Required Minimum Distribution Election Form - Penn Mutual

Required Minimum Distribution Election Form - Penn Mutual

Required Minimum Distribution Election Form - Penn Mutual

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

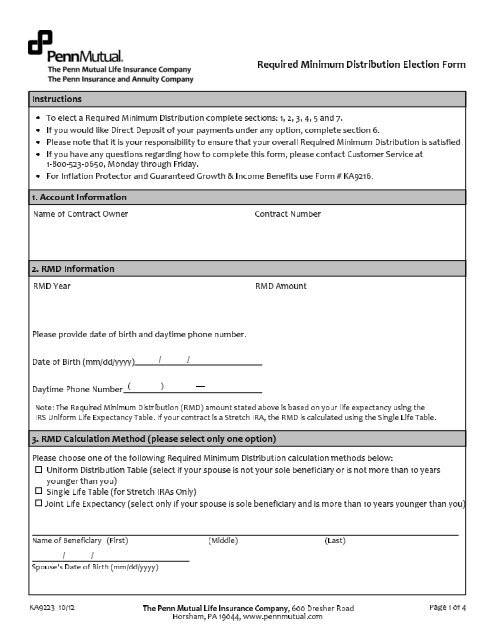

<strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> <strong>Election</strong> <strong>Form</strong><br />

Instructions<br />

• To elect a <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> complete sections: 1, 2, 3, 4, 5 and 7.<br />

• If you would like Direct Deposit of your payments under any option, complete section 6.<br />

• Please note that it is your responsibility to ensure that your overall <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> is satisfied.<br />

• If you have any questions regarding how to complete this form, please contact Customer Service at<br />

1-800-523-0650, Monday through Friday.<br />

• For Inflation Protector and Guaranteed Growth & Income Benefits use <strong>Form</strong> # KA9216.<br />

1. Account Information<br />

Name of Contract Owner<br />

Contract Number<br />

2. RMD Information<br />

RMD Year<br />

RMD Amount<br />

Please provide date of birth and daytime phone number.<br />

Date of Birth (mm/dd/yyyy)<br />

/ /<br />

Daytime Phone Number<br />

( ) —<br />

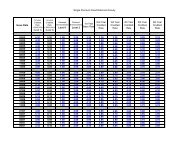

Note: The <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> (RMD) amount stated above is based on your life expectancy using the<br />

IRS Uniform Life Expectancy Table. If your contract is a Stretch IRA, the RMD is calculated using the Single Life Table.<br />

3. RMD Calculation Method (please select only one option)<br />

Please choose one of the following <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> calculation methods below:<br />

Uniform <strong>Distribution</strong> Table (select if your spouse is not your sole beneficiary or is not more than 10 years<br />

younger than you)<br />

Single Life Table (for Stretch IRAs Only)<br />

Joint Life Expectancy (select only if your spouse is sole beneficiary and is more than 10 years younger than you)<br />

Name of Beneficiary (First) (Middle) (Last)<br />

/ /<br />

Spouse's Date of Birth (mm/dd/yyyy)<br />

KA9223 10/12 The <strong>Penn</strong> <strong>Mutual</strong> Life Insurance Company, 600 Dresher Road<br />

Page 1 of 4<br />

Horsham, PA 19044, www.pennmutual.com

4. RMD Withdrawal Schedule Selection (please select only one option). Option 1 is a Withdrawal<br />

Schedule and Option 2 is a One-Time <strong>Distribution</strong>.<br />

If you would like to start having your <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> amount automatically withdrawn from your<br />

contract, please complete this section.<br />

Option 1. RMD Withdrawal Schedule - If you choose a monthly, quarterly or semi-annual frequency, we<br />

will divide the payments by the remaining months in the calendar year.<br />

RMD Withdrawal Frequency Monthly Quarterly Semi - Annual Annual<br />

RMD Withdrawal Start Date(s)<br />

You must specify the start date for your RMD automatic withdrawals in section A below. If you<br />

become 70 ½ this year and are an IRA or retired 403(b) owner, you have the option to defer your<br />

first RMD payment until April 1st of the following year. To select the deferral option, complete<br />

section B only.<br />

Must Select A or B.<br />

A. RMD Automatic Withdrawal Start Date (mm/dd/yyyy)<br />

OR<br />

B. April 1st Lump Sum <strong>Distribution</strong> Date (mm/dd/yyyy)<br />

RMD Automatic Withdrawal Start Date (mm/dd/yyyy)<br />

/ /<br />

/ /<br />

/ /<br />

Notes:<br />

• Non-spousal Stretch IRA holders must begin RMD by December 31st of the year following the date of death.<br />

