credit card payments for initial term premiums - AIG.com

credit card payments for initial term premiums - AIG.com

credit card payments for initial term premiums - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Credit Card Payments <strong>for</strong> Initial Term Premiums<br />

<strong>AIG</strong> Independent Agency Group is pleased to announce that effective March 1 st 2007,<br />

we will accept <strong>credit</strong> <strong>card</strong> payment <strong>for</strong> <strong>initial</strong> <strong>premiums</strong> on <strong>term</strong> policies in all states<br />

except New York and New Jersey. Please note, this applies only to <strong>initial</strong> <strong>premiums</strong> and<br />

only to <strong>term</strong> policies, including LTG Ultra, LTG Ultra-C and ROPTerm. We will accept<br />

<strong>payments</strong> via Master<strong>card</strong>, VISA and American Express, as well as debit <strong>card</strong>s.<br />

Initial <strong>premiums</strong> can be paid via <strong>credit</strong> or debit <strong>card</strong> in conjunction with either the full life<br />

application (#AGLC100565-2006), or the <strong>term</strong>-only application (#AGLC100240-2006).<br />

In addition to the application and the other customary new business <strong>for</strong>ms, you will need<br />

to submit a <strong>credit</strong> <strong>card</strong> authorization <strong>for</strong>m (#AGLC100949) <strong>for</strong> <strong>term</strong> cases where <strong>initial</strong><br />

premium will be paid via <strong>credit</strong> <strong>card</strong>. You can obtain state-specific versions of all new<br />

business <strong>for</strong>ms, including the <strong>credit</strong> <strong>card</strong> authorization, on FastForms Web, which is<br />

accessible from our website (www.aig-iag.<strong>com</strong>).<br />

For your reference, we have attached answers to frequently asked questions about<br />

<strong>credit</strong> <strong>card</strong> premium <strong>payments</strong>, <strong>credit</strong> <strong>card</strong> processing guidelines, a sample declination<br />

letter, and a <strong>credit</strong> <strong>card</strong> authorization <strong>for</strong>m. We also attached a copy of the Limited<br />

Temporary Life Insurance Agreement (LTLIA) and the LTLIA Receipt. The LTLIA<br />

includes a <strong>com</strong>pleted and signed <strong>credit</strong> <strong>card</strong> authorization in its definition of how the<br />

<strong>initial</strong> premium can be paid.<br />

The ability to accept payment of <strong>initial</strong> <strong>term</strong> <strong>premiums</strong> via <strong>credit</strong> <strong>card</strong> represents an<br />

important addition to our new business processing capabilities. Please review these<br />

materials carefully and contact Producer Care Center 1-800-247-8837 prompt 1, prompt<br />

2 with any questions.

Using Credit Card <strong>for</strong> Initial Premium – Frequent Asked Questions<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

Question:<br />

Answer:<br />

When can the applicant use a <strong>credit</strong> <strong>card</strong> to pay the <strong>initial</strong> premium?<br />

A <strong>credit</strong> <strong>card</strong> may be used to pay <strong>initial</strong> premium <strong>for</strong> any <strong>term</strong> application,<br />

including the Ultra, LTG Ultra-C and ROPTerm products.<br />

Is <strong>credit</strong> <strong>card</strong> payment of <strong>initial</strong> <strong>term</strong> <strong>premiums</strong> allowed in all states?<br />

No, it is allowed in all states except New Jersey and New York.<br />

Which <strong>credit</strong> <strong>card</strong>s can be used?<br />

Master Card, Visa and American Express may be used.<br />

Can debit <strong>card</strong>s be used?<br />

Yes, but please do not collect and submit the client’s debit <strong>card</strong> PIN<br />

number.<br />

What do I have to do to make this happen?<br />

The applicant must <strong>com</strong>plete the Credit Card Authorization Form in<br />

duplicate, retain one copy and return the other with the application<br />

paperwork. Some important items to check:<br />

• The Credit Card Authorization must be <strong>com</strong>pletely filled out.<br />

• The Card Number must be 16 digits and valid (15 digits <strong>for</strong><br />

American Express). Please make sure the <strong>card</strong> has not expired.<br />

• The authorization must be signed by the <strong>card</strong>holder.<br />

When will the account be charged?<br />

The account will be charged when the policy is put in <strong>for</strong>ce:<br />

For applications that are issued as applied <strong>for</strong>, this will occur when issue<br />

is processed. For applications that are conditionally issued, this will occur<br />

when the delivery requirements are satisfied and the policy is put in <strong>for</strong>ce.<br />

