The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

The Inflation Cycle of 2002 to 2015 - Uhlmann Price Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industrial Portfolio Strategy<br />

<strong>The</strong> <strong>Inflation</strong> <strong>Cycle</strong> <strong>of</strong> <strong>2002</strong> <strong>to</strong> <strong>2015</strong> ⎯ April 19, <strong>2002</strong> -32- Legg Mason Wood Walker, Inc.<br />

ects that China will have 349 million people aged 35 <strong>to</strong> 49. In addition <strong>to</strong> economic growth implications, we<br />

believe that China is a developing country with a greater propensity <strong>to</strong> consume raw materials and foreign<br />

capital. This situation may aggravate the U.S. current account deficit in the coming years by reducing the<br />

succor provided by the capital account surplus, and weakening the U.S. dollar, in our view.<br />

<strong>The</strong> Commodity <strong>Price</strong> Sensitivity <strong>of</strong> the U.S. Economy<br />

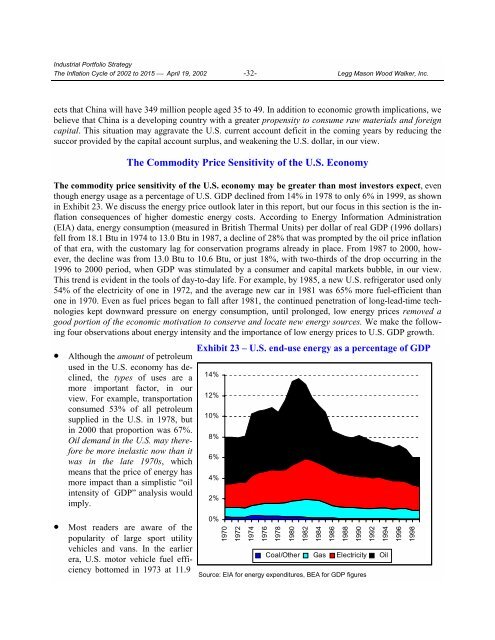

<strong>The</strong> commodity price sensitivity <strong>of</strong> the U.S. economy may be greater than most inves<strong>to</strong>rs expect, even<br />

though energy usage as a percentage <strong>of</strong> U.S. GDP declined from 14% in 1978 <strong>to</strong> only 6% in 1999, as shown<br />

in Exhibit 23. We discuss the energy price outlook later in this report, but our focus in this section is the inflation<br />

consequences <strong>of</strong> higher domestic energy costs. According <strong>to</strong> Energy Information Administration<br />

(EIA) data, energy consumption (measured in British <strong>The</strong>rmal Units) per dollar <strong>of</strong> real GDP (1996 dollars)<br />

fell from 18.1 Btu in 1974 <strong>to</strong> 13.0 Btu in 1987, a decline <strong>of</strong> 28% that was prompted by the oil price inflation<br />

<strong>of</strong> that era, with the cus<strong>to</strong>mary lag for conservation programs already in place. From 1987 <strong>to</strong> 2000, however,<br />

the decline was from 13.0 Btu <strong>to</strong> 10.6 Btu, or just 18%, with two-thirds <strong>of</strong> the drop occurring in the<br />

1996 <strong>to</strong> 2000 period, when GDP was stimulated by a consumer and capital markets bubble, in our view.<br />

This trend is evident in the <strong>to</strong>ols <strong>of</strong> day-<strong>to</strong>-day life. For example, by 1985, a new U.S. refrigera<strong>to</strong>r used only<br />

54% <strong>of</strong> the electricity <strong>of</strong> one in 1972, and the average new car in 1981 was 65% more fuel-efficient than<br />

one in 1970. Even as fuel prices began <strong>to</strong> fall after 1981, the continued penetration <strong>of</strong> long-lead-time technologies<br />

kept downward pressure on energy consumption, until prolonged, low energy prices removed a<br />

good portion <strong>of</strong> the economic motivation <strong>to</strong> conserve and locate new energy sources. We make the following<br />

four observations about energy intensity and the importance <strong>of</strong> low energy prices <strong>to</strong> U.S. GDP growth.<br />

• Although the amount <strong>of</strong> petroleum<br />

used in the U.S. economy has declined,<br />

the types <strong>of</strong> uses are a<br />

more important fac<strong>to</strong>r, in our<br />

view. For example, transportation<br />

consumed 53% <strong>of</strong> all petroleum<br />

supplied in the U.S. in 1978, but<br />

in 2000 that proportion was 67%.<br />

Oil demand in the U.S. may therefore<br />

be more inelastic now than it<br />

was in the late 1970s, which<br />

means that the price <strong>of</strong> energy has<br />

more impact than a simplistic “oil<br />

intensity <strong>of</strong> GDP” analysis would<br />

imply.<br />

Exhibit 23 – U.S. end-use energy as a percentage <strong>of</strong> GDP<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

• Most readers are aware <strong>of</strong> the<br />

popularity <strong>of</strong> large sport utility<br />

vehicles and vans. In the earlier<br />

era, U.S. mo<strong>to</strong>r vehicle fuel efficiency<br />

bot<strong>to</strong>med in 1973 at 11.9 Source: EIA for energy expenditures, BEA for GDP figures<br />

0%<br />

1970<br />

1972<br />

1974<br />

1976<br />

1978<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1992<br />

1994<br />

1996<br />

Coal/Other Gas Electricity Oil<br />

1998