />

and BUCKLEYGRAYYEOMAN.COM<br />

20 020 Issue 2 Q2 2013<br />

H2SO.COM 21

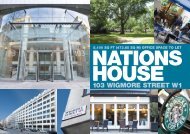

DOING A GREAT DEAL<br />

CENTRAL LONDON OFFICE SPECIALISTS<br />

Leasing / Investment / development / Lease Advisory<br />

Some 2012 HIGHLIGHTS<br />

23 Savile Row, W1<br />

The Wellington Portfolio, WC2<br />

1 Berkeley Street, W1<br />

Bond Street House, W1<br />

Client: Quantum Global Real<br />

Estate Fund / LaSalle<br />

Investment Management<br />

Client: CBRE Global Investors<br />

Sold for £43m<br />

Client: Crosstree<br />

Lease advisory<br />

Client: iii<br />

Lease advisory<br />

Acquired for £218m<br />

33 Margaret Street, W1<br />

Client: Great Portland Estates<br />

95,000 sq ft pre-let<br />

Whitehall Place, SW1<br />

Client: The Crown Estate<br />

Sold for £20m<br />

The Soho Portfolio, W1<br />

Client: Noved Investments<br />

Sold for £74m<br />

Commodity Quay,<br />

St Katharine Docks, E1<br />

Client: Max Property Group<br />

Leasing agents<br />

for 130,000 sq ft<br />

Oliver’s Yard, EC1<br />

Rathbone Place, W1<br />

Crane Building, SE1<br />

33 Jermyn Street, SW1<br />

Client: Derwent London<br />

Client: Great Portland Estates<br />

Client: Dorrington<br />

Client: Standard Life<br />

Lease advisory<br />

Design development and<br />

leasing agents for 180,000 sq ft<br />

Design development and leasing<br />

agents for 50,000 sq ft<br />

Lease advisory<br />

30 Berkeley Square, W1<br />

Client: PRUPIM<br />

50,000 sq ft sale agreed<br />

Devonshire House,<br />

1 Mayfair Place, W1<br />

Client: Offshore Unit Trust<br />

Leasing agents for 80,000 sq ft<br />

Western House,<br />

99 Great Portland Street, W1<br />

Client: Scottish Widows<br />

Investment Partnership<br />

Acquired for £12m<br />

7 Howick Place, SW1<br />

Client: Estate4<br />

Sold for £54m<br />

Minerva House, SE1<br />

Client: Great Portland Estates<br />

Acquired for £60m<br />

1-5 Poland Street, W1<br />

Client: PRUPIM<br />

27,000 sq ft let and sold<br />

for £30.4m<br />

French Railways House/<br />

50 Jermyn Street, SW1<br />

Client: Great Portland Estates<br />

Acquired for £39m<br />

Johnson Building, EC1<br />

Client: Derwent London<br />

Lease advisory<br />

40 Grosvenor Place, SW1<br />

Client: Grosvenor London<br />

Office Fund<br />

50% share sold for £107m<br />

Rex House,<br />

Regent Street, SW1<br />

Client: The Crown Estate<br />

Lease advisory<br />

Kinnaird House<br />

Pall Mall East, SW1<br />

Client: Delek<br />

Lease advisory<br />

12-18 Grosvenor Gardens, SW1<br />

Client: LVMH<br />

30,000 sq ft acquired<br />

22 020 Issue 2 Q2 2013<br />

H2SO.COM 23

THE<br />

SILVER<br />

LINING<br />

When the walkway connecting HMS Belfast to the southbank<br />

of the Thames collapsed, it closed the hugely popular tourist<br />

attraction for six months. But some good has <strong>com</strong>e from the<br />

