Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

Pace plc Annual Report and Accounts 2012 - Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

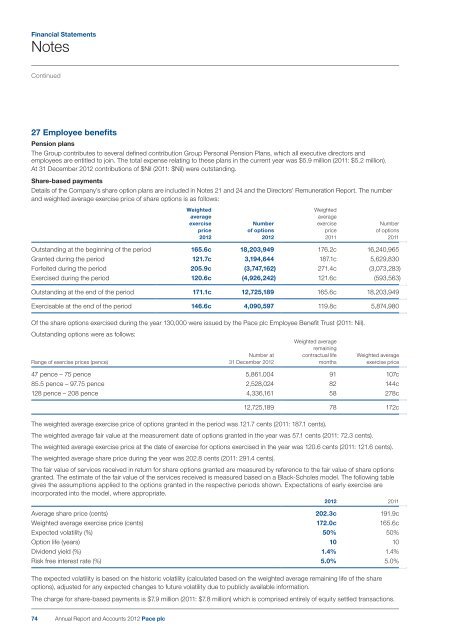

<strong>Financial</strong> <strong>Statements</strong>NotesContinued27 Employee benefitsPension plansThe Group contributes to several defined contribution Group Personal Pension Plans, which all executive directors <strong>and</strong>employees are entitled to join. The total expense relating to these plans in the current year was $5.9 million (2011: $5.2 million).At 31 December <strong>2012</strong> contributions of $Nil (2011: $Nil) were outst<strong>and</strong>ing.Share-based paymentsDetails of the Company’s share option plans are included in Notes 21 <strong>and</strong> 24 <strong>and</strong> the Directors’ Remuneration <strong>Report</strong>. The number<strong>and</strong> weighted average exercise price of share options is as follows:WeightedWeightedaverageaverageexercise Number exercise Numberprice of options price of options<strong>2012</strong> <strong>2012</strong> 2011 2011Outst<strong>and</strong>ing at the beginning of the period 165.6c 18,203,949 176.2c 16,240,965Granted during the period 121.7c 3,194,644 187.1c 5,629,830Forfeited during the period 205.9c (3,747,162) 271.4c (3,073,283)Exercised during the period 120.6c (4,926,242) 121.6c (593,563)Outst<strong>and</strong>ing at the end of the period 171.1c 12,725,189 165.6c 18,203,949Exercisable at the end of the period 146.6c 4,090,597 119.8c 5,874,980Of the share options exercised during the year 130,000 were issued by the <strong>Pace</strong> <strong>plc</strong> Employee Benefit Trust (2011: Nil).Outst<strong>and</strong>ing options were as follows:Weighted averageremainingNumber at contractual life Weighted averageRange of exercise prices (pence) 31 December <strong>2012</strong> months exercise price47 pence – 75 pence 5,861,004 91 107c85.5 pence – 97.75 pence 2,528,024 82 144c128 pence – 208 pence 4,336,161 58 278c12,725,189 78 172cThe weighted average exercise price of options granted in the period was 121.7 cents (2011: 187.1 cents).The weighted average fair value at the measurement date of options granted in the year was 57.1 cents (2011: 72.3 cents).The weighted average exercise price at the date of exercise for options exercised in the year was 120.6 cents (2011: 121.6 cents).The weighted average share price during the year was 202.8 cents (2011: 291.4 cents).The fair value of services received in return for share options granted are measured by reference to the fair value of share optionsgranted. The estimate of the fair value of the services received is measured based on a Black-Scholes model. The following tablegives the assumptions applied to the options granted in the respective periods shown. Expectations of early exercise areincorporated into the model, where appropriate.<strong>2012</strong> 2011Average share price (cents) 202.3c 191.9cWeighted average exercise price (cents) 172.0c 165.6cExpected volatility (%) 50% 50%Option life (years) 10 10Dividend yield (%) 1.4% 1.4%Risk free interest rate (%) 5.0% 5.0%The expected volatility is based on the historic volatility (calculated based on the weighted average remaining life of the shareoptions), adjusted for any expected changes to future volatility due to publicly available information.The charge for share-based payments is $7.9 million (2011: $7.8 million) which is comprised entirely of equity settled transactions.74<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong> <strong>Pace</strong> <strong>plc</strong>