What happens if the <strong>credit</strong> <strong>card</strong> transaction is declined?<br />

We will post a delivery requirement <strong>for</strong> the amount of <strong>initial</strong> premium<br />

due on the case and send a letter to the client. The client can then either<br />

write and submit a personal check <strong>for</strong> the full amount due or <strong>com</strong>plete<br />

another Credit Card Authorization.<br />

If a client pays the <strong>initial</strong> <strong>term</strong> premium with a <strong>credit</strong> or debit <strong>card</strong>, will the<br />

coverage be bound?<br />

Please refer to the attached LTLIA <strong>for</strong> the answer to this question.<br />

Can we also use a <strong>credit</strong> or debit <strong>card</strong> to pay on-going premium?<br />

Not at this time. Only <strong>initial</strong> <strong>premiums</strong> may be paid via <strong>credit</strong> or debit<br />

<strong>card</strong>.

Premium Processing<br />

Initial Payment with a Credit Card<br />

General Guidelines:<br />

• The Credit Card Authorization Form must be filled out <strong>com</strong>pletely<br />

□ The <strong>credit</strong> <strong>card</strong> number must be <strong>com</strong>plete and legible on the <strong>for</strong>m<br />

□ For American Express the full 15 digits must be present<br />

□ For MasterCard and Visa the full 16 digits must be present<br />

• Credit <strong>card</strong>s are accepted <strong>for</strong> <strong>com</strong>plete <strong>initial</strong> premium (amount required to put in<br />

<strong>for</strong>ce) only. Partial premium <strong>payments</strong> will not be accepted<br />

• Credit <strong>card</strong>s cannot be used <strong>for</strong> payment of permanent products<br />

• Credit <strong>card</strong>s cannot be used <strong>for</strong> payment if the application state is New Jersey or<br />

New York<br />

• The acceptable <strong>credit</strong> <strong>card</strong> brands are American Express, MasterCard, Visa or<br />

debit <strong>card</strong>s<br />

• An ongoing payment mode must be provided on the Credit Card Authorization<br />

Form<br />

• The Credit Card Authorization <strong>for</strong>m must be <strong>com</strong>pleted in duplicate – one copy<br />

<strong>for</strong> the customer and one <strong>for</strong> American General Life Insurance Company<br />

• The Credit Card Authorization <strong>for</strong>m must be signed by the <strong>credit</strong> <strong>card</strong> holder<br />

(whose name appears on the <strong>credit</strong> <strong>card</strong>)<br />

• The <strong>credit</strong> <strong>card</strong> will not be charged until the case is put in <strong>for</strong>ce<br />

• If the <strong>credit</strong> <strong>card</strong> is declined, has expired at the time of issue, or cannot be<br />

accepted:<br />

□ Amount of premium due will be based on mode noted on the application<br />

□ The case will be Conditionally Issued and <strong>initial</strong> premium will be posted<br />

as a delivery requirement<br />

□ A status requirement stating ‘<strong>credit</strong> <strong>card</strong> declined’ will be posted<br />

□ A <strong>credit</strong> <strong>card</strong> decline letter will be sent to the client

Sample<br />

Generic Decline Letter<br />

(Date)<br />

{Owner Name}<br />

{Addr 1}<br />

{Addr 2}<br />

{Addr 3}<br />

{Zip}<br />

Insured: {Insured Name}<br />

Policy Number: {Policy #}<br />

Dear {Owner Name}:<br />

We have reviewed and <strong>com</strong>pleted processing of your application <strong>for</strong> insurance with<br />

American General Life Insurance Company. At the time of application, you signed a<br />

Credit Card Authorization and requested that your <strong>initial</strong> premium be paid via <strong>credit</strong> <strong>card</strong>.<br />

However, we were not able to charge the <strong>initial</strong> premium to your <strong>credit</strong> <strong>card</strong> as requested.<br />

Consequently, no coverage is in effect.<br />

In order <strong>for</strong> coverage to take effect, we will need to collect the <strong>initial</strong> premium by check<br />

at this time. Please send a check in the amount of {$###.##} to:<br />

American General Life Insurance Company<br />

Attn: IAG Room<br />

750 W. Virginia St.<br />

Milwaukee, WI 53204<br />

Please write your policy number on the front of the check. If this check is not received<br />

within thirty (30) business days of the date of this letter, this offer will <strong>term</strong>inate.<br />

