U.S. Bank Loan Capital Markets – Market Snapshot

U.S. Bank Loan Capital Markets – Market Snapshot

U.S. Bank Loan Capital Markets – Market Snapshot

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

U.S. <strong>Bank</strong> <strong>Loan</strong> <strong>Capital</strong> <strong><strong>Market</strong>s</strong> <strong>–</strong> <strong>Market</strong> <strong>Snapshot</strong><br />

April 2, 2012<br />

Peter Kline 312-325-8983 Richard Jones 312-325-8906 Kavian Boots 312-325-8723<br />

Daniel Chapman 877-673-2258 Jeffrey Duncan 704-335-4570 Michael Mahoney 314-418-2661<br />

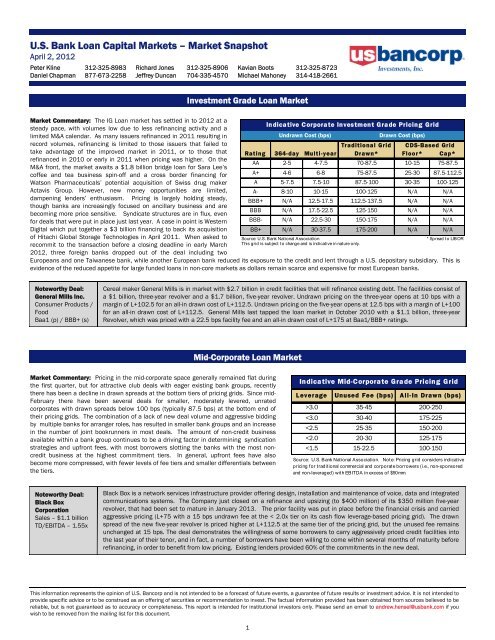

<strong>Market</strong> Commentary: The IG <strong>Loan</strong> market has settled in to 2012 at a<br />

steady pace, with volumes low due to less refinancing activity and a<br />

limited M&A calendar. As many issuers refinanced in 2011 resulting in<br />

record volumes, refinancing is limited to those issuers that failed to<br />

take advantage of the improved market in 2011, or to those that<br />

refinanced in 2010 or early in 2011 when pricing was higher. On the<br />

M&A front, the market awaits a $1.8 billion bridge loan for Sara Lee’s<br />

coffee and tea business spin-off and a cross border financing for<br />

Watson Pharmaceuticals’ potential acquisition of Swiss drug maker<br />

Actavis Group. However, new money opportunities are limited,<br />

dampening lenders’ enthusiasm. Pricing is largely holding steady,<br />

though banks are increasingly focused on ancillary business and are<br />

becoming more price sensitive. Syndicate structures are in flux, even<br />

for deals that were put in place just last year. A case in point is Western<br />

Digital which put together a $3 billion financing to back its acquisition<br />

of Hitachi Global Storage Technologies in April 2011. When asked to<br />

recommit to the transaction before a closing deadline in early March<br />

2012, three foreign banks dropped out of the deal including two<br />

Europeans<br />

Noteworthy Deal:<br />

General Mills Inc.<br />

Consumer Products /<br />

Food<br />

Baa1 (p) / BBB+ (s)<br />

Investment Grade <strong>Loan</strong> <strong>Market</strong><br />

Europeans and one Taiwanese bank, while another European bank reduced its exposure to the credit and lent through a U.S. depositary subsidiary. This is<br />

evidence of the reduced appetite for large funded loans in non-core markets as dollars remain scarce and expensive for most European banks.<br />

Cereal maker General Mills is in market with $2.7 billion in credit facilities that will refinance existing debt. The facilities consist of<br />

a $1 billion, three-year revolver and a $1.7 billion, five-year revolver. Undrawn pricing on the three-year opens at 10 bps with a<br />

margin of L+102.5 for an all-in drawn cost of L+112.5. Undrawn pricing on the five-year opens at 12.5 bps with a margin of L+100<br />

for an all-in drawn cost of L+112.5. General Mills last tapped the loan market in October 2010 with a $1.1 billion, three-year<br />

Revolver, which was priced with a 22.5 bps facility fee and an all-in drawn cost of L+175 at Baa1/BBB+ ratings.<br />

