Notes to the consolidated financial statements - NLMK Group

Notes to the consolidated financial statements - NLMK Group

Notes to the consolidated financial statements - NLMK Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>consolidated</strong><br />

<strong>financial</strong> <strong>statements</strong> continued<br />

as at and for <strong>the</strong> years ended December 31, 2008, 2007 and 2006<br />

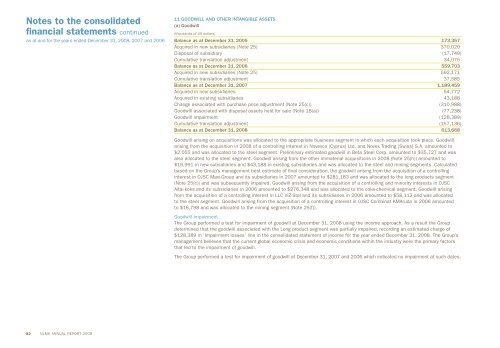

11 GOODWILL AND OTHER INTANGIBLE ASSETS<br />

(a) Goodwill<br />

(thousands of US dollars)<br />

Balance as at December 31, 2005 173,357<br />

Acquired in new subsidiaries (Note 25) 370,020<br />

Disposal of subsidiary (17,749)<br />

Cumulative translation adjustment 34,075<br />

Balance as at December 31, 2006 559,703<br />

Acquired in new subsidiaries (Note 25) 592,171<br />

Cumulative translation adjustment 37,585<br />

Balance as at December 31, 2007 1,189,459<br />

Acquired in new subsidiaries 54,772<br />

Acquired in existing subsidiaries 43,188<br />

Change associated with purchase price adjustment (Note 25(c)) (310,988)<br />

Goodwill associated with disposal assets held for sale (Note 18(a)) (77,238)<br />

Goodwill impairment (128,389)<br />

Cumulative translation adjustment (157,136)<br />

Balance as at December 31, 2008 613,668<br />

Goodwill arising on acquisitions was allocated <strong>to</strong> <strong>the</strong> appropriate business segment in which each acquisition <strong>to</strong>ok place. Goodwill<br />

arising from <strong>the</strong> acquisition in 2008 of a controlling interest in Novexco (Cyprus) Ltd. and Novex Trading (Swiss) S.A. amounted <strong>to</strong><br />

$2,055 and was allocated <strong>to</strong> <strong>the</strong> steel segment. Preliminary estimated goodwill in Beta Steel Corp. amounted <strong>to</strong> $35,727 and was<br />

also allocated <strong>to</strong> <strong>the</strong> steel segment. Goodwill arising from <strong>the</strong> o<strong>the</strong>r immaterial acquisitions in 2008 (Note 25(h)) amounted <strong>to</strong><br />

$16,991 in new subsidiaries and $43,188 in existing subsidiaries and was allocated <strong>to</strong> <strong>the</strong> steel and mining segments. Calculated<br />

based on <strong>the</strong> <strong>Group</strong>’s management best estimate of final consideration, <strong>the</strong> goodwill arising from <strong>the</strong> acquisition of a controlling<br />

interest in OJSC Maxi-<strong>Group</strong> and its subsidiaries in 2007 amounted <strong>to</strong> $281,183 and was allocated <strong>to</strong> <strong>the</strong> long products segment<br />

(Note 25(c)) and was subsequently impaired. Goodwill arising from <strong>the</strong> acquisition of a controlling and minority interests in OJSC<br />

Altai-koks and its subsidiaries in 2006 amounted <strong>to</strong> $276,348 and was allocated <strong>to</strong> <strong>the</strong> coke-chemical segment. Goodwill arising<br />

from <strong>the</strong> acquisition of a controlling interest in LLC VIZ-Stal and its subsidiaries in 2006 amounted <strong>to</strong> $58,112 and was allocated<br />

<strong>to</strong> <strong>the</strong> steel segment. Goodwill arising from <strong>the</strong> acquisition of a controlling interest in OJSC Combinat KMAruda in 2006 amounted<br />

<strong>to</strong> $16,798 and was allocated <strong>to</strong> <strong>the</strong> mining segment (Note 25(f)).<br />

Goodwill impairment<br />

The <strong>Group</strong> performed a test for impairment of goodwill at December 31, 2008 using <strong>the</strong> income approach. As a result <strong>the</strong> <strong>Group</strong><br />

determined that <strong>the</strong> goodwill associated with <strong>the</strong> Long product segment was partially impaired, recording an estimated charge of<br />

$128,389 in ‘Impairment losses’ line in <strong>the</strong> <strong>consolidated</strong> statement of income for <strong>the</strong> year ended December 31, 2008. The <strong>Group</strong>’s<br />

management believes that <strong>the</strong> current global economic crisis and economic conditions within <strong>the</strong> industry were <strong>the</strong> primary fac<strong>to</strong>rs<br />

that led <strong>to</strong> <strong>the</strong> impairment of goodwill.<br />

The <strong>Group</strong> performed a test for impairment of goodwill at December 31, 2007 and 2006 which indicated no impairment at such dates.<br />

82 <strong>NLMK</strong> ANNUAL REPORT 2008