Should you have any questions, you may contact your agent.<br />

Thank you <strong>for</strong> choosing American General Life Insurance Company. We look <strong>for</strong>ward to<br />

being able to <strong>com</strong>plete this transaction and service all of your present and future<br />

insurance needs.<br />

Sincerely,<br />

American General Life Insurance Company<br />

Member of American International Group, Inc.<br />

cc: {AGENT NAME}

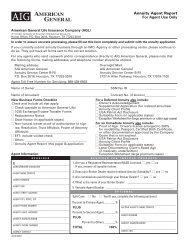

Credit Card Authorization Form<br />

American General Life Insurance Company<br />

A member <strong>com</strong>pany of American International Group, Inc.<br />

Form to be used only <strong>for</strong> the<br />

collection of <strong>initial</strong> insurance premium<br />

Please read this authorization carefully and <strong>com</strong>plete all requested items.<br />

Type of Insurance/Contract Applied For: ____________________________________________________________________<br />

Policy Number: ____________________________________________________________________________________________<br />

Name of Proposed Insured: ________________________________________________________________________________<br />

Proposed Policy Owner:____________________________________________________________________________________<br />

Cardholder Name: (exactly as it appears on the <strong>card</strong>) ________________________________________________________<br />

Cardholder Billing Address: ________________________________________________________________________________<br />

__________________________________________________________________________________________________________<br />

Credit Card Number:_________________________________________________ Expiration Date: ______________________<br />

Card Type: American Express ® MasterCard ® Visa ®<br />

Quoted Initial Premium Amount: __________________ Mode of ongoing premium <strong>payments</strong>: ____________________<br />

By signing below, I, _________________________________________________________, authorize American General Life<br />

Insurance Company ("Company") or its representative to charge my <strong>credit</strong> <strong>card</strong>, listed above. I also understand and<br />

agree that:<br />

1) If there are no changes to the policy/contract as applied <strong>for</strong> or the frequency of ongoing premium <strong>payments</strong>,<br />

the charge to my account <strong>for</strong> the Quoted Initial Premium Amount will be processed when the Company<br />

places my policy/contract in <strong>for</strong>ce.<br />

2) In the event of changes to the policy/contract as applied <strong>for</strong> or the mode of ongoing premium <strong>payments</strong>, the<br />

new in<strong>for</strong>mation will be <strong>com</strong>municated to me. If I accept the change(s), the charge to my account <strong>for</strong> the new<br />

amount will be processed when the Company places my policy/contract in <strong>for</strong>ce.<br />

I understand and agree that this transaction is subject to the acceptance by, and the <strong>term</strong>s and conditions of, the<br />

<strong>credit</strong> <strong>card</strong> <strong>com</strong>pany indicated above. I understand and agree that this Authorization Form is not a part of the<br />

application or policy/contract of insurance applied <strong>for</strong> and does not modify any <strong>term</strong>s or conditions contained<br />

therein. I understand and agree that the Company shall incur no liability if the <strong>credit</strong> <strong>card</strong> <strong>com</strong>pany dishonors any<br />

amount charged under this Authorization and may <strong>term</strong>inate this Authorization immediately if any charges are not<br />

paid. I agree to hold the Company harmless against any liability pursuant to this authorization. I understand and<br />

agree that payment of the <strong>initial</strong> premium is one of the conditions required <strong>for</strong> coverage to be placed into effect.<br />

If the charge is declined <strong>for</strong> any reason, I understand and agree that coverage will not be placed into effect.<br />

Cardholder’s Signature: X_____________________________________________________ Date: ______________________<br />

For Internal Use Only<br />

#: ________________________________________________ Date: _________________________________________________<br />

AGLC100949 Please return this copy with the application. Rev0705

Credit Card Authorization Form<br />

American General Life Insurance Company<br />

A member <strong>com</strong>pany of American International Group, Inc.<br />

Form to be used only <strong>for</strong> the<br />

collection of <strong>initial</strong> insurance premium<br />

Please read this authorization carefully and <strong>com</strong>plete all requested items.<br />

Type of Insurance/Contract Applied For: ____________________________________________________________________<br />

Policy Number: ____________________________________________________________________________________________<br />

Name of Proposed Insured: ________________________________________________________________________________<br />

Proposed Policy Owner:____________________________________________________________________________________<br />

Cardholder Name: (exactly as it appears on the <strong>card</strong>) ________________________________________________________<br />

Cardholder Billing Address: ________________________________________________________________________________<br />

__________________________________________________________________________________________________________<br />

Credit Card Number:_________________________________________________ Expiration Date: ______________________<br />