Mid-Corporate <strong>Loan</strong> <strong>Market</strong><br />

<strong>Market</strong> Commentary: Pricing in the mid-corporate space generally remained flat during<br />

the first quarter, but for attractive club deals with eager existing bank groups, recently<br />

there has been a decline in drawn spreads at the bottom tiers of pricing grids. Since mid-<br />

February there have been several deals for smaller, moderately levered, unrated<br />

corporates with drawn spreads below 100 bps (typically 87.5 bps) at the bottom end of<br />

their pricing grids. The combination of a lack of new deal volume and aggressive bidding<br />

by multiple banks for arranger roles, has resulted in smaller bank groups and an increase<br />

in the number of joint bookrunners in most deals. The amount of non-credit business<br />

available within a bank group continues to be a driving factor in determining syndication<br />

strategies and upfront fees, with most borrowers slotting the banks with the most noncredit<br />

business at the highest commitment tiers. In general, upfront fees have also<br />

become more compressed, with fewer levels of fee tiers and smaller differentials between<br />

the tiers.<br />

Noteworthy Deal:<br />

Black Box<br />

Corporation<br />

Sales <strong>–</strong> $1.1 billion<br />

TD/EBITDA <strong>–</strong> 1.55x<br />

Indicative Corporate Investment Grade Pricing Grid<br />

Undrawn Cost (bps) Drawn Cost (bps)<br />

Traditional Grid CDS-Based Grid<br />

Rating 364-day Multi-year Drawn* Floor* Cap*<br />

AA 2-5 4-7.5 70-87.5 10-15 75-87.5<br />

A+ 4-6 6-8 75-87.5 25-30 87.5-112.5<br />

A 5-7.5 7.5-10 87.5-100 30-35 100-125<br />

A- 8-10 10-15 100-125 N/A N/A<br />

BBB+ N/A 12.5-17.5 112.5-137.5 N/A N/A<br />

BBB N/A 17.5-22.5 125-150 N/A N/A<br />

BBB- N/A 22.5-30 150-175 N/A N/A<br />

BB+ N/A 30-37.5 175-200 N/A N/A<br />

Source: U.S. <strong>Bank</strong> National Association * Spread to LIBOR<br />

This grid is subject to change and is indicative in nature only.<br />

Black Box is a network services infrastructure provider offering design, installation and maintenance of voice, data and integrated<br />

communications systems. The Company just closed on a refinance and upsizing (to $400 million) of its $350 million five-year<br />

revolver, that had been set to mature in January 2013. The prior facility was put in place before the financial crisis and carried<br />

aggressive pricing (L+75 with a 15 bps undrawn fee at the < 2.0x tier on its cash flow leverage-based pricing grid). The drawn<br />

spread of the new five-year revolver is priced higher at L+112.5 at the same tier of the pricing grid, but the unused fee remains<br />

unchanged at 15 bps. The deal demonstrates the willingness of some borrowers to carry aggressively priced credit facilities into<br />

the last year of their tenor, and in fact, a number of borrowers have been willing to come within several months of maturity before<br />

refinancing, in order to benefit from low pricing. Existing lenders provided 60% of the commitments in the new deal.<br />

This information represents the opinion of U.S. Bancorp and is not intended tobeaforecastoffutureevents,aguaranteeoffutureresultsorinvestment advice. It is not intended to<br />

provide specific advice or to be construed as an offering of securities or recommendation to invest. The factual information provided has been obtained from sources believed to be<br />

reliable, but is not guaranteed as to accuracy or completeness. This report is intended for institutional investors only. Please send an email to andrew.hensel@usbank.com if you<br />

wish to be removed from the mailing list for this document.<br />

1<br />

Indicative Mid-Corporate Grade Pricing Grid<br />

Leverage Unused Fee (bps) All-In Drawn (bps)<br />

>3.0 35-45 200-250<br />

U.S. <strong>Bank</strong> <strong>Loan</strong> <strong>Capital</strong> <strong><strong>Market</strong>s</strong> <strong>–</strong> <strong>Market</strong> <strong>Snapshot</strong><br />

April 2, 2012<br />

Peter Kline 312-325-8983 Richard Jones 312-325-8906 Kavian Boots 312-325-8723<br />

Daniel Chapman 877-673-2258 Jeffrey Duncan 704-335-4570 Michael Mahoney 314-418-3571<br />

