Loans Overview - Nonprofit Finance Fund

Loans Overview - Nonprofit Finance Fund

Loans Overview - Nonprofit Finance Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

®<br />

Where Money<br />

Meets Mission ®<br />

For 30 years, <strong>Nonprofit</strong> <strong>Finance</strong> <strong>Fund</strong> (NFF) has connected finance to nonprofit success, particularly in<br />

underserved communities, by providing access to capital, creative financing, and advice, while advocating<br />

for change. We’ve lent and leveraged over $1.3 billion in financing, and each year we touch more than 1,000<br />

organizations nationwide. To learn more, visit us online at nonprofitfinancefund.org.<br />

Year1<br />

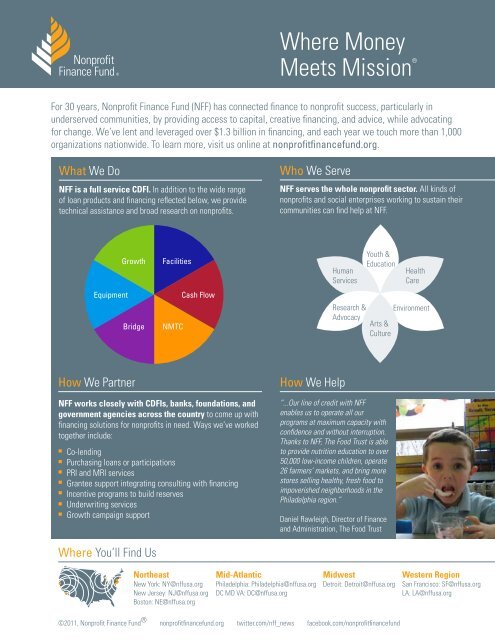

What We Do<br />

NFF is a full service CDFI. In addition to the wide range<br />

of loan products and financing reflected below, we provide<br />

technical assistance and broad research on nonprofits.<br />

Who We Serve<br />

NFF serves the whole nonprofit sector. All kinds of<br />

nonprofits and social enterprises working to sustain their<br />

communities can find help at NFF.<br />

Equipment<br />

Growth<br />

Bridge<br />

Facilities<br />

NMTC<br />

Cash Flow<br />

Series1<br />

Human<br />

Series2<br />

Services<br />

Series3<br />

Series4<br />

Series5<br />

Series6<br />

Research Series7 &<br />

Advocacy<br />

Series8<br />

Youth &<br />

Education<br />

Arts &<br />

Culture<br />

Health<br />

Care<br />

Environment<br />

How We Partner<br />

How We Help<br />

NFF works closely with CDFIs, banks, foundations, and<br />

government agencies across the country to come up with<br />

financing solutions for nonprofits in need. Ways we’ve worked<br />

together include:<br />

Co-lending<br />

Purchasing loans or participations<br />

PRI and MRI services<br />

Grantee support integrating consulting with financing<br />

Incentive programs to build reserves<br />

Underwriting services<br />

Growth campaign support<br />

“...Our line of credit with NFF<br />

enables us to operate all our<br />

programs at maximum capacity with<br />

confidence and without interruption.<br />

Thanks to NFF, The Food Trust is able<br />

to provide nutrition education to over<br />

50,000 low-income children, operate<br />

26 farmers’ markets, and bring more<br />

stores selling healthy, fresh food to<br />

impoverished neighborhoods in the<br />

Philadelphia region.”<br />

Daniel Rawleigh, Director of <strong>Finance</strong><br />

and Administration, The Food Trust<br />

Where You’ll Find Us<br />

Northeast<br />

New York: NY@nffusa.org<br />

New Jersey: NJ@nffusa.org<br />

Boston: NE@nffusa.org<br />

Mid-Atlantic<br />

Philadelphia: Philadelphia@nffusa.org<br />

DC MD VA: DC@nffusa.org<br />

Midwest<br />

Detroit: Detroit@nffusa.org<br />

Western Region<br />

San Francisco: SF@nffusa.org<br />

LA: LA@nffusa.org<br />

©2011, <strong>Nonprofit</strong> <strong>Finance</strong> <strong>Fund</strong> ® nonprofitfinancefund.org twitter.com/nff_news facebook.com/nonprofitfinancefund