Card Type: American Express ® MasterCard ® Visa ®<br />

Quoted Initial Premium Amount: __________________ Mode of ongoing premium <strong>payments</strong>: ____________________<br />

By signing below, I, _________________________________________________________, authorize American General Life<br />

Insurance Company ("Company") or its representative to charge my <strong>credit</strong> <strong>card</strong>, listed above. I also understand and<br />

agree that:<br />

1) If there are no changes to the policy/contract as applied <strong>for</strong> or the frequency of ongoing premium <strong>payments</strong>,<br />

the charge to my account <strong>for</strong> the Quoted Initial Premium Amount will be processed when the Company<br />

places my policy/contract in <strong>for</strong>ce.<br />

2) In the event of changes to the policy/contract as applied <strong>for</strong> or the mode of ongoing premium <strong>payments</strong>, the<br />

new in<strong>for</strong>mation will be <strong>com</strong>municated to me. If I accept the change(s), the charge to my account <strong>for</strong> the new<br />

amount will be processed when the Company places my policy/contract in <strong>for</strong>ce.<br />

I understand and agree that this transaction is subject to the acceptance by, and the <strong>term</strong>s and conditions of, the<br />

<strong>credit</strong> <strong>card</strong> <strong>com</strong>pany indicated above. I understand and agree that this Authorization Form is not a part of the<br />

application or policy/contract of insurance applied <strong>for</strong> and does not modify any <strong>term</strong>s or conditions contained<br />

therein. I understand and agree that the Company shall incur no liability if the <strong>credit</strong> <strong>card</strong> <strong>com</strong>pany dishonors any<br />

amount charged under this Authorization and may <strong>term</strong>inate this Authorization immediately if any charges are not<br />

paid. I agree to hold the Company harmless against any liability pursuant to this authorization. I understand and<br />

agree that payment of the <strong>initial</strong> premium is one of the conditions required <strong>for</strong> coverage to be placed into effect.<br />

If the charge is declined <strong>for</strong> any reason, I understand and agree that coverage will not be placed into effect.<br />

Cardholder’s Signature: X_____________________________________________________ Date: ______________________<br />

AGLC100949 Applicant: Please retain this copy <strong>for</strong> your records. Rev0705

This <strong>for</strong>m must be <strong>com</strong>pleted, signed and left with the applicant.<br />

Limited Temporary Life Insurance Agreement (Agreement)<br />

THIS AGREEMENT PROVIDES A LIMITED AMOUNT OF LIFE INSURANCE COVERAGE FOR A LIMITED PERIOD<br />

OF TIME, SUBJECT TO THE TERMS AND CONDITIONS SET FORTH BELOW. SUCH INSURANCE IS NOT<br />

AVAILABLE FOR ANY RIDERS OR ACCIDENT AND/OR HEALTH INSURANCE. PLEASE FOLLOW STEPS 1 - 4.<br />

1. Check appropriate Company:<br />

American General Life The United States Life Insurance Company <strong>AIG</strong> Life Insurance<br />

Insurance Company, in the City of New York, Company,<br />

Houston, TX New York, NY Wilmington, DE<br />

In this Agreement, "Company" refers to the insurance <strong>com</strong>pany whose name is checked above, which is<br />

responsible <strong>for</strong> the obligation and payment of benefits under any policy that it may issue. No other <strong>com</strong>pany<br />

shown is responsible <strong>for</strong> such obligations or <strong>payments</strong>. In this Agreement, "Policy" refers to the Policy or<br />

Certificate applied <strong>for</strong> in the application. In this Agreement, “Proposed Insured(s)” refers to the<br />

Primary Proposed Insured under the life policy and the Other Proposed Insured under a joint life or<br />

survivorship policy, if applicable.<br />

2. Complete the following: (please print)<br />

Primary Proposed Insured ____________________________________________________________________________<br />

Other Proposed Insured ______________________________________________________________________________<br />

(applicable only <strong>for</strong> a joint life or survivorship policy)<br />

Owner (if other than Primary Proposed Insured) ________________________________________________________<br />

Modal Premium Amount Received ____________________________________________________________________<br />

Date of Policy Application ____________________________________________________________________________<br />