Leveraged <strong>Loan</strong> <strong>Market</strong><br />

<strong>Market</strong> Commentary: Activity in the leveraged loan market continues to build,<br />

with issuance jumping 71% to $106 billion in 1Q12 from $62 billion in 4Q11.<br />

Despite this sequential improvement, leveraged loan issuance dropped some 25%<br />

Indicative Leveraged Pricing<br />

Average New-Issue Pricing (YTM)<br />

in 1Q12 versus the same period in 2011. Much like the year ago period, the<br />

majority (52%) of 1Q12 volume supported refinancing activity, and M&A volume<br />

Ratings Jun-11 Sep-11 Dec-11 Mar-12<br />

remained noticeably light at $26 billion or 25% of 1Q12 issuance and 10% below BB/BB- 4.57% 5.92% 4.43% 4.55%<br />

4Q11. The relative lack of M&A activity - although some promising situations loom<br />

on the horizon - continues to mystify, as the European crisis moves to the back<br />

pages and economic indicators continue to show improvement domestically.<br />

Modest net new issuance, combined with surging demand for the asset class, has<br />

B+/B 6.27%<br />

Source: Standard & Poor's LCD<br />

8.37% 7.20% 6.12%<br />

contributed to an issuer friendly technical environment. Opportunistic deal flow, including loan repricings, amend-to-extend deals, and dividend dealsare<br />

now widely accepted for quality issuers, and comprised 45% of 1Q12 volume. Moreover, the supply/demand imbalance continues to pressure yields, now<br />

hitting their lowest level since last June. Overall, leveraged loan pricing in 1Q12 tightened the most in the single-B space, while double-B pricing remained<br />

relatively flat. The BB/BB- and B+/B indices came in at 4.55% and 6.12%, respectively, in March, from 4.43% and 7.20%, respectively, in December.<br />

Noteworthy Deal:<br />

Dispensing Dynamics<br />

International<br />

City of Industry,<br />

California<br />

Asset Based Finance <strong>Market</strong><br />

<strong>Market</strong> Commentary: Asset-based loan volume continues to be light since the peak in<br />

2Q11 making for the third straight quarter of declining volumes. The market continues to<br />

be dominated by refinancings versus new money transactions, with little news of additional<br />

LBO transactions being added to the forward calendar. One industry that seems to be<br />

active is the Metals Industry, in which we’ve seen at least four borrowers come to market to<br />

increase their line of credit to support tuck-in acquisitions and working capital growth,<br />

including O’Neal Steel, Olympic Steel, Steel Pipe & Supply, and McJunkin Red Man. Even<br />

with a slow pipeline, most lenders expect pricing to stabilize during the year with<br />

anticipation of bank regulation and Basel III liquidity requirements impacting banks’ pricing<br />

models.<br />

Noteworthy Deal:<br />

Titanium Metals<br />

Corporation<br />

Dallas, Texas<br />

Metals<br />

U.S. <strong>Bank</strong> was the Sole Book Runner and Administrative Agent on a new $83 million senior secured set of facilities for<br />

Dispensing Dynamics International, a California-based manufacturer of paper-towel and soap dispensers. Kinderhook Industries,<br />

LLC is the sponsor. The $15 million revolver and $68 million term loan, both five-year facilities, backed the purchase of The<br />

Colman Group, parent of the San Jamar (an international supplier of food safety tools and disposable dispensers) and Chef<br />

Revival (a supplier of chef and crew apparel, kitchen gloves, towels, and insulated bags) brands. Pricing on the deal, which<br />

closed at the end of February, was L+500 bps, with a 1.50% LIBOR floor, and a 98.5 issue price.<br />

U.S. Bancorp served as Sole Bookrunner and Administrative Agent on a new $200 million, 5-year, syndicated ABL revolving<br />

credit facility for Titanium Metals Corporation. The new facility will help support working capital growth anticipated in the<br />

commercial aerospace industry, which the company primarily serves.<br />

This information represents the opinion of U.S. Bancorp and is not intended to be a forecast of future events, a guarantee of future results or investment advice. It is not intended to<br />

provide specific advice or to be construed as an offering of securities or recommendation to invest. The factual information provided has been obtained from sources believed to be<br />

reliable, but is not guaranteed as to accuracy or completeness. This report is intended for institutional investors only. Please send an email to andrew.hensel@usbank.com if you wish<br />

to be removed from the mailing list for this document.<br />

2<br />

Indicative Asset Based Pricing Grid<br />

LIBOR Spreads<br />

Deal Size<br />

Credit Fundamentals $125mm<br />

Strong/Stable 150 <strong>–</strong> 200 175 <strong>–</strong> 225<br />

Storied Credits 225 <strong>–</strong> 275 250 - 300<br />

Undrawn pricing typically ranges from 37.5 to 50.0 bps, with a grid t hat is<br />

to usage of the facility.