calamity and signalled a brighter future for the warship.<br />

You can’t just<br />

present a ship,<br />

you need<br />

much more<br />

interpretation<br />

Phil Reed, Museum Director<br />

HMS Belfast<br />

On November 29th 2011, Phil Reed left his<br />

office on board HMS Belfast and crossed<br />

the walkway that connected the ship to the<br />

south bank of the Thames. The Imperial War<br />

Museum Director with responsibility for the<br />

warship tourist attraction was heading for a<br />

meeting in the West End, but before he had<br />

reached that appointment the entire walkway<br />

he had just crossed crashed into the Thames.<br />

He recalls: “We had decided to restore the<br />

brow – most people would call it the gangplank<br />

– which enabled visitors to get aboard from<br />

Queen’s Walk. We’d been doing restoration on<br />

its three separate sections and that day were<br />

working on the oldest section closest to the ship.<br />

“The contractors were actually getting very<br />

close to finishing the job when someone<br />

inadvertently sawed through some metal<br />

work that they shouldn’t, and that was that.”<br />

The result was that the unique attraction was<br />

closed for six months, but the misfortune<br />

precipitated an already planned-for<br />

redevelopment of the quayside ticket office<br />

into a café, shop, admissions area and<br />

fashionable roof-top bar. While it was hardly the<br />

circumstance in which Reed would have wanted<br />

to proceed with the works, he points out that<br />

the silver lining is that it hastened work which<br />

will be a long-term benefit for the attraction.<br />

“The previous building was put up as a<br />

temporary structure more than 20 years ago<br />

and actually belonged to St Martin’s Property<br />

Corporation, which has substantial ownerships<br />

along this Southbank stretch of the Thames.<br />

“The other relevant party to getting the project<br />

off the ground was the Port of London Authority<br />

who basically control all moorings and access<br />

points on the Thames.”<br />

Reed brought in Felix Fiennes of H2SO to<br />

negotiate new leases with St Martin’s and the<br />

PLA so that the future of Belfast’s mooring and<br />

visitor centre would be secured. It was an unusual<br />

and sometimes <strong>com</strong>plex process. Fiennes points<br />

out: “There’s not much precedence for negotiating<br />

leases for 75-year old warships on the Thames”.<br />

However, there are now lease agreements in place<br />

which, as Reed puts it, will essentially apply as<br />

long as the Belfast is moored on the river.<br />

The new £2m visitor centre was <strong>com</strong>pleted<br />

at the turn of the year and Reed is excited by<br />

the contribution it will make.<br />

“We wanted to redevelop to make more of it.<br />

It will be more wel<strong>com</strong>ing to people than the old<br />

structure. It’ll make clear the ship is a place to visit<br />

– and it will help generate much needed in<strong>com</strong>e<br />

to sustain the long-term future of the ship.<br />

Although the ship is a designated National<br />

Museum it does not get any Government<br />

funding so the Imperial War Museum has to<br />

subsidise, and the ship has got to earn its keep.<br />

After the opening of the new quayside building,<br />

the aim is for the attraction to be fully paying its<br />

way within five to 10 years.<br />

Prior to the brow collapse, around 250,000<br />

people had been visiting the ship each year.<br />

H2SO.COM 25

Under Reed’s management, it has been<br />

transformed from a rather static exhibit to a<br />

much more interactive, interpretive experience.<br />

“We are trying to enliven the ship because<br />

people’s expectations of museum attractions<br />

have changed. You can’t just present a ship,<br />

you need much more interpretation.”<br />

Younger visitors can now do the “Kip-on-aship”<br />

overnight stays on the Belfast. There are<br />

interactive screens dotted around the ship and a<br />

new Gun Turret Experience. Reed is <strong>com</strong>mitted<br />

to improvements that will make the ship <strong>com</strong>e<br />

alive to visitors but not cheapen its history or<br />

the memory of those who served on the ship.<br />

HMS Belfast was launched on St Patrick’s Day<br />

in 1938. A “Town” class warship whose first<br />

active service was to form part of the blockade<br />

against the German Navy after war broke out in<br />

1939, the ship had an early success capturing<br />

a disguised German vessel which was trying<br />

to return with reservists from Brazil. Shortly<br />

afterward, she struck a mine and broke her keel.<br />

Long repairs were necessary but the ship was<br />

refitted, returned to action and was involved in the<br />

sinking of the German battleship Scharnhorst, D-Day<br />

landings, and the war in the Far East against Japan.<br />

The ship was in active service for a further<br />

20 years including action in the Korean War<br />

before being de<strong>com</strong>missioned in 1963.<br />

By the late 1960s, she was threatened with<br />