3. Answer the following questions:<br />

a. Has any Proposed Insured ever had a heart attack, stroke, cancer, diabetes or disorder of the<br />

immune system, or during the last two years been confined in a hospital or other health care<br />

facility or been advised to have any diagnostic test or surgery not yet per<strong>for</strong>med?<br />

b. Is any Proposed Insured age 71 or above?<br />

Yes<br />

<br />

<br />

No<br />

<br />

<br />

STOP If the correct answer to any question above is YES, or any question is answered falsely or left blank,<br />

coverage is not available under this Agreement and it is void. This <strong>for</strong>m should not be <strong>com</strong>pleted and<br />

premium may not be collected. Any collection of premium will not activate coverage under this Agreement.<br />

TERMS AND CONDITIONS OF COVERAGE UNDER THIS AGREEMENT<br />

A. Eligibility <strong>for</strong> Coverage: If the correct answer is YES to any of the questions listed above, temporary insurance<br />

is NOT available and this Agreement is void.<br />

Agents do not have authority to waive these requirements or to collect premium by any means including<br />

cash, check, bank draft authorization, <strong>credit</strong> <strong>card</strong> authorization, salary savings, government allotment, payroll<br />

deduction or any other monetary instrument if any Proposed Insured is ineligible <strong>for</strong> coverage under this<br />

Agreement.<br />

B. When Coverage Will Begin:<br />

COVERAGE WILL BEGIN WHEN ALL OF THE FOLLOWING CONDITIONS HAVE BEEN MET:<br />

• Part A of the application must be <strong>com</strong>pleted, signed and dated; and<br />

• The first modal premium must be paid; and<br />

• Part B of the application must be <strong>com</strong>pleted, signed and dated and all medical exam requirements satisfied.<br />

AGLC101431-2006 Page 1 of 2

Coverage under this Agreement will not exist until all of the conditions listed above have been met.<br />

The first modal premium will be considered paid, if one of the following valid items is submitted with<br />

Part A of the application and that payment is honored: (i) a check in the amount of the first modal premium;<br />

(ii) a <strong>com</strong>pleted and signed Automatic Bank Draft Agreement; (iii) a <strong>com</strong>pleted and signed Credit Card<br />

Authorization <strong>for</strong>m; (iv) a <strong>com</strong>pleted and signed salary savings authorization; (v) a <strong>com</strong>pleted and signed<br />

government allotment authorization; (vi) a <strong>com</strong>pleted and signed payroll deduction authorization. Temporary life<br />

insurance under this Agreement will not begin if any <strong>for</strong>m of payment submitted is not honored. All premium<br />

<strong>payments</strong> must be made payable to the Company checked above. Do not leave payee blank or make payable to<br />

the agent. The prepayment <strong>for</strong> this temporary insurance will be applied to the first premium due if the policy is<br />

issued, or refunded if the Company declines the application or if the policy is not accepted by the Owner.<br />

C. When Coverage Will End:<br />

COVERAGE UNDER THIS AGREEMENT WILL END at 12:01 A.M. ON THE EARLIEST OF THE FOLLOWING DATES:<br />

• The date the policy is delivered to the Owner or his/her agent and all amendments and delivery<br />

requirements have been <strong>com</strong>pleted;<br />

• The date the Company mails or otherwise provides notice to the Owner or his/her agent that it was unable<br />

to approve the requested coverage at the premium amount quoted and a counter offer is made by the<br />

Company;<br />

• The date the Company mails or otherwise provides notice to the Owner or his/her agent that it has declined<br />

or cancelled the application;<br />

• The date the Company mails or otherwise provides notice to the Owner or his/her agent that the application<br />

will not be considered on a prepaid basis;<br />

• The date the Company mails or otherwise provides a premium refund to the Owner or his/her agent; or<br />

• 60 calendar days from the date coverage begins under this Agreement.<br />

D. The Company will pay the death benefit amount described below to the beneficiary named in the application if:<br />

• The Company receives due proof of death that the Primary Proposed Insured (and the Other Proposed<br />

Insured if the application was <strong>for</strong> a joint life or survivorship policy) died, while the coverage under this<br />

Agreement was in effect, except due to suicide; and<br />

• All eligibility requirements and conditions <strong>for</strong> coverage under this Agreement have been met.<br />

The total death benefit amount pursuant to this Agreement and any other limited temporary life insurance<br />

agreements covering the Primary Proposed Insured (and the Other Proposed Insured if the application was <strong>for</strong><br />

a joint life or survivorship policy) will be the lesser of:<br />

• The Plan amount applied <strong>for</strong> to cover the Proposed Insured(s) under the base life policy; or<br />

• $500,000 plus the amount of any premium paid <strong>for</strong> coverage in excess of $500,000; or<br />

• If death is due to suicide, the amount of premium paid will be refunded, and no death benefit will be paid.<br />