U.S. <strong>Bank</strong> Debt <strong>Capital</strong> <strong><strong>Market</strong>s</strong> <strong>–</strong> <strong>Market</strong> <strong>Snapshot</strong><br />

April 2, 2012<br />

Terry Martin 646-935-4581 Violet Grecu 877-673-2289 David Wood 312-325-8745<br />

Michael Dullaghan 612-336-7629 Amanda Lamberti 314-325-2025<br />

Private Placements <strong>Market</strong><br />

<strong>Market</strong> Commentary: Private Placement <strong>Market</strong> issuance activity continues at<br />

a moderate pace. During the month of February, we saw a solid $3.5 billion in<br />

issuance, following the robust $4.9 billion in volume seen in January. Total YTD<br />

2012 volume now stands at over $8.4 billion. Investor liquidity continues to be<br />

strong, and is driving favorable, issuer-friendly structures such as attractive<br />

pricing, lengthening tenors and delaying funding options. U.S. Treasury yields<br />

experienced some volatility in March and increased above 2.0% for the 10-year,<br />

a level not seen since October 2011. In reaction to increasing Treasuries, credit<br />

spreads are expected to modestly decline. Regardless, coupons remain<br />

attractive and near historical record low levels. Transactions for foreign issuers<br />

continue to dominate the new issue calendar. YTD 2012, cross-border<br />

transactions have represented over 65% of issuance. Given the continued<br />

heightened levels of cross-border issuance, investors are particularly eager to<br />

invest in transactions for domestic issuers presently.<br />

Noteworthy Deal:<br />

Financial Services<br />

U.S. Bancorp is serving as Joint Lead Placement Agent on a $64 million senior notes offering for a financial services company. The<br />

company is a holding company with an NAIC 1 rating profile. The company seeks two tranches: (1) an $11 million 5-year bullet;<br />

and (2) a $53 million 20-year final / 10.25-year average life amortizing tranche. Proceeds will be used to support capital<br />

expenditures. The transaction will include a partial delayed funding of 6 months.<br />

High Grade <strong>Market</strong> Commentary (for the week ended March 30 th )<br />

Public Debt <strong>Market</strong><br />

Private Placement Spreads to U.S. Treasury<br />

NAIC<br />

Rating<br />

5-Year (bps) 7-Year (bps) 10-Year (bps)<br />

1 180-200 175-225 175-200<br />

2 225-250 225-275 250-300<br />

3<br />

475-575<br />

(if available)<br />

525-650<br />

(if available)<br />

525-650<br />

(if available)<br />

Source: Private Placement Monitor (as of February 2012)<br />

Please note that actual pricing will be sector and issuer specific. Given this and the market’s volatility;<br />

drastic spread changes could occur at anytime. Please contact Terry Martin at (646) 935-4581 to<br />

review and discuss potential individual basis.<br />

As we close out the first quarter of 2012 we take a look back at the largest 1st quarter on record in terms of new issue supply, and the 3rd largest quarter of<br />

all time. Q1 finishes with a monthly average of $95 billion in new issue supply, and a weekly average of $22 billion, both well above historical averages. We’ll<br />

be focused on whether or not this feverish pace can be sustained over the balance of the year, or if what we are experiencing is the continued advancement<br />

of funding plans which will leave most expecting a slower than normal second half of the year. The consensus would be that we are off to a remarkable start<br />

and at some point the other shoe has to drop. A number of risk factors could potentially lead to a slowdown; Sovereign issues, politics and the upcoming<br />

election, or disappointing economic news here in the states. <strong>Market</strong> participants will continue to focus on anything that could potentially derail this<br />

impressive run in investment grade credit, and we would not be surprised if we see some profit taking during signs of weakness.<br />

