Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

Technical Market View<br />

Recommendation<br />

SYMBOL<br />

RELCAPITAL<br />

Buy/Sell<br />

Sell Fut<br />

CMP 332.2<br />

Initiation range 334 - 335<br />

RELCAPITAL: The stock has formed Head and Shoulder<br />

formation on the intraday chart, this is a trend reversal<br />

formation indicating bearish move ahead. Accordingly, one<br />

may initiate trade as per levels given in table. (Trading<br />

period: 3-5 trading sessions)<br />

Stop Loss 346<br />

Target 310<br />

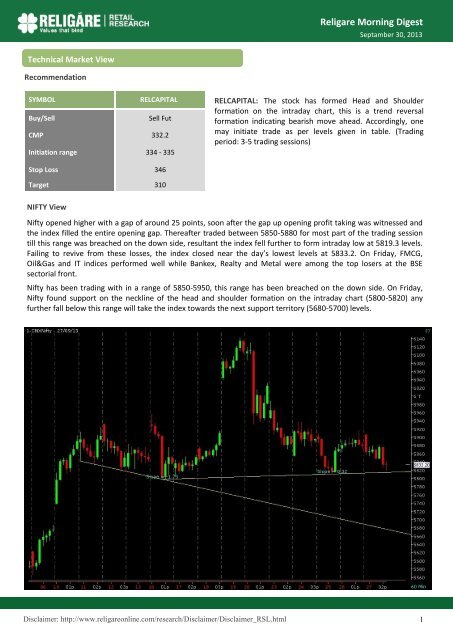

NIFTY View<br />

Nifty opened higher with a gap of around 25 points, soon after the gap up opening profit taking was witnessed and<br />

the index filled the entire opening gap. Thereafter traded between 5850-5880 for most part of the trading session<br />

till this range was breached on the down side, resultant the index fell further to form intraday low at 5819.3 levels.<br />

Failing to revive from these losses, the index closed near the day’s lowest levels at 5833.2. On Friday, FMCG,<br />

Oil&Gas and IT indices performed well while Bankex, Realty and Metal were among the top losers at the BSE<br />

sectorial front.<br />

Nifty has been trading with in a range of 5850-5950, this range has been breached on the down side. On Friday,<br />

Nifty found support on the neckline of the head and shoulder formation on the intraday chart (5800-5820) any<br />

further fall below this range will take the index towards the next support territory (5680-5700) levels.<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

1

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

Technical Market View<br />

TRENDSHEET - INDEX TREND *<br />

INDEX SPOT Close Trend Trend changed on Trend changed at Closing Stop Loss<br />

NIFTY 6083.15 5833.20 Down Up 23-May-13 05-Sep-13 5967.05 5592.95 6200 5670<br />

BANKNIFTY 12961.55 9899.75 Up 05-Sep-13 16-Apr-13 11871.60 9682.40 12630 9800<br />

CNX-IT 6410.95 8166.55 Up 08-May-13 21-Aug-13 6380.15 8175.30 6050 7885<br />

CNXMIDCAP 7914.80 7052.50 Down Up 23-May-13 10-Sep-13 7802.05 6889.00 8200 6790<br />