®<br />

<strong>Loans</strong> and<br />

Financial Services<br />

<strong>Nonprofit</strong>s are the cornerstones of our communities, providing vital services that address our most pressing social<br />

problems. With their varied business models and unique operating environments, nonprofits need a lending partner that<br />

can appreciate their particular situation and provide innovative, customized solutions. Since 1980, <strong>Nonprofit</strong> <strong>Finance</strong><br />

<strong>Fund</strong> (NFF) has lent over $235 million and provided over $130 million in New Markets Tax Credit financing to nonprofits,<br />

leveraging $1.3 billion of capital investment on behalf of our clients. Our financing helps nonprofits manage growth, build<br />

and renovate facilities, balance government contract payments and cash flow, and bridge capital campaigns so they can<br />

better serve their communities. We also partner with funders to structure philanthropic capital and program-related<br />

investments and manage capital for guided investment in programs.<br />

Typical <strong>Nonprofit</strong> Loan Clients<br />

Our typical clients are financially equipped to use debt as a<br />

strategic tool. We consider applications from organizations that<br />

meet the following criteria:<br />

• In existence for 3 years or more<br />

• Unrestricted annual operating revenue of at least $500,000<br />

• A 501(c)(3) organization or other entity which promotes the<br />

economic, social and cultural development of its community.<br />

NFF lenders also evaluate smaller nonprofits and social<br />

enterprises on a case-by-case basis.<br />

<strong>Nonprofit</strong> Financing Options<br />

<strong>Loans</strong><br />

NFF provides flexible, tailored loans to individual clients based<br />

on their unique financial story, plans and capacity. <strong>Loans</strong><br />

typically range between $100,000 and $2.5 million and are used<br />

for the following purposes:<br />

Facility <strong>Loans</strong><br />

• Acquisition<br />

• Construction, renovation and leasehold improvement<br />

• Related soft costs, such as professional fees and permits<br />

• Relocation costs<br />

Working Capital <strong>Loans</strong><br />

• Bridging capital campaign receipts, grants, government<br />

contracts, and other receivables<br />

• Lines of credit to support temporary cash flow needs<br />

• Program expansion<br />

Equipment <strong>Loans</strong><br />

• Office equipment and furniture<br />

• Computer hardware and software<br />

• HVAC and security systems<br />

• Other program- and facility-related equipment<br />

New Markets Tax Credit (NMTC) Program<br />

NFF has received $151 million of NMTC allocation so<br />

far, which we use to attract private capital and finance<br />

nonprofits and community facilities. NMTC-related<br />

loans are available for projects over $5 million that may<br />

involve acquisition, substantial renovations, leasehold<br />

improvements, or new construction of community spaces<br />

such as charter schools, health clinics, community centers,<br />

arts & cultural spaces, and others.<br />

Delivering PRIs and MRIs for <strong>Fund</strong>ers<br />

<strong>Fund</strong>ers are increasingly considering modified, low-interest<br />

lending programs such as Program-Related Investments (PRIs)<br />

and Mission-Related Investments (MRIs), as supplements<br />

to their traditional grantmaking practices. For foundations<br />

considering these two kinds of investments, NFF provides<br />

underwriting, structuring and portfolio management services<br />

that enhance the efficiency and impact of the program.<br />

NFF can also give seasoned, knowledgeable advice and services<br />

to organizations that already have these programs in place.<br />

We tailor a plan to best fit the size and scope of both lending<br />

programs and individual investments. Our services include:<br />

• Analysis and underwriting investments for working capital,<br />

growth and facilities development<br />

• Preparation and presentation of investment recommendations<br />

• Loan closing and documentation services<br />

• Monitoring of loans throughout their term<br />

• Billing and collection services on foundations’ behalf<br />

• Reporting on efficacy of overall investment portfolio and<br />

individual investments<br />

Visit us at nonprofitfinancefund.org<br />

©2011, <strong>Nonprofit</strong> <strong>Finance</strong> <strong>Fund</strong> ®<br />

<strong>Nonprofit</strong> <strong>Finance</strong> <strong>Fund</strong> (NFF) works to strengthen the nonprofit sector, particularly<br />

in underserved communities, through broader access to capital, creative financing,<br />

changes in funding practices, stronger financial management and education.