This week finished with just under $20 billion in new supply as the market started experiencing some fatigue late in the week as the book build process was<br />

somewhat slower than what has become the “norm”. New issue concessions started off the week in negative territory but as the week wore on; issuers lost<br />

leverage and were required to pay up (roughly 15 bps NIC for deals Wednesday - Friday vs. flat for deals Monday & Tuesday).<br />

The broader market continues to perform well with the Dow closing just 40 points off the recent 52-week high and finishing Q1 +8.14%; a similar story with<br />

the S&P, closing out Q1 +12%. We continue to see cash pouring into high grade bond funds with an additional $1.5 billion inflow this week making the YTD<br />

figure +$17.3 billion which equates to a weekly average inflow of $1.4 billion. The month of April is typically slower from a volume standpoint as we enter into<br />

Q1 earnings season. The 10-year average for April just above $40 billion, and we would anticipate something in the $45-60 billion range for April.<br />

High Yield <strong>Market</strong> Commentary (for the week ended March 30th )<br />

Volume in the high yield new issue market picked up this week and we passed the $30 billion mark for the month and the $90 billion market for the quarter.<br />

This makes the first quarter of 2012 the busiest quarter on record, surpassing the fourth quarter of 2010, which held record at $84+ billion. Since the end<br />

of last year, the market environment has created very favorable conditions for high yield issuance. On the supply side, never before seen low rates in the<br />

high yield market has encouraged issuers to continue to refinance their debt. With 2012 and 2013 issues largely refinanced, we are starting to see issuers<br />

refinance their 2014, 2015 and 2016 maturities. On the demand side the record breaking low yields in the US treasury, corporate and other markets has<br />

made high yield one of the few places to find yield, albeit at historically low levels for the asset class.<br />

The secondary market was softer this week, closing Thursday back over 600 bps, at +602. Despite this weakness in the secondary market, new issues<br />

performed well post pricing. All deals broke post pricing either at issue bid or better. The big winner of the week was Lawson Software (Caa1/B-). They<br />

priced over a $1 billion of 7-year non-call 3-year notes at par to yield 9.375% and bonds traded up almost 4 points post pricing. Again we saw another inflow<br />

into the sector with $457 million being put into high yield funds. While this is down from the previous week, it is still the seventeenth inflow in a row for over<br />

$18 billion in that time frame.<br />

Investment Products and Services are available through U.S. Bancorp Investments, Inc., member of FINRA and SIPC, an investment advisor, a brokerage subsidiary of U.S. Bancorp,<br />

and an affiliate of U.S. <strong>Bank</strong>. U.S. <strong>Bank</strong> is not responsible for and does not guarantee the products, services, or performance of it affiliates and third party providers. This information<br />

represents the opinion of U.S. Bancorp and is not intended to be a forecast of future events, a guarantee of future results or investment advice. It is not intended to provide specific<br />

advice or to be construed as an offering of securities or recommendation to invest. The factual information provided has been obtained from sources believed to be reliable, but is not<br />

guaranteed as to accuracy or completeness. This report is intended for institutional investors only.<br />

Not a Deposit ● Not FDIC Insured ● Not Guaranteed by the <strong>Bank</strong> ● May Lose Value ● Not Insured by any Federal Government Agency<br />

3

U.S. <strong>Bank</strong> Debt <strong>Capital</strong> <strong><strong>Market</strong>s</strong> <strong>–</strong> <strong>Market</strong> <strong>Snapshot</strong><br />

April 2, 2012<br />

Terry Martin 646-935-4581 Violet Grecu 877-673-2289 David Wood 312-325-8745<br />

Michael Dullaghan 612-336-7629 Amanda Lamberti 314-325-2025<br />

Public Debt <strong>Market</strong> <strong>–</strong> Recent High Grade New Issues<br />

Date Issuer Industry YKE / DMS Amount Securities Maturity Coupon Price Yield Spread Mdy S&P<br />

3/30/2012 Weatherford International Ltd Energy Domestic $750.0 Senior Notes 4/15/2022 4.500% 99.855 4.518% 230 Baa2 BBB<br />

3/30/2012 Weatherford International Ltd Energy Domestic $550.0 Senior Notes 4/15/2042 5.950% 99.291 6.001% 265 Baa2 BBB<br />

3/29/2012 Sparebank 1 Boligkreditt <strong>Bank</strong> Yankee $1,250.0 Covered Bonds 6/30/2017 2.300% 99.756 2.350% 133.4 Aaa NR<br />