4. Complete and sign this section:<br />

Any misrepresentation contained in this Agreement or the Receipt and relied on by the Company may be<br />

used to deny a claim or to void this Agreement. The Company is not bound by any acts or statements that<br />

attempt to alter or change the <strong>term</strong>s of this Agreement or the Receipt.<br />

I, the Owner, have received and read this Agreement and the Receipt or they were read to me and agree to<br />

be bound by the <strong>term</strong>s and conditions stated herein.<br />

Signature of Owner __________________________________________________________<br />

Signature of Primary Proposed Insured ________________________________________<br />

Date ____________________<br />

Date ____________________<br />

Signature of Other Proposed Insured (if applicable) ____________________________ Date ____________________<br />

Writing Agent Name (please print) ____________________________________________ Writing Agent # __________<br />

AGLC101431-2006 Page 2 of 2

This <strong>for</strong>m to be <strong>com</strong>pleted, detached and submitted with the signed application.<br />

Limited Temporary Life Insurance Agreement Receipt<br />

1. Check appropriate Company:<br />

American General Life The United States Life Insurance Company <strong>AIG</strong> Life Insurance<br />

Insurance Company, in the City of New York, Company,<br />

Houston, TX New York, NY Wilmington, DE<br />

In this Receipt, “Proposed Insured(s)” refers to the Primary Proposed Insured under the life policy and the<br />

Other Proposed Insured under a joint life or survivorship policy, if applicable. The “Agreement” refers to<br />

the Limited Temporary Life Insurance Agreement.<br />

2. Complete the following: (please print)<br />

Primary Proposed Insured ____________________________________________________________________________<br />

Other Proposed Insured ______________________________________________________________________________<br />

(applicable only <strong>for</strong> a joint life or survivorship policy)<br />

Owner (if other than Primary Proposed Insured) ________________________________________________________<br />

Modal Premium Amount Received ____________________________________________________________________<br />

3. Answer the following questions:<br />

a. Has any Proposed Insured ever had a heart attack, stroke, cancer, diabetes or disorder of the<br />

immune system, or during the last two years been confined in a hospital or other health care<br />

facility or been advised to have any diagnostic test or surgery not yet per<strong>for</strong>med?<br />

b. Is any Proposed Insured age 71 or above?<br />

Yes<br />

<br />

<br />

No<br />

<br />

<br />

STOP If the correct answer to any question above is YES, or any question is answered falsely or left blank,<br />

coverage is not available under the Agreement and it is void. This <strong>for</strong>m should not be <strong>com</strong>pleted and<br />

premium may not be collected. Any collection of premium will not activate coverage under the Agreement.<br />

The Company will pay the death benefit amount described below to the beneficiary named in the application if:<br />

• The Company receives due proof of death that the Primary Proposed Insured (and the Other Proposed<br />

Insured if the application was <strong>for</strong> a joint life or survivorship policy) died, while the coverage under the<br />

Agreement was in effect, except due to suicide; and<br />

• All eligibility requirements and conditions <strong>for</strong> coverage under the Agreement have been met.<br />

The total death benefit amount pursuant to the Agreement and any other limited temporary life insurance<br />

agreements covering the Primary Proposed Insured (and the Other Proposed Insured if the application was <strong>for</strong> a<br />

joint life or survivorship policy) will be the lesser of:<br />

• The Plan amount applied <strong>for</strong> to cover the Proposed Insured(s) under the base life policy; or<br />

• $500,000 plus the amount of any premium paid <strong>for</strong> coverage in excess of $500,000.<br />

If death is due to suicide, the amount of premium paid will be refunded, and no death benefit will be paid.<br />

4. Complete and sign this section:<br />

Any misrepresentation contained in the Agreement or this Receipt and relied on by the Company may be<br />

used to deny a claim or to void the Agreement. The Company is not bound by any acts or statements that<br />

attempt to alter or change the <strong>term</strong>s of the Agreement or this Receipt.<br />

I, the Owner, have received and read the Agreement and this Receipt or they were read to me and agree to<br />

be bound by the <strong>term</strong>s and conditions stated therein.<br />

Signature of Owner __________________________________________________________<br />

Signature of Primary Proposed Insured ________________________________________<br />

Date ____________________<br />

Date ____________________<br />

Signature of Other Proposed Insured (if applicable) ____________________________ Date ____________________<br />

Writing Agent Name (please print) ____________________________________________ Writing Agent # __________<br />

AGLC101432-2006