• Spousal Stretch IRA holders can postpone RMD until the decedent would have been age 70 ½.<br />

• Do not specify the 29th, 30th or 31st day of the month since these dates do not occur every month.<br />

• For withdrawals to be sent via Electronic Funds Transfer (EFT) to your bank, your withdrawal effective date<br />

must be the 2nd, 8th, 15th, or 28th of a given month. (Note: It will take a minimum of 2 business days for the<br />

transfer to process.)<br />

• Because of calculations that occur on your policy anniversary, systematic withdrawals cannot be scheduled<br />

on the "day" of contract issue. For example, if your contract issue date is 03/19/1997 you cannot elect to start<br />

withdrawals on the 19th day of any month.<br />

For IRAs and retired 403(b) owners only: if you become 70 ½ this year you can defer your first payment until<br />

April 1st of the following year. However, if you do so, you must satisfy both distributions - one for the year you<br />

turned 70 ½ and another for the following year.<br />

• The first distribution must be taken by April 1 of next year, in one lump sum payment and the second<br />

distribution must be taken by December 31st of the same year.<br />

• If you choose to defer your payment, please select the dates in which you want to satisfy both of your<br />

distributions in Option B above.<br />

Option 2. One-Time <strong>Distribution</strong><br />

At this time, I do not want to set up an automatic <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> payout. I would<br />

like to take a one-time distribution to satisfy my <strong>Required</strong> <strong>Minimum</strong> <strong>Distribution</strong> for this year only.<br />

I understand that this distribution will be effective as of the date <strong>Penn</strong> <strong>Mutual</strong> receives this form.<br />

KA9224 10/12 Page 2 of 4

5. W-4P Notice of Federal and State Tax Withholding (select one)<br />

Do not withhold federal income tax from the taxable portion of my withdrawal payment(s). I understand that<br />

if I do not have federal income tax withheld, I may be responsible for payments of estimated tax and penalties<br />

if I fail to make such payments.<br />

Please withhold % for federal withholding and/or % for state withholding.<br />

Important Information Regarding Your Withholding:<br />

• If you do not specify a withholding election percentage, we are required by the IRS to withhold 10% of the<br />

taxable portion of your distribution.<br />

• If you elect federal withholding, the minimum amount of withholding elected must be at least 10% of the<br />

taxable portion of your distribution.<br />

• Please note that some states require mandatory state withholding if you elect federal withholding.<br />

• <strong>Distribution</strong>s from your annuity may have tax implications. You may wish to consult your financial professional.<br />

• You may change your withholding election for future withdrawals by completing a new W-4P.<br />

6. Direct Deposit Banking Information<br />

Please complete the following information, to set up direct deposit for your withdrawal payments.<br />

Note: If you do not select direct deposit, we will mail a check to your address of record. The check will be made<br />

payable to the contract owner of record.<br />

1. Type of Account Checking Account Savings Account<br />

2. Name of Account<br />

3. ABA Routing Transit No.<br />

4. Account No.<br />

5. Bank Phone Number with Area Code<br />

( ) —<br />

If you have elected to have your withdrawal payments transferred electronically, please include a copy of a voided<br />

check for verification purposes. Your check must be pre-printed with your name and the bank's name. You may<br />

submit written verification from your financial institution if you have a Savings Account or do not have pre-printed<br />

checks for your account. Please attach below.<br />

Attach check here:<br />

KA9225 10/12 Page 3 of 4

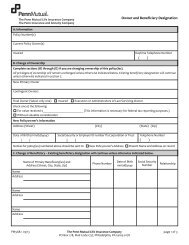

7. Signatures<br />

There may be contractual charges for taking a withdrawal from your annuity contract. If you have any<br />

questions, please consult your contract prospectus, your financial professional, or one of our Customer<br />

Service Representatives.<br />

• I represent that no bankruptcy or insolvency proceeding is pending with respect to me.<br />

• My signature below indicates I have read and understand the preceding information and elect to proceed<br />

with this transaction.<br />

Contract Owner Signature<br />

/ /<br />

Date (mm/dd/yyyy)<br />

Contract Co-Owner Signature (if applicable)<br />

/ /<br />

Date (mm/dd/yyyy)<br />

Please return form to <strong>Penn</strong> <strong>Mutual</strong> Life Insurance Company, Annuity Services<br />

P.O. Box 178, Philadelphia, PA 19105-0178, or fax to 215-956-7699<br />

If you have questions please call Customer Service, Monday through Friday at 1-800-523-0650<br />

KA9226 10/12 Page 4 of 4