3/29/2012 Heineken NV Food & Bev Yankee $750.0 Senior Notes 4/1/2022 3.400% 99.731 3.432% 127 Baa1 BBB+<br />

3/29/2012 China Resources Gas Group Utility Yankee $750.0 Senior Notes 4/5/2022 4.500% 97.950 4.760% 260 Baa1 NR<br />

3/29/2012 MassMutual Global Funding II Insurance Domestic $500.0 FA-Backed 4/5/2017 2.000% 99.565 2.092% 110 Aa2 AA+<br />

3/29/2012 Barrick Gold Corp Industrial Yankee $1,250.0 Senior Notes 4/1/2022 3.850% 99.943 3.857% 170 Baa1 A-<br />

3/29/2012 Barrick Gold Corp Industrial Yankee $750.0 Senior Notes 4/1/2042 5.250% 99.820 5.262% 200 Baa1 A-<br />

3/29/2012 Flow ers Foods Inc Food & Bev Domestic $400.0 Senior Notes 4/1/2022 4.375% 99.760 4.405% 225 Baa2 BBB-<br />

3/29/2012 Trustees of the University of Pennsylvania University Domestic $300.0 Senior Notes 9/1/2112 4.674% 100.000 4.674% 145 Aa2 AA+<br />

3/28/2012 Potomac Electric Pow er Co Utility Domestic $200.0 FMB's 4/1/2022 3.050% 99.700 3.094% 90 A3 A<br />

3/28/2012 Svenska Handelsbanken AB <strong>Bank</strong> Yankee $1,250.0 Senior Notes 4/4/2017 2.895% 99.908 2.895% 187.5 Aa2 AA-<br />

3/28/2012 Vale Overseas Ltd (Re-Open) Industrial Yankee $1,250.0 Senior Notes 1/11/2022 4.375% 101.345 4.205% 200 Baa2 A-<br />

3/28/2012 Bladex <strong>Bank</strong> Yankee $400.0 Senior Notes 4/4/2017 3.750% 99.271 3.912% 287.5 NR BBB<br />

3/27/2012 Prudential Covered Trust 2012-1 Insurance Domestic $1,000.0 Senior Secured 9/30/2015 2.997% 100.000 2.997% 250 NR A<br />

3/27/2012 MetLife Institutional Funding II Insurance Domestic $750.0 FA-Backed 4/2/2015 1.625% 99.936 1.647% 115 Aa3 AA-<br />

3/27/2012 Health Care REIT Inc Real Estate Domestic $600.0 Senior Notes 4/1/2019 4.125% 99.694 4.176% 260 Baa2 BBB-<br />

3/27/2012 Central Hudson Gas & Electric Corp Utility Domestic $48.0 Senior Notes 4/1/2042 4.776% 100.000 4.776% 147.5 A3 A<br />

3/27/2012 HSBC Holdings PLC <strong>Bank</strong> Yankee $2,000.0 Senior Notes 3/20/2022 4.000% 99.348 4.080% 190 Aa2 A+<br />

3/27/2012 CEZ AS Utility Yankee $2,000.0 Senior Notes 4/3/2022 4.250% 99.300 4.337% 215 A2 A-<br />

3/27/2012 CEZ AS Utility Yankee $300.0 Senior Notes 4/3/2042 5.625% 99.669 5.648% 235 A2 A-<br />

3/26/2012 Korea National Oil Corp Energy Yankee $1,000.0 Senior Notes 4/3/2017 3.125% 99.706 3.189% 210 A1 A<br />

3/26/2012 Lincoln National Corp Insurance Domestic $300.0 Senior Notes 3/15/2022 4.200% 100.000 4.200% 195 Baa2 A-<br />

3/26/2012 Anglo American <strong>Capital</strong> Plc Industrial Yankee $600.0 Senior Notes 4/3/2017 2.625% 99.781 2.672% 160 Baa1 BBB+<br />

3/26/2012 DNB <strong>Bank</strong> ASA <strong>Bank</strong> Yankee $2,000.0 Senior Notes 4/3/2017 3.200% 99.913 3.219% 215 Aa3 A+<br />

3/26/2012 Canadian Oil Sands Ltd Energy Yankee $400.0 Senior Notes 4/1/2022 4.500% 99.221 4.598% 235 Baa2 BBB<br />