Nifty 50 - Trend Sheet *<br />

STOCKS LTP Trend Trend changed on Trend changed at at Closing Stop Loss<br />

ACC 1245.45 1099.55 Up 10-Sep-13 25-Apr-13 1022.55 1255.05 1030 1190<br />

AMBUJACEM 185.6 184.5 Up 16-Apr-13 24-Jul-13 171.6 180.45 178 175<br />

ASIANPAINT 4826.05 469.8 Down Up 10-Sep-13 9-Apr-13 445.8 4531.6 440 5000<br />

AXISBANK 1478.15 1030.9 Up 05-Sep-13 16-Apr-13 927.5 1363.3 1020 1400<br />

BAJAJ-AUTO 1993.15 1818.1 Up 04-Sep-13 23-Apr-13 1888.75 1805 1850 1730<br />

BANKBARODA 682.25 501.25 Down Up 24-Sep-13 25-Apr-13 503.7 708.55 545 680<br />

BHARTIARTL 309.15 325.3 Down Up 06-Sep-13 24-May-13 313.75 298.5 315 332<br />

BHEL 196.95 143.75 Up 23-Aug-13 25-Apr-13 116.1 192.55 130 187<br />

BPCL 377.45 328.6 Down 25-Sep-13 23-May-13 305.5 379.9 340 415<br />

CAIRN 286.15 317.75 Down Up 23-May-13 19-Jul-13 308.05 277.55 310 305<br />

CIPLA 401.5 434.3 Up 28-Jun-13 08-Mar-13 391.95 391.8 400 390<br />

COALINDIA 313.8 306.9 Down Up 05-Sep-13 24-Jan-13 283.4 343.65 285 320<br />

DLF 131.85 215.3 Down 23-Sep-13 22-May-13 141.65 227.15 145 235<br />

DRREDDY 2090.95 2412.2 Up 29-Aug-13 4-Apr-13 2258.45 1889.75 2300 1960<br />

GAIL 324.5 326.3 Down Up 13-Sep-13 23-May-13 313.8 324.3 305 345<br />

GRASIM 2680.55 2991.8 Up 10-Sep-13 25-Apr-13 2449.9 2983.2 2500 2900<br />

HCLTECH 1072.75 741.7 Up 9-May-13 770.15 1000 695<br />

HDFC 929.5 784.2 Up 05-Sep-13 11-Mar-13 750.4 831.65 775 840<br />

HDFCBANK 715.05 608.9 Down Up 25-Sep-13 16-Apr-13 620.6 663.35 660 675<br />

HEROMOTOCO 1654.35 2048.05 Up 23-Apr-13 15-Jul-13 1573.6 1725 1900 1550<br />

HINDALCO 110.6 113.9 Up 12-Aug-13 23-Apr-13 94.05 96.3 108 100<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

2

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

Technical Market View<br />

STOCKS LTP Trend Trend when changed Rate when trend changed Closing Stop loss<br />

HINDUNILVR 621 Up 10-Sep-13 653.5 620<br />

ICICIBANK 923.3 Down 27-Sep-13 923.3 1000<br />

IDFC 88.85 Down 25-Sep-13 90.05 100<br />

INDUSINDBK 375.65 Down 23-Sep-13 386 415<br />

INFY 3006.6 Up 03-Jun-13 2514.1 2850<br />

ITC 347.9 Up 10-Sep-13 335.9 325<br />

JINDALSTEL 235.95 Up 10-Sep-13 237 235<br />

JPASSOCIAT 36.6 Down 23-Sep-13 37.75 41<br />

KOTAKBANK 682.85 Up 30-Aug-13 690.85 680<br />

LT 815.85 Up 10-Sep-13 807.2 800<br />

LUPIN 853.5 Up 03-Sep-13 840.4 820<br />

M&M 844 Up 11-Sep-13 827.35 800<br />

MARUTI 1366.95 Up 11-Sep-13 1360.8 1330<br />

NMDC 126.75 Up 12-Aug-13 108.75 115<br />

NTPC 147.95 Up 10-Sep-13 138.6 137<br />

ONGC 274.4 Down 24-Sep-13 274.5 301<br />

PNB 477.65 Down 23-Sep-13 483.85 525<br />

POWERGRID 98.95 Up 10-Sep-13 102.25 94<br />

RANBAXY 334 Down 16-Sep-13 359.2 370<br />

RELIANCE 839.9 Up 30-Aug-13 853.85 835<br />

RELINFRA 392.35 Up 06-Sep-13 366 375<br />

SBIN 1640.7 Up 05-Sep-13 1638.15 1600<br />

SESAGOA 182.7 Up 12-Aug-13 135.25 170<br />

SUNPHARMA 589.85 Up 10-Sep-13 549.7 545<br />

TATAMOTORS 340.1 Up 05-Sep-13 318.1 320<br />

TATAPOWER 81.65 Up 13-Sep-13 78.4 76<br />

TATASTEEL 287.4 Up 12-Aug-13 236.55 280<br />

TCS 1948.1 Up 28-Jun-13 1518.15 1900<br />

ULTRACEMCO 1829 Up 06-Sep-13 1601.05 1680<br />

*Refer Annexure to understand this table<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

3

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

Derivative Market View<br />

Nifty closes negative led by fall in stocks from the banking segment and FMCG like ICICI Bank, HDFC Bank, SBI, ITC and HUL.<br />

Volumes was low but stock specific trend is negative, sector specific Bank Nifty has broken crucial support of 9920, it appears to<br />

be a bearish “Flag” pattern breakout and could lead to 9500 or lower levels.<br />

India VIX closed up by 0.25% to close at 24.06 levels. Nifty futures closed down 59.15 points at 5888.15 with a premium of<br />

