Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ISSN: 2247-6172<br />

ISSN-L: 2247-6172<br />

<strong>Review</strong> <strong>of</strong> <strong>Applied</strong> <strong>Socio</strong>- <strong>Economic</strong> Research<br />

(<strong>Volume</strong> 3, Issue 1/ <strong>2012</strong> ), pp. 52<br />

URL: http://www.reaser.eu<br />

e-mail: editors@reaser.eu<br />

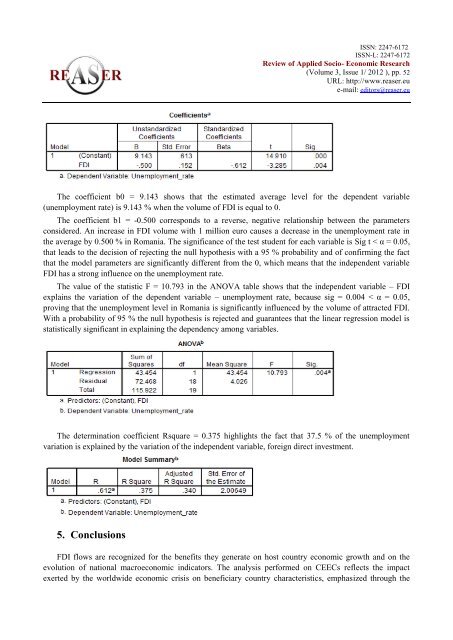

The coefficient b0 = 9.143 shows that the estimated average level for the dependent variable<br />

(unemployment rate) is 9.143 % when the volume <strong>of</strong> FDI is equal to 0.<br />

The coefficient b1 = -0.500 corresponds to a reverse, negative relationship between the parameters<br />

considered. An increase in FDI volume with 1 million euro causes a decrease in the unemployment rate in<br />

the average by 0.500 % in Romania. The significance <strong>of</strong> the test student for each variable is Sig t < α = 0.05,<br />

that leads to the decision <strong>of</strong> rejecting the null hypothesis with a 95 % probability and <strong>of</strong> confirming the fact<br />

that the model parameters are significantly different from the 0, which means that the independent variable<br />

FDI has a strong influence on the unemployment rate.<br />

The value <strong>of</strong> the statistic F = 10.793 in the ANOVA table shows that the independent variable – FDI<br />

explains the variation <strong>of</strong> the dependent variable – unemployment rate, because sig = 0.004 < α = 0.05,<br />

proving that the unemployment level in Romania is significantly influenced by the volume <strong>of</strong> attracted FDI.<br />

With a probability <strong>of</strong> 95 % the null hypothesis is rejected and guarantees that the linear regression model is<br />

statistically significant in explaining the dependency among variables.<br />

The determination coefficient Rsquare = 0.375 highlights the fact that 37.5 % <strong>of</strong> the unemployment<br />

variation is explained by the variation <strong>of</strong> the independent variable, foreign direct investment.<br />

5. Conclusions<br />

FDI flows are recognized for the benefits they generate on host country economic growth and on the<br />

evolution <strong>of</strong> national macroeconomic indicators. The analysis performed on CEECs reflects the impact<br />

exerted by the worldwide economic crisis on beneficiary country characteristics, emphasized through the