3/26/2012 Canadian Oil Sands Ltd Energy Yankee $300.0 Senior Notes 4/1/2042 6.000% 99.435 6.041% 270 Baa2 BBB<br />

3/22/2012 Tufts University Domestic $250.0 Senior Notes 4/15/2112 5.017% 100.000 5.017% 165 Aa2 AA-<br />

3/22/2012 Zions Bancorporation <strong>Bank</strong> Domestic $300.0 Senior Notes 3/27/2017 4.500% 94.250 5.843% Ba3 BBB-<br />

3/21/2012 The George Washington University University Domestic $300.0 Senior Notes 9/15/2022 3.485% 100.000 3.485% 112 A1 A+<br />

3/21/2012 Northw estern University University Domestic $200.0 Senior Notes 12/1/2047 4.198% 99.706 Aaa AAA<br />

3/21/2012 Schahin II Finance Coo SPV Finance Yankee $750.0 Senior Secured 9/25/2022 5.875% 100.000 5.875% Baa3 BBB-<br />

3/21/2012 <strong>Capital</strong> One Financial Co <strong>Bank</strong> Domestic $1,250.0 Senior Notes 3/23/2015 2.150% 99.916 2.179% 160 A2 A<br />

3/21/2012 Sygenta Finance N.V. Finance Yankee $500.0 Senior Notes 3/28/2022 3.125% 99.838 3.144% 85 A2 A<br />

3/21/2012 Sygenta Finance N.V. Finance Yankee $250.0 Senior Notes 3/28/2042 4.375% 99.834 4.385% 100 A2 A<br />

3/21/2012 American Express Credit Corp Finance Domestic $1,500.0 Senior Notes 3/24/2017 2.375% 99.729 2.433% 130 A2 BBB+<br />

3/21/2012 Caterpillar Financial Services Corp Finance Domestic $325.0 Senior Notes 3/26/2015 1.050% 99.915 1.079% 50 A2 A<br />

3/21/2012 Caterpillar Financial Services Corp Finance Domestic $275.0 Senior Notes 3/24/2017 1.750% 99.819 1.079% 65 A2 A<br />

3/21/2012 Lloyds TSB <strong>Bank</strong> Plc <strong>Bank</strong> Yankee $1,500.0 Senior Notes 3/28/2017 4.200% 99.848 4.234% 310 A1 A<br />

3/21/2012 Raymond James Financial Broker Dealer Domestic $250.0 Senior Notes 4/1/2024 5.625% 99.602 5.671% 337.5 Baa2 BBB<br />

3/20/2012 Southw est Gas Corp Utility Domestic $250.0 Senior Notes 4/1/2022 3.875% 99.966 3.879% 150 Baa1 BBB+<br />

3/20/2012 Sempra Energy Utility Domestic $600.0 Senior Notes 4/1/2017 2.300% 99.948 2.311% 110 Baa1 BBB+<br />

3/19/2012 AIG Insurance Domestic $750.0 Senior Notes 3/20/2015 3.000% 99.844 3.055% 245 Baa1 A-<br />

3/19/2012 AIG Insurance Domestic $1,250.0 Senior Notes 3/22/2017 3.800% 99.797 3.845% 265 Baa1 A-<br />

*Shaded transactions represent those in which U.S. <strong>Bank</strong> played a role.<br />

Source: Bloomberg<br />

Investment Products and Services are available through U.S. Bancorp Investments, Inc., member of FINRA and SIPC, an investment advisor, a brokerage subsidiary of U.S. Bancorp,<br />

and an affiliate of U.S. <strong>Bank</strong>. U.S. <strong>Bank</strong> is not responsible for and does not guarantee the products, services, or performance of it affiliates and third party providers. This information<br />

represents the opinion of U.S. Bancorp and is not intended to be a forecast of future events, a guarantee of future results or investment advice. It is not intended to provide specific<br />

advice or to be construed as an offering of securities or recommendation to invest. The factual information provided has been obtained from sources believed to be reliable, but is not<br />

guaranteed as to accuracy or completeness. This report is intended for institutional investors only.<br />

Not a Deposit ● Not FDIC Insured ● Not Guaranteed by the <strong>Bank</strong> ● May Lose Value ● Not Insured by any Federal Government Agency<br />

4