being broken up before a private trust led by<br />

Rear Admiral Sir Morgan Morgan-Giles<br />

successfully campaigned for its preservation.<br />

Since 1971, it has been permanently moored<br />

on the Thames in the shadow of Tower Bridge.<br />

Phil Reed has been with the Imperial War<br />

Museum for more than 30 years and was closely<br />

involved in the development of the Churchill War<br />

Rooms in Whitehall as a major attraction. He took<br />

over responsibility for the Belfast two years ago<br />

and the initial priority was maintenance of the<br />

ship’s fabric.<br />

“The ship needs a lot of work. Its active service<br />

means that on many occasions it had to be<br />

quickly patched up to get back into action so<br />

there’s been quite a few ad hoc repairs along<br />

the way: if you look at the funnels, an awful lot<br />

of what you see is filler.<br />

“Just the basic maintenance is pretty onerous.<br />

We are looking to paint the ship’s starboard<br />

side which faces the city at the moment and<br />

are looking for a sponsor because the cost is<br />

about £75,000.”<br />

With regard to the visitor experience, the main<br />

focus is giving people an impression of what it<br />

must have been like to serve and live on board<br />

in peace time and in periods of extreme danger.<br />

While some tourist attractions were disappointed<br />

by failure of the Olympics to generate more<br />

visitors, Reed believes there will be more of a<br />

slow-burn effect which will see the benefits<br />

<strong>com</strong>e through in 2013 and beyond.<br />

“I think most of the new visitor flow will <strong>com</strong>e<br />

this year. It wasn’t really likely that people would<br />

<strong>com</strong>e when hotel prices were stratospheric<br />

and the perception was it would be difficult to<br />

get around London, but the games have been<br />

a great advertisement for the City. Everybody<br />

is expecting a big bounce back this year in<br />

tourism. For the Belfast, my aim would be to<br />

get attendance up to 350,000 and beyond.”<br />

As the number of people who served in the<br />

Second World War dwindles, the Imperial War<br />

Museum faces the task of maintaining the<br />

relevance of its museums – including HMS<br />

Belfast – and <strong>com</strong>municating an understanding<br />

of what they represent.<br />

However, Reed believes that in meeting that<br />

challenge the IWM has a major ally: the popularity<br />

of genealogy.<br />

“It was a concern of the war museum some years<br />

ago that the more remote the major conflicts<br />

became, the less interest there would be from<br />

the public because they couldn’t relate to them.<br />

“However, in fact if anything it has <strong>com</strong>e<br />

the other way round because there has been<br />

a huge growth in researching family history.<br />

For a growing number of people, the further<br />

they get from events the more they want to<br />

know about them.<br />

“Millions of people in the UK have relatives who<br />

were involved in some way in the Second and<br />

probably the First World War, and many of them<br />

want to see how grandad, great grandad or<br />

whoever served in the Navy and how they lived.”<br />

HMS Belfast is an eloquent reminder of Britain<br />

in times of war and peace and is an essential<br />

visit if you want to understand the realities of<br />

serving in a navy warship.<br />

Reed’s enthusiasm for the ship is huge and when<br />

he speaks about the relationship that sailors have<br />

with their ships it is clear he could be speaking<br />

about himself.<br />

“People who serve in the Navy love their ships,<br />

they really do,” he says “The old saying was that<br />

a sailor’s ship was his mistress and that they<br />

often put them ahead of their wives.<br />

“I don’t know about that, but I can see why they<br />

say it. You do get wedded to them in a way.”<br />

More information at: IWM.ORG.UK<br />

“There’s not much<br />

precedence for<br />

negotiating leases<br />

for 75-year old<br />

warships on<br />

the Thames<br />

Felix Fiennes, H2SO<br />

26 020 Issue 2 Q2 2013<br />

H2SO.COM 27

COMPETITION<br />

LONDON<br />

ROCKS<br />

The Beatles set a trend for using<br />

London as a backdrop for album<br />

covers when they were pictured<br />

striding across a zebra crossing<br />

on Abbey Road.<br />

AS VINYL BECOMES HIP ONCE AGAIN,<br />

CAN YOU NAME THE PLACES IN LONDON<br />

FEATURED IN THE ICONIC ALBUM<br />

COVERS OPPOSITE?<br />

IF YOU THINK YOU KNOW the answers,<br />

EMAIL DUNCAN.LAMB@H2SO.COM<br />

THERE’S A MAGNUM OF CHAMPAGNE<br />

FOR THE FIRST NAME OUT OF<br />

THE EDITOR’S HAT.<br />

*Closing date for entries: May 31, 2013<br />

28 020 Issue 2 Q2 2013<br />

H2SO.COM 29

020 Real Estate<br />

020 Real<br />

Estate<br />

AS THE BOUNDARIES BETWEEN<br />

COMMERCIAL AND RESIDENTIAL<br />

PROPERTY CONTINUE TO BLUR,<br />

WE TAKE A LOOK AT WHAT’S<br />

HAPPENING IN THE CENTRAL<br />

LONDON PROPERTY MARKET.<br />

P30-32<br />

News<br />

º TAG takes Poland Street<br />

º Savile Row buy is largest<br />

2012 West End deal<br />

º Auctioneer swoops IN<br />