49.05 points to the spot closing of 5833.20<br />

Nifty appears to be in a range between 5940 and 5800 but with a negative bias. If breaks below 5800 in cash Nifty will be<br />

negative up to 5688 which is the Strong support due to the Gap.<br />

Nifty would be positive provided 5800 is maintained and crosses above 6040 in that case we can see a target of 6200. However,<br />

bias is negative and looks like down side breakout below 5800 is strongly possible. Nifty fut. resistance for tomorrow is at 5945-<br />

5980 support exists at 5830-5780.<br />

Stocks Futures with Upward Potential<br />

Stocks Futures with Downward Potential<br />

Stocks Price % Change OI<br />

Change<br />

In OI<br />

Stocks Price % Change OI<br />

Change<br />

In OI<br />

BATAINDIA 864.85 4.01 1132 21.2 RELCAP 329.30 -3.83 5344 8.0<br />

ADANIENT 147.75 2.43 6347 1.5 JSWSTEEL 733.75 -2.63 14873 1.9<br />

MCDOWELL-N 2642 5.94 47487 3.7 ORIENTBANK 150.95 -4.46 1998 9.8<br />

F & O Trade / Strategy Recommendation for today<br />

Stock View CMP Strategy<br />

Recommended<br />

Price/ Initiation<br />

Range<br />

Target Price<br />

Stop loss<br />

HAVELLS BULLISH 637.40 BUY OCT. FUT 628-631 655 621<br />

Today’s Derivatives Summary<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

4

22-Aug<br />

26-Aug<br />

27-Aug<br />

28-Aug<br />

29-Aug<br />

30-Aug<br />

2-Sep<br />

3-Sep<br />

4-Sep<br />

5-Sep<br />

6-Sep<br />

10-Sep<br />

11-Sep<br />

12-Sep<br />

13-Sep<br />

16-Sep<br />

17-Sep<br />

18-Sep<br />

19-Sep<br />

20-Sep<br />

23-Sep<br />

24-Sep<br />

25-Sep<br />

26-Sep<br />

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

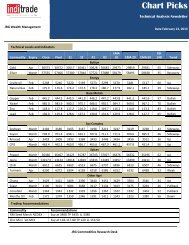

Fundamental Market view<br />

After a dreary trading session; markets edged lower, weakness in European stocks also weighed on<br />

sentiments. Combative comments from the Reserve Bank of India governor Raghuram Rajan on Thursday,<br />

26 September 2013, that inflation continued to remain high also adversely hit the markets. Metals,<br />

Mining, Capital goods, Banking and Realty were the major contributors to this dull day. Bond prices<br />

dropped again.<br />

Daily Trends In FIIs Investments (Rs Crore)<br />

4000<br />

3000<br />

2000<br />

1000<br />

0<br />

-1000<br />

-2000<br />

Corporate News<br />

Mahindra & Mahindra Ltd has announced a price increase ranging from Rs 6,000 to Rs 20,000<br />

covering its passenger and commercial vehicles. The price hike works out to be about 2% across its<br />

product portfolio.<br />

Bajaj Auto plans to increase the prices of its vehicles across segments due to rise in input costs.<br />

Glenmark Pharmaceuticals received a small research fee payment from Forest Laboratories Inc. on<br />

collaboration for the development of novel mPGES-1 inhibitors.<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

5

<strong>Religare</strong> <strong>Morning</strong> <strong>Digest</strong><br />

Septamber 30, 2013<br />

Annexure<br />

How to Understand the Trend Sheet table<br />

When trend changes to up, one can buy & when trend changes to down one can sell.<br />

Resistance is mentioned for stocks which are in downtrend where one can go short with closing stop loss<br />

as mentioned. Support is mentioned for stocks which are in uptrend where one can go long with closing<br />

stop loss as mentioned.<br />

Closing stop loss has to be seen at closing at 3:30pm. All stocks prices refer to spot price.<br />

In this table of trends, it has been observed that if someone tries to take all levels of a stock or index continuously,<br />

the losses are small but once the market catches a strong trend in either direction, one makes<br />

a huge profit that time.<br />

In our trend sheet,<br />

If we underline only the stock name and closing stop loss then it means we have trailed our closing stop<br />

loss.<br />

If we underline the complete line including all fields Stock’s name, LTP, Trend, Trend changed on, Trend<br />

changed at & closing stop loss, it signifies fresh reversal of the trend.<br />

Note – For our running recommendations and past performance, please click here<br />

Disclaimer: http://www.religareonline.com/research/Disclaimer/Disclaimer_RSL.html<br />

6