Berkeley Square<br />

º Soho sells at 4.5%<br />

º Government exit lines<br />

up residential scheme<br />

º Investors <strong>com</strong>pete for<br />

Whitehall freehold<br />

º REVIEW SIGNALS RENT UPLIFT<br />

P33-34<br />

THE ‘LOST OFFICES’ OF<br />

LONDON’S WEST END<br />

a unique perspective on<br />

the office-to-residential<br />

conversion trend in<br />

central London<br />

p35<br />

THE market: OFFICE AGENCY<br />

p36<br />

THE market: investment AGENCY<br />

p37<br />

THE market: lease Advisory<br />

& Asset Management<br />

30 020 Issue 2 Q2 2013<br />

TAG takes<br />

Poland<br />

Street<br />

Tag Worldwide Group and its parent<br />

<strong>com</strong>pany, Williams Lea, are moving<br />

their London office to 1-5 Poland<br />

Street in Soho.<br />

The 27,000 sq ft building was<br />

acquired as a development<br />

opportunity by PRUPIM on behalf<br />

of its M&G Property Portfolio.<br />

A <strong>com</strong>prehensive refurbishment<br />

was <strong>com</strong>pleted last summer.<br />

Williams Lea has taken a 15-year<br />

lease on the building with a break<br />

option at the tenth year and will pay<br />

an initial rent of £1.56m per year,<br />

after an 18-month rent-free period.<br />

The initial rent equates to £57 per<br />

sq ft on average or £65 per sq ft<br />

on the best space.<br />

The rent on the ground floor retail<br />

unit is £181,000 per year and will be<br />

subject to an additional 24-month<br />

rent-free period.<br />

PRUPIM Investment Management<br />

Director, Michael Wood,<br />

<strong>com</strong>mented: “Williams Lea and<br />

Tag are market leaders in their<br />

respective fields of corporate<br />

information solutions and creative<br />

marketing design and production.<br />

Their decision to <strong>com</strong>e to Poland<br />

Street is a strong endorsement of both<br />

the quality of the building and also of<br />

Soho as a London office location”.<br />

H2SO advised PRUPIM on the<br />

leasing of the building and also<br />

advised on the subsequent sale<br />

of the building for £30.4m.<br />

Savile Row buy<br />

is largest 2012<br />

West End deal<br />

Auctioneer swoops<br />

IN Berkeley Square<br />

The £218m acquisition of 23 Savile Row by Plaza<br />

Global Real Estate Partners was the largest 2012<br />

office investment transaction in London’s West End.<br />

Plaza was advised in the purchase by H2SO and<br />

is a joint venture between LaSalle Investment<br />

Management and Quantum Global Real Estate.<br />

The venture is targeting predominantly core real<br />

estate assets: quality long-term investments in<br />

excess of $100 million located in major mature real<br />

estate markets around the world. Initial focus is<br />

expected to be on Australia, France, Germany,<br />

the United Kingdom and the United States.<br />

H2SO partner, John Olney, <strong>com</strong>mented: “23 Savile<br />

Row is one of the best office buildings in London’s<br />

West End. The interest it provoked when it came<br />

to the market is testament to the depth of investor<br />

demand that is currently focused on the West End”.<br />

Art auctioneer, Phillips, is to move to a new London<br />

headquarters at 30 Berkeley Square.<br />

The auctioneer’s parent <strong>com</strong>pany has acquired<br />

PRUPIM’s long leasehold interest in the entire building.<br />

Paul Smith of H2SO – who advised PRUPIM –<br />

<strong>com</strong>ments: “Buildings on Berkeley Square have<br />

always been among the key indicators for the West<br />

End prime market. When PRUPIM announced its plans<br />

for a new 52,000 sq ft office scheme at the building,<br />

there was huge interest from across the market.<br />

“The high-value art sector – whether represented<br />

by galleries or, in this case, an auction house – has<br />

be<strong>com</strong>e increasingly influential in the West End<br />

market and this acquisition is an example of that<br />

continuing trend.”<br />

H2SO.COM 31

020 Real Estate<br />

RESEARCH: OFFICES-TO-RESIDENTIAL<br />

Soho sells at 4.5%<br />

A 13,000 sq ft office and residential property<br />

in the heart of London’s Soho has been sold<br />

to DTZ Investment Management for £11.275m<br />

at a yield of 4.53%.<br />

The building at 22 Soho Square <strong>com</strong>prises<br />

offices on lower ground, ground and five upper<br />

floors with two apartments on the sixth and<br />

seventh floors. It is multi-let on leases with<br />

expiries between 2014 and 2021, and currently<br />

produces rental in<strong>com</strong>e of £540,000 pa.<br />

The investment was sold by RoebuckCapital on<br />

behalf of Moneypenny Limited, a <strong>com</strong>pany which<br />

owns a portfolio of <strong>com</strong>mercial properties and<br />

which was acquired in 2012 by the Stobart Group.<br />

Roebuck’s Nick Rhodes <strong>com</strong>ments: “We are<br />

delighted to achieve a price which reflects a<br />

premium of over 16% from the purchase price by<br />

Stobart in early 2012. This deal is testament to the<br />

current strength of the central London market”.<br />

H2SO acted for Roebuck Capital.<br />

